Professional Documents

Culture Documents

Banking Companies: © The Institute of Chartered Accountants of India

Banking Companies: © The Institute of Chartered Accountants of India

Uploaded by

shajiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Companies: © The Institute of Chartered Accountants of India

Banking Companies: © The Institute of Chartered Accountants of India

Uploaded by

shajiCopyright:

Available Formats

CHAPTER 8

BANKING

COMPANIES

Banks are vital to the prosperity and well-being of any society or country. Banks

enable a society to create the platform for the satisfaction of wants of its people

by managing and maintaining the flow of money to carry out transactions.

For smoothly meeting cash payment requirement, banks have to maintain Cash

Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

The capital adequacy norms given in this unit are as per existing Basel II norms. The

RBI requires Banks to maintain minimum capital risk adequacy ratio at prescribed

rate on an ongoing basis.

Capital is divided into two tiers according to the characteristics/qualities of each

qualifying instrument. Tier I capital consists mainly of share capital and disclosed

reserves and it is a bank’s highest quality capital because it is fully available to cover

losses. Tier II capital on the other hand consists of certain reserves and certain types

of subordinated debt.

The Banks have to classify their advances into two broad groups: 1. Performing

Assets; 2. Non-Performing Assets. These classification is done based on the

principle laid down by the RBI in Income Recognition and Asset Classification (IRAC)

norms.

© The Institute of Chartered Accountants of India

8.2 ADVANCED ACCOUNTING

Performing assets are also called as Standard Assets. The Non-Performing Assets

is again classified into three groups and they are (i) sub-standard Assets (ii)

doubtful assets & (iii) Loss Assets.

The banks have to maintain provisioning for Non-Performing Assets at the

prescribed rates. A banking company also performs Discounting of bills; Collection

of bills and Acceptances on behalf of customers

While preparing financial statements, banks have to follow various guidelines /

directions given by RBI/Government of India governing the Financial Statements.

The chapter has been divided into 6 units for the purpose of convenience in

understanding of the topic.

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.3

UNIT 1: SOME RELEVANT PROVISIONS OF THE

BANKING REGULATIONS ACT, 1949

LEARNING OUTCOMES

After studying this unit, you will be able to:

❑ Understand the legal definition of banking, the composition of

management team of a bank and types of banks operating in

India.

❑ Learn the conditions to be fulfilled for obtaining a license for

banking activities in India.

❑ Learn the provisions relating to capital, reserve, liquidity norm

(Capital Reserve Ratio & Statutory Liquidity Ratio), reserve fund

and dividend payment.

❑ Try to relate such provisions with the financial information

obtained from any banking companies.

© The Institute of Chartered Accountants of India

8.4 ADVANCED ACCOUNTING

1.1 MEANING OF BANKING

Banks are vital to the prosperity and well-being of any society or country. Banks

enable a society to create the platform for the satisfaction of wants of its people

by managing and maintaining the flow of money to carry out transactions. The role

of banks may be likened to the heart in a human being, circulating and managing

money through the economy, thereby playing a crucial role for its good health.

Banks in India and their activities are regulated by the Banking Regulation Act,

1949.

Banking: Under Section 5(b) of the said Act “Banking” means,

➢ Accepting deposits of money from public for the purpose of lending or

investing

➢ These deposits are repayable on demand or otherwise, and can be withdrawn

by cheque, draft or otherwise.

Banking Company: Any bank which transacts this business as stated in section 5

(b) of the act in India is called a banking company. However merely accepting public

deposits by a company for financing its own business shall not make it a bank.It

may be mentioned that the Banking Regulation Act, 1949 is not applicable to a

primary agricultural society, a co-operative land mortgage bank and any other co-

operative society.

1.1.1 Types of banks

There are two main categories of Commercial Bank in India namely:-

1. Scheduled Commercial Bank

2. Scheduled Co-operative Bank

Scheduled Commercial Banks are again divided into five types and the Scheduled

Co-operative Banks into two as given in the following chart.

