Professional Documents

Culture Documents

Amanjot Singh Sidhu 013 (Final Report)

Amanjot Singh Sidhu 013 (Final Report)

Uploaded by

parth shahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amanjot Singh Sidhu 013 (Final Report)

Amanjot Singh Sidhu 013 (Final Report)

Uploaded by

parth shahCopyright:

Available Formats

1

A REPORT ON

“Retail Operations and Strategy of the Retail

Management System.”

SUBMITTED BY:

Parth Bharat Shah

21BSPJP01C095

For: Arvind Ltd.

1

A REPORT ON

“Retail Operations and Strategy of the Retail

Management System.”

SUBMITTED BY:

Parth Bharat Shah

21BSPJP01C095

For: Arvind Ltd.

A report submitted in partial fulfilment of the requirements of MBA

Program of IBS, JAPIUR

SUBMITTED TO:

FACULTY GUIDE COMPANY GUIDE

AUTHORISATION

This is to authorize that the project report titled “Retail Operations and Strategy of

the Retail Management System”. This is a bona fide record and an original work

done by Parth Bharat Shah, Enrolment Id – 21BSPJP01C095, MBA 2021-2023, IBS

JAPIUR, during his Summer Internship Program at Arvind Ltd. This internship

program was conducted for the duration of 16th FEB 2022 to 15th May 2022. This

work is submitted in partial fulfilment of the requirement of the MBA program of

IBS JAPIUR.

A copy of this report has been sent to my company guide for approval. This work has not

been submitted to any other university or Organization for assessment or award.

This report is formally submitted to:

Dr. Archana Rathore

Campus Mentor

IBS JAPIUR

ACKNOWLEDGEMENT

Parth Bharat Shah 2|Page

210BSPJP01C095

A project work is a mixture of knowledge, creativity and experience. Firstly, I would like to

thank IBS JAPIUR for giving me an opportunity to be engrossed in such an experience I

would like to thank, Arvind Ltd. for thinking me capable enough for this summer internship

program. They have also provided me an exposure to the corporate world, which has been a

great experience for me. It has also enabled me to enhance my skills and learn things

practically.

I would full heartedly like to thank my company guide, Mr. Hardik Sinh Jadeja. Because of

him, this experience has been full of learning. I would also like to thank him for his constant

support and motivation in completing my assigned projects. He has helped me expand my

knowledge in operations management and especially in the field of retail operations. I have

tried to reflect his valuable contribution and guidance through my project.

I would also like to thank my faculty guide, Dr. Alka M Shrivastava who always helped me

throughout this project. He always been available to answer my smallest query and has also

motivated me to deliver my best work. I have been lucky to have had the opportunity to

complete this project under her guidance.

Last but not the least, I would like to thank my family and friends who have been a support

throughout.

Parth Bharat Shah

21BSPJP01C095

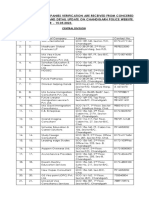

TABLE OF CONTENTS

SR. NO. PARTICULAR PAGE NO.

Parth Bharat Shah 3|Page

210BSPJP01C095

I. AUTHORISATION 3

II. ACKNOWLEDGEMENT 4

III. ABSTRACT 6

IV. LIST OF ILLUSTRATIONS 7-8

1. INTRODUCTION 9-10

1.1. Retail Sector 11-13

1.2. Arvind Ltd. 13-14

1.3. The Arvind Store 14-18

1.4. Marketing Concepts 19-20

1.5. Research Methodology 21-22

1.6. SWOT Analysis 23

1.7. Porter’s 5 Force Model OF HDFC Life 24-25

2. DESIGNING AD CAMPAIGNS 26

2.1. USP Based Ads Campaign 26

RESEARCH PROJECT – 1

3. 27-29

(TITLE: CONSUMER BEHAVIOR TOWARDS REATIL SECTOR)

4. SMC BASED AD CAMPAIGN 30

5. RESEARCH PROJECT -2 (TITLE: SMC RESEARCH PROJECT) 31-32

6. COMPETITIVE ANALYSIS 33

6.1. Example of Raymond 33-34

6.2. Website Analysis 35-39

6.3. AMJ Project 39

7. POSSIBLE DEVELOPMENTS THAT CUSTOMER EXPECTS 40-41

8 AMJ Project 43

9.1. AMJ Analysis of Competitors -

9.2. AMJ Agenda’s for HDFC Life -

9.3. Contents for AMJ Agenda’s 63

9 DESIGNING ADVERTISEMENT POSTERS 64-65

10 AGEND FOR REMAINING QUARTERS 66-67

11 REFERENCES 68

ABSTRACT

The Project entitled - “Retail Operations and Strategy of the Retail Management

System.” aims to focus on understanding how a retail operations plays an important role in

Parth Bharat Shah 4|Page

210BSPJP01C095

the retail sector and how we work on the marketing strategies for attaining the company’s

objective.

Initially started working on Retail Operations and Strategy of the Retail Management

System, followed by the understanding of Consumer Behaviour and Target Segment for the

same. To find the USP, a Research project entitled “MARKETING AND PROMOTION

STRATEGIES OF HDFC LIFE” was undertaken.

Factor analysis was done on the market research data by using SPSS Software. Consumer

behaviour was observed through factors derived from the market research. Ad campaigns

were designed based on these derived factors, target group, and consumer behaviour.

Further, Competitive Analysis of 5 major competitors of HDFC Life was prepared in which

we analysed the types of Ads they majorly post on social media, what social media strategies

they follow, AMJ Project, etc.

Researched the Possible Development that our target audience expects in life insurance

projects and suggested some points to the company so that they can work on those

developments.

Another aspect of the internship was an introduction to the concept of personal selling and a

comparative analysis of insurance policies as per the requirement of the client.

Quarterly Analysis was done for 4 quarters through which suggestions were given to HDFC

Life on how marketing strategies can be designed for these quarters.

Worked on making Ad posters for HDFC life based on the agenda and content that we had

analysed and identified for the AMJ quarter.

LIST OF ILLUSTRATIONS

TABLES

Parth Bharat Shah 5|Page

210BSPJP01C095

S.NO PARTICULAR PAGE NO

1. Key Details of HDFC Life 16

2. Example of USP based Ad Campaigns 28-29

No. of Posts/Ads across Social media Handles of ICICI Prudential

3. 33

2019

No. of Posts/Ads across Social media Handles of ICICI Prudential

4. 34

2020

No. of Posts/Ads across Social media Handles of ICICI Prudential

5. 34

2021

6. Details of the Analysis of Social Media Handle of ICICI Prudential 34

7. Policy Details 44

8. List of AMJ Agenda’s for HDFC Life 50-51

FIGURES

S.NO PARTICULAR PAGE

NO

1. Results of Factor Analysis 28

2. How much time do you spend on social media? 31

3. How long do you prefer watching an advertisement? 32

4. How frequently do you use social media? 32

5. Example of More Interactive Website 35

Parth Bharat Shah 6|Page

210BSPJP01C095

6. Language Preference 35

7. Side by side Plan Comparison 36

8. Featuring of best policies on the home page 36

9. Plan customization option 37

10. Example of Tutorials 37

11. Option to create your own plan 38

12. Easy plan maker option 38

13. Customer reviews with their own photos 39

14. Illustration for HDFC Life Sanchay Plus policy 43

15. Poster1 of World No Tobacco Day 65

16. Poster2 of World No Tobacco Day 65

17. Poster for #Pic of the day 66

18. Poster on World Laughter Day 66

19. Poster on Covid-19 Vaccination 67

20. Poster on How to use a Mask 67

1. INTRODUCTION

Textile retailing is the sale of textile goods or merchandise, usually for personal or domestic

use, from a permanent site or in conjunction with related services. Textile retailers are

individuals or businesses who buy large quantities of textile products from manufacturers or

importers directly or through a wholesaler, then sell individual product items or small

quantities to the general public in shops or stores.

Textile whole sale and retail are phrases that are intimately linked to the business side of the

textile industry. Textile wholesaling is the practice of selling textile items or merchandise to

retailers, commercial, institutional, or other professional business users, as well as other

textile wholesalers. Wholesalers frequently physically assemble, sift, and grade large

quantities of products, then break the bulk and repack and redistribute them in smaller

numbers.

