Professional Documents

Culture Documents

Coursebook Chapter 16 Answers

Coursebook Chapter 16 Answers

Uploaded by

Ahmed ZeeshanCopyright:

Available Formats

You might also like

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- ASAL Accounting Workbook AnswersDocument201 pagesASAL Accounting Workbook Answersღ꧁Lizzy X Roxiie꧂ღNo ratings yet

- Igcse and o Level Accounting Course BookDocument31 pagesIgcse and o Level Accounting Course Bookngaa100% (2)

- Accounting Notes For IGCSE PDFDocument52 pagesAccounting Notes For IGCSE PDFAliMushtaq76% (96)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii87% (15)

- Accounting-Formats For Cambridge IGCSEDocument11 pagesAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (9)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument6 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii73% (11)

- Workbook AnswersDocument112 pagesWorkbook AnswersAbdullah Akmal100% (1)

- Coursebook Section 3 Practice Question AnswersDocument9 pagesCoursebook Section 3 Practice Question AnswersAhmed Zeeshan92% (12)

- Accounting Workbook Section 2 AnswersDocument4 pagesAccounting Workbook Section 2 AnswersAhmed Zeeshan77% (13)

- Accounting Workbook Section 1 AnswersDocument24 pagesAccounting Workbook Section 1 AnswersAhmed Zeeshan94% (34)

- Accounting Workbook Section 4 AnswersDocument49 pagesAccounting Workbook Section 4 AnswersAhmed Zeeshan100% (25)

- ASAL Accounting Workbook Starter PackDocument26 pagesASAL Accounting Workbook Starter Packcthiruvazhmarban100% (1)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii92% (13)

- Cambridge Igcse and o Level Accounting Course BookDocument8 pagesCambridge Igcse and o Level Accounting Course BookJaime0% (1)

- Ratios AS - Topical A Level Accounting Past PaperDocument27 pagesRatios AS - Topical A Level Accounting Past PaperVersha 2021100% (1)

- Chemical Energetics: Bond Energy CalculationDocument13 pagesChemical Energetics: Bond Energy CalculationAhmed Zeeshan100% (2)

- Coursebook Section 2 Practice Question AnswersDocument5 pagesCoursebook Section 2 Practice Question AnswersAhmed Zeeshan100% (9)

- Coursebook Chapter 6 AnswersDocument2 pagesCoursebook Chapter 6 AnswersAhmed Zeeshan90% (10)

- Explorent - Micro-Laryngoscopy-CatalogueDocument80 pagesExplorent - Micro-Laryngoscopy-Cataloguedrtarek255442No ratings yet

- Worksheet 1.2 Introducing Double EntryDocument3 pagesWorksheet 1.2 Introducing Double EntryKenshin HayashiNo ratings yet

- Igcse Accounting Essential 2e Answers 27 PDFDocument11 pagesIgcse Accounting Essential 2e Answers 27 PDFRitu Singla.No ratings yet

- Unemployment in IndiaDocument21 pagesUnemployment in IndiaSagar Nawale73% (37)

- Design Build and Assess Composite Hub Bar For Gyroplane Application GYRATEDocument30 pagesDesign Build and Assess Composite Hub Bar For Gyroplane Application GYRATEvictorNo ratings yet

- Supporting Community-Based Disaster ResponseDocument10 pagesSupporting Community-Based Disaster ResponseBill de BlasioNo ratings yet

- AC7108 Rev. F - Audit Criteria For Chemical ProcessingDocument74 pagesAC7108 Rev. F - Audit Criteria For Chemical ProcessingfdsbdfsbhdgndsnNo ratings yet

- Accounts Textbook AnswersDocument84 pagesAccounts Textbook AnswersVidhi Patel100% (4)

- PDF Coursebook Chapter 4 Answers - CompressDocument6 pagesPDF Coursebook Chapter 4 Answers - CompressSama ZabadyNo ratings yet

- Answers-Accounting CB 2nd Ed CambridgeDocument119 pagesAnswers-Accounting CB 2nd Ed Cambridgebk4t7j8g92No ratings yet

- Coursebook Chapter 15 AnswersDocument3 pagesCoursebook Chapter 15 AnswersAhmed Zeeshan80% (10)

