Professional Documents

Culture Documents

Advance Corporate Accounting Syllabus I

Advance Corporate Accounting Syllabus I

Uploaded by

Jøël Jøël0 ratings0% found this document useful (0 votes)

45 views2 pagesThis document provides details about the Advanced Corporate Accounting I course for the 5th semester of the B.Com General program, including the scheme of instruction, scheme of examination, course objectives, and course outcomes. The course aims to acquaint students with various accounting aspects related to companies. It will be taught over 5 hours per week for 5 credits. Students will learn about accounting for holding companies, electricity companies, life insurance, and general insurance. They will also learn about human resource accounting. The course aims to help students construct consolidated financial statements, apply double-entry accounting for utilities, and prepare insurance company financial statements according to regulatory requirements.

Original Description:

Iiiioooo

Original Title

AdvanceCorporateAccountingSyllabusI

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides details about the Advanced Corporate Accounting I course for the 5th semester of the B.Com General program, including the scheme of instruction, scheme of examination, course objectives, and course outcomes. The course aims to acquaint students with various accounting aspects related to companies. It will be taught over 5 hours per week for 5 credits. Students will learn about accounting for holding companies, electricity companies, life insurance, and general insurance. They will also learn about human resource accounting. The course aims to help students construct consolidated financial statements, apply double-entry accounting for utilities, and prepare insurance company financial statements according to regulatory requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

45 views2 pagesAdvance Corporate Accounting Syllabus I

Advance Corporate Accounting Syllabus I

Uploaded by

Jøël JøëlThis document provides details about the Advanced Corporate Accounting I course for the 5th semester of the B.Com General program, including the scheme of instruction, scheme of examination, course objectives, and course outcomes. The course aims to acquaint students with various accounting aspects related to companies. It will be taught over 5 hours per week for 5 credits. Students will learn about accounting for holding companies, electricity companies, life insurance, and general insurance. They will also learn about human resource accounting. The course aims to help students construct consolidated financial statements, apply double-entry accounting for utilities, and prepare insurance company financial statements according to regulatory requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

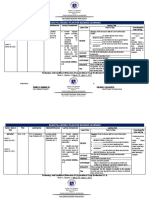

SEMESTER V

B.Com General

ADVANCE CORPORATE ACCOUNTING I

DSE

w.e.f 2019 -20 AY

SCHEME OF INSTRUCTION SCHEME OF EXAMINATION

Hours per Week :5 Maximum Marks : 100

Credits :5 Internal Assessment : 40

Instruction Mode : Lecture External Examination : 60

Course Code :BC.07.101.17T External Exam Duration : 3 Hrs

Course Objectives:

To acquaint the student with knowledge on various accounting aspects related to

company.

Course Outcomes

On Successful completion of the Course, Students will be able to:

CO 1: Construct consolidated balance sheet of holding companies using provisions of AS 21.

CO 2: Use Double accounting system for electricity companies.

CO 3: Prepare LIC final accounts as per IRDA provisions.

CO 4: Prepare general insurance as per IRDA provisions.

CO 5: Appraise the need, pros and cons of human resource accounting in India.

Unit I: Accounting for Holding Companies 12Hrs

Nature of holding Companies, Legal requirements for Holding Companies, Provisions of Ind AS

110, Calculation of Minority Interest, Cost of Control or Goodwill, Capital Reserve, Inter

Company Owings, Preference shares and debentures in subsidiary company, Pre acquisition

profits, Bonus Shares, Dividends in Subsidiary Company.

Unit II: Accounting for Electricity Companies 12 Hrs

Meaning of Double Account System, Revenue Account, Net Revenue Account, Capital Account

and General Balance Sheet, Calculation of Reasonable Return and Disposal of Surplus.

Unit III: Life Insurance Accounts 12 Hrs

Meaning, Types of Insurance, Terms in Insurance, Provisions of IRDA relating to LIC,

Preparation of LIC final accounts as per IRDA, Valuation Balance Sheet, Calculation of

corrected fund.

Unit IV: General Insurance Accounts 12 Hrs

Meaning, Types of General Insurance, Provision for unexpired risk, provisions of IRDA relating

to GIC, Preparation of final accounts.

