Professional Documents

Culture Documents

Auditing

Auditing

Uploaded by

PrincessOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing

Auditing

Uploaded by

PrincessCopyright:

Available Formats

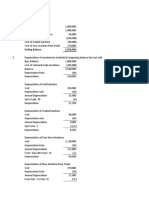

1.

a. Describe two conditions that might indicate the recording of fraudulent sales.

Suspicious year-end sales to a single or few customer that is unusually

large compared to other sales transactions.

Questionably large amount of sales return after the reporting date

b. Define bill and hold transactions and describe the audit significance of such

transactions.

Sales that are billed by the seller but are not yet delivered to buyer are

known as bill-and-hold transactions. The relevance of these transactions

to audit is the timing of revenue recognition because for the transaction

to qualify as a sale, it must first meet strict accounting criteria.

c. Define channel stuffing and describe the audit significance of this practice.

Channel stuffing is a method of artificially boosting a company's revenues

or sales just before a reporting period. It may also mean the process of

providing enormous incentives to resellers to buy significantly more

goods than they can resale in a regular length of time. The significance of

this practice in audit is the level of tests that an auditor should carry out

due to the fallacy that this practice creates making the company looks

better than it actually is and resulting to a substantial amount of sales

returns after the reporting date.

2.

a. For effective control over credit sales, describe four major functions that should

be segregated.

Authorization of sales.

Credit approval.

Billing of accounts.

Maintenance of accounting records.

b. In addition to adequate segregation of duties, describe two other internal

controls over sales transactions.

Purchase order authorization over a certain limit and authorization over

receivables write-offs.

Pre-numbering shipping documents that are accounted for by the billing

department.

3.

a. Describe three conditions which should exist for the auditors to use the

negative form of request.

Control risk and inherent risk is low

Large number of accounts with small balances

There's reason to believe the individual receiving the confirmation will

consider the request.

b. If a response is not received to an initial positive confirmation request,

describe the action that should be taken by the auditors, including a discussion of

alternative auditing procedures.

Send another request.

Consider sending another request or contact the customer

Perform alternative auditing procedures including:

• Examining subsequent cash receipts.

• Vouching transactions making up the account balance to invoices and

shipping documents.

• Establishing the validity of the customer.

You might also like

- JKJ Pension Funds AssignmentDocument14 pagesJKJ Pension Funds AssignmentRitdhwara Data0% (2)

- Fulfillment Services AgreementDocument4 pagesFulfillment Services AgreementRocketLawyer67% (3)

- Summary Selling Today Partnering To Create Value Chapter 1 PDFDocument3 pagesSummary Selling Today Partnering To Create Value Chapter 1 PDFAayush SinhaNo ratings yet

- Sales Force ManagementDocument17 pagesSales Force Managementapi-377461433% (3)

- Chapter 16 HomeworkDocument9 pagesChapter 16 HomeworkRin ZhafiraaNo ratings yet

- Brannon Chapter 5Document49 pagesBrannon Chapter 5fairchildbooks100% (2)

- Trade IndiaDocument12 pagesTrade IndiaDeepali PanditNo ratings yet

- Avenue Supermarket - Team11Document13 pagesAvenue Supermarket - Team11harsh069550% (2)

- Cost Sheet of Cadbury MilkDocument6 pagesCost Sheet of Cadbury Milkamya_sinha1163% (8)

- Operation MGT Indivitual AssignmentDocument10 pagesOperation MGT Indivitual AssignmentEyu Des100% (1)

- ReceivablesDocument9 pagesReceivablesThinagari JevataranNo ratings yet

- Chapter Three-Auditing Receivables and SalesDocument4 pagesChapter Three-Auditing Receivables and SalesBantamkak FikaduNo ratings yet

- Tusming 3 Audit Rivialdo Kazhadiva 023002000012Document4 pagesTusming 3 Audit Rivialdo Kazhadiva 023002000012Fosu- XNo ratings yet

- Audit On ReceivablesDocument7 pagesAudit On ReceivablesVenus Lyka LomocsoNo ratings yet

- Ato Asrat Audit 2 Chapter 1Document48 pagesAto Asrat Audit 2 Chapter 1yebegashetNo ratings yet

- IC3 Audit Procedures by Transaction Cycle Part 1Document12 pagesIC3 Audit Procedures by Transaction Cycle Part 1ReynaLyn TangaranNo ratings yet

