Professional Documents

Culture Documents

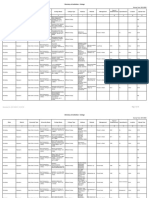

Content:: Module 3: Strategy Formulation

Content:: Module 3: Strategy Formulation

Uploaded by

rakshith bond007Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Content:: Module 3: Strategy Formulation

Content:: Module 3: Strategy Formulation

Uploaded by

rakshith bond007Copyright:

Available Formats

Module 3: Strategy Formulation:

CONTENT:

A. Competitor Analysis;

B. BCG Matrix;

C. International Dimensions of Strategy: Growth, Stability, Profitability, Efficiency,

Market Leadership, Survival, Merger, and Acquisition;

D. Core Competence. Bench marking,

E. McKinsey’s 7S Framework.

F. Formulation of strategy at corporate, business and functional levels.

G. Turnaround strategy and Diversification strategy.

H. Factors affecting strategic choice,

I. Generic competitive strategies: Cost leadership- Differentiation- Focus;

A] Competitor Analysis

Organizations must operate within a competitive industry environment. They do not exist in

vacuum. Analysing organization’s competitors helps an organization to discover its

weaknesses, to identify opportunities for and threats to the organization from the industrial

environment. While formulating an organization’s strategy, managers must consider the

strategies of organization’s competitors. Competitor analysis is a driver of an organization’s

strategy and effects on how firms act or react in their sectors. The organization does a

competitor analysis to measure / assess its standing amongst the competitors.

Competitor analysis begins with identifying present as well as potential competitors. It

portrays an essential appendage to conduct an industry analysis. An industry analysis gives

information regarding probable sources of competition (including all the possible strategic

actions and reactions and effects on profitability for all the organizations competing in the

industry). However, a well-thought competitor analysis permits an organization to concentrate

on those organizations with which it will be in direct competition, and it is especially important

when an organization faces a few potential competitors.

Michael Porter in Porter’s Five Forces Model has assumed that the competitive environment

within an industry depends on five forces- Threat of new potential entrants, Threat of substitute

product/services, bargaining power of suppliers, bargaining power of buyers, Rivalry among

current competitors. These five forces should be used as a conceptual background for

identifying an organization’s competitive strengths and weaknesses and threats to and

opportunities for the organization from it’s competitive environment.

Prof Bhavya Vinil, School of Management, CMR University

The main objectives of doing competitor analysis can be summarized as follows:

To study the market;

To predict and forecast organization’s demand and supply;

To formulate strategy;

To increase the market share;

To study the market trend and pattern;

To develop strategy for organizational growth;

When the organization is planning for the diversification and expansion plan;

To study forthcoming trends in the industry;

Understanding the current strategy strengths and weaknesses of a competitor can suggest

opportunities and threats that will merit a response;

Insight into future competitor strategies may help in predicting upcoming threats and

opportunities.

Competitors should be analyzed along various dimensions such as their size, growth and

profitability, reputation, objectives, culture, cost structure, strengths and weaknesses, business

strategies, exit barriers, etc.

What is Competitive Advantage in the Field of Strategic Management?

It is a truism that strategic management is all about gaining and maintaining competitive

advantage. The term can be defined to mean “anything that a firm does especially well when

compared with rival firms”. Note the emphasis on comparison with rival firms as competitive

advantage is all about how best to best the rivals and stay competitive in the market.

Competitive advantage accrues to a firm when it does something that the rivals cannot

do or owns something that the rival firms desire. For instance, for some firms, competitive

advantage in these recessionary times can mean a hoard of cash where it can buy out struggling

firms and increase its strategic position. In other cases, competitive advantage can mean that a

firm has lesser-fixed assets when compared to rival firms, which is again a plus in an economic

downturn.

Prof Bhavya Vinil, School of Management, CMR University

What is Sustained Competitive Advantage?

A firm can have a source of competitive advantage for only a certain period because the rival

firms imitate and copy the successful firms’ strategies leading to the original firm losing its

source of competitive advantage over the longer term. Hence, it is imperative for firms to

develop and nurture sustained competitive advantage. This can be done by:

▪ Continually adapting to the changing external business landscape and matching internal

strengths and capabilities by channelling resources and competencies in a fluid manner.

▪ By formulating, implementing, and evaluating strategies in an effective manner which

make use of the factors described above.

B] BCG Matrix or Growth Share Matrix:

The Boston Consulting Group (BCG) growth-share matrix is a planning tool that uses

graphical representations of a company’s products and services in an effort to help the

company decide what it should keep, sell, or invest more in.

The matrix plots a company’s offerings in a four-square matrix, with the y-axis representing

the rate of market growth and the x-axis representing market share. It was introduced by the

Boston Consulting Group in 1970

Understanding a BCG Growth-Share Matrix

The BCG growth-share matrix breaks down products into four categories, known heuristically

as "dogs," "cash cows," "stars," and “question marks.” Each category quadrant has its own set

of unique characteristics.2

1. Stars- Stars represent business units having large market share in a fast growing

industry. They may generate cash but because of fast growing market, stars require

huge investments to maintain their lead. Net cash flow is usually modest. SBU’s located

in this cell are attractive as they are located in a robust industry and these business units

are highly competitive in the industry. If successful, a star will become a cash cow when

the industry matures.

2. Cash Cows- Cash Cows represents business units having a large market share in a

mature, slow growing industry. Cash cows require little investment and generate cash

that can be utilized for investment in other business units. These SBU’s are the

corporation’s key source of cash, and are specifically the core business. They are the

base of an organization. These businesses usually follow stability strategies. When cash

Prof Bhavya Vinil, School of Management, CMR University

cows loose their appeal and move towards deterioration, then a retrenchment policy

may be pursued.

3. Question Marks- Question marks represent business units having low relative market

share and located in a high growth industry. They require huge amount of cash to

maintain or gain market share. They require attention to determine if the venture can be

viable. Question marks are generally new goods and services which have a good

commercial prospective. There is no specific strategy which can be adopted. If the firm

thinks it has dominant market share, then it can adopt expansion strategy, else

retrenchment strategy can be adopted. Most businesses start as question marks as the

company tries to enter a high growth market in which there is already a market-share.

If ignored, then question marks may become dogs, while if huge investment is made,

then they have potential of becoming stars.

4. Dogs- Dogs represent businesses having weak market shares in low-growth markets.

They neither generate cash nor require huge amount of cash. Due to low market share,

these business units face cost disadvantages. Generally retrenchment strategies are

adopted because these firms can gain market share only at the expense of

competitor’s/rival firms. These business firms have weak market share because of high

costs, poor quality, ineffective marketing, etc. Unless a dog has some other strategic

aim, it should be liquidated if there is fewer prospects for it to gain market share.

