Professional Documents

Culture Documents

Real Interest Rate Nominal Interest Rate

Real Interest Rate Nominal Interest Rate

Uploaded by

sania HashmiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Real Interest Rate Nominal Interest Rate

Real Interest Rate Nominal Interest Rate

Uploaded by

sania HashmiCopyright:

Available Formats

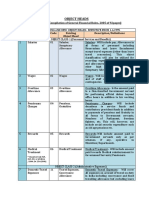

According to the principle of monetary neutrality, an increase in the rate of

money growth raises the rate of inflation but does not affect any real variable. he

Fisher Effect states that the real interest rate equals the nominal interest rate

minus the expected inflation rate. The Fisher Effect can be seen each time you go

to the bank; the interest rate an investor has on a savings account is really the

nominal interest rate. For example, if the nominal interest rate on a savings

account is 4% and the expected rate of inflation is 3%, then the money in the

savings account is really growing at 1%. The smaller the real interest rate, the

longer it will take for savings deposits to grow substantially when observed from a

purchasing power perspective.

To understand the relationship between money, inflation, and interest rates,

recall

the distinction between the nominal interest rate and the real interest rate. The

nominal interest rate is the interest rate you hear about at your bank. If you have

a savings account, for instance, the nominal interest rate tells you how fast the

number of dollars in your account will rise over time. The real interest rate

corrects

the nominal interest rate for the effect of inflation to tell you how fast the

purchasing

power of your savings account will rise over time. The real interest rate is the

nominal interest rate minus the inflation rate:

As we discussed earlier in the book, the supply and demand for loanable funds

determine the real interest rate. And according to the quantity theory of money,

growth in the money supply determines the inflation rate.

Let’s now consider how the growth in the money supply affects interest rates.

In the long run over which money is neutral, a change in money growth should

not affect the real interest rate. The real interest rate is, after all, a real variable.

For the real interest rate not to be affected, the nominal interest rate must adjust

one-for-one to changes in the inflation rate. Thus, when the Fed increases the

rate of

money growth, the long-run result is both a higher inflation rate and a higher

nominal

interest rate. This adjustment of the nominal interest rate to the inflation rate is

called the Fisher effect, after Irving Fisher (1867–1947), the economist who first

studied it.

Keep in mind that our analysis of the Fisher effect has maintained a long-run

perspective. The Fisher effect need not hold in the short run because inflation

may

be unanticipated. A nominal interest rate is a payment on a loan, and it is typically

set when the loan is first made. If a jump in inflation catches the borrower and

lender by surprise, the nominal interest rate they agreed on will fail to reflect the

higher inflation. But if inflation remains high, people will eventually come to

expect it, and loan agreements will reflect this expectation. To be precise,

therefore,

the Fisher effect states that the nominal interest rate adjusts to expected

inflation.

Expected inflation moves with actual inflation in the long run, but that is not

necessarily true in the short run.

You might also like

- Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioFrom EverandInvesting 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioRating: 4.5 out of 5 stars4.5/5 (38)

- Offer Letter and CTC Breakup 1Document3 pagesOffer Letter and CTC Breakup 1Namrata MahantNo ratings yet

- Fisher EffectDocument7 pagesFisher EffectZahid MalikNo ratings yet

- Fisher EffectDocument3 pagesFisher EffectamarbuzzearNo ratings yet

- Fisher EffectDocument15 pagesFisher EffectRk BainsNo ratings yet

- The Fisher Effect Is An Economic Theory Proposed by Economist Irving FisherDocument2 pagesThe Fisher Effect Is An Economic Theory Proposed by Economist Irving Fishermisha bansalNo ratings yet

- Fisher Hypothesis - Wikipedia, The Free EncyclopediaDocument2 pagesFisher Hypothesis - Wikipedia, The Free EncyclopediaParag AwateNo ratings yet

- InflationDocument6 pagesInflationasmiNo ratings yet

- Lesson 9 - Money and Interest RatesDocument5 pagesLesson 9 - Money and Interest RatesAnthony BandaNo ratings yet