Without a question, the appeal and quality of the products that a business carries are the most

crucial factors in its success. Other variables that contribute to success include the store's

design, the attentiveness and knowledge competence of the employees, the originality of the

marketing and promotions, and the visual merchandising's attractiveness.

Parth Bharat Shah 7|Page

210BSPJP01C095

As a result, the process that supports range planning and purchasing is central to any retailer's

operations. This process entails not only the selection of the product itself, but also the

identification of the criteria that will influence and constrain this selection, as well as the

factors to consider to ensure that we get it right.

➢ Scope of The Project:

• This report will help to understand the importance of the retail operations.

• It also opens the various factors which can affect the retail sector and there marketing

strategies.

• This report provides a frame of mind of people, what are the expectations of

consumer and up to how much level those expectations can meet.

➢ Objective:

The purpose of the project is to understand the various key, external and internal variables

which influence various market segments while marketing various advertising campaigns.

However, the main objectives of the project are:

• To get exposed to the practical situations of the business.

• To know how things work practically in corporate.

• To learn to interact with various corporate people.

• To know the effects of brand value of HDFC life.

• To know consumer behaviour while an advertisement is released or showcased.

Parth Bharat Shah 8|Page

210BSPJP01C095

• To sell the products of Insurance via Advertisement.

• To know the consumer view regarding service/after sales service.

• To understand and analyse various strategies used by different companies to attract

consumers.

• To find out the consumer preferences.

• To increase the sales of the Insurance products and services of the brand HDFC life.

➢ Limitations of The Research

The following are the limitations of this research study:

• Taking interview of the respondents was quite a difficult job. Because there were

customers were unwilling to respond to my questions.

• The study of Marketing advertising campaigns to understand the consumer behaviour

towards it was conducted only to the target audience which were preferred.

• The sample size of 180 was collected as a whole since this project/ questionnaire was

a collective on and every individual had to collect response of about 10 to 15.

• Most of concern person were busy with their work.

• Many of the respondents did not submit their form properly filed also since we had

individually call them and ask them the questions and most of them were not available

during the given time.

• Some of the customer shown their interest only to get the complimentary gift, and just

for the sake to get the questionnaire filed.

1.1. INSURANCE SECTOR

AMANJOT SINGH SIDHU FINAL REPORT 9|Page

20BSPJP01C013

➢ Introduction

The insurance industry is critical for any country’s economic development. A well-

developed insurance sector boosts risk-taking in the economy, as it provides some

security in the event of an unforeseen, loss-causing incident. It also provides much

needed support to family members in the case of loss of life or health. Since the assets

under management of insurance companies represent long-term capital, they also act

as a pool in which to invest in long-term projects such as infrastructure development.

The insurance industry in India has also grown along with the country’s economy.

Several insurance companies in the country are expanding their operations, across

both the public and private sector.

➢ History

The history of India’s insurance industry reflects the history of India’s economy.

Insurance companies in India were nationalised during pre-liberalisation. This was

done to protect the interests of policyholders. Two state-owned insurance companies

were thus created: The Life Insurance Corporation in 1956, and the General Insurance

Corporation in 1972 for the non-life insurance business.

Post liberalization, the industry was opened up. The Insurance Regulatory and

Development Authority of India (IRDAI) was created in 1999 to regulate the

insurance industry in India. Thus, the insurance sector was opened to private players.

This allowed foreign players to collaborate with Indian entities to enter the sector. The

number of insurance companies in India has increased quickly and continuously, and

this has led to a vibrant insurance sector- with more variety and affordability for the

consumer.

➢ Market Size

In India, the overall market size of the insurance sector is expected to US$ 280 billion

in 2020. Government's policy of insuring the uninsured has gradually pushed

insurance penetration in the country and proliferation of insurance schemes.

AMANJOT SINGH SIDHU FINAL REPORT 10 | P a g e

20BSPJP01C013

Gross premium collected by life insurance companies in India increased from Rs.

2.56 trillion (US$ 39.7 billion) in FY12 to Rs. 7.31 trillion (US$ 94.7 billion) in

FY20. During FY12-FY20, premium from new business of life insurance companies

in India increased at a CAGR of 15% to reach Rs. 2.13 trillion (US$ 37 billion) in

FY20.

Overall insurance penetration (premiums as% of GDP) in India reached 3.71% in FY19

from 2.71% in FY02.

Life insurers reported 14% YoY growth in individual annualised premium equivalent

(APE) in October 2020, compared with 4% YoY in September 2020.

The market share of private sector companies in the non-life insurance market rose

from 15% in FY04 to 56% in FY21 (till April 2020). In life insurance segment private

players had a market share of 31.3% in new business in FY20.

In October 2020, health insurance witnessed an increase in premiums at Rs. 4,074.8 crore

(US$)

553.93 million) compared with Rs. 3,840.6 crore (US$ 554.29 million), recording 6%

growth on y-o-y basis. Retail health also witnessed a 30% increase in premiums to Rs.

1,982.6 crore (US$ 269.69 million).

➢ Present Scenario

There are currently 57 insurance companies in India, of which 46 are from the private

sector. There are 24 life insurance and 33 non-life insurance companies in India. The

major names in the sector are:

Life Insurance:

i. Life Insurance Corporation (LIC) ii.

HDFC Life iii. SBI Life Insurance iv.

ICICI Prudential Life Insurance Non-

life Insurance:

AMANJOT SINGH SIDHU FINAL REPORT 11 | P a g e

20BSPJP01C013

i. New India Assurance ii.

United India Assurance iii.

National Insurance Company iv.

ICICI Lombard

v. Oriental Insurance Company

1.2. HDFC GROUP

Housing Development Finance Corporation (HDFC) is a privately owned Indian

development finance Institution with its headquarters in Mumbai, India. On 17

October 1977, it was incorporated as the first specialized mortgage company in

India, and Mr. H. T. Parekh, being appointed as Chairman for the same. HDFC

was promoted by the Industrial Credit and Investment Corporation of India

(ICICI). Hasmukh Bhai Parekh played a key role in the foundation of this

company. The principal business is to provide financial assistance to individuals,

corporate houses, and developers for the purchase, construction development, and

repair of commercial property and houses apartments in India.

It is one of the major housing finance providers in India and also extends its

presence in banking, life and general insurance, asset management, education,

venture capital, realty, deposits and education loans

➢ Products and Services Provided by HDFC Group are:

• Mortgage

• Life Insurance

• General Insurance

• Mutual Funds

➢ Subsidiaries and associates of HDFC

AMANJOT SINGH SIDHU FINAL REPORT 12 | P a g e

20BSPJP01C013

• HDFC's key associates and subsidiary companies include:

• HDFC Bank

• HDFC Standard Life Insurance Company Limited

• HDFC Asset Management Company

• HDFC ERGO General Insurance Company

• GRUH Finance

• HDFC Property Fund

• HDFC RED

• HDFC Credila Financial Services

1.3. HDFC LIFE

➢ Introduction

HDFC Life Insurance Company Ltd. a long-term life insurance provider with its

headquarters in Mumbai, offering individual and group insurance services.

The company is a joint venture between Housing Development Finance Corporation

Ltd (HDFC), one of India's leading housing finance institutions and Standard Life

Aberdeen, a global investment company.

As on 31 March 2020, the promoters; HDFC Ltd. and Standard Life (Mauritius

Holdings) 2006 Ltd. hold a 51.4% and 12.3% stake in HDFC Life respectively. The

remaining equity is held by public shareholders.

AMANJOT SINGH SIDHU FINAL REPORT 13 | P a g e

20BSPJP01C013

HDFC Life Insurance Company Limited (formerly HDFC Standard Life Insurance

Company Limited) ('HDFC Life' / ‘Company’) is a joint venture between HDFC Ltd.,

India’s leading housing finance institution and Standard Life Aberdeen, a global

investment company.

Established in 2000, HDFC Life is a leading long-term life insurance solutions provider in

India, offering a range of individual and group insurance solutions that meet various

customer needs such as Protection, Pension, Savings, Investment, Annuity and Health. As

on September 30, 2020, the

Company had 36 individual and 13 group products in its portfolio, along with 7 optional

rider benefits, catering to a diverse range of customer needs.

