Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

29 viewsAnalysis of Ramco Systems

Analysis of Ramco Systems

Uploaded by

sudipta shrivastavaRamco Systems is an enterprise software company based in Chennai, India that provides multi-tenant cloud and mobile software for HR, payroll, ERP, and aviation maintenance. It has around 1800 employees across 24 global offices. Key products include ERP software (40% of revenue), HR and payroll digital transformation software (37%), and aviation software for civil and defense companies (23%). While the company has reported profits, it has not paid dividends, has low interest coverage, and delivered only 7.27% sales growth over five years.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- SQL Case Study 2Document6 pagesSQL Case Study 2hiteshNo ratings yet

- Proposals For FundingDocument15 pagesProposals For Fundingmurphytjay100% (5)

- MGMT 3000 AssignmentDocument14 pagesMGMT 3000 AssignmentAshan MarambeNo ratings yet

- Sharda-Cropchem-Limited 204 InitiatingCoverageDocument4 pagesSharda-Cropchem-Limited 204 InitiatingCoveragelkamalNo ratings yet

- Kaynes Technology Limited Research Note 07112022Document9 pagesKaynes Technology Limited Research Note 07112022Raj Kishore BarikNo ratings yet

- Nirmal Bang 26th July 2018 IPO NoteDocument13 pagesNirmal Bang 26th July 2018 IPO NoteNiruNo ratings yet

- Ramco WordDocument4 pagesRamco WordSomil GuptaNo ratings yet

- Meghmani Organics SMIFS PDFDocument20 pagesMeghmani Organics SMIFS PDFAkCNo ratings yet

- JM Financial - Initiating CoverageDocument11 pagesJM Financial - Initiating Coveragerchawdhry123No ratings yet

- Ramco WordDocument8 pagesRamco WordSomil GuptaNo ratings yet

- Risco - Ro: Financial Rating - CuiDocument9 pagesRisco - Ro: Financial Rating - CuiAmine DiabyNo ratings yet

- 360 ONE High Growth Companies Fund - Apr24Document2 pages360 ONE High Growth Companies Fund - Apr24speedenquiryNo ratings yet

- HDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoverageDocument13 pagesHDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoveragehamsNo ratings yet

- UTI Asset Management Company: A Turnaround in The Works BUYDocument32 pagesUTI Asset Management Company: A Turnaround in The Works BUYGarvit GoyalNo ratings yet

- Fullerton Relaxo 27 July 2012Document9 pagesFullerton Relaxo 27 July 2012Sibina ANo ratings yet

- Marico LTD: A Safe Parachute!: Recommendation: BUYDocument14 pagesMarico LTD: A Safe Parachute!: Recommendation: BUYAnandNo ratings yet

- Aditya Birla Capital: Equentis Scale 1 2 3 4 5 Below Avg. Avg. Good Very Good ExcellentDocument2 pagesAditya Birla Capital: Equentis Scale 1 2 3 4 5 Below Avg. Avg. Good Very Good Excellentsayuj83No ratings yet

- PB Fintech Icici SecuritiesDocument33 pagesPB Fintech Icici SecuritieshamsNo ratings yet

- AA - REPORT Expansion SaaS Benchmarking StudyDocument43 pagesAA - REPORT Expansion SaaS Benchmarking StudyRobert KoverNo ratings yet

- Top 5 Pharma Stocks To BuyDocument8 pagesTop 5 Pharma Stocks To BuyAshutosh GuptaNo ratings yet

- AMC Sector - HDFC Sec-201901111558114702001 PDFDocument99 pagesAMC Sector - HDFC Sec-201901111558114702001 PDFmonikkapadiaNo ratings yet

- High Conviction Stock IdeasDocument7 pagesHigh Conviction Stock Ideasshravan38No ratings yet

- Bajaj Finance: Category Number of Shares Percentage of CapitalDocument5 pagesBajaj Finance: Category Number of Shares Percentage of Capitalwph referenceNo ratings yet

- Dabur India (DABUR IN) : Upgrade From N To OW - Stock Correction, Accretive Acquisition Leads To Buying OpportunityDocument9 pagesDabur India (DABUR IN) : Upgrade From N To OW - Stock Correction, Accretive Acquisition Leads To Buying OpportunityAmit0828No ratings yet