- CH 14 WebDocument29 pagesCH 14 WebDaniel TadejaNo ratings yet

- Audit Procedure ReceivablesDocument3 pagesAudit Procedure ReceivablesayyazmNo ratings yet

- Allen AuditDocument3 pagesAllen AuditERICK MLINGWANo ratings yet

- How Do Different Levels of Control Risk in The RevDocument3 pagesHow Do Different Levels of Control Risk in The RevHenry L BanaagNo ratings yet

- Chap 011Document36 pagesChap 011Angel TumamaoNo ratings yet

- Audit of The Sales and Collection CycleDocument5 pagesAudit of The Sales and Collection Cyclemrs lee100% (1)

- Subs Testing Proc AAADocument18 pagesSubs Testing Proc AAARosario Garcia CatugasNo ratings yet

- AP-03 Purchase To Pay Process - Audit of Trade PayablesDocument19 pagesAP-03 Purchase To Pay Process - Audit of Trade PayablesKate NuevaNo ratings yet

- Project IN AuditingDocument9 pagesProject IN AuditingToniNo ratings yet

- Exam 3 Practice QuestionsDocument19 pagesExam 3 Practice QuestionsrogealynNo ratings yet

- Chapter 14Document37 pagesChapter 14Bảo TrungNo ratings yet

- Acctg 16a Final Exam AnswerDocument4 pagesAcctg 16a Final Exam AnswerLy JaimeNo ratings yet

- CA Inter (QB) - Chapter 5Document85 pagesCA Inter (QB) - Chapter 5Aishu SivadasanNo ratings yet

- ACC 403 Homework CH 10 and 11Document5 pagesACC 403 Homework CH 10 and 11leelee0302100% (1)

- Overall Responses 5Document7 pagesOverall Responses 5hmmmmnNo ratings yet

- Exercises - SC 14 AudDocument4 pagesExercises - SC 14 AudSarah GherdaouiNo ratings yet

- Kunci Jawaban Module 5Document4 pagesKunci Jawaban Module 5meyyNo ratings yet

- Chapter 4 Internal Control Sales and CashDocument82 pagesChapter 4 Internal Control Sales and Cashtrangalc123No ratings yet

- Chapter 6Document8 pagesChapter 6Jesther John VocalNo ratings yet

- Aguila, Paulo Timothy - Cis c9Document3 pagesAguila, Paulo Timothy - Cis c9Paulo Timothy AguilaNo ratings yet

- Audit of ReceivablesDocument23 pagesAudit of ReceivablesBridget Zoe Lopez BatoonNo ratings yet

- Quiz Auditing II Before Midtest Ubakrie April 23, 2021Document9 pagesQuiz Auditing II Before Midtest Ubakrie April 23, 2021Wisnu Aldi WibowoNo ratings yet

- Auditing The Revenue CycleDocument2 pagesAuditing The Revenue CycleBella PatriceNo ratings yet

- Test 1 - 2022Document3 pagesTest 1 - 2022Ten Lee0% (1)

- Auditing Revenue Cycle HandoutDocument8 pagesAuditing Revenue Cycle HandoutwinidsolmanNo ratings yet

- Chapter08 - Answer Cabrera Applied Auditing 2007Document29 pagesChapter08 - Answer Cabrera Applied Auditing 2007Pau Laguerta100% (6)

- Positive Confirmations Requests That A Customer Review The Account Balance Listed On TheDocument4 pagesPositive Confirmations Requests That A Customer Review The Account Balance Listed On TheERICK MLINGWANo ratings yet

- Auditing The Revenue Cycle: Prepared By: Sartini, S.E., M.SC., AktDocument30 pagesAuditing The Revenue Cycle: Prepared By: Sartini, S.E., M.SC., Akthanafi prasentiantoNo ratings yet

- 1 Order To Cash (O2C) ProcessesDocument6 pages1 Order To Cash (O2C) ProcessesanupriyaNo ratings yet

- Audit of The Sales and Collection Cycle: Tests of Controls Review Questions 12-1Document22 pagesAudit of The Sales and Collection Cycle: Tests of Controls Review Questions 12-1Tilahun MikiasNo ratings yet

