Professional Documents

Culture Documents

Blog - Fed Watch Nifty Fifty

Blog - Fed Watch Nifty Fifty

Uploaded by

Owm Close CorporationOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blog - Fed Watch Nifty Fifty

Blog - Fed Watch Nifty Fifty

Uploaded by

Owm Close CorporationCopyright:

Available Formats

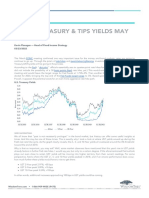

WisdomTree BLOG ARTICLE

FED WATCH: NIFTY-FIFTY

Kevin Flanagan — Head of Fixed Income Strategy

05/04/2022

In a somewhat anti-climactic fashion, the Fed delivered not only on their widely anticipated 50 basis point (bp) rate hike,

but also announced their plans for quantitative tightening (QT) at the May FOMC meeting. With this move, the Federal

Funds trading range has now moved up to 0.75%–1%. For the record, this Fed Funds increase was the first half-point rate

hike since the May 2000 Fed meeting, 22 years ago.

The money and bond markets will now quickly move on and continue trying to price in what comes next. Heading into

the May 2022 gathering, the implied probability for Fed Funds Futures was leaning toward an additional 50 bp increase

at each of the next three FOMC meetings. If the policymakers act accordingly, that would mean a total of 225 bps worth

of rate hikes will have occurred by the end of September. For 2022 as a whole, Fed Funds have been priced to finish the

year in the 2.75%–3% range.

While it makes for good sport trying to determine the magnitude of future Fed rate moves, as I’ve written over the past

few months, the track record for Fed Funds Futures certainly leaves something to be desired. As a result, I would argue

that investors should avoid getting bogged down with how many 50-bp moves there may be in the next few months.

Ultimately, the Fed is going to get to the same place anyway—it’s just a matter of when. Indeed, Powell & Co. have

made it clear that their aim is to get to a neutral Fed Funds Rate sooner rather than later and to follow that goal by

moving policy into restrictive territory to tame inflation.

Certainly, based on the Fed’s rhetoric, another half-point rate hike at the June FOMC meeting will be “on the table,” to

use Powell’s words. After that, the size of the remaining increases could become a bit more data dependent. While the

disappointing 1.4% decline for Q1 real GDP did not act as an impediment for the expected tightening in policy at

today’s meeting, it likely wasn’t an outcome the Fed was expecting. That said, rate hikes at the remaining five FOMC

meetings in this calendar year and into 2023 remains our base case scenario, which could take the Fed Funds target into

the 3%–3.50% range.

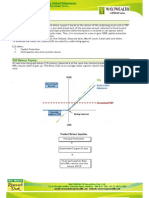

And…don’t forget QT! While balance sheet drawdown does not capture the lion’s share of Fed-related headlines, the

FOMC has provided the markets with forward guidance that they will be using this policy tool more aggressively than

last time. As I’ve mentioned before, QT can be viewed in the context of being a quarter point rate hike in and of itself. In

addition, QT can impact the entire Treasury (UST) yield curve, not just those maturities that are more closely related to

changes in the Fed Funds Rate.

Conclusion

By implementing this two-pronged policy tightening approach, the Fed is taking the bond market into uncharted

territory. While Treasury yields have already risen in a visible fashion year-to-date, Powell & Co. have only just begun to

put their words into action, keeping rate risk elevated, accordingly. Against this backdrop, we continue to recommend

fixed income investors position their portfolios for further increases in interest rates going forward.

For standardized performance and the most recent month-end performance click here NOTE, this material is intended

for electronic use only. Individuals who intend to print and physically deliver to an investor must print the monthly

performance report to accompany this blog.

Related Blogs

+ Is This a Defining Moment for the Bond Market?

+ On the QT

+ Are Inverted Yield Curves “Fake News”?

View the online version of this article here.

WisdomTree.com 1-866-909-WISE (9473)

WisdomTree BLOG ARTICLE

IMPORTANT INFORMATION

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives,

risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political

and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller

companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and

alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to

change, and should not to be considered or interpreted as a recommendation to participate in any particular trading

strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no

guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of

the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future

results. This material should not be relied upon as research or investment advice regarding any security in particular. The

user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree

nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal

advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings

expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and

may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI

information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind

of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an

indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on

an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of

its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI

Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any

liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (

www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael

Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel,

Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund

Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.

