Professional Documents

Culture Documents

Fundamentals of Investment - Module IV

Fundamentals of Investment - Module IV

Uploaded by

Muhammed Yaseen MOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals of Investment - Module IV

Fundamentals of Investment - Module IV

Uploaded by

Muhammed Yaseen MCopyright:

Available Formats

FUNDAMENTALS OF INVESTMENT

MODULE-IV (Portfolio analysis)

Portfolio

A portfolio is a collection of securities held together as an investment. It

is a collection of financial investments.

Types of portfolio

1. Aggressive portfolio

It is a type of portfolio that attempt to maximize returns by taking a

relatively higher degree of risks.

2. Conservative portfolio

It is a type of portfolio designed to preserve value by increasing its

concentration of lower risk securities.

Portfolio analysis

The process of estimating the expected return and risk of different set

of portfolios is called portfolio analysis.

Portfolio management

Portfolio management is the art of establishing the best investment

policy for an individual in terms of least risk and maximum return.

Objectives/ Importance of portfolio management

Safety of principle investment

Capital appreciation

Consistency in return on investment

Marketability

Liquidity

Diversification of portfolios

Tax planning

Phases/ Stages/Steps of portfolio management

1. Specification of investment objectives and constraints

2. Quantification of capital market expectations

3. Asset allocation

4. Formulating portfolio strategy

5. Selection of securities

6. Portfolio execution

7. Portfolio revision

8. Performance evaluation

Portfolio diversification

Portfolio diversification is the process of investing money in different

asset classes and securities in order to minimize the overall risk of the

portfolio.

Efficient portfolio

It is also known as optimal portfolio. It offers the highest expected

return for a given level of risk, or one with the lowest level of risk for a

given expected return.

Markowitz model

Harry Markowitz put forward this model in 1952.

It assist in selection of most efficient portfolio of the given securities.

This model shows investors how to reduce their risk.

This model is also called mean variance model.

Assumptions of Markowitz theory

Returns from all the assets are distributed normally.

The investor is rational.

All investors have the access to the same information.

All the investors having the same view on rate of return expected.

Unlimited capital at the risk free rate of return can be borrowed.

Investors will give their best to maximize return.

Random walk theory

Random walk theory is a stock market mathematical model. This theory

advocates that the prices of securities in the stock market follow a

random walk.

This theory is also known as random walk hypothesis. It suggest that

stock prices are completely independent of past stock price.

Assumptions of Random walk theory

Stock prices discounts all information.

Markets are strongly efficient.

All investors have same access to information.

Investors behave in rational manner.

The prices of each securities in the stock market follow random walk.

Efficient market hypothesis (EMH)

It is a financial theory. It says that asset prices reflect all the available

information or data and stock trades at fair value at all time.

Assumptions of EMH

Stocks are traded on exchanges at fair market value.

Market value of stock represents all the relevant information.

Investors act rationally and normal.

Information is costless.

There is no tax and transaction cost.

No single trader can affect the price.

Forms/ Levels of EMH

1. Weak form of efficient market hypothesis

It assumes that stock prices includes all information publically available,

but not the information that is not publically available.

2. Semi strong form of efficient market hypothesis

This form give no importance to both technical and fundamental

analysis.

3. Strong form of efficient market hypothesis

It assumes that both public and private information is priced into the

stock price. Private information is available to insiders.

JUBAIR MAJEED

8089778065 (WhatsApp only)

You might also like

- Carding SetupDocument16 pagesCarding SetupNaeem Islam100% (1)

- EMH Assignment 1Document8 pagesEMH Assignment 1khusbuNo ratings yet

- Indonesia Flexible Packaging Market Growth, Trends, COVID 19 ImpactDocument135 pagesIndonesia Flexible Packaging Market Growth, Trends, COVID 19 ImpactIndah YuneNo ratings yet

- Efficient MarketDocument10 pagesEfficient MarketShafiq KhanNo ratings yet

- Security Analysis and Portfolio ManagementDocument71 pagesSecurity Analysis and Portfolio ManagementRaghavendra yadav KM80% (15)

- General Standards (NDT)Document2 pagesGeneral Standards (NDT)agniva dattaNo ratings yet

- Fundamentals of Investment - 4-JurazDocument4 pagesFundamentals of Investment - 4-JurazAkshay UkNo ratings yet

- Chapter 5 Market Mechanisms and EfficiencyDocument12 pagesChapter 5 Market Mechanisms and EfficiencyBrenden KapoNo ratings yet

- Portfolio Managment ProjectDocument11 pagesPortfolio Managment Projectmayuri mundadaNo ratings yet

- Individual Work BurseDocument6 pagesIndividual Work BurseMihaelaNo ratings yet

- Efficient Market HypothesisDocument7 pagesEfficient Market HypothesisAdedapo AdeluyiNo ratings yet

- Lecture ThreeDocument9 pagesLecture ThreeDenzel OrwenyoNo ratings yet

- ArchDocument47 pagesArchHitesh MittalNo ratings yet

- Efficient Market HypothesisDocument3 pagesEfficient Market HypothesisAlex SemusuNo ratings yet

