Professional Documents

Culture Documents

Financial Accounting - Intercorporate Investments

Financial Accounting - Intercorporate Investments

Uploaded by

Vikrant SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting - Intercorporate Investments

Financial Accounting - Intercorporate Investments

Uploaded by

Vikrant SinghCopyright:

Available Formats

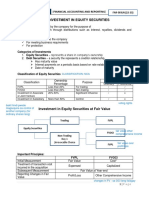

Intercorporate Investments

Passive - debt or non-voting stock or less than 20% of voting stock

Strategic

Significant - 20-50% of voting stock

Controlling - >50% of voting stock

Passive -> fair-value accounting

Significant -> equity method

Controlling -> consolidate - purchase method

Passive Investments

Fair Value Method

All passive investments are reported at fair value (recorded in BS at

fair value).

As the market value of security changes, the changes are reflected on

BS and IS.

Changes in fair value flow into the current period's net income, and

therefore, retained earnings.

Dividends and Capital Gains/Losses included in income.

What is fair value?

Level 1 -> Quoted market price, if the security is traded in active

markets

Level 2 -> Quoted market price in active markets for similar securities

and model-based valuation techniques, if all significant inputs are observable in

the market

Level 3 -> Unobservable inputs that are not supported by any market

activities.

Issue with fair value

Unrealized gains cause fluctuations in balance sheet and net income

Alternative

Instead of recording in net income, record it in a separate place AOCI

(Accumulated Other Comprehensive Income), till shares are sold

Under US GAAP - Not available for equity investments since 2019

Under IFRS/Ind AS - allowed if security is classified as FVTOCI (i.e

security was not brought for speculative purpose)

What happens to AOCI once gains are realized?

Under IFRS, amount remains in AOCI even if realized

Under Ind AS, amount can be transferred from AOCI to Retained Earnings

(Net Income)

Types of equity securities

Trading

held for a short period of time and has to be actively traded

Investment value is fair value

Recognized in net income

causes change in interest income

classified as FVTPL

Available for sale

may be sold prior to their maturity to meet liquidity needs

Investment value is fair value

Recognized in AOCI component of equity

In IndAS, causes change in interest income

classified as FVTOCI (held for collection and selling)

Held to Maturity

intent and ability to hold their maturity

Investment value is amortized cost

Not recognized

causes change in interest income

Significant Investments

use equity method

fluctuations in stock prices are not affected in IS and BS

investee's dividend payments are not recognized as income in IS or BS

investee's share of net income increases our assets

Look at Operating Performance of company and increase your investment

by (Net Income - Dividends paid out, if any)

Controlling Investments

Use consolidation method

Patents and Brand Name can be added to parent company's BS when consolidating

goodwill - represents that assets together could be valued more than the sum

of their parts

If it is not a 100% acquisition

Split net income into two parts

Share of net income attributable to controlling interest (i.e.

you) -> CI

Share of net income attributable to non-controlling interest (i.e

not you) -> NCI

You might also like

- FARAP 4406A Investment in Equity SecuritiesDocument8 pagesFARAP 4406A Investment in Equity SecuritiesLei PangilinanNo ratings yet

- Understanding Mutual Fund AccountingDocument6 pagesUnderstanding Mutual Fund AccountingSwati MishraNo ratings yet

- Affidavit of Revocation of Signature For Good Cause Introductory CertificationDocument2 pagesAffidavit of Revocation of Signature For Good Cause Introductory CertificationjoeNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Hermet E'zine - Issue No1Document39 pagesHermet E'zine - Issue No1Rubaphilos Salfluere100% (3)

- FAR 4307 Investment in Equity SecuritiesDocument3 pagesFAR 4307 Investment in Equity SecuritiesATHALIAH LUNA MERCADEJASNo ratings yet

- Investment in Securities (Notes)Document5 pagesInvestment in Securities (Notes)Karla BordonesNo ratings yet

