Professional Documents

Culture Documents

PLD News 2011 6 3 General

PLD News 2011 6 3 General

Uploaded by

Eric VeillonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PLD News 2011 6 3 General

PLD News 2011 6 3 General

Uploaded by

Eric VeillonCopyright:

Available Formats

Prologis, L.P., Formerly AMB Property, L.P.

, Announces Final Results of Exchange Offers

SAN FRANCISCO and DENVER, June 3, 2011 /PRNewswire/ -- As announced earlier this morning, ProLogis and AMB Property

Corporation completed a merger of equals on June 3, 2011. In connection with the completion of the merger, AMB Property

Corporation changed its name to Prologis, Inc. (NYSE: PLD), AMB Property, L.P. changed its name to Prologis, L.P., and

ProLogis, which became an indirect wholly owned subsidiary of Prologis, L.P., changed its name to Prologis. In addition,

Prologis, Inc. today announced final results from the offers to exchange all outstanding notes of the series described in the

table below issued by Prologis (the "Prologis Notes") for corresponding series of notes to be issued by Prologis, Inc.'s

operating partnership, Prologis, L.P. and guaranteed by Prologis, Inc. As of 9:00 a.m., New York City time, on June 3, 2011 (the

"Expiration Date"), and as indicated in the table below, approximately $4.37 billion aggregate principal amount of Prologis Notes

had been validly tendered for exchange (and not validly withdrawn), such that the requisite consents for the applicable series

of Prologis Notes have been received. In light of having received the requisite consents and the completion of the merger, the

proposed amendments to the Prologis indenture governing the Prologis Notes will be adopted, assuming all other conditions of

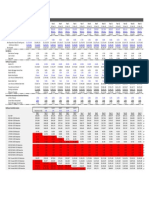

the exchange offers and consent solicitations are satisfied or waived, as applicable. The following table shows the principal

amount of each such series tendered for exchange. The exchange offers are expected to settle on June 8, 2011.

Series of Prologis Non-

Aggregate Convertible Notes Issued CUSIP No. Percent of Aggregate Principal

Principal by of the Prologis Non- Outstanding Principal Amount Amount Tendered as of the

Amount Prologis to be Exchanged Convertible Notes Tendered as of the Expiration Date Expiration Date

5.500% Notes due April 1,

$58,935,000 2012 743410 AK8 $49,055,000 83.24%

5.500% Notes due March 1,

$61,443,000 2013 743410 AE2 $58,683,000 95.51%

7.625% Notes due August 15,

$350,000,000 2014 743410 AU6 $325,454,000 92.99%

7.810% Notes due February 1,

$48,226,750 2015 81413WAA8 $33,367,000 69.19%

9.340% Notes due March 1,

$5,511,625 2015 814138 AB9 $4,338,000 78.71%

5.625% Notes due November

$155,320,000 15, 2015 743410 AJ1 $136,487,000 87.87%

5.750% Notes due April 1,

$197,758,000 2016 743410 AL6 $166,805,000 84.35%

8.650% Notes due May 15,

$36,402,700 2016 814138 AJ2 $34,040,000 93.51%

5.625% Notes due November

$182,104,000 15, 2016 743410 AN2 $170,827,000 93.81%

6.250% Notes due March 15,

$300,000,000 2017 743410 AX0 $280,572,000 93.52%

$100,000,000 7.625% Notes due July 1, 2017 814138 AK9 $96,182,000 96.18%

6.625% Notes due May 15,

$600,000,000 2018 743410 AT9 $585,580,000 97.60%

7.375% Notes due October 30,

$396,641,000 2019 743410 AV4 $386,361,000 97.41%

6.875% Notes due March 15,

$561,049,000 2020 743410 AW2 $540,077,000 96.26%

Series of Prologis

Aggregate Convertible Notes Issued CUSIP No. Percent of Aggregate Principal

Principal by of the Prologis Outstanding Principal Amount Amount Tendered as of the

Amount Prologis to be Exchanged Convertible Notes Tendered as of the Expiration Date Expiration Date

