Professional Documents

Culture Documents

In The High Court at Calcutta: Subrata

In The High Court at Calcutta: Subrata

Uploaded by

parmodCopyright:

Available Formats

You might also like

- Chapter 06 - SamplesDocument3 pagesChapter 06 - SamplesJessica ZhangNo ratings yet

- LawFinder 2056403Document26 pagesLawFinder 2056403Adv Shyam KGNo ratings yet

- Gujarat State Civil Supplies Corporation Ltd. Vs Mahakali Foods Pvt. Ltd. (Unit 2)Document22 pagesGujarat State Civil Supplies Corporation Ltd. Vs Mahakali Foods Pvt. Ltd. (Unit 2)Vashishtha AakashNo ratings yet

- (P. 81 & 82) Jalgaon Janta Sahakari Bank Ltd. Vs Joint Commissioner of Sales TaxDocument155 pages(P. 81 & 82) Jalgaon Janta Sahakari Bank Ltd. Vs Joint Commissioner of Sales TaxAtik Mohd.No ratings yet

- Videocon Industries Ltd. Ma 1306 of 2018 CP 02 - 2018 NCLT On 08.08.2019 FinalDocument52 pagesVideocon Industries Ltd. Ma 1306 of 2018 CP 02 - 2018 NCLT On 08.08.2019 FinalWishwaPratapTomerNo ratings yet

- Vrj/Agk: wp4128-2021 & Connected-FinalDocument56 pagesVrj/Agk: wp4128-2021 & Connected-FinalCA Jay ShahNo ratings yet

- Supreme Court Decision - 2022Document24 pagesSupreme Court Decision - 2022akanshavarma44No ratings yet

- Synergy JudgmentDocument177 pagesSynergy JudgmentNikhil Mohan GoyalNo ratings yet

- Ambaradi Seva Sahkari Mandali Vs The Dcit CPC Bangaluru On 10 February 2023Document9 pagesAmbaradi Seva Sahkari Mandali Vs The Dcit CPC Bangaluru On 10 February 2023taxationsocietyNo ratings yet

- PETITIONER-Midas Online GamesDocument27 pagesPETITIONER-Midas Online GamesGeerthana ArasuNo ratings yet

- National Textile Corporation Vs Elixir Engineering 464817Document31 pagesNational Textile Corporation Vs Elixir Engineering 464817Sachika VijNo ratings yet

- J 2017 SCC OnLine CCI 48 Manasclatprep Gmailcom 20240320 103534 1 43Document43 pagesJ 2017 SCC OnLine CCI 48 Manasclatprep Gmailcom 20240320 103534 1 43Manas AaNo ratings yet

- Vidya Suresh AminDocument3 pagesVidya Suresh AminShyam APA JurisNo ratings yet

- Bombay wp-1537-2023Document22 pagesBombay wp-1537-2023surajsharma199705No ratings yet

- RESPONDENT-The GST DepartmentDocument29 pagesRESPONDENT-The GST DepartmentGeerthana ArasuNo ratings yet

- T10DDocument40 pagesT10DmsNo ratings yet

- Team-Oleander (Respondent Memorial)Document21 pagesTeam-Oleander (Respondent Memorial)superman1996femaleNo ratings yet

- TC - 03 Respondent PDFDocument28 pagesTC - 03 Respondent PDFShivamp6No ratings yet

- Trademark Dispute MemoDocument21 pagesTrademark Dispute MemoSidharath GoyalNo ratings yet

- Dhanappa I. Koshti: Judgment-WPL 2880/2020Document17 pagesDhanappa I. Koshti: Judgment-WPL 2880/2020ReachNo ratings yet

- In The High Court of Delhi at New Delhi W.P. (C) 5918/2020Document8 pagesIn The High Court of Delhi at New Delhi W.P. (C) 5918/2020Ekansh AroraNo ratings yet

- Uils I D M C C, 2018: in The Matter ofDocument23 pagesUils I D M C C, 2018: in The Matter ofuditiNo ratings yet

- Supreme Court Monsanto Nuziveedu InvnTree Aug1stDocument9 pagesSupreme Court Monsanto Nuziveedu InvnTree Aug1stkira-auditoreNo ratings yet

- Memorial Submission - AppellantDocument26 pagesMemorial Submission - AppellantSAUMYA RAI 19213032No ratings yet

- Ca Final New Syllabus Elective Paper 6D Economic Laws: Summary of Significant Case LawsDocument38 pagesCa Final New Syllabus Elective Paper 6D Economic Laws: Summary of Significant Case Lawslakshmi kbNo ratings yet

- CIA 3 Economics LawDocument8 pagesCIA 3 Economics Lawsovit agarwalNo ratings yet

- Bharti Airtel LTD and Ors Vs Vijaykumar V Iyer (MA230) PDFDocument29 pagesBharti Airtel LTD and Ors Vs Vijaykumar V Iyer (MA230) PDFAditya SharmaNo ratings yet

- Intra Moot Respondent HPDocument24 pagesIntra Moot Respondent HPswastik groverNo ratings yet

