Professional Documents

Culture Documents

Total Capital After Formation: Addition of The 2 Capitals

Total Capital After Formation: Addition of The 2 Capitals

Uploaded by

RHEA ALYXES JOYCE LAYSONOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Total Capital After Formation: Addition of The 2 Capitals

Total Capital After Formation: Addition of The 2 Capitals

Uploaded by

RHEA ALYXES JOYCE LAYSONCopyright:

Available Formats

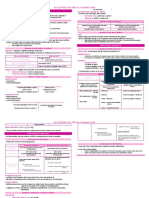

PARTNERSHIP C.

Admission of a new partner/two proprietors form a partnership

Governing authority: Partnership Law

Definition: “by the contract of partnership, 2 or more persons bind themselves to FIRST TIME FORMATION

contribute money, property or industry to a common fund, with the - Cash investment - face value

intention of dividing the profits among themselves” - Noncash investment - fair value – via independent appraisals or agreement of

Factors: -2 or more persons the partners

-to carry on as co-owners - Bonus or Goodwill – agreed interest that vary to the net assets invested

-business for profit: non-profit org. may not be partnership Initial Investment: Pedro – 70,000 and Jose – 50,000

Characteristics: o Bonus method: capital transfer/adjustments based on the agreed

1. Separate legal personality – juridical personality (Art. 1768) interest (if 50-50)

2. Ease of formation – oral, written, or implied (inferences) Pedro, Capital 10,000

3. Co-ownership of partnership property and profits – all assets of partners Jose, Capital 10,000

become property of partnership (except: limited partnership) Total capital after formation: Addition of the 2 capitals

4. Limited life – any change in agreement terminates the partnership o Goodwill method: addition of capital to equalize the agreed interest (if

5. Mutual Agency – equal rights of partners to act for the partnership 50-50)

6. Unlimited Liability – all properties may be used for settlement of liabilities Goodwill 20,000

(except: limited partnership) Jose, Capital 20,000

Total capital after formation: Highest capital x 2

PERSONAL AND THE BUSINESS *In the absence of method agreement: Bonus method

Proprietorship: In practice – treated as separate entities PROPRIETOR AND INDIVIDUAL

In theory – treated as one - If agreed, the assets contributed will undergo revaluation

Small partnerships: In practice – treated as one in case of 2 partners - The entry to transfer the assets to the partnership will based on the books of

Partnerships: In general – treated as separate entities each proprietor

Ideal ledger accounts to be maintained in partnership TWO PROPRIETORS FORM A PARTNERSHIP

a. Capital Accounts - First: agreement on the partner’s interest

CR: Original & additional investment, partner’s profit - Second: agreement regarding the values of the assets to be assigned and

DR: Permanent Withdrawal, drawing, end, partner’s loss liabilities to be assumed

b. Drawing or personal accounts NOTE:

CR: Partnership obligations, claims of partner, salaries - per capital interest recorded may vary with per capital contribution, as per

DR: Withdrawal, personal indebtedness, claims of partnership agreement

c. Account for loans to or from partners

DR: Receivable from partner: a withdrawal by a partner with intention of

repayment to the firm

CR: Loans/Notes Payable: an advance given by partner to the firm, with the

intention of repayment by the firm

NOTE:

Advances from: Partner’s liability

Advances to: Partnership’s liability

FORMATION

A. First time formation

B. Proprietor and Individual

PARTNERSHIP OPERATIONS -

Not treated as expense in the determination of net income

-

In the absence of agreement: Salaries are automatically allowed even when

AREA TO DISCUSS losses are incurred

a. Determine the distribution of profit & losses - Parties may allow salaries on a pro-rata basis if earnings are lower than the

b. Preparation of FS total salaries.

c. Changes in profit and loss ratios Bonus as: Expense Not

d. Correction of net income of prior years Expense

Based on NI before S, I, B x

A. DISTRIBUTION OF PROFIT & LOSSES Based on NI before S, I, but after bonus x

- Division is based with the agreement - If bonus is allowed to the managing partner as per agreement, it must specify

- No agreement: division is based with the original contribution the basis of the bonus.

