Professional Documents

Culture Documents

BF LAS 7 For Reproduction

BF LAS 7 For Reproduction

Uploaded by

Nielvin VinluanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BF LAS 7 For Reproduction

BF LAS 7 For Reproduction

Uploaded by

Nielvin VinluanCopyright:

Available Formats

Republic of the Philippines

Department of Education

Region III - Central Luzon

Schools Division of Tarlac Province

Marawi National High School

Camiling, Tarlac

Business Finance

Quarter 3 – Module 7:

Capital Budgeting

Name of Student:

___________________________________________________

Grade & Section:

___________________________________________________

1

Page

Marawi National High School

Marawi, Camiling, Tarlac

Contact No.: (045) 800-9003

Email Address: 300972.marawinhs@deped.gov.ph

Republic of the Philippines

Department of Education

Region III - Central Luzon

Schools Division of Tarlac Province

Marawi National High School

Camiling, Tarlac

What I Need to Know

This module is designed and written to understand the different tools in

computing finance and investment problems like payback method, net present

value, and internal rate of return.

After going through this module, you are expected to apply mathematical

concepts and tools in computing for finance and investment problems. (ABM_BF12-

IIIg-h-21).

Specifically, you are going to:

1. define capital budgeting;

2. compute for the payback method and net present value; and

3. apply mathematical concepts and tools in computing for finance and

investment problems. (ABM_BF12-IIIg-h-21).

Lesson 1: Capital Budgeting

Every businessman should plan and decide where his resources would go

and what would be the benefits of his decision. He may also decide to acquire long-

term investments such as additional units of the plant, property and equipment,

replacement of machine or purchasing fixed assets. All these decisions require the

use of capital budgeting tools and equipment.

Capital Budgeting

Capital budgeting is the process that a business uses in evaluating and

selecting major projects or investment. It involves capital investments proposal

evaluation, allocation of capital investment funds among approved projects and

programs, and control of such expenditures. Capital expenditures are a long-term

investment.

2

Page

Marawi National High School

Marawi, Camiling, Tarlac

Contact No.: (045) 800-9003

Email Address: 300972.marawinhs@deped.gov.ph

Republic of the Philippines

Department of Education

Region III - Central Luzon

Schools Division of Tarlac Province

Marawi National High School

Camiling, Tarlac

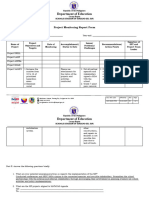

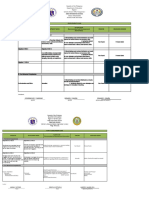

Steps in Capital Budgeting

1

Investment 2

Proposal

All levels within the Review and Analysis 3

organization are of the Proposal

encouraged to make

suggetions for capital The financial Decision-making 4

personnels review and

expenditures

analyze the benefits

and costs that may be

The analysis will be

presented to decide Implementation 5

derived from the whether the proposal

After being approved,

proposal using the will push or not.

the funds will be Monitoring

financial tools. available and the

project will be The actual costs are

recorded, reported

operational.

and compared with

the budgeted figures.

Corrective measures

may be required if

there are some

deviations.

What Is It

Terms related to capital budgeting:

1. Exclusive Projects

a. Independent projects do not compete with other projects.

Example: Project Proposal A is for increasing the sales volume of Product A.

Project Proposal B is for the opening of a new outlet in Mindanao.

b. Mutually exclusive projects compete with other projects and the

approval of one eliminates the other projects.

Example: Project Proposals A and B are presented to increase the sales

volume of the product. If Project Proposal A is accepted, Project B will be

eliminated.

2. Capital Rationing and Unlimited Funds

a. The business with capital rationing will choose a project with the best

opportunities.

b. If the business has unlimited funds, it will accept all the projects that

pass the risk-return criteria.