- Coursebook Chapter 8 AnswersDocument4 pagesCoursebook Chapter 8 AnswersAhmed Zeeshan100% (9)

- Coursebook Chapter 20 AnswersDocument3 pagesCoursebook Chapter 20 AnswersAhmed Zeeshan100% (11)

- Coursebook Chapter 10 AnswersDocument2 pagesCoursebook Chapter 10 AnswersAhmed Zeeshan100% (4)

- Coursebook Chapter 9 AnswersDocument5 pagesCoursebook Chapter 9 AnswersAhmed Zeeshan92% (12)

- Coursebook Chapter 11 AnswersDocument4 pagesCoursebook Chapter 11 AnswersAhmed Zeeshan100% (9)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDoris Yee50% (2)

- Coursebook Chapter 5 Answers PDFDocument3 pagesCoursebook Chapter 5 Answers PDFXx Yung Wei Chin100% (1)

- Name: Grade: SubjectDocument5 pagesName: Grade: SubjectArkar.myanmar 2018100% (1)

- 02 Accounting Study NotesDocument4 pages02 Accounting Study NotesJonas Scheck100% (2)

- CH 19-Answers To Textbook Ques 1025243368Document4 pagesCH 19-Answers To Textbook Ques 1025243368ayten.ayman.eleraky100% (2)

- Cambridge IGCSE and O Level Accouting Workbook AnswersDocument107 pagesCambridge IGCSE and O Level Accouting Workbook Answersღ꧁Lizzy X Roxiie꧂ღ100% (3)

- Acc - Chapter 18 AmroDocument9 pagesAcc - Chapter 18 AmroWassim AlwanNo ratings yet

- Accounts Chapter 8Document10 pagesAccounts Chapter 8R.mNo ratings yet

- 1.2 Introducing Double Entry: Suggested ActivitiesDocument2 pages1.2 Introducing Double Entry: Suggested ActivitiesDonatien Oulaii0% (1)

- 1.4 Introducing Three Column Cash Books: Suggested ActivitiesDocument2 pages1.4 Introducing Three Column Cash Books: Suggested ActivitiesDonatien Oulaii100% (1)

- 1.3 Introducing Trial Balances: Suggested ActivitiesDocument2 pages1.3 Introducing Trial Balances: Suggested ActivitiesDonatien Oulaii100% (5)

- IGCSE & OL Accounting Worksheets AnswersDocument53 pagesIGCSE & OL Accounting Worksheets Answerssana.ibrahimNo ratings yet

- POA Exercise 28.11, 28.12A, 28.13Document6 pagesPOA Exercise 28.11, 28.12A, 28.13Ain FatihahNo ratings yet

- IGCSE & OL Accounting WorksheetsDocument73 pagesIGCSE & OL Accounting Worksheetssana.ibrahim100% (1)

- Introduction To AccountingDocument3 pagesIntroduction To AccountingDamith Piumal Perera100% (1)

- Eduseeds: IGCSE Accounting 902Document21 pagesEduseeds: IGCSE Accounting 902NandaNo ratings yet

- 1.1 Introducing Accounting: Suggested ActivitiesDocument2 pages1.1 Introducing Accounting: Suggested ActivitiesDonatien Oulaii100% (1)

- Worksheet 4.1 Introducing Bank ReconciliationDocument4 pagesWorksheet 4.1 Introducing Bank ReconciliationHan Nwe Oo100% (1)

- Cambridge International AS and A Level Accounting Coursebook AnswerDocument5 pagesCambridge International AS and A Level Accounting Coursebook AnswerMopur NELLORE0% (1)

- CHP 14 NotesDocument22 pagesCHP 14 NotesDhruvit DadNo ratings yet

- Control AccountsDocument4 pagesControl AccountsTyanna TaylorNo ratings yet

- Acc Clerk Chapter. 6-Control Accounts (Ledgers)Document28 pagesAcc Clerk Chapter. 6-Control Accounts (Ledgers)Ephraim PryceNo ratings yet

- Control Acc F5Document15 pagesControl Acc F5Tinevimbo NdlovuNo ratings yet

- O Level Accounting P1 Theory BookletDocument62 pagesO Level Accounting P1 Theory Booklettayyabkhalid010203040506No ratings yet

