Professional Documents

Culture Documents

Gas Taxes in Florida

Gas Taxes in Florida

Uploaded by

Gary DetmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gas Taxes in Florida

Gas Taxes in Florida

Uploaded by

Gary DetmanCopyright:

Available Formats

Revised 2022

Florida Fuel Tax, Collection Allowance,

Refund, and Pollutants Tax Rates

Page Exhibit Description of Exhibit

2 A Rate Changes for 2022

2022 State Taxes, Inspection Fee, Ninth-Cent, Local Option, Additional

2 B Local Option, and State Comprehensive Enhanced Transportation System

Tax (SCETS) on products defined as motor fuel.

3 C Tax and Collection Allowance Rates by Tax Return and Line Item

Local Option Tax Entitled and Not Entitled to Collection Allowance

5 D

(Gasoline, Gasohol, and Fuel Grade Ethanol)

6 E Pollutants Tax Rates

6 F Refund Rates

Licensed Mass Transit System Provider Credit/Refund Rate (Gasoline,

7 G

Gasohol, and Fuel Grade Ethanol)

Refundable Portion of Local Option and State Comprehensive Enhanced

Transportation System (SCETS) Tax. This schedule is used by qualified

8 H mass transit system providers, farmers, commercial fishermen, and

aviation ground support companies to determine the refund rate on

gasoline (Part II of Form DR-138 and DR-160).

Shared Collection Allowance Rates – Terminal Suppliers and Importers

may not offset tax by the collection allowance unless 50% of the collection

8 I allowance is shared with any purchaser licensed as a wholesaler or

terminal supplier in Florida. The rates in this exhibit can be multiplied by

the fuel tax paid to calculate the shared collection allowance.

Florida Department of Revenue, 2022 Fuel Tax Rates, Page 1

Exhibit A

Rate Changes for 2022

Statewide Fuel Taxes on Motor Fuel (Gasoline, Gasohol, and Fuel Grade Ethanol)

Excise Sales Ninth Inspection Fee Local Option SCETS Total

Cent

All Counties $0.040 $0.150 $0.00 $0.00125 $0.06 $0.083 *$0.33425

*Total does not include local option taxes above the statewide minimum collected and remitted

by licensed wholesalers and terminal suppliers on each sale, delivery, or consignment to retail

dealers, resellers, and end users. See Exhibit B for the local option tax above the minimum on

motor fuel.

Statewide Fuel Taxes on Undyed Diesel Fuel

Excise Sales Ninth-Cent Local SCETS Total

Option

All Counties $0.040 $0.150 $0.01 $0.06 $0.083 $0.343

Statewide Fuel Taxes on Aviation Fuel

State Tax Effective Date of Tax Rate

All Counties $0.0427 July 1, 2019 Forward

New Taxes Imposed/Repealed:

1. Duval County – New ordinances increased Additional Local Option Tax from zero to

5 cents and the Ninth Cent Fuel Tax from zero to 1 cent.

Exhibit B

2022 State Taxes, Inspection Fee, Ninth-Cent, Local Option,

Additional Local Option and SCETS Motor Fuel Taxes

LOCAL

ADDITIONAL MINIMUM **TOTAL

STATE INSPECTION NINTH LOCAL *COUNTY OPTION

COUNTY LOCAL SCETS LOCAL TAX

TAXES FEE CENT OPTION TOTAL ABOVE

OPTION OPTION IMPOSED

MINIMUM

Alachua $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Baker $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Bay $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Bradford $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Brevard $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Broward $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Calhoun $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Charlotte $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Citrus $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Clay $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Collier $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Columbia $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Miami-Dade $0.190 $0.00125 $0.01 $0.06 $0.03 $0.083 $0.183 $0.143 $0.040 $0.37425

DeSoto $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Dixie $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Duval $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Escambia $0.190 $0.00125 $0.01 $0.06 $0.04 $0.083 $0.193 $0.143 $0.050 $0.38425

Flagler $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Franklin $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Gadsden $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Gilchrist $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Florida Department of Revenue, 2022 Fuel Tax Rates, Page 2

LOCAL

ADDITIONAL MINIMUM **TOTAL

STATE INSPECTION NINTH LOCAL *COUNTY OPTION

COUNTY LOCAL SCETS LOCAL TAX

TAXES FEE CENT OPTION TOTAL ABOVE

OPTION OPTION IMPOSED

MINIMUM

Glades $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Gulf $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Hamilton $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Hardee $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Hendry $0.190 $0.00125 $0.01 $0.06 $0.02 $0.083 $0.173 $0.143 $0.030 $0.36425

Hernando $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Highlands $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Hillsborough $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Holmes $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Indian River $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Jackson $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Jefferson $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Lafayette $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Lake $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Lee $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Leon $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Levy $0.190 $0.00125 $0.00 $0.06 $0.05 $0.083 $0.193 $0.143 $0.050 $0.38425