3.250% Convertible Senior

$460,000,000 Notes due 2015 743410 AY8 $451,181,000 98.08%

2.250% Convertible Senior 743410 AP7

$592,980,000 Notes due 2037 743410 AQ5 $549,043,000 92.59%

1.875% Convertible Senior

$141,635,000 Notes due 2037 743410 AR3 $140,987,000 99.54%

2.625% Convertible Senior

$386,250,000 Notes due 2038 743410 AS1 $363,782,000 94.18%

The exchange offers and the solicitation of consents are being made under terms and subject to the conditions set forth in the

prospectus filed by Prologis, Inc. and Prologis, L.P. with the Securities and Exchange Commission (the "SEC") and a related

letter of transmittal and consent that contains a more complete description of the terms and conditions of the exchange offers

and the solicitation of consents.

Citi and RBS are serving as the dealer managers and solicitation agents and Global Bondholder Services Corporation is

serving as exchange agent and information agent for the exchange offers and the solicitation of consents. Requests for

documents may be directed to Global Bondholder Services Corporation, Attn: Corporate Actions, 65 Broadway, Suite 723, New

York, NY 10006, or by telephone for banks and brokers collect at (212) 430-3774, all others toll-free at (866) 470-3700.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy the securities described herein, nor

shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The exchange offers and

solicitation of consents are being made solely by means of a prospectus that is part of a registration statement.

About Prologis, Inc.

Prologis, Inc., is a leading owner, operator and developer of industrial real estate, focused on global and regional markets

across the Americas, Europe and Asia. As of March 31, 2011, on a pro forma basis giving effect to the merger, Prologis owned

or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects

expected to total more than 600 million square feet (55.7 million square meters) in 22 countries. The company leases modern

distribution facilities to more than 4,500 customers, including manufacturers, retailers, transportation companies, third-party

logistics providers and other enterprises.

Cautionary Statement Regarding Forward-Looking Statements

In addition to historical information, this document contains forward-looking statements within the meaning of Section 27A of the

U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These

forward-looking statements are based on current expectations, estimates and beliefs. Words such as "expects," "anticipates,"

"intends," "plans," "believes," "seeks," "estimates," variations of such words and similar expressions are intended to identify

such forward-looking statements, which generally are not historical in nature. Such forward-looking statements include, but are

not limited to, statements relating to the terms and timing of the exchange offers and the solicitation of consents. These

statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult

to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable

assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may

differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect

outcomes and results include, but are not limited to: (i) national, international, regional and local economic climates, (ii)

changes in financial markets, interest rates and foreign currency exchange rates, and (iii) those additional risks and factors

discussed in reports filed with the Securities and Exchange Commission ("SEC") by Prologis, Inc. and Prologis from time to time,

including those discussed under the heading "Risk Factors" in their respective most recently filed reports on Form 10-K and

10-Q. Prologis, Inc. does not undertake any duty to update any forward-looking statements appearing in this document.

SOURCE Prologis, Inc.

News Provided by Acquire Media

You might also like

- Bonnie Road ModelDocument14 pagesBonnie Road Modelmzhao8100% (1)

- Holoease: Jacob Sheridan 4/13/2020 To Perform A Financial Analysis For The Startup Tech Company, HoloeaseDocument11 pagesHoloease: Jacob Sheridan 4/13/2020 To Perform A Financial Analysis For The Startup Tech Company, HoloeaseJacob SheridanNo ratings yet

- Macrs Depreciation: New Smart Phone Calculation AnalysisDocument4 pagesMacrs Depreciation: New Smart Phone Calculation AnalysisErro Jaya Rosady100% (1)

- QUCT 2016 FinancialsDocument24 pagesQUCT 2016 FinancialskdwcapitalNo ratings yet

- 2013 Nov 26 - Conditional Curve Trades e PDFDocument13 pages2013 Nov 26 - Conditional Curve Trades e PDFkiza66No ratings yet