Number of dogs should be avoided and minimized in an organization.

Prof Bhavya Vinil, School of Management, CMR University

Limitations of BCG Matrix

The BCG Matrix produces a framework for allocating resources among different business units

and makes it possible to compare many business units at a glance. But BCG Matrix is not free

from limitations, such as-

1. BCG matrix classifies businesses as low and high, but generally businesses can be

medium also. Thus, the true nature of business may not be reflected.

Prof Bhavya Vinil, School of Management, CMR University

2. Market is not clearly defined in this model.

3. High market share does not always leads to high profits. There are high costs also

involved with high market share.

4. Growth rate and relative market share are not the only indicators of profitability. This

model ignores and overlooks other indicators of profitability.

5. At times, dogs may help other businesses in gaining competitive advantage. They can

earn even more than cash cows sometimes.

6. This four-celled approach is considered as to be too simplistic.

C] International Dimensions of Strategy:

Growth, Stability, Profitability, Efficiency, Market Leadership, Survival, Merger, and

Acquisition

Growth Strategies:

Your business will never increase in value without growth. But business growth does not

happen accidentally; it's the result of strategic initiatives. There are four basic growth

strategies you can employ to expand your business: market penetration, product

development, market expansion and diversification.

Prof Bhavya Vinil, School of Management, CMR University

What is the Ansoff Matrix?

The Ansoff Matrix, also called the Product/Market Expansion Grid, is a tool used by firms to

analyze and plan their strategies for growth. The matrix shows four strategies that can be used

to help a firm grow and also analyzes the risk associated with each strategy.

Understanding the Ansoff Matrix

The matrix was developed by applied mathematician and business manager, H. Igor

Ansoff, and was published in the Harvard Business Review in 1957. The Ansoff Matrix has

helped many marketers and executives better understand the risks inherent in growing their

business.

The four strategies of the Ansoff Matrix are:

1. Market Penetration: This focuses on increasing sales of existing products to an

existing market.

2. Product Development: Focuses on introducing new products to an existing market.

3. Market Development: This strategy focuses on entering a new market using existing

products.

4. Diversification: Focuses on entering a new market with the introduction of new

products.

Of the four strategies, market penetration is the least risky, while diversification is the riskiest.

Prof Bhavya Vinil, School of Management, CMR University

The Ansoff Matrix: Market Penetration

In a market penetration strategy, the firm uses its products in the existing market. In other

words, a firm is aiming to increase its market share with a market penetration strategy.

The market penetration strategy can be executed in a number of ways:

1. Decreasing prices to attract new customers

2. Increasing promotion and distribution efforts

3. Acquiring a competitor in the same marketplace

For example, telecommunication companies all cater to the same market and employ a market

penetration strategy by offering introductory prices and increasing their promotion and

distribution efforts.

The Ansoff Matrix: Product Development

In a product development strategy, the firm develops a new product to cater to the existing

market. The move typically involves extensive research and development and expansion of the

company’s product range. The product development strategy is employed when firms have a

strong understanding of their current market and are able to provide innovative solutions to

meet the needs of the existing market.

This strategy, too, may be implemented in a number of ways:

1. Investing in R&D to develop new products to cater to the existing market

2. Acquiring a competitor’s product and merging resources to create a new product that

better meets the need of the existing market

3. Forming strategic partnerships with other firms to gain access to each partner’s

distribution channels or brand

For example, automotive companies are creating electric cars to meet the changing needs of

their existing market. Current market consumers in the automobile market are becoming more

environmentally conscious.

The Ansoff Matrix: Market Development

In a market development strategy, the firm enters a new market with its existing product(s). In

this context, expanding into new markets may mean expanding into new geographic regions,

customer segments, etc. The market development strategy is most successful if (1) the firm

owns proprietary technology that it can leverage into new markets, (2) potential consumers in

Prof Bhavya Vinil, School of Management, CMR University

the new market are profitable (i.e., they possess disposable income), and (3) consumer behavior

in the new markets does not deviate too far from that of consumers in the existing markets.

The market development strategy may involve one of the following approaches:

1. Catering to a different customer segment

2. Entering into a new domestic market (expanding regionally)

3. Entering into a foreign market (expanding internationally)

For example, sporting goods companies such as Nike and Adidas recently entered the Chinese

market for expansion. The two firms are offering roughly the same products to a new

demographic.

The Ansoff Matrix: Diversification

In a diversification strategy, the firm enters a new market with a new product. Although such

a strategy is the riskiest, as both market and product development are required, the risk can be

mitigated somewhat through related diversification. Also, the diversification strategy may offer

the greatest potential for increased revenues, as it opens up an entirely new revenue stream for

the company – accesses consumer spending dollars in a market that the company did not

previously have any access to.

There are two types of diversification a firm can employ:

1. Related diversification: There are potential synergies to be realized between the existing

business and the new product/market.

For example, a leather shoe producer that starts a line of leather wallets or accessories is

pursuing a related diversification strategy.

2. Unrelated diversification: There are no potential synergies to be realized between the

existing business and the new product/market.

For example, a leather shoe producer that starts manufacturing phones is pursuing an unrelated

diversification strategy.

CORPORATE LEVEL STRATEGY:

Prof Bhavya Vinil, School of Management, CMR University

Meaning of Corporate Strategy. A business organization operates under the influence of

various environmental forces / factors. In order to survive and grow, an organization has to

constantly interact with various environmental forces and adapt and adjust it’s strategies

accordingly. So environmental and organizational analysis acts as the foundation for generating

strategic alternatives that an organization can consider for adoption

The corporate level strategies refer to identifying the businesses the company shall be engaged

in. They determine the direction that the firm takes in order to achieve its objectives. For a

small business firm, the corporate strategy can identify the courses of action for improving

profitability of the firm. In case of the large firm, the corporate strategy means managing the

various businesses to maximize their contribution to the achievement of overall corporate

objectives

Corporate level strategy is concerned with two main questions :

1) What business areas should a company deal in so as to maximize its long term profitability?

2) What strategies should it use to enter into and exit from business areas? I

In other words, corporate level strategies are basically about decisions related to allocating

resources among the different businesses of a firm, transferring resources from one set of

businesses to others and managing a portfolio of businesses in such a way that the overall

corporate objectives are achieved

International Dimensions- Corporate Level Strategies :

There are four generic ways in which corporate level strategy alternatives can be considered a)

stability b) growth c) retrenchment and d) combination. Firms take into consideration these

strategy alternatives while formulating their corporate strategies because only through generic

strategies, they can locate the particular route best suited for achieving the chosen objective.

