Professional Documents

Culture Documents

Weekly Capital Market Report - Week Ending 29.04.2022

Weekly Capital Market Report - Week Ending 29.04.2022

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Capital Market Report - Week Ending 29.04.2022

Weekly Capital Market Report - Week Ending 29.04.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

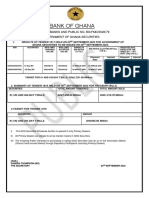

29TH APRIL 2022

WEEKLY CAPITAL MARKET REPORT

INVESTMENT TERM OF THE WEEK GSE EQUITY MARKET PERFORMANCE

Loan-to-Value (LTV) Ratio: The loan-to-value (LTV) ratio is an Indicator Current Previous Change

assessment of lending risk that financial institutions and other Week Week

lenders examine before approving a mortgage. Typically, loan GSE-Composite Index 2,691.19 2,696.67 -5.48 pts

assessments with high LTV ratios are considered higher risk loans. YTD (GSE-CI) -3.52% -3.32% 6.02%

GSE-Financial Stock Index 2,209.70 2,219.66 -9.96 pts

YTD (GSE-FSI) 2.69% 3.15% -14.60%

ETFs: GREAT DEAL FOR INVESTORS

Market Cap. (GH¢ MN) 63,817.52 64,040.47 -222.95

An exchange traded fund (ETF) is a type of security that tracks an Volume Traded 87,630,871 10,980,196 698.08%

index, sector, commodity, or other asset, but which can be Value Traded (GH¢) 89,227,903.01 10,983,012.32 712.42%

purchased or sold on a stock exchange the same as a regular stock. TOP TRADED EQUITIES

New Gold ETF (GLD), an exchange traded fund sponsored by Absa Ticker Volume Value (GH¢)

Capital, offers the opportunity to invest in gold bullion.

MTNGH 86,422,631 86,422,631.00

The company issues listed instruments (structured as debentures) GCB 501,264 2,556,446.40

backed by physical gold. Each debenture is approximately ETI 300,491 57,286.35

equivalent to 1/100 ounces of gold bullion, which is held with a secure POP 144,599 98,327.23 96.85%

PBC 116,500 2,330.00

depository on behalf of investors. The debentures are listed on the

Ghana (GSE) and six other African stock exchanges.

The current share price of New Gold ETF (GLD) is GH¢142.50. KEY ECONOMIC INDICATORS

Indicator Current Previous

Monetary Policy Rate February 2022 17.00% 14.50%

EQUITY MARKET HIGHLIGHTS: The Ghana Stock

Real GDP Growth December 2021 5.4% 0.40%

Market lost 5.48 points over the week to close at Inflation March 2022 19.4% 15.7%

2,691.19; returns -3.52% YTD. Source: GSS, BOG, GBA

Market activity for the week decreased by 5.48 points to close at

GAINER & DECLINERS

2,691.19 translating into a YTD return of -3.52%. The GSE Financial

Ticker Close Price Open Price Price Y-t-D

Stock Index (GSE-FSI) on the other hand decreased by 9.96 points to (GH¢) (GH¢) Change Change

CAL 0.90 0.86 0.04 4.65%

close the week at 2,209.70 translating into a YTD return of 2.69%. In

ETI 0.19 0.20 -0.01 -5.00%

the aggregate, twenty-six (26) equities participated in trading, SIC 0.25 0.26 -0.01 -3.85%

ending with one (1) gainer and four (4) decliners. CAL was the sole GCB 5.10 5.12 -0.02 -0.39%

GLD 142.50 158.60 -16.10 -10.15%

gainer as it closed at GH¢0.90 representing a YTD gain of 4.65%. The

decliners were ETI, SIC, GCB and GLD as they closed at GH¢0.19,

GH¢0.25, GH¢5.10 and GH¢142.50 representing a YTD loss of 5.00%, GSE-CI & GSE-FSI YTD PERFORMANCE

4.00% 2.69%

3.85%, 0.39% and 10.15% respectively.

2.00%

Market Capitalization decreased by GH¢222.95 million to close the

trading week at GH¢63.82 billion. 0.00%

26-Apr

1-Mar

29-Mar

5-Apr

19-Apr

4-Jan

25-Jan

15-Feb

11-Jan

1-Feb

12-Apr

8-Mar

22-Mar

18-Jan

8-Feb

22-Feb

15-Mar

A total of 87.63Smillion shares valued at GH¢89.23 million traded -2.00%

during the week compared to 10.98 million shares valued at

-4.00%

GH¢10.98 million which traded the previous week. Scancom PLC. -3.52%

-6.00%

(MTNGH) recorded the lion’s share of trades per value as it

GSE-CI GSE-FSI

accounted for 96.85% of the total value traded.