- Technical Analysis-: Dow TheoryDocument8 pagesTechnical Analysis-: Dow TheoryVaibhav DubeyNo ratings yet

- SA&PMDocument102 pagesSA&PMAnkita TripathiNo ratings yet

- Finance ManagementDocument17 pagesFinance ManagementJackieNo ratings yet

- Investment NotesDocument12 pagesInvestment NotesGoogle GoogleNo ratings yet

- Security Analysis and Portfolio ManagementDocument71 pagesSecurity Analysis and Portfolio ManagementParitosh KaushikNo ratings yet

- Efficient Market HypothesisDocument13 pagesEfficient Market Hypothesiskunalacharya5No ratings yet

- Overview of Financial MarketsDocument15 pagesOverview of Financial MarketsDavidNo ratings yet

- MF0001 Security AnalysisDocument24 pagesMF0001 Security Analysisnsmu838No ratings yet

- Efficient Capital MarketsDocument25 pagesEfficient Capital MarketsAshik Ahmed NahidNo ratings yet

- The EMHDocument6 pagesThe EMHMd. Saiful IslamNo ratings yet

- Investment Analysis & Portfolio MGT - 040119Document8 pagesInvestment Analysis & Portfolio MGT - 040119Walton Jr Kobe TZNo ratings yet

- Testing Random Walk Hypothesis: A Study On Indian Stock MarketDocument10 pagesTesting Random Walk Hypothesis: A Study On Indian Stock Markethk_scribdNo ratings yet

- What Is Market EfficiencyDocument8 pagesWhat Is Market EfficiencyFrankGabiaNo ratings yet

- Ecm 4fmeDocument25 pagesEcm 4fmeMark BautistaNo ratings yet

- Market EfficiencyDocument11 pagesMarket Efficiencyking czar mardi dignosNo ratings yet

- Market Efficiency: Kevin C.H. ChiangDocument11 pagesMarket Efficiency: Kevin C.H. ChiangMuntazir HussainNo ratings yet

- Market EfficiencyDocument11 pagesMarket Efficiencyking czar mardi dignosNo ratings yet

- Market Efficiency: Kevin C.H. ChiangDocument11 pagesMarket Efficiency: Kevin C.H. Chiangking czar mardi dignosNo ratings yet

- Market Efficiency: Kevin C.H. ChiangDocument11 pagesMarket Efficiency: Kevin C.H. Chiangking czar mardi dignosNo ratings yet

- Efficient Market TheoryDocument17 pagesEfficient Market Theorysahiwalgurnoor100% (1)

- Mppa Efficient Market PortfolioDocument5 pagesMppa Efficient Market PortfoliozaphneathpeneahNo ratings yet

- Efficient Market Hypothesis in Indian Stock MarketDocument7 pagesEfficient Market Hypothesis in Indian Stock MarketranjuramachandranNo ratings yet

- Market efficien-WPS OfficeDocument2 pagesMarket efficien-WPS OfficeWalton Jr Kobe TZNo ratings yet

- Article1379417503 - Omisore Et AlDocument10 pagesArticle1379417503 - Omisore Et AlThanaa LakshimiNo ratings yet

- Ecm 4fmeDocument25 pagesEcm 4fmeMark BautistaNo ratings yet

- AnswerDocument9 pagesAnswerAnika VarkeyNo ratings yet

- Chapter7-Stock Price Behavior & Market EfficiencyDocument9 pagesChapter7-Stock Price Behavior & Market Efficiencytconn8276No ratings yet

- Notes of Port Folio ManagemntDocument3 pagesNotes of Port Folio ManagemntmirgasaraNo ratings yet

- The Harry Markowitz ModelDocument2 pagesThe Harry Markowitz ModelShahbaz JaffriNo ratings yet

- Efficient Market HypothesisDocument14 pagesEfficient Market Hypothesissashankpandey9No ratings yet

- DerivativesDocument48 pagesDerivativesBapiraj MallipudiNo ratings yet

- Market EfficiencyDocument9 pagesMarket Efficiencyiqra sarfarazNo ratings yet

- Coporate FinanceDocument6 pagesCoporate FinanceMuhammad AbdullahNo ratings yet

- IA&M-Module 3 EMHDocument17 pagesIA&M-Module 3 EMHShalini HSNo ratings yet

- Notes On Portfolio MGMTDocument7 pagesNotes On Portfolio MGMTKripal Singh RathodNo ratings yet

- Capital Markehhhhshst-WPS OfficeDocument3 pagesCapital Markehhhhshst-WPS OfficeWalton Jr Kobe TZNo ratings yet

- Unit 1 Financial Management IIDocument5 pagesUnit 1 Financial Management IIjoseguticast99No ratings yet

- The Efficient Market HypothesisDocument4 pagesThe Efficient Market HypothesisSalma Khalid100% (1)

- Efficient Market HypothesisDocument5 pagesEfficient Market HypothesisAdarsh KumarNo ratings yet

- Efficient Capital Markets: Dr. Amir RafiqueDocument45 pagesEfficient Capital Markets: Dr. Amir RafiqueUmar AliNo ratings yet