- Chapter 3Document27 pagesChapter 3giang1022002No ratings yet

- Auditing Theories and Problems Quiz WEEK 1Document19 pagesAuditing Theories and Problems Quiz WEEK 1Sarah GNo ratings yet

- Control Account NotesDocument2 pagesControl Account NotesNipuni PereraNo ratings yet

- Chapter 3...Document26 pagesChapter 3...giang1022002No ratings yet

- Audit of Receivables CaseDocument4 pagesAudit of Receivables CaseJohn Victor Mancilla MonzonNo ratings yet

- Lecture 3 Accounting Cycle-2Document26 pagesLecture 3 Accounting Cycle-2azizbektokhirbekovNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationAhmed ZeeshanNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationSMPM 18No ratings yet

- Cambridge IGCSE: Computer Science 0478/22Document12 pagesCambridge IGCSE: Computer Science 0478/22Miguel Oubiña SánchezNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationSarala Devi DNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationAhmed ZeeshanNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument16 pagesCambridge International General Certificate of Secondary EducationAhmed ZeeshanNo ratings yet

- 0478 w15 2 1 QPDocument12 pages0478 w15 2 1 QPBindiya RamchurnNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationAhmed ZeeshanNo ratings yet

- Cambridge IGCSE: Computer Science 0478/23Document12 pagesCambridge IGCSE: Computer Science 0478/23Ahmed ZeeshanNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationMohamed MahmoudNo ratings yet

- 0478 s16 QP 21Document12 pages0478 s16 QP 21Tejas KothariNo ratings yet

- Cambridge IGCSE: Computer Science 0478/21Document12 pagesCambridge IGCSE: Computer Science 0478/21Shop AliceNo ratings yet

- Cambridge IGCSE: Computer Science 0478/23Document12 pagesCambridge IGCSE: Computer Science 0478/23Shop AliceNo ratings yet

- Coursebook Chapter 15 AnswersDocument3 pagesCoursebook Chapter 15 AnswersAhmed Zeeshan80% (10)

- DynprogDocument18 pagesDynprogHykinel Bon GuarteNo ratings yet

- 6866587D12 - A TCR1000 Basic Service Manual - MR9.6Document78 pages6866587D12 - A TCR1000 Basic Service Manual - MR9.6rjmsantosNo ratings yet

- GeoVancouver2016 - Vazaios Vlachopoulos DiederichsDocument8 pagesGeoVancouver2016 - Vazaios Vlachopoulos DiederichsIoannis VazaiosNo ratings yet

- Z VF-S15 PIDcontrol-InstrMan Neutral e E6581879Document23 pagesZ VF-S15 PIDcontrol-InstrMan Neutral e E6581879mdtabanioNo ratings yet

- The Sherman Antitrust Act (1890) - Ley - (032860)Document2 pagesThe Sherman Antitrust Act (1890) - Ley - (032860)Luis Alberto Velasquez AgapitoNo ratings yet

- Project Management and Its Effects of Quality Control in ConstructionDocument5 pagesProject Management and Its Effects of Quality Control in Constructionbotch100% (3)

- Peer Mentoring in A University Jazz Ensemble: by Andrew GoodrichDocument27 pagesPeer Mentoring in A University Jazz Ensemble: by Andrew GoodrichMatthew BelyeuNo ratings yet

- IU Video IndexDocument24 pagesIU Video IndexRhian VelasquezNo ratings yet

- BU2103 - IBM G2 International Trade Law - S20 - Quiz #2 - TonyDocument7 pagesBU2103 - IBM G2 International Trade Law - S20 - Quiz #2 - TonyRajvi ChatwaniNo ratings yet

- Ix T7A: Installation ManualDocument28 pagesIx T7A: Installation ManualSidney Chaves de LimaNo ratings yet

- Sahulat Takaful PlanDocument7 pagesSahulat Takaful PlanMuhammad IrfanNo ratings yet

- Usupervisor Com PDFDocument92 pagesUsupervisor Com PDFVictor Hugo SantosNo ratings yet