- BUS 5110 Managerial Accounting - Written Assignment Unit 7Document7 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 7LaVida LocaNo ratings yet

- JM - Homefirst PDFDocument10 pagesJM - Homefirst PDFSanjay PatelNo ratings yet

- Rane - REVL AR 2018 19 With KMPDocument101 pagesRane - REVL AR 2018 19 With KMPshountyNo ratings yet

- VIB - Section2 - Group5 - Final Project - ReportDocument13 pagesVIB - Section2 - Group5 - Final Project - ReportShrishti GoyalNo ratings yet

- Stewart & Mackertich - Initiating Coverage Report On SpiceJet Ltd.Document21 pagesStewart & Mackertich - Initiating Coverage Report On SpiceJet Ltd.Umar Pathan PathanNo ratings yet

- Medplus IPO Note - VenturaDocument19 pagesMedplus IPO Note - Venturaaniket birariNo ratings yet

- Nykaa - Company Update - Jan23Document8 pagesNykaa - Company Update - Jan23Abhishek MurarkaNo ratings yet

- Quarterly Update Report Laurus Labs Q1 FY24Document8 pagesQuarterly Update Report Laurus Labs Q1 FY24RAHUL NIMMAGADDANo ratings yet

- Angel One - IC - HSIE-202112201239150341854Document28 pagesAngel One - IC - HSIE-202112201239150341854hamsNo ratings yet

- TREASURY MODULE-Introduction: Trinadha Raju Rudra Raju, SAP May 28, 2018Document63 pagesTREASURY MODULE-Introduction: Trinadha Raju Rudra Raju, SAP May 28, 2018Suresh NayakNo ratings yet

- Polaris Software Laboratories LTDDocument23 pagesPolaris Software Laboratories LTDwebrohanNo ratings yet

- October 2020 FactsheetDocument2 pagesOctober 2020 FactsheetMohit AgarwalNo ratings yet

- Safari Industries BUY: Growth Momentum To Continue.Document20 pagesSafari Industries BUY: Growth Momentum To Continue.dcoolsamNo ratings yet

- Under Review: Indian Energy Exchange LimitedDocument9 pagesUnder Review: Indian Energy Exchange LimitedsumanchalkiNo ratings yet

- Fin254 Report DraftsDocument23 pagesFin254 Report DraftsShahryar NavidNo ratings yet

- SRF LTD Fundamental Monthly PickDocument3 pagesSRF LTD Fundamental Monthly PickAyushi ShahNo ratings yet

- DMART - IC - 010719 - Retail 01 July 2019 1197526894Document33 pagesDMART - IC - 010719 - Retail 01 July 2019 1197526894Dhruval KabariyaNo ratings yet

- Mahindra Logistics Limited: Challenging Business Outlook For The Medium TermDocument6 pagesMahindra Logistics Limited: Challenging Business Outlook For The Medium TermdarshanmadeNo ratings yet

- Latent View Analytics Limited Ipo: All You Need To Know AboutDocument7 pagesLatent View Analytics Limited Ipo: All You Need To Know AboutPeterNo ratings yet

- Nirmal_Bang_Update_on_Nippon_Life_India_Asset_Management_StrongDocument4 pagesNirmal_Bang_Update_on_Nippon_Life_India_Asset_Management_StrongPratik ChandankhedeNo ratings yet

- Ami Oragnics Limited IPO: All You Need To Know AboutDocument6 pagesAmi Oragnics Limited IPO: All You Need To Know AboutNeil MannikarNo ratings yet

- Central Depository Services: Stable Growth StoryDocument13 pagesCentral Depository Services: Stable Growth Storyrchawdhry123No ratings yet

- Happiest Minds Technologies LTD Q4FY24 Result UpdateDocument8 pagesHappiest Minds Technologies LTD Q4FY24 Result Updatecarbtools purchaseNo ratings yet

- 7 Undervalued Stocks With High Growth Potential Over Next One YearDocument6 pages7 Undervalued Stocks With High Growth Potential Over Next One Yearhoney1002No ratings yet