- Investment Banking OverviewDocument77 pagesInvestment Banking OverviewEmerson De Mello100% (26)

- CUSIP IdentifierDocument4 pagesCUSIP IdentifierFreeman Lawyer97% (36)

- Chapter Iv - Data Analysis and Interpretation: Property #1Document32 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- Chapter Iv - Data Analysis and Interpretation: Property #1Document12 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- And Investment Holdings 32015Document10 pagesAnd Investment Holdings 32015Milan PetrikNo ratings yet

- Audit of LiabilitiesDocument9 pagesAudit of LiabilitiesMichBadilloCalanogNo ratings yet

- MB2001 FA 2025 Week5B Liabilities Practice ExercisesDocument31 pagesMB2001 FA 2025 Week5B Liabilities Practice ExerciseschloeileenspearsNo ratings yet

- Income Statement: Financial StatementsDocument15 pagesIncome Statement: Financial StatementsMahnoorNo ratings yet

- Refinance Analysis v1.01Document1 pageRefinance Analysis v1.01AlexNo ratings yet

- Transocean LTDDocument86 pagesTransocean LTDmontyviaderoNo ratings yet

- Case Study #3Document5 pagesCase Study #3Jenny OjoylanNo ratings yet

- Term ReportDocument17 pagesTerm Reportabdul.fattaahbakhsh29No ratings yet

- Emergency Response Master Budget FormatDocument51 pagesEmergency Response Master Budget FormatNaveed UllahNo ratings yet

- SL Update 2016Document10 pagesSL Update 2016datasiswaNo ratings yet

- FInancial Statement ExcelDocument17 pagesFInancial Statement Excelshikhamit20No ratings yet

- Balance Sheet (Vertical & Horizontal Analysis)Document7 pagesBalance Sheet (Vertical & Horizontal Analysis)Nguyen Dac ThichNo ratings yet

- Ejercicios Tema 3Document48 pagesEjercicios Tema 3Javier RubiolsNo ratings yet

- Selling Forward: Profit FactorDocument4 pagesSelling Forward: Profit FactorAnandNo ratings yet

- Financial Planning and Control: AFN, Leverage and Break Even Point Additional Fund NeededDocument6 pagesFinancial Planning and Control: AFN, Leverage and Break Even Point Additional Fund NeededCalistaNo ratings yet

- 2.0 Mba 670 GMDocument6 pages2.0 Mba 670 GMLauren LoshNo ratings yet

- GCCFC 2004-gg1Document6 pagesGCCFC 2004-gg1ZerohedgeNo ratings yet

- Wa0002.Document20 pagesWa0002.adriana utariNo ratings yet

- Adesoye, Adeniji-Scena - CorrectDocument11 pagesAdesoye, Adeniji-Scena - CorrectAdesoye AdenijiNo ratings yet

- ანრი მაჭავარიანი ფინალურიDocument40 pagesანრი მაჭავარიანი ფინალურიAnri MachavarianiNo ratings yet

- 3 Statement Financial Model: How To Build From Start To FinishDocument9 pages3 Statement Financial Model: How To Build From Start To FinishMiks EnriquezNo ratings yet

- Case Study #2: Growing PainsDocument3 pagesCase Study #2: Growing PainsMissey Grace PuntalNo ratings yet

- Angsuran PinjamanDocument15 pagesAngsuran PinjamanslimgraneroNo ratings yet

- Beginning Book Value 11/30/06 Additions/ Changes For Period Ending Book Value 02/28/07 Beginning Market Value 11/30/06Document11 pagesBeginning Book Value 11/30/06 Additions/ Changes For Period Ending Book Value 02/28/07 Beginning Market Value 11/30/06Navarro CollegeNo ratings yet

- Philbin Financial GroupDocument13 pagesPhilbin Financial GroupakbarNo ratings yet

- Chapter 5 - FSADocument16 pagesChapter 5 - FSALuu Nhat MinhNo ratings yet

- Loans 2Document83 pagesLoans 2api-256791069No ratings yet

- Wall Street Prep Financial Modeling Quick Lesson DCF1Document18 pagesWall Street Prep Financial Modeling Quick Lesson DCF1NuominNo ratings yet