- Activity Proposal-Stakeholders Forum 2Document6 pagesActivity Proposal-Stakeholders Forum 2Rob MachiavelliNo ratings yet

- AZ-120 Lab01a-Azure VM Linux ClusteringDocument20 pagesAZ-120 Lab01a-Azure VM Linux ClusteringErosNo ratings yet

- GC TodayDocument31 pagesGC TodayBrayan GuzmanNo ratings yet

- Week 5Document42 pagesWeek 5Nabilah Mat YasimNo ratings yet

- App Development in Creatio 7.18Document20 pagesApp Development in Creatio 7.18Imam Aditya P TNo ratings yet

- Operational and Expenditure Plan of Result Area 2 of Strive Spiu AssamDocument2 pagesOperational and Expenditure Plan of Result Area 2 of Strive Spiu AssamKaushik DasNo ratings yet

- PT-059 TG-6 Uwc 2019-05Document1 pagePT-059 TG-6 Uwc 2019-05Sylvie CatalanNo ratings yet

- Manila Prince Hotel vs. GSISDocument5 pagesManila Prince Hotel vs. GSISFenina ReyesNo ratings yet

- LTD Palabrica NotesDocument20 pagesLTD Palabrica NotesDarla Grey0% (1)

- Individual Daily Log and Accomplishment Report: Enclosure No. 3 To Deped Order No. 011, S. 2020Document2 pagesIndividual Daily Log and Accomplishment Report: Enclosure No. 3 To Deped Order No. 011, S. 2020cristina maquintoNo ratings yet

- Dangers of Social Networking 1Document4 pagesDangers of Social Networking 1Kerri McFarlaneNo ratings yet

- Systems EngineeringDocument5 pagesSystems EngineeringBidkar Harshal S100% (5)

- ATOM V-808: Cleaning InstructionsDocument10 pagesATOM V-808: Cleaning Instructionsjerson_rojas19899571No ratings yet

Coursebook Chapter 16 Answers

Coursebook Chapter 16 Answers

Uploaded by

Ahmed ZeeshanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coursebook Chapter 16 Answers

Coursebook Chapter 16 Answers

Uploaded by

Ahmed ZeeshanCopyright:

Available Formats

Cambridge IGCSE and O Level Accounting

Coursebook answers

Chapter 16

Answers to test yourself questions

Test yourself 16.1

1 Sales ledger control account

2 Purchases ledger control account

3 Three from:

• assist in locating errors when the trial balance fails to balance

• are proof of the arithmetical accuracy of the ledgers they control

• the balances on these accounts are regarded as being equal to the total of the trade

receivables and the total of the trade payables, so this information is available immediately

• draft financial statements can be prepared quickly because of the balances provided by

the control accounts

• they help to reduce fraud as the control accounts are prepared by someone who has not

been involved in making the entries on those particular ledgers

• they provide a summary of the transactions affecting the trade receivables and trade

payables for each financial period.

Test yourself 16.2

1

1 The control accounts must be prepared independently and information in the individual ledger

account in the sales and purchases ledgers must not be used. An error in the sales ledger or the

purchases ledger would not be revealed by a control account if it had been prepared using the

information in those ledgers.

2 a Purchases returns journal

b Cash book

c Journal

Test yourself 16.3

1 A credit customer’s account can have credit balance because of an overpayment by the

customer, the customer returning goods after paying the account, the customer paying in

advance for the goods or cash discount not being deducted before payment was made.

Test yourself 16.4

1 A contra entry is an entry which appears in both the sales ledger control account and the

purchases ledger control account. It arises when a business sells goods to another business and

also buys different goods from that business. Rather than each business sending the other a

cheque to cover the amount due they may agree to make a contra entry to set one account off

against the other.

Answers to exam-style questions

1 D

2 C

3 D

© Cambridge University Press 2018

Cambridge IGCSE and O Level Accounting

4 a One from:

• more convenient to use

• allows for division of work

• allows checking procedures to be introduced

• reduces the possibility of fraud.

b Two from:

• assists in locating errors

• checks the arithmetical accuracy of the purchases ledger

• provides an immediate total of the amount owing to trade payables

• allows draft financial statements to be prepared quickly

• may reduce fraud

• provides a summary of the transactions affecting trade payables.