- KAR AAAR 14F 2019-20 ManipalEnergyInfratechLtdDocument13 pagesKAR AAAR 14F 2019-20 ManipalEnergyInfratechLtdjainrushab55No ratings yet

- DownloadedDocument26 pagesDownloadedMohanNo ratings yet

- Final Memo For Respondent 2018Document19 pagesFinal Memo For Respondent 2018Pravesh BishnoiNo ratings yet

- Memorial Submission RespondentDocument26 pagesMemorial Submission RespondentSAUMYA RAI 19213032No ratings yet

- The Deputy Commissioner of Income Tax Vs Bharath Fritz Werner Ltd. ITAT BangaloreDocument6 pagesThe Deputy Commissioner of Income Tax Vs Bharath Fritz Werner Ltd. ITAT BangaloreRavi AgarwalNo ratings yet

- In The High Court of Delhi at New Delhi: W.P. (C) 7010/2020 & Other Connected Matters Page 1 of 5Document5 pagesIn The High Court of Delhi at New Delhi: W.P. (C) 7010/2020 & Other Connected Matters Page 1 of 5Ekansh Arora0% (1)

- DCIT Vs Nirshilp Securities Pvt. Ltd. ITAT MumbaiDocument63 pagesDCIT Vs Nirshilp Securities Pvt. Ltd. ITAT MumbaiCA Prakash Chandra BhandariNo ratings yet

- Final Memo For Appellants 2018Document20 pagesFinal Memo For Appellants 2018Pravesh BishnoiNo ratings yet

- Sesa Goa Limited Vs Joint Commissioner of Income Tax Bombay High CourtDocument22 pagesSesa Goa Limited Vs Joint Commissioner of Income Tax Bombay High CourtPurnima ShekharNo ratings yet

- Case No. 13 of 2020 Page 1 of 6Document6 pagesCase No. 13 of 2020 Page 1 of 6Simran KaurNo ratings yet

- Gen PDFDocument13 pagesGen PDFKapil SharmaNo ratings yet

- Team Code: T-05A: in The Matter ofDocument17 pagesTeam Code: T-05A: in The Matter ofSiddhant SodhiaNo ratings yet

- W.P. Nos.2885, 2888, 2890,3930, 3936 and 3933 of 2020 & WMP Nos.3341, 3345, 3336, 4664, 4656 and 4661 of 2020 W.P.No.2885 of 2021Document8 pagesW.P. Nos.2885, 2888, 2890,3930, 3936 and 3933 of 2020 & WMP Nos.3341, 3345, 3336, 4664, 4656 and 4661 of 2020 W.P.No.2885 of 2021A AgarwalNo ratings yet

- Big Bazaar Vs Ashok KumarDocument11 pagesBig Bazaar Vs Ashok KumarHJ ManviNo ratings yet

- Swiss Ribbson V Union of IndiaDocument149 pagesSwiss Ribbson V Union of IndiaskvaleeNo ratings yet

- Tata Eng.Document10 pagesTata Eng.Aastha SinghNo ratings yet

- 04 - Opposite Party Memo FINAL DRAFTDocument27 pages04 - Opposite Party Memo FINAL DRAFTSANJANA.SNo ratings yet

- MSME ACT Overrides Arb Act 1996Document23 pagesMSME ACT Overrides Arb Act 1996amanNo ratings yet

- 2020 1 1503 39396 Judgement 31-Oct-2022Document56 pages2020 1 1503 39396 Judgement 31-Oct-2022Kamaksshee KhajuriaNo ratings yet

- Before The Hon'Ble National Company Law Tribunal of Titan: Memorial On Behalf of ApplicantDocument26 pagesBefore The Hon'Ble National Company Law Tribunal of Titan: Memorial On Behalf of ApplicantSiddharth TripathiNo ratings yet

- Team-Oleander (Petitioner Memorial)Document25 pagesTeam-Oleander (Petitioner Memorial)superman1996femaleNo ratings yet

- WP57879 16 26 09 2023Document25 pagesWP57879 16 26 09 2023vinay rakshithNo ratings yet

- Cas3 LawsDocument2 pagesCas3 LawsK R Rajeev KrishnanNo ratings yet

- Math ResearchDocument5 pagesMath ResearchChikesh SahooNo ratings yet

- ITAT Bangalaore Holds Interest Dividend Income From Investment With Cooperative Society Is Entitled To Deduction Us 80 P (2) (D) of Income Tax Act ITAT Remits To AO For Fresh Consideration.Document6 pagesITAT Bangalaore Holds Interest Dividend Income From Investment With Cooperative Society Is Entitled To Deduction Us 80 P (2) (D) of Income Tax Act ITAT Remits To AO For Fresh Consideration.KAMAL SINGHNo ratings yet

- APPELANTDocument30 pagesAPPELANTTAS MUNNo ratings yet

- IA No. 843/2020 in CP (IB) No.121/Chd/Pb/2018 (Admitted)Document6 pagesIA No. 843/2020 in CP (IB) No.121/Chd/Pb/2018 (Admitted)NivasNo ratings yet

- Tata Engineering and Locomotive ... Vs State of Bihar and Others On 25 February, 1964 PDFDocument14 pagesTata Engineering and Locomotive ... Vs State of Bihar and Others On 25 February, 1964 PDFaditya_chandra9291No ratings yet