Unit V: Human Resource Accounting 12 Hrs

Definition, objectives, approaches, assumptions, advantages and disadvantages of HRA, HRA in

India (Only Theory)

TEXT BOOKS

1. S.P. Jain and K.L.Narang, Advance Corporate Accounting, Kalyani Publications

2. S.P. Jain and K.L.Narang, Corporate Accounting, Kalyani Publications

REFERENCE BOOKS

1. RL Gupta and VK Gupta, Principles and practice of accounting, Sultan chand and Sons

2. SN Maheshwari and VL Maheshwari, Advanced Accounting (Vol III), Vikas Publishing

House

3. Shukla and Grewal, Advanced accounting, ; S.Chand and Co

You might also like

- Rural Marketing Project ReportDocument35 pagesRural Marketing Project Reportkamdica100% (12)

- RAISE Plus WEEKLY PLAN FOR BLENDED LEARNING TleDocument3 pagesRAISE Plus WEEKLY PLAN FOR BLENDED LEARNING TleRomeo jr RamirezNo ratings yet

- FA MBA Quarter I SNU Course Outline 2020Document7 pagesFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajNo ratings yet

- Behind The Scenes of AWPDocument5 pagesBehind The Scenes of AWPJayesh BoleNo ratings yet

- Feasibility Study For Assembly of Bicycle Project Proposal Business Plan in Ethiopia. - Haqiqa Investment Consultant in EthiopiaDocument1 pageFeasibility Study For Assembly of Bicycle Project Proposal Business Plan in Ethiopia. - Haqiqa Investment Consultant in EthiopiaSuleman100% (2)

- BBA 6th SemesterDocument8 pagesBBA 6th SemesterAshFaq KhAnNo ratings yet

- CommerceDocument32 pagesCommerceyashwanthbnyashwanthNo ratings yet

- Syllabus AFRDocument2 pagesSyllabus AFRHarsh KandeleNo ratings yet

- Bge CSC03Document2 pagesBge CSC03selvamNo ratings yet

- Income Tax PDFDocument6 pagesIncome Tax PDFSatyavir KhatriNo ratings yet

- B Com Sem VI Sub Auditing Course BCG 603Document154 pagesB Com Sem VI Sub Auditing Course BCG 603rizwanaabegum88No ratings yet

- ASM SOC B. Com. (Hons.) Course Syllabus 2019-22Document99 pagesASM SOC B. Com. (Hons.) Course Syllabus 2019-22Rajdeep Kumar RautNo ratings yet

- Syllabus B.com. First 22 23Document24 pagesSyllabus B.com. First 22 23Sadiya TufailNo ratings yet

- SyllabusDocument30 pagesSyllabusREJITHANo ratings yet

- Prog ModifiedDocument11 pagesProg ModifiedRahul RoyNo ratings yet

- AccountsDocument2 pagesAccountsKevin BookerNo ratings yet

- BBA C202 Hons NEP 2022 Pages 9Document1 pageBBA C202 Hons NEP 2022 Pages 9saumyaaggarwal04augNo ratings yet

- B.K Goel PDFDocument22 pagesB.K Goel PDFSumit KumarNo ratings yet

- Curriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisDocument16 pagesCurriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisAnand BabarNo ratings yet

- Semester-Iii: Scheme of Examination and CoursesDocument44 pagesSemester-Iii: Scheme of Examination and CoursesBhavna MuthyalaNo ratings yet

- Financial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - IDocument126 pagesFinancial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - Isambhav jindal100% (1)

- P - Sem-IIIDocument27 pagesP - Sem-IIIAndroid TricksNo ratings yet

- Bcom 8818Document30 pagesBcom 8818mayank guptaNo ratings yet

- 4corporate AccountingDocument2 pages4corporate AccountingShariaNo ratings yet

- Sem Vi Tybcom FinaccDocument10 pagesSem Vi Tybcom FinaccMusical FeistaNo ratings yet

- BookletDocument266 pagesBookletVivek YadavNo ratings yet

- Syllabus - B.Com (NEP) - 2023-24Document15 pagesSyllabus - B.Com (NEP) - 2023-24arghadas88242No ratings yet

- FA Sem1 FADocument2 pagesFA Sem1 FApraveenpatidar209No ratings yet

- BCOM 1001 - Financial Accounting SEM IDocument4 pagesBCOM 1001 - Financial Accounting SEM Ixc123544No ratings yet

- Syllabus and Scheme of Examination For: (Draft Approved by Faculty of Commerce and Business On 26 - 6-15)Document70 pagesSyllabus and Scheme of Examination For: (Draft Approved by Faculty of Commerce and Business On 26 - 6-15)Rohan SinghNo ratings yet

- Course Objective: Basic Concepts: Income Agricultural Income Person Assessee Assessment Year PreviousDocument3 pagesCourse Objective: Basic Concepts: Income Agricultural Income Person Assessee Assessment Year PreviousHarivansh GogiaNo ratings yet