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.5

Types of Bank

Scheduled Commercial Banks Scheduled Co-operative Bank

Nationalised Bank eg. BOB,

SBI* Scheduled State Co-

operative Bank

Development Bank eg.

NABARD, EXIM

Scheduled Urban Co-

operative Bank

Regional Rural Bank

(Gramin Bank)**

Foreign Banks e.g. CITI

Bank, BNP Paribas

Private Sector Bank e.g.

ICICI, Axis

Scheduled Banks in India constitute those banks which have been included in the

Second Schedule of Reserve Bank of India(RBI) Act, 1934. After May 1997 there are

no non-scheduled commercial banks existing in India. However, there are small to

tiny non-scheduled Urban Co-operative Banks also known as Nidhi ond Schedule

ots of the country.

The banks included in this schedule list should fulfil following two conditions:

1. The paid up capital and reserves in aggregate should not be less than ` 5

lakhs.

2. Any activity of the bank will not adversely affect the interests of depositors.

The Reserve Bank includes a bank in this schedule if it fulfils certain other conditions

too.

© The Institute of Chartered Accountants of India

8.6 ADVANCED ACCOUNTING

The RBI as the Central Bank is the ‘Bank of Last Resort’ i.e. when other commercial

banks are in trouble RBI helps them out. The services provided by RBI to scheduled

commercial banks include the following:

(a) The purchase, sale, and re-discounting of certain bills of exchange, or

promissory notes.

(b) Purchase and sale of foreign exchange.

(c) Purchase, sale and re-discounting of foreign bills of exchange.

(d) Making of loans and advances to scheduled banks.

(e) Maintenance of accounts of the scheduled bank in its banking department

and issue department.

(f) Remittance of money between different branches of scheduled banks

through the offices, branches or agencies of Reserve Bank free of cost or at

nominal rates.

1.2 RESERVE FUNDS (SECTION 17)

Every banking company incorporated in India is required to create a Reserve Fund

and to transfer at least 20% of its profit to the reserve fund. The profit of the

year as per the profit and loss account prepared under Section 29 is to be taken as

base for the purpose of such transfer and transfer to reserve fund should be made

before declaration of any dividend.

If any banking company makes any appropriation from the reserve fund or share

premium account, it has to report to the Reserve Bank of India the reasons for such

appropriation within 21 days.

1.3 RESTRICTION AS TO PAYMENT OF DIVIDEND

(SECTION 15)

Before paying any dividend, a banking company has to write off completely all its

capitalised expenses including preliminary expenses, organisation expenses, share-

selling commission, brokerage, and amounts of losses incurred by tangible assets.

However, a banking company may pay dividend on its shares without writing off -

1. the depreciation in the value of its investment in approved securities in any

case where such depreciation has not actually been capitalised or accounted

for as a loss.

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.7

2. the depreciation in the value of its investment in shares, debentures or bonds

(other than approved securities) in any case where adequate provision for

such depreciation has been made to the satisfaction of the auditor of the

banking company.

3. the bad debts in any case where adequate provision for such debts had been

made to the satisfaction of the auditor of the banking company.

1.4 CASH RESERVE

For smoothly meeting cash payment requirement, banks have to maintain certain

minimum ready cash balances at all times. This is called as Cash Reserve Ratio(CRR)

Cash reserve can be maintained by way of either a cash reserve with itself or as

balance in a current account with the Reserve Bank of India or by way of net balance

in current accounts or in one or more of the aforesaid ways.

Every Scheduled Commercial Bank has to maintain cash reserve ratio (i.e. CRR) as

per direction of the RBI issued under Section 42(IA) of the Reserve Bank of India

Act, 1934.

1.5 LIQUIDITY NORMS

Banking companies have to maintain sufficient liquid assets in the normal course

of business called as Statutory Liquidity Ratio (SLR). This safeguards the interest of

depositors and prevents banks from over-extending their resources, liquidity norms

have been settled and given statutory recognition. Every banking company has to

maintain the SLR in the form of: cash, gold and unencumbered approved securities.