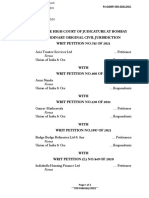

- In The High Court of Judicature at Bombay Ordinary Original Civil Jurisdiction Writ Petition No.785 of 2021Document3 pagesIn The High Court of Judicature at Bombay Ordinary Original Civil Jurisdiction Writ Petition No.785 of 2021Abhineet SharmaNo ratings yet

- CL-07 ApplicantDocument29 pagesCL-07 ApplicantShivamp6No ratings yet

- 10th Sem MemorialDocument22 pages10th Sem Memorialmunmun kadamNo ratings yet

- Bureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamFrom EverandBureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamNo ratings yet

- Maple Leaf Internship ReportDocument91 pagesMaple Leaf Internship Reportyaser_ar20051929100% (7)

- Instructions To TenderersDocument25 pagesInstructions To TenderersАліна Гуляйгродська100% (1)

- Candidate Information Booklet For The Real Estate Sales Associate ExaminationDocument17 pagesCandidate Information Booklet For The Real Estate Sales Associate Examinationnour abdallaNo ratings yet

- Kepatuhan Wajib Pajak Kendaraan Bermotor: Studi Kritis Empiris Di Daerah Khusus Istimewa JakartaDocument16 pagesKepatuhan Wajib Pajak Kendaraan Bermotor: Studi Kritis Empiris Di Daerah Khusus Istimewa Jakartaulya71014No ratings yet

- Atrill Capital Structure SlidesDocument8 pagesAtrill Capital Structure SlidesEYmran RExa XaYdiNo ratings yet

- GST in India - An IntroductionDocument24 pagesGST in India - An IntroductionMehak KaushikkNo ratings yet

- Tire City - WorksheetDocument3 pagesTire City - WorksheetBach CaoNo ratings yet

- L2 - Group No.3 - Berjaya CorporationDocument22 pagesL2 - Group No.3 - Berjaya CorporationYONG YI HONo ratings yet

- Insurance GovernanceDocument73 pagesInsurance GovernanceTarun Kumar SinghNo ratings yet

- 7 ElevenDocument20 pages7 ElevenArmyrule HawkameNo ratings yet

- TaxitionDocument55 pagesTaxitionZakirullah ZakiNo ratings yet

- MahindraDocument5 pagesMahindraworkf17hoursformeNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationvijaykumartaxNo ratings yet

- Acca f6 Taxation Vietnam 2011 Dec AnswerDocument8 pagesAcca f6 Taxation Vietnam 2011 Dec AnswerNguyễn GiangNo ratings yet

- Tutorial 4 Q and ADocument7 pagesTutorial 4 Q and ASwee Yi LeeNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)sandeep patilNo ratings yet

- SGLGB Form 3. Technical NotesDocument9 pagesSGLGB Form 3. Technical Notesnenita t. sison100% (2)

- An Overview of The Natural Gas Sector in TanzaniaDocument11 pagesAn Overview of The Natural Gas Sector in TanzaniaHussein BoffuNo ratings yet

- 21 CIR vs. BASF Coating + Inks Phils., Inc. (GR No. 198677 Dated November 26, 2014)Document17 pages21 CIR vs. BASF Coating + Inks Phils., Inc. (GR No. 198677 Dated November 26, 2014)Alfred GarciaNo ratings yet

- qCh.3 Topic 2-Taxes (Direct and Indirect)Document7 pagesqCh.3 Topic 2-Taxes (Direct and Indirect)Joshua MaNo ratings yet

- Wage Determination in The Irish Economy - Ruane Lyons QEC 2002Document17 pagesWage Determination in The Irish Economy - Ruane Lyons QEC 2002Ronan LyonsNo ratings yet

- Ao No. 03 s14 Guidelines in The Disposition of Untitled Privately Claimed Agricultural Lands PDFDocument18 pagesAo No. 03 s14 Guidelines in The Disposition of Untitled Privately Claimed Agricultural Lands PDFchachiNo ratings yet

- InvoiceDocument2 pagesInvoicedevesh6900No ratings yet

- CFA III Individual投资者关键词清单Document26 pagesCFA III Individual投资者关键词清单Thanh NguyenNo ratings yet

- WESM Participant Handbook Vol3Document18 pagesWESM Participant Handbook Vol3midas33No ratings yet

- Ship Operations AssignmentDocument9 pagesShip Operations AssignmentBruno MadalenoNo ratings yet

- Statements of Comprehensive IncomeDocument7 pagesStatements of Comprehensive IncomewawanNo ratings yet

- The Origins of Tax Systems: A French-American Comparison: Kjmorgan@gwu - Edu M-Prasad@northwestern - EduDocument65 pagesThe Origins of Tax Systems: A French-American Comparison: Kjmorgan@gwu - Edu M-Prasad@northwestern - EduHa JeepNo ratings yet

- Right Thing To DoDocument45 pagesRight Thing To DoThomas DoubterNo ratings yet

In The High Court at Calcutta: Subrata

In The High Court at Calcutta: Subrata

Uploaded by

parmodOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In The High Court at Calcutta: Subrata

In The High Court at Calcutta: Subrata

Uploaded by

parmodCopyright:

Available Formats

www.taxguru.

in

IN THE HIGH COURT AT CALCUTTA

13-12-2021 Constitutional Writ Jurisdiction

Item No.1-8 Appellate Side

Subrata

WPA No.23512 of 2019

M/s LGW Industries Limited & Ors.

