Professional Documents

Culture Documents

Chapter 3: Financial Statements and Ratio Analysis

Chapter 3: Financial Statements and Ratio Analysis

Uploaded by

hana osman0 ratings0% found this document useful (0 votes)

23 views5 pagesThis document discusses key financial ratios and analysis tools used to evaluate a company's financial statements. It covers ratios related to liquidity, profitability, leverage, efficiency and includes true/false and multiple choice questions testing understanding of ratios like the current ratio, quick ratio, return on assets, debt ratio, and DuPont analysis. Financial ratio analysis and tools like DuPont analysis are used to assess a company's financial condition and performance over time.

Original Description:

Financial ratios

Original Title

Chapter 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses key financial ratios and analysis tools used to evaluate a company's financial statements. It covers ratios related to liquidity, profitability, leverage, efficiency and includes true/false and multiple choice questions testing understanding of ratios like the current ratio, quick ratio, return on assets, debt ratio, and DuPont analysis. Financial ratio analysis and tools like DuPont analysis are used to assess a company's financial condition and performance over time.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

23 views5 pagesChapter 3: Financial Statements and Ratio Analysis

Chapter 3: Financial Statements and Ratio Analysis

Uploaded by

hana osmanThis document discusses key financial ratios and analysis tools used to evaluate a company's financial statements. It covers ratios related to liquidity, profitability, leverage, efficiency and includes true/false and multiple choice questions testing understanding of ratios like the current ratio, quick ratio, return on assets, debt ratio, and DuPont analysis. Financial ratio analysis and tools like DuPont analysis are used to assess a company's financial condition and performance over time.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

Chapter 3: Financial Statements and Ratio Analysis

Q1. True and False:

1. The income statement is a financial summary of a firm's operating results during a specified

period while the balance sheet is a summary statement of a firm's financial position at a given

point in time.

Answer: TRUE

2. The basic inputs to an effective financial analysis are the firm's income statement and the

balance sheet.

Answer: TRUE

3. Current ratio provides a firm's ability to meet its long-term obligations.

Answer: FALSE

4. Average age of inventory can be calculated as inventory divided by 365.

Answer: FALSE

5. The statement of cash flows reconciles the net income earned during a given year, and any cash

dividends paid, with the change in retained earnings between the start and end of that year.

Answer: FALSE

6. Time-series analysis evaluates the performance of various firms at the same point in time using

financial ratios.

Answer: FALSE

7. Return on total assets (ROA) measures the overall effectiveness of management in generating

profits with its available assets.

Answer: TRUE

8. Gross profit margin measures the percentage of each sales dollar left after a firm has paid for its

goods and operating expenses.

Answer: FALSE

9. The financial leverage multiplier is the ratio of a firm's total assets to common stock equity.

Answer: TRUE

10. The DuPont formula allows a firm to break down its return into the net profit margin, which

measures the firm's profitability on sales, and its total asset turnover, which indicates how

efficiently the firm has used its assets to generate sales.

Answer: TRUE

11. Benchmarking is a type of cross-sectional analysis in which a firm's ratios are compared to a key

competitor firm within the same industry, primarily to identify areas for improvement.

Answer: TRUE

12. Book value per share is the ratio of fixed assets to number of outstanding common shares.

Answer: FALSE

13. Price/earnings ratio measures the return earned on the common stockholders' investment in

the firm.

Answer: FALSE

14. The debt-to-equity ratio measures the relative proportion of total liabilities and common stock

equity used to finance the firm’s total assets.

Answer: TRUE

15. The fixed-payment coverage ratio measures the firm’s ability to meet all fixed-payment

obligations.

Answer: TRUE

Q2. MCQ:

1. The ________ represents a summary statement of a firm's financial position at a given point in

time.

A) income statement

B) balance sheet

C) statement of cash flows

D) statement of retained earnings

Answer: B

2. The statement of cash flows ________.

A) shows the financial position of a firm at a given point of time.

B) summarizes all the purchase and sale of fixed assets and raw materials

C) provides insight into a firm's operating, investment, and financing cash flows

D) classifies a firm's cash flows as operating, investing, financing, and other activities

Answer: C

3. ________ analysis involves the comparison of different firms' financial ratios at the same point

in time.