3

Page

Marawi National High School

Marawi, Camiling, Tarlac

Contact No.: (045) 800-9003

Email Address: 300972.marawinhs@deped.gov.ph

Republic of the Philippines

Department of Education

Region III - Central Luzon

Schools Division of Tarlac Province

Marawi National High School

Camiling, Tarlac

3. Cash Returns

These are the net cash inflows one expects to get when the business or

project has already started.

Tools in Capital Budgeting

1. Payback Method

It is a method that evaluates a project by measuring the time (usually

expressed in years) it will take to recover the initial investments.

Even Cash Flow

Example 1: ABCD Company is considering a project requiring an initial investment of

Php 120,000.00. The project is expected to realize annual cash returns of Php

25,000.00 for 6 years. Calculate the payback period of the project.

Payback period = Initial Investment / Annual Cash returns

= Php 120,000.00 / Php 25,000.00

= 4.8 years.

In this example, ABCD Company will accept the project because the payback

period is 4.8 years shorter than 6 years.

Uneven Cash Returns

When the cash returns are uneven, the payback period is computed

by adding the cash returns until the total is equal to the investment.

Example 2: ABCD Company is planning to undertake another project with an initial

investment of Php 100,000.00. It is expected to receive net cash returns of Php 25,000.00

in Year 1; Php 30,000.00 in Year 2; Php 35,000.00 in Year 3;

Php 40,000.00 in Year 4; and Php 45,000.00 in Year 5.

We already recovered Php

90,000.00 by adding the cash returns

in year 1, 2 and 3. We only need Php

10,000.00 to reach the initial

investment of

Php100,000.00. So in Year 4, we only

need Php 10,000.00 from the Php

40,000.00 projected cash return,

which is 0.25 or 25% of the annual cash

return.

4

Page

The payback period is 3.25 years (3 + 0.25).

Marawi National High School

Marawi, Camiling, Tarlac

Contact No.: (045) 800-9003

Email Address: 300972.marawinhs@deped.gov.ph

Republic of the Philippines

Department of Education

Region III - Central Luzon

Schools Division of Tarlac Province

Marawi National High School

Camiling, Tarlac

2. Net Present Value (NPV)

This refers to the difference between the present value of cash inflows and

the net present value of cash outflows over a period. It is used in capital budgeting

and investment planning to analyze if the project is profitable or not.

If the NPV is positive, the project or investment should be accepted. If it is

negative, it means that it will result to a loss so it should be rejected.

You can use the PVIFA

table in page 9. Locate 6

years at 7%.

3. Internal Rate of Return (IRR)

The IRR is the most used technique in capital budgeting. It is defined as the

discount rate that makes the net present value of an investment equals to zero.

Example 4: ABCD Company is evaluating the profitability of Project A. It requires Php

100,000.00 of funding and after one year, the company is expected to receive Php

125,000.00. Compute for the internal rate of return.

IRR = Php 25,000.00/Php 100,000.

00 = .25 or 25% NPV = Php 125,

5

000/(1+.25) – Php 100,000.00 = 0

Page

Marawi National High School

Marawi, Camiling, Tarlac

Contact No.: (045) 800-9003

Email Address: 300972.marawinhs@deped.gov.ph

Republic of the Philippines

Department of Education

Region III - Central Luzon

Schools Division of Tarlac Province

Marawi National High School

Camiling, Tarlac

6

Page

Marawi National High School

Marawi, Camiling, Tarlac

Contact No.: (045) 800-9003

Email Address: 300972.marawinhs@deped.gov.ph

Republic of the Philippines

Department of Education

Region III - Central Luzon

Schools Division of Tarlac Province

Marawi National High School

Camiling, Tarlac

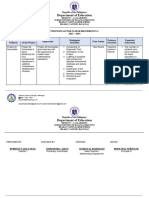

Activity 7

A: Solve the problem below and answer the questions that

follow.