The above assets have to be held at the close of business on any day and shall be

valued at a price not exceeding the current market price of the above assets.

The percentage of SLR is changed by the Reserve Bank of India from time to time

considering the general economic conditions. This is in addition to the Cash

Reserve Ratio balance which a scheduled bank is required to maintain under

Section 42 of the Reserve Bank of India Act.

1.6 RESTRICTION ON ACQUISITION OF SHARES

IN OTHER COMPANY

A banking company cannot form any subsidiary except for one or more of the

following purposes:

© The Institute of Chartered Accountants of India

8.8 ADVANCED ACCOUNTING

1. The undertaking of any business permissible for banking company to

undertake.

2. Carrying on business of banking, exclusively outside India with previous

permission in writing, of the Reserve Bank.

3. The undertaking of such other business consider to be conducive to the

spread of banking in India or to be otherwise useful or necessary in the public

interest, which the Reserve Bank of India may permit with prior approval of

the Central Government.

Other than formation of such subsidiary companies as mentioned above, a banking

company cannot hold shares in any company either as pledge, mortgage, or absolute

owner of an amount not exceeding 30% of the paid-up share capital of that company

or 30% of its own paid-up share capital and reserves, whichever is less.

1.7 RESTRICTION ON LOANS AND ADVANCES

Under Section 20 of the Banking Regulations Act, a banking company shall not

grant any loans or advances on the security of its own shares. Further, it cannot

enter into any commitment for granting any loan or advance to or on behalf of -

(i) any of its directors.

(ii) any firm in which any of its directors is interested as partner, manager,

employee or guarantor.

(iii) any company other than the subsidiary of the banking company, or a

company which is entitled to dispense with the use of the word Ltd in its

name under the Companies Act, or a Government company of which any of

the directors of the banking company is a director, manager, employee or

guarantor or in which he holds substantial interest.

(iv) any individual in respect of whom any of its directors is a partner or a

guarantor.

1.8 PROHIBITION OF CHARGE ON UNPAID

CAPITAL AND FLOATING CHARGE ON

ASSETS

Under Section 14 of the Banking Regulation Act, no banking company shall create

any charge upon any unpaid capital of the company, and any charge if created shall

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.9

be invalid. A banking company also cannot create a floating charge on the

undertaking or any property of the company or any part thereof unless the creation

of such floating charge is certified in writing by the Reserve Bank as not being

detrimental to the interest of the depositors of such company. Any charge created

without obtaining the certificate from the RBI as above shall be invalid.

1.9 ACCOUNTS

At the end of each calendar year or at the expiration of twelve months ending on such

date as the Central Government may specify in this regard, every banking company

incorporated in India, in respect of business transacted by it, and every banking

company incorporated outside India, in respect of business transacted by its branches

in India, shall prepare with reference to that year or period, a Balance Sheet (Form A)

and Profit and Loss Account (Form B) as on the last working day of that year or the

period in the forms set out in the Third Schedule of Banking Regulation Act.

The Balance Sheet and the Profit and Loss Account must be signed by the manager

or principal officer and by at least three directors or all directors if there are not

more than three directors in case of a banking company incorporated in India. In

case of a banking company incorporated outside India, the statement of accounts

must be signed by the manager or agent of the principal office of the company in

India. In addition to the above, the Reserve Bank of India has also issued Master

Circular on Disclosures to be made in the Financial Statement of these Companies.

© The Institute of Chartered Accountants of India

You might also like

- RN - 2103213618 - 1 - MT - 697758 638063847099525545 Ist 618 Final Exam 22Document5 pagesRN - 2103213618 - 1 - MT - 697758 638063847099525545 Ist 618 Final Exam 22shajiNo ratings yet

- Module 1 (Database Management in Construction)Document42 pagesModule 1 (Database Management in Construction)MARTHIE JASELLYN LOPENANo ratings yet