- Control Print Stock ValuationDocument1 pageControl Print Stock ValuationSiddharth ShahNo ratings yet

- Bharat Rasayan - Deep Dive - Template - Rohit BalakrishnanDocument8 pagesBharat Rasayan - Deep Dive - Template - Rohit BalakrishnanAnil RainaNo ratings yet

- Bajaj Finance - Incred EquitiesDocument42 pagesBajaj Finance - Incred Equitieskumar somyaNo ratings yet

- Fundamental of Analysis 1674219712Document87 pagesFundamental of Analysis 1674219712Andy Calderón Meléndez100% (1)

- Sun Pharma: Promising Specialty PipelineDocument8 pagesSun Pharma: Promising Specialty PipelineDinesh ChoudharyNo ratings yet

- Insurance Stocks AnalysisDocument38 pagesInsurance Stocks AnalysisAnjaiah PittalaNo ratings yet

- 360 ONE Equity Opportunity Fund - Apr24Document2 pages360 ONE Equity Opportunity Fund - Apr24speedenquiryNo ratings yet

- Summarecon Agung: Indonesia Company GuideDocument10 pagesSummarecon Agung: Indonesia Company GuideGoro ZhouNo ratings yet

- SMIFSLimited SwarajEnginesLtd Q3FY24ResultUpdate TractorsontheedgeofpickingupSwarajpositionedwellAccumulate SMIFSInstitutionalResearch Jan 25 2024Document10 pagesSMIFSLimited SwarajEnginesLtd Q3FY24ResultUpdate TractorsontheedgeofpickingupSwarajpositionedwellAccumulate SMIFSInstitutionalResearch Jan 25 2024karankumar432447634784No ratings yet

- Anupam Rasayan India Limited ReportDocument8 pagesAnupam Rasayan India Limited Reportankur taunkNo ratings yet

- Broking - Update - Mar19 - HDFC Sec-201903191711243793044Document16 pagesBroking - Update - Mar19 - HDFC Sec-201903191711243793044Sanjay RijhwaniNo ratings yet

- Reliance Capital: Reliance Home Finance: A Deep Dive Into Business ModelDocument15 pagesReliance Capital: Reliance Home Finance: A Deep Dive Into Business Modelsharkl123No ratings yet

- 2point2 Capital - Investor Update Q4 FY20Document6 pages2point2 Capital - Investor Update Q4 FY20Rakesh PandeyNo ratings yet

- Risk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveFrom EverandRisk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveNo ratings yet

- United States Court of Appeals, Third CircuitDocument11 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Goodenough Jewishh Symbols PDFDocument259 pagesGoodenough Jewishh Symbols PDFAlejandroNo ratings yet

- Global Divides 2Document11 pagesGlobal Divides 2Collin Ray I. LidaNo ratings yet

- Blitzkrieg For BeginnersDocument9 pagesBlitzkrieg For BeginnersJoseph CavalliNo ratings yet

- FAO Fisheries & Aquaculture - Fishery and Aquaculture Country Profiles - The Republic of IndonesiaDocument16 pagesFAO Fisheries & Aquaculture - Fishery and Aquaculture Country Profiles - The Republic of IndonesiaSofa Zuhad MNo ratings yet

- Skidmore v. Led Zeppelin - Plaintiff Exhibit List PDFDocument30 pagesSkidmore v. Led Zeppelin - Plaintiff Exhibit List PDFMark JaffeNo ratings yet

- 1a895selection of Channel PartnersDocument9 pages1a895selection of Channel Partnersmanav badhwarNo ratings yet

- Kamljeet Kamble - ResumeDocument6 pagesKamljeet Kamble - Resumeulhas.maargeenNo ratings yet

- What Will Next-Gen Submarine Cable Architecture Look Like inDocument7 pagesWhat Will Next-Gen Submarine Cable Architecture Look Like inCliff6948No ratings yet

- LogtxtDocument123 pagesLogtxtAisa HambaliNo ratings yet

- Kulayan v. Tan G.R. No. 187298, July 3, 2012PONENTE SERENO, J.Document3 pagesKulayan v. Tan G.R. No. 187298, July 3, 2012PONENTE SERENO, J.melbertgutzby vivasNo ratings yet