Two investment proposals have been made and the following

data are given below:

Yea Project X Project Y

r

0 (Php (Php

50,000.00) 75,000.00)

1 Php Php

15,000.00 24,000.00

2 Php Php

20,000.00 24,000.00

3 Php Php

25,000.00 24,000.00

4 Php Php

30,000.00 24,000.00

1. What is the payback period of each proposal? (4 points)

_______________________________________________________

_______________________________________________________

_______________________________________________________

2. Compute for the net present value of each proposal if the cost of

capital is 10%. (4 points)

_______________________________________________________

_______________________________________________________

_______________________________________________________

3. Which project should be accepted? Why? (2 points)

_______________________________________________________

_______________________________________________________

7

Page

_______________________________________________________

Marawi National High School

Marawi, Camiling, Tarlac

Contact No.: (045) 800-9003

Email Address: 300972.marawinhs@deped.gov.ph

Republic of the Philippines

Department of Education

Region III - Central Luzon

Schools Division of Tarlac Province

Marawi National High School

Camiling, Tarlac

B: Write T if the statement is correct and write F if the

statement is incorrect.

______1. Capital budgeting is the process that a business use in

evaluating and selecting major projects or investment.

______2. Payback method evaluates a project by measuring the time

(usually in years) it will take to recover the initial investments.

______3. Independent projects compete with one another and the approval

of one eliminates the other projects.

______4. Internal rate of return refers to the difference between the present

value of cash inflows and the net present value of cash outflows over a

period.

______5. Cash returns are the net cash inflows one expects to get when

the business or project has already started.

______6. Net present value is defined as the discount rate that makes the

net present value of an investment equals to zero.

______7. If the net present value is negative, the project should be

rejected.

______8. If the net present value is positive, the project should be

accepted.

______9. Mutually exclusive projects are those projects that do not

compete with other projects.

______10. When the cash returns are even, the payback period is

computed by adding the cash returns until the total is equal to the

investment.

8

Page

Marawi National High School

Marawi, Camiling, Tarlac

Contact No.: (045) 800-9003

Email Address: 300972.marawinhs@deped.gov.ph

You might also like

- The Monster Guide To Candlestick PatternsDocument37 pagesThe Monster Guide To Candlestick Patternsbrindha90% (10)

- Feasibility Study On Bachelor of Science in Accountancy and Bachelor of Science in Business Administration Major inDocument7 pagesFeasibility Study On Bachelor of Science in Accountancy and Bachelor of Science in Business Administration Major inBongbong GalloNo ratings yet

- ICT 2022 Mentorship NotesDocument4 pagesICT 2022 Mentorship NotesAnto Richards0% (1)

- Jones Blair Company Case StudyDocument4 pagesJones Blair Company Case StudyAmeen AlmohsenNo ratings yet

- Mayes 8e CH03 Problem SetDocument8 pagesMayes 8e CH03 Problem SetBunga Mega WangiNo ratings yet

- Department of Education: Republic of The PhilippinesDocument11 pagesDepartment of Education: Republic of The PhilippinesNeil Balbuena100% (13)

- CCTV ResearchDocument8 pagesCCTV ResearchAnton NaingNo ratings yet

- Development Plan 2021 Jhs Escamillas, Mary JoyDocument4 pagesDevelopment Plan 2021 Jhs Escamillas, Mary JoyRamilNo ratings yet

- SLAC ACTIVITY IMPLEMENTATION PLAN-Provision of Technical AssistanceDocument4 pagesSLAC ACTIVITY IMPLEMENTATION PLAN-Provision of Technical Assistancecherry.pastoralNo ratings yet

- Ipcrf Development - Abayare, Danica M. 2021-2022Document2 pagesIpcrf Development - Abayare, Danica M. 2021-2022Cynthia LuayNo ratings yet

- Business Finance Q1M1Document16 pagesBusiness Finance Q1M1K's Music PhNo ratings yet

- Republic of The Philippines Department of EducationDocument8 pagesRepublic of The Philippines Department of EducationMeg PerezNo ratings yet

- Monitoring and Evaluation (M &E) Format LatestDocument5 pagesMonitoring and Evaluation (M &E) Format LatestRonnie Francisco Tejano100% (1)