WisdomTree.com 1-866-909-WISE (9473)

WisdomTree BLOG ARTICLE

DEFINITIONS

Federal Reserve : The Federal Reserve System is the central banking system of the United States.

Basis point : 1/100th of 1 percent.

Rate Hike : refers to an increase in the policy rate set by a central bank. In the U.S., this generally refers to the Federal

Funds Target Rate.

Quantitative Tightening : Quantitative easing is a process whereby a central bank targets lowering longer-term interest

rates by purchasing bonds and other securities to stimulate the economy. Quantitative tightening is the reverse process

whereby securities are either sold or the proceeds of maturing securities are not reinvested with the goal of tightening

economic conditions to prevent the economy from overheating.

Federal Open Market Committee (FOMC) : The branch of the Federal Reserve Board that determines the direction of

monetary policy.

Fed Fund Futures : A financial instrument that let’s market participants determine the future value of the Federal Funds

Rate.

Inflation : Characterized by rising price levels.

Gross domestic product (GDP) : The sum total of all goods and services produced across an economy.

Balance sheet : refers to the cash and cash equivalents part of the Current Assets on a firms balance sheet and cash

available for purchasing new position.

Drawdowns : Periods of sustained negative trends of return.

Curve : Refers to the yield curve. Positioning on the yield curve is important to investors, especially during non-parallel

shifts.

WisdomTree.com 1-866-909-WISE (9473)

You might also like

- Soal Week 3Document2 pagesSoal Week 3Muhammad Ananda PutraNo ratings yet

- Cosmetics Business PlanDocument21 pagesCosmetics Business PlanJinendra Sandeepa100% (6)

- Titan Co Financial ModelDocument15 pagesTitan Co Financial ModelAtharva OrpeNo ratings yet

- Blog - Where Treasury TIPS Yields May Be HeadedDocument5 pagesBlog - Where Treasury TIPS Yields May Be HeadedOwm Close CorporationNo ratings yet

- Global Macro Commentary July 14Document2 pagesGlobal Macro Commentary July 14dpbasicNo ratings yet

- Global Macro Commentary Dec 4Document3 pagesGlobal Macro Commentary Dec 4dpbasicNo ratings yet

- Quarterly Review of Credit Policy - July07Document3 pagesQuarterly Review of Credit Policy - July07vylisseryNo ratings yet

- The Contra-QE Trade LoomsDocument3 pagesThe Contra-QE Trade LoomsdpbasicNo ratings yet

- Global Macro Commentary Jan 13Document2 pagesGlobal Macro Commentary Jan 13dpbasicNo ratings yet

- Investment Strategy For A Post Election Environment: Morgan Stanley GWMG Asset Allocation and Investment StrategyDocument2 pagesInvestment Strategy For A Post Election Environment: Morgan Stanley GWMG Asset Allocation and Investment StrategyGNo ratings yet

- Beat FDs With US Treasuries - Century FinancialDocument9 pagesBeat FDs With US Treasuries - Century FinancialRayan WarnerNo ratings yet

- Treasury Research News Bulletin - 27 November 2013Document2 pagesTreasury Research News Bulletin - 27 November 2013r3iherNo ratings yet

- Mark Baribeau Jennison Associates Navigating Global Equities ThroughDocument9 pagesMark Baribeau Jennison Associates Navigating Global Equities ThroughWarren RileyNo ratings yet

- Has Forward Guidance Been Effective?Document22 pagesHas Forward Guidance Been Effective?AdminAliNo ratings yet

- Global Macro Commentary March 20Document3 pagesGlobal Macro Commentary March 20dpbasicNo ratings yet

- 4 December Affluence RegDocument12 pages4 December Affluence Regapi-279593513No ratings yet

- 01-5 Advantages of Main FundingDocument4 pages01-5 Advantages of Main FundingABHIJIT PRAKASH JHANo ratings yet