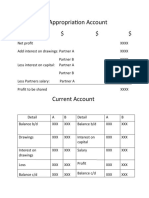

c

Hamir

Purchases ledger control account

Date Details Fo. $ Date Details Fo. $

20–1 20–1

May 1 Balance b/d 105 May 1 Balance b/d 4 897

May 31 Purchases returns 657 May 31 Purchases 5 424

Bank/cash 4 312 Interest 20

Discount received 88 Balance c/d 76

2

Balance c/d 25 255 10 417

10 417 10 417

20–1 20–1

Jun 1 Balance b/d 76 Jun 1 Balance b/d 5 255

d i Journal

ii Purchases returns journal

iii Cash book

5 a i Debit: cash book

ii Credit: cash book

iii Credit: purchases journal

iv Debit: journal

v Debit: cash book

vi Credit: journal

vii Debit: purchases returns journal

b If the purchases ledger control account was prepared from the purchases ledger and there

was an error in that ledger it would be repeated in the control account and would not be

revealed.

c A contra entry occurs when an account in the sales ledger is offset against an account of the

same business/person in the purchases ledger. This is required when a business/person is

both a credit customer and a credit supplier.

© Cambridge University Press 2018

Cambridge IGCSE and O Level Accounting

6 a

Eva

Sales ledger control account

Date Details Fo. $ Date Details Fo. $

20–5 20–5

Feb 1 Balance b/d 2 470 Feb 1 Balance b/d 110

28 Sales 3 480 28 Sales returns 118

Bank (dis. chq) 104 Bank 3 403

Balance c/d 95 Discount allowed 144

Irrecoverable debts 200

Contra entry 240

6 149 Balance c/d 1 934

6 149 6 149

20–5 20–5

Mar 1 Balance b/d 1 934 Mar 1 Balance b/d 95

b Credit sales − sales journal, dishonoured cheque − cash book, sales returns − sales returns

journal, cheques received − cash book, discount allowed − cash book, bad debts − journal,

contra entry − journal

c Two from:

• provision for doubtful debts

• cash sales

3

• discount received.

None of these would appear in the account of a credit customer so do not appear in the

sales ledger control account.

d Two from:

• an overpayment by a credit customer

• the credit customer returning goods after paying the account

• the credit customer paying in advance for the goods

• cash discount not being deducted before payment was made.

© Cambridge University Press 2018

You might also like

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- ASAL Accounting Workbook AnswersDocument201 pagesASAL Accounting Workbook Answersღ꧁Lizzy X Roxiie꧂ღNo ratings yet

- Igcse and o Level Accounting Course BookDocument31 pagesIgcse and o Level Accounting Course Bookngaa100% (2)

- Accounting Notes For IGCSE PDFDocument52 pagesAccounting Notes For IGCSE PDFAliMushtaq76% (96)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii87% (15)

- Accounting-Formats For Cambridge IGCSEDocument11 pagesAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (9)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument6 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii73% (11)

- Workbook AnswersDocument112 pagesWorkbook AnswersAbdullah Akmal100% (1)

- Coursebook Section 3 Practice Question AnswersDocument9 pagesCoursebook Section 3 Practice Question AnswersAhmed Zeeshan92% (12)

- Accounting Workbook Section 2 AnswersDocument4 pagesAccounting Workbook Section 2 AnswersAhmed Zeeshan77% (13)

- Accounting Workbook Section 1 AnswersDocument24 pagesAccounting Workbook Section 1 AnswersAhmed Zeeshan94% (34)

- Accounting Workbook Section 4 AnswersDocument49 pagesAccounting Workbook Section 4 AnswersAhmed Zeeshan100% (25)

- ASAL Accounting Workbook Starter PackDocument26 pagesASAL Accounting Workbook Starter Packcthiruvazhmarban100% (1)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii92% (13)

- Cambridge Igcse and o Level Accounting Course BookDocument8 pagesCambridge Igcse and o Level Accounting Course BookJaime0% (1)

- Ratios AS - Topical A Level Accounting Past PaperDocument27 pagesRatios AS - Topical A Level Accounting Past PaperVersha 2021100% (1)

