Professional Documents

Culture Documents

Gmo Resources Strategy: Facts

Gmo Resources Strategy: Facts

Uploaded by

Owm Close CorporationOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gmo Resources Strategy: Facts

Gmo Resources Strategy: Facts

Uploaded by

Owm Close CorporationCopyright:

Available Formats

As of February 28, 2022

GMO RESOURCES STRATEGY

OVERVIEW FACTS

The GMO Resources Strategy seeks to deliver total return by investing in the

equities of companies in the natural resources sector. Strategy Inception Date December 28, 2011

Benchmark MSCI ACWI Commodity Producers

Total Assets as of 01/31/22 $2.5bn USD

PORTFOLIO MANAGEMENT

Lucas White, CFA Tom Hancock

▪ Joined GMO in 2006 ▪ Joined GMO in 1995

▪ 24 yrs industry experience ▪ 26 yrs industry experience

▪ B.A. from Duke University ▪ Ph.D. from Harvard University

Performance Net of Fees (USD)

TOTAL RETURN (%) ANNUALIZED RETURNS (%) AS OF 02/28/2022

MSCI ACWI Commodity

Portfolio Producers

MTD 1.29 5.71 35.00

30.66

QTD 3.22 13.92 30.00

YTD 3.22 13.92 25.00

20.00 16.26

ANNUAL TOTAL RETURN (%) 13.80

15.00

2021 22.73 28.14 8.91

10.00 8.03 7.70

2020 22.53 -12.32

2019 20.31 13.06 5.00 1.39 2.47

2018 -7.19 -11.75 0.00

2017 28.36 13.70

1 Year 5 Years 10 Years ITD

2016 44.77 32.44

2015 -22.06 -25.83

Portfolio MSCI ACWI Commodity Producers

2014 -16.78 -14.69

Composite Inception Date: December 31, 2011

2013 4.39 3.31

2012 9.23 1.96

Returns shown for periods greater than one year are on an annualized basis.

Performance data quoted represents past performance and is not predictive of future performance. Net returns are presented after the deduction of a model advisory fee and

incentive fee if applicable. These returns include transaction costs, commissions and withholding taxes on foreign income and capital gains and include the reinvestment of

dividends and other income, as applicable. Fees paid by accounts within the composite may be higher or lower than the model fees used. A Global Investment Performance

Standards (GIPS®) Composite Report is available on GMO.com by clicking the GIPS® Composite Report link in the documents section of the strategy page. GIPS® is a

registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained

herein. Actual fees are disclosed in Part 2 of GMO's Form ADV and are also available in each strategy’s Composite Report.

Risks associated with investing in the Strategy may include Focused Investment Risk, Commodities Risk, Market Risk - Equities, Management and Operational Risk, and Non-U.S.

Investment Risk.

40 Rowes Wharf | Boston, Massachusetts 02110

(617) 330-7500 | www.gmo.com

GMO LLC © 2022

As of February 28, 2022

GMO RESOURCES STRATEGY

CHARACTERISTICS RISK PROFILE - 5-YEAR TRAILING

MSCI ACWI MSCI ACWI

Commodity Commodity

Portfolio Producers Portfolio Producers

Price/Earnings - Forecast 1 Yr Wtd Mdn 9.1x 10.2x Alpha (Jensen's) 8.41 N/A

Price/Book - Hist 1 Yr Wtd Avg 1.5x 1.7x

Beta 0.97 N/A

Price/Cash Flow - Hist 1 Yr Wtd Mdn 6.1x 7.0x

R Squared 0.87 N/A

Return on Equity - Hist 1 Yr Mdn 13.1% 14.1%

Sharpe Ratio 0.64 0.31

Dividend Yield - Hist 1 Yr Wtd Avg 4.6% 4.3%

Market Cap - Wtd Mdn Bil 5.6 USD 59.2 USD Standard Deviation 23.64 22.83

Number of Equity Holdings 108 214 Alpha is a measure of risk-adjusted return. Beta is a measure of a portfolio's

sensitivity to the market. R-Squared is a measure of how well a portfolio tracks the

market. Sharpe Ratio is the return over the risk free rate per unit of risk. Std Deviation

is a measure of the volatility of a portfolio. Risk profile data is net.