- QMU Underperformance in Fixed Income Markets IFS FINAL 3.22.12 ADADocument3 pagesQMU Underperformance in Fixed Income Markets IFS FINAL 3.22.12 ADAPaulo AraujoNo ratings yet

- CIO Note Feb 6 2018Document2 pagesCIO Note Feb 6 2018Anonymous 2LowCnVdfNo ratings yet

- Trading Strateg: April 2022 Pension Fund Rebalancing EstimatesDocument2 pagesTrading Strateg: April 2022 Pension Fund Rebalancing EstimatessirdquantsNo ratings yet

- Bond Market Perspectives: The Yield Ascent ResumesDocument3 pagesBond Market Perspectives: The Yield Ascent Resumesapi-234126528No ratings yet

- July Monthly LetterDocument2 pagesJuly Monthly LetterTheLernerGroupNo ratings yet

- Switzerland: The Worst Seems To Be Over For Swiss IndustryDocument5 pagesSwitzerland: The Worst Seems To Be Over For Swiss Industryangelos_siopisNo ratings yet

- Rating Action:: Moody's Upgrades Indonesia's Sovereign Rating To Baa3 Outlook StableDocument5 pagesRating Action:: Moody's Upgrades Indonesia's Sovereign Rating To Baa3 Outlook StableMelyastarda SiregarNo ratings yet

- Global Macro Commentary July 21 - Too Much of EverythingDocument2 pagesGlobal Macro Commentary July 21 - Too Much of EverythingdpbasicNo ratings yet

- 2013 q2 Crescent Commentary Steve RomickDocument16 pages2013 q2 Crescent Commentary Steve RomickCanadianValueNo ratings yet

- Bullish Under The Hood December Policy TakeawaysDocument3 pagesBullish Under The Hood December Policy Takeawaysvishal_lal89No ratings yet

- UpdateDocument6 pagesUpdatemtwang100% (1)

- Strategy Update: News FlagDocument3 pagesStrategy Update: News FlagbodaiNo ratings yet

- Yield Curve What Is It Predicting YardeniDocument28 pagesYield Curve What Is It Predicting YardenisuksesNo ratings yet

- Knowledge Series : Typical Payoff Scenario Typical Payoff ScenarioDocument2 pagesKnowledge Series : Typical Payoff Scenario Typical Payoff ScenarioAvinash NairNo ratings yet

- IDirect RBIActions Feb16Document4 pagesIDirect RBIActions Feb16umaganNo ratings yet

- Kanza Rehmani Bba/Bsaf 2 Securities Tradings and Applied EconomicsDocument4 pagesKanza Rehmani Bba/Bsaf 2 Securities Tradings and Applied EconomicsBushra RubabNo ratings yet

- March Monthly LetterDocument2 pagesMarch Monthly LetterTheLernerGroupNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Sign Up For Our Financial Insights NewsletterDocument2 pagesSign Up For Our Financial Insights NewsletterAnonymous 1QrlZi8No ratings yet

- Global Macro Commentary Dec 19Document3 pagesGlobal Macro Commentary Dec 19dpbasicNo ratings yet

- Motilal Oswal-Market Valuation Apr 2020Document5 pagesMotilal Oswal-Market Valuation Apr 2020ramkrishna mahatoNo ratings yet

- Market Analysis Aug 2023Document17 pagesMarket Analysis Aug 2023nktradzNo ratings yet

- Treasury Research News Bulletin - 25 October 2013Document2 pagesTreasury Research News Bulletin - 25 October 2013r3iherNo ratings yet

- Interest Rates InflationDocument3 pagesInterest Rates InflationHans WidjajaNo ratings yet

- The Future of Your Wealth: How the World Is Changing and What You Need to Do about It: A Guide for High Net Worth Individuals and FamiliesFrom EverandThe Future of Your Wealth: How the World Is Changing and What You Need to Do about It: A Guide for High Net Worth Individuals and FamiliesNo ratings yet

- 8TH Dimension Weekly ReportDocument7 pages8TH Dimension Weekly ReportKizito EdwardNo ratings yet