- 06A Investment in Equity Securities (Financial Assets at FMV, Investment in Associates)Document6 pages06A Investment in Equity Securities (Financial Assets at FMV, Investment in Associates)randomlungs121223No ratings yet

- FAR-Lecture 3Document9 pagesFAR-Lecture 3wingsenigma 00No ratings yet

- FAR-4207 (Investment in Equity Securities)Document3 pagesFAR-4207 (Investment in Equity Securities)Jhonmel Christian AmoNo ratings yet

- Investment NotesDocument12 pagesInvestment NotesLenrey CobachaNo ratings yet

- Audit of Investment-LectureDocument15 pagesAudit of Investment-LecturemoNo ratings yet

- CHAPTER 15 Financial Asset at Fair ValueDocument23 pagesCHAPTER 15 Financial Asset at Fair ValueJohn CentinoNo ratings yet

- Earning Bjectives: Investments, The Investor Intends To Establish or Maintain A Long-Term Operating Relationship WithDocument3 pagesEarning Bjectives: Investments, The Investor Intends To Establish or Maintain A Long-Term Operating Relationship WithjakeNo ratings yet

- Chapter 2 Study Notes Revised For FinalDocument1 pageChapter 2 Study Notes Revised For FinalAlyssaNo ratings yet

- H.09 Accounting For InvestmentsDocument14 pagesH.09 Accounting For Investmentschen.abellar.swuNo ratings yet

- AP 200 6 Audit of InvestmentDocument5 pagesAP 200 6 Audit of Investmentshai santiagoNo ratings yet

- 01 Course Notes On InvestmentsDocument6 pages01 Course Notes On InvestmentsMaxin TanNo ratings yet

- Ifrs 9Document2 pagesIfrs 9MuhammadNo ratings yet

- Intacc 1 Notes - Financial Assets StartDocument8 pagesIntacc 1 Notes - Financial Assets StartKing BelicarioNo ratings yet

- Invst Reviewer Ver1Document3 pagesInvst Reviewer Ver1evenslzrNo ratings yet

- IAS 28 - IFRS 9 (Accounting For Associates and Financial Instruments)Document29 pagesIAS 28 - IFRS 9 (Accounting For Associates and Financial Instruments)Hiền MỹNo ratings yet

- CH1 AkombisDocument17 pagesCH1 AkombisRisky SimaremareNo ratings yet

- Reviewer in Intermediate Accounting (Midterm)Document9 pagesReviewer in Intermediate Accounting (Midterm)Czarhiena SantiagoNo ratings yet

- Acquisition of Subsidiaries: Relevant Guidance Acquisition MethodDocument18 pagesAcquisition of Subsidiaries: Relevant Guidance Acquisition MethodKyle MariéNo ratings yet

- Chapter 12 - 220426 - 162131Document47 pagesChapter 12 - 220426 - 162131CY YangNo ratings yet

- 19 - Us Gaap Vs Indian GaapDocument5 pages19 - Us Gaap Vs Indian GaapDeepti SinghNo ratings yet

- True or FalseDocument1 pageTrue or Falseprins kyla SaboyNo ratings yet

- Horngren Ima15 Im 17Document19 pagesHorngren Ima15 Im 17Ahmed AlhawyNo ratings yet

- Investment and International OperationsDocument53 pagesInvestment and International Operationsmukul3087_305865623No ratings yet

- Ap106 Investments Lecture NotesDocument6 pagesAp106 Investments Lecture NotesheyriccaNo ratings yet

- 9 - Separate Financial Statements PDFDocument6 pages9 - Separate Financial Statements PDFDarlene Faye Cabral RosalesNo ratings yet

- Accounting For InvestmentsDocument17 pagesAccounting For InvestmentsPradeep Gupta100% (1)

- Unit IV InvestmentsDocument16 pagesUnit IV InvestmentsJonnacel TañadaNo ratings yet

- UBL Annual Report 2018-177Document1 pageUBL Annual Report 2018-177IFRS LabNo ratings yet