- if profit agreement only: loss will be based on profit agreement - Even with agreement, the provision for bonus if net loss, is disregarded

- if loss agreement only: profit will be based on original contribution CHANGES IN PROFIT AND LOSS

Summary of Possible Methods of Distribution of Net Income BONUS (B) Bonus = NI before S, I, B

1. Equally Bonus = NI after S, I, B B = rate x NI

2. Ratio B = r x [NI – S – I – (rate x B)] Bonus = NI before S, I, after B

3. Ratio of capital balances on a particular date or Bonus = NI after S, I, before B B = r x (NI – B)

B = r x (NI – S – I)

Ratio of average capital balances during the year

4. Interest on capital balances and dividing the remaining net income

in a specified ratio OLD: X = 10% ; Y=90% NEW: X= 25% ; Y=75%

5. Salaries and dividing the remaining net income in a specified ratio Difference: 15%

6. Bonus to managing partner based on net income 2 Approaches for a fair valuation

*if income is to be divided based on capital balances and no agreement as to 1. Adjust and record all assets and liabilities that are unadjusted and unrecorded to

computation: Average capital balances should be used. If not original capital reflect their fair values and close it with the capital account using old profit and loss

balances ratio.

Dr: Land = 300,000

Division of Profits Entry Cr: X, Capital = 30,000, Y Capital = 270,000

Income Summary xx 2. Adjust only the capital account for the net effect of these adjustments using old

X, Capital xx profit and loss ratio. (300,000 x 15%)

Y, Capital xx Dr: X, Capital 45,000

Cr: Y, Capital 45,000

Interest Allowed on Partner’s Capital

- Interest allowances for encouragement of capital investments

- Interest rate should base on the agreement

- Not an expense of the partnership, therefore, it has no effect on net income

computation

- If the agreement provides to allow interest on capital balances even if net loss,

the provision for interest must be enforced.

Salary and Bonus Allowances

CORRECTION OF PARTNERSHIP NET INCOME OF PRIOR PERIOD

- Error in computing depreciation

- Error in inventory evaluation

- Omission of accrued expenses

Procedures for Correction

1. Determine the correct net profit of the prior period

2. Compute the proper share of each partner using the p&l ratio in the year in which

the error occurred

3. Compute the share received and share that would have received.

4. Adjust the capital from no. 3

You might also like

- Gumbaynggirr Dreaming UnitDocument19 pagesGumbaynggirr Dreaming Unitapi-355090152No ratings yet

- BMW Case Study SolutionDocument10 pagesBMW Case Study SolutionsarasNo ratings yet

- Pshiptax2010 Cheat SheetDocument4 pagesPshiptax2010 Cheat SheetsmyantNo ratings yet

- Partnership Formation - : Agreed Cap. 115,750 57,875 57,875 231,500Document4 pagesPartnership Formation - : Agreed Cap. 115,750 57,875 57,875 231,500JOEMAR LEGRESONo ratings yet

- AFAR 01 - Partnership AccountingDocument7 pagesAFAR 01 - Partnership AccountingcheoreciNo ratings yet

- PArtDocument6 pagesPArtMay DabuNo ratings yet

- AFAR NotesDocument7 pagesAFAR NotesMay Grethel Joy PeranteNo ratings yet

- Reviewer in PartnershipDocument121 pagesReviewer in PartnershipGlizette SamaniegoNo ratings yet

- Chapter 1: PartnershipDocument121 pagesChapter 1: PartnershipGab IgnacioNo ratings yet

- Afar NotesDocument6 pagesAfar NotesJane EstradaNo ratings yet

- ACC 311 - Chapter 1 PartnershipDocument4 pagesACC 311 - Chapter 1 PartnershipAlyssa GuinoNo ratings yet

- Accounting For Special TransactionsDocument13 pagesAccounting For Special Transactionsviva nazarenoNo ratings yet

- Chapter 1 - PartnershipDocument18 pagesChapter 1 - PartnershipFrancisco PradoNo ratings yet

- AFAR 1. PartnershipDocument8 pagesAFAR 1. PartnershipKristine May PeraltaNo ratings yet

- REG CPA - Entity Basis IssuesDocument2 pagesREG CPA - Entity Basis IssuesManny MarroquinNo ratings yet

- Chapter 1Document3 pagesChapter 1Jemima FernandezNo ratings yet

- Afar NotesDocument8 pagesAfar NotesToni Rose AbreraNo ratings yet

- PartnershipDocument1 pagePartnershipwaragud218No ratings yet

- Reviewer in Partnership PDF FreeDocument120 pagesReviewer in Partnership PDF Free잔잔No ratings yet

- PARTNERSHIPDocument8 pagesPARTNERSHIPShayne BenaweNo ratings yet

- Financial Liabilities SummaryDocument4 pagesFinancial Liabilities SummaryNancy Litera MusicoNo ratings yet

- CCCSPECIALIZEDTRANSACTIONSLECTURE1 Partnersip Oct 32023Document2 pagesCCCSPECIALIZEDTRANSACTIONSLECTURE1 Partnersip Oct 32023EljayNo ratings yet