- Furnace PDFDocument9 pagesFurnace PDFBilalNo ratings yet

- Pub CopDocument13 pagesPub CopcheeNo ratings yet

- Banking Law and Practice Units-2Document52 pagesBanking Law and Practice Units-2പേരില്ലോക്കെ എന്തിരിക്കുന്നുNo ratings yet

- GK Power Capsule For SBI Associate Assistant 2015Document56 pagesGK Power Capsule For SBI Associate Assistant 2015Nilay VatsNo ratings yet

- Women Entrepreneurs in Smes Bangladesh PerspectiveDocument332 pagesWomen Entrepreneurs in Smes Bangladesh PerspectiveUsa 2021No ratings yet

- EBL Annual Report 2018Document308 pagesEBL Annual Report 2018TasnimulNo ratings yet

- B2B L - CDocument25 pagesB2B L - C12-057 MOHAMMAD MUSHFIQUR RAHMANNo ratings yet

- Banking Notes Functions of BanksDocument17 pagesBanking Notes Functions of Banksbestread67No ratings yet

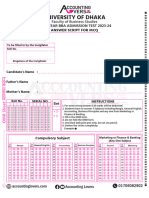

- Du OMR Sheet PDFDocument2 pagesDu OMR Sheet PDFfarhanmajumder420No ratings yet

- All MCQDocument6 pagesAll MCQChabala LwandoNo ratings yet

- MCQ of Banking CompanyDocument2 pagesMCQ of Banking Companydr SanjayNo ratings yet

- Governance in Financial Institutions (GFI) - Question SolutionDocument11 pagesGovernance in Financial Institutions (GFI) - Question Solutionnajneen khatunNo ratings yet

- Banking Reforms - 1991Document9 pagesBanking Reforms - 1991Ashley MathewNo ratings yet

- Rural Development Scheme of Islami Bank BangladeshDocument66 pagesRural Development Scheme of Islami Bank Bangladeshyeasmin mituNo ratings yet

- CBM Question BankDocument34 pagesCBM Question BankHimanshu AroraNo ratings yet

- Final Digital Banking of Services The City Bank Limited-Mahfuz RahmanDocument48 pagesFinal Digital Banking of Services The City Bank Limited-Mahfuz Rahmanhitech.mahfuzNo ratings yet

- 1673157644sample Business Letters Promo FormatDocument5 pages1673157644sample Business Letters Promo FormatIshan PalNo ratings yet

- Financial DerivativesDocument9 pagesFinancial DerivativesaliNo ratings yet

- RATIO ANALYSIS MCQsDocument9 pagesRATIO ANALYSIS MCQsAS GamingNo ratings yet

- Credit Questions Summarized (Final Dose)Document40 pagesCredit Questions Summarized (Final Dose)uttamdas79No ratings yet

- Branch Banking PDFDocument4 pagesBranch Banking PDFAbdul BasitNo ratings yet

- Role of Financial Intelligence in Resolving CrimeDocument4 pagesRole of Financial Intelligence in Resolving CrimeChawandanNo ratings yet

- Asset Liability Management in BanksDocument8 pagesAsset Liability Management in Bankskpved92No ratings yet

- Financial Management MCQ On Sources of FinancingDocument7 pagesFinancial Management MCQ On Sources of FinancinghtethtethlaingNo ratings yet

- Financial Institution & Markets - Short NotesDocument41 pagesFinancial Institution & Markets - Short NotesGovind RathiNo ratings yet

- Growth of Private Commercial Banks in BangladeshDocument15 pagesGrowth of Private Commercial Banks in Bangladeshantara nodiNo ratings yet

- JIIB Test PpersDocument51 pagesJIIB Test PpersPriyanka LincolnNo ratings yet

- Mcqs Based On Bank'S Circulars During July, 2021Document8 pagesMcqs Based On Bank'S Circulars During July, 2021Shilpa JhaNo ratings yet

- Bank ManagementDocument36 pagesBank ManagementMohammed ShaffanNo ratings yet

- HDFC Bank: Housing FinanceDocument16 pagesHDFC Bank: Housing FinanceSatish VermaNo ratings yet