SBL RECOMMENDED PICKS EQUITY UNDER REVIEW:

SCANCOM PLC. (MTNGH)

Equity Price Opinion Market Outlook

Share Price GH¢1.00

MTN GHANA GH¢ 1.06 Strong 2021 FY Financials Higher Ask Price

Price Change (YtD) -9.91%

BOPP GH¢ 6.00 Strong 2021 FY Financials Low offers Market Cap. (GH¢) GH¢12.29 billion

CAL BANK GH¢ 0.85 Strong 2021 FY Financials Improving bids Dividend Yield 0.00%

ECOBANK GH¢ 7.60 Strong 2021 Q3 Financials Bargain bids Earnings Per Share GH¢0.2303

SOGEGH GH¢ 1.19 Strong 2021 FY Financials Low demand Avg. Daily Volumes 2,235,410

FANMILK GH¢ 3.00 Positive Sentiment Low demand Value Traded (YtD) GH¢364,850,592

SUMMARY OF MAR 2022 EQUITY MARKET ACTIVITIES GSE AGAINST SELECTED AFRICAN STOCK MARKETS

Indicator March March % Change Country Current Level YTD

2022 2021 2,691.19 -3.52%

(Ghana) GSE-CI

GSE-CI YTD CHANGE -1.67% 13.99% - (Botswana) BGSMDC 7,245.06 3.36%

GSE-CI 2,742.85 2,213.29 23.93 11,047.70 -7.54%

(Egypt) EGX-30

GSE-FSI YTD CHANGE 1.07% 3.54% - 150.17 -9.79%

(Kenya) NSE ASI

GSE-FSI 2,174.96 1,845.92 17.83 49,638.94 16.21%

(Nigeria) NGSE ASI

VOLUME 214.97 M 57.70 M 272.29 72,438.25 1.21%

(South Africa) JSE ASI

VALUE (GH¢) 237.14 M 48.46 M 389.35 220,25 8.88%

(WAEMU) BRVM

MKT. CAP. (GH¢M) 64,029.79 57,162.18 12.01 Source: Bloomberg

ADVANCERS & |

DECLINERS

Source: Ghana Stock Exchange, SBL Research

COMMODITIES MARKET

CURRENCY MARKET

Commodity Closing Previous YTD

Currency Closing Previous YTD

Week Week (%)

Week Week Change

(GH¢) (GH¢) %

BRENT CRUDE OIL 109.59 107.00 38.51%

DOLLAR 7.1128 7.1124 -15.56%

(US$/bbl.)

POUND 8.9333 9.1284 -9.02%

EURO 7.4963 7.6674 -8.91% GOLD 1,910.06 1,935.72 4.67%

YEN 0.0548 0.0552 -4.74% (US$/oz)

YUAN 1.0763 1.0928 -12.22%

CFA FRANC 87.5041 85.5514 9.79% 2,421.00 2,479.17 -1.19%

COCOA

Source: Bank of Ghana (US$/MT)

Source: Bloomberg, Bullion by Post, ICCO

JUSTIFICATIONS FOR INCLUDING STOCKS IN A PORTFOLIO ANALYSTS

Typically, stocks outperform all other investment options over a ten-year period

Godwin Kojo Odoom: Senior Research Analyst

making them a must for long term portfolio.

They are excellent vehicles for retirement. Obed Owusu Sackey: Analyst

Except for a few short periods, stocks have consistently outpaced the rate of inflation.

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- July 23, 2009 Through August 24, 2009 JPMorgan Chase BankDocument4 pagesJuly 23, 2009 Through August 24, 2009 JPMorgan Chase BankMaria Blackburn33% (3)

- Valuation Methods and Shareholder Value CreationFrom EverandValuation Methods and Shareholder Value CreationRating: 4.5 out of 5 stars4.5/5 (3)

- Adventure Travel Sample Marketing PlanDocument26 pagesAdventure Travel Sample Marketing PlanPalo Alto Software100% (9)

- ChE 140 1.01 IntroductionDocument30 pagesChE 140 1.01 IntroductionJelor GallegoNo ratings yet

- Weekly Capital Market Report - Week Ending 20.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 20.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 13.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 13.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 27.05.2022 2022-05-27Document2 pagesWeekly Capital Market Report Week Ending 27.05.2022 2022-05-27Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 22.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 22.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.02.2022Document3 pagesWeekly Capital Market Report - Week Ending 25.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 04.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 25.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 03.06.2022 2022-06-03Document2 pagesWeekly Capital Market Report Week Ending 03.06.2022 2022-06-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 22.07.2022 2022-07-22Document2 pagesWeekly Capital Market Report Week Ending 22.07.2022 2022-07-22Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.03.2022Document3 pagesWeekly Capital Market Report - Week Ending 04.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 26.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 26.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 15.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 15.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 02.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 02.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 29.07.2022 2022-07-29Document2 pagesWeekly Capital Market Report Week Ending 29.07.2022 2022-07-29Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 28.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 28.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.06.2022Document2 pagesWeekly Capital Market Report - Week Ending 10.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 24.06.2022 2022-06-24Document2 pagesWeekly Capital Market Report Week Ending 24.06.2022 2022-06-24Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 05.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 05.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 12.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 12.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.08.2022Document1 pageDaily Equity Market Report - 11.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2022Document1 pageDaily Equity Market Report - 08.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.06.2022Document1 pageDaily Equity Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.10.2021Document1 pageDaily Equity Market Report - 07.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- 06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICDocument2 pages06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICFuaad DodooNo ratings yet