- Neo-Fisherism A Radical Idea, or The Most Obvious Solution To The Low-Inflation Problem?Document6 pagesNeo-Fisherism A Radical Idea, or The Most Obvious Solution To The Low-Inflation Problem?Valentina Pedraza CaamañoNo ratings yet

- What Does International Fisher EffectDocument3 pagesWhat Does International Fisher EffectGauri JainNo ratings yet

- AC3104 - Chapter 2-3 AssessmentDocument2 pagesAC3104 - Chapter 2-3 AssessmentJohn Francis SumalinogNo ratings yet

- Notes On The Effects of Money On Interest RatesDocument2 pagesNotes On The Effects of Money On Interest RatesAbid HussainNo ratings yet

- Lacker Speech 20151112Document5 pagesLacker Speech 20151112Rukhsar RahimiNo ratings yet

- Interest Rate Expectations: Why Interest Rates Matter For Forex TradersDocument7 pagesInterest Rate Expectations: Why Interest Rates Matter For Forex Tradersvlad_adrian_7No ratings yet

- Interest Rates and Their Role in FinanceDocument17 pagesInterest Rates and Their Role in FinanceClyden Jaile RamirezNo ratings yet

- CH 20 End of Chapter QuestionDocument4 pagesCH 20 End of Chapter QuestionMuhammad ZafarNo ratings yet

- Group G IFM PrnstationDocument12 pagesGroup G IFM PrnstationMaryamNo ratings yet

- How Interest Rates Affect The Stock MarketDocument7 pagesHow Interest Rates Affect The Stock MarketSandeep BabajiNo ratings yet

- Week 14B - Inflation, Deflation, and Duration - INF516 InvestmentsDocument46 pagesWeek 14B - Inflation, Deflation, and Duration - INF516 InvestmentshuguesNo ratings yet

- Chapter 2-Home Work QuestionsDocument3 pagesChapter 2-Home Work QuestionsSarah MoonNo ratings yet

- Kamatna StopaDocument16 pagesKamatna StopaMarina VasicNo ratings yet

- The Demand For Money: Nominal Interest Rate Real Interest RateDocument8 pagesThe Demand For Money: Nominal Interest Rate Real Interest RateHani AmirNo ratings yet

- Inflation and Interest RatesDocument21 pagesInflation and Interest RatesWahyu HidayatNo ratings yet

- Modern Theory of InterestDocument27 pagesModern Theory of InterestuzmaNo ratings yet

- Inflation 1Document3 pagesInflation 1Lata BinaniNo ratings yet

- International Fisher EffectDocument3 pagesInternational Fisher EffectVaibhav TelangNo ratings yet

- FIN350 - Solutions Slides 10Document3 pagesFIN350 - Solutions Slides 10David NguyenNo ratings yet

- Darby 1975Document11 pagesDarby 1975Syed Aal-e RazaNo ratings yet

- It Starts With InflationDocument3 pagesIt Starts With InflationVelayNo ratings yet

- Study Material - Principles of Macro Economics IIDocument35 pagesStudy Material - Principles of Macro Economics IIMousam JaiswalNo ratings yet

- Bond Valuation - Interest RatesDocument3 pagesBond Valuation - Interest RatesPrincess ArasherNo ratings yet

- HW 3Document4 pagesHW 3Marino NhokNo ratings yet

- Nis AFMDocument19 pagesNis AFMnyshanairNo ratings yet

- International Financial SystemDocument7 pagesInternational Financial SystemArdhi PutraNo ratings yet

- Word Doc... On InflationDocument9 pagesWord Doc... On InflationTanya VermaNo ratings yet

- Interest Rate Differentials: How Monetary Policy Affects The Forex MarketDocument3 pagesInterest Rate Differentials: How Monetary Policy Affects The Forex Marketvlad_adrian_70% (1)