- Performance StandardsDocument3 pagesPerformance StandardsMark Joshua AnimasNo ratings yet

- Entrep Week 6 - EbiasDocument2 pagesEntrep Week 6 - Ebiaslladera631No ratings yet

- LM 1 (Introduction To Engg Economics)Document7 pagesLM 1 (Introduction To Engg Economics)evanel rogelNo ratings yet

- Chapter-1-Research-Proposal-Mayce Joy LamparDocument22 pagesChapter-1-Research-Proposal-Mayce Joy LamparMJ LamparNo ratings yet

- (SGC) Monitoring and Evaluation-Quarter 4Document2 pages(SGC) Monitoring and Evaluation-Quarter 4MARIA JONALYN GANGANNo ratings yet

- Template School Career Guidance Implementation ReportDocument2 pagesTemplate School Career Guidance Implementation ReportKenneth San JuanNo ratings yet

- "Failing To Prepare Is Preparing To Fail.": Calangitan High SchoolDocument3 pages"Failing To Prepare Is Preparing To Fail.": Calangitan High SchoolSteff Musni-QuiballoNo ratings yet

- Division of Samar Learning Continuity PlanDocument55 pagesDivision of Samar Learning Continuity PlanEsther CondeNo ratings yet

- Midyear 23 24 Accomplishment ReportDocument3 pagesMidyear 23 24 Accomplishment ReportAshley De Guzman LptNo ratings yet

- Realism Mpa503 PosoDocument3 pagesRealism Mpa503 PosoDexter ChowNo ratings yet

- SIP Project Monitoring ReportDocument3 pagesSIP Project Monitoring ReportARIEL PALERNo ratings yet

- Dinagat Central Elementary SchoolDocument3 pagesDinagat Central Elementary SchoolArseli CanonesNo ratings yet

- Development PlanDocument1 pageDevelopment PlanJerome DesameroNo ratings yet

- Microsyllabus CREDITCOLLECTIONDocument4 pagesMicrosyllabus CREDITCOLLECTIONAlyssa Joy TercenioNo ratings yet

- Organization and Management: Quarter 2 LAS 6: Different Controlling Methods and Techniques in Accounting and MarketingDocument8 pagesOrganization and Management: Quarter 2 LAS 6: Different Controlling Methods and Techniques in Accounting and Marketingaio modestoNo ratings yet

- Development Plan 2021 Jhs Pacifico, RolynDocument3 pagesDevelopment Plan 2021 Jhs Pacifico, RolynRamilNo ratings yet

- L D Templates and ToolsDocument21 pagesL D Templates and ToolsAl DavidNo ratings yet

- Senior 11 Org and MGNT Q2 - M6Document24 pagesSenior 11 Org and MGNT Q2 - M6Gerlie VillameroNo ratings yet

- CEPPDocument6 pagesCEPPDENNIS RAMIREZNo ratings yet

- ULOe - Financial Planning - 0Document19 pagesULOe - Financial Planning - 0pam pamNo ratings yet

- Action PlanDocument3 pagesAction PlanKenneth Panes Dela VegaNo ratings yet

- Final ProjectDocument16 pagesFinal ProjectBilly OnteNo ratings yet

- Approved Project Monitoring Tool Project SSSDocument4 pagesApproved Project Monitoring Tool Project SSSmarvin.baugbogNo ratings yet

- 6may 10 Apply Business Principles, Tools, Techniques in Participating in Various Types of IndustryDocument4 pages6may 10 Apply Business Principles, Tools, Techniques in Participating in Various Types of IndustryRonalyn CortezNo ratings yet

- Advance Financial Planning Pracrice Book Part 2 Case Studies 1Document26 pagesAdvance Financial Planning Pracrice Book Part 2 Case Studies 1Meenakshi67% (3)

- LCP - Macatcatud PS School Year 2021-2022Document7 pagesLCP - Macatcatud PS School Year 2021-2022Geoff ReyNo ratings yet