- Equities: Nifty & DJIA - at Crucial Support LevelsDocument4 pagesEquities: Nifty & DJIA - at Crucial Support LevelsSubodh GuptaNo ratings yet

- Global Monthly Perspectives (May 2021)Document29 pagesGlobal Monthly Perspectives (May 2021)masterumNo ratings yet

- HYEM and IHY Investment CaseDocument21 pagesHYEM and IHY Investment CaseRussell FryNo ratings yet

- (LGT) 20210316 - DRU - Sector RotationDocument3 pages(LGT) 20210316 - DRU - Sector RotationRuehYinn YapNo ratings yet

- Global Macro Commentary Feb 26Document2 pagesGlobal Macro Commentary Feb 26dpbasicNo ratings yet

- Sunlife Balanced Fund KFDDocument4 pagesSunlife Balanced Fund KFDPaolo Antonio EscalonaNo ratings yet

- Hussman 112513Document18 pagesHussman 112513alphathesisNo ratings yet

- PRUlink Dana Urudana Urus 2 2011Document7 pagesPRUlink Dana Urudana Urus 2 2011shadowz123456No ratings yet

- February Monthly LetterDocument2 pagesFebruary Monthly LetterTheLernerGroupNo ratings yet

- 06.14.22 Market Sense Final DeckDocument16 pages06.14.22 Market Sense Final DeckRhytham SoniNo ratings yet

- Monthly Factsheet - March 2024Document35 pagesMonthly Factsheet - March 2024Try Easy BusinessNo ratings yet

- China September CPIDocument4 pagesChina September CPIAnonymous Ht0MIJNo ratings yet

- Unconventional Wisdom. Original Thinking.: Bulletin BoardDocument12 pagesUnconventional Wisdom. Original Thinking.: Bulletin BoardCurve123No ratings yet

- March 2016Document2 pagesMarch 2016TheLernerGroupNo ratings yet

- Blog - Narratives and Earnings On Chinese Equity What ChangedDocument4 pagesBlog - Narratives and Earnings On Chinese Equity What ChangedOwm Close CorporationNo ratings yet

- R03 Capital Market Expectations, Part 1 - Framework and Macro Considerations HY NotesDocument7 pagesR03 Capital Market Expectations, Part 1 - Framework and Macro Considerations HY NotesArcadioNo ratings yet

- 1 The Yield Curve - YardeniDocument57 pages1 The Yield Curve - YardeniLeo CunesNo ratings yet

- RBIAnnual Monetary Policy ReviewDocument3 pagesRBIAnnual Monetary Policy ReviewtomydaloorNo ratings yet

- Global Macro Commentary March 12Document2 pagesGlobal Macro Commentary March 12dpbasicNo ratings yet

- Third Quarter 2016 Investment Outlook: Asset Class SectorDocument6 pagesThird Quarter 2016 Investment Outlook: Asset Class SectorAnonymous DJrec2No ratings yet

- 5 Key Factors Facing U.S. Treasury Yields - Seeking AlphaDocument12 pages5 Key Factors Facing U.S. Treasury Yields - Seeking AlphaOwm Close CorporationNo ratings yet

- Horizonte Furnace - 20220225-Award-Of-Furnace-ContractDocument4 pagesHorizonte Furnace - 20220225-Award-Of-Furnace-ContractOwm Close CorporationNo ratings yet

- ING Think Rates Spark Inflation Reasserts Itself As The Main Driver of Rates 2Document5 pagesING Think Rates Spark Inflation Reasserts Itself As The Main Driver of Rates 2Owm Close CorporationNo ratings yet

- Fed Hikes 50bp With Much More To Come: Economic and Financial AnalysisDocument5 pagesFed Hikes 50bp With Much More To Come: Economic and Financial AnalysisOwm Close CorporationNo ratings yet

- Gmo Resources Strategy: FactsDocument2 pagesGmo Resources Strategy: FactsOwm Close CorporationNo ratings yet

- Lithium Exploration Budgets Rebounded in 2021 and Increased 25% Year Over Year To $249 MillionDocument3 pagesLithium Exploration Budgets Rebounded in 2021 and Increased 25% Year Over Year To $249 MillionOwm Close CorporationNo ratings yet