HDFC Life continues to benefit from its increased presence across the country having a

wide reach with 420 branches and additional distribution touch-points through several

new tie-ups and partnerships. The count of our partnerships is in excess of 300,

comprising traditional partners such as NBFCs, MFIs and SFBs, and includes more than

50 new-ecosystem partners. The Company has a strong base of financial consultants.

AMANJOT SINGH SIDHU FINAL REPORT 14 | P a g e

20BSPJP01C013

Trade Name HDFC Life

Type Public

• BSE: 540777

• NSE: HDFCLIFE

Traded as • NSE NIFTY 50 Constituent

Industry Financial services

Founded 2000

Headquarters Mumbai, India

Area served India

Key people Vibha Padalkar (MD & CEO)

Life insurance Investment management Consumer

Products

finance

Revenue ₹1,687.70 Crore (US$240 million) (2020)

Operating Income ₹1,313.92 Crore (US$180 million) (2020)

Net income ₹1,297.45 Crore (US$180 million) (2020)

Total assets ₹132,223.86 Crore (US$19 billion) (2020)

Total equity ₹6,801.03 Crore (US$950 million) (2020)

Parent HDFC Standard Life Aberdeen

Website hdfclife.com

Table 1: Key Details of HDFC Life

➢ Corporate History

The Insurance Regulatory and Development Authority (IRDA) was constituted in 1999 as

an autonomous body to regulate and develop the insurance industry. The IRDA opened

up the market in August 2000 with the invitation for application for registrations. HDFC

AMANJOT SINGH SIDHU FINAL REPORT 15 | P a g e

20BSPJP01C013

Life was established in 2000 becoming the first private sector life insurance company in

India.

By 2001, the company had its 100th customer, strengthened its employee force to 100 and

had settled its first claim. HDFC Life launched its first TV advertising campaign 'Sar

Utha Ke Jiyo' in 2005. In 2006, a study conducted by the Brand Equity – Economic Times

had put HDFC Life at 29th rank in the most trusted Indian Brands amongst the Top 50

Service Brands of 2010.

The Insurance Regulatory and Development Authority (IRDA) gave accreditation to

HDFC Life for 149 training centres housed in its branches to cater to the mandatory

training required to be given as well as for other sales training requirements in 2009.

In 2012, it the first private life insurance company to bring back pension plans under the

new regulatory regime, with the launch of two pension plans – HDFC Life Pension Super

Plus and HDFC Life Single Premium Pension Super.

➢ Presence & Distribution

HDFC Life has 421 branches and is present in 980+ cities and towns in India. The

company has also established a liaison office in Dubai.

HDFC Life distributes its products through a multi-channel network consisting of

Insurance agents, Bancassurance partners (HDFC Bank, Saraswat Bank, RBL Bank), a

Direct channel, Insurance Brokers and an Online Insurance Platform.

➢ Products & Services

HDFC Life's products include Protection, Pension, Savings, Investment, Health along

with Children and Women plans. The company also provides an option of customizing

the plans, by adding optional benefits called riders, at an additional price. The company

currently has 37 retail and 11 group products, along with 6 optional rider benefits (as on

24 March 2020).

AMANJOT SINGH SIDHU FINAL REPORT 16 | P a g e

20BSPJP01C013

• Protection Plans – insurance plans that provide protection and financial

stability to the family in case of any unforeseen events.

• Click2Protect life is their online term plan.

• Launched CSC Suraksha to be sold exclusive through the Common Services

Centre network.

• Click2Invest is their online ULIP investment plan.

• Health Plan – offers financial security to meet health related contingencies.

• Savings & Investment plans – These plans help in investment to achieve

financial goals.

• Retirement plans – financial security for life post retirement.

• Women's plans – plans catering to different financial needs of women.

• Children's plans – plans meant to secure children's future.

• Rural & social Plans – meant specifically for rural customers.

• Click2Retire completed their Click2 portfolio.

• ULIP Investment with more funds.

1.4. MARKETING CONCEPTS

➢ Marketing

AMANJOT SINGH SIDHU FINAL REPORT 17 | P a g e

20BSPJP01C013

▪ Marketing is a communication of values to the target audience.

▪ Values: how we can add benefits to our customer’s life.

▪ Target audience: for that we made an excel file in which we segmented our

targeted audience with respect to demographic, interest and behaviour factors.

➢ Marketing Communication

Marketing communication is derived from the consumer behaviour of the target

audience towards USP. Marketing communication includes:

▪ Advertising

▪ Sales Promotion

▪ Events and Experiences (sponsorship)

▪ Public Relations and Publicity

▪ Direct Marketing, Interactive Marketing

▪ Word-of-Mouth Marketing

▪ Personal Selling

➢ Consumer Behaviour

▪ The motive and behaviour towards a product or service.

▪ Consumer behaviour is the study of how individuals, groups and organisations

select, buy, use and dispose of goods, services, ideas, or experiences to satisfy

their needs and wants. Studying consumer provides clues for improving or

introducing products or services, setting prices, devising channels, crafting

messages, and developing other marketing activities (Kotler, et al., 2008).

➢ Types of Advertisements

AMANJOT SINGH SIDHU FINAL REPORT 18 | P a g e

20BSPJP01C013

▪ USP Based Advertisements

▪ SMC (Social Media Calendar) Advertisements

▪ Social Cause Based Advertisements

▪ Market Trend Based Advertisements

➢ Target Group

▪ A target market is a group of consumers or organizations most likely to buy a

company’s products or services. Because those buyers are likely to want or need

a company’s offerings, it makes the most sense for the company to focus its

marketing efforts on reaching them. Marketing to these buyers is the most

effective and efficient approach.

▪ In our internship, we learnt about detailed targeting under Facebook ads

manager.

▪ It is the way target specific group of audience whom we need to sell our products

or who would require our products. It includes Demographics, Interests,

Behaviours.

1.5. RESEARCH METHODOLOGY

➢ Definition:

AMANJOT SINGH SIDHU FINAL REPORT 19 | P a g e

20BSPJP01C013

Research refers to a search for knowledge ‟. It can be defined as a scientific and

systematic search for pertinent information on a specific topic. Research comprises

defining and redefining problems, formulating hypothesis or suggested solutions;

collecting, organizing and evaluating data; making deduction and reaching conclusions;

and at last, carefully testing the conclusions to determine whether they fit the formulating

hypothesis – Clifford Wood.

➢ Research Methodology:

It is a way to systematically solve the research problem. It may be understood as science

of studying how research is done scientifically. To complete a research successfully it is

required to study the subject thoroughly. As the prime objective of the project is to know

the consumer behaviour while purchasing a refrigerator, a research methodology adopted

that is basically based on the primary data which has been collected during my

internship. Secondary data has been used to support the primary data whenever needed.

➢ Research Design:

A research design is the determination and statement of the general research approach or

strategy adopted for the particular project. It is the heart of the planning. If the design

adheres to the research objectives, it will ensure that the client need will be served.

Research design is a plan structured and strategies of investigation. It is the arrangement

of condition and analysis of data in a manner to combine relevance to the research

purpose with economy in procedure

➢ Sample Frame:

Since the data was collected through personal contacts, the sample frames were the

individuals who are investing in life insurance policies. The following methodology is

adopted to achieve the above objectives. This research article is based upon descriptive as

well as exploratory research were primary data is used since survey and questionnaire

were made and the responses were collected individually. Secondary sources of data have

AMANJOT SINGH SIDHU FINAL REPORT 20 | P a g e

20BSPJP01C013

been collected for the study. The relevant and required data are collected from the text

books, national and international articles, RBI Bulletin (various issues) as well as annual

reports of LIC.

➢ Sampling Elements:

Individual respondents were the sampling elements. Sampling Techniques: Purposive

sampling technique was used to select the samples.

➢ Sample Size:

Sample size was 180 respondents.

➢ Tools Used For Data Collection

Self-designed questionnaire was used for the evaluation of factors affecting consumer’s

perception towards insurance. Data was collected on Likert’s type scale, where 1 stood

for minimum agreement and 5 stood for maximum agreement. The statistical tools used in

this research article are Factor analysis, pie charts, surveys, questionnaires, and basic

Social media research to study the current status, growth, volume of competition and

SWOT analysis of this Industry as well as the analysis of HDFC life.