- Group 4 - PARITY CONDITIONS IN INTERNATIONAL FINANCE AND CURRENCY FORECASTINGDocument37 pagesGroup 4 - PARITY CONDITIONS IN INTERNATIONAL FINANCE AND CURRENCY FORECASTINGadindaNo ratings yet

- Develop Appropriate Values Like Consideration and Understanding During The Time of InflationDocument10 pagesDevelop Appropriate Values Like Consideration and Understanding During The Time of InflationLomyna MorreNo ratings yet

- Lending Interest RateDocument2 pagesLending Interest RateAMIRUL RAJA ROSMANNo ratings yet

- Monetary PolicyDocument46 pagesMonetary PolicyTanvi Shukla (Yr. 21-23)No ratings yet

- Yield Curve and Its Importance: Short-Term Versus Long-Term Rates and YieldsDocument4 pagesYield Curve and Its Importance: Short-Term Versus Long-Term Rates and YieldsJulio GaziNo ratings yet

- Basic Concepts of InflationDocument4 pagesBasic Concepts of Inflationrashitekwani5No ratings yet

- Money Growth and Inflation: The Classical Theory of InflationDocument5 pagesMoney Growth and Inflation: The Classical Theory of InflationIzzahNo ratings yet

- Mohd. Moktasid Hossain Bhuiyan ID: 19304024Document2 pagesMohd. Moktasid Hossain Bhuiyan ID: 19304024Moktasid HossainNo ratings yet

- Macroeconomics: Unit 15 Monetary Policy and Theory The Top Five ConceptsDocument28 pagesMacroeconomics: Unit 15 Monetary Policy and Theory The Top Five ConceptsAsma Ul Husna MumuNo ratings yet

- ME end termDocument18 pagesME end termdiwanshusharma2020No ratings yet

- Interest Rates and ImpactsDocument6 pagesInterest Rates and ImpactsSunny KalraNo ratings yet

- Seigniorage:: Interest Rate. If I Denotes The Nominal Interest Rate, R The Real Interest Rate, and P The Rate ofDocument2 pagesSeigniorage:: Interest Rate. If I Denotes The Nominal Interest Rate, R The Real Interest Rate, and P The Rate ofSadi MohaiminulNo ratings yet

- Relationship Among InflationDocument4 pagesRelationship Among InflationMohiuddin Al FarukNo ratings yet

- Monetary Policy of ChinaDocument12 pagesMonetary Policy of Chinavenkatesh fmNo ratings yet

- Nominal and Real Interest RatesDocument6 pagesNominal and Real Interest RatesGeromeNo ratings yet

- Money Market and Nominal Interest RateDocument2 pagesMoney Market and Nominal Interest RateMario SarayarNo ratings yet

- Ch. 34 - Notes - The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument11 pagesCh. 34 - Notes - The Influence of Monetary and Fiscal Policy On Aggregate DemandBing TinsleyNo ratings yet

- Factsheet Ton How Do Inflation and The Rise in Interest Rates Affect My MoneyDocument8 pagesFactsheet Ton How Do Inflation and The Rise in Interest Rates Affect My Moneyimhidayat2021No ratings yet

- Inflation AssignmentDocument18 pagesInflation AssignmentAmul Shrestha25% (4)

- Chapter 2Document9 pagesChapter 2api-25939187No ratings yet

- The Relationship Between Money and InflationDocument5 pagesThe Relationship Between Money and InflationMussa AthanasNo ratings yet

- Preserving Wealth in Inflationary Times - Strategies for Protecting Your Financial Future: Alex on Finance, #4From EverandPreserving Wealth in Inflationary Times - Strategies for Protecting Your Financial Future: Alex on Finance, #4No ratings yet

- The Insider Trading Anomaly Endures 50 Years After It Was First Identified by Lorie and NiederhofferDocument3 pagesThe Insider Trading Anomaly Endures 50 Years After It Was First Identified by Lorie and Niederhoffertidomam303No ratings yet

- TVS Motor - Taxmann VersionDocument19 pagesTVS Motor - Taxmann VersionSripal JainNo ratings yet