- Invasion Effect On PGMS: Base Case Unchanged, But Upside Price RiskDocument4 pagesInvasion Effect On PGMS: Base Case Unchanged, But Upside Price RiskOwm Close CorporationNo ratings yet

- Blog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessDocument11 pagesBlog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessOwm Close CorporationNo ratings yet

- ING Think Us Housing Market Exhibits More Signs of SlowdownDocument6 pagesING Think Us Housing Market Exhibits More Signs of SlowdownOwm Close CorporationNo ratings yet

- ING Think Japanese Investors Turn Cautious On Sovereign Bonds Ahead of Global QTDocument4 pagesING Think Japanese Investors Turn Cautious On Sovereign Bonds Ahead of Global QTOwm Close CorporationNo ratings yet

- An Impressive Start To The Year For Nickel As It Hits 10-Year HighDocument7 pagesAn Impressive Start To The Year For Nickel As It Hits 10-Year HighOwm Close CorporationNo ratings yet

- The Flip Side of Large M&A DealsDocument6 pagesThe Flip Side of Large M&A DealsOwm Close CorporationNo ratings yet

- En - 20220322 Award of Epcm Contract To AfryDocument4 pagesEn - 20220322 Award of Epcm Contract To AfryOwm Close CorporationNo ratings yet

- Rate Shock Pandemic Spreading - Juggling DynamiteDocument3 pagesRate Shock Pandemic Spreading - Juggling DynamiteOwm Close CorporationNo ratings yet

- ING Think The Impact of The War in Ukraine On Food Agri Has Only Just Started To UnravelDocument7 pagesING Think The Impact of The War in Ukraine On Food Agri Has Only Just Started To UnravelOwm Close CorporationNo ratings yet

- Blog - Where Treasury TIPS Yields May Be HeadedDocument5 pagesBlog - Where Treasury TIPS Yields May Be HeadedOwm Close CorporationNo ratings yet

- ING Think Aluminium Caught Up in Nickels Wild RideDocument4 pagesING Think Aluminium Caught Up in Nickels Wild RideOwm Close CorporationNo ratings yet

- ASX Release: Karouni Plant Site Where Construction Commenced in February 2015Document6 pagesASX Release: Karouni Plant Site Where Construction Commenced in February 2015Owm Close CorporationNo ratings yet

- ING Think Why Us Secs Proposed Climate Disclosure Rules Are A Game ChangerDocument6 pagesING Think Why Us Secs Proposed Climate Disclosure Rules Are A Game ChangerOwm Close CorporationNo ratings yet

- News Release: Red Chris Block Cave Pre-Feasibility Study Confirms Low Cost, Long LifeDocument5 pagesNews Release: Red Chris Block Cave Pre-Feasibility Study Confirms Low Cost, Long LifeOwm Close CorporationNo ratings yet

- Presidential Opening of The Aktogay Expansion Project FinalDocument1 pagePresidential Opening of The Aktogay Expansion Project FinalOwm Close CorporationNo ratings yet

- RBPlat Vs Northam BidDocument2 pagesRBPlat Vs Northam BidOwm Close CorporationNo ratings yet

- ING Think Latam FX Outlook 2022 Return of The Pink TideDocument5 pagesING Think Latam FX Outlook 2022 Return of The Pink TideOwm Close CorporationNo ratings yet

- Acquisition of Ferronickel Processing EquipmentDocument4 pagesAcquisition of Ferronickel Processing EquipmentOwm Close CorporationNo ratings yet

- Nomad Royalty Company Acquires $75 Million Gold Stream On Ivanhoe Mines' Platreef PGM ProjectDocument6 pagesNomad Royalty Company Acquires $75 Million Gold Stream On Ivanhoe Mines' Platreef PGM ProjectOwm Close CorporationNo ratings yet

- Defective Rule 43 Application - Family LawDocument5 pagesDefective Rule 43 Application - Family LawOwm Close CorporationNo ratings yet

- Merger and Acquisition StrategiesDocument45 pagesMerger and Acquisition Strategies--bolabolaNo ratings yet