- General Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshDocument47 pagesGeneral Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshMoyan HossainNo ratings yet

- Finger Tips 2022 - Part - 1Document333 pagesFinger Tips 2022 - Part - 1aksjsimrNo ratings yet

- Ga MCQ-NSRDocument15 pagesGa MCQ-NSRCREDIT BHARATPURNo ratings yet

- Ladder For Leaders 24 2433Document654 pagesLadder For Leaders 24 2433JosephNo ratings yet

- Bangla To English Machine TranslationDocument112 pagesBangla To English Machine TranslationSagor Sarkar GoutomNo ratings yet

- Central Bank RegulationDocument2 pagesCentral Bank RegulationGwenn PosoNo ratings yet

- CV - JOYNUL ABEDIN New PDFDocument4 pagesCV - JOYNUL ABEDIN New PDFJoynul Abedin0% (1)

- Banking Diploma Bangladesh Law Short NotesDocument19 pagesBanking Diploma Bangladesh Law Short NotesNiladri HasanNo ratings yet

- Question Bank On Customer Service: Prepared by SBILD AurangabadDocument22 pagesQuestion Bank On Customer Service: Prepared by SBILD AurangabadsayanNo ratings yet

- Credit Appraisal IBDocument48 pagesCredit Appraisal IBHenok mekuriaNo ratings yet

- Delivery Channels in Retail BankingDocument5 pagesDelivery Channels in Retail BankingSahibaNo ratings yet

- Material 2008 BDocument227 pagesMaterial 2008 BshikumamaNo ratings yet

- Partnership Related DocumentsDocument1 pagePartnership Related DocumentsSonalNo ratings yet

- Thesis On IFIC BANK BangladeshDocument94 pagesThesis On IFIC BANK BangladeshjilanistuNo ratings yet

- Banking 150 MCQ QuestionsDocument22 pagesBanking 150 MCQ QuestionsYogesh MassNo ratings yet

- CRM in Banking IndustryDocument16 pagesCRM in Banking IndustrypriteshhegdeNo ratings yet

- Day 1 1.1 Session-1 1.2 Banking System in India: AnswersDocument51 pagesDay 1 1.1 Session-1 1.2 Banking System in India: AnswersAkella LokeshNo ratings yet

- Mandatory e Lessosn Answer KeyDocument95 pagesMandatory e Lessosn Answer KeyMIRZA MEHMOOD ALIBAIG MIRZA MEHMOOD ALIBAIGNo ratings yet

- Economy of BangladeshDocument15 pagesEconomy of BangladeshMohaiminul Islam TalhaNo ratings yet

- Zero Coupon BondsDocument8 pagesZero Coupon BondsNaveen KumarNo ratings yet

- Vidya Deepam Circ Gist Mar20 - Mar21Document105 pagesVidya Deepam Circ Gist Mar20 - Mar21pradeep kumar0% (1)

- DAY - NULM (DAY - National Urban Livelihoods Mission) 'राष्ट्रीय शहरी आजीविका मिशन'Document9 pagesDAY - NULM (DAY - National Urban Livelihoods Mission) 'राष्ट्रीय शहरी आजीविका मिशन'Abinash MandilwarNo ratings yet

- Black BookDocument41 pagesBlack BookMoazza QureshiNo ratings yet

- Final MCS Book 10 01 2019Document420 pagesFinal MCS Book 10 01 2019Sahilkhan Pathan Advocate100% (1)

- Principles and Practices of BankingDocument57 pagesPrinciples and Practices of BankingYogesh Devmore100% (1)

- MCLR Lending Rate (Finalised)Document2 pagesMCLR Lending Rate (Finalised)Raktim MukherjeeNo ratings yet

- A Short Report On UCB of HRMDocument23 pagesA Short Report On UCB of HRMPeterson0% (1)

- Promotion Exams Study Material - Vol I-General BankingDocument165 pagesPromotion Exams Study Material - Vol I-General Bankingdilip rajNo ratings yet