- AFAR - Sir BradDocument36 pagesAFAR - Sir BradOliveros JaymarkNo ratings yet

- Accounting For Special TransactionDocument2 pagesAccounting For Special TransactionJoresol AlorroNo ratings yet

- AFAR - Until Conso FS HeyheiDocument31 pagesAFAR - Until Conso FS Heyheimisonim.eNo ratings yet

- Chapter 1 - Part 1Document2 pagesChapter 1 - Part 1clarizaNo ratings yet

- Bam201 ReviewerDocument7 pagesBam201 Reviewerjireh mallariNo ratings yet

- ACC406 - Chapter 7Document24 pagesACC406 - Chapter 7Carol LeslyNo ratings yet

- Dayag Notes Partnership FormationDocument3 pagesDayag Notes Partnership FormationGirl Lang AkoNo ratings yet

- Special TransactionsDocument3 pagesSpecial TransactionsTracy AguirreNo ratings yet

- Partnership Dissolution: Liability of Incoming Partner For Existing Obligations of The PartnershipDocument28 pagesPartnership Dissolution: Liability of Incoming Partner For Existing Obligations of The PartnershipChristine SalvadorNo ratings yet

- Advance Financial Accounting and Reporting 2 Notes CompressDocument35 pagesAdvance Financial Accounting and Reporting 2 Notes CompressthegreatNo ratings yet

- AFAR - QuickyDocument27 pagesAFAR - QuickywktxlsrkfNo ratings yet

- Lesson 1 - Accounting For Special Transactions PDFDocument6 pagesLesson 1 - Accounting For Special Transactions PDFcooperNo ratings yet

- Afar Summary NotesDocument10 pagesAfar Summary NotesShaira BugayongNo ratings yet

- Lesson 1. Introduction To PartnershipDocument4 pagesLesson 1. Introduction To Partnershipangelinelucastoquero548No ratings yet

- College of Accountancy and Business Administration: Partnership Operation Changes in CapitalDocument6 pagesCollege of Accountancy and Business Administration: Partnership Operation Changes in CapitalVenti AlexisNo ratings yet

- Accspec 1Document2 pagesAccspec 1Aye ChavezNo ratings yet

- 113 Module 1 - INTODUCTORY NOTES AND TRADE PAYABLES AND ACCRUED LIABILITIESDocument4 pages113 Module 1 - INTODUCTORY NOTES AND TRADE PAYABLES AND ACCRUED LIABILITIESRay SanzeninNo ratings yet

- Advanced Acctg & Financial ReportingDocument6 pagesAdvanced Acctg & Financial ReportingMa. Cristy BroncateNo ratings yet

- Ast Millan CH1Document2 pagesAst Millan CH1Maxine OngNo ratings yet

- First 20 PagesDocument21 pagesFirst 20 Pageszainab.xf77No ratings yet

- M1 - Partnership FormationDocument11 pagesM1 - Partnership FormationJhay MenesesNo ratings yet

- Partnership Ex1Document10 pagesPartnership Ex1Queenel MabbayadNo ratings yet

- Chapter 11 - Notes - 15thDocument6 pagesChapter 11 - Notes - 15thnishit patelNo ratings yet

- Final Exam Outline Full Ver1263165054Document22 pagesFinal Exam Outline Full Ver1263165054LawNerdNYCNo ratings yet

- Partnership NotesDocument35 pagesPartnership Notesa86476007No ratings yet

- Govacc NotesDocument39 pagesGovacc Notesmaria claraNo ratings yet

- AFAR Chapter 2Document2 pagesAFAR Chapter 2msjoyceroxaneNo ratings yet

- Accounting For Partnership QuicknotesDocument4 pagesAccounting For Partnership Quicknoteslornajohanna.gasconNo ratings yet

- Level Up-CMPC 131 ReviewerDocument6 pagesLevel Up-CMPC 131 ReviewerazithethirdNo ratings yet

- 2 - Partnership OperationsDocument6 pages2 - Partnership OperationsAangela Del Rosario CorpuzNo ratings yet

- Outline Taxation of PartnershipsDocument22 pagesOutline Taxation of PartnershipsHardeep ChauhanNo ratings yet

- Corporation Partnership Basis FicpaDocument33 pagesCorporation Partnership Basis FicpaPaoNo ratings yet

- AFAR - Part 1Document18 pagesAFAR - Part 1Myrna LaquitanNo ratings yet

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesNo ratings yet

- AFAR Notes by DR Ferrer - Summary BS AccountancyDocument28 pagesAFAR Notes by DR Ferrer - Summary BS AccountancyMABI ESPENIDONo ratings yet

