Professional Documents

Culture Documents

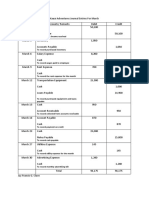

BSA Journal Date Particulars PR Debit Credit

BSA Journal Date Particulars PR Debit Credit

Uploaded by

Koleen Lalap0 ratings0% found this document useful (0 votes)

14 views2 pagesThis journal records transactions from January 1 to January 30 for a computer services company. It shows initial capital investment, purchases of equipment and supplies, payment of expenses like rent and utilities, revenue earned from services, and collection of payments from customers. Debits and credits are balanced at $100,775 each.

Original Description:

Original Title

Wilson Done

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis journal records transactions from January 1 to January 30 for a computer services company. It shows initial capital investment, purchases of equipment and supplies, payment of expenses like rent and utilities, revenue earned from services, and collection of payments from customers. Debits and credits are balanced at $100,775 each.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views2 pagesBSA Journal Date Particulars PR Debit Credit

BSA Journal Date Particulars PR Debit Credit

Uploaded by

Koleen LalapThis journal records transactions from January 1 to January 30 for a computer services company. It shows initial capital investment, purchases of equipment and supplies, payment of expenses like rent and utilities, revenue earned from services, and collection of payments from customers. Debits and credits are balanced at $100,775 each.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

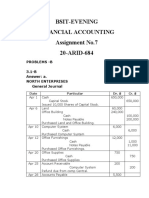

BSA

JOURNAL

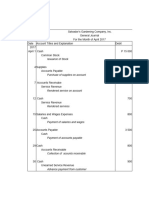

Date Particulars PR Debit Credit

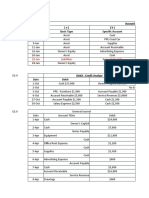

Jan.1 Cash 50,000

W.Adams,Capital 50,000

To record Initial investment to W.A

Computer Services Company

Jan.2

Rent Expense 2,500

Cash 2,500

To record payment of rent

expense

Jan.5

Office Equipment 14,000

Accounts Payable 14,000

To record purchased

office equipment on account

Jan.6

Art Equipment 2,700

Cash 2,700

To record purchased art

equipment

Jan.7

Supplies 1,050

Cash 1,050

To record purchased supplies

Jan.10

Office Cleaning Service 500

Cash 500

To record payment of office

cleaning

Jan.12

Revenue 3,600

Accounts Receivable 1,400

Service revenue 5,000

To record payment to rendered services

Jan.15

Cash 300

Supplies 300

To record returned damaged supplies

Jan.18

Office equipment 2,500

Cash 1,500

Accounts Payable 1,000

To record office equipment balance payable

Jan.20

Office Equipment 7,000

Cash 7,000

To record purchase equipment

Jan.26

Account Receivable 3,900

Cash 3,900

To record collection of payment from

customer account

Jan.27

Telephone Expense 275

Cash 275

To record payment on telephone

bill

Jan.30

Cash 3,200

Account Receivable 3,200

To record collection of payment from

Customer's account

Accounts Payable 350

Utilities Expense 350

To record payment on various expenses

Accounts Payable 7,500

Salaries Expense 7,500

100, 775 100,775

You might also like

- Mystical Stitches Downloadable PDFDocument51 pagesMystical Stitches Downloadable PDFJudit Lozano Peiró67% (3)

- 02 - CONFERO Service Manuals PDFDocument1,719 pages02 - CONFERO Service Manuals PDFLamro TambaNo ratings yet

- Joseph Vella - Learn Maltese Why NotDocument109 pagesJoseph Vella - Learn Maltese Why Notchambilici100% (3)

- Field Guide To Lens DesignDocument158 pagesField Guide To Lens DesignTasawar Khan JadoonNo ratings yet

- Name: Section: Score:: ActivityDocument3 pagesName: Section: Score:: ActivityRae Michael57% (7)