- Ism Revised Syllabus 2020 21Document59 pagesIsm Revised Syllabus 2020 21Sudharsan DonNo ratings yet

- Sem Iii Sybcom Finacc Mang AccDocument6 pagesSem Iii Sybcom Finacc Mang AccKishori KumariNo ratings yet

- Bge CSC01Document2 pagesBge CSC01selvamNo ratings yet

- Individual Due Date: 19 April 2019 (Week 7) : The Individual Assessment Task Consist Of: Part A: 10% Part B: 5%Document5 pagesIndividual Due Date: 19 April 2019 (Week 7) : The Individual Assessment Task Consist Of: Part A: 10% Part B: 5%hi2joeyNo ratings yet

- Semester-I V: Scheme of Examination and Courses of Reading For B. Com. (Prog.)Document34 pagesSemester-I V: Scheme of Examination and Courses of Reading For B. Com. (Prog.)dbNo ratings yet

- Advanced Accounts: Course Code: MBA 407 Credit Units: 03 Course ObjectiveDocument1 pageAdvanced Accounts: Course Code: MBA 407 Credit Units: 03 Course ObjectiveShanky SinglaNo ratings yet

- Prog PDFDocument24 pagesProg PDFAbnmsNo ratings yet

- Syllabus Bcomacct Nep2023-2024Document12 pagesSyllabus Bcomacct Nep2023-2024trishabarik57No ratings yet

- Financial Accounting and Costing: FacultyDocument190 pagesFinancial Accounting and Costing: FacultySamNo ratings yet

- Syllabus - UG Sem II NEP 2020Document7 pagesSyllabus - UG Sem II NEP 2020ZoroNo ratings yet

- HonsDocument27 pagesHonsPavitriNo ratings yet

- COMMERCE III & IV SEM Revised 02-12-2022Document28 pagesCOMMERCE III & IV SEM Revised 02-12-2022prashanthuddar6No ratings yet

- PC-14 SyllabusDocument2 pagesPC-14 SyllabusSharad ChafleNo ratings yet

- Sem Iv Sybcom AuditingDocument3 pagesSem Iv Sybcom AuditingSejal KhambalNo ratings yet

- Syllabus BCOMACCT NEP2023-2024Document13 pagesSyllabus BCOMACCT NEP2023-2024Vdj AtmaNo ratings yet

- Odd Semester SyllabusDocument30 pagesOdd Semester Syllabusjazzyman 251No ratings yet

- Terminal SP21 AuditingDocument5 pagesTerminal SP21 AuditingMariam AfzalNo ratings yet

- Cbse Class 12 Syllabus 2019 20 AccountancyDocument10 pagesCbse Class 12 Syllabus 2019 20 AccountancyDhanbad TalksNo ratings yet

- ProgramDocument54 pagesProgramManeet SinghNo ratings yet

- Cost Accounting L T P C 3 2 0 4 Marks 100 Course ObjectiveDocument17 pagesCost Accounting L T P C 3 2 0 4 Marks 100 Course ObjectiveKritiSanchitSharmaNo ratings yet

- B. Com. (Hons.) : SyllabusDocument43 pagesB. Com. (Hons.) : SyllabusAditya SharmaNo ratings yet

- Sem 320Document8 pagesSem 320Rohit JaiswaraNo ratings yet

- SyllabusDocument99 pagesSyllabusparthNo ratings yet

- Corporate AccountingDocument10 pagesCorporate AccountingSHREY SANGAL 1823164No ratings yet

- Commerce Accounting Finance Bcom SyllabusDocument39 pagesCommerce Accounting Finance Bcom SyllabusMichael MaddyNo ratings yet

- Course OutcomeDocument14 pagesCourse OutcomeSuchandra SarkarNo ratings yet

- Bcom MGKVP SlybusDocument30 pagesBcom MGKVP SlybusHoney SrivastavaNo ratings yet

- B Com s-3 PDFDocument14 pagesB Com s-3 PDFYashas k nNo ratings yet

- Odd Semester SyllabusDocument25 pagesOdd Semester SyllabusKRATOS GAMINGNo ratings yet

- Analysis of Pupil Performance: AccountsDocument43 pagesAnalysis of Pupil Performance: AccountsT.K. MukhopadhyayNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Test Bank For Managerial Accounting 16th Edition Ray Garrison Eric Noreen Peter BrewerDocument24 pagesTest Bank For Managerial Accounting 16th Edition Ray Garrison Eric Noreen Peter BrewerJanetCampbellbpgq100% (55)