➢ Tools Used for Data Analysis

Item to total correlation was applied to check the internal consistency of the

questionnaire. The measures were standardized through computation of reliability and

validity. Factor analysis was applied to identify the underlying factors. For the processing

the data and estimating the results SPSS -15 and Excel have been used.

1.6. SWOT ANALYSIS

AMANJOT SINGH SIDHU FINAL REPORT 21 | P a g e

20BSPJP01C013

➢ Strength:

▪ Easy online presence as it connects with people all around the world using social

media platforms.

▪ Engaged in CSR activities like Promoting education including employment

enhancing vocation skills. Promoting healthcare, sanitation and making safe

drinking water available. Skill training for employment. Contributing towards

environmental sustainability.

▪ They vision and Excellence, People, Engagement, Integrity, Customer Centricity,

Collaboration.

▪ Provides innovative and customer-centric insurance plans that can help the

customers secure their family's future as well as help them with other benefits

such as tax savings.

➢ Weakness:

▪ Absence in rural Areas

➢ Opportunities:

▪ Growing potential in rural market

▪ Alignment with govt schemes

▪ Better awareness of the product among people for getting insurance

➢ Threats:

▪ Economic crises

▪ Economic instability

AMANJOT SINGH SIDHU FINAL REPORT 22 | P a g e

20BSPJP01C013

▪ Competitors

1.7. PORTER’S 5 FORCE MODEL OF HDFC LIFE

➢ Competitive Rivalry

▪ Highly Competitive Industry

▪ Large insurance companies offer similar products

▪ Insurance products similar to commodity

▪ Companies with low costs, operating efficiency, and superior customer service

will be more competitive

▪ Consolidation and activity among the larger companies

➢ The Threat of New Entrance and Development

▪ Difficult to enter insurance industry as a small “start-up” player due to capital

and regulatory.

▪ Requirements

▪ Large financial services companies such as banks or investment banks offering

insurance products.

▪ Entrance of niche companies such as Life Settlement firms that buy existing

policies.

➢ The Power Of Buyer

▪ Individual consumers are not a major factor

AMANJOT SINGH SIDHU FINAL REPORT 23 | P a g e

20BSPJP01C013

▪ Brokers and distributors of HDFC LIFE products have more bargaining power as

to what products to sell to consumers

➢ Threat Of Substitute Products

▪ Many substitutes in the insurance industry

▪ Most of HDFC LIFE competitors (LIC, TATA AIA, ICICI LIFE INSURANCE)

▪ offer a similar suite of retirement and protection products

➢ The Power of Supplier

▪ Suppliers of capital, such as reinsurers, control the cost structure of external

capital which could cause difficulties with insurers to write new business.

▪ Threat of suppliers or other competitors hiring away key professional and

executive talent.

AMANJOT SINGH SIDHU FINAL REPORT 24 | P a g e

20BSPJP01C013

2. DESIGNING AD CAMPAIGNS

Initially we started working on the Consumer Behaviour and Designing Ad Campaigns.

Four Types of Ad Campaigns are:

➢ Campaign which are entirely based on USP.

➢ Social Media Calendar based Campaign.

➢ Social Cause.

➢ Market Trends based Campaign.

2.1. USP BASED AD CAMPAIGNS

Firstly we started working on USP based Ad Campaigns, For USP based Ads we need to

find :

➢ USP (Process of identifying USP is Research)

➢ Target Segment

➢ Consumer Behaviour – The motives and behaviour towards a Product or Service.

➢ Marketing Communication Goal

➢ Ad Script

To find the USP and behaviour of the consumer, we did our 1st Research Project on

“Consumer Behaviour Towards Insurance”.

Details of the Resarch Project – 1 are given below:

AMANJOT SINGH SIDHU FINAL REPORT 25 | P a g e

20BSPJP01C013

3. RESEARCH PROJECT – 1

TITLE – CONSUMER BEHAVIOUR TOWARDS

INSURANCE

We had to study the behaviour of the consumer, assuming what do they think before buying

an insurance, for whom will they buy the insurance, what is the thought process of theirs,

which factors they consider important and not important while buying the insurance policy.

We conducted a primary research and a secondary research. The secondary research was

done by getting information from the internet through various tool, sites and blogs. Reading

people’s comments and their way of reacting to a particular plan, company etc.

Based on these factors we obtained from the secondary research, we created a questionnaire

with 5 questions (with 12 variables each) and each having Likert scale as its option where 1

represents – Strongly Disagree and so on till 5 represents Strongly Agree.

Researched on the following Aspects:

➢ Why Life Insurance is Important?

➢ Why Private is better than the Government sector?

➢ What are the factors that affect choosing of a brand?

➢ What are your expectations from a life insurance product?

➢ What are your expectations from the hassle-free buying process?

We collected the data by calling various people and getting a proper view of what they feel

while buying a life insurance. After having a word with the different people, we collected

over 200 responses and then to find the USP, we did Factor Analysis on SPSS for the same.

Those variables whose values are close to 1, will be our USP for that product.

AMANJOT SINGH SIDHU FINAL REPORT 26 | P a g e

20BSPJP01C013

Figure1:Results of Factor Analysis

These all are the USP’s we got through Factor Analysis, then we started working on the

Target Segment, Consumer Behaviour and Ad Script.

One of the Example of USP based Ad is given below:

QUESTIONS USP Target Consumer Ad Script

Segment Behavior

Why Insurance Tax Employers Employees can One guy who has insurance, the other one

is Important Saving save a certain doesn't. they are filling their income tax ; one guy

amount of their got more return than the other;

income from

getting taxed by

getting insured.

Business and Businessman can One guy who has insurance, the other one doesn't.

Industries save a certain they are filling their income tax; one guy got more

amount of their return than the other;

income from

getting taxed by

getting insured.

Family Military People who serve A military officer and his mother are having

Security in the forces are breakfast on the day of departure of her son. His

worried about the mother was recalling all the memories when he got

security of their ill or injured while playing and she was always

family as their job there for him but now when he is leaving so she

involves high life starts getting tensed about his security and

risk. wellbeing. Then he replies that "Maa, you've done

everything for me since day 1 and made me an

intelligent and smart person. Now it’s my duty to

care for your security. Hence, I am doing my bit

for you (says while handing her the insurance

policy).

All parents Parents usually A young boy who has the dream to perform sky

save money for diving, he makes paintings and notes his dreams

their children to in a journal to fulfil his bucket lists but could not

protect their do it have he knew the risks and uncertainties in

future and to it, years went by and his dreams were never met

secure them from he got carried away with his life, work and his

any unforeseen career and one day he found his journal were he

financial crisis had written his dreams but still he feared the risk

of his life and family then one of his friends

informs him about HDFC life where they would

AMANJOT SINGH SIDHU FINAL REPORT 27 | P a g e

20BSPJP01C013

provide him family security through insurance

and he could without any fear can accomplish his

dream of sky diving.

Long Employee Employees create A husband who is about to get retired from the

Term long-term saving organization he works, his wife asks him for to

Savings goal in order to take her for lunch but he denies it, another time

Goal keep certain she asks him to take her out shopping and again

amount of money the husband denies it by saying that he has lot of

for their work left since his retirement day is nearing, the

retirement plan wife gets agitated and upset because of this...later

when his retirement day comes there is a

retirement party in his organization and he takes

his wife to the party, later the husband tells his

wife that he has planned a trip to Dubai and the

wife is stunned to hear it and asks him how can

he afford such expenses, that’s when he reveals

that he has long back got insured by HDFC and

his retirement plans are settled.

All parents Parents usually A middle class parent where the husband is an

saves money for auto driver and the wife are a knitter, the wife

their children's used to keep her money that she earned from

higher education knitting saved for the marriage of her single

and marriage daughter but unfortunately the husband was

purpose. hospitalized and all the money she saved for her

daughter’s wedding was spent in his diagnosis but

the fact was that the husband had taken a policy

for her daughter long back but the wife and

daughter were unaware about this and after the

treatment is complete the wife is frustrated and

this is when he reveals that he had insured a

policy for their daughter long back.