- Accounting Policies ModelDocument7 pagesAccounting Policies ModelShalini GuptaNo ratings yet

- Financial Asset at Fair Value: Intermediate Accounting 1 Ray Patrick S. Guangco, CPADocument17 pagesFinancial Asset at Fair Value: Intermediate Accounting 1 Ray Patrick S. Guangco, CPAClaire Magbunag AntidoNo ratings yet

- Investments DiscussionDocument5 pagesInvestments DiscussionKathrine CruzNo ratings yet

- Notes Chapter 3 FARDocument4 pagesNotes Chapter 3 FARcpacfa100% (7)

- Ifrs VS Us GaapDocument118 pagesIfrs VS Us GaapAhmed SabirNo ratings yet

- MCOM Sem 1 FA Project On Consolidated Financial StatementDocument27 pagesMCOM Sem 1 FA Project On Consolidated Financial StatementAnand Singh100% (5)

- Financial Instruments (PFRS 9)Document14 pagesFinancial Instruments (PFRS 9)HeheheNo ratings yet

- Chap 005Document41 pagesChap 005Loser Neet100% (1)

- InvestmentsDocument4 pagesInvestmentsAguilan, Alondra JaneNo ratings yet

- PPT-7 (Intercorporate Investments)Document61 pagesPPT-7 (Intercorporate Investments)Taniya GuptaNo ratings yet

- Financial Fundamental AnalysisDocument4 pagesFinancial Fundamental AnalysisRahul Rajesh GovalkarNo ratings yet

- Lecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 1130794Document18 pagesLecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 1130794Đức DramaNo ratings yet

- Investment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Document11 pagesInvestment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Richie BoomaNo ratings yet

- Accounting Policies BataDocument5 pagesAccounting Policies BataHarini SundarNo ratings yet

- ACC 1100 Chapter 12Document42 pagesACC 1100 Chapter 12harishNo ratings yet

- FAR Equity Securities 1Document7 pagesFAR Equity Securities 1ueeueieeNo ratings yet

- Financial Statement Analysis: K.R. SubramanyamDocument42 pagesFinancial Statement Analysis: K.R. Subramanyamhasan jabrNo ratings yet

- Aik CH 5Document10 pagesAik CH 5rizky unsNo ratings yet

- Analyzing Investing Activities Chapter 5Document29 pagesAnalyzing Investing Activities Chapter 5Agathos Kurapaq0% (1)

- Chapter 5 Investments in Equity SecuritiesDocument13 pagesChapter 5 Investments in Equity SecuritiesKrissa Mae Longos100% (2)

- Chapter 08Document32 pagesChapter 08nadeemNo ratings yet

- Chapter 9Document18 pagesChapter 9Rubén ZúñigaNo ratings yet

- Annual Report Acer GroupDocument6 pagesAnnual Report Acer GroupfirmansyahNo ratings yet

- Chapter 7 InvestmentsDocument11 pagesChapter 7 InvestmentsRizia Feh EustaquioNo ratings yet

- IndexDocument27 pagesIndexjhak3426No ratings yet

- Dividend Investing: Passive Income and Growth Investing for BeginnersFrom EverandDividend Investing: Passive Income and Growth Investing for BeginnersNo ratings yet

- Grade 9: Research Quiz: Citation FormatsDocument20 pagesGrade 9: Research Quiz: Citation Formatsvia macario100% (1)

- Essay: OthelloDocument22 pagesEssay: OthelloAlessia OrlandoNo ratings yet

- G.R. No. 138774 March 8, 2001 Regina Francisco and Zenaida PASCUAL, Petitioners, Aida Francisco-ALFONSO, Respondent. Pardo, J.Document12 pagesG.R. No. 138774 March 8, 2001 Regina Francisco and Zenaida PASCUAL, Petitioners, Aida Francisco-ALFONSO, Respondent. Pardo, J.JuralexNo ratings yet