EXPOSURE BY SEGMENT (%) TOP HOLDINGS

Segment Exposure Company Country Segment %

Energy 54.99 Kosmos Energy Ltd United States Fossil Fuels 4.63

Fossil Fuels 30.26 Diversified

Brazil 4.36

Energy Drilling, Equipment, & Services 1.62 Bradespar SA Metals & Mining

Diversified

Clean Energy 23.1 United Kingdom 3.82

Glencore PLC Metals & Mining

Industrial Metals 31.67

Petroleo Brasileiro SA Brazil Fossil Fuels 3.63

Diversified Metals & Mining 18.94

Shell PLC United Kingdom Fossil Fuels 3.37

Copper 8.07

Renewable Energy Group Inc United States Clean Energy 3.23

Lithium 3.38

Grupo Mexico SAB de CV Mexico Copper 3.02

Platinum Group Metals 1.29

Canadian Solar Inc Canada Clean Energy 2.97

Agriculture 8.99

Agricultural Productivity 1.92 Darling Ingredients Inc United States Clean Energy 2.91

Farming 2.58 Sunrun Inc United States Clean Energy 2.73

Precision Agriculture 3 Total 34.67

Timber 0.48

Fish Farming 1

Water 2.03

Cash 2.33 Portfolio holdings are percent of equity. Where applicable, the top holdings are

derived by looking through to the underlying portfolios in which the asset allocation

strategy invests and, where appropriate, individual security positions are aggregated.

They are subject to change and should not be considered a recommendation to buy

individual securities. This portfolio continues to hold de minimis Russian exposure as

a result of past positioning and ongoing illiquidity. GMO has suspended net new

purchases of Russian securities firm-wide.

The MSCI ACWI (All Country World) Commodity Producers Index (MSCI Standard Index Series, net of withholding tax) is an independently maintained and widely published index

comprised of listed large and mid capitalization commodity producers within the global developed and emerging markets. MSCI data may not be reproduced or used for any other

purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

The above information is based on a representative account in the Strategy selected because it has the fewest restrictions and best represents the implementation of the Strategy.

About GMO: Founded in 1977, GMO is a private partnership whose sole business is investment management. The firm manages global portfolios with

offices and clients around the world. Investment offerings include equity, fixed income, multi-asset class, and alternative strategies. GMO is known for

blended fundamental and quantitative investment research expertise and a long-term orientation toward value opportunities.

You might also like

- Internship Report v3Document87 pagesInternship Report v3hardik100% (2)

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionDocument44 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionSumit Kumar Dam33% (3)

- Resources FundDocument2 pagesResources Fundb1OSphereNo ratings yet

- International Developed Equity Allocation FundDocument2 pagesInternational Developed Equity Allocation Fundb1OSphereNo ratings yet

- Global Equity Allocation FundDocument2 pagesGlobal Equity Allocation Fundb1OSphereNo ratings yet

- GMO Quality-FundDocument2 pagesGMO Quality-Fundb1OSphereNo ratings yet

- ValueResearchFundcard ICICIPrudentialBalancedAdvantageFund 2017dec18Document4 pagesValueResearchFundcard ICICIPrudentialBalancedAdvantageFund 2017dec18santoshk.mahapatraNo ratings yet

- JPMorgan Global Growth & Income PLC (GB - EN) (25 - 05 - 2022)Document3 pagesJPMorgan Global Growth & Income PLC (GB - EN) (25 - 05 - 2022)George StevensonNo ratings yet

- Untuk Kestabilan HayatiDocument3 pagesUntuk Kestabilan HayatiM Fahmi NNo ratings yet