Table 2:Example of USP based Ad Campaigns

4. social media CALENDER BASED

CAMPAIGN

For SMC based Ads, we need to find:

AMANJOT SINGH SIDHU FINAL REPORT 28 | P a g e

20BSPJP01C013

➢ History of that Day. (Why do we celebrate Mother’s Day)

▪ (Mother’s Day, Father’s Day, Daughter’s Day, Women’s Day)

➢ Target Segment

➢ Consumer Behaviour

▪ Day to day life (General Behaviour)

▪ What we people (kids) do on Mother’s Day.

➢ Consumer Insight

▪ Hidden Truth behind our Action.

In this we majorly worked on 4 SMC Days:

• Mother’s Day

• Father’s Day

• Daughter’s Day

• Women’s Day

Before launching an SMC Ad Campaign, we did our 2nd Research Project – SMC Research

Project to know the consumer behaviour like how much time they spend on Social Media,

What type of content they watch, Which platform they majorly use on Social Media or At

what time they are most Active on Social Media. So that accordingly we will work on our Ad

Campaign.

The Details of the SMC Research Project are given below:

5. RESEARCH PROJECT –

2 TITLE – SMC RESEARCH PROJECT

To know the consumer behaviour like how much time they spend on social media, What type

of content they watch, Which platform they majorly use on Social Media or At what time

AMANJOT SINGH SIDHU FINAL REPORT 29 | P a g e

20BSPJP01C013

they are most Active on Social Media. So that accordingly we will work on our Ad

Campaign.

For this, we majorly worked on these 6 Questions:

➢ Which platform do you prefer to use?

➢ How much time do you spend on social media?

➢ How frequently do you use social media?

➢ What type of content do you prefer to watch?

➢ For how long do you prefer watching an advertisement?

➢ At what time are you most active on social media?

Results / Analysis for some of these questions are given below:

Figure 2: How much time do you spend on Social Media?

AMANJOT SINGH SIDHU FINAL REPORT 30 | P a g e

20BSPJP01C013

Figure 3: How long do you prefer watching an advertisement?

Figure 4: How frequently do you use social media?

AMANJOT SINGH SIDHU FINAL REPORT 31 | P a g e

20BSPJP01C013

6. COMPETITIVE ANALYSIS

Here we did a Competitive Analysis of the competitors of HDFC life ltd. For Competitive

Analysis below are the 5 brands worked upon:

➢ TATA AIA

➢ ABSLI

➢ Bajaj Alliance Life Insurance

➢ Kotak Life Insurance

➢ ICICI Prudential

To understand the Social Media Strategies adopted by the competitors in the past 2 years (i.e.,

March, 2019 – March,2021). Like what types of Ads, they post on Social Media, how

frequently they post Ads on Social Media, how much followers they have, what strategies

they use, on which USP or SMC they were more focused on, so that accordingly we can

improve all these things in HDFC also.

Worked on all the social media platforms of the competitors like Facebook, Instagram,

LinkedIn, Twitter, YouTube.

6.1 EXAMPLE

ICICI Prudential: - 2019

USP SMC SC MT Others

Instagram 33 19 13 0 8

Facebook 45 40 0 1 18

Twitter 10 3 0 1 7

LinkedIn 0 0 0 0 0

YouTube 21 2 0 0 18

Table 3: No. of Posts/Ads across Social media Handles of ICICI Prudential 2019

2020

USP SMC SC MT Others

AMANJOT SINGH SIDHU FINAL REPORT 32 | P a g e

20BSPJP01C013

Instagram 64 48 36 1 14

Facebook 63 44 40 0 8

Twitter 15 8 13 1 3

LinkedIn 35 30 37 0 22

YouTube 31 2 12 0 15

Table 4: No. of Posts/Ads across Social media Handles of ICICI Prudential 2020

2021

USP SMC SC MT Others

Instagram 20 12 7 2 0

Facebook 21 11 3 0 1

Twitter 3 0 1 0 0

LinkedIn 13 7 9 0 6

YouTube 19 1 18 0 3

Table 5: No. of Posts/Ads across Social media Handles of ICICI Prudential 2021

Details

Target segment Families, households, Newly Married

USP Security and growth with other financial plans

SMC Protection day and other Famous and most celebrated festivals

Social cause Mental health, emotional health, healthy living, physical wellbeing.

Market trend Cricket

Others Awards, educational posts and Interviews done

Table 6: Details of the Analysis of Social Media Handle of ICICI Prudential

6.2 WEBSITE ANALYSIS

We did Analysis of our competitors’ website and suggested some points to HDFC that we can

improve, Following are the points:

➢ More interactive Website. Ref.: Tata AIA.

AMANJOT SINGH SIDHU FINAL REPORT 33 | P a g e

20BSPJP01C013

Figure 5: Example of More Interactive Website

➢ Language preference

Figure 6: Language Preference

AMANJOT SINGH SIDHU FINAL REPORT 34 | P a g e

20BSPJP01C013

Side by side plan comparison. Ref.: ICICI Prudential Life

Figure 7: Side by side Plan Comparison

➢ User experience Feedback Form.

➢ Feature the best/most bought policy on the home page. Ref.: ICICI Prudential Life

Figure 8: Featuring of best policies on the home page

➢ Premium Calculator (For all plans)

➢ Better Fraud Management Practices (vigorous checks, use of data analytics and

technology-enabled KYC verification process has enabled the insurers to detect

fraudulent attempts and practices even before a policy is issued.)

Plan customization option on the home page. Ref.: ICICI Prudential life

AMANJOT SINGH SIDHU 35 | P a g e

20BSPJP01C013

Figure 9: Plan customization option

➢ Inclusion of tutorials

Figure 10: Example of Tutorials

➢ HDFC life websites should be simpler like Kotak.

Option to create your own plan

AMANJOT SINGH SIDHU 36 | P a g e

20BSPJP01C013

Figure 11: Option to create your own plan

➢ Easy plan maker whereby you can put the type of plan you require and the plan

amount.

Figure 12: Easy plan maker option

Hdfc life website should add photos with customers while they give reviews.

AMANJOT SINGH SIDHU 37 | P a g e

20BSPJP01C013

Figure 13: Customer reviews with their own photos

6.3 AMJ Project

➢ Worked on the Ad content of competitors (TATA AIA 2019 – SMC World No

Tobacco Day & ABSLI 2019 – Educational, Health Advisory #ProtectYourEveryday)

for April, May, June.

➢ How our competitors engage the customers in these 3 months.

AMANJOT SINGH SIDHU 38 | P a g e

20BSPJP01C013

7. POSSIBLE DEVELOPMENTS THAT

CUSTOMER EXPECTS

A research was conducted to understand the wants and expectations of the target audience for

Life Insurance products. The outcomes were further suggested to HDFC Life in order to

make the necessary improvements in the plan.

The outcomes of the research:

➢ Customer-Focused Solutions (flexibility to choose between different sections of their

policy.):

A customer may have many needs and wants in terms of taking a policy but he

might not get the personalized and customized policy of his desire thus insurance

companies must ensure that customer satisfaction is their first preference rather than the

sale of their policy. The customer must feel reliable about the brand and the product they

are selling which could give them the flexibility to choose between products that are

affordable and convenient to their needs which can also be customized or reformed in the

future.

➢ Employ knowledgeable salespeople ( Consumers are looking for a reassuring, trustworthy

experience, and an experienced sales staff demonstrates confidence and competence.):

The sales team should be trained regularly with the launch of new policies and

features. When a customer addresses his requirements about the type of policy he

needs to purchase, the salesperson should be able to provide specific solutions to such

needs. He should be thorough with all the products that the company offers as

incomplete knowledge is a turn-off for potential customers.

➢ Multi- lingual option:

A customer should have the facility to change the language based on his/her

location/hometown using geo-location tagging. This is irrespective of the fact that the

website page and other communication channels will be in English/Hindi as people

understand these two languages easily. But considering reaching potential customers pan

India, the company must ensure that they have a multilingual option ready as it helps

them to gain more prospects.

AMANJOT SINGH SIDHU FINAL REPORT 39 | P a g e

20BSPJP01C013

Eg: English ,Hindi, Tamil, Malayalam, Kannada ,Marathi

➢ Flexible complaint management:

A customer may have several expectations before taking life insurance and, as they

are investing a large sum of money, they want each step of their policy to be

transparent. Customers can make a call if they want to get some more information

about their policies or if they have any policy-related complaints. There shouldn't be

any delay in fixing their issues or complaints, so the employees should be thorough

with all the products that the company offers and they should have fluent

communication skills to fix their customer’s issue as incomplete knowledge is a turn

off for potential customers.