- Dev Plan 2019Document2 pagesDev Plan 2019Catherine Jhoy Carolino-DomalantaNo ratings yet

- L D Templates and Tools 1Document22 pagesL D Templates and Tools 1roger cabarles iiiNo ratings yet

- Learning and Development Needs Report: Department of EducationDocument20 pagesLearning and Development Needs Report: Department of EducationAl DavidNo ratings yet

- Business Finance12 Q3 M3Document16 pagesBusiness Finance12 Q3 M3Chriztal TejadaNo ratings yet

- Best Practices 2022 TemplateDocument6 pagesBest Practices 2022 TemplateSARAH JANE BUCTUANNo ratings yet

- SDO MISAMIS OCCIDENTAL Authority To Hire Admin Support Staff in Schools Under COSDocument4 pagesSDO MISAMIS OCCIDENTAL Authority To Hire Admin Support Staff in Schools Under COSKleen NateNo ratings yet

- M and E ToolDocument6 pagesM and E ToolLeigh ShaneNo ratings yet

- Paymemts BankDocument16 pagesPaymemts BankPriyanshuNo ratings yet

- Start Up PLDT Final PaperDocument13 pagesStart Up PLDT Final PaperYaba, Brixzel F.No ratings yet

- Module 3.1.1-Situation Appraisal & GoalsDocument6 pagesModule 3.1.1-Situation Appraisal & Goalsdridgely ric c. dyNo ratings yet

- Fabm2 - Q2 - M8Document12 pagesFabm2 - Q2 - M8Earl Christian BonaobraNo ratings yet

- PROPOSED PLAN - Rapid Testing For COVID19 of JAMC - Baril Macauba PerezDocument9 pagesPROPOSED PLAN - Rapid Testing For COVID19 of JAMC - Baril Macauba PerezDiane Sairah PerezNo ratings yet

- FinMan SyllabusDocument11 pagesFinMan SyllabusJamelleNo ratings yet

- TAX1 OBTL Syllabus 1s 20-21Document12 pagesTAX1 OBTL Syllabus 1s 20-21Paula Rodalyn MateoNo ratings yet

- Gap AnalysisDocument3 pagesGap AnalysisMithz SuneNo ratings yet

- 2may 3 Apply Business Principles, Tools, Techniques in Participating in Various Types of IndustryDocument5 pages2may 3 Apply Business Principles, Tools, Techniques in Participating in Various Types of IndustryRonalyn CortezNo ratings yet

- Ge Elec 6 Flexible Obtl A4Document9 pagesGe Elec 6 Flexible Obtl A4Alexandra De LimaNo ratings yet

- Personal Financial MGT F1Document3 pagesPersonal Financial MGT F1cheyneegayle.eguiaNo ratings yet

- PMRF BlankDocument1 pagePMRF BlankLJ DolosaNo ratings yet

- Obtl Afar 2Document11 pagesObtl Afar 2KezNo ratings yet

- Far Eastern University: Institute of Accounts, Business and FinanceDocument13 pagesFar Eastern University: Institute of Accounts, Business and FinancesareaNo ratings yet

- Development Plan: Washington National High SchoolDocument2 pagesDevelopment Plan: Washington National High SchoolxieNo ratings yet

- MINANG ES AUGUST-2022-Monthly-Instructional-Supervisory-PlanDocument3 pagesMINANG ES AUGUST-2022-Monthly-Instructional-Supervisory-PlanPacita ImpongNo ratings yet

- Salupan PS - Kabasalan District School Pir Report 4THDocument6 pagesSalupan PS - Kabasalan District School Pir Report 4THMarieAnne RoblesNo ratings yet

- Planning and Managing Distance Education for Public Health CourseFrom EverandPlanning and Managing Distance Education for Public Health CourseNo ratings yet

- ABM - AE12-Ia-d-1 ADocument3 pagesABM - AE12-Ia-d-1 ANielvin VinluanNo ratings yet

- Chapter 3.2 To 3.5Document14 pagesChapter 3.2 To 3.5Nielvin VinluanNo ratings yet