- Rubrik CDM Version 6.0 CLI Reference Guide (Rev. B3)Document86 pagesRubrik CDM Version 6.0 CLI Reference Guide (Rev. B3)Chill BeatzNo ratings yet

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- Requirement 1 2 3: ACCT500: Course ProjectDocument18 pagesRequirement 1 2 3: ACCT500: Course Projectsuruth242No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Mr. Addams' EditingDocument15 pagesMr. Addams' EditingKim KoalaNo ratings yet

- Addams&Family IncDocument16 pagesAddams&Family IncKim KoalaNo ratings yet

- Addams&Family Inc.Document5 pagesAddams&Family Inc.Trisha Mae CorpuzNo ratings yet

- WAC Chief HongDocument24 pagesWAC Chief HongJasmine ActaNo ratings yet

- Nu Assignment 3 MidtermDocument1 pageNu Assignment 3 MidtermJay Francis ClaveNo ratings yet

- Assignment No.7 AccountingDocument7 pagesAssignment No.7 Accountingibrar ghaniNo ratings yet

- ACTIVITY # 1 - 030322 With AnswerDocument6 pagesACTIVITY # 1 - 030322 With AnswerVanessaNo ratings yet

- Journalizing ExerciseDocument2 pagesJournalizing ExercisejscikagbkuNo ratings yet

- Latihan Balance Sheet DohertyDocument3 pagesLatihan Balance Sheet DohertyRetno TitisariNo ratings yet

- Chapter 01 Transaction AnalysisDocument28 pagesChapter 01 Transaction Analysistanvir ahmedNo ratings yet

- Activity 1 - JournalizingDocument2 pagesActivity 1 - JournalizingJesther Nasa-anNo ratings yet

- Accounting NavjotDocument1 pageAccounting Navjotyour0samNo ratings yet

- BT kế toán quốc tếDocument58 pagesBT kế toán quốc tếUyên Nguyễn Hoàng ThanhNo ratings yet

- Tran Hoai Anh Bai Tap Chap 4Document16 pagesTran Hoai Anh Bai Tap Chap 4Vũ Nhi AnNo ratings yet

- Account Debited (A) (B) Date Basic Type Specific AccountDocument12 pagesAccount Debited (A) (B) Date Basic Type Specific AccountVALENCIA TORENTHANo ratings yet

- Balance Sheet - Base EspañolDocument3 pagesBalance Sheet - Base EspañolCesar AltamiranoNo ratings yet

- Tugas 1 PADocument10 pagesTugas 1 PAkennykerjaanNo ratings yet

- Carlo Alancado Accounting CycleDocument16 pagesCarlo Alancado Accounting Cyclenglc srzNo ratings yet

- Question No 1: Cash Capital StockDocument6 pagesQuestion No 1: Cash Capital StockBushra NazNo ratings yet

- 3.3.2.3 Elaborate 1 - Recording TransactionsDocument2 pages3.3.2.3 Elaborate 1 - Recording Transactionsshairene marie villenaNo ratings yet

- Samson's Journal EntryDocument2 pagesSamson's Journal EntryShayne PagwaganNo ratings yet

- FM HLDocument16 pagesFM HLhuleNo ratings yet

- Recording Process Illustrated Ledger JournalDocument3 pagesRecording Process Illustrated Ledger JournalCem KaradumanNo ratings yet

- AcctngWork - Kalaw ConsultancyDocument19 pagesAcctngWork - Kalaw ConsultancyAndrea RamosNo ratings yet

- Third HW - Nabilah Khansa Luthfiyah - 1911000089Document12 pagesThird HW - Nabilah Khansa Luthfiyah - 1911000089NABILAH KHANSA 1911000089No ratings yet

- 2204 - Journalizing and Trial BalanceDocument3 pages2204 - Journalizing and Trial BalanceKasey Mae AsoyNo ratings yet

- General Journal BestDocument12 pagesGeneral Journal BestNhatty WeroNo ratings yet