- L&TIndiaValueFund 2017jul25Document4 pagesL&TIndiaValueFund 2017jul25Krishnan ChockalingamNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grossadcb704No ratings yet

- ValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Document4 pagesValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Ankit ShuklaNo ratings yet

- ValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Document6 pagesValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Prakash SainiNo ratings yet

- Fundcard: ICICI Prudential Multi Asset Fund - Direct PlanDocument4 pagesFundcard: ICICI Prudential Multi Asset Fund - Direct Planmanoj_sitecNo ratings yet

- Msci Acwi Growth Index Usd GrossDocument3 pagesMsci Acwi Growth Index Usd GrossAbudNo ratings yet

- Gmo Climate Change Investment Fund - Fact SheetDocument2 pagesGmo Climate Change Investment Fund - Fact Sheetb1OSphereNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Fundcard: BNP Paribas Midcap FundDocument4 pagesFundcard: BNP Paribas Midcap FundChiman RaoNo ratings yet

- Msci India Domestic Mid Cap Index Inr GrossDocument3 pagesMsci India Domestic Mid Cap Index Inr Grossadcb704No ratings yet

- UNIONBANK - Investor Presentation - 13-May-22 - TickertapeDocument69 pagesUNIONBANK - Investor Presentation - 13-May-22 - Tickertapesukash sNo ratings yet

- Trent 10 08 2023 IscDocument7 pagesTrent 10 08 2023 Iscaghosh704No ratings yet

- Fundcard: Birla Sun Life Equity FundDocument4 pagesFundcard: Birla Sun Life Equity FundSana BrahmaiahNo ratings yet

- LKP Moldtek 01feb08Document2 pagesLKP Moldtek 01feb08nillchopraNo ratings yet

- Msci Brazil Index BRL NetDocument3 pagesMsci Brazil Index BRL Nettofanao iaraNo ratings yet

- Msci World Consumer Staples Index Usd NetDocument3 pagesMsci World Consumer Staples Index Usd Nettech.otakus.studioNo ratings yet

- PWC Ghana 2023 Budget DigestDocument49 pagesPWC Ghana 2023 Budget DigestAl SwanzyNo ratings yet

- ValueResearchFundcard KotakGiltInvestmentRegular 2010nov24Document6 pagesValueResearchFundcard KotakGiltInvestmentRegular 2010nov24zankurNo ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap IndexrichardsonNo ratings yet

- Top Glove Ar 2021Document170 pagesTop Glove Ar 2021WONG WEI QINo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grosssantosh kumarNo ratings yet

- NewgenDocument2 pagesNewgenSubir BhuniaNo ratings yet

- ValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02Document4 pagesValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02ravisankarNo ratings yet

- ValueResearchFundcard SBIBluechipFund 2017jan27 PDFDocument4 pagesValueResearchFundcard SBIBluechipFund 2017jan27 PDFcaptjas9886No ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

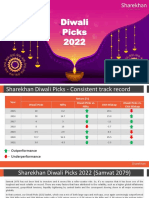

- DiwaliPicks2022 131022Document22 pagesDiwaliPicks2022 131022tranganathanNo ratings yet

- Fundcard: SBI Consumption Opportunities FundDocument4 pagesFundcard: SBI Consumption Opportunities FundNikit ShahNo ratings yet

- Fundcard: Franklin India Smaller Companies FundDocument4 pagesFundcard: Franklin India Smaller Companies FundChiman RaoNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr Grosshakim shaikhNo ratings yet

- Italy Innovazioni SpADocument6 pagesItaly Innovazioni SpAterradasbaygualNo ratings yet

- Value Research: FundcardDocument6 pagesValue Research: Fundcardsim_godeNo ratings yet

- ValueResearchFundcard RelianceIncomeFund DirectPlan 2019jun15Document4 pagesValueResearchFundcard RelianceIncomeFund DirectPlan 2019jun15Phani VemuriNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr GrossadityafantageNo ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap Indexodanodan84No ratings yet