- DC Study PR Maritime Transportation Services ProjectDocument52 pagesDC Study PR Maritime Transportation Services ProjectCORALationsNo ratings yet

- Performance Evaluation of Square Textile Ltd. & Apex Spinning and Knitting Mills Ltd. Prepared ForDocument28 pagesPerformance Evaluation of Square Textile Ltd. & Apex Spinning and Knitting Mills Ltd. Prepared ForEnaiya IslamNo ratings yet

- DRDP Results Matrices 2017 2022Document161 pagesDRDP Results Matrices 2017 2022Belen AvestruzNo ratings yet

- Consumer Behavior of The Selected Rizal Technological University Students During Covid-19 PandemicDocument7 pagesConsumer Behavior of The Selected Rizal Technological University Students During Covid-19 PandemicArsenio N. RojoNo ratings yet

- Oblicon Module 5Document6 pagesOblicon Module 5Jenjen ArutaNo ratings yet

- Barco Projection SystemsDocument15 pagesBarco Projection SystemsAakanksha Gulabdhar MishraNo ratings yet

- PratimaMehta May2020Document3 pagesPratimaMehta May2020rajan mishraNo ratings yet

- NET PRESENT VALUE (NPV) PwrpointDocument42 pagesNET PRESENT VALUE (NPV) Pwrpointjumar_loocNo ratings yet

- Object Head List PDFDocument6 pagesObject Head List PDFLal ZahawmaNo ratings yet

- Test Item Table by Major Section of The Chapter and Level of Learning Major Section of The and Tracking Studies Level of Learning (LL)Document227 pagesTest Item Table by Major Section of The Chapter and Level of Learning Major Section of The and Tracking Studies Level of Learning (LL)ROMULO CUBIDNo ratings yet

- Assure FundDocument58 pagesAssure FundVishalNo ratings yet

- DocumentDocument5 pagesDocumentyogitaNo ratings yet

- Consumer Behavior and Sustainable MarketingDocument14 pagesConsumer Behavior and Sustainable Marketinglon choNo ratings yet

- Case Study 1 - HR at EnterpriseDocument1 pageCase Study 1 - HR at EnterpriseHimanshu DaniNo ratings yet

- Macro 1to3 English ColourDocument8 pagesMacro 1to3 English Colourhanoonaa786No ratings yet

- Goldman Sachs Cover Letter AdviceDocument7 pagesGoldman Sachs Cover Letter Advicefdgwmljbf100% (2)

- Finals - Arts & HumanitiesDocument19 pagesFinals - Arts & HumanitiesBacang, Joemar G.No ratings yet

- STRATC2 Activity 4Document4 pagesSTRATC2 Activity 4Micaela EncinasNo ratings yet

- KHK HandbookDocument37 pagesKHK HandbookA JoshiNo ratings yet

- Layout Planning, Logistics in Garment IndustryDocument13 pagesLayout Planning, Logistics in Garment IndustryPRIYANKA GADENo ratings yet

- What Does Economics Have To Do With Running A BusinessDocument13 pagesWhat Does Economics Have To Do With Running A Businesswalsonsanaani3rdNo ratings yet

- Technological Development in Banking SectorDocument5 pagesTechnological Development in Banking SectorPrabhu89% (9)

- 1 ModelsDocument30 pages1 Modelssara alshNo ratings yet

- Rice Distribution Pattern: A Study On Food Security in South KalimantanDocument6 pagesRice Distribution Pattern: A Study On Food Security in South KalimantanAdelNo ratings yet

- Law 1Document1 pageLaw 1Cyrille Keith FranciscoNo ratings yet

- First Quarter Examination 1 Semester: SY: Business Mathematics 2018 - 2019Document2 pagesFirst Quarter Examination 1 Semester: SY: Business Mathematics 2018 - 2019Glenn MendezNo ratings yet

- Tamil Selvan AssignmentDocument2 pagesTamil Selvan AssignmentAkshaya ArunachalamNo ratings yet