- Chapter 5Document20 pagesChapter 5temedebereNo ratings yet

- Audit of ReceivableDocument26 pagesAudit of ReceivableHannah AngNo ratings yet

- Mcqs Audit - PRTC2Document16 pagesMcqs Audit - PRTC2jpbluejnNo ratings yet

- Signs The Checks LastDocument8 pagesSigns The Checks Lastboerd77No ratings yet

- Chapter 14 Audit of The Sales and Collection CycleDocument8 pagesChapter 14 Audit of The Sales and Collection CycleAaqib HossainNo ratings yet

- Nigel Uruilal - 008201800059 - Chapter 9 Auditing The Revenue Cycle - Assignment 9Document2 pagesNigel Uruilal - 008201800059 - Chapter 9 Auditing The Revenue Cycle - Assignment 9Nigel UruilalNo ratings yet

- Auditing and AssuranceDocument14 pagesAuditing and AssurancePrincess Vie RomeroNo ratings yet

- Chapter 2Document7 pagesChapter 2Jarra AbdurahmanNo ratings yet

- AP-300 (Audit of Liabilities)Document10 pagesAP-300 (Audit of Liabilities)Pearl Mae De VeasNo ratings yet

- Trade PayablesDocument2 pagesTrade PayablesMeghaNo ratings yet

- Audit Tut 8Document7 pagesAudit Tut 8najaneNo ratings yet

- Audit of Sales and ReceivablesDocument5 pagesAudit of Sales and ReceivablesTilahun S. Kura100% (1)

- Audit of Liabilities Theories QuestionsDocument3 pagesAudit of Liabilities Theories QuestionsFernalyn Calixtro SayoNo ratings yet

- Auditing Theory MCQsDocument21 pagesAuditing Theory MCQsDawn Caldeira100% (1)

- Audit of Receivables SCDocument8 pagesAudit of Receivables SCJames R JunioNo ratings yet

- III - A Audit of The Expenditure and Disbursements CycleDocument10 pagesIII - A Audit of The Expenditure and Disbursements CycleVan MateoNo ratings yet

- Audit On RevenueDocument27 pagesAudit On Revenue黄勇添No ratings yet

- Integration APDocument9 pagesIntegration AProcaholicnepsNo ratings yet

- Discussion QuestionsDocument3 pagesDiscussion QuestionsAzelie Judd0% (1)

- Methods Use To Gather EveidenceDocument9 pagesMethods Use To Gather EveidenceJaden EuNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 4.5 out of 5 stars4.5/5 (2)

- BDO Unibank 2020 Annual ReportDocument96 pagesBDO Unibank 2020 Annual ReportPrincessNo ratings yet

- Sustainability Report 2018Document68 pagesSustainability Report 2018PrincessNo ratings yet

- Policy Outline SuggestionDocument5 pagesPolicy Outline SuggestionPrincessNo ratings yet

- UB SR 2019 Digital 0521Document61 pagesUB SR 2019 Digital 0521PrincessNo ratings yet

- AT Quizzer (CPAR) - Audit SamplingDocument2 pagesAT Quizzer (CPAR) - Audit SamplingPrincessNo ratings yet

- Firm Infrastructure Risk Management Human Resources Technologic Al Developme NTDocument3 pagesFirm Infrastructure Risk Management Human Resources Technologic Al Developme NTPrincessNo ratings yet

- Annual Report 2020 - 06-04-2021Document342 pagesAnnual Report 2020 - 06-04-2021PrincessNo ratings yet

- Annual Report 2017 - 01-01-2018Document329 pagesAnnual Report 2017 - 01-01-2018PrincessNo ratings yet

- Annual Report 2019 - 07-31-2020Document336 pagesAnnual Report 2019 - 07-31-2020PrincessNo ratings yet

- Annual Report 2018 - 01-01-2019Document325 pagesAnnual Report 2018 - 01-01-2019PrincessNo ratings yet

- Annual Report 2016 - 01-01-2017Document277 pagesAnnual Report 2016 - 01-01-2017PrincessNo ratings yet

- Auditing ActivityDocument4 pagesAuditing ActivityPrincessNo ratings yet

- Labor LawDocument58 pagesLabor LawPrincessNo ratings yet

- Special Transaction ACtivityDocument4 pagesSpecial Transaction ACtivityPrincessNo ratings yet

- Labor LawDocument58 pagesLabor LawPrincessNo ratings yet

- Cash Fraud Schemes: The FraudsterDocument2 pagesCash Fraud Schemes: The FraudsterPrincessNo ratings yet