- Css 2015 Selected ListDocument24 pagesCss 2015 Selected ListSrinivas ChintuNo ratings yet

- Samples of Philosophy of EducationDocument6 pagesSamples of Philosophy of EducationElma Polillo-OrtineroNo ratings yet

- The Rebbe Is The Eternal Foundation Stone: D'Var MalchusDocument33 pagesThe Rebbe Is The Eternal Foundation Stone: D'Var MalchusB. MerkurNo ratings yet

- Bridge Is A Structure Which Provides Passage Over The Obstacles Like Valley, River, Road or RailwayDocument59 pagesBridge Is A Structure Which Provides Passage Over The Obstacles Like Valley, River, Road or RailwayVinay BagodiNo ratings yet

- Curriculum Development: 4 Major Educational PhilosophiesDocument26 pagesCurriculum Development: 4 Major Educational PhilosophiesMax GustinNo ratings yet

- Inter Banking System WithDocument7 pagesInter Banking System WithBharathJagadeeshNo ratings yet

- Christ University Christ University: PES Facebook PES Twitter PES BlogDocument11 pagesChrist University Christ University: PES Facebook PES Twitter PES BlogRakeshKumar1987No ratings yet

- Strict LiabilityDocument10 pagesStrict LiabilitysaidatuladaniNo ratings yet

- WV - Unit 7-8Document14 pagesWV - Unit 7-8chostoyNo ratings yet

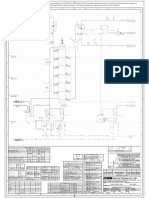

- Evs-1504-P&id-Atfd-Agitated Thin Film DryerDocument1 pageEvs-1504-P&id-Atfd-Agitated Thin Film DryerHsein WangNo ratings yet

- (Drawing) What To Draw and How To Draw ItDocument88 pages(Drawing) What To Draw and How To Draw ItBolivar Chagas100% (2)

- Walter Elias DisneyDocument4 pagesWalter Elias Disneyapi-205641182No ratings yet

- 1.4.2 ParousiaTeachingsDocument6 pages1.4.2 ParousiaTeachingskay addoNo ratings yet

- H-Net - Vaughn On Haddick, ' Fire On The Water - China, America, and The Future of The Pacific, Second Edition' - 2023-05-09Document3 pagesH-Net - Vaughn On Haddick, ' Fire On The Water - China, America, and The Future of The Pacific, Second Edition' - 2023-05-090No ratings yet

- S2 Heirs of Ignacio v. Home Bankers Savings and Trust CoDocument11 pagesS2 Heirs of Ignacio v. Home Bankers Savings and Trust CoMichael Parreño VillagraciaNo ratings yet

- Overnight CampingDocument14 pagesOvernight CampingAditya VardhanNo ratings yet

Analysis of Ramco Systems

Analysis of Ramco Systems

Uploaded by

sudipta shrivastava0 ratings0% found this document useful (0 votes)

29 views1 pageRamco Systems is an enterprise software company based in Chennai, India that provides multi-tenant cloud and mobile software for HR, payroll, ERP, and aviation maintenance. It has around 1800 employees across 24 global offices. Key products include ERP software (40% of revenue), HR and payroll digital transformation software (37%), and aviation software for civil and defense companies (23%). While the company has reported profits, it has not paid dividends, has low interest coverage, and delivered only 7.27% sales growth over five years.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRamco Systems is an enterprise software company based in Chennai, India that provides multi-tenant cloud and mobile software for HR, payroll, ERP, and aviation maintenance. It has around 1800 employees across 24 global offices. Key products include ERP software (40% of revenue), HR and payroll digital transformation software (37%), and aviation software for civil and defense companies (23%). While the company has reported profits, it has not paid dividends, has low interest coverage, and delivered only 7.27% sales growth over five years.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

29 views1 pageAnalysis of Ramco Systems

Analysis of Ramco Systems

Uploaded by

sudipta shrivastavaRamco Systems is an enterprise software company based in Chennai, India that provides multi-tenant cloud and mobile software for HR, payroll, ERP, and aviation maintenance. It has around 1800 employees across 24 global offices. Key products include ERP software (40% of revenue), HR and payroll digital transformation software (37%), and aviation software for civil and defense companies (23%). While the company has reported profits, it has not paid dividends, has low interest coverage, and delivered only 7.27% sales growth over five years.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Ramco Systems Ltd.