Prof Bhavya Vinil, School of Management, CMR University

a) Stability Strategy - When a company finds that it should continue in the existing business

and is doing reasonably well in that business and there is no scope for significant growth, the

stability strategy is used.

b) Growth Strategy - When growth strategy is adopted, it can lead to addition of new products

/ or new markets or functions. Even without a change in business definition, many firms

undertake major increases in the scope of activities. Growth is usually considered as the way

to improve performance in terms of market share, sales turnover and profitability of the firm

It is possible for the firm to grow through the use of a) Internal and b) External growth

strategies.

A) Internal Growth Strategies – Internal growth is within the organization or with the help

of it’s internal resources. i.e. the capital, employees, the technique used for production etc.

There are no major changes in the management and operations of the organization, if it focuses

on internal growth. Internal growth can take place either by a) Intensification or b)

Diversification of business.

a) Intensification Strategy - In this strategy, a firm intends to grow by concentrating on its

existing businesses. This strategy involves three alternatives.

1) Market Penetration Strategy - This strategy involves using aggressive sales promotion

techniques for promoting the sale of existing products in existing markets. In order to capture

higher share of the market, a firm may cut prices, improve distribution network and adopt sales

promotion techniques to increase the sale to existing customers, convincing the non users to

purchase the products and also attracting the users of competing brands.

2) Market Development Strategy - This strategy involves finding out new markets for the

existing products. It aims at reaching new customer segments within an existing geographic

market, or it may aim at expanding into new geographic areas, including overseas markets.

3) Product Development Strategy - This strategy involves developing new products for existing

markets or for new markets. In product development, the firm may improve it’s product’s

features or performance or it may extend its product line.

b) Diversification Strategy - In this strategy, the firm enters into the new line of business. It

involves expansion or growth of business by introducing new products either in the same

market or in different markets. The firm may diversity for various reasons such as to spread

the risks by operating in various businesses, the make optimum use of resources, to face

competition effectively etc.

Diversification strategy involves the following forms :

Prof Bhavya Vinil, School of Management, CMR University

1) Vertical Diversification - In this case, the company expands its activities or product lines

vertically i.e. by forward or backword integration. i) Forward Integration - In forward

integration, the firm may start marketing its products by its elf i.e. by establishing it’s own

retail outlets. The purpose is to reduce the dependence on distributors and to enjoy control over

marketing of it’s products. ii) Backward Integration - In backward integration, the firm may

start manufacturing its own raw materials, spare parts and components. The purpose is to

reduce the dependence on suppliers and to enjoy control over it’s supplies.

2) Horizontal Diversification - In this case, a company expands its activities by introducing

new products or product lines which are related to a certain extent to the current line of

business. The products are related because they perform a closely related function, or are sold

to the same customer groups, or are marketed through the same distribution channel. For

example, a company manufacturing refrigerators may enter into manufacturing of air

conditioners or a truck manufacturing company may set up a car making unit.

3) Concentric Diversification - In involves diversification into such areas or products, which

are indirectly related to its existing line of business. In concentric diversification, the new

business is linked to the existing business through process, technology or marketing. For

example, a car dealer may start a finance company to finance hire purchase of cars.

4) Conglomerate Diversification - It involves entry in a totally new area or business. It is an

attempt to diversity outside the present market or product. In conglomerate diversification,

there are no linkages between the new business and the existing business. New line of business

is quite different as far as process, technology or functions are concerned. For example, a

computer software company may enter into insurance business.

B) External Growth Strategies : Growth with the help of external resources or organisations

is called external growth.

The external growth strategies can be broadly divided into three groups.

1) Mergers and Acquisitions

2) Amalgamations

3) Joint Ventures

1) Mergers and Acquisitions / Takeovers : In merger and acquisition, two companies come

together but only one company retains its existence and the other loses its identity i.e. the

company which acquires other company continues to operate in the business but the merging

company loses its existence. In merger, the acquiring company takes over the assets &

liabilities of another company. Shareholders of merging company are given the shares of the

acquiring company.

Prof Bhavya Vinil, School of Management, CMR University

Mergers represent a process of allocation and reallocation of resources of firms in response to

changes in economic conditions and technological innovations. The main rationale for a merger

is that the value of the merged firm is expected to be greater than the total of the independent

values of merging firms due to operating economies, tax benefits, opportunities of

diversification, ability to face competition and so on.

Merger may be horizontal, vertical or conglomerate. In horizontal merger, both the companies

(merging and merged) are engaged in the same line of business. In vertical merger, the

combining companies are engaged in the successive stages of production / marketing. In the

case of conglomerate merger, the combining companies are engaged in different business

activities which are unrelated.

There is minor difference between acquisition and takeover. In acquisition, both the companies

are willing to merge. In a takeover, the willingness is absent in the seller’s management.

Takeover is with force i.e. without the consent while acquisition is with mutual consent and

persuasion.

2) Amalgamation - An amalgamation is an arrangement in which the assets and liabilities of

two or more companies become vested in another company. In other words, it is a process of

combining two or more companies and a new company is formed. The shareholders of the

amalgamating companies become shareholders of new entity (amalgamated company)

Amalgamations are governed by the companies Act and require consent of the shareholders

and creditors.

3) Joint Ventures - Joint venture is a form of business combination. Two or more companies

form a temporary partnership and arrive at an agreement on certain issues of mutual interest.

New company is not created but suitable working arrangements are agreed upon. Such

agreements are beneficial to combining units. It is an economic route for gaining increased

competitiveness to combining units. Joint venture covers more areas of co-operation between

the two companies. Joint ventures are useful for the inflow of foreign capital, machinery and

technology for rapid industrial growth in developing countries. They are popular among the

developing counties and are not harmful provided the joint venture agreements are made with

due care and caution. In a joint venture, the business units from two different countries come

together for starting a new industrial activity. Joint venture is also possible among two or more

domestic companies. However, leading foreign companies are normally preferred. It is

generally for sharing of ownership and control of an economic enter pries between foreign firm

and local firm.

Prof Bhavya Vinil, School of Management, CMR University

Joint Venture is not an integration of two units. It is not a business combination in the ordinary

sense of the term as two companies maintain their independent identity even after the joint

venture agreement. It only suggests co-operation and participation for setting up a new

manufacturing unit in the country.

c) Retrenchment Strategies - Various external and internal developments create the problems

to the prospects of business firms. In declining industries, companies face such risks as falling

demand, emergence of more attractive substitutes, adverse government policies, and changing

customer needs and preferences. In addition to external developments, there are company

specific problems such as inefficient management and wrong strategies that lead to company

failures. In such circumstances, the industries, markets and companies face the danger of

decline in sales and profit and thereby intend to sub statically reduce the scope of its activity.