➢ Contactless claims (Technology is used to report the claim, capture damage or invoices,

run a system audit and communicate with the customer electronically.: This can be used in

insurances like vehicle insurances, health insurance, medical insurance, property

insurance, etc., which involves damages or any disasters. Computer vision or Automation

technology involves detecting the number of damages involved as automation involves

fixing a certain algorithm that estimates the claims to be given for accident losses that

have happened. It helps increase operational efficiency and optimize the claim process. It

can improve loss ratios, reduce the loss adjustment claims, improve claim cycle time, etc.

9. AMJ Project

➢ Firstly, Worked on the Ad content of competitors (TATA AIA 2019 – SMC World No

Tobacco Day & ABSLI 2019 – Educational, Health Advisory #ProtectYourEveryday)

for April, May, June.

AMANJOT SINGH SIDHU FINAL REPORT 40 | P a g e

20BSPJP01C013

➢ How our competitors engage the customers in these 3 months.

9.1 AMJ ANALYSIS OF COMPETITORS

➢ TATA AIA

▪ 2019

Analysis was done on April, May, June. Mostly the content was focused on SMC

based ads and Market Trend based ads. The SMC based ads mostly include World

health day, Father’s Day, Earth day, Mother’s Day, Eid Mubarak, even

International family’s day and international firefighters’ day were celebrated by

TATA. The major focus was given on SMC based ads as they Linked it with Their

major #Rakshakarankireet and #raksharanhero. This #tag is one of the major

success behind the content TATA AIA post on their social media channels. They

even Worked on Market Trend based ad post where the focus was on cricket and

Election. Only very few ad content and post were USP based ads and some other

post which were educational and advisory base ad post. One of the major

Campaign and content they have posted on their social media channels was the

Campaign on World No tobacco Day where they had done it for a total of 21 days. The

content mostly includes people to be aware of the health hazards and diseases caused

by the use of tobacco and to keep oneself safe from it.

▪ 2020

Conducted an analysis on Social Media Content from April-June 2020 In the

analysis we have found that in the month of April, May, June they have mainly

posted ads on Social cause as covid in the month of April, May, June. And they

have posted main content in terms of Thank You Post and also, they have posted

very less ads in terms of SMC based ads like Father’s Day, Insurance awareness

day, Tobacco day, Labour day, Bengal and Tamil new year. So, our conclusion is

that there are majorly post on Thank you Post and also there are post on SMC.

AMANJOT SINGH SIDHU FINAL REPORT 41 | P a g e

20BSPJP01C013

➢ ABSLI (Aditya Birla Sun Life Insurance)

▪ 2019

Analysis was done on the social media content from April - June 2019.

Most of the ads during these months were educational, Health advisory and

Nutrition based ads. USP and SMC based ads were limited for these months. Most

of the ads are Expert talks on financial growth in terms of future also they have

been working on protection survey and some of the SMC were Baisakhi, Easter,

labour days Mother’s Day, Father’s Day, Eid Mubarak etc. The USP based ads

were financial protection. Claim settlement etc. They were also working on

#protect your everyday based ad campaigns. They used this #tag in this to show

and make awareness about the daily protective action that needed to be taken care

of so that one be protected from deadly diseases and have a good health. This

includes the advisory ad campaign also.

▪ 2020

Conducted an analysis on Social media content from April - June 2020 They

have not posted any content for the month of April on Instagram. They started to

post content from May 2020 skipping April. They have made post in terms of

digital self-services as in to stay at home and solve all the problems from home,

as in to drop a mail to them in case of any query.

The ads they have worked on are USP and SMC based ads mostly with a hashtag

#SAHI (stay at home India)

The USP based ads are mostly on digital self-services which is mostly to let

people know that they can solve their query regarding insurance at home during

this pandemic which as the following ad type WhatsApp assistants, to cover

excess premium refund, also looking to efficient claim settlement process, direct

deduction of policy premium, premium payment mode etc.

SMC focuses on Eid Mubarak also focused on World Environment Day, Father’s

Day

The contents Posted on Facebook, Twitter and LinkedIn are more related to Social

causes as in the Precautions and safety, Health and Nutrition etc. The posts mostly

AMANJOT SINGH SIDHU FINAL REPORT 42 | P a g e

20BSPJP01C013

indicate/represent #SAHI (stay at home India) where they are talking about digital

access during lockdown. Most of the posts are mostly Contests, and advisory and

Nutrition and hygiene related post to safeguard their family and loved ones. They

have also focused on the health insurance during this pandemic by doing making a

#hashtag called #Healthfromhome.

➢ Bajaj Allianz

▪ 2019

From the advertisement analysis, it can be inferred that the company put less

efforts in promoting their products in this quarter. More consumer engagement

posts like become an insurance consultant with Bajaj, fitness workshops with

influencers, Consumer educational posts that help with wealth management,

workshops that help in building emotional and mental peace in the lockdown,

certain social cause posts were in much more volume. Out of 85 posts in this

quarter only 10 were focused on promoting the benefits of their products (USP

based ads). 7 were SMC posts and the rest were fitness from home workshops that

were conducted almost daily.

▪ 2020

This analysis is for the month April, May and June where Bajaj had posted content

on their social media platforms which also had content in terms of the current

pandemic which is going on. The content they had posted were mostly SMC and

Social cause-based ads. The SMC content involves April fool’s day , health day,

Mother’s Day, Father’s Day etc. they had made content on all the necessary SMC

days which is celebrated at the same time they had posted content mainly based

on social causes which is basically to keep your health in check and protect

yourself from covid -19 . The posts mostly involved advisory posts, Yoga for

keeping your health in check also nutritional posts so that one can have a healthy

diet during this pandemic. Other posts involve Meditation for sound mind and also

few USP based content which are basically automated premium payment and Life

AMANJOT SINGH SIDHU FINAL REPORT 43 | P a g e

20BSPJP01C013

assist app which is the online and mobile presence of the product they sell. This

also means that they have focused mostly on social causes rather than USP.

➢ ICICI Prudential

▪ 2019

Out of the 25 adds in the quarter April, May and June, 12 posts were Social media

calendar-based posts, 6 were USP based adds. 4 posts were made to enlighten the

customer and were Educational posts. 1 of the post was a Market trend-based ad.

Here most of the ads were SMC and USP based ads were the Content of USP was

on Signature plan and protection and SMC based Involved ads like world health

day, Baisakhi, easter, puthandu etc. Basically, they have focused on major SMC

days. Some other posts involve Protection day and Market trend post where they

Focused on Educational Post and other posts like Award winning post etc. They

had least focused on Market trend or social cause-based ads.

▪ 2020

Analysis was done on April, May, June. Mostly the content was focused on SMC

based ads and Social cause-based ads. The SMC based ads mostly include World

health day, Mother’s Day, protection day, happy Easter, even International

family’s day and were celebrated by ICICI prudential life insurance. The major

focus was given on SMC based ads as they Linked it with Their major #tag world

health day and #real protectors. This #tag is one of the major success behind the

content ICICI post on their social media channels. They even Worked on social

caused based ad where their focus was on nutrition and current pandemic. Only

very few ad content and post were USP based ads and some other post which were

hassle-free payments and claim settlement ad post. The content mostly includes

people to be aware of the health hazards and diseases during this covid situation

➢ KOTAK LIFE INSURANCE

AMANJOT SINGH SIDHU FINAL REPORT 44 | P a g e

20BSPJP01C013

▪ 2019

In the analysis we have find that in the month of April, May, June in the year there

is no ads in the Instagram, twitter and there are maximum ads of Kotak life

insurance in Facebook in the month of April, May, June.

And they have posted main content in terms of Thank You Post in order to thanks

their efficient employee and also, they have posted Ads in terms of Branding and

Foundation Post in which they have shown that they are starting a Project and

there is majorly very less post in terms of SMC like there are post as in the day on

Father’s Day and Brand Day and also, they have posted one or two ads targeting

there # hashtag “Har Sapna Hai Khas”. So, saying as a conclusion that there are

majorly post on Thank you Post and also there are post on Branding and

Foundation.