Business Overview 19/04/2022

Ramco Systems is an enterprise

software player having multi-tenant

cloud and mobile-based enterprise Data Snapshot

software in HR and Global Payroll,

Current Market Price Rs.327.65

ERP and M&E MRO for Aviation. The

Market cap: Rs. 1,009.62 cr

company is a part of Ramco Group. It

52-week high/low: Rs. 687.25 / 262

is headquartered in Chennai, and has

NSE volume:(No of shares)3.08 cr

around 1800+ employees spread

across 24 offices globally.

Shareholding Pattern (%)

Key Highlights

Ramco ERP (40%): This product line

provides ERP solutions.

Ramco HRP (37%): It works on digital

transformation in the HR and Payroll

Ramco Aviation (23%): The product is

focused on civil and defense companies.

Risk Factors

Though the company is reporting repeated profits,

it is not paying out dividends. The company has a

low-interest coverage ratio.

Key Ratios

The company has delivered a poor sales

growth of 7.27% over the past five years. Earnings per share -7.73

The company had a low return on equity of 4.62% ROCE- 16%

for the last 3 years. Price to cash flow 7.04%

Interest cover ratio 11.26

Financial Snapshot

Technical View

RSI Mid Range. RSI is 53.6

MFI is overbought, MFI is 79.4,

Beta is Low volatility, Beta is 0.9

50 Day SMA Rs 321.9

200 Day SMA Rs 439.6

Recommendation

(Hold)

Disclaimer: This report has been made using information from sources believed to be reliable. This is for information

purposes only and should not be construed as investment advice.

You might also like

- SQL Case Study 2Document6 pagesSQL Case Study 2hiteshNo ratings yet

- Proposals For FundingDocument15 pagesProposals For Fundingmurphytjay100% (5)

- MGMT 3000 AssignmentDocument14 pagesMGMT 3000 AssignmentAshan MarambeNo ratings yet

- Sharda-Cropchem-Limited 204 InitiatingCoverageDocument4 pagesSharda-Cropchem-Limited 204 InitiatingCoveragelkamalNo ratings yet

- Kaynes Technology Limited Research Note 07112022Document9 pagesKaynes Technology Limited Research Note 07112022Raj Kishore BarikNo ratings yet

- Nirmal Bang 26th July 2018 IPO NoteDocument13 pagesNirmal Bang 26th July 2018 IPO NoteNiruNo ratings yet

- Ramco WordDocument4 pagesRamco WordSomil GuptaNo ratings yet

- Meghmani Organics SMIFS PDFDocument20 pagesMeghmani Organics SMIFS PDFAkCNo ratings yet

- JM Financial - Initiating CoverageDocument11 pagesJM Financial - Initiating Coveragerchawdhry123No ratings yet

- Ramco WordDocument8 pagesRamco WordSomil GuptaNo ratings yet

- Risco - Ro: Financial Rating - CuiDocument9 pagesRisco - Ro: Financial Rating - CuiAmine DiabyNo ratings yet

- 360 ONE High Growth Companies Fund - Apr24Document2 pages360 ONE High Growth Companies Fund - Apr24speedenquiryNo ratings yet

- HDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoverageDocument13 pagesHDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoveragehamsNo ratings yet

- UTI Asset Management Company: A Turnaround in The Works BUYDocument32 pagesUTI Asset Management Company: A Turnaround in The Works BUYGarvit GoyalNo ratings yet

- Fullerton Relaxo 27 July 2012Document9 pagesFullerton Relaxo 27 July 2012Sibina ANo ratings yet

- Marico LTD: A Safe Parachute!: Recommendation: BUYDocument14 pagesMarico LTD: A Safe Parachute!: Recommendation: BUYAnandNo ratings yet