–vs-

Union of India & Ors.

with

WPA No.10776 of 2021

Anmol Industries Ltd. & Anr.

-vs-

Union of India & Ors.

with

WPA No.12964 of 2019

Surya Alloy Industries Ltd. & Anr.

-vs-

Union of India & Ors.

with

CAN No.1 of 2021

with

WPA No.6768 of 2020

Raj Metal Industries & Anr.

-vs-

Union of India & Ors.

with

WPA No.6771 of 2020

Raj Metal Industries & Anr.

-vs-

Union of India & Ors.

with

CAN No.1 of 2020

(Old CAN No.5711 of 2020)

with

WPA No.7285 of 2020

M/s. LGW Industries Ltd. & Ors.

-vs-

Union of India & Ors.

with

CAN No.1 of 2020

with

WPA No.8195 of 2020

Victoria Global & Anr.

-vs-

Union of India & Ors.

and

WPA No.8289 of 2021

Raj Metal Industries & Anr.

-vs-

Joint Commissioner, Sales Tax & Ors.

Mr. Vinay Kumar Shraff

Mr. Himangshu Kumar Ray

Ms. Priya Sarah Paul …for the petitioners

(in all writ petitions, except WPA 12964/2019)

www.taxguru.in

2

Mr. Jaydip Kar, sr. adv.

Mr. Arijit Chakraborty

Mr. Debsoumya Basak

Mr. Pranit Bag

Mr. Nilotpal Chowdhury

Mr. Prabir Bera

Mr. Subhas Chandra Jana

Mr. V. Neogi

Mr. D. Saha …for the petitioners

(in WPA 12964/2019)

Mr Y.J. Dastoor, Additional Solicitor-General

Mr. S. Bhattacharya

Mr. V. Kundalia

Mr. S. Lahiri

Mr. Tapan Bhanja

Mr. Sujit Mitra …for the Union of India

Mr. K.K. Maiti

Mr. Amitabha Roy

Mr. Bhaskar Prasad Banerjee

Mr. Somnath Ganguli

Ms. Sabnam Basu

Ms. Manasi Mukherjee

Mr. Sukalpa Seal …for Customs

Mr. S.N. Mookherjee, Advocate-General

Mr. A. Ray, Government Pleader

Md. T.M. Siddiqui

Mr. S. Mukherjee

Mr. D. Ghosh

Mr. N. Chatterjee …for the State

In view of similarity in facts and questions of law

involved in the writ petitions in item nos. 1, 4, 6 and 8 -

WPA No.23512 of 2019, WPA No.6768 of 2020, WPA

No.7285 of 2020 with CAN No.1 of 2020 and WPA No.8289

of 2021, these are heard together and disposed of by a

common order.

The petitioners in those writ petitions are aggrieved

by the impugned notices issued by the respondents

concerned for not allowing the petitioners, who are the

purchasers of the goods in question and refusing to grant

the benefit of input tax credit (ITC) on purchase from the

www.taxguru.in

3

suppliers and also asking the petitioners to pay penalty and

interest under relevant provisions of GST Act.

Petitioners have also challenged the constitutional

validity of section 16(2)(c) of the CGST/WBGST Act, which,

according to me, does not require consideration in these

cases, since it appears on perusal of relevant record that

the refusal to grant benefit of input tax credit (ITC) to the

petitioners are not on the grounds of non-deposit of tax in

the Government account by the suppliers which have been

collected from the petitioners, under Section 16 (2) (c) of the

CGST/WBGST Act.

In these cases, it is the case of the respondents-GST

authorities that on inquiry, they came to know that the

suppliers from whom the petitioners/buyers are claiming to

have purchased the goods in question are all fake and non-

existing and the bank accounts opened by those suppliers

are on the basis of fake documents and petitioners’ claim of

benefit of input tax credit are not supported by the relevant

documents, and the case of the respondents is also that the

petitioners have not verified the genuineness and identity of

the aforesaid suppliers who are registered taxable persons

(RTP) before entering into any transaction with those

suppliers.

Further grounds of denying the input tax credit

benefit to the petitioners by the respondents are that the

registration of suppliers in question has already been

cancelled with retrospective effect covering the transactions

period in question.