For this purpose, the problem areas are identified and the causes of the problems are diagnosed.

Then, steps are taken to solve the problems that result in different types of retrenchment

strategies.

The retrenchment strategies can be of the following forms :

1) Turn around strategy

2) Divestment strategy

3) Liquidation strategy

1) Turnaround Strategy : Turnaround strategy can be referred as converting a loss making unit

into a profitable one. According to Dictionary of Marketing ‘Turnaround means making the

company profitable again.’ Normally the turnaround strategy aims at improvement in declining

sales or market share and profits. The declining sales or market share may be due to several

factors both internal and external to the firm. Some of these factors may include high cost of

materials, reduction in prices of the goods and services, increased competition, recession,

managerial inefficiency etc.

Turnaround is possible only when the company can restructure its business operations. Certain

strategies which can be used for turning around include changing the management, redefining

the Co’s strategic focus, divesting for closing unwanted assets, improving profitability of

remaining operations, making acquisitions to rebuild core operations and so on.

2) Divestment Strategy - Divestment involves the sale of a division or a plant or a unit of one

firm to another. From seller’s point of view, it represents contraction of port folio, and from

the buyer’s point of view, it represents expansion

Prof Bhavya Vinil, School of Management, CMR University

Divestment is not an end in itself. Rather, it is a means to a larger end, building a company that

can grow and prosper over the long run. Wise executives divest businesses so that they can

create new ones and expand existing ones. Ultimate aim should be optimum utilization of

resources for creating shareholder value.

3) Liquidation Strategy : Winding up or liquidation of a company is the complete closing down

of the business of a company Basically it refers to a proceeding by which a company is

permanently dissolved and its assets are then disposed off to pay its debts. Surplus, if any is

distributed among the members according to their rights in the company. The decision to close

down or liquidate a company is taken after careful consideration, only when it is not possible

to carry on the company in the present state of affairs. It should also not be possible, for a

turnaround of the company in the future. Liquidation strategy should be considered as the last

resort because it leads to serious consequences such as loss of employment for workers and

other employee’s loss of job opportunities and the stigma of failure.

D) Combination Strategies : When an organization adopts a mix of stability, expansion and

retrenchment either simultaneously or sequentially for the purpose of improving its

performance, it is said to follow the combination strategies. Combination strategies are applied

at the same time in different businesses or at different times in the same business. No

organization has grown or survived by following a single strategy. The complex nature of

businesses requires that different strategies be adopted to suit the situation i.e. as companies

divest businesses, they also need to formulate expansion plans focused on strengthening

remaining businesses, starting new ones or making acquisitions. An organization following a

stability strategy for quite some time has to consider expansion and one that has been on

expansion path for long has to pause to consolidate its businesses. Multi business firms have

to adopt multiple strategies either simultaneously or sequentially.

D] What Are Core Competencies?

Core competencies are the resources and capabilities that comprise the strategic advantages

of a business. A modern management theory argues that a business must define, cultivate, and

exploit its core competencies in order to succeed against the competition.

A variation of the principle that has emerged in recent years recommends that job seekers

focus on their personal core competencies in order to stand out from the crowd. These positive

Prof Bhavya Vinil, School of Management, CMR University

characteristics may be developed and listed on a resume. Some personal core competencies

include analytical abilities, creative thinking, and problem resolution skills.

A successful business has identified what it can do better than anyone else, and why. Its core

competencies are the "why." Core competencies are also known as core capabilities or

distinctive competencies. Core competencies lead to competitive advantages.

Real-World Examples

A business is not limited to just one core competency, and competencies vary based on the

industry in which the institution operates.

Some of the core competencies of established and successful brands tend to be there for all to

see:

• McDonald's has standardization. It serves nine million pounds of French fries every

day, and every one of them has precisely the same taste and texture.2

• Apple has style. The beauty of its devices and their interfaces gives them an edge over

its many competitors.

• Walmart has buying power. The sheer size of its buying operation gives it the ability

to buy cheap and undersell retail competitors.

Benchmarking:

Benchmarking, is a tool of strategic management, that allows the organization to set goals and

measure productivity, on the basis of the best industry practices. It is a practice in which quality

level is used as a point of reference to evaluate things by making a comparison.

The process helps in comparing and gauging the processes, programs, strategies and

performance metrics with the standard measurements or to other similar companies. It is

concerned with the analysis of three major dimensions:

• Quality

• Time

• Cost

It is a useful technique for enhancing the organisation’s performance by identifying and

implementing the finest process and practices, for achieving them.

The process involves repeatedly evaluating the aspects of performance with the similar

measurements of its peers, identifying the gaps, discovering new methods for filling gaps and

also for excelling the condition, so that the gaps might prove positive for the organisation.

Prof Bhavya Vinil, School of Management, CMR University

E] McKinsey’s 7S Framework

McKinsey 7S model is a tool that analyzes firm’s organizational design by looking at 7 key

internal elements: strategy, structure, systems, shared values, style, staff and skills, in order to

identify if they are effectively aligned and allow organization to achieve its objectives.

Understanding the tool

McKinsey 7s model was developed in 1980s by McKinsey consultants Tom Peters, Robert

Waterman and Julien Philips with a help from Richard Pascale and Anthony G. Athos. Since

the introduction, the model has been widely used by academics and practitioners and remains

one of the most popular strategic planning tools. It sought to present an emphasis on human

resources (Soft S), rather than the traditional mass production tangibles of capital,

infrastructure and equipment, as a key to higher organizational performance. The goal of the

model was to show how 7 elements of the company: Structure, Strategy, Skills, Staff, Style,

Systems, and Shared values, can be aligned together to achieve effectiveness in a company.

The key point of the model is that all the seven areas are interconnected and a change in one

area requires change in the rest of a firm for it to function effectively.

The model

can be applied to many situations and is a valuable tool when organizational design is at

question. The most common uses of the framework are:

• To facilitate organizational change.

• To help implement new strategy.

Prof Bhavya Vinil, School of Management, CMR University

• To identify how each area may change in a future.

• To facilitate the merger of organizations.

7s factors

In McKinsey model, the seven areas of organization are divided into the ‘soft’ and ‘hard’ areas.

Strategy, structure and systems are hard elements that are much easier to identify and manage

when compared to soft elements. On the other hand, soft areas, although harder to manage, are

the foundation of the organization and are more likely to create the sustained competitive

advantage.