- Internship-Report UcbDocument35 pagesInternship-Report UcbAhnaf AliNo ratings yet

- Banking CompaniesDocument18 pagesBanking CompaniesSunanda SharmaNo ratings yet

- 20004ipcc Paper5 Cp6.CrackedDocument122 pages20004ipcc Paper5 Cp6.CrackedNitteshdas ChatergiNo ratings yet

- Accounting of Banking CompaniesDocument118 pagesAccounting of Banking CompaniesRohit ShawNo ratings yet

- 1 TM TM MF BondseriesDocument1 page1 TM TM MF BondseriesshajiNo ratings yet

- GovernmentalDocument25 pagesGovernmentalshajiNo ratings yet

- 1 TM TM MF OklandDocument2 pages1 TM TM MF OklandshajiNo ratings yet

- 1 Discussion-PostDocument1 page1 Discussion-PostshajiNo ratings yet

- Spilker TIBE 10e Ch09 SMDocument55 pagesSpilker TIBE 10e Ch09 SMshajiNo ratings yet

- EquityDocument3 pagesEquityshajiNo ratings yet

- Ab'saberDocument1 pageAb'sabershajiNo ratings yet

- Rare Material in Academic Libraries: Collection Building October 2010Document19 pagesRare Material in Academic Libraries: Collection Building October 2010shajiNo ratings yet

- 1 MarketreportDocument2 pages1 MarketreportshajiNo ratings yet

- 1 TM C StockvalueDocument1 page1 TM C StockvalueshajiNo ratings yet

- EquityDocument3 pagesEquityshajiNo ratings yet

- EyecareDocument6 pagesEyecareshajiNo ratings yet

- 05 IMY WoM enDocument6 pages05 IMY WoM enshajiNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- Economic ArticleDocument1 pageEconomic ArticleshajiNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- BakeryDocument9 pagesBakeryshajiNo ratings yet

- Jayawant Institute of Management StudiesDocument22 pagesJayawant Institute of Management StudiesshajiNo ratings yet

- PFC 5 Cs of CreditDocument1 pagePFC 5 Cs of CreditshajiNo ratings yet

- Relevance of Corporate GovernanceDocument3 pagesRelevance of Corporate GovernanceshajiNo ratings yet

- FDIC Center For Financial Research Working Paper No. 2006-01Document48 pagesFDIC Center For Financial Research Working Paper No. 2006-01shajiNo ratings yet

- Symmetry: EEG Frontal Asymmetry in Dysthymia, Major Depressive Disorder and Euthymic Bipolar DisorderDocument13 pagesSymmetry: EEG Frontal Asymmetry in Dysthymia, Major Depressive Disorder and Euthymic Bipolar DisordershajiNo ratings yet

- Pub CH Rating Credit RiskDocument69 pagesPub CH Rating Credit RiskshajiNo ratings yet

- Persistent Depressive Disorder or Dysthymia: An Overview of Assessment and Treatment ApproachesDocument13 pagesPersistent Depressive Disorder or Dysthymia: An Overview of Assessment and Treatment ApproachesshajiNo ratings yet

- Federal Grants To State and Local Governments: A Historical Perspective On Contemporary IssuesDocument43 pagesFederal Grants To State and Local Governments: A Historical Perspective On Contemporary IssuesshajiNo ratings yet

- Market Share Based Credit AnalysisDocument12 pagesMarket Share Based Credit AnalysisshajiNo ratings yet

- Financial Stateemnt of BanksDocument42 pagesFinancial Stateemnt of BanksshajiNo ratings yet

- Banking Books AccountsDocument18 pagesBanking Books Accountsshaji100% (1)

- Liquidation of CompaniesDocument53 pagesLiquidation of CompaniesshajiNo ratings yet

- Moore and Wright Mwex2016-17 - Complete - CatalogueDocument92 pagesMoore and Wright Mwex2016-17 - Complete - CatalogueVallik TadNo ratings yet