The main contention of the petitioners in these writ

petitions are that the transactions in question are genuine

and valid by relying upon all the supporting relevant

documents required under law and contend that petitioners

with their due diligence have verified the genuineness and

www.taxguru.in

4

identity of the suppliers in question and more particularly

the names of those suppliers as registered taxable person

were available at the Government portal showing their

registrations as valid and existing at the time of

transactions in question and petitioners submit that they

have limitation on their part in ascertaining the validity and

genuineness of the suppliers in question and they have

done whatever possible in this regard and more so, when

the names of the suppliers as a registered taxable person

were already available with the Government record and in

Government portal at the relevant period of transaction

petitioners could not be faulted if they appeared to be fake

later on. Petitioners further submit that they have paid the

amount of purchases in question as well as tax on the same

not in cash and all transactions were through banks and

petitioners are helpless if at some point of time after the

transactions were over, if the respondents concerned finds

on enquiries that the aforesaid suppliers (RTP) were fake

and bogus and on this basis petitioners could not be

penalised unless the department/respondents establish

with concrete materials that the transactions in question

were the outcome of any collusion between the

petitioners/purchasers and the suppliers in question.

Petitioners further submit that all the purchases in

question invoices-wise were available on the GST portal in

form GSTR-2A which are matters of record.

Considering the facts as recorded subject to further

verification it cannot be said that that there was any failure

on the part of the petitioners in compliance of any

obligation required under the statute before entering the

transactions in question or for verification of the

genuineness of the suppliers in question.

The petitioners in support of their contention and

proposition of law as discussed above rely on the following

www.taxguru.in

5

decisions:–

1) Commissioner of C. Ex. East Singhbhum v. Tata Motors

Ltd. reported in 2013 (294) ELT 394 (Jhar).

2) R.S. Infra-Transmission Ltd. v. State of Rajasthan

through its Secretary, Ministry of Finance in Civil Writ

Petition No.12445/2016 passed by the High Court of

Rajasthan Bench at Jaipur.

3) Commissioner of Trade & Taxes, Delhi & 66 Ors. v. Arise

India Limited & Ors. reported in TS-2 SC-2018-VAT.

4) On Quest Merchandising India Pvt. Ltd. v. Government

on NCT of Delhi, reported in TS314-HC 2017 (Del)-VAT;

2018 (10) GSTL. 182 (Del);

5) M/s. Tarapore & Company, Jamshedspur v. The State of

Jharkhand in W.P.(T) No. 773 of 2018 passed by

Jharkhand High Court;

6) Gheru Lal Bal chand v. State of Haryana reported in

(2011) 45 VST 195 (P&H);

7) D.Y. Beathel enterprises v. State Tax Officer (Data Cell)

Tiruneveli reported in (2021) 127 Taxman. Com 80

(Madras);

8) Taparia Overseas (P) Ltd. v. Union of India reported in

2003 (161) E.L.T. 47 (Bom);

9) Prayagaj Dying & Printing Mills Pvt. Ltd. v. Union of India

reported in 2013 (290) ELT 61 (Guj);

10) Star Plastic Industries v. Additional Commissioner of

Sales Tax (Appeal) & Ors. reported 2021 SC OnLine Ori

1618; and

11) State of Maharashta v. Suresh Trading Company

reported in (1998) 109 STC 439 (SC).

The respondents have relied on the following

decisions in support of their contention:–

1) P. R. Mani Electronics v. Union of India reported in 2020

TIOL-1198 HC Mad GST;

2) ALD Automotive Pvt. Ltd. v. The Commercial Tax Officer,

reported in 2019 (13) SCC 225;

www.taxguru.in

6

3) Jayram & Co. v. Assistant Commissioner & Ors. reported

in 2016 (15) SCC 125;

4) Godrej & Boycentg & Co. Pvt. Ltd. v. GST reported in

1992 (3) SCC 624;

5) TVS Motors v. State of Tamil Nadu reported in 2019 (13)

SCC 403;

(6) Collector of Ex Commissioner v. Douba Cooperative

Sugar Mills Ltd. reported in 1988 (37) ELT-478; and

7) D.Y. Bethal Enterprise v. The State Tax Officer (Data Cell)

in W.P. (MD) No.2127 of 2021.

Considering the submission of the parties and on

perusal of records available, these writ petitions are

disposed of by remanding these cases to the respondents

concerned to consider afresh the cases of the petitioners on

the issue of their entitlement of benefit of input tax credit in

question by considering the documents which the

petitioners want to rely in support of their claim of

genuineness of the transactions in question and shall also

consider as to whether payments on purchases in question

along with GST were actually paid or not to the suppliers

(RTP) and also to consider as to whether the transactions

and purchases were made before or after the cancellation of

registration of the suppliers and also consider as to

compliance of statutory obligation by the petitioners in

verification of identity of the suppliers (RTP).

If it is found upon considering the relevant

documents that all the purchases and transactions in

question are genuine and supported by valid documents

and transactions in question were made before the

cancellation of registration of those suppliers and after

taking into consideration the judgments of the Supreme

Court and various High Courts which have been referred in

this order and in that event the petitioners shall be given

the benefit of input tax credit in question.

www.taxguru.in

7

These cases of the petitioners shall be disposed of by

the respondents concerned in accordance with law and in

the light of observation made above and by passing a

reasoned and speaking order after giving effective

opportunity of hearing to the petitioners and by dealing

with the judgments petitioners want to rely at the time of

hearing of the cases, within eight weeks from the date of

communication of this order.

These Writ Petitions being WPA No.23512 of 2019,

WPA No.6768 of 2020, WPA No.7285 of 2020 with CAN No.1

of 2020 and WPA No.8289 of 2021 are disposed of in the

light of observation and directions as made above.