- Nanosonics-AR2020 Web PDFDocument108 pagesNanosonics-AR2020 Web PDFjo moNo ratings yet

- Nanosonics-AR2020 Web PDFDocument108 pagesNanosonics-AR2020 Web PDFjo moNo ratings yet

- Msci India Domestic Large Cap Index Inr GrossDocument3 pagesMsci India Domestic Large Cap Index Inr Grossadcb704No ratings yet

- SS Cloud Business PlanDocument5 pagesSS Cloud Business Planminhbu114No ratings yet

- Top Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearDocument4 pagesTop Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearJNo ratings yet

- Msci Usa Index (Usd) : Cumulative Index Performance - Gross Returns (Usd) (DEC 2006 - DEC 2021) Annual Performance (%)Document3 pagesMsci Usa Index (Usd) : Cumulative Index Performance - Gross Returns (Usd) (DEC 2006 - DEC 2021) Annual Performance (%)Sahil GoyalNo ratings yet

- Fundcard: Tata India Tax Savings FundDocument4 pagesFundcard: Tata India Tax Savings FundKrishnan ChockalingamNo ratings yet

- Worldwide: Acoustic Pianos & Stringed Keyboard InstrumentsDocument12 pagesWorldwide: Acoustic Pianos & Stringed Keyboard InstrumentsFernando LPNo ratings yet

- City of Fort St. John - 2023-2027 Operating BudgetDocument30 pagesCity of Fort St. John - 2023-2027 Operating BudgetAlaskaHighwayNewsNo ratings yet

- Doc4 - CorporateDocument10 pagesDoc4 - CorporateRishabhNo ratings yet

- MSCI Sri Lanka Index (USD)Document3 pagesMSCI Sri Lanka Index (USD)Chong Wai KenNo ratings yet

- RelianceTaxSaver (ELSS) Fund 2017jul25Document4 pagesRelianceTaxSaver (ELSS) Fund 2017jul25Krishnan ChockalingamNo ratings yet

- Transforming Bangladesh’s Participation in Trade and Global Value ChainFrom EverandTransforming Bangladesh’s Participation in Trade and Global Value ChainNo ratings yet

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- ING Think Rates Spark Inflation Reasserts Itself As The Main Driver of Rates 2Document5 pagesING Think Rates Spark Inflation Reasserts Itself As The Main Driver of Rates 2Owm Close CorporationNo ratings yet

- 5 Key Factors Facing U.S. Treasury Yields - Seeking AlphaDocument12 pages5 Key Factors Facing U.S. Treasury Yields - Seeking AlphaOwm Close CorporationNo ratings yet

- Blog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessDocument11 pagesBlog - The WisdomTree Q2 2022 Economic and Market Outlook in 10 Charts or LessOwm Close CorporationNo ratings yet

- Fed Hikes 50bp With Much More To Come: Economic and Financial AnalysisDocument5 pagesFed Hikes 50bp With Much More To Come: Economic and Financial AnalysisOwm Close CorporationNo ratings yet

- Lithium Exploration Budgets Rebounded in 2021 and Increased 25% Year Over Year To $249 MillionDocument3 pagesLithium Exploration Budgets Rebounded in 2021 and Increased 25% Year Over Year To $249 MillionOwm Close CorporationNo ratings yet

- Invasion Effect On PGMS: Base Case Unchanged, But Upside Price RiskDocument4 pagesInvasion Effect On PGMS: Base Case Unchanged, But Upside Price RiskOwm Close CorporationNo ratings yet

- Blog - Fed Watch Nifty FiftyDocument3 pagesBlog - Fed Watch Nifty FiftyOwm Close CorporationNo ratings yet

- An Impressive Start To The Year For Nickel As It Hits 10-Year HighDocument7 pagesAn Impressive Start To The Year For Nickel As It Hits 10-Year HighOwm Close CorporationNo ratings yet