Hard S Soft S

Strategy Style

Structure Staff

Systems Skills

Shared Values

Strategy is a plan developed by a firm to achieve sustained competitive advantage and

successfully compete in the market. What does a well-aligned strategy mean in 7s McKinsey

model? In general, a sound strategy is the one that’s clearly articulated, is long-term, helps to

achieve competitive advantage and is reinforced by strong vision, mission and values. But it’s

hard to tell if such strategy is well-aligned with other elements when analyzed alone. So the

key in 7s model is not to look at your company to find the great strategy, structure, systems

and etc. but to look if its aligned with other elements. For example, short-term strategy is

usually a poor choice for a company but if its aligned with other 6 elements, then it may provide

strong results.

Structure represents the way business divisions and units are organized and includes the

information of who is accountable to whom. In other words, structure is the organizational

chart of the firm. It is also one of the most visible and easy to change elements of the

framework.

Systems are the processes and procedures of the company, which reveal business’ daily

activities and how decisions are made. Systems are the area of the firm that determines how

business is done and it should be the main focus for managers during organizational change.

Prof Bhavya Vinil, School of Management, CMR University

Skills are the abilities that firm’s employees perform very well. They also include capabilities

and competences. During organizational change, the question often arises of what skills the

company will really need to reinforce its new strategy or new structure.

Staff element is concerned with what type and how many employees an organization will need

and how they will be recruited, trained, motivated and rewarded.

Style represents the way the company is managed by top-level managers, how they interact,

what actions do they take and their symbolic value. In other words, it is the management style

of company’s leaders.

Shared Values are at the core of McKinsey 7s model. They are the norms and standards that

guide employee behavior and company actions and thus, are the foundation of every

organization.

F] Three Levels of Strategy: Corporate Strategy, Business Strategy and Functional

Strategy

Strategy is at the foundation of every decision that has to be made within an organization. If

the strategy is poorly chosen and formulated by top management, it has a major impact on the

effectiveness of employees in pretty much every department within the organization. In our

previous article on ‘What is Strategy?!‘ we have already tried to define and explain what

business strategy refers to and what is NOT considered to be part of strategy. In this article, we

will dissect strategy in three different components or ‘Levels of Strategy‘. These three levels

are: Corporate-level strategy, Business-level strategy and Functional-level strategy. Together,

these three levels of strategy can be illustrated in a so called ‘Strategy Pyramid’ (Figure 1).

Corporate strategy is different from Business strategy and Functional strategy. Even though

Prof Bhavya Vinil, School of Management, CMR University

Corporate-level strategy is at the top of the pyramid, we start this article by explaining

Business-level strategy first.

Figure 1: Three Levels of Strategy Pyramid

Business-level strategy

The Business-level strategy is what most people are familiar with and is about the question

“How do we compete?”, “How do we gain (a sustainable) competitive advantage over rivals?”.

In order to answer these questions it is important to first have a good understanding of a

business and its external environment. At this level, we can use internal analysis frameworks

like the Value Chain Analysis and the VRIO Model and external analysis frameworks

like Porter’s Five Forces and PESTEL Analysis. When good strategic analysis has been done,

top management can move on to strategy formulation by using frameworks as the Value

Disciplines, Blue Ocean Strategy and Porter’s Generic Strategies. In the end, the business-level

strategy is aimed at gaining a competitive advantage by offering true value for customers while

being a unique and hard-to-imitate player within the competitive landscape.

Functional-level strategy

Functional-level strategy is concerned with the question “How do we support the business-

level strategy within functional departments, such as Marketing, HR, Production and R&D?”.

These strategies are often aimed at improving the effectiveness of a company’s operations

Prof Bhavya Vinil, School of Management, CMR University

within departments. Within these department, workers often refer to their ‘Marketing Strategy’,

‘Human Resource Strategy’ or ‘R&D Strategy’. The goal is to align these strategies as much

as possible with the greater business strategy. If the business strategy is for example aimed at

offering products to students and young adults, the marketing department should target these

people as accurately as possible through their marketing campaigns by choosing the right

(social) media channels. Technically, these decisions are very operational in nature and are

therefore NOT part of strategy. As a consequence, it is better to call them tactics instead of

strategies.

Corporate-level strategy

At the corporate level strategy however, management must not only consider how to gain a

competitive advantage in each of the line of businesses the firm is operating in, but also which

businesses they should be in in the first place. It is about selecting an optimal set of businesses

and determining how they should be integrated into a corporate whole: a portfolio. Typically,

major investment and divestment decisions are made at this level by top management. Mergers

and Acquisitions (M&A) is also an important part of corporate strategy. This level of strategy

is only necessary when the company operates in two or more business areas through different

business units with different business-level strategies that need to be aligned to form an

internally consistent corporate-level strategy. That is why corporate strategy is often not seen

in small-medium enterprises (SME’s), but in multinational enterprises (MNE’s) or

conglomerates.

Example Samsung

Samsung is a conglomerate consisting of multiple strategic business units (SBU’s) with a

diverse set of products. Samsung sells smartphones, cameras, TVs, microwaves, refrigerators,

laundry machines, and even chemicals and insurances. Each product or strategic business unit

needs a business strategy in order to compete successfully within its own industry. However,

at the corporate level Samsung has to decide on more fundamental questions like: “Are we

going to pursue the camera business in the first place?” or “Is it perhaps better to invest more

into the smartphone business or should we focus on the television screen business instead?”.

Prof Bhavya Vinil, School of Management, CMR University

G] Turnaround strategy and Diversification strategy.

The Turnaround Strategy is a retrenchment strategy followed by an organization when it

feels that the decision made earlier is wrong and needs to be undone before it damages the

profitability of the company. turnaround strategy is backing out or retreating from the decision

wrongly made earlier and transforming from a loss making company to a profit making

company.

Now the question arises, when the firm should adopt the turnaround strategy? Following are

certain indicators which make it mandatory for a firm to adopt this strategy for its survival.

These are:

• Continuous losses

• Poor management

• Wrong corporate strategies

• Persistent negative cash flows

• High employee attrition rate

• Poor quality of functional management

• Declining market share

• Uncompetitive products and services

Also, the need for a turnaround strategy arises because of the changes in the external

environment Viz, change in the government policies, saturated demand for the product, a threat

from the substitute products, changes in the tastes and preferences of the customers, etc.

Prof Bhavya Vinil, School of Management, CMR University

Example: Dell is the best example of a turnaround strategy. In 2006. Dell announced the cost-

cutting measures and to do so; it started selling its products directly, but unfortunately, it

suffered huge losses. Then in 2007, Dell withdrew its direct selling strategy and started selling

its computers through the retail outlets and today it is the second largest computer retailer in

the world.