- Aditya Birla Capital: Equentis Scale 1 2 3 4 5 Below Avg. Avg. Good Very Good ExcellentDocument2 pagesAditya Birla Capital: Equentis Scale 1 2 3 4 5 Below Avg. Avg. Good Very Good Excellentsayuj83No ratings yet

- PB Fintech Icici SecuritiesDocument33 pagesPB Fintech Icici SecuritieshamsNo ratings yet

- AA - REPORT Expansion SaaS Benchmarking StudyDocument43 pagesAA - REPORT Expansion SaaS Benchmarking StudyRobert KoverNo ratings yet

- Top 5 Pharma Stocks To BuyDocument8 pagesTop 5 Pharma Stocks To BuyAshutosh GuptaNo ratings yet

- AMC Sector - HDFC Sec-201901111558114702001 PDFDocument99 pagesAMC Sector - HDFC Sec-201901111558114702001 PDFmonikkapadiaNo ratings yet

- High Conviction Stock IdeasDocument7 pagesHigh Conviction Stock Ideasshravan38No ratings yet

- Bajaj Finance: Category Number of Shares Percentage of CapitalDocument5 pagesBajaj Finance: Category Number of Shares Percentage of Capitalwph referenceNo ratings yet

- Dabur India (DABUR IN) : Upgrade From N To OW - Stock Correction, Accretive Acquisition Leads To Buying OpportunityDocument9 pagesDabur India (DABUR IN) : Upgrade From N To OW - Stock Correction, Accretive Acquisition Leads To Buying OpportunityAmit0828No ratings yet

- BUS 5110 Managerial Accounting - Written Assignment Unit 7Document7 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 7LaVida LocaNo ratings yet

- JM - Homefirst PDFDocument10 pagesJM - Homefirst PDFSanjay PatelNo ratings yet

- Rane - REVL AR 2018 19 With KMPDocument101 pagesRane - REVL AR 2018 19 With KMPshountyNo ratings yet

- VIB - Section2 - Group5 - Final Project - ReportDocument13 pagesVIB - Section2 - Group5 - Final Project - ReportShrishti GoyalNo ratings yet

- Stewart & Mackertich - Initiating Coverage Report On SpiceJet Ltd.Document21 pagesStewart & Mackertich - Initiating Coverage Report On SpiceJet Ltd.Umar Pathan PathanNo ratings yet

- Medplus IPO Note - VenturaDocument19 pagesMedplus IPO Note - Venturaaniket birariNo ratings yet

- Nykaa - Company Update - Jan23Document8 pagesNykaa - Company Update - Jan23Abhishek MurarkaNo ratings yet

- Quarterly Update Report Laurus Labs Q1 FY24Document8 pagesQuarterly Update Report Laurus Labs Q1 FY24RAHUL NIMMAGADDANo ratings yet

- Angel One - IC - HSIE-202112201239150341854Document28 pagesAngel One - IC - HSIE-202112201239150341854hamsNo ratings yet

- TREASURY MODULE-Introduction: Trinadha Raju Rudra Raju, SAP May 28, 2018Document63 pagesTREASURY MODULE-Introduction: Trinadha Raju Rudra Raju, SAP May 28, 2018Suresh NayakNo ratings yet

- Polaris Software Laboratories LTDDocument23 pagesPolaris Software Laboratories LTDwebrohanNo ratings yet

- October 2020 FactsheetDocument2 pagesOctober 2020 FactsheetMohit AgarwalNo ratings yet

- Safari Industries BUY: Growth Momentum To Continue.Document20 pagesSafari Industries BUY: Growth Momentum To Continue.dcoolsamNo ratings yet

- Under Review: Indian Energy Exchange LimitedDocument9 pagesUnder Review: Indian Energy Exchange LimitedsumanchalkiNo ratings yet

- Fin254 Report DraftsDocument23 pagesFin254 Report DraftsShahryar NavidNo ratings yet

- SRF LTD Fundamental Monthly PickDocument3 pagesSRF LTD Fundamental Monthly PickAyushi ShahNo ratings yet

- DMART - IC - 010719 - Retail 01 July 2019 1197526894Document33 pagesDMART - IC - 010719 - Retail 01 July 2019 1197526894Dhruval KabariyaNo ratings yet

