Professional Documents

Culture Documents

Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)

Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)

Uploaded by

SK TECH TRICKSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)

Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)

Uploaded by

SK TECH TRICKSCopyright:

Available Formats

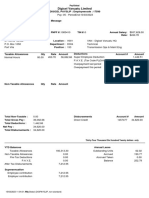

Sterling and Wilson Pvt Ltd

Sterling and Wilson Pvt. Ltd ; 13th Floor, P L Lokhande Marg, Chembur(W)

Payslip for the month of Mar 2022

Employee Code : MUM/1676

Location : Maharashtra

Name : Galib Anwar Khan DOJ : 01-Jun-2019

Bank : ICICI Bank

Department : O&M Month Days : 31

Bank A/c : 120001507390

Cost center : Godrej Society- TilakNagar Arrear LWOP : 0

PAN No : CKWPK0936K

Designation : Electrician Payable Days : 31

UAN No : 101121880133

Gender : Male ESI No : 3515048319

PF No :

Job Code : N/21/0438

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic 10,856.00 10,856.00 0.00 10,856.00 Esic 137.00

HRA 3,374.00 3,374.00 0.00 3,374.00 PF Employee Contr 1,612.00

Furnishing Allowance 53.00 53.00 0.00 53.00 Ptax 200.00

DA 1,794.00 1,794.00 728.00 2,522.00

Wash Allowance 1,000.00 1,000.00 0.00 1,000.00

Shft_Allow 0.00 1,314.00 0.00 1,314.00

ARR SHFT_ALLOW 0.00 84.00 0.00 84.00

GROSS PAY 18,475.00 728.00 19,203.00 GROSS DEDUCTION 1,949.00

Net Pay : 17,254.00 (SEVENTEEN THOUSAND TWO HUNDRED FIFTY FOUR ONLY)

Income Tax Worksheet for the Period April 2021 - March 2022

Description Gross Exempt Taxable Deduction Under Chapter VI-A

Basic 130,272.00 0.00 130,272.00 PF Employee Contr 17,833.00

HRA 40,488.00 0.00 40,488.00

Total of Investment u/s 80C 17,833.00

Furnishing Allowance 636.00 0.00 636.00 Tax Deducted

DEDUCTION U/C 80C 17,833.00 Details

DA 17,706.00 0.00 17,706.00

Deduction Under Chapter VI-A 17,833.00 Month Amount

Wash Allowance 12,000.00 0.00 12,000.00

Apr 2021 0.00

Bonus 11,833.00 0.00 11,833.00

Total Income Other Than Salary 0.00 May 2021 0.00

Shft_Allow 27,346.00 0.00 27,346.00

Jun 2021 0.00

ARR SHFT_ALLOW 156.00 0.00 156.00

Jul 2021 0.00

Gross Salary 240,437.00 0.00 240,437.00

Aug 2021 0.00

Deduction

Sep 2021 0.00

Previous Employer Professional Tax 0.00

Oct 2021 0.00

Standard Deduction 50,000.00

Nov 2021 0.00

Professional Tax 2,500.00

Dec 2021 0.00

Under Chapter VI-A 17,833.00

Jan 2022 0.00

Any Other Income 0.00

Feb 2022 0.00

Taxable Income 170,104.00

Mar 2022 0.00

Total Tax 0.00

Tax Rebate 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax /Month 0.00

Tax on Non-Recurring Earnings 0.00

Tax Deduction for this month 0.00

HRA Exemption Calculation

From To Rent Paid Actual HRA 40/50% of Basic Rent - 10% of Basic Exempted HRA

This is a computer generated document and it does not require a signature.

You might also like

- Salaryslip YM2023013686 December 2023Document1 pageSalaryslip YM2023013686 December 2023jessypriyadharshini9No ratings yet

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- Dec Salary SlipDocument1 pageDec Salary SlipShubhamNo ratings yet

- Payslip 1 PDFDocument1 pagePayslip 1 PDFkrishnaNo ratings yet

- Future Retail Limited: Salary Statement For The Month of MAY-2019Document1 pageFuture Retail Limited: Salary Statement For The Month of MAY-2019Himanshu MalikNo ratings yet

- Payslip For The Month of May 2022: VVDN Technologies Private LimitedDocument1 pagePayslip For The Month of May 2022: VVDN Technologies Private LimitedAbinashNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details: Arrears Current AmountBipuri PavankumarNo ratings yet

- Sept Salary SlipDocument1 pageSept Salary SlipBhavesh MishraNo ratings yet

- Wage and Salary AdministrationDocument34 pagesWage and Salary AdministrationSAVI100% (2)