- Chemical Energetics: Bond Energy CalculationDocument13 pagesChemical Energetics: Bond Energy CalculationAhmed Zeeshan100% (2)

- Coursebook Section 2 Practice Question AnswersDocument5 pagesCoursebook Section 2 Practice Question AnswersAhmed Zeeshan100% (9)

- Coursebook Chapter 6 AnswersDocument2 pagesCoursebook Chapter 6 AnswersAhmed Zeeshan90% (10)

- Explorent - Micro-Laryngoscopy-CatalogueDocument80 pagesExplorent - Micro-Laryngoscopy-Cataloguedrtarek255442No ratings yet

- Worksheet 1.2 Introducing Double EntryDocument3 pagesWorksheet 1.2 Introducing Double EntryKenshin HayashiNo ratings yet

- Igcse Accounting Essential 2e Answers 27 PDFDocument11 pagesIgcse Accounting Essential 2e Answers 27 PDFRitu Singla.No ratings yet

- Unemployment in IndiaDocument21 pagesUnemployment in IndiaSagar Nawale73% (37)

- Design Build and Assess Composite Hub Bar For Gyroplane Application GYRATEDocument30 pagesDesign Build and Assess Composite Hub Bar For Gyroplane Application GYRATEvictorNo ratings yet

- Supporting Community-Based Disaster ResponseDocument10 pagesSupporting Community-Based Disaster ResponseBill de BlasioNo ratings yet

- AC7108 Rev. F - Audit Criteria For Chemical ProcessingDocument74 pagesAC7108 Rev. F - Audit Criteria For Chemical ProcessingfdsbdfsbhdgndsnNo ratings yet

- Accounts Textbook AnswersDocument84 pagesAccounts Textbook AnswersVidhi Patel100% (4)

- PDF Coursebook Chapter 4 Answers - CompressDocument6 pagesPDF Coursebook Chapter 4 Answers - CompressSama ZabadyNo ratings yet

- Answers-Accounting CB 2nd Ed CambridgeDocument119 pagesAnswers-Accounting CB 2nd Ed Cambridgebk4t7j8g92No ratings yet

- Coursebook Chapter 15 AnswersDocument3 pagesCoursebook Chapter 15 AnswersAhmed Zeeshan80% (10)

- Coursebook Chapter 8 AnswersDocument4 pagesCoursebook Chapter 8 AnswersAhmed Zeeshan100% (9)

- Coursebook Chapter 20 AnswersDocument3 pagesCoursebook Chapter 20 AnswersAhmed Zeeshan100% (11)

- Coursebook Chapter 10 AnswersDocument2 pagesCoursebook Chapter 10 AnswersAhmed Zeeshan100% (4)

- Coursebook Chapter 9 AnswersDocument5 pagesCoursebook Chapter 9 AnswersAhmed Zeeshan92% (12)

- Coursebook Chapter 11 AnswersDocument4 pagesCoursebook Chapter 11 AnswersAhmed Zeeshan100% (9)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDoris Yee50% (2)

- Coursebook Chapter 5 Answers PDFDocument3 pagesCoursebook Chapter 5 Answers PDFXx Yung Wei Chin100% (1)

- Name: Grade: SubjectDocument5 pagesName: Grade: SubjectArkar.myanmar 2018100% (1)

- 02 Accounting Study NotesDocument4 pages02 Accounting Study NotesJonas Scheck100% (2)

- CH 19-Answers To Textbook Ques 1025243368Document4 pagesCH 19-Answers To Textbook Ques 1025243368ayten.ayman.eleraky100% (2)

- Cambridge IGCSE and O Level Accouting Workbook AnswersDocument107 pagesCambridge IGCSE and O Level Accouting Workbook Answersღ꧁Lizzy X Roxiie꧂ღ100% (3)

- Acc - Chapter 18 AmroDocument9 pagesAcc - Chapter 18 AmroWassim AlwanNo ratings yet

- Accounts Chapter 8Document10 pagesAccounts Chapter 8R.mNo ratings yet

- 1.2 Introducing Double Entry: Suggested ActivitiesDocument2 pages1.2 Introducing Double Entry: Suggested ActivitiesDonatien Oulaii0% (1)