- Daily Lesson Plan: Jski - DVDocument5 pagesDaily Lesson Plan: Jski - DVNielvin VinluanNo ratings yet

- Daily Lesson Plan: Jski - DVDocument5 pagesDaily Lesson Plan: Jski - DVNielvin VinluanNo ratings yet

- 21st ExamDocument3 pages21st ExamNielvin VinluanNo ratings yet

- 08L0767 Fy18-19 Kyc Aml CFT Fatca CRSDocument13 pages08L0767 Fy18-19 Kyc Aml CFT Fatca CRSabhi646son5124No ratings yet

- E-Icc & E-TripDocument2 pagesE-Icc & E-TripGeeti Grover AroraNo ratings yet

- Ieee STD 835 1994 PDFDocument28 pagesIeee STD 835 1994 PDFGabriela BarralagaNo ratings yet

- Mock Numerical Questions: Model Test PaperDocument12 pagesMock Numerical Questions: Model Test PaperNaman JainNo ratings yet

- Claim Form CaDocument4 pagesClaim Form CaManjunath YallankarNo ratings yet

- Ignacio Fried: SkillsDocument1 pageIgnacio Fried: SkillsRajandra NurhadiNo ratings yet

- PP Asia Monthly Scan ReportDocument15 pagesPP Asia Monthly Scan ReportvenkatspmNo ratings yet

- Example of Tradin PlanDocument5 pagesExample of Tradin PlanRobbie Aleksander0% (1)

- Colgate Palmolive India LTDDocument18 pagesColgate Palmolive India LTDgunjan100No ratings yet

- The Different Types of Benchmarking - Bernard MarrDocument14 pagesThe Different Types of Benchmarking - Bernard MarrEzra Mikah G. CaalimNo ratings yet

- 17, 29 Dalisay Investments vs. SSS DigestDocument7 pages17, 29 Dalisay Investments vs. SSS DigestBay NazarenoNo ratings yet

- Dream2Success: About UsDocument3 pagesDream2Success: About UsGionee P2No ratings yet

- Chapter 13-A Capital Budgeting: Edited May 25, 2011Document68 pagesChapter 13-A Capital Budgeting: Edited May 25, 2011dianne caballeroNo ratings yet

- IE Project (Manufaturing of Hydrogen Fuel by Electrolysis)Document5 pagesIE Project (Manufaturing of Hydrogen Fuel by Electrolysis)shukeshNo ratings yet

- Trugo, Karluz BT - SW1 - C9Document15 pagesTrugo, Karluz BT - SW1 - C9moreNo ratings yet

- Estimation of Ship Construction Costs: LibrariesDocument108 pagesEstimation of Ship Construction Costs: LibrariesEmreNo ratings yet

- E-Stamp: Government of KarnatakaDocument21 pagesE-Stamp: Government of KarnatakaHarishNo ratings yet

- ENTREP Chapter 2Document3 pagesENTREP Chapter 2Mea Jade M. OCTAVIANONo ratings yet

- Chart of AccountsDocument1 pageChart of Accountssharomeo castroNo ratings yet

- Power Purchase Agreement Work ScheduleDocument10 pagesPower Purchase Agreement Work ScheduleSuraj DahalNo ratings yet

- Ang v. Ang 2013Document1 pageAng v. Ang 2013ALEXIR MENDOZANo ratings yet

- International Petroleum Business ProgramDocument8 pagesInternational Petroleum Business ProgramJosé PedroNo ratings yet

- SMEs in BangladeshDocument95 pagesSMEs in BangladeshSuman Saha94% (16)

- Why Do They Do ItDocument5 pagesWhy Do They Do Itenzo.rojasaliaga97No ratings yet

- Church Budget Template (Advanced) (Spanish)Document11 pagesChurch Budget Template (Advanced) (Spanish)FrancexcoNo ratings yet

- SCMDocument11 pagesSCMHardik GangarNo ratings yet