Further, let these Writ Petitions being WPA No.

10776 of 2021, WPA No. 12964 of 2019, WPA No. 6771 of

2020 with CAN No. 1 of 2020 (Old CAN No. 5711 of 2020)

and WPA No. 8195 of 2020 be listed for hearing two weeks

after the Christmas Vacation.

[Md. Nizamuddin, J]

You might also like

- Chapter 06 - SamplesDocument3 pagesChapter 06 - SamplesJessica ZhangNo ratings yet

- LawFinder 2056403Document26 pagesLawFinder 2056403Adv Shyam KGNo ratings yet

- Gujarat State Civil Supplies Corporation Ltd. Vs Mahakali Foods Pvt. Ltd. (Unit 2)Document22 pagesGujarat State Civil Supplies Corporation Ltd. Vs Mahakali Foods Pvt. Ltd. (Unit 2)Vashishtha AakashNo ratings yet

- (P. 81 & 82) Jalgaon Janta Sahakari Bank Ltd. Vs Joint Commissioner of Sales TaxDocument155 pages(P. 81 & 82) Jalgaon Janta Sahakari Bank Ltd. Vs Joint Commissioner of Sales TaxAtik Mohd.No ratings yet

- Videocon Industries Ltd. Ma 1306 of 2018 CP 02 - 2018 NCLT On 08.08.2019 FinalDocument52 pagesVideocon Industries Ltd. Ma 1306 of 2018 CP 02 - 2018 NCLT On 08.08.2019 FinalWishwaPratapTomerNo ratings yet

- Vrj/Agk: wp4128-2021 & Connected-FinalDocument56 pagesVrj/Agk: wp4128-2021 & Connected-FinalCA Jay ShahNo ratings yet

- Supreme Court Decision - 2022Document24 pagesSupreme Court Decision - 2022akanshavarma44No ratings yet

- Synergy JudgmentDocument177 pagesSynergy JudgmentNikhil Mohan GoyalNo ratings yet

- Ambaradi Seva Sahkari Mandali Vs The Dcit CPC Bangaluru On 10 February 2023Document9 pagesAmbaradi Seva Sahkari Mandali Vs The Dcit CPC Bangaluru On 10 February 2023taxationsocietyNo ratings yet

- PETITIONER-Midas Online GamesDocument27 pagesPETITIONER-Midas Online GamesGeerthana ArasuNo ratings yet

- National Textile Corporation Vs Elixir Engineering 464817Document31 pagesNational Textile Corporation Vs Elixir Engineering 464817Sachika VijNo ratings yet

- J 2017 SCC OnLine CCI 48 Manasclatprep Gmailcom 20240320 103534 1 43Document43 pagesJ 2017 SCC OnLine CCI 48 Manasclatprep Gmailcom 20240320 103534 1 43Manas AaNo ratings yet

- Vidya Suresh AminDocument3 pagesVidya Suresh AminShyam APA JurisNo ratings yet

- Bombay wp-1537-2023Document22 pagesBombay wp-1537-2023surajsharma199705No ratings yet

- RESPONDENT-The GST DepartmentDocument29 pagesRESPONDENT-The GST DepartmentGeerthana ArasuNo ratings yet

- T10DDocument40 pagesT10DmsNo ratings yet

- Team-Oleander (Respondent Memorial)Document21 pagesTeam-Oleander (Respondent Memorial)superman1996femaleNo ratings yet

- TC - 03 Respondent PDFDocument28 pagesTC - 03 Respondent PDFShivamp6No ratings yet

- Trademark Dispute MemoDocument21 pagesTrademark Dispute MemoSidharath GoyalNo ratings yet

- Dhanappa I. Koshti: Judgment-WPL 2880/2020Document17 pagesDhanappa I. Koshti: Judgment-WPL 2880/2020ReachNo ratings yet

- In The High Court of Delhi at New Delhi W.P. (C) 5918/2020Document8 pagesIn The High Court of Delhi at New Delhi W.P. (C) 5918/2020Ekansh AroraNo ratings yet

- Uils I D M C C, 2018: in The Matter ofDocument23 pagesUils I D M C C, 2018: in The Matter ofuditiNo ratings yet

- Supreme Court Monsanto Nuziveedu InvnTree Aug1stDocument9 pagesSupreme Court Monsanto Nuziveedu InvnTree Aug1stkira-auditoreNo ratings yet

- Memorial Submission - AppellantDocument26 pagesMemorial Submission - AppellantSAUMYA RAI 19213032No ratings yet

- Ca Final New Syllabus Elective Paper 6D Economic Laws: Summary of Significant Case LawsDocument38 pagesCa Final New Syllabus Elective Paper 6D Economic Laws: Summary of Significant Case Lawslakshmi kbNo ratings yet

- CIA 3 Economics LawDocument8 pagesCIA 3 Economics Lawsovit agarwalNo ratings yet

- Bharti Airtel LTD and Ors Vs Vijaykumar V Iyer (MA230) PDFDocument29 pagesBharti Airtel LTD and Ors Vs Vijaykumar V Iyer (MA230) PDFAditya SharmaNo ratings yet