A) Time-series

B) Cross-sectional

C) Marginal

D) Technical

Answer: B

4. The two basic measures of liquidity are ________.

A) inventory turnover and current ratio

B) current ratio and quick ratio

C) gross profit margin and ROE

D) current ratio and total asset turnover

Answer: B

5. Which of the following is excluded when calculating acid-test ratio?

A) accounts receivable

B) accounts payable

C) cash

D) inventory

Answer: D

6. Which of the following is true of current ratio?

A) The more predictable a firm's cash flows, the higher the acceptable current ratio.

B) A higher current ratio indicates a higher return on equity.

C) The more predictable a firm's current ratio, the higher the current liabilities.

D) A higher current ratio indicates a greater degree of liquidity.

Answer: D

7. ________ measures the percentage of profit earned on each sales dollar before interest and

taxes but after all costs and expenses.

A) Net profit margin

B) Operating profit margin

C) Gross profit margin

D) Earnings available to common shareholders

Answer: B

8. A firm with sales of $1,000,000, net profits after taxes of $30,000, total assets of $1,500,000,

and common stockholders' investment of $750,000 has a return on equity of ________.

A) 20 percent

B) 15 percent

C) 3 percent

D) 4 percent

Answer: D

9. P/E ratio measures the ________.

A) market value of the stock to earnings per share

B) intrinsic value of the stock to earnings per share

C) book value of the stock to earnings per share

D) market price of the stock to retained earnings

Answer: A

10. Cross-sectional ratio analysis is used to ________.

A) correct expected problems in operations

B) isolate the causes of problems

C) provide conclusive evidence of the existence of a problem

D) measure relative performance of a firm with its peers

Answer: D

11. The three basic ratios used in the DuPont system of analysis are ________.

A) net profit margin, total asset turnover, and return on investment

B) net profit margin, total asset turnover, and return on equity

C) net profit margin, total asset turnover, and equity multiplier

D) net profit margin, financial leverage multiplier, and return on equity

Answer: C

12. Using the DuPont system of analysis, holding other factors constant, an increase in financial

leverage will result in ________.

A) an increase in the return on equity

B) a decrease in the gross profit margin

C) an increase in the gross profit margin

D) an increase in retained earnings

Answer: A

13. Nico Corporation has cost of goods sold of $300,000 and inventory of $30,000, then the

inventory turnover is ________ and the average age of inventory is ________.

A) 36.5; 10

B) 10; 36.5

C) 36.0; 10

D) 30; 36.0

Answer: B

14. The higher, the value of ________ ratio, the better able a firm is to fulfill its interest obligations.

A) dividend payout

B) average collection period

C) times interest earned

D) average payment period

Answer: C

15. Given the following information calculate the quick ratio.

Cash = 450

Accounts receivables= 660

Inventory= 550

Current liabilities = 550

Long-term liabilities =1102

A) 3.018

B) 2.018

C) 0.331

D) 0.441

Answer: B

16. Given that accounts receivable is $8,900 and sales revenue is $100,000. Calculate the average

collection period.

A) 32.5 days.

B) 11.8 days.

C) 25.3 days.

D) 35.9 days.

Answer: A

17. Given the following information calculate the return on total assets for Dana Dairy Products.

Sales revenue=$10,000

Net profit= $900

Current assets= $14,250

Total assets= $36,000

A) 0.9 percent

B) 5.5 percent

C) 25 percent

D) 2.5 percent

Answer: D

18. If total assets equal $6,750,000 and total liabilities equal $3,375,000. Calculate the debt ratio.

A) 0.67

B) 0.5

C) 2

D) 0.4

Answer: B

19. The ________ is used by financial managers as a structure for dissecting a firm's financial

statements to assess its financial condition.