▪ 2020

In the analysis they have posted a lot of content on the covid 19 cases and the

precautions should be taken during the lockdown and what can be done to utilize

the free time. They used to bring posters during this lockdown using hashtags “20

days 20” tasks. They also used contest ads and some ads on result declaration

about those customers who participated in 20 days 20 tasks challenge. In the

month of

May, they mostly focused on SMC based ads like Mother’s Day using tagline of

mom Hai Hamesha and Labor Day and in the month of June most of the ads are

based on SMC based ads of Father’s Day using the #hastags” Har Sapna Hai

Khaas” and hashtag Hum Hain Hamesha and some ads are on steps to have a

hassle-free buying process. Also, we have seen that there are post where

influencers and mangers from companies come to five advisory talks and also

speaks about the impact of covid 19 on the economy.

9.2 AMJ Agenda’s for HDFC Life

AMANJOT SINGH SIDHU FINAL REPORT 45 | P a g e

20BSPJP01C013

Work on more #tags like for example #SAHI ( Stay at home India by ABSLI,

1

#Rakshakaranhero by TATA )

Make educational ad posts such as why to invest in insurance, meaning of terms in

2

insurance etc

work on Health based posts like good nutrition during this pandemic, what kind of foods

3

to eat, the diet timing etc.

Work on posts that includes efficient online presence as in the use of websites and apps

4

for easy accessibility and friendly user interface.

Keeping your physically fit is a challenge during this pandemic is a difficult task thus

5

they can focus on yoga and give out campaigns and posts related to it.

As we know that IPL is going on thus the current market trend based ads which includes

6

health consciousness can be made.

Can focus on Partnership which other small brands to bring awareness campaigns on

7

covid -19

8 Can focus on pension plans and retirement plans

For better reach, can work on international SMC Days Such as International

9

firefighters’ day etc.

Can provide more workshops and advisory and expert talk posts and campaigns which

10

can include the current pandemic, financial advisory, fitness, nutrition etc

11 It can be focused on brand day and foundation day

12 Give more preference on thank you posts

13 Work more on world environment day , business line , Kotak day etc

14 It can be focused on SMC like father day, international day

15 work more on others post as thankyou post , awarding posts

16 Give more preference to posts as # har Sapna Hai khas as others posts

17 You can make on the social cause posts as pandemic posts to be safe

18 It can be on SMC like Earth day, Mother day, family day, labour day etc

Give more preference to USP posts as online claim settlement , claim intimation, filling

19

claims etc

20 you can make post on social cause as swaach bharat Abhiyan , home quarantine etc

21 they can focus on health day ads

22 more emphasize can be given on protection day ads

23 they also focused on festivals like bihu

AMANJOT SINGH SIDHU FINAL REPORT 46 | P a g e

20BSPJP01C013

24 world laughter day can be a highlighting agenda

25 posts on yoga day can also be done

26 educational posts can also be considered

posts on social cause like for example stay healthy, nutritious and healthy diet plan ads

27

can be considered

28 posts on current pandemic situation

29 posts on social cause like atmanirbhar bharat

30 Mother’s Day and Father’s Day ads are most commonly used ads by competitors

31 World No Tobacco Day (21 posts by TATA AIA 2019)

32 Cricket and Elections (Market Trend based) (Focused by TATA AIA 2019)

33 We can focus on health advisories related to Covid-19

Some SMC based Ad focused by TATA AIA - World Health Day, Father’s Day, Earth

34

Day, Mother’s Day, Eid Mubarak, International Families day etc.

35 Expert talks on Financial Growth (ABSLI 2019)

36 Start a Campaign like TATA as Planting a sapling for every term plan sold

Can work on the current issue of no oxygen supply at hospitals and thus bring about

37 awareness among people from different diversities and states to provide help for people

around them .

The ads have to be posted on a regular basis as in not every day do we have SMCs so

during such day’s posts and campaigns like a contest or educational or eve USP based

38

ads can be posted as this will make consumer understand that the company is dedicated

in their work.

39 can work on more SMC and social caused based ads

Contests, games, and talk shows by celebrities and influencers and bring both

40

information and brand awareness.

41 posts about how family can bond over activities in the lockdown

42 Helping kids develop their social skills in the lockdown post

43 Mental health and emotional health importance highlighting posts

44 Becoming a life insurance consultant with HDFC posts

Influencers sharing their fitness regimes in the lockdown and conducting live workshops

45

Table 8: List of AMJ Agenda’s for HDFC Life

AMANJOT SINGH SIDHU FINAL REPORT 47 | P a g e

20BSPJP01C013

9.3 Contents for AMJ Agenda’s

➢ Work on more #tags like for example #SAHI ( Stay at home India by

ABSLI, #Rakshakaranhero by TATA )

▪ This #tag #SAHI was used by Aditya Birla sun life AND #Rakshakaran was used by

TATA AIA and they have made good results out of it.

▪ The tag of ABSLI symbolises that people should stay at home and stay safe from

harmful diseases. Also they should start to make progress online.

▪ The Rakshakarantag is used by TATA AIA to represent the complete concept of

protection in Terms of health as well as financial support. This tag is used in all the ad

types Being it SMC, market trend and even Social cause.

▪ We can create a #tag for a particular period of time as in taking into consideration the

current scenario of Pandemic, for example - #Picoftheday especially fo covid 19 where

The company can post a picture of a patient who survived covid -19 after he was

AMANJOT SINGH SIDHU FINAL REPORT 48 | P a g e

20BSPJP01C013

hospitalized and had issues with low oxygen supply and now he made it back thus

giving the viewers strength and confidence and a smile to make their day better - The

content can be posted everyday as this will make people stay motivated and bring a

smile everyday thus the reach and awareness of the content and brand will increase.

▪ The tag can be based on the current low oxygen supply in several states and how we

can tackle it. The tag should compromise the difficulty of people suffering and how we

Hdfc life can help them overcome it. The tag can be posted in terms of all the ad types

SMC, USP, social cause, And market trend which can be the current IPL.

▪ The post has to be posted 4 days in a week thus letting people become more aware and

self conscious about managing and monitoring their oxygen level.

▪ Use of #tag with fashion can be a good idea for example #fashionlovers

#outfitoftheday #fashionweek #fashionaddict #fashionistas #fashiongram #fashion

style #fashionable #fashionista #style .

AMANJOT SINGH SIDHU FINAL REPORT 49 | P a g e

20BSPJP01C013

▪ Ads like children now a days are fond of more fashionable and funky outfits to

standout from the rest. In the same way parents also want their children to have a

bright future and to stand in their own feet , so parent prefer life insurance so that their

life , future as well as their fondness towards fashion can also be secured.

▪ Using #tags for travellers or exploring can be like for example #travellerseason or

#exploretheworld

▪ Using ads on travellers for example a family like to travel a lot and always like to

capture their incredible memories . Here we can use the topic of life insurance to make

their journey even more fun and risk free and secure

AMANJOT SINGH SIDHU FINAL REPORT 50 | P a g e

20BSPJP01C013

➢ World No Tobacco Day (21 posts by TATA AIA 2019)

▪ TATA AIA worked on World No Tobacco Day in June 2019 in which they have posted

21 posts for 21 Days in which they are sharing one tip a day for 21 days to help the

customer for Smoke-free life.

▪ As it takes 21 days to change or form a habit, that’s why they have worked on this

campaign for 21 days. And also related this campaign with their

#RakshakaranKiReet (YOUR RAKSHAKARTA IN SICKNESS AND IN

HEALTH).

▪ Now we can raise awareness on the harmful and deadly effects of tobacco use.

▪ The COVID-19 pandemic has led to millions of tobacco users saying they want to quit.

So, we can help them in quitting by telling them the harmful effects of tobacco.

▪ This is the best time to quit smoking. People are now worried about immunity,

respiratory issues and are willing to adopt health practices.

▪ Smoking suppresses immunity and increases the risk of being infected with diseases

related to respiratory illnesses like COVID-19 .

▪ Smoking may raise the risk of Covid-19 by elevating enzymes that allow the

coronavirus to gain access into lung cells.

▪ Smoking not only affects the smokers but also Non-smokers who are exposed to

second-hand smoke are inhaling many of the same cancer-causing substances and

poisons as smokers. Even brief second-hand smoke exposure can damage cells in ways

that set the cancer process in motion.