- Nifty Index Options: Open Interest Analysis of Options ChainDocument34 pagesNifty Index Options: Open Interest Analysis of Options ChainPraveen Rangarajan100% (1)

- EMH by SaleemDocument4 pagesEMH by SaleemMuhammad Saleem SattarNo ratings yet

- (HNS) - IIIyrSem6 - FundamentalsOfInvestments - Week4 - DR - KanuDocument17 pages(HNS) - IIIyrSem6 - FundamentalsOfInvestments - Week4 - DR - Kanumuzamil BhuttaNo ratings yet

- QLDMDT Q&aDocument2 pagesQLDMDT Q&aNguyễn Thanh PhongNo ratings yet

- Research Proposal:Share Market Efficiency: Is The Indian Capital Market Weak Form Efficient?Document13 pagesResearch Proposal:Share Market Efficiency: Is The Indian Capital Market Weak Form Efficient?Adil100% (4)

- Market Efficiency ExplainedDocument8 pagesMarket Efficiency ExplainedJay100% (1)

- Stock Market Secrets For Beginners: Get In On This Lucrative OpportunityFrom EverandStock Market Secrets For Beginners: Get In On This Lucrative OpportunityNo ratings yet

- History of Madurai Revealed From MaduraikkanchiDocument52 pagesHistory of Madurai Revealed From MaduraikkanchiSathish KumarNo ratings yet

- Ssy R R 2017 Form IDocument3 pagesSsy R R 2017 Form ISoumen Gorai50% (2)

- Memorial For The Appellants-Team Code L PDFDocument44 pagesMemorial For The Appellants-Team Code L PDFAbhineet KaliaNo ratings yet

- Chapter 15 PDFDocument12 pagesChapter 15 PDFDarijun SaldañaNo ratings yet

- Week 1, Hebrews 1:1-14 HookDocument9 pagesWeek 1, Hebrews 1:1-14 HookDawit ShankoNo ratings yet

- Sakshi Bhambhani Jn180128 SipreportDocument41 pagesSakshi Bhambhani Jn180128 SipreportHarshvardhan Singh rathoreNo ratings yet

- Blue Economy CourseDocument2 pagesBlue Economy CourseKenneth FrancisNo ratings yet

- Korean Made Easy For Beginners 2nd Edition by Seu 22Document36 pagesKorean Made Easy For Beginners 2nd Edition by Seu 22takoshaloshviliNo ratings yet

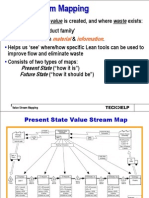

- 4 Slides Value Stream MappingDocument13 pages4 Slides Value Stream MappingRanjan Raj Urs100% (2)

- M607 L01 SolutionDocument7 pagesM607 L01 SolutionRonak PatelNo ratings yet

- Maimonides 0739 Ebk v6Document525 pagesMaimonides 0739 Ebk v6futurity34No ratings yet

- I Nyoman Trikasudha Gamayana - 2201541145 (ASSIGNMENT 2)Document3 pagesI Nyoman Trikasudha Gamayana - 2201541145 (ASSIGNMENT 2)trikaNo ratings yet

- Nnadili v. Chevron U.s.a., Inc.Document10 pagesNnadili v. Chevron U.s.a., Inc.RavenFoxNo ratings yet

- The Black Map-A New Criticism AnalysisDocument6 pagesThe Black Map-A New Criticism AnalysisxiruomaoNo ratings yet

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pavan KumarNo ratings yet

- Ho, Medieval Proof, J L Religion, 2004 PDFDocument44 pagesHo, Medieval Proof, J L Religion, 2004 PDFJanaNo ratings yet

- The Danube 3D: Europeity and EuropeismDocument14 pagesThe Danube 3D: Europeity and EuropeismcursantcataNo ratings yet

- M B ADocument98 pagesM B AGopuNo ratings yet

- Coraline QuotesDocument2 pagesCoraline Quotes145099No ratings yet

- Environgard CorporationDocument4 pagesEnvirongard CorporationRina Nanu33% (3)

- Consignment ProcessDocument8 pagesConsignment ProcessSuganya Soundar0% (1)

- Iqwq-Ft-Rspds-00-120103 - 1 Preservation During Shipping and ConstructionDocument31 pagesIqwq-Ft-Rspds-00-120103 - 1 Preservation During Shipping and Constructionjacksonbello34No ratings yet

- 14-128 MTR Veh Appraisal FormDocument2 pages14-128 MTR Veh Appraisal FormJASONNo ratings yet

- Chapter On 'Aqidah - SH Abdulqadir Al-JilaniDocument12 pagesChapter On 'Aqidah - SH Abdulqadir Al-JilaniUjjal MazumderNo ratings yet

- The Insiders Game How Elites Make War and Peace Elizabeth N Saunders Full ChapterDocument67 pagesThe Insiders Game How Elites Make War and Peace Elizabeth N Saunders Full Chapterjoann.lamb584100% (16)

- Copia de The Green Banana Lecturas I 2020Document4 pagesCopia de The Green Banana Lecturas I 2020Finn SolórzanoNo ratings yet