- Masterseal B1 Foam: Fire Retardant, Expanding Foam and Gap FillerDocument2 pagesMasterseal B1 Foam: Fire Retardant, Expanding Foam and Gap FillerAbidNo ratings yet

- Arc Welding System (TPS Fronius Generator) : Comau Robotics Instruction HandbookDocument48 pagesArc Welding System (TPS Fronius Generator) : Comau Robotics Instruction HandbookvulduovlakNo ratings yet

- Filtration Systems With Pile Cloth Filter MediaDocument8 pagesFiltration Systems With Pile Cloth Filter MediaSagnik DasNo ratings yet

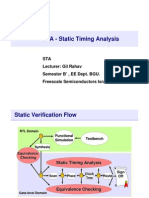

- Sta 9 1Document125 pagesSta 9 1Jayaprakash Polimetla100% (1)

- Punong Barangay Over The Barangay Secretary and Barangay Treasurer and TheDocument2 pagesPunong Barangay Over The Barangay Secretary and Barangay Treasurer and TheJessie Montealto100% (1)

- PMC Composites:,, Are Generally SmallDocument13 pagesPMC Composites:,, Are Generally SmallharnoorNo ratings yet

- Ethics in Engineering Profession - IES General StudiesDocument16 pagesEthics in Engineering Profession - IES General StudiesSandeep PrajapatiNo ratings yet

- Acti iID RCCB - A9R12463Document2 pagesActi iID RCCB - A9R12463Trong Hung NguyenNo ratings yet

- Topic F BenlacDocument5 pagesTopic F BenlacJho MalditahNo ratings yet

- Module 10Document3 pagesModule 10Ailene Nace GapoyNo ratings yet

- POS 205 GroupDocument5 pagesPOS 205 GroupnathanharyehrinNo ratings yet

- Effect of Road Expansion To The Local Household Lalitpur DistrictDocument8 pagesEffect of Road Expansion To The Local Household Lalitpur DistrictJoshua CenizaNo ratings yet

- Sensortronics Load Cells: Product OverviewDocument4 pagesSensortronics Load Cells: Product Overviewsrboghe651665No ratings yet

- Fowler - The New MethodologyDocument18 pagesFowler - The New MethodologypglezNo ratings yet

- Edu en Vcdicm103 Lab IeDocument230 pagesEdu en Vcdicm103 Lab IeLANo ratings yet

- Unemployment and PovertyDocument9 pagesUnemployment and PovertyRaniNo ratings yet

- DocxDocument5 pagesDocxymt1123100% (1)

- P1 CompreDocument3 pagesP1 CompreCris Tarrazona CasipleNo ratings yet

- Fortnite CheatDocument1 pageFortnite CheatShahab Samar100% (1)

- UT Dallas Syllabus For Soc4396.501.11s Taught by Malinda Hicks (Meh033000)Document11 pagesUT Dallas Syllabus For Soc4396.501.11s Taught by Malinda Hicks (Meh033000)UT Dallas Provost's Technology GroupNo ratings yet

- Guide On Advertising - 26032019-v3Document20 pagesGuide On Advertising - 26032019-v3kkNo ratings yet

- 230/33Kv Bole Lemi Substation Calculation Note - Protection Relay Setting - 230Kv Bus Bar & Bus CouplerDocument29 pages230/33Kv Bole Lemi Substation Calculation Note - Protection Relay Setting - 230Kv Bus Bar & Bus CouplerDebebe TsedekeNo ratings yet

- Inf Luence of Tip Clearance On The Flow Field and Aerodynamic Performance of The Centrif Ugal ImpellerDocument6 pagesInf Luence of Tip Clearance On The Flow Field and Aerodynamic Performance of The Centrif Ugal Impellerarm coreNo ratings yet

- Astm D36Document4 pagesAstm D36Esteban FinoNo ratings yet

- 2 - Skip - Nonlinear RegressionDocument41 pages2 - Skip - Nonlinear RegressionEmdad HossainNo ratings yet

- Guy Huynh-Ba 2018Document15 pagesGuy Huynh-Ba 2018IsmaelNo ratings yet