- 1.4 Introducing Three Column Cash Books: Suggested ActivitiesDocument2 pages1.4 Introducing Three Column Cash Books: Suggested ActivitiesDonatien Oulaii100% (1)

- 1.3 Introducing Trial Balances: Suggested ActivitiesDocument2 pages1.3 Introducing Trial Balances: Suggested ActivitiesDonatien Oulaii100% (5)

- IGCSE & OL Accounting Worksheets AnswersDocument53 pagesIGCSE & OL Accounting Worksheets Answerssana.ibrahimNo ratings yet

- POA Exercise 28.11, 28.12A, 28.13Document6 pagesPOA Exercise 28.11, 28.12A, 28.13Ain FatihahNo ratings yet

- IGCSE & OL Accounting WorksheetsDocument73 pagesIGCSE & OL Accounting Worksheetssana.ibrahim100% (1)

- Introduction To AccountingDocument3 pagesIntroduction To AccountingDamith Piumal Perera100% (1)

- Eduseeds: IGCSE Accounting 902Document21 pagesEduseeds: IGCSE Accounting 902NandaNo ratings yet

- 1.1 Introducing Accounting: Suggested ActivitiesDocument2 pages1.1 Introducing Accounting: Suggested ActivitiesDonatien Oulaii100% (1)

- Worksheet 4.1 Introducing Bank ReconciliationDocument4 pagesWorksheet 4.1 Introducing Bank ReconciliationHan Nwe Oo100% (1)

- Cambridge International AS and A Level Accounting Coursebook AnswerDocument5 pagesCambridge International AS and A Level Accounting Coursebook AnswerMopur NELLORE0% (1)

- CHP 14 NotesDocument22 pagesCHP 14 NotesDhruvit DadNo ratings yet

- Control AccountsDocument4 pagesControl AccountsTyanna TaylorNo ratings yet

- Acc Clerk Chapter. 6-Control Accounts (Ledgers)Document28 pagesAcc Clerk Chapter. 6-Control Accounts (Ledgers)Ephraim PryceNo ratings yet

- Control Acc F5Document15 pagesControl Acc F5Tinevimbo NdlovuNo ratings yet

- O Level Accounting P1 Theory BookletDocument62 pagesO Level Accounting P1 Theory Booklettayyabkhalid010203040506No ratings yet

- Chapter 3Document27 pagesChapter 3giang1022002No ratings yet

- Auditing Theories and Problems Quiz WEEK 1Document19 pagesAuditing Theories and Problems Quiz WEEK 1Sarah GNo ratings yet

- Control Account NotesDocument2 pagesControl Account NotesNipuni PereraNo ratings yet

- Chapter 3...Document26 pagesChapter 3...giang1022002No ratings yet

- Audit of Receivables CaseDocument4 pagesAudit of Receivables CaseJohn Victor Mancilla MonzonNo ratings yet

- Lecture 3 Accounting Cycle-2Document26 pagesLecture 3 Accounting Cycle-2azizbektokhirbekovNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationAhmed ZeeshanNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationSMPM 18No ratings yet

- Cambridge IGCSE: Computer Science 0478/22Document12 pagesCambridge IGCSE: Computer Science 0478/22Miguel Oubiña SánchezNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationSarala Devi DNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationAhmed ZeeshanNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument16 pagesCambridge International General Certificate of Secondary EducationAhmed ZeeshanNo ratings yet

- 0478 w15 2 1 QPDocument12 pages0478 w15 2 1 QPBindiya RamchurnNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationAhmed ZeeshanNo ratings yet

- Cambridge IGCSE: Computer Science 0478/23Document12 pagesCambridge IGCSE: Computer Science 0478/23Ahmed ZeeshanNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationMohamed MahmoudNo ratings yet

- 0478 s16 QP 21Document12 pages0478 s16 QP 21Tejas KothariNo ratings yet

- Cambridge IGCSE: Computer Science 0478/21Document12 pagesCambridge IGCSE: Computer Science 0478/21Shop AliceNo ratings yet