- ING Think Us Housing Market Exhibits More Signs of SlowdownDocument6 pagesING Think Us Housing Market Exhibits More Signs of SlowdownOwm Close CorporationNo ratings yet

- En - 20220322 Award of Epcm Contract To AfryDocument4 pagesEn - 20220322 Award of Epcm Contract To AfryOwm Close CorporationNo ratings yet

- Horizonte Furnace - 20220225-Award-Of-Furnace-ContractDocument4 pagesHorizonte Furnace - 20220225-Award-Of-Furnace-ContractOwm Close CorporationNo ratings yet

- ING Think Japanese Investors Turn Cautious On Sovereign Bonds Ahead of Global QTDocument4 pagesING Think Japanese Investors Turn Cautious On Sovereign Bonds Ahead of Global QTOwm Close CorporationNo ratings yet

- ING Think Aluminium Caught Up in Nickels Wild RideDocument4 pagesING Think Aluminium Caught Up in Nickels Wild RideOwm Close CorporationNo ratings yet

- ING Think The Impact of The War in Ukraine On Food Agri Has Only Just Started To UnravelDocument7 pagesING Think The Impact of The War in Ukraine On Food Agri Has Only Just Started To UnravelOwm Close CorporationNo ratings yet

- The Flip Side of Large M&A DealsDocument6 pagesThe Flip Side of Large M&A DealsOwm Close CorporationNo ratings yet

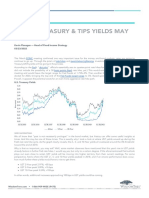

- Blog - Where Treasury TIPS Yields May Be HeadedDocument5 pagesBlog - Where Treasury TIPS Yields May Be HeadedOwm Close CorporationNo ratings yet

- RBPlat Vs Northam BidDocument2 pagesRBPlat Vs Northam BidOwm Close CorporationNo ratings yet

- Presidential Opening of The Aktogay Expansion Project FinalDocument1 pagePresidential Opening of The Aktogay Expansion Project FinalOwm Close CorporationNo ratings yet

- Rate Shock Pandemic Spreading - Juggling DynamiteDocument3 pagesRate Shock Pandemic Spreading - Juggling DynamiteOwm Close CorporationNo ratings yet

- ING Think Why Us Secs Proposed Climate Disclosure Rules Are A Game ChangerDocument6 pagesING Think Why Us Secs Proposed Climate Disclosure Rules Are A Game ChangerOwm Close CorporationNo ratings yet

- ASX Release: Karouni Plant Site Where Construction Commenced in February 2015Document6 pagesASX Release: Karouni Plant Site Where Construction Commenced in February 2015Owm Close CorporationNo ratings yet

- News Release: Red Chris Block Cave Pre-Feasibility Study Confirms Low Cost, Long LifeDocument5 pagesNews Release: Red Chris Block Cave Pre-Feasibility Study Confirms Low Cost, Long LifeOwm Close CorporationNo ratings yet

- Acquisition of Ferronickel Processing EquipmentDocument4 pagesAcquisition of Ferronickel Processing EquipmentOwm Close CorporationNo ratings yet

- Defective Rule 43 Application - Family LawDocument5 pagesDefective Rule 43 Application - Family LawOwm Close CorporationNo ratings yet

- ING Think Latam FX Outlook 2022 Return of The Pink TideDocument5 pagesING Think Latam FX Outlook 2022 Return of The Pink TideOwm Close CorporationNo ratings yet

- Nomad Royalty Company Acquires $75 Million Gold Stream On Ivanhoe Mines' Platreef PGM ProjectDocument6 pagesNomad Royalty Company Acquires $75 Million Gold Stream On Ivanhoe Mines' Platreef PGM ProjectOwm Close CorporationNo ratings yet

- Test - Consolidated Financial StatementsDocument1 pageTest - Consolidated Financial StatementsSibika GadiaNo ratings yet