- Intra Moot Respondent HPDocument24 pagesIntra Moot Respondent HPswastik groverNo ratings yet

- KAR AAAR 14F 2019-20 ManipalEnergyInfratechLtdDocument13 pagesKAR AAAR 14F 2019-20 ManipalEnergyInfratechLtdjainrushab55No ratings yet

- DownloadedDocument26 pagesDownloadedMohanNo ratings yet

- Final Memo For Respondent 2018Document19 pagesFinal Memo For Respondent 2018Pravesh BishnoiNo ratings yet

- Memorial Submission RespondentDocument26 pagesMemorial Submission RespondentSAUMYA RAI 19213032No ratings yet

- The Deputy Commissioner of Income Tax Vs Bharath Fritz Werner Ltd. ITAT BangaloreDocument6 pagesThe Deputy Commissioner of Income Tax Vs Bharath Fritz Werner Ltd. ITAT BangaloreRavi AgarwalNo ratings yet

- In The High Court of Delhi at New Delhi: W.P. (C) 7010/2020 & Other Connected Matters Page 1 of 5Document5 pagesIn The High Court of Delhi at New Delhi: W.P. (C) 7010/2020 & Other Connected Matters Page 1 of 5Ekansh Arora0% (1)

- DCIT Vs Nirshilp Securities Pvt. Ltd. ITAT MumbaiDocument63 pagesDCIT Vs Nirshilp Securities Pvt. Ltd. ITAT MumbaiCA Prakash Chandra BhandariNo ratings yet

- Final Memo For Appellants 2018Document20 pagesFinal Memo For Appellants 2018Pravesh BishnoiNo ratings yet

- Sesa Goa Limited Vs Joint Commissioner of Income Tax Bombay High CourtDocument22 pagesSesa Goa Limited Vs Joint Commissioner of Income Tax Bombay High CourtPurnima ShekharNo ratings yet

- Case No. 13 of 2020 Page 1 of 6Document6 pagesCase No. 13 of 2020 Page 1 of 6Simran KaurNo ratings yet

- Gen PDFDocument13 pagesGen PDFKapil SharmaNo ratings yet

- Team Code: T-05A: in The Matter ofDocument17 pagesTeam Code: T-05A: in The Matter ofSiddhant SodhiaNo ratings yet

- W.P. Nos.2885, 2888, 2890,3930, 3936 and 3933 of 2020 & WMP Nos.3341, 3345, 3336, 4664, 4656 and 4661 of 2020 W.P.No.2885 of 2021Document8 pagesW.P. Nos.2885, 2888, 2890,3930, 3936 and 3933 of 2020 & WMP Nos.3341, 3345, 3336, 4664, 4656 and 4661 of 2020 W.P.No.2885 of 2021A AgarwalNo ratings yet

- Big Bazaar Vs Ashok KumarDocument11 pagesBig Bazaar Vs Ashok KumarHJ ManviNo ratings yet

- Swiss Ribbson V Union of IndiaDocument149 pagesSwiss Ribbson V Union of IndiaskvaleeNo ratings yet

- Tata Eng.Document10 pagesTata Eng.Aastha SinghNo ratings yet

- 04 - Opposite Party Memo FINAL DRAFTDocument27 pages04 - Opposite Party Memo FINAL DRAFTSANJANA.SNo ratings yet

- MSME ACT Overrides Arb Act 1996Document23 pagesMSME ACT Overrides Arb Act 1996amanNo ratings yet

- 2020 1 1503 39396 Judgement 31-Oct-2022Document56 pages2020 1 1503 39396 Judgement 31-Oct-2022Kamaksshee KhajuriaNo ratings yet

- Before The Hon'Ble National Company Law Tribunal of Titan: Memorial On Behalf of ApplicantDocument26 pagesBefore The Hon'Ble National Company Law Tribunal of Titan: Memorial On Behalf of ApplicantSiddharth TripathiNo ratings yet

- Team-Oleander (Petitioner Memorial)Document25 pagesTeam-Oleander (Petitioner Memorial)superman1996femaleNo ratings yet

- WP57879 16 26 09 2023Document25 pagesWP57879 16 26 09 2023vinay rakshithNo ratings yet

- Cas3 LawsDocument2 pagesCas3 LawsK R Rajeev KrishnanNo ratings yet

- Math ResearchDocument5 pagesMath ResearchChikesh SahooNo ratings yet

- ITAT Bangalaore Holds Interest Dividend Income From Investment With Cooperative Society Is Entitled To Deduction Us 80 P (2) (D) of Income Tax Act ITAT Remits To AO For Fresh Consideration.Document6 pagesITAT Bangalaore Holds Interest Dividend Income From Investment With Cooperative Society Is Entitled To Deduction Us 80 P (2) (D) of Income Tax Act ITAT Remits To AO For Fresh Consideration.KAMAL SINGHNo ratings yet

- APPELANTDocument30 pagesAPPELANTTAS MUNNo ratings yet

- IA No. 843/2020 in CP (IB) No.121/Chd/Pb/2018 (Admitted)Document6 pagesIA No. 843/2020 in CP (IB) No.121/Chd/Pb/2018 (Admitted)NivasNo ratings yet