- WK 1 Intro 2 PartnershipDocument6 pagesWK 1 Intro 2 PartnershipkehindeadeniyiNo ratings yet

- Partnership 2Document14 pagesPartnership 2Shayne BenaweNo ratings yet

- Accounting For PartnershipDocument11 pagesAccounting For PartnershipgabNo ratings yet

- 1 - Partnership ReviewDocument6 pages1 - Partnership ReviewTherese Anne VillaricoNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Summarised Maths Notes (Neilab Osman)Document37 pagesSummarised Maths Notes (Neilab Osman)dubravko_akmacicNo ratings yet

- (As Filed) DISH Opposition To SpaceX ETC DesignationDocument11 pages(As Filed) DISH Opposition To SpaceX ETC DesignationSimon AlvarezNo ratings yet

- FortiGate WAN Optimization Guide 4.0Document108 pagesFortiGate WAN Optimization Guide 4.0Paolo BoarettoNo ratings yet

- Sign Permit: Office of The Building OfficialDocument2 pagesSign Permit: Office of The Building OfficialRAYMUND SANTTOSNo ratings yet

- UTS ENGLISH - 112011192 - Netta Delyana PutriDocument2 pagesUTS ENGLISH - 112011192 - Netta Delyana Putrinetta delyana putriNo ratings yet

- Let's Get Scotland Walking - The National Walking Strategy - Escócia - 2019Document29 pagesLet's Get Scotland Walking - The National Walking Strategy - Escócia - 2019Natália CostaNo ratings yet

- English One EditDocument120 pagesEnglish One Edit20036 -Bagas Andrian PermanaNo ratings yet

- Non-Nutritive Sucking Habit Breakers Carlos Loza and Christina Rodriguez NutritionDocument6 pagesNon-Nutritive Sucking Habit Breakers Carlos Loza and Christina Rodriguez Nutritionapi-421866375No ratings yet

- The Deodorant Market in India - FinalDocument6 pagesThe Deodorant Market in India - Finalabhisheklakh100% (4)

- Đề MOS WORD 1Document2 pagesĐề MOS WORD 1Lan Anhh100% (1)

- Yesterday's Tomorrow 'Pulp Edition' - Core RulebookDocument27 pagesYesterday's Tomorrow 'Pulp Edition' - Core RulebookJuan Manuel100% (1)

- Φουρνος- convotherm - 4Document120 pagesΦουρνος- convotherm - 4Dimitris ThanasopoulosNo ratings yet

- Quality Basics 1Document17 pagesQuality Basics 1jorge pinzonNo ratings yet

- Interstate-Mcbee Sensors: Serving The Diesel and Natural Gas Industry For Over 60 YearsDocument1 pageInterstate-Mcbee Sensors: Serving The Diesel and Natural Gas Industry For Over 60 YearsRicardoNo ratings yet

- CONFIRMALDocument50 pagesCONFIRMALSri SaiNo ratings yet

- Microsoft Age of Empires III Trial Readme File: September 2005Document4 pagesMicrosoft Age of Empires III Trial Readme File: September 2005Yoga RajNo ratings yet

- Diabetes Mellitus Diagnosis Using Optical Ring Resonators-758Document7 pagesDiabetes Mellitus Diagnosis Using Optical Ring Resonators-758Darshan rajNo ratings yet

- CH-5 Laws of MotionDocument23 pagesCH-5 Laws of MotionAkash GuptaNo ratings yet

- English ReportDocument10 pagesEnglish Reportsherpanawang41No ratings yet

- DLL - Science 4 - Q1 - W9Document3 pagesDLL - Science 4 - Q1 - W9XXVKNo ratings yet

- 12 Step Manual V2.0Document68 pages12 Step Manual V2.0Daniel BatánNo ratings yet

- Stress Due To Surface LoadDocument7 pagesStress Due To Surface LoadDesalegn TamirNo ratings yet

- Final1 PDFDocument10 pagesFinal1 PDFAngelica SantiagoNo ratings yet

- InDesign ToolsDocument3 pagesInDesign ToolsolywaltNo ratings yet

- Pipe JoiningDocument248 pagesPipe JoiningRam Shiv Verma100% (1)

- Authors BookDocument189 pagesAuthors Bookمحمد رضا رضوانیNo ratings yet

- TLETVL HECookery 9 11 Q3 Module 1Document26 pagesTLETVL HECookery 9 11 Q3 Module 1Ya SiNo ratings yet

- DLP IN ORAL COMMUNICATION-GRADE 11-EditedDocument6 pagesDLP IN ORAL COMMUNICATION-GRADE 11-EditedMaeann MirandoNo ratings yet