Diversification is a strategy for growth through branching out into a new market segment,

allowing your business to expand its presence and occupy a totally new space. This is achieved

through expanding (or diversifying) your product or service offering to target new

customers and grow profits.

There isn’t just one type of diversification; there are several different ways to diversify and

grow your company. Below, I’ll walk you through different types of diversification

strategies and illustrate the advantages and disadvantages of each for your company.

Types of diversification strategies

There are six established types of diversification strategies:

1. Horizontal diversification

2. Vertical diversification

3. Concentric diversification

4. Conglomerate diversification

5. Defensive diversification

6. Offensive diversification

Why diversification is important

Diversification may not be for everyone and every business, but it’s a business strategy that is

definitely worth considering for any company looking to grow.

Diversification has been used by some of the most successful companies around the globe,

including Apple, Google, Starbucks, and more.

Here are the main reasons to consider diversification:

• Diversification allows businesses to significantly increase their revenue by leveraging

their existing resources, brand recognition, and customer base.

• Diversifying your business, rather than investing in a single product or market, lowers

your company’s risks.

• Diversification allows you to remain profitable during industry ups and downs, as a

society, the economy, and consumerism fluctuate.

• Diversification allows you to maximize your company’s current resources, which

may be underutilized.

Prof Bhavya Vinil, School of Management, CMR University

H] Strategic Choice – Factors Affecting & Process of Strategic Choice

Strategic choice refers to the decision which determines the future strategy of a firm. It

addresses the question “Where shall we go”.

A SWOT analysis is conducted to examine the strengths and weaknesses of the firm and

opportunities that can be exploited are also determined.

Based on the analysis the firm selects a path among various other alternatives that will

successfully achieve the firm`s objectives. Strategic choice is, therefore, the decision to select

from among the grand strategies considered, the strategy which will best meet the enterprise

objectives. The decision involves the following four steps – focusing on a few alternatives,

considering the selection factors, evaluating the alternatives

against these criteria and making the actual choice.

Factors Affecting Strategic Choice

• Environmental constraints

• Internal organizations and management power relationships

• Values and preferences

• Management`s attitude towards risk

• Impact of past strategy

• Time constraints- time pressure, frame horizon, the timing of the decision

• Information constraints

• Competitors reaction

Process of Strategic choice

1. Focusing on alternatives – The aim of this step is to narrow down the choice to a

manageable number of feasible strategies. It can be done by

visualizing a future state and working backward from it. Managers generally use GAP analysis

for this purpose. By reverting to a business definition it helps the managers to think in a

structured manner along any one or more dimensions of the business.

• At the Corporate level, strategic alternatives are -Expansion, Stability, Retrenchment,

Combination

• At the Business level, strategic alternatives are – Cost leadership, Differentiation or

Focused business strategy.

•

2. Analyzing the strategic alternatives- The alternatives have to be subjected to a thorough

analysis that relies on certain factors known as selection factors. These selection factors

determine the criteria on the basis of which the evaluation will take place. They are:

Objective factors – These are based on analytical techniques and are hard facts used to

facilitate strategic choice.

Subjective factors – These are based on one`s personal judgment, collective or descriptive

factors.

3. Evaluation of strategies – Each factor is evaluated for its capability to help the organization

to achieve its objectives. This step involves bringing together analysis carried out on the basis

Prof Bhavya Vinil, School of Management, CMR University

of subjective and objective factors. Successive iterative steps of analyzing different alternatives

lie at the heart of such evaluation.

4. Making a strategic choice– A strategic choice must lead to a clear assessment of

alternatives which is the most suitable alternative under the

existing conditions. A blueprint has to be made that will describe the strategies and conditions

under which it operates. Contingency strategies

must be also devised

I] Porter's Generic Competitive Strategies (ways of competing)

A firm's relative position within its industry determines whether a firm's profitability is above

or below the industry average. The fundamental basis of above average profitability in the long

run is sustainable competitive advantage. There are two basic types of competitive advantage

a firm can possess: low cost or differentiation. The two basic types of competitive advantage

combined with the scope of activities for which a firm seeks to achieve them, lead to three

generic strategies for achieving above average performance in an industry: cost leadership,

differentiation, and focus. The focus strategy has two variants, cost focus and differentiation

focus.

1. Cost Leadership

In cost leadership, a firm sets out to become the low cost producer in its industry. The sources

of cost advantage are varied and depend on the structure of the industry. They may include the

pursuit of economies of scale, proprietary technology, preferential access to raw materials and

other factors. A low cost producer must find and exploit all sources of cost advantage. if a firm

can achieve and sustain overall cost leadership, then it will be an above average performer in

its industry, provided it can command prices at or near the industry average.

2. Differentiation

In a differentiation strategy a firm seeks to be unique in its industry along some dimensions

that are widely valued by buyers. It selects one or more attributes that many buyers in an

industry perceive as important, and uniquely positions itself to meet those needs. It is rewarded

for its uniqueness with a premium price.

Prof Bhavya Vinil, School of Management, CMR University

3. Focus

The generic strategy of focus rests on the choice of a narrow competitive scope within an

industry. The focuser selects a segment or group of segments in the industry and tailors its

strategy to serving them to the exclusion of others.

The focus strategy has two variants.

(a) In cost focus a firm seeks a cost advantage in its target segment, while

in (b) differentiation focus a firm seeks differentiation in its target segment. Both

variants of the focus strategy rest on differences between a focuser's target segment and

other segments in the industry. The target segments must either have buyers with

unusual needs or else the production and delivery system that best serves the target

segment must differ from that of other industry segments. Cost focus exploits

differences in cost behaviour in some segments, while differentiation focus exploits the

special needs of buyers in certain segments.

[IMPORTANT NOTE: THESE ARE LECTURE NOTES AND ARE NOT

COMPLETE AND EXHAUSIVE. REFER CLASS NOTES AND REFERENCE

BOOKS AND GATHER COMPLETE INFORMATION.]