- Cambridge IGCSE: Computer Science 0478/23Document12 pagesCambridge IGCSE: Computer Science 0478/23Shop AliceNo ratings yet

- Coursebook Chapter 15 AnswersDocument3 pagesCoursebook Chapter 15 AnswersAhmed Zeeshan80% (10)

- DynprogDocument18 pagesDynprogHykinel Bon GuarteNo ratings yet

- 6866587D12 - A TCR1000 Basic Service Manual - MR9.6Document78 pages6866587D12 - A TCR1000 Basic Service Manual - MR9.6rjmsantosNo ratings yet

- GeoVancouver2016 - Vazaios Vlachopoulos DiederichsDocument8 pagesGeoVancouver2016 - Vazaios Vlachopoulos DiederichsIoannis VazaiosNo ratings yet

- Z VF-S15 PIDcontrol-InstrMan Neutral e E6581879Document23 pagesZ VF-S15 PIDcontrol-InstrMan Neutral e E6581879mdtabanioNo ratings yet

- The Sherman Antitrust Act (1890) - Ley - (032860)Document2 pagesThe Sherman Antitrust Act (1890) - Ley - (032860)Luis Alberto Velasquez AgapitoNo ratings yet

- Project Management and Its Effects of Quality Control in ConstructionDocument5 pagesProject Management and Its Effects of Quality Control in Constructionbotch100% (3)

- Peer Mentoring in A University Jazz Ensemble: by Andrew GoodrichDocument27 pagesPeer Mentoring in A University Jazz Ensemble: by Andrew GoodrichMatthew BelyeuNo ratings yet

- IU Video IndexDocument24 pagesIU Video IndexRhian VelasquezNo ratings yet

- BU2103 - IBM G2 International Trade Law - S20 - Quiz #2 - TonyDocument7 pagesBU2103 - IBM G2 International Trade Law - S20 - Quiz #2 - TonyRajvi ChatwaniNo ratings yet

- Ix T7A: Installation ManualDocument28 pagesIx T7A: Installation ManualSidney Chaves de LimaNo ratings yet

- Sahulat Takaful PlanDocument7 pagesSahulat Takaful PlanMuhammad IrfanNo ratings yet

- Usupervisor Com PDFDocument92 pagesUsupervisor Com PDFVictor Hugo SantosNo ratings yet

- Activity Proposal-Stakeholders Forum 2Document6 pagesActivity Proposal-Stakeholders Forum 2Rob MachiavelliNo ratings yet

- AZ-120 Lab01a-Azure VM Linux ClusteringDocument20 pagesAZ-120 Lab01a-Azure VM Linux ClusteringErosNo ratings yet

- GC TodayDocument31 pagesGC TodayBrayan GuzmanNo ratings yet

- Week 5Document42 pagesWeek 5Nabilah Mat YasimNo ratings yet

- App Development in Creatio 7.18Document20 pagesApp Development in Creatio 7.18Imam Aditya P TNo ratings yet

- Operational and Expenditure Plan of Result Area 2 of Strive Spiu AssamDocument2 pagesOperational and Expenditure Plan of Result Area 2 of Strive Spiu AssamKaushik DasNo ratings yet

- PT-059 TG-6 Uwc 2019-05Document1 pagePT-059 TG-6 Uwc 2019-05Sylvie CatalanNo ratings yet

- Manila Prince Hotel vs. GSISDocument5 pagesManila Prince Hotel vs. GSISFenina ReyesNo ratings yet

- LTD Palabrica NotesDocument20 pagesLTD Palabrica NotesDarla Grey0% (1)

- Individual Daily Log and Accomplishment Report: Enclosure No. 3 To Deped Order No. 011, S. 2020Document2 pagesIndividual Daily Log and Accomplishment Report: Enclosure No. 3 To Deped Order No. 011, S. 2020cristina maquintoNo ratings yet

- Dangers of Social Networking 1Document4 pagesDangers of Social Networking 1Kerri McFarlaneNo ratings yet

- Systems EngineeringDocument5 pagesSystems EngineeringBidkar Harshal S100% (5)

- ATOM V-808: Cleaning InstructionsDocument10 pagesATOM V-808: Cleaning Instructionsjerson_rojas19899571No ratings yet