- Issued StockDocument17 pagesIssued Stockapi-16021729No ratings yet

- Indi 1Document6 pagesIndi 1Minh Van NguyenNo ratings yet

- Gilbert Pratical TestDocument2 pagesGilbert Pratical TestINP PAINNo ratings yet

- FM HL FinalDocument16 pagesFM HL FinalhuleNo ratings yet

- Activity 3Document8 pagesActivity 3Angeline Gonzales PaneloNo ratings yet

- General Journal Date Accounts and Explanation Debit CreditDocument6 pagesGeneral Journal Date Accounts and Explanation Debit CreditShaina AragonNo ratings yet

- Problem 3Document6 pagesProblem 3Idolprince DeveraNo ratings yet

- 회계학원론 과제 P2.1Document1 page회계학원론 과제 P2.1yeopseo05No ratings yet

- Diaz - Journal EntriesDocument4 pagesDiaz - Journal EntriesPangitkaNo ratings yet

- Journalizing Business Transactions-EspinaDocument3 pagesJournalizing Business Transactions-EspinaVanessa FajardoNo ratings yet

- Date Accounts Debit Credit: 1. Journal 2.ledgerDocument13 pagesDate Accounts Debit Credit: 1. Journal 2.ledgerNguyen Huong Huyen (K15 HL)100% (1)

- Instruction 1: Record The Following Transaction in A Two-Column Journal (General Journal)Document13 pagesInstruction 1: Record The Following Transaction in A Two-Column Journal (General Journal)Nhatty WeroNo ratings yet

- Activity 4- Gan Consulting Company (1)Document4 pagesActivity 4- Gan Consulting Company (1)Anore, Anton NikolaiNo ratings yet

- Problem P2 2ADocument2 pagesProblem P2 2ASHAMSUN NAHARNo ratings yet

- Quiz 2 Bookkeeping-1Document6 pagesQuiz 2 Bookkeeping-1John Vincent D. ReyesNo ratings yet

- Date Account Titles and Explanation P.R. Debit Credit: General JournalDocument19 pagesDate Account Titles and Explanation P.R. Debit Credit: General JournalHạnh Nguyễn HồngNo ratings yet

- 01 - eLMS - Activity - 1 FINAREPDocument2 pages01 - eLMS - Activity - 1 FINAREPMa. Daniella LavariasNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- Lecture 4Document44 pagesLecture 4Tanveer AhmedNo ratings yet

- Fabm1 Q2 PPT W2Document24 pagesFabm1 Q2 PPT W2esmeraylunaaaNo ratings yet

- Accounting Cycle WorksheetDocument11 pagesAccounting Cycle Worksheettarikuabdisa0No ratings yet

- MERELOS Accounting-Cycle FARDocument19 pagesMERELOS Accounting-Cycle FARRae Jeniña E.MerelosNo ratings yet

- Financial StatementsDocument13 pagesFinancial StatementsAlbert Jun Piquero AlegadoNo ratings yet

- Amaliya Quiz Tutor Finacc 1 Week 2Document8 pagesAmaliya Quiz Tutor Finacc 1 Week 2Amaliya MalikovaNo ratings yet

- Journalizing of Transaction: Debit Cash On HandDocument15 pagesJournalizing of Transaction: Debit Cash On HandKazaku OrochimaruNo ratings yet

- TT02 AnsDocument6 pagesTT02 AnsDuyên Lê Ngọc TriềuNo ratings yet

- Accounting TermDocument8 pagesAccounting TermErick Danilo Salguero EscalanteNo ratings yet

- Book 1Document16 pagesBook 1Bushra RizviNo ratings yet

- CHAPTER 2 - ExercisesDocument3 pagesCHAPTER 2 - ExercisesPhạm Hà MinhNo ratings yet