- Mahindra Logistics Limited: Challenging Business Outlook For The Medium TermDocument6 pagesMahindra Logistics Limited: Challenging Business Outlook For The Medium TermdarshanmadeNo ratings yet

- Latent View Analytics Limited Ipo: All You Need To Know AboutDocument7 pagesLatent View Analytics Limited Ipo: All You Need To Know AboutPeterNo ratings yet

- Nirmal_Bang_Update_on_Nippon_Life_India_Asset_Management_StrongDocument4 pagesNirmal_Bang_Update_on_Nippon_Life_India_Asset_Management_StrongPratik ChandankhedeNo ratings yet

- Ami Oragnics Limited IPO: All You Need To Know AboutDocument6 pagesAmi Oragnics Limited IPO: All You Need To Know AboutNeil MannikarNo ratings yet

- Central Depository Services: Stable Growth StoryDocument13 pagesCentral Depository Services: Stable Growth Storyrchawdhry123No ratings yet

- Happiest Minds Technologies LTD Q4FY24 Result UpdateDocument8 pagesHappiest Minds Technologies LTD Q4FY24 Result Updatecarbtools purchaseNo ratings yet

- 7 Undervalued Stocks With High Growth Potential Over Next One YearDocument6 pages7 Undervalued Stocks With High Growth Potential Over Next One Yearhoney1002No ratings yet

- Control Print Stock ValuationDocument1 pageControl Print Stock ValuationSiddharth ShahNo ratings yet

- Bharat Rasayan - Deep Dive - Template - Rohit BalakrishnanDocument8 pagesBharat Rasayan - Deep Dive - Template - Rohit BalakrishnanAnil RainaNo ratings yet

- Bajaj Finance - Incred EquitiesDocument42 pagesBajaj Finance - Incred Equitieskumar somyaNo ratings yet

- Fundamental of Analysis 1674219712Document87 pagesFundamental of Analysis 1674219712Andy Calderón Meléndez100% (1)

- Sun Pharma: Promising Specialty PipelineDocument8 pagesSun Pharma: Promising Specialty PipelineDinesh ChoudharyNo ratings yet

- Insurance Stocks AnalysisDocument38 pagesInsurance Stocks AnalysisAnjaiah PittalaNo ratings yet

- 360 ONE Equity Opportunity Fund - Apr24Document2 pages360 ONE Equity Opportunity Fund - Apr24speedenquiryNo ratings yet

- Summarecon Agung: Indonesia Company GuideDocument10 pagesSummarecon Agung: Indonesia Company GuideGoro ZhouNo ratings yet

- SMIFSLimited SwarajEnginesLtd Q3FY24ResultUpdate TractorsontheedgeofpickingupSwarajpositionedwellAccumulate SMIFSInstitutionalResearch Jan 25 2024Document10 pagesSMIFSLimited SwarajEnginesLtd Q3FY24ResultUpdate TractorsontheedgeofpickingupSwarajpositionedwellAccumulate SMIFSInstitutionalResearch Jan 25 2024karankumar432447634784No ratings yet

- Anupam Rasayan India Limited ReportDocument8 pagesAnupam Rasayan India Limited Reportankur taunkNo ratings yet

- Broking - Update - Mar19 - HDFC Sec-201903191711243793044Document16 pagesBroking - Update - Mar19 - HDFC Sec-201903191711243793044Sanjay RijhwaniNo ratings yet

- Reliance Capital: Reliance Home Finance: A Deep Dive Into Business ModelDocument15 pagesReliance Capital: Reliance Home Finance: A Deep Dive Into Business Modelsharkl123No ratings yet

- 2point2 Capital - Investor Update Q4 FY20Document6 pages2point2 Capital - Investor Update Q4 FY20Rakesh PandeyNo ratings yet

- Risk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveFrom EverandRisk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveNo ratings yet

- United States Court of Appeals, Third CircuitDocument11 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Goodenough Jewishh Symbols PDFDocument259 pagesGoodenough Jewishh Symbols PDFAlejandroNo ratings yet