▪ Quitting smoking helps bring the heartbeat back to normal in 20 minutes; within a day,

blood levels of carbon monoxide fall; in a few weeks, the risk of getting heart attack

▪ Reduces and finally over a long period of time, you reduce the risk of getting lung, oral

and other cancers.

❖ #Commit to Quit By WHO

▪ The COVID-19 pandemic has led millions of tobacco users saying they want to quit.

Commit to quit today and sign the pledge.

AMANJOT SINGH SIDHU FINAL REPORT 51 | P a g e

20BSPJP01C013

▪ We can create such a #tag and bring out awareness programs and campaigns to

make people quit smoking during this pandemic.

▪ We can conduct webinar and Doctors talk shows explaining the measures of quitting

smoking and the outcomes of smoking.

▪ Tobacco exposure is a threat to lung health for everyone - Not just smokers

▪ Second-hand smoke is smoke emitted from the burning end of a cigarette or from

other smoked tobacco products, usually in combination with smoke exhaled by the

smoker. Tobacco smoking and exposure to second-hand smoke are major risk

factors for lung cancer, chronic obstructive pulmonary disease (COPD), tuberculosis

(TB) and asthma.

▪ One in five smokers will develop Chronic obstructive pulmonary disease (COPD) in

their lifetime, and almost half of COPD deaths are attributable to smoking.

▪ Chronic obstructive pulmonary disease (COPD)isa lung disease that causes episodes

of breathlessness, coughing and mucus production. These episodes are seriously

disabling; they can last from several days to several months, and sometimes result in

death. In 2016, it was estimated that over 251 million people live with COPD.

▪ Tobacco smoking is the most important risk factor for COPD, causing swelling and

rupturing of the air sacs in the lungs, which reduces the lung’s capacity to take in

oxygen and expel carbon dioxide. It also causes the build-up of purulent mucus in

the lungs, resulting in a painful cough and agonizing breathing difficulties.

AMANJOT SINGH SIDHU FINAL REPORT 52 | P a g e

20BSPJP01C013

▪ We can make posters and doodle which can bring awareness among people to quit

smoking as it has hazardous health issues.

❖ Examples Of Posters :-

❖ Some Of The Beneficial Health Changes That Take Place Are:

▪ Within 20 minutes, your heart rate and blood pressure

▪ In 12 hours, the carbon monoxide level in your blood drops to normal and in 2- to 12

weeks, your lung function increases.

▪ In 1 to 9 months, coughing and shortness of breath decrease and in 1 year, your risk

of coronary heart disease is about half that of a smoker's

❖ World No Tobacco Day Quotes

We can post a doodle or a poster with a quotation said by great people which could

give them a sense of mortality. Some of the quotes can be

▪ "Giving up smoking is the easiest thing in the world. I know because I’ve done it

thousands of times" Mark Twain

▪ "A cigarette is the only consumer product which when used as directed kills its

consumer." -Gro Brundtland

AMANJOT SINGH SIDHU FINAL REPORT 53 | P a g e

20BSPJP01C013

▪ "Smoking kills. If you're killed, you've lost a very important part of your life." Brooke

Shields

➢ CONSUMER ENGAGEMENT POSTS

From the advertisement analysis done on various companies, consumer engagement

posts like becoming an insurance consultant, fitness workshops with influencers,

Consumer educational posts that help with wealth management, workshops that help

in building emotional and mental peace in the lock-down, certain social cause posts

were in much more volume.

Out of 85 posts in a quarter in a company, only 10 were focused on promoting the

benefits of their products(USP based ads). 7 were SMC posts and the rest were fitness

from home workshops an that were conducted almost daily.

As many posts of such nature can be seen on the social media handles of our

competitors, More of such engagement posts will fit in line with the consumer

behavior as the consumer wants a company that not only just cares about the products

and services but also the mental, financial, and physical well being of the customers.

Examples and facts on the topic can be referred from the Illustrations below.

❖ Post 1: Fitness from home workshop :Like the picture below, Bajaj Allianz has

made a series of posts that were to help people work out while they were locked

down during the pandemic. These are live workshops where famous personalities

come online and teach such workouts to the public.

AMANJOT SINGH SIDHU FINAL REPORT 54 | P a g e

20BSPJP01C013

❖ Post 2:Become a life insurance agent with HDFC : To generate extra income for

people and getting people to sell the products to their peer groups, HDFC can add

Insurance agents which will generate more business for the company. It will also

provide a job opportunity to the people in need in these critical times.

❖ Post 3: Workshops that help in building emotional and mental peace in the

lockdown:

People are struggling with coping up with the losses incurred by the pandemic. A

consumer which is at peace mentally and emotionally will be able to make informed

decisions when it comes to financial planning.

Posts like:

AMANJOT SINGH SIDHU FINAL REPORT 55 | P a g e

20BSPJP01C013

▪ Spend time with the elderly at your home and ensure they’re not stressed about the

situation.

▪ Spend time with your children teaching them self calming techniques like yoga and

meditation.

▪ Play games that help reduce stress with your family.

▪ Workshops where parents can mingle with their children,and steps to do so.

❖ Post4: Consumer educational posts that help with wealth management: A

consumer is usually unaware about how to plan wisely and achieve his/her financial

goals.

A workshop that has live interaction and allows the customers to ask questions could

be of real help. All the workshops conducted by the competitors don’t have an

option to Interact.

Post - HDFC can make a post where its focus is on Financial guidance. Post -

HDFC can make a post where it shares a link for a Wealth management

program.

Post- Post for an Interactive workshop

Post- Teaching how to use the HDFC online insurance buying process.

AMANJOT SINGH SIDHU FINAL REPORT 56 | P a g e

20BSPJP01C013

❖ Post5: Covid 19 resources update posts:

No company yet has posted about how and where to get the resources in this

pandemic. As hospitals are running out of the essentials, HDFC can make certain

posts which links the people who are helping with resources with the public. Such

posts will not only give the justification of doing business in the society but also

engrave a feeling of reliability among the customers.

➢ COVID VACCINATION FOR (18 -45)

❖ Possible Side Effects

COVID-19 vaccination will help protect you from getting COVID-19. You may have

some side effects, which are normal signs that your body is building protection. These

side effects may affect your ability to do daily activities, but they should go away in a

few days. Some people have no side effects.

▪ Common Side Effects:

On the arm where you got the shot:

✓ Pain

✓ Redness

✓ Swelling

▪ Throughout the rest of your body:

✓ Fever

✓ Tiredness

✓ Headache

✓ Muscle pain

✓ Chills

✓ Fever

✓ Nausea

❖ Helpful Tips

AMANJOT SINGH SIDHU FINAL REPORT 57 | P a g e

20BSPJP01C013

▪ Talk to your doctor about taking over-the-counter medicine, such as ibuprofen,

acetaminophen, aspirin, or antihistamines, for any pain and discomfort you may

experience after getting vaccinated. You can take these medications to relieve

post-vaccination side effects if you have no other medical reasons that prevent you

from taking these medications normally.

▪ It is not recommended you take these medicines before vaccination for the

purpose of trying to prevent side effects.

▪ To reduce pain and discomfort where you got the shot ✓ Apply a clean, cool, wet

washcloth over the area.

✓ Use or exercise your arm.

▪ To reduce discomfort from fever ✓ Drink plenty of fluids.

✓ Dress lightly.

▪ If You Received a Second Shot

✓ Side effects after your second shot may be more intense than the ones you

experienced after your first shot. ‘

✓ These side effects are normal signs that your body is building protection

and should go away within a few days.

▪ When to Call the Doctor/Nurse:

✓ In most cases, discomfort from pain or fever is a normal sign that your body

is building protection. Contact your doctor or healthcare provider:

✓ If the redness or tenderness where you got the shot gets worse after 24

hours

✓ If your side effects are worrying you or do not seem to be going away after

a few days

✓ If you get a COVID-19 vaccine and you think you might be having a severe

allergic reaction after leaving the vaccination site, seek immediate medical

AMANJOT SINGH SIDHU FINAL REPORT 58 | P a g e

20BSPJP01C013

care by calling 911. Learn more about COVID-19 vaccines and rare severe

allergic reactions.

▪ Remember

✓ Side effects can affect your ability to do daily activities, but they should go

away in a few days.