- SLM-Q1M02-CSS9 - V2Document26 pagesSLM-Q1M02-CSS9 - V2DarylCrisNo ratings yet

- Torres Vs Javier - AC 5910 - September 21, 2005 - J. Carpio-Morales - Third Division - Decision PDFDocument12 pagesTorres Vs Javier - AC 5910 - September 21, 2005 - J. Carpio-Morales - Third Division - Decision PDFKyle AgustinNo ratings yet

- The Problems of GuiltDocument3 pagesThe Problems of GuiltXosé María André RodríguezNo ratings yet

- Solubility of Benzoic Acid in Organic SolventsDocument2 pagesSolubility of Benzoic Acid in Organic Solventssrshah67% (6)

- Unit 4 - Inventions and Technologies PDFDocument5 pagesUnit 4 - Inventions and Technologies PDFТимур выфыфNo ratings yet

- Elecciones Injustas, Una Cronología de Incidentes No Democráticos Desde 1999. Por Vladimir Chelminski (No Publicado)Document124 pagesElecciones Injustas, Una Cronología de Incidentes No Democráticos Desde 1999. Por Vladimir Chelminski (No Publicado)AgusGulman100% (1)

- Export Act 1963Document27 pagesExport Act 1963Anonymous OPix6Tyk5INo ratings yet

- Cloud, David. For Love of The BibleDocument509 pagesCloud, David. For Love of The BiblePavelNo ratings yet

- Why & What Is Cooperative Learning at The Computer: Teaching TipsDocument8 pagesWhy & What Is Cooperative Learning at The Computer: Teaching Tipsapi-296655270No ratings yet

- Lexical Concepts, Cognitive Models and Meaning-Construction: Vyvyan EvansDocument44 pagesLexical Concepts, Cognitive Models and Meaning-Construction: Vyvyan EvansДарья БелокрыльцеваNo ratings yet

- Navratna: Navratna Was The Title Given Originally To NineDocument5 pagesNavratna: Navratna Was The Title Given Originally To NineblokeshwaranNo ratings yet

- DUCKWEEDDocument2 pagesDUCKWEEDRALPH LAURENCE CASTRONo ratings yet

- Management of Hepato-Splenomegale A Case StudyDocument4 pagesManagement of Hepato-Splenomegale A Case Studyksr prasadNo ratings yet

- Mti and Pulsed DopplerDocument33 pagesMti and Pulsed DopplerWaqar Shaikh67% (3)

- Ido Portal Method Book - M (Eaux) TionDocument13 pagesIdo Portal Method Book - M (Eaux) TionzentropiaNo ratings yet

- Taxation - Updated MaterialDocument125 pagesTaxation - Updated Materialtrishul poovaiahNo ratings yet

- Sample 1Document26 pagesSample 1Vraizen LagnayoNo ratings yet

- Interchange - 5ed - 1 - Students - Book CONTESTADODocument166 pagesInterchange - 5ed - 1 - Students - Book CONTESTADORodrigoNo ratings yet

- Service Marketing: BY, Bhavithra AsokanDocument20 pagesService Marketing: BY, Bhavithra AsokanDomnic SavioNo ratings yet

- Chapter Three Theft Article 308. Who Are Liable For Theft. - Theft Is Committed by Any Person Who, With Intent To Gain ButDocument4 pagesChapter Three Theft Article 308. Who Are Liable For Theft. - Theft Is Committed by Any Person Who, With Intent To Gain Butquail090909No ratings yet

- Architectural Engineering Syllabus - AmieDocument7 pagesArchitectural Engineering Syllabus - AmieUrvoshi DuttaNo ratings yet

- Assignment 3 Islamic FinanceDocument4 pagesAssignment 3 Islamic FinanceMasoom ZahraNo ratings yet

- Words, Sentence and Dictionaries. MorphologyDocument5 pagesWords, Sentence and Dictionaries. MorphologyNur Al-AsimaNo ratings yet

- 24 LC 16Document32 pages24 LC 16josjcrsNo ratings yet