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- Gane 1824Document1 pageGane 1824govindansanNo ratings yet

- Salary Slip U Can Edit and UseDocument1 pageSalary Slip U Can Edit and Useshail100% (1)

- Amara Raja Batteries LimitedDocument1 pageAmara Raja Batteries LimitedNani AnugaNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10No ratings yet

- Sep Pay SlipDocument1 pageSep Pay SlipSharma SkNo ratings yet

- Arshiya Logistics Services Limited: Payslip For The Month of April 2020 Suhas AmbadeDocument1 pageArshiya Logistics Services Limited: Payslip For The Month of April 2020 Suhas AmbadeSuhas AmbadeNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- "Maxim Infrastructure LTD." Old Nlunicipal Jail IndiaDocument3 pages"Maxim Infrastructure LTD." Old Nlunicipal Jail IndiaAmanNo ratings yet

- Payslip For The Month of Oct 2021: Rivigo Services PVT LTDDocument1 pagePayslip For The Month of Oct 2021: Rivigo Services PVT LTDDeeptimayee SahooNo ratings yet

- Ilovepdf - Merged - 2023-07-14T193418.587Document3 pagesIlovepdf - Merged - 2023-07-14T193418.587SRINIVASREDDY PIRAMALNo ratings yet

- #408, Ashirwad Enclave,, 104 I.P. Extention,, Delhi-110092Document1 page#408, Ashirwad Enclave,, 104 I.P. Extention,, Delhi-110092Ashutosh SharmaNo ratings yet

- Inr014298 53291001Document2 pagesInr014298 53291001NARASIMHS MURTHYNo ratings yet

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraNo ratings yet

- Payslip 2018 2019 1 100000000421201 IGSLDocument1 pagePayslip 2018 2019 1 100000000421201 IGSLArivu AkilNo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Paystub 202109Document1 pagePaystub 202109Ankush BarheNo ratings yet

- Aug PayslipDocument1 pageAug PayslipBabu RajNo ratings yet

- Payslip For The Month of September-2021: Personal InformationDocument1 pagePayslip For The Month of September-2021: Personal InformationDeep KoleyNo ratings yet

- PayslipDocument1 pagePayslipkumar_akhilesh82No ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- May 2019 PDFDocument2 pagesMay 2019 PDFVinodhkumar ShanmugamNo ratings yet

- Tata Business Support Services LTD: 00110283 KhushbuDocument1 pageTata Business Support Services LTD: 00110283 KhushbuKhushbu SinghNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet

- Pay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is RequiredDocument1 pagePay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is Requiredsv netNo ratings yet

- Divi Atchut Kumar - TCL11442 - April - 2021 - Employee - Basic - PayslipDocument1 pageDivi Atchut Kumar - TCL11442 - April - 2021 - Employee - Basic - PayslipDivi AtchutNo ratings yet

- Combined Submitted DocsDocument15 pagesCombined Submitted DocsViraj ShahNo ratings yet

- SameeraDocument1 pageSameeraTabrez AhamadNo ratings yet

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Pay SlipDocument1 pagePay SlipVISHESH JAISWALNo ratings yet

- Payslip For The Month of November 2016Document1 pagePayslip For The Month of November 2016chittaNo ratings yet

- PaySlip 221253181486P PDFDocument1 pagePaySlip 221253181486P PDFpraveenNo ratings yet

- Payslip Tax 9 2022 UnlockedDocument4 pagesPayslip Tax 9 2022 UnlockedDhruvNo ratings yet

- Salary SlipDocument1 pageSalary SlipManish KumarNo ratings yet

- Payslip 172820180712150142Document1 pagePayslip 172820180712150142LakshmananNo ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- Payslip 11 2020Document1 pagePayslip 11 2020Sk Sameer100% (1)

- Pay Slip - 604316 - Oct-22Document1 pagePay Slip - 604316 - Oct-22ArchanaNo ratings yet

- PaySlip 11 2023Document1 pagePaySlip 11 2023Sujoy GhoshalNo ratings yet

- April Moth PayslipDocument1 pageApril Moth PayslipLoan LoanNo ratings yet

- Kelly PayslipDocument1 pageKelly PayslipadtyshkhrNo ratings yet

- Pay Period 01.03.2022 To 31.03.2022: Income Tax ComputationDocument3 pagesPay Period 01.03.2022 To 31.03.2022: Income Tax ComputationParveen SainiNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNo ratings yet

- SRL Limited: Payslip For The Month of FEBRUARY 2019Document1 pageSRL Limited: Payslip For The Month of FEBRUARY 2019mkumarsejNo ratings yet