- Standard Occupancy Agreement: Furnished (If Furnished, An Inventory Can Be Attached)Document6 pagesStandard Occupancy Agreement: Furnished (If Furnished, An Inventory Can Be Attached)Jizza DegorioNo ratings yet

- Ram Rattan V State of UPDocument8 pagesRam Rattan V State of UPNiveditha Ramakrishnan ThantlaNo ratings yet

- Process Control, Network Systems, and SCADADocument13 pagesProcess Control, Network Systems, and SCADASTNo ratings yet

- LPAC and ARD CommitteeDocument3 pagesLPAC and ARD CommitteenewgenoogenNo ratings yet

- Secrets. - in Addition To The Proper Administrative Action, TheDocument10 pagesSecrets. - in Addition To The Proper Administrative Action, TheDino AbieraNo ratings yet

- Foucault, Michel - What Is EnlightenmentDocument15 pagesFoucault, Michel - What Is EnlightenmentDhiraj Menon100% (1)

- UNIT 1 Eng FORM 5Document4 pagesUNIT 1 Eng FORM 5leonal neevedthanNo ratings yet

- 1992 - Purpose - of - Signs - and - Wonders DACARSON PDFDocument16 pages1992 - Purpose - of - Signs - and - Wonders DACARSON PDFDavid CameiraNo ratings yet

- FFT Tutorial: 1 Getting To Know The FFTDocument6 pagesFFT Tutorial: 1 Getting To Know The FFTDavid NasaelNo ratings yet

- Karachi Public School Cambridge Section Class: IX English Language Midyear Syllabus Session: 2021 - 22Document2 pagesKarachi Public School Cambridge Section Class: IX English Language Midyear Syllabus Session: 2021 - 22Ameer hamzaNo ratings yet

- 10 Partial Di Erential Equations and Fourier MethodsDocument11 pages10 Partial Di Erential Equations and Fourier MethodsNico PriestNo ratings yet

- GRE Physics Test: Practice BookDocument91 pagesGRE Physics Test: Practice BookGalo CandelaNo ratings yet

- Paper Saturation Height MethodsDocument12 pagesPaper Saturation Height Methodsscribdhuli100% (1)

- Iot Standardisation: Challenges, Perspectives and Solution: June 2018Document10 pagesIot Standardisation: Challenges, Perspectives and Solution: June 2018Iman MagzoubNo ratings yet

- Animal Senses: Brew Potion Arms and Equipment GuideDocument6 pagesAnimal Senses: Brew Potion Arms and Equipment GuideAlkarsilverbladeNo ratings yet

- Effect of Atmospheric Parameters On The Silicon Solar Cells PerformanceDocument4 pagesEffect of Atmospheric Parameters On The Silicon Solar Cells PerformanceSašaSnješka GojkovicNo ratings yet

- Narrative Text ExerciseDocument2 pagesNarrative Text ExerciseaditantrapNo ratings yet

- Smith International Inc v. Halliburton Energy Services Inc - Document No. 20Document3 pagesSmith International Inc v. Halliburton Energy Services Inc - Document No. 20Justia.comNo ratings yet

- XIIBSTCh6S17082023014050 0Document13 pagesXIIBSTCh6S17082023014050 0Abdullah KhanNo ratings yet

- ServitisationDocument32 pagesServitisation256850100% (1)

- 60617-12 1999Document214 pages60617-12 1999Ezrizal YusufNo ratings yet

- Heart Copy of Demonstration-Teaching-Rating-Sheet-ICTDocument3 pagesHeart Copy of Demonstration-Teaching-Rating-Sheet-ICTLouann Heart Lupo100% (1)

- Aqa A Level Pe Coursework Mark SchemeDocument4 pagesAqa A Level Pe Coursework Mark Schemebdg9hkj6100% (2)

- Irregular VerbsDocument1 pageIrregular Verbsdima telesovNo ratings yet

- (Q2) - Improving The Experience For Software-Measurement System End-UsersDocument25 pages(Q2) - Improving The Experience For Software-Measurement System End-UserscheikhNo ratings yet