- Global Divides 2Document11 pagesGlobal Divides 2Collin Ray I. LidaNo ratings yet

- Blitzkrieg For BeginnersDocument9 pagesBlitzkrieg For BeginnersJoseph CavalliNo ratings yet

- FAO Fisheries & Aquaculture - Fishery and Aquaculture Country Profiles - The Republic of IndonesiaDocument16 pagesFAO Fisheries & Aquaculture - Fishery and Aquaculture Country Profiles - The Republic of IndonesiaSofa Zuhad MNo ratings yet

- Skidmore v. Led Zeppelin - Plaintiff Exhibit List PDFDocument30 pagesSkidmore v. Led Zeppelin - Plaintiff Exhibit List PDFMark JaffeNo ratings yet

- 1a895selection of Channel PartnersDocument9 pages1a895selection of Channel Partnersmanav badhwarNo ratings yet

- Kamljeet Kamble - ResumeDocument6 pagesKamljeet Kamble - Resumeulhas.maargeenNo ratings yet

- What Will Next-Gen Submarine Cable Architecture Look Like inDocument7 pagesWhat Will Next-Gen Submarine Cable Architecture Look Like inCliff6948No ratings yet

- LogtxtDocument123 pagesLogtxtAisa HambaliNo ratings yet

- Kulayan v. Tan G.R. No. 187298, July 3, 2012PONENTE SERENO, J.Document3 pagesKulayan v. Tan G.R. No. 187298, July 3, 2012PONENTE SERENO, J.melbertgutzby vivasNo ratings yet

- Css 2015 Selected ListDocument24 pagesCss 2015 Selected ListSrinivas ChintuNo ratings yet

- Samples of Philosophy of EducationDocument6 pagesSamples of Philosophy of EducationElma Polillo-OrtineroNo ratings yet

- The Rebbe Is The Eternal Foundation Stone: D'Var MalchusDocument33 pagesThe Rebbe Is The Eternal Foundation Stone: D'Var MalchusB. MerkurNo ratings yet

- Bridge Is A Structure Which Provides Passage Over The Obstacles Like Valley, River, Road or RailwayDocument59 pagesBridge Is A Structure Which Provides Passage Over The Obstacles Like Valley, River, Road or RailwayVinay BagodiNo ratings yet

- Curriculum Development: 4 Major Educational PhilosophiesDocument26 pagesCurriculum Development: 4 Major Educational PhilosophiesMax GustinNo ratings yet

- Inter Banking System WithDocument7 pagesInter Banking System WithBharathJagadeeshNo ratings yet

- Christ University Christ University: PES Facebook PES Twitter PES BlogDocument11 pagesChrist University Christ University: PES Facebook PES Twitter PES BlogRakeshKumar1987No ratings yet

- Strict LiabilityDocument10 pagesStrict LiabilitysaidatuladaniNo ratings yet

- WV - Unit 7-8Document14 pagesWV - Unit 7-8chostoyNo ratings yet

- Evs-1504-P&id-Atfd-Agitated Thin Film DryerDocument1 pageEvs-1504-P&id-Atfd-Agitated Thin Film DryerHsein WangNo ratings yet

- (Drawing) What To Draw and How To Draw ItDocument88 pages(Drawing) What To Draw and How To Draw ItBolivar Chagas100% (2)

- Walter Elias DisneyDocument4 pagesWalter Elias Disneyapi-205641182No ratings yet

- 1.4.2 ParousiaTeachingsDocument6 pages1.4.2 ParousiaTeachingskay addoNo ratings yet

- H-Net - Vaughn On Haddick, ' Fire On The Water - China, America, and The Future of The Pacific, Second Edition' - 2023-05-09Document3 pagesH-Net - Vaughn On Haddick, ' Fire On The Water - China, America, and The Future of The Pacific, Second Edition' - 2023-05-090No ratings yet

- S2 Heirs of Ignacio v. Home Bankers Savings and Trust CoDocument11 pagesS2 Heirs of Ignacio v. Home Bankers Savings and Trust CoMichael Parreño VillagraciaNo ratings yet

- Overnight CampingDocument14 pagesOvernight CampingAditya VardhanNo ratings yet