- 187 Chetan Pramod Dagwar Salary 2020-04Document1 page187 Chetan Pramod Dagwar Salary 2020-04chetan pramod dagwarNo ratings yet

- Apr 2021Document1 pageApr 2021Suraj KadamNo ratings yet

- Amazon Development Center India Pvt. LTD: Amount in INRDocument1 pageAmazon Development Center India Pvt. LTD: Amount in INRMaaz Uddin Siddiqui0% (1)

- May 2019Document2 pagesMay 2019Vinodhkumar ShanmugamNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- Employment Law (HRM 657)Document18 pagesEmployment Law (HRM 657)Lia AliaaNo ratings yet

- Botswana Budget 2023 24Document12 pagesBotswana Budget 2023 24PHENYONo ratings yet

- Hrishad - Income TaxDocument9 pagesHrishad - Income Taxkhayyum0% (1)

- BIR-How To Compute Fringe Benefit Tax, REL PARTYDocument69 pagesBIR-How To Compute Fringe Benefit Tax, REL PARTYLeandrix Billena Remorin Jr75% (4)

- Which of The Followin Level IVDocument2 pagesWhich of The Followin Level IVGuddataa Dheekkamaa100% (2)

- Standard Withdrawal FormDocument8 pagesStandard Withdrawal FormAntónio MoreiraNo ratings yet

- Chapter 6 - Income Tax For PartnershipDocument40 pagesChapter 6 - Income Tax For PartnershipNineteen Aùgùst100% (1)

- FA Additional Retirement Deferred CompDocument1 pageFA Additional Retirement Deferred CompWaila SarcedoNo ratings yet

- Payslip 10-03-23Document1 pagePayslip 10-03-23gmelenamuNo ratings yet

- SWAS Project Performance ReportDocument3 pagesSWAS Project Performance Reportamar vyasNo ratings yet

- Developing Understanding of Taxation AssignmentDocument2 pagesDeveloping Understanding of Taxation Assignmentnigus100% (2)

- Chapter Non Depository InstitutionsDocument5 pagesChapter Non Depository Institutionstasfaan50% (2)

- LiabilitiesDocument5 pagesLiabilitiesmalaya negadNo ratings yet

- FIN 242 Chapter 10 (Mathematic of Finance)Document24 pagesFIN 242 Chapter 10 (Mathematic of Finance)MUHAMMAD FAUZAN ABU BAKARNo ratings yet

- Classification of Individual Taxpayers:: Income Tax RatesDocument21 pagesClassification of Individual Taxpayers:: Income Tax RatesAngelica E. RefuerzoNo ratings yet

- May 2020 Corporate Reporting (Paper 3.1)Document28 pagesMay 2020 Corporate Reporting (Paper 3.1)FrankNo ratings yet

- 2022 TaxReturnDocument9 pages2022 TaxReturnmicheelleeex3No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument14 pagesU.S. Individual Income Tax Return: Filing StatusDavid Dautel100% (1)

- Pension Forfeiture and Police MisconductDocument34 pagesPension Forfeiture and Police MisconductABC6/FOX28No ratings yet

- Deduction Allowed and Not Allowed Under The Head Income From Business PDFDocument6 pagesDeduction Allowed and Not Allowed Under The Head Income From Business PDFMuhammad sheran sattiNo ratings yet

- Name: Haries Vi T. Micolob Bsba-Hrm 1 Year College (OPTED OFFLINE)Document2 pagesName: Haries Vi T. Micolob Bsba-Hrm 1 Year College (OPTED OFFLINE)Haries Vi Traboc MicolobNo ratings yet

- Form No. 12B: (See Rule 26A)Document3 pagesForm No. 12B: (See Rule 26A)sumit vermaNo ratings yet

- Organization For Labor Cost Accounting and ControlDocument22 pagesOrganization For Labor Cost Accounting and ControlPatrick LanceNo ratings yet

- Quiz 1 On Mid Term Period - Notes ReceivableDocument3 pagesQuiz 1 On Mid Term Period - Notes ReceivableErille Julianne (Rielianne)No ratings yet

- Taxation LawDocument7 pagesTaxation LawJoliza CalingacionNo ratings yet

- Aug MARDocument3 pagesAug MARSittie Aina Lao-DNo ratings yet

- Modern Labor Economics: Labor Supply: Household Production, The Family, and The Life CycleDocument40 pagesModern Labor Economics: Labor Supply: Household Production, The Family, and The Life CyclesamuelNo ratings yet

- Financial Liabilities SummaryDocument4 pagesFinancial Liabilities SummaryNancy Litera MusicoNo ratings yet