- 1st Pre-Board - P2 October 2011 BatchDocument8 pages1st Pre-Board - P2 October 2011 BatchKim Cristian MaañoNo ratings yet

- 3415 Corporate Finance Assignment 2: Dean CulliganDocument13 pages3415 Corporate Finance Assignment 2: Dean CulliganAdam RogersNo ratings yet

- NBP Islamic Mahana Amdani Fund (Nimaf)Document1 pageNBP Islamic Mahana Amdani Fund (Nimaf)Afnan TariqNo ratings yet

- Bii Global Outlook 2024Document16 pagesBii Global Outlook 2024harikevadiya4No ratings yet

- Financial Economics - Group 2: Problem Set 3Document2 pagesFinancial Economics - Group 2: Problem Set 3Luigi Pastrana RosarioNo ratings yet

- 349 SEC Investigating Melvin Capital Management - WSJDocument2 pages349 SEC Investigating Melvin Capital Management - WSJrahulNo ratings yet

- American Finance AssociationDocument19 pagesAmerican Finance AssociationMissaoui IbtissemNo ratings yet

- Notice For Dut Athletics Club Anual General Meeting 2023Document1 pageNotice For Dut Athletics Club Anual General Meeting 2023NcediswaNo ratings yet

- Fin 320 Company Analysis 3Document10 pagesFin 320 Company Analysis 3api-319942276No ratings yet

- IAS 1 Presentation of Financial StatementsDocument33 pagesIAS 1 Presentation of Financial StatementsAbdullah Shaker TahaNo ratings yet

- Financial Literacy and Investor AwarenessDocument3 pagesFinancial Literacy and Investor AwarenessRishabh KhichiNo ratings yet

- National Pension System (Enps) - Subscriber Registration FormDocument8 pagesNational Pension System (Enps) - Subscriber Registration FormSasankNo ratings yet

- CFO Controller VP Finance in San Diego CA Resume John LarnerDocument2 pagesCFO Controller VP Finance in San Diego CA Resume John LarnerJohnLarnerNo ratings yet

- SA Top Companies 2016Document49 pagesSA Top Companies 2016Herbert NgwaraiNo ratings yet

- SWOT-TOWS MatrixDocument2 pagesSWOT-TOWS MatrixJasonHrvyNo ratings yet

- Colliers - Global Advantage BrochureDocument12 pagesColliers - Global Advantage BrochureYaritNo ratings yet

- GWC Fact Sheet 31 2018 EN PDFDocument2 pagesGWC Fact Sheet 31 2018 EN PDFpranav prakashNo ratings yet

- Project Finance Set 2Document7 pagesProject Finance Set 2Titus ClementNo ratings yet

- Fdnacct Chap 24 & 2Document8 pagesFdnacct Chap 24 & 2Leanne AnguloNo ratings yet

- Opt ppt1Document8 pagesOpt ppt1pramodkumar808751528270No ratings yet

- Mokshada Palande CV Fulltime Ohana PDF PDFDocument2 pagesMokshada Palande CV Fulltime Ohana PDF PDFHetal SethiyaNo ratings yet

- Global Private Assets Fund: Hamilton LaneDocument4 pagesGlobal Private Assets Fund: Hamilton LaneJonathan ShaoNo ratings yet

- Case Study of SnapdealDocument13 pagesCase Study of SnapdealVk GuptaNo ratings yet

- 20 - Assignment 4 CTRDocument2 pages20 - Assignment 4 CTRCamilo ToroNo ratings yet

- Chapter Six Corporation Organization and OperationDocument8 pagesChapter Six Corporation Organization and OperationSamuel DebebeNo ratings yet

- Quarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterDocument3 pagesQuarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterKelvin Jay Sebastian SaplaNo ratings yet

- Artko Capital 2019 Q2 LetterDocument7 pagesArtko Capital 2019 Q2 LetterSmitty WNo ratings yet