- REAL ESTATE Changin Trends Hyderabad REMAXDocument56 pagesREAL ESTATE Changin Trends Hyderabad REMAXBrajesh100% (1)

- AFIN209 2018 Semester 1 Final Exam PDFDocument6 pagesAFIN209 2018 Semester 1 Final Exam PDFGeorge MandaNo ratings yet

- The Early Stage Opportunity in IndiaDocument29 pagesThe Early Stage Opportunity in IndiaAbhishek BaliNo ratings yet

- Life Sciences Outlook For 2014Document7 pagesLife Sciences Outlook For 2014Sheltie ForeverNo ratings yet

- Mutual Fund DataDocument194 pagesMutual Fund DatashreyaNo ratings yet

- For Check RequestDocument6 pagesFor Check RequestPaul LeeNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter FiveDocument12 pagesSolutions For End-of-Chapter Questions and Problems: Chapter FiveYasser AlmishalNo ratings yet

- Dias Information FileDocument8 pagesDias Information FileLorcan BondNo ratings yet

- BCG - Dealing With Investors Expectations PDFDocument76 pagesBCG - Dealing With Investors Expectations PDFLouis C. MartinNo ratings yet

- Kenneth Andrade & Sunil Singhania Buy Cheap Blue-Chip MNC StockDocument9 pagesKenneth Andrade & Sunil Singhania Buy Cheap Blue-Chip MNC StockSam vermNo ratings yet

- IMPACT OF CAPITAL STRUCTURE ON PROFITABILITY NoorDocument41 pagesIMPACT OF CAPITAL STRUCTURE ON PROFITABILITY Noorsaqib100% (1)

- Villareal vs. RamirezDocument1 pageVillareal vs. RamirezJillie Bean DomingoNo ratings yet

- MP - 3 - Peso Growth FundDocument2 pagesMP - 3 - Peso Growth FundFrank TaquioNo ratings yet

- PSE Disclosure RulesDocument31 pagesPSE Disclosure RulesLeolaida AragonNo ratings yet

- Investment Is Defined As The Employment of Funds, With The Aim of Achieving Additional Income or Some Growth in Its ValueDocument5 pagesInvestment Is Defined As The Employment of Funds, With The Aim of Achieving Additional Income or Some Growth in Its ValuePera AnandNo ratings yet

- The Merger of Associate Banks With State Bank of India A Pre and Post Merger AnalysisDocument13 pagesThe Merger of Associate Banks With State Bank of India A Pre and Post Merger AnalysisRachit GoyalNo ratings yet

- CMAT 2024 Innovation Entrepreneurship - mBX6GlTDocument80 pagesCMAT 2024 Innovation Entrepreneurship - mBX6GlTushajaisur123No ratings yet

- Chapter 07 Solutions ManualDocument12 pagesChapter 07 Solutions ManualImroz MahmudNo ratings yet

- Management of Bank AL Habib LimitedDocument74 pagesManagement of Bank AL Habib LimitedKhalil ShakirNo ratings yet

- (Trading) A Beginners Guide To Investing in GoldDocument12 pages(Trading) A Beginners Guide To Investing in GoldMiklós GrécziNo ratings yet

- Al Hokair Group - Prospectus - ENDocument384 pagesAl Hokair Group - Prospectus - ENsahal2080No ratings yet

- Technical Analysis of Stocks Commodities 2018 No 06Document64 pagesTechnical Analysis of Stocks Commodities 2018 No 06s9298No ratings yet

- Industrial ElectronicsDocument2 pagesIndustrial ElectronicsMartinFS110380% (5)

- Chap01 (Compatibility Mode)Document8 pagesChap01 (Compatibility Mode)Abhishek NaikNo ratings yet

- An Analysis of Risk & Return of Listed Non-Life Insurance Companies in NepalDocument12 pagesAn Analysis of Risk & Return of Listed Non-Life Insurance Companies in NepalarbindshrNo ratings yet

- Charges List - Fyers - Free Investment Zone PDFDocument4 pagesCharges List - Fyers - Free Investment Zone PDFPershotam UppalNo ratings yet