A) Statement of cash flows

B) DuPont system of analysis

C) Break-even analysis

D) Technical analysis

Answer: B

20. The modified DuPont formula relates the firm's return on total assets (ROA) to its ________.

A) return on equity (ROE)

B) operating leverage multiplier

C) net profit margin

D) total asset turnover

Answer: A

You might also like

- Bu127 PQDocument618 pagesBu127 PQah75% (4)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Commercial BPO - CreatedDocument4 pagesCommercial BPO - CreatedBPO Forms33% (3)

- Financial Statement Analysis With Answer PDFDocument27 pagesFinancial Statement Analysis With Answer PDFKimNo ratings yet

- UAC Creative Best PracticesDocument109 pagesUAC Creative Best PracticeselizabetkennyNo ratings yet

- Managerial Economics 7th Edition Keat Young Erfle Test BankDocument5 pagesManagerial Economics 7th Edition Keat Young Erfle Test Bankcasey100% (19)

- Manac Quiz 2 With AnswersDocument4 pagesManac Quiz 2 With AnswersReymilyn Sanchez78% (9)

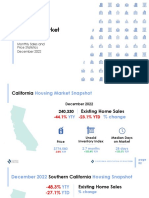

- 2022-12 Monthly Housing Market OutlookDocument58 pages2022-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Practice Test 1Document2 pagesPractice Test 1Khail GoodingNo ratings yet

- FINA 4383 QuizzesDocument10 pagesFINA 4383 QuizzesSamantha Luna100% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Chapter3 Review QuestionsDocument6 pagesChapter3 Review QuestionsMohamed HanyNo ratings yet

- Process CostingDocument10 pagesProcess CostingTricia Mae Fernandez67% (3)

- Andi Nur Indah Mentari - Mid Exam SheetsDocument8 pagesAndi Nur Indah Mentari - Mid Exam SheetsAríesNo ratings yet

- Financial Statements and Ratio Analysis: True or FalseDocument18 pagesFinancial Statements and Ratio Analysis: True or FalseAbd El-Rahman El-syeoufyNo ratings yet

- 4E Analysis (Wed - 15-11-2023) - Final Mid-TermDocument32 pages4E Analysis (Wed - 15-11-2023) - Final Mid-TermahmedNo ratings yet

- Test 2 True / False QuestionsDocument6 pagesTest 2 True / False QuestionsIslam FarhanaNo ratings yet

- Mid-Term Exam Solution Fall2022Document6 pagesMid-Term Exam Solution Fall2022ahmadbinowaidhaNo ratings yet

- TB CH 2Document7 pagesTB CH 2Jaz AliNo ratings yet

- Financial Statement Analysis-Test BankDocument35 pagesFinancial Statement Analysis-Test BankSameh Yassien100% (1)

- Financial Statement Analysis-Test BankDocument41 pagesFinancial Statement Analysis-Test BankZyad MohamedNo ratings yet

- Mcqs SolvedDocument4 pagesMcqs SolvedRahmatullah MardanviNo ratings yet

- Quiz 1 CDocument6 pagesQuiz 1 Crana ahmedNo ratings yet

- Financial Management (Chapter 4: Financial Analysis-Sizing Up Firm Performance)Document24 pagesFinancial Management (Chapter 4: Financial Analysis-Sizing Up Firm Performance)Steven consueloNo ratings yet

- Chap 019Document36 pagesChap 019skuad_024216No ratings yet

- Fin QnaDocument4 pagesFin QnaMayur AgrawalNo ratings yet

- Ba 42 Midterm ExamscaballeroDocument4 pagesBa 42 Midterm ExamscaballeroKristelle Ann Hilario CaballeroNo ratings yet

- Commerce and Accountancy Mcqs-3: Ans. (B) ExplanationDocument4 pagesCommerce and Accountancy Mcqs-3: Ans. (B) ExplanationGaurav Chandra DasNo ratings yet

- Quiz 1 FIN202Document4 pagesQuiz 1 FIN202Ngọc MinhNo ratings yet

- Chapter 5 ExercisesDocument7 pagesChapter 5 ExercisesTrang TranNo ratings yet

- Scarb Eesbm6e TB 11Document40 pagesScarb Eesbm6e TB 11Nour AbdallahNo ratings yet