- NP EX 4 SunriseDocument13 pagesNP EX 4 SunriseakbarNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- TT KPI Rate 1 2 3: I Ingame StatisticDocument5 pagesTT KPI Rate 1 2 3: I Ingame StatisticNguyễn Duy TùngNo ratings yet

- FINAL Case Study 2 Growing PainsDocument15 pagesFINAL Case Study 2 Growing PainsCheveem Grace Emnace100% (1)

- Cashflow LPG BisnisDocument2 pagesCashflow LPG Bisnisceon sevenNo ratings yet

- Fina Sample ReportsDocument61 pagesFina Sample ReportsqNo ratings yet

- Bab-Mk Afn1Document6 pagesBab-Mk Afn1CalistaNo ratings yet

- Real EstateDocument8 pagesReal EstatenguyentrantoquynhtqNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- Hold SellDocument6 pagesHold SellVishal VermaNo ratings yet

- Private Health Insurance Risk Equalisation Financial Year Results 2018-19Document80 pagesPrivate Health Insurance Risk Equalisation Financial Year Results 2018-19jimmy rodolfo LazanNo ratings yet

- Statement of Income Expected 2016 2015 2014Document29 pagesStatement of Income Expected 2016 2015 2014Rendy Setiadi MangunsongNo ratings yet

- Magic Castle Valuation AnalysisDocument4 pagesMagic Castle Valuation AnalysissrigopNo ratings yet

- Advanced AccountingDocument4 pagesAdvanced Accountinggisela gilbertaNo ratings yet

- Annual Report of Immigrant Visa Applicants in The Family-Sponsored and Employment-Based Preferences Registered at The National Visa Center As of November 1, 2015Document15 pagesAnnual Report of Immigrant Visa Applicants in The Family-Sponsored and Employment-Based Preferences Registered at The National Visa Center As of November 1, 2015RFCapRNNo ratings yet

- Estimasi Rencana Arus Kas: Form: AWM/PMF 004Document2 pagesEstimasi Rencana Arus Kas: Form: AWM/PMF 004Key NajdatNo ratings yet

- Private Equity Real Estate Exam SolutionDocument10 pagesPrivate Equity Real Estate Exam SolutionangadNo ratings yet

- (11-2020) Head Office (Interest)Document27 pages(11-2020) Head Office (Interest)Apanar OoNo ratings yet

- Brunswick County Feasibility Report-2nd Draft 9-16-19Document48 pagesBrunswick County Feasibility Report-2nd Draft 9-16-19Johanna Ferebee StillNo ratings yet

- Re CalcuDocument4 pagesRe CalcuDarren WaynNo ratings yet

- Analisa SahamDocument10 pagesAnalisa SahamGede AriantaNo ratings yet

- STSC Rates W.E.F 12 01 23 2Document3 pagesSTSC Rates W.E.F 12 01 23 2Federal Land CommissionNo ratings yet

- Financial PlanDocument14 pagesFinancial Planagotevan0No ratings yet

- DCF TLKM Full Year 2020Document4 pagesDCF TLKM Full Year 2020i wayan suputraNo ratings yet

- Q4 2010 Quarterly EarningsDocument15 pagesQ4 2010 Quarterly EarningsAlexia BonatsosNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- Scanimpots ParisDocument1 pageScanimpots ParisEric VeillonNo ratings yet

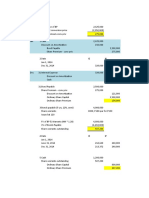

- Résultat CADocument1 pageRésultat CAEric VeillonNo ratings yet

- CPFREYDocument2 pagesCPFREYEric VeillonNo ratings yet

- Tresor AyraultDocument1 pageTresor AyraultEric VeillonNo ratings yet

- FedEx Express - European SME Export Report PDFDocument49 pagesFedEx Express - European SME Export Report PDFEric VeillonNo ratings yet