- Open Letter To California's Superintendent of Public Education Tony Thurmond Regarding Magnolia Public SchoolsDocument3 pagesOpen Letter To California's Superintendent of Public Education Tony Thurmond Regarding Magnolia Public SchoolsRobert AmsterdamNo ratings yet

- The Power of Media and InformationDocument17 pagesThe Power of Media and InformationEajay RosumanNo ratings yet

- Summer Internship Project 1Document53 pagesSummer Internship Project 1Karishma Bisht100% (1)

- Creating Effective Organization DesignDocument6 pagesCreating Effective Organization DesignSafwan JamilNo ratings yet

- Theory of Consumption Andtheory of ProductionDocument6 pagesTheory of Consumption Andtheory of ProductionMarinale LabroNo ratings yet

- 09 Apr 2021: UPSC Exam Comprehensive News Analysis: A. GS 1 Related B. GS 2 RelatedDocument12 pages09 Apr 2021: UPSC Exam Comprehensive News Analysis: A. GS 1 Related B. GS 2 RelatedArpita Sen BhattacharyaNo ratings yet

- ECO101 Solved Problems Games and Oligopoly SolutionsDocument10 pagesECO101 Solved Problems Games and Oligopoly Solutionsphineas12345678910ferbNo ratings yet

- ProjectManager Project Closure Template NDDocument11 pagesProjectManager Project Closure Template NDVocika MusixNo ratings yet

- Power BI - Revenue - Industry Agnostic Revenue - Analysis - Step-by-Step GuideDocument15 pagesPower BI - Revenue - Industry Agnostic Revenue - Analysis - Step-by-Step GuideGian Carlo Gonzales AnastacioNo ratings yet

- Full Download Test Bank For Economics Principles and Policy 14th Edition William J Baumol Alan S Blinder John L Solow PDF Full ChapterDocument36 pagesFull Download Test Bank For Economics Principles and Policy 14th Edition William J Baumol Alan S Blinder John L Solow PDF Full Chapterinkleunsevensymdy100% (15)

- IDBI Bank: This Article Has Multiple Issues. Please HelpDocument15 pagesIDBI Bank: This Article Has Multiple Issues. Please HelpmayurivinothNo ratings yet

- Trident ApplicationDocument5 pagesTrident ApplicationAarjav SinghNo ratings yet

- What Is BootstrappingDocument3 pagesWhat Is BootstrappingCharu SharmaNo ratings yet

- Selects Appropriate Business Opportunities Based On The Needs of The CommunityDocument4 pagesSelects Appropriate Business Opportunities Based On The Needs of The CommunityBerlin AlcaydeNo ratings yet

- Tech Mahindra LTD: by Apanshula Mishra Vijetta ThakurDocument13 pagesTech Mahindra LTD: by Apanshula Mishra Vijetta ThakurApanshula Anantabh MishraNo ratings yet

- AcryliCo Races Ahead With CrystalCoat MP 100Document4 pagesAcryliCo Races Ahead With CrystalCoat MP 100Chethan UpadhyayaNo ratings yet

- 537 4756 1 PB PDFDocument5 pages537 4756 1 PB PDFRe LNo ratings yet

- Media Planning ObjectivesDocument13 pagesMedia Planning ObjectivesSudhanshu JaiswalNo ratings yet

- NWC PM Manual - Road Map NWC PM Manual - Road Map NWC PM Manual - Road MapDocument10 pagesNWC PM Manual - Road Map NWC PM Manual - Road Map NWC PM Manual - Road MapEng hassan hussienNo ratings yet

- PRF For Tripura (Tourism Component) Prf-Tri/Ttdcl/Pdmc-02: Economic Review of Tripura 2017-18Document6 pagesPRF For Tripura (Tourism Component) Prf-Tri/Ttdcl/Pdmc-02: Economic Review of Tripura 2017-18Vishnu RaoNo ratings yet

- Planned Maintenance ManualDocument2 pagesPlanned Maintenance Manualait mimouneNo ratings yet

- The Inox Group Is A WellDocument7 pagesThe Inox Group Is A WellPriyanshu SharmaNo ratings yet

- Assignment/ Tugasan - Integrated Case StudyDocument11 pagesAssignment/ Tugasan - Integrated Case StudySYARAH NURDIYANAH BINTI SAFRUDDIN STUDENTNo ratings yet

- Receiving User GuideDocument76 pagesReceiving User GuideKamal MeshramNo ratings yet

- Assignment Banking Law, Shubham Singh Kirar IX Sem, BBALLBDocument7 pagesAssignment Banking Law, Shubham Singh Kirar IX Sem, BBALLBShubham Singh KirarNo ratings yet