- CH 01Document4 pagesCH 01Hoàng HuyNo ratings yet

- Managerial Economics Keat 7th Edition Test BankDocument6 pagesManagerial Economics Keat 7th Edition Test BankMichael Sullivan100% (33)

- MCQ Practice Test 2 (9648)Document4 pagesMCQ Practice Test 2 (9648)MelvinNo ratings yet

- Managerial Economics Keat 7th Edition Test BankDocument6 pagesManagerial Economics Keat 7th Edition Test Banksarahduncaninwexgjrbm100% (53)

- Chap 019Document36 pagesChap 019Jesus Anthony QuiambaoNo ratings yet

- BUS 306 Exam 1 - Spring 2011 (B) - Solution by MateevDocument10 pagesBUS 306 Exam 1 - Spring 2011 (B) - Solution by Mateevabhilash5384No ratings yet

- Assignment 1Document3 pagesAssignment 1Shrouk MohamedNo ratings yet

- Ross12e Chapter03 TBDocument20 pagesRoss12e Chapter03 TBhi babyNo ratings yet

- Financial Management Chapter 1 QuizDocument112 pagesFinancial Management Chapter 1 QuizasimNo ratings yet

- Ross12e Chapter03 TBDocument21 pagesRoss12e Chapter03 TBHải YếnNo ratings yet

- Chapter 4 Sample BankDocument18 pagesChapter 4 Sample BankWillyNoBrainsNo ratings yet

- Chapter 14 HomeworkDocument22 pagesChapter 14 HomeworkCody IrelanNo ratings yet

- In - Class Activity (1) - Fall 2021 Chapter 3 - Ratio AnalysisDocument4 pagesIn - Class Activity (1) - Fall 2021 Chapter 3 - Ratio AnalysisMohamed HosnyNo ratings yet

- FINDocument10 pagesFINAnbang XiaoNo ratings yet

- Chapter 03 Working With Financial Statements Answer KeyDocument12 pagesChapter 03 Working With Financial Statements Answer KeyfiraolmosisabonkeNo ratings yet

- Management Advisory Services-Elimination RoundDocument18 pagesManagement Advisory Services-Elimination RoundRyan Christian M. Coral0% (1)

- MAC Material 2Document33 pagesMAC Material 2Blessy Zedlav LacbainNo ratings yet

- Test BankDocument33 pagesTest BankThelma T. DancelNo ratings yet

- Ch16 Financial Statement AnalysisDocument134 pagesCh16 Financial Statement AnalysisLeigh Garanchon100% (3)

- Lms Quiz - Fin322B: Financial Statement AnalysisDocument9 pagesLms Quiz - Fin322B: Financial Statement AnalysisJosiah AgyeiNo ratings yet

- TB Special - PDF 15 & 16Document12 pagesTB Special - PDF 15 & 16Rabie HarounNo ratings yet

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsAsim Mahato100% (3)

- FIN202 - Quiz Test 1Document4 pagesFIN202 - Quiz Test 1Nguyen Phuong Linh (k17 HCM)No ratings yet

- Basic Accounting MCQsDocument22 pagesBasic Accounting MCQsOrtyomNo ratings yet

- Questions and Answers For Chapter 3Document11 pagesQuestions and Answers For Chapter 3高泽政No ratings yet

- Accounting Concepts and Business Performance Quiz 1 QuestionsDocument9 pagesAccounting Concepts and Business Performance Quiz 1 QuestionsMohammad Usman TanveerNo ratings yet

- TQ in Financial Management (Pre-Final)Document8 pagesTQ in Financial Management (Pre-Final)Christine LealNo ratings yet

- Financial Analysis and ControlDocument6 pagesFinancial Analysis and Controlakm.mhs20No ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Questions On Ratios 1Document2 pagesQuestions On Ratios 1hana osmanNo ratings yet

- Cost Ch1Document15 pagesCost Ch1hana osmanNo ratings yet

- CH 9 - Intermediate AccountingDocument28 pagesCH 9 - Intermediate Accountinghana osmanNo ratings yet

