Professional Documents

Culture Documents

06 Task Performance 01

06 Task Performance 01

Uploaded by

rebecca cruzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

06 Task Performance 01

06 Task Performance 01

Uploaded by

rebecca cruzCopyright:

Available Formats

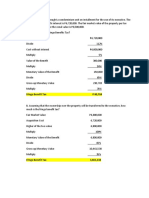

1. In 2018, Delta Corporation bought a condominium unit on installment for the use of its executive.

The acquisition cost inclusive of 12% interest is P6,720,000. The fair market value of the property per

tax declaration is P6,800,000 while the zonal value is P6,500,000.

a. How much is the fringe benefits tax?

P6,800,000

x 5%

P340,000

X 50%

P170,000

÷ 65%

P261,538.46

X 35%

P91,538.46

The fringe benefit tax is P91,538.46

b. Assuming that the ownership over the property will be transferred to the executive, how much is the

fringe benefits tax?

P6,720,000

x 100%

P6,720,000

÷ 65%

P10,338,461.54

X 35%

P3,618,461.54

The fringe benefit tax is P3,618,461.54

2. Delata Corporation bought a condominium unit for P6,000,0000. The fair market value of the

property per tax declaration is P6,800,000 while the zonal value is P6,500,000. It was transferred in the

name of Pedro, one of its executives, for a lower consideration amounting to P5,800,000. How much is

the fringe benefits tax?

P6,800,000

- 5,800,000

P1,000,000

÷ 65%

P1,538,461.54

X 35%

P538,461.54

The fringe benefits tax is P538,461.54

3. Omega Corporation purchased a motor vehicle worth P1,400,000 for the use of its executive. It

was registered under the executive’s name despite the agreement that it should be used partly for

the company’s benefit. How much is the fringe benefits tax?

P1,400,000

÷ 65%

P2,153,846.15

X 35%

P753,846.15

The fringe benefits tax is P753,846.15

4. First Metro Pacific was able to persuade Francis to join the company as its Assistant Vice

President for Finance which included a car plan worth P3,000,000 in its compensation package. The

company purchased the vehicle and registered the same in favor of Francis. Assuming further that Francis is

a non-resident alien not engaged in trade or business, how much is the fringe benefits tax?

P3,000,000

÷ 75%

P4,000,000

X 25%

P1,000,000

The fringe benefits tax is P1,000,000

You might also like

- Accounting Book 1 Lupisan Baysa Answer KeyDocument176 pagesAccounting Book 1 Lupisan Baysa Answer KeyNicole Anne Santiago Sibulo67% (3)

- Quizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Document3 pagesQuizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Ferb Cruzada83% (6)

- 27 Flights Controls PDFDocument186 pages27 Flights Controls PDFAaron Harvey100% (3)

- This Study Resource Was: Unit Contribution MarginDocument9 pagesThis Study Resource Was: Unit Contribution MarginRea Mariz Jordan0% (1)

- TAX-06-FRINGE-BENEFITS-TAX (With Answers) WITHOUT TYPODocument8 pagesTAX-06-FRINGE-BENEFITS-TAX (With Answers) WITHOUT TYPOKendrew Sujide100% (1)

- Fuchs - in Defense of The Human Being (2021)Document273 pagesFuchs - in Defense of The Human Being (2021)BododNo ratings yet

- This Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Document8 pagesThis Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Kin LeeNo ratings yet

- 06 Task PerformanceDocument2 pages06 Task PerformanceKatherine Borja67% (3)

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- Solution: P8 / (P96.50 - P2.38) 8.5%Document4 pagesSolution: P8 / (P96.50 - P2.38) 8.5%Edrielle100% (1)

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionRating: 4.5 out of 5 stars4.5/5 (15)

- Emg 2303 NotesDocument65 pagesEmg 2303 NotesAnonymous UnchpksNo ratings yet

- 06 Taskperformance 1 TaxationDocument2 pages06 Taskperformance 1 TaxationTrisha DomingoNo ratings yet

- Income TaxationDocument2 pagesIncome TaxationEricah DumalaganNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- Answers, Solutions and Clarifications To Form 6Document5 pagesAnswers, Solutions and Clarifications To Form 6Annie LindNo ratings yet

- INCOME TAXATION Chap 5 PG (184-192) PDFDocument2 pagesINCOME TAXATION Chap 5 PG (184-192) PDFnazarene moralesNo ratings yet

- Theories: B. 2 and 3 OnlyDocument5 pagesTheories: B. 2 and 3 OnlyLucille Mae EndigaNo ratings yet

- Fringe Benefit TaxDocument4 pagesFringe Benefit TaxKenneth Bryan Tegerero Tegio100% (1)

- TAXATIONDocument3 pagesTAXATIONcherry blossomNo ratings yet

- For The Month.: Answer: The Total Allowable Deduction From Business Income of Lucky Corporation Is 258,923Document2 pagesFor The Month.: Answer: The Total Allowable Deduction From Business Income of Lucky Corporation Is 258,923Aleksa FelicianoNo ratings yet