- Daily Equity Market Report - 11.11.2021Document1 pageDaily Equity Market Report - 11.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2021Document1 pageDaily Equity Market Report - 07.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.11.2021Document1 pageDaily Equity Market Report - 15.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 21.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 21.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Medium Power Film Capacitor AvxDocument70 pagesMedium Power Film Capacitor AvxPeio GilNo ratings yet

- Economics SBADocument24 pagesEconomics SBAJamol benjaminNo ratings yet

- Veg Roll Recipe - Frankie Recipe For Kids - Swasthi's RecipesDocument22 pagesVeg Roll Recipe - Frankie Recipe For Kids - Swasthi's RecipespmaNo ratings yet

- Lymphoproliferative DisordersDocument36 pagesLymphoproliferative DisordersBrett FieldsNo ratings yet

- Group Medical Insurance - 2020-21Document2 pagesGroup Medical Insurance - 2020-21Vilaz VijiNo ratings yet

- Key Performance IndicatorsDocument27 pagesKey Performance IndicatorsZiad NayyerNo ratings yet

- Laboratory Diagnosis of Cerebrospinal Fluid: MM Cajucom MicrobiologyDocument21 pagesLaboratory Diagnosis of Cerebrospinal Fluid: MM Cajucom Microbiologymarc cajucomNo ratings yet

- Module 3 - AmcmlDocument3 pagesModule 3 - AmcmlAmotsik GolezNo ratings yet

- MLOG GX CMXA75 v4 0 322985a0 UM-ENDocument311 pagesMLOG GX CMXA75 v4 0 322985a0 UM-ENjamiekuangNo ratings yet

- Praise Be To Allah: Mymona HendricksDocument37 pagesPraise Be To Allah: Mymona HendricksRulytta MimiNo ratings yet

- Marquipt Mounting Systems FR SS LadDocument2 pagesMarquipt Mounting Systems FR SS LadAyhan ÇalışkanNo ratings yet

- Multimode Relay MT: 2 / 3 Pole 10 A, DC-or AC-coilDocument4 pagesMultimode Relay MT: 2 / 3 Pole 10 A, DC-or AC-coilgoo gleNo ratings yet

- Historical Change and Ceramic Tradition: The Case of Macedonia - Zoi KotitsaDocument15 pagesHistorical Change and Ceramic Tradition: The Case of Macedonia - Zoi KotitsaSonjce Marceva100% (2)

- Pugh Method Example-2Document4 pagesPugh Method Example-2Shaikh AkhlaqueNo ratings yet

- I) H3C - MSR3600 - Datasheet PDFDocument15 pagesI) H3C - MSR3600 - Datasheet PDFSON DANG LAMNo ratings yet

- The Cattell-Horn-Carroll Theory of Cognitive AbilitiesDocument13 pagesThe Cattell-Horn-Carroll Theory of Cognitive Abilitiessergio_poblete_ortegaNo ratings yet

- Instruction Book Manual de Instrucciones Livre D'InstructionsDocument79 pagesInstruction Book Manual de Instrucciones Livre D'InstructionsWilfrido RosadoNo ratings yet

- BTS Power ManagementDocument21 pagesBTS Power ManagementSam FicherNo ratings yet

- Pioneer Plasma TV - ScanBoard & ICs Removal Re Installation GuideDocument12 pagesPioneer Plasma TV - ScanBoard & ICs Removal Re Installation GuideRagnar7052No ratings yet

- History: The History of The Hospitality Industry Dates All The WayDocument10 pagesHistory: The History of The Hospitality Industry Dates All The WaySAKET TYAGINo ratings yet

- Training Day-1 V5Document85 pagesTraining Day-1 V5Wazabi MooNo ratings yet

- Surbir Singh Negi: Surbir99 - Negi@yahoo - Co.in, Surbir - Negi1@yahoo - Co.inDocument3 pagesSurbir Singh Negi: Surbir99 - Negi@yahoo - Co.in, Surbir - Negi1@yahoo - Co.insurbir_negi1100% (2)

- Ibm - R61i Vga ShareDocument100 pagesIbm - R61i Vga Shareحسن علي نوفلNo ratings yet

- Chronic Suppurative Otitis MediaDocument37 pagesChronic Suppurative Otitis Media43 Mohamed RazikNo ratings yet

- Synchro Studio 8: Getting Started and What's New in Version 8Document35 pagesSynchro Studio 8: Getting Started and What's New in Version 8Fernando Luis FerrerNo ratings yet

- Mamake Bobo Recipe Book 1Document74 pagesMamake Bobo Recipe Book 1ngugibibaNo ratings yet

- Film ConventionsDocument9 pagesFilm ConventionsAnjali Kaur ChannaNo ratings yet