- TEST Yourself: More Questions On CH (2) Personality &learningDocument11 pagesTEST Yourself: More Questions On CH (2) Personality &learninghana osmanNo ratings yet

- Castwise CookwareDocument9 pagesCastwise CookwarePreet Inder SinghNo ratings yet

- 7 QC ToolsDocument116 pages7 QC ToolsAyalew TayeNo ratings yet

- Model Driven Architecture For Reverse Engineering Technologies Strategic Directions and System EvolutionDocument460 pagesModel Driven Architecture For Reverse Engineering Technologies Strategic Directions and System EvolutionMounika BandariNo ratings yet

- Property Tax PMCDocument2 pagesProperty Tax PMCBhushan TalwelkarNo ratings yet

- Time Limit For Issue of Invoices Under GST: Who Should Raise InvoicesDocument3 pagesTime Limit For Issue of Invoices Under GST: Who Should Raise Invoicesjibin samuelNo ratings yet

- Internal Stakeholders - SimplicableDocument16 pagesInternal Stakeholders - Simplicablemoinahmed99No ratings yet

- 4 Citizen's Charter San Carlos City 2019 1st EditionDocument274 pages4 Citizen's Charter San Carlos City 2019 1st EditionAntonio V. RanqueNo ratings yet

- Rittman OBIEE ArchitectureDocument97 pagesRittman OBIEE Architecturesmreddynlg100% (1)

- NeuViz 128 - User Manual - V2 - BRDocument143 pagesNeuViz 128 - User Manual - V2 - BRSergio AmancioNo ratings yet

- Inv 8800Document1 pageInv 8800Vincen JunjunNo ratings yet

- SIMMODE Paper of Learning Team 3Document34 pagesSIMMODE Paper of Learning Team 3Karl AdreNo ratings yet

- Aditya Birla Fashion - Motilal Oswal - AR AnalysisDocument24 pagesAditya Birla Fashion - Motilal Oswal - AR Analysisvipul sharmaNo ratings yet

- What Is JciDocument20 pagesWhat Is JciMani sandeep NatarajaNo ratings yet

- Omnibus Sworn Statement: Republic of The Philippines) Santiago City) S.SDocument2 pagesOmnibus Sworn Statement: Republic of The Philippines) Santiago City) S.SRhie-Anne Keight Florendo VicenteNo ratings yet

- Sabena CaseDocument2 pagesSabena CaseUNo ratings yet

- Chap 12-Pages-16-24,29-47Document28 pagesChap 12-Pages-16-24,29-47RITZ BROWNNo ratings yet

- Essay My Favorite HobbyDocument6 pagesEssay My Favorite Hobbyaaqvuknbf100% (2)

- Financial Position of The STCDocument13 pagesFinancial Position of The STCSalwa AlbalawiNo ratings yet

- Itc FinalDocument32 pagesItc FinalbuntysaunakNo ratings yet

- GST 12 To 18 EDDocument3 pagesGST 12 To 18 EDcivtect indiaNo ratings yet

- Tugas Inggris M Edi SuryaDocument9 pagesTugas Inggris M Edi SuryaAstaghfirullahNo ratings yet

- Careers Workbook - Supervisor Track (1) .XLSMDocument141 pagesCareers Workbook - Supervisor Track (1) .XLSMÇrox Rmg PunkNo ratings yet

- Indramayu Coal-Fired Power Plant Project: September 2017Document186 pagesIndramayu Coal-Fired Power Plant Project: September 2017benito siahaanNo ratings yet

- Councilman Michael Polensek Press Release On Daves Market ClosureDocument2 pagesCouncilman Michael Polensek Press Release On Daves Market ClosureWKYC.comNo ratings yet

- FSA-Tutorial 4 Analyzing Investing Activities Part 1Document9 pagesFSA-Tutorial 4 Analyzing Investing Activities Part 11 KohNo ratings yet

- 4-Laboratory of Economics For The Assessment of Environmental Impact Caused by Industrial ActivitiesDocument5 pages4-Laboratory of Economics For The Assessment of Environmental Impact Caused by Industrial ActivitiesKOPSIDAS ODYSSEASNo ratings yet