Prof Bhavya Vinil, School of Management, CMR University

You might also like

- 2015 2016 IPPCR Test: October 2015 - April 2016Document16 pages2015 2016 IPPCR Test: October 2015 - April 2016Edgar40% (5)

- Customer Satisfaction at McdonaldDocument24 pagesCustomer Satisfaction at McdonaldMudita Khare56% (18)

- Boston Consulting GroupDocument11 pagesBoston Consulting GroupMehereen AubdoollahNo ratings yet

- Unit 4 - Business PolicyDocument22 pagesUnit 4 - Business PolicysodusfurikNo ratings yet

- Chapter 7 BCG MatrixDocument5 pagesChapter 7 BCG Matriximranpathan30No ratings yet

- G12 ABM Marketing Lesson 3 HandoutsDocument11 pagesG12 ABM Marketing Lesson 3 HandoutsLeo SuingNo ratings yet

- What Is The BCG GrowthDocument14 pagesWhat Is The BCG GrowthAngna DewanNo ratings yet

- SM Notes Unit 4 Part IDocument10 pagesSM Notes Unit 4 Part IANKUR CHOUDHARYNo ratings yet

- BCG Matrix Portfolio Analysis Definition: Portfolio Analysis Is An Examination of The Components Included in A Mix of Products With TheDocument6 pagesBCG Matrix Portfolio Analysis Definition: Portfolio Analysis Is An Examination of The Components Included in A Mix of Products With TheJite PiteNo ratings yet

- Project RepeatDocument14 pagesProject RepeatSalman SajidNo ratings yet

- Module-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionDocument6 pagesModule-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionkimsrNo ratings yet

- Strategy FormulationDocument31 pagesStrategy FormulationAftAb AlAm50% (2)

- Boston Consulting Group (BCG) Matrix Is A Four Celled Matrix Developed by BCG, USA. It IsDocument2 pagesBoston Consulting Group (BCG) Matrix Is A Four Celled Matrix Developed by BCG, USA. It IsShakib Ahmed Emon 0389No ratings yet

- Unit III Part III Corporate Level AnalysisDocument11 pagesUnit III Part III Corporate Level AnalysisAbhinav ShrivastavaNo ratings yet

- Marketing ModelsDocument28 pagesMarketing ModelsRecrupp VideosNo ratings yet

- Strategic ManagementDocument13 pagesStrategic ManagementClarisse jane ojo0% (1)

- SM Unit 4Document27 pagesSM Unit 4mohammadimran4310No ratings yet

- BCG MATRIX Boston Consulting GroupDocument16 pagesBCG MATRIX Boston Consulting GroupDana DrNo ratings yet

- Winning Market Through Market Oriented Strategic PlanningDocument25 pagesWinning Market Through Market Oriented Strategic PlanningKafi Mahmood NahinNo ratings yet

- Pom PlanningDocument50 pagesPom PlanningBhaumik Gandhi100% (1)

- Mission and Vision StatementsDocument5 pagesMission and Vision StatementsSachin SinghNo ratings yet

- CorporateDocument10 pagesCorporatekedarnathvishwakarmaNo ratings yet

- Vickey Verma AssignmentDocument20 pagesVickey Verma AssignmentSheetal VermaNo ratings yet

- Chapter 2 POMDocument6 pagesChapter 2 POMMeghnaNo ratings yet

- Assignment - 1 Strategic Management: Submitted ToDocument14 pagesAssignment - 1 Strategic Management: Submitted ToNakulNo ratings yet

- Master of Business Administration MBA Semester-4: Clearanc Certificate Number: 0013Document45 pagesMaster of Business Administration MBA Semester-4: Clearanc Certificate Number: 0013Apu MajumdarNo ratings yet

- Lecture 6 Levels and Types of StrategyDocument10 pagesLecture 6 Levels and Types of StrategycovenantrjssNo ratings yet

- Business Policy and Strategy (BBA 6 Sem) Unit 2 Organizational CapabilitiesDocument9 pagesBusiness Policy and Strategy (BBA 6 Sem) Unit 2 Organizational CapabilitiesAyushNo ratings yet

- BCG MatrixDocument15 pagesBCG Matrixvilas bollabathiniNo ratings yet

- 20085ipcc Paper7B Vol2 Cp3Document17 pages20085ipcc Paper7B Vol2 Cp3Piyush GambaniNo ratings yet

- Review and Discussion Questions: External OpportunitiesDocument4 pagesReview and Discussion Questions: External OpportunitiesMuthiah FarahNo ratings yet

- Corporate Strategies: What Is Corporate Strategy?Document3 pagesCorporate Strategies: What Is Corporate Strategy?Reynaldi Satria Aryudhika100% (1)

- BCG MatrixDocument3 pagesBCG Matrixpriyank1256No ratings yet

- MKTG 2400 CH 2 NotesDocument11 pagesMKTG 2400 CH 2 NotesDawson TeagueNo ratings yet

- UNIT-4-Choice of Business Strategies: Understanding The ToolDocument12 pagesUNIT-4-Choice of Business Strategies: Understanding The ToolNishath NawazNo ratings yet

- Business Unit Strategic PlanningDocument17 pagesBusiness Unit Strategic PlanningDulkifil KottaNo ratings yet

- BCG MatrixDocument2 pagesBCG Matrixsukhiromana0No ratings yet

- Strategies Policies A Planning PremisesDocument19 pagesStrategies Policies A Planning PremisesAashti Zaidi0% (1)

- Module 2Document45 pagesModule 2amit thakurNo ratings yet

- Chapter 9Document17 pagesChapter 9jaoceelectricalNo ratings yet

- Master of Business Administration-MBA Semester IV MB0052 - Strategic Management and Business Policy Assignment Set-1Document25 pagesMaster of Business Administration-MBA Semester IV MB0052 - Strategic Management and Business Policy Assignment Set-1Darshit ShahNo ratings yet

- Meaning of CommunicationDocument4 pagesMeaning of CommunicationAMALA ANo ratings yet

- Boston Consulting GroupDocument3 pagesBoston Consulting GroupPuran SinghNo ratings yet

- Tata DataDocument2 pagesTata DataRoshan KumarNo ratings yet

- Marketing Strategy2 NotesDocument29 pagesMarketing Strategy2 NotesMohamed El ShalakanyNo ratings yet

- Name: Saptarshi Das Mba - 4 Semester Reg. No. 511010222Document16 pagesName: Saptarshi Das Mba - 4 Semester Reg. No. 511010222Nayan DasNo ratings yet

- Stratman ReviewDocument9 pagesStratman Reviewleiqiao saturneNo ratings yet

- BCG Matrix and GE Nine Cells MatrixDocument15 pagesBCG Matrix and GE Nine Cells MatrixBinodBasnet0% (1)

- Module 3 - Company AnalysisDocument15 pagesModule 3 - Company AnalysisMer VelasquezNo ratings yet

- Chapter 8-Quản trị họcDocument5 pagesChapter 8-Quản trị họcHey Y’allNo ratings yet

- BCG Matrix: The Growth Share Matrix Was Created in 1968 by BCG's Founder, Bruce HendersonDocument4 pagesBCG Matrix: The Growth Share Matrix Was Created in 1968 by BCG's Founder, Bruce HendersonRuhul Amin Rasel100% (1)