- Tata Engineering and Locomotive ... Vs State of Bihar and Others On 25 February, 1964 PDFDocument14 pagesTata Engineering and Locomotive ... Vs State of Bihar and Others On 25 February, 1964 PDFaditya_chandra9291No ratings yet

- In The High Court of Judicature at Bombay Ordinary Original Civil Jurisdiction Writ Petition No.785 of 2021Document3 pagesIn The High Court of Judicature at Bombay Ordinary Original Civil Jurisdiction Writ Petition No.785 of 2021Abhineet SharmaNo ratings yet

- CL-07 ApplicantDocument29 pagesCL-07 ApplicantShivamp6No ratings yet

- 10th Sem MemorialDocument22 pages10th Sem Memorialmunmun kadamNo ratings yet

- Bureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamFrom EverandBureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamNo ratings yet

- Maple Leaf Internship ReportDocument91 pagesMaple Leaf Internship Reportyaser_ar20051929100% (7)

- Instructions To TenderersDocument25 pagesInstructions To TenderersАліна Гуляйгродська100% (1)

- Candidate Information Booklet For The Real Estate Sales Associate ExaminationDocument17 pagesCandidate Information Booklet For The Real Estate Sales Associate Examinationnour abdallaNo ratings yet

- Kepatuhan Wajib Pajak Kendaraan Bermotor: Studi Kritis Empiris Di Daerah Khusus Istimewa JakartaDocument16 pagesKepatuhan Wajib Pajak Kendaraan Bermotor: Studi Kritis Empiris Di Daerah Khusus Istimewa Jakartaulya71014No ratings yet

- Atrill Capital Structure SlidesDocument8 pagesAtrill Capital Structure SlidesEYmran RExa XaYdiNo ratings yet

- GST in India - An IntroductionDocument24 pagesGST in India - An IntroductionMehak KaushikkNo ratings yet

- Tire City - WorksheetDocument3 pagesTire City - WorksheetBach CaoNo ratings yet

- L2 - Group No.3 - Berjaya CorporationDocument22 pagesL2 - Group No.3 - Berjaya CorporationYONG YI HONo ratings yet

- Insurance GovernanceDocument73 pagesInsurance GovernanceTarun Kumar SinghNo ratings yet

- 7 ElevenDocument20 pages7 ElevenArmyrule HawkameNo ratings yet

- TaxitionDocument55 pagesTaxitionZakirullah ZakiNo ratings yet

- MahindraDocument5 pagesMahindraworkf17hoursformeNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationvijaykumartaxNo ratings yet

- Acca f6 Taxation Vietnam 2011 Dec AnswerDocument8 pagesAcca f6 Taxation Vietnam 2011 Dec AnswerNguyễn GiangNo ratings yet

- Tutorial 4 Q and ADocument7 pagesTutorial 4 Q and ASwee Yi LeeNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)sandeep patilNo ratings yet

- SGLGB Form 3. Technical NotesDocument9 pagesSGLGB Form 3. Technical Notesnenita t. sison100% (2)

- An Overview of The Natural Gas Sector in TanzaniaDocument11 pagesAn Overview of The Natural Gas Sector in TanzaniaHussein BoffuNo ratings yet

- 21 CIR vs. BASF Coating + Inks Phils., Inc. (GR No. 198677 Dated November 26, 2014)Document17 pages21 CIR vs. BASF Coating + Inks Phils., Inc. (GR No. 198677 Dated November 26, 2014)Alfred GarciaNo ratings yet

- qCh.3 Topic 2-Taxes (Direct and Indirect)Document7 pagesqCh.3 Topic 2-Taxes (Direct and Indirect)Joshua MaNo ratings yet

- Wage Determination in The Irish Economy - Ruane Lyons QEC 2002Document17 pagesWage Determination in The Irish Economy - Ruane Lyons QEC 2002Ronan LyonsNo ratings yet

- Ao No. 03 s14 Guidelines in The Disposition of Untitled Privately Claimed Agricultural Lands PDFDocument18 pagesAo No. 03 s14 Guidelines in The Disposition of Untitled Privately Claimed Agricultural Lands PDFchachiNo ratings yet

- InvoiceDocument2 pagesInvoicedevesh6900No ratings yet

- CFA III Individual投资者关键词清单Document26 pagesCFA III Individual投资者关键词清单Thanh NguyenNo ratings yet

- WESM Participant Handbook Vol3Document18 pagesWESM Participant Handbook Vol3midas33No ratings yet

- Ship Operations AssignmentDocument9 pagesShip Operations AssignmentBruno MadalenoNo ratings yet

- Statements of Comprehensive IncomeDocument7 pagesStatements of Comprehensive IncomewawanNo ratings yet

- The Origins of Tax Systems: A French-American Comparison: Kjmorgan@gwu - Edu M-Prasad@northwestern - EduDocument65 pagesThe Origins of Tax Systems: A French-American Comparison: Kjmorgan@gwu - Edu M-Prasad@northwestern - EduHa JeepNo ratings yet

- Right Thing To DoDocument45 pagesRight Thing To DoThomas DoubterNo ratings yet