- Submissions 05. Taxation TAX.06 DIY DrillDocument9 pagesSubmissions 05. Taxation TAX.06 DIY DrillLovely SheenNo ratings yet

- Divided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Document4 pagesDivided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Bernardita OpongNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- Fringe Benefit ExercisesDocument6 pagesFringe Benefit ExercisesGet BurnNo ratings yet

- Fringe Benefits 1Document13 pagesFringe Benefits 1Jessa Mae ZamudioNo ratings yet

- Solution: P450,000: Answer: The Float Is P450,000Document1 pageSolution: P450,000: Answer: The Float Is P450,000Unknowingly AnonymousNo ratings yet

- FBT Sample ComputationsDocument3 pagesFBT Sample ComputationsLynn HermNo ratings yet

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Document3 pagesThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Answer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Document2 pagesAnswer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Unknowingly AnonymousNo ratings yet

- Junior Philippine Institute of Accountants: Rizal Technological UniversityDocument4 pagesJunior Philippine Institute of Accountants: Rizal Technological UniversityA BNo ratings yet

- Activity On Financial LeverageDocument2 pagesActivity On Financial Leveragesweet ecstacyNo ratings yet

- Dividend Policy - Q & ADocument4 pagesDividend Policy - Q & AJERICO RAMOSNo ratings yet

- 08 Act 01Document2 pages08 Act 01Angelo MorenoNo ratings yet

- Average Quiz Set ADocument5 pagesAverage Quiz Set AMarvin AndresNo ratings yet

- Income TAX Chapter 13 ReviewerDocument31 pagesIncome TAX Chapter 13 ReviewerEryn GabrielleNo ratings yet

- Chapter 5-Dayag-Problem 3Document7 pagesChapter 5-Dayag-Problem 3Mazikeen DeckerNo ratings yet

- A5 - Fringe Benefit TaxationDocument3 pagesA5 - Fringe Benefit TaxationJomer FernandezNo ratings yet

- ParCorp Answer KeyDocument176 pagesParCorp Answer KeyAndrew Gino CruzNo ratings yet

- IRA No. 2 Answer KeyDocument2 pagesIRA No. 2 Answer KeyProlen AcantoNo ratings yet

- Chapter 3 Management of ReceivablesDocument7 pagesChapter 3 Management of ReceivablesAbhishek TiwariNo ratings yet

- Guided Exercises Investment in AssociateDocument2 pagesGuided Exercises Investment in AssociateMireya YueNo ratings yet

- Accounting For Shareholders Equity ProblemsDocument30 pagesAccounting For Shareholders Equity ProblemsJhon baal S. SetNo ratings yet

- Accounting Book 1 Lupisan Baysa Answer KeyDocument176 pagesAccounting Book 1 Lupisan Baysa Answer KeyAngel ChuaNo ratings yet

- 2.4 Mock Exam Jun 06 Answer-AJ PDFDocument20 pages2.4 Mock Exam Jun 06 Answer-AJ PDFsaeed_r2000422No ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument119 pagesChapter 16 Advanced Accounting Solution ManualAsuncion BarquerosNo ratings yet

- IRA No. 4 Answer KeyDocument3 pagesIRA No. 4 Answer KeyProlen AcantoNo ratings yet

- Capital BudgetingDocument67 pagesCapital BudgetingRosanna RosalesNo ratings yet

- Chapter 8Document5 pagesChapter 8Misherene MagpileNo ratings yet

- This Study Resource Was: Assessment Task 3Document5 pagesThis Study Resource Was: Assessment Task 3maria evangelistaNo ratings yet

- Afar - CVPDocument3 pagesAfar - CVPJoanna Rose Deciar0% (1)

- 05.02 - ProblemSolvingChapter16.docx-2Document5 pages05.02 - ProblemSolvingChapter16.docx-2Murien Lim100% (1)

- Module 5: Assignment: 2. Bond Discount (P6,000,000 X .04)Document3 pagesModule 5: Assignment: 2. Bond Discount (P6,000,000 X .04)Camille BonaguaNo ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument94 pagesChapter 16 Advanced Accounting Solution ManualVanessa DozonNo ratings yet

- Consginment Sales Problems Answer KeyDocument5 pagesConsginment Sales Problems Answer KeykimberlyroseabianNo ratings yet

- 07.2 UPDATED Capital Investment DecisionsDocument6 pages07.2 UPDATED Capital Investment DecisionsMilani Joy LazoNo ratings yet

- Supplementary Material: Illustration. The Following Series of Illustrations Are Based On The Figures ObtainedDocument3 pagesSupplementary Material: Illustration. The Following Series of Illustrations Are Based On The Figures ObtainedGabrielle Joshebed AbaricoNo ratings yet

- Aa2 - Chapter 3 Suggested Answers: Exercises Exercise 3 - 1Document14 pagesAa2 - Chapter 3 Suggested Answers: Exercises Exercise 3 - 1Mary Joy BalangcadNo ratings yet