- Ra 10142 Financial Rehabilitaion and Insolvency ActDocument41 pagesRa 10142 Financial Rehabilitaion and Insolvency ActPrincessNo ratings yet

- Special TransactionDocument2 pagesSpecial TransactionPrincessNo ratings yet

- Business Combinations: Advantages Disadvantages T Y E PDocument1 pageBusiness Combinations: Advantages Disadvantages T Y E PPrincessNo ratings yet

- Pakistan Company Requirement 1: Journal EntryDocument4 pagesPakistan Company Requirement 1: Journal EntryPrincessNo ratings yet

- PROBLEM 1: Goodwill and Barain Purchase Option Requirement 1Document2 pagesPROBLEM 1: Goodwill and Barain Purchase Option Requirement 1PrincessNo ratings yet

- Rigidifying Global Financial Conditions and Inequality Brought Upon by Enduring PovertyDocument2 pagesRigidifying Global Financial Conditions and Inequality Brought Upon by Enduring PovertyPrincessNo ratings yet

- Shareholder's WealthDocument1 pageShareholder's WealthPrincessNo ratings yet

- Law On PatentDocument30 pagesLaw On PatentPrincessNo ratings yet

- 03 Logic Based DI Cetking CAT DILR150 Frequently Repeated QuestionsDocument2 pages03 Logic Based DI Cetking CAT DILR150 Frequently Repeated QuestionsSshivam AnandNo ratings yet

- Investment Center and Transfer PricingDocument10 pagesInvestment Center and Transfer Pricingrakib_0011No ratings yet

- Export of Cashew Nuts: Presented By: Gargi Vohra, R740209037, Mba - Ibm III - Sem UpesDocument39 pagesExport of Cashew Nuts: Presented By: Gargi Vohra, R740209037, Mba - Ibm III - Sem UpesBysani Vinod KumarNo ratings yet

- Anand Transformers Private LimitedDocument3 pagesAnand Transformers Private LimitedNamit GuptaNo ratings yet

- 8 Value of Supply - TYBCOM FinalDocument13 pages8 Value of Supply - TYBCOM FinalNew AccountNo ratings yet

- Dissertation PDFDocument78 pagesDissertation PDFrajeshaisdu009No ratings yet

- Hand-Out2 LP FormulationDocument6 pagesHand-Out2 LP FormulationPatricia Allison GaniganNo ratings yet

- Parts of Proposal in Buisness CommunicationDocument9 pagesParts of Proposal in Buisness CommunicationFalak Naz0% (1)

- Case Analysis - Sylhet PWD Vs Asob AliDocument3 pagesCase Analysis - Sylhet PWD Vs Asob Alinbh427No ratings yet

- IGSTDocument5 pagesIGSTAnonymous I5SUhZwNo ratings yet

- Cost-Volume-Profit AnalysisDocument6 pagesCost-Volume-Profit Analysisakashgupta67No ratings yet

- Markets For Product Modification Information: Ganesh Iyer - David SobermanDocument23 pagesMarkets For Product Modification Information: Ganesh Iyer - David SobermanRishab MehtaNo ratings yet

- About McdonaldsDocument54 pagesAbout McdonaldsKrishnaKantpalNo ratings yet

- Impact of Digital Marketing On Consumer BehaviorDocument13 pagesImpact of Digital Marketing On Consumer BehaviorMd Belayet Hosen RajuNo ratings yet

- Contemporary Issues in MarketingDocument23 pagesContemporary Issues in MarketingKumaran Balasubramanian0% (1)

- MODERN SCHOOL Assignment EconomicsDocument2 pagesMODERN SCHOOL Assignment EconomicsP Janaki RamanNo ratings yet

- ISC Accounts ConsignmentDocument4 pagesISC Accounts Consignmentbcom100% (3)

- Premium Liability SummaryDocument2 pagesPremium Liability SummaryAngelica Madson100% (1)

- Bha Coil Tubing CatalogDocument82 pagesBha Coil Tubing CatalogJose Leonardo Materano PerozoNo ratings yet

- Sales and Distribution and SAP2Document4 pagesSales and Distribution and SAP2Mohamed NazimNo ratings yet

- Rebuild Options Guide - EAME VersionDocument27 pagesRebuild Options Guide - EAME Versionenjoythedocs100% (1)