- Strategic Planning: HDCS 4393/4394 Internship Dr. Shirley EzellDocument18 pagesStrategic Planning: HDCS 4393/4394 Internship Dr. Shirley Ezellravi pratapNo ratings yet

- Chapter 1Document11 pagesChapter 1Beth LeeNo ratings yet

- KMBN 301 Strategic Management Unit 3Document16 pagesKMBN 301 Strategic Management Unit 3Ashish DubeyNo ratings yet

- Chapter1 - EstrategiaDocument12 pagesChapter1 - EstrategiaSebastian Salazar DiazNo ratings yet

- BPSM Avi AssingmentDocument9 pagesBPSM Avi AssingmentAvi JainNo ratings yet

- 22 - Creating Enterprise-Wide Go-To-Market CapabilitiesDocument3 pages22 - Creating Enterprise-Wide Go-To-Market CapabilitiesDlx AreaOneNo ratings yet

- Module PrinciplesOfMarketing Chapter2 120304Document9 pagesModule PrinciplesOfMarketing Chapter2 120304Kaye PauleNo ratings yet

- Advantages of Strategic Business UnitsDocument4 pagesAdvantages of Strategic Business Unitsgopika premarajanNo ratings yet

- Competition Demystified (Review and Analysis of Greenwald and Kahn's Book)From EverandCompetition Demystified (Review and Analysis of Greenwald and Kahn's Book)No ratings yet

- Targeted Tactics®: Transforming Strategy into Measurable ResultsFrom EverandTargeted Tactics®: Transforming Strategy into Measurable ResultsNo ratings yet

- Strategy Pure and Simple II (Review and Analysis of Robert's Book)From EverandStrategy Pure and Simple II (Review and Analysis of Robert's Book)Rating: 5 out of 5 stars5/5 (1)

- A Social Assesment of LAnd Certification in IndonesiaDocument54 pagesA Social Assesment of LAnd Certification in IndonesiaAndria Drew SusantoNo ratings yet

- Concept Paper - Group 5Document8 pagesConcept Paper - Group 5Paulette Beatrice MalicayNo ratings yet

- Hotel and Restaurant Management Sample Research PaperDocument4 pagesHotel and Restaurant Management Sample Research PaperorlfgcvkgNo ratings yet

- Sampling With Replacement - DefinitionDocument1 pageSampling With Replacement - DefinitionKashif ShahNo ratings yet

- The Effect of Online Game Addiction To TheDocument5 pagesThe Effect of Online Game Addiction To TheRafuell Amper CablasNo ratings yet

- Managing Change: Self-Assessment Questions and AnswersDocument7 pagesManaging Change: Self-Assessment Questions and AnswersPraveen Perumal PNo ratings yet

- Jurnal Pendukung 3Document14 pagesJurnal Pendukung 3Prata BestoNo ratings yet

- Solutions To PovertyDocument3 pagesSolutions To PovertyRanShibasaki100% (1)

- Chapter 5Document17 pagesChapter 5Carraa Faqqaada CaalaaNo ratings yet

- JF608: Quality Control: Prepared By: Zainal Abidin Bin Ab Kasim Noor Hapizah Binti AbdullahDocument31 pagesJF608: Quality Control: Prepared By: Zainal Abidin Bin Ab Kasim Noor Hapizah Binti AbdullahA LishaaaNo ratings yet

- A Survey of Penetration Mechanics For Long Rods PDFDocument44 pagesA Survey of Penetration Mechanics For Long Rods PDFleiNo ratings yet

- Grafton Campus MapDocument1 pageGrafton Campus MapPUSKESMAS KECAMATAN KEPULAUAN SERIBU UTARANo ratings yet

- Directory of Institution - College 24012020011036777PMDocument10 pagesDirectory of Institution - College 24012020011036777PMravism3No ratings yet

- KVPY Examination DetailsDocument5 pagesKVPY Examination DetailsSibaprasad DasNo ratings yet

- Understanding The Importance & Impact of Technology in An AccountDocument31 pagesUnderstanding The Importance & Impact of Technology in An Accounttaehyung kimNo ratings yet

- Impact of Food Aid On Local Crop Production of SomalilandDocument7 pagesImpact of Food Aid On Local Crop Production of SomalilandMohamed Yusuf SomalilanderNo ratings yet

- Regression Models: To AccompanyDocument39 pagesRegression Models: To AccompanyRazel TercinoNo ratings yet

- Tok Quant - Qual EssayDocument2 pagesTok Quant - Qual Essay[5Y16] Partier Natalie MichelleNo ratings yet

- Observation ReportDocument16 pagesObservation ReportV- irusNo ratings yet

- Technology - Just A Part of The Solution SKF Acquires USA Maintenance Engineering CompanyDocument18 pagesTechnology - Just A Part of The Solution SKF Acquires USA Maintenance Engineering CompanyJHON ANGEL VARGAS HUAHUASONCCONo ratings yet

- Hub Pengetahuan TTG TB DGN Perilaku Pencg TBDocument9 pagesHub Pengetahuan TTG TB DGN Perilaku Pencg TBRindy PrawitaNo ratings yet

- Consultancy Services For Construction Supervision of The Green Urban Infrastructure in Beira Project - (Gui) RFP N: 01/Wb/Kfw/Pcmc/Aias/2017Document9 pagesConsultancy Services For Construction Supervision of The Green Urban Infrastructure in Beira Project - (Gui) RFP N: 01/Wb/Kfw/Pcmc/Aias/2017Delfino Bernardo ViegasNo ratings yet

- Best Example On AstrologyDocument40 pagesBest Example On AstrologywyomeshNo ratings yet

- BMP6005 WER-Assessment 2 BriefDocument3 pagesBMP6005 WER-Assessment 2 BriefIulian RaduNo ratings yet

- A Study On 3c Pest Swot Timing Positioning Key Words 3cpest PestDocument12 pagesA Study On 3c Pest Swot Timing Positioning Key Words 3cpest PestMadalina PatriciaNo ratings yet

- TQM and Knowledge Management: Literature Review and Proposed FrameworkDocument11 pagesTQM and Knowledge Management: Literature Review and Proposed Frameworknaqash sonuNo ratings yet

- Marketing Research: DR - Kalpana AgrawalDocument15 pagesMarketing Research: DR - Kalpana Agrawalkalpna_prestigeNo ratings yet

- Professional Behaviors Student Self Assessment 4 2010 Generic Abilities NewDocument14 pagesProfessional Behaviors Student Self Assessment 4 2010 Generic Abilities Newapi-677682477No ratings yet