- Tax On Individuals - QuizDocument3 pagesTax On Individuals - QuizJM NoynayNo ratings yet

- Advanced Taxation-Previous YearDocument4 pagesAdvanced Taxation-Previous YearObeng CliffNo ratings yet

- MULTIPLE CHOICE: Choose The Best AnswerDocument3 pagesMULTIPLE CHOICE: Choose The Best AnswerEppie SeverinoNo ratings yet

- Franchise Comprehensive Prob PDF FreeDocument6 pagesFranchise Comprehensive Prob PDF FreetrishaNo ratings yet

- Module 3 Literature ActivitiesDocument3 pagesModule 3 Literature ActivitiesAlexis Joy P. DangoNo ratings yet

- Kaos GnosticismDocument1 pageKaos Gnosticismanton eNo ratings yet

- Case Studies of Lower Respiratory Tract InfectionsDocument25 pagesCase Studies of Lower Respiratory Tract InfectionsMarianNo ratings yet

- Past Tenses: Wiz NJ HN TH e - ( WH NJ HN TH - (Document1 pagePast Tenses: Wiz NJ HN TH e - ( WH NJ HN TH - (Sammy OushanNo ratings yet

- Human Relations The Art and Science of Building Effective Relationships 2nd Edition Mccann Solutions ManualDocument16 pagesHuman Relations The Art and Science of Building Effective Relationships 2nd Edition Mccann Solutions Manualoraliemaximusp474w3100% (26)

- Partnership Deed (Nanjunda)Document8 pagesPartnership Deed (Nanjunda)naveen KumarNo ratings yet

- Pe 2 - Introduction To DancesDocument57 pagesPe 2 - Introduction To DancesMelencio Dela Cruz INo ratings yet

- CN Assignment June 2014 FinalDocument4 pagesCN Assignment June 2014 Finalikuamichael100% (2)

- Sarah GarzaDocument1 pageSarah Garzasarah_garza67424No ratings yet

- Description: P Ack AgeDocument3 pagesDescription: P Ack AgeAlexandru CioponeaNo ratings yet

- 865 F.2d 1260 Unpublished DispositionDocument25 pages865 F.2d 1260 Unpublished DispositionScribd Government DocsNo ratings yet

- 99 Names of Allah SWT and Mohammed (PBUH)Document11 pages99 Names of Allah SWT and Mohammed (PBUH)api-26870382100% (1)

- Westbourne Baptist Church NW CalgaryDocument4 pagesWestbourne Baptist Church NW CalgaryBonnie BaldwinNo ratings yet

- What Is COBIT ?: COBIT Is A Framework Created by ISACA For InformationDocument41 pagesWhat Is COBIT ?: COBIT Is A Framework Created by ISACA For Informationkarthigajana1850No ratings yet

- 3.1.3.2 Batu Saluran KemihDocument64 pages3.1.3.2 Batu Saluran Kemihwinda musliraNo ratings yet

- Bible Greek VpodDocument134 pagesBible Greek VpodEmanuel AlvarezNo ratings yet

- Design and Analysis of AlgorithmsDocument200 pagesDesign and Analysis of AlgorithmsChitra RNo ratings yet

- Expenditure Method For Measurement of National IncomeDocument4 pagesExpenditure Method For Measurement of National Incomeakashsoni1995No ratings yet

- Elementary Differential Equations by Earl D Rainville B0000cm3caDocument5 pagesElementary Differential Equations by Earl D Rainville B0000cm3caJohncarlo PanganibanNo ratings yet

- Wisdom-Sophia: Contrasting Approaches To A Complex ThemeDocument12 pagesWisdom-Sophia: Contrasting Approaches To A Complex ThemeDramonesNo ratings yet

- Nicholas Healy - HENRI DE LUBAC ON NATURE AND GRACE: A NOTE ON SOME RECENT CONTRIBUTIONS TO THE DEBATEDocument30 pagesNicholas Healy - HENRI DE LUBAC ON NATURE AND GRACE: A NOTE ON SOME RECENT CONTRIBUTIONS TO THE DEBATEFrancisco J. Romero CarrasquilloNo ratings yet

- Who Coined The Term "PHILOSOPHY"? A) PythagorasDocument42 pagesWho Coined The Term "PHILOSOPHY"? A) PythagorasMosalas CompanyNo ratings yet

- PoeticsDocument4 pagesPoeticsCalvin PenacoNo ratings yet

- First Trimester TranslateDocument51 pagesFirst Trimester TranslateMuhammad Zakki Al FajriNo ratings yet

- DUBAI International Business PPT-2Document30 pagesDUBAI International Business PPT-2vignesh vikeyNo ratings yet

- Step 7 Err Code125936644Document37 pagesStep 7 Err Code125936644mohammadNo ratings yet

- Use of Realism in Mulk Raj Anand's Novels: Karan SharmaDocument2 pagesUse of Realism in Mulk Raj Anand's Novels: Karan SharmasirajahmedsNo ratings yet