- Q1 Results July 15Document3 pagesQ1 Results July 15Eric VeillonNo ratings yet

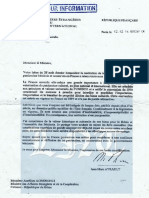

- Reponse Prefet PDFDocument3 pagesReponse Prefet PDFEric VeillonNo ratings yet

- Turkish Cargo Corporate Presentation Long ENGDocument42 pagesTurkish Cargo Corporate Presentation Long ENGEric VeillonNo ratings yet

- Turkish Cargo Corporate Presentation Long ENGDocument42 pagesTurkish Cargo Corporate Presentation Long ENGEric VeillonNo ratings yet

- International Capital Market.Document18 pagesInternational Capital Market.sereneanu100% (11)

- Online Brokers UpdatedDocument4 pagesOnline Brokers UpdatedHassan RazaNo ratings yet

- NoticeDocument4 pagesNoticejasmin coNo ratings yet

- Deutsche Bank at A Glance: Facts and FiguresDocument14 pagesDeutsche Bank at A Glance: Facts and FiguresKaustav MukherjeeNo ratings yet

- Sunset v. Campos-DigestDocument2 pagesSunset v. Campos-DigestNina S100% (1)

- Brazil Issue: International Law QuarterlyDocument80 pagesBrazil Issue: International Law QuarterlySantiago CuetoNo ratings yet

- 1Document56 pages1Renee WilliamsNo ratings yet

- Bop HRMDocument80 pagesBop HRMAmir Shahzad100% (1)

- Variable Examination Review Session (Verse) Mock ExamDocument12 pagesVariable Examination Review Session (Verse) Mock ExamArvinALNo ratings yet

- Form Sec 10.1Document3 pagesForm Sec 10.1xtinemaniegoNo ratings yet

- FM 415 - Chapter 5Document6 pagesFM 415 - Chapter 5Josiphine PaezNo ratings yet

- Commercial Paper + Secured TransactionsDocument15 pagesCommercial Paper + Secured TransactionsDavid Shim100% (2)

- CK Infrastructure Holdings Limited: (Note 1)Document1 pageCK Infrastructure Holdings Limited: (Note 1)WF YeungNo ratings yet

- 2018 Annual Report - Information StatementsDocument68 pages2018 Annual Report - Information StatementsJOSE KARLO MARI TOTTOCNo ratings yet

- DFS Report On Community BanksDocument33 pagesDFS Report On Community BanksCasey SeilerNo ratings yet

- BankFin Midterm Mod 4Document6 pagesBankFin Midterm Mod 4Devon DebarrasNo ratings yet

- List of Abbreviations PDFDocument15 pagesList of Abbreviations PDFKunal KantNo ratings yet

- The Rise of CrowdfundingDocument4 pagesThe Rise of CrowdfundingeliforuNo ratings yet

- Introduction To DerivatiesDocument37 pagesIntroduction To DerivatiesyopoNo ratings yet

- Indian Bond MarketDocument4 pagesIndian Bond MarketAmritangshu BanerjeeNo ratings yet

- Chapter 3 - Sources of FinancingDocument5 pagesChapter 3 - Sources of FinancingSteffany RoqueNo ratings yet

- CH 3 Transfer and Transmission of Securities PDFDocument19 pagesCH 3 Transfer and Transmission of Securities PDFYashJainNo ratings yet

- Business Studies f2 NotesDocument114 pagesBusiness Studies f2 NotesIsaac OkotNo ratings yet

- Unit I Banking and Insurance Law Study NotesDocument12 pagesUnit I Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Unit I VDocument231 pagesUnit I Vsimran bansalNo ratings yet

- Special Counsel For Carey Ebert, As Trustee For Latitude Solutions, IncDocument94 pagesSpecial Counsel For Carey Ebert, As Trustee For Latitude Solutions, IncLakisha Schwartz100% (1)

- Project 1Document52 pagesProject 1Anurima BanerjeeNo ratings yet