Liberty $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Madison $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Manatee $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Marion $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Martin $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Monroe $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Nassau $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Okaloosa $0.190 $0.00125 $0.01 $0.06 $0.03 $0.083 $0.183 $0.143 $0.040 $0.37425

Okeechobee $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Orange $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Osceola $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Palm Beach $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Pasco $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Pinellas $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Polk $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Putnam $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

St. Johns $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

St. Lucie $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Santa Rosa $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Sarasota $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Seminole $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Sumter $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Suwannee $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Taylor $0.190 $0.00125 $0.00 $0.06 $0.00 $0.083 $0.143 $0.143 $0.000 $0.33425

Union $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Volusia $0.190 $0.00125 $0.01 $0.06 $0.05 $0.083 $0.203 $0.143 $0.060 $0.39425

Wakulla $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Walton $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

Washington $0.190 $0.00125 $0.01 $0.06 $0.00 $0.083 $0.153 $0.143 $0.010 $0.34425

* County Total = Ninth-Cent + Local Option + Additional Local Option + SCETS

** Total Tax Imposed = County Total + State Taxes + Inspection Fee

Florida Department of Revenue, 2022 Fuel Tax Rates, Page 3

Exhibit C

Tax and Collection Allowance Rates

By Form and Line Item

Blender/Retailer of

Terminal Supplier Wholesaler/Importer Florida Air Carrier

Alternative Fuel

DR-309631 DR-309632 DR-309635 DR-182

State Tax, Inspection Fee, and Minimum Local Option Tax

Gasoline Page 4 (Line 10) Page 4 (Line 8) Page 4 (Line 8) Page 3 (Line 23)

(State and Page 13 (Line 6) Page 13 (Line 6) Page 13 (Line 6) Page 3 (Line 24A)

Minimum Page 13 (Line 20) $0.33425 Page 13 (Line 20) $0.33425 Page 13 (Line 20) $0.33425 $0.33425

Local Option

Tax) Page 17 (Line 2)

Blender/Retailer of

Terminal Supplier Wholesaler/Importer Florida Air Carrier

Alternative Fuel

DR-309631 DR-309632 DR-309635 DR-182

State Tax, Inspection Fee, and Minimum Local Option Tax

Page 4 (Line 10) Page 4 (Line 8) Page 4 (Line 8) Page 3 (Line 23)

Page 13 (Line 6) Page 13 (Line 6) Page 13 (Line 6) Page 3 (Line 24A)

Undyed Diesel $0.190 $0.190 $0.190 $0.190

Page 13 (Line 20) Page 13 (Line 20) Page 13 (Line 20)

Page 17 (Line 2)

Page 4 (Line 11) Page 4 (Line 9) Page 4 (Line 9) Page 3 (Line 22)

Page 13 (Line 6) Page 13 (Line 6) Page 13 (Line 6) Page 3 (Line 24B)

Aviation $0.0427 $0.0427 $0.0427 $0.0427

Page 13 (Line 20) Page 13 (Line 20) Page 13 (Line 20)

Page 17 (Line 2)

Collection Page 4 (Line 12) Page 4 (Line 10) Page 4 (Line 10) Page 3 (Line 26)

Allowance Page 13 (Line 8) 0.00311 Page 13 (Line 8) 0.00311 Page 13 (Line 8) 0.00311 0.00311

(Gasoline) Page 17 (Line 4)

Collection Page 4 (Line 13) Page 4 (Line 11) Page 4 (Line 11) Page 3 (Line 27)

Allowance Page 13 (Line 8) Page 13 (Line 8) Page 13 (Line 8)

0.0067 0.0067 0.0067 0.0067

(Undyed

Page 17 (Line 4)

Diesel)

Collection Page 4 (Line 12) Page 4 (Line 10) Page 4 (Line 10) Page 3 (Line 25)

Allowance Page 13 (Line 8) 0.002 Page 13 (Line 8) 0.002 Page 13 (Line 8) 0.002 0.002

(Aviation) Page 17 (Line 4)

Local Option Tax (Gasoline)

Local Option

Tax Entitled to See Exhibit See See See

Collection D Exhibit D Exhibit D Exhibit D

Allowance

Collection

Page 4 (Line 16) 0.011 Page 4 (Line 14) 0.011 Page 4 (Line 14) 0.011 Page 3 (Line 30) 0.011

Allowance

Local Option

Tax Not

See Exhibit See See See

Entitled to

D Exhibit D Exhibit D Exhibit D

Collection

Allowance

Local Option Tax (Undyed Diesel)

Local Option Page 4 (Line 19) Page 4 (Line 17) Page 4 (Line 17) Page 3 (Line 33) $0.070

Tax Entitled to $0.070 $0.070

$0.070

Collection Page 13 (Line 10) Page 13 (Line 10) Page 13 (Line 10)

Allowance

Page 17 (Line 6)

Page 4 (Line 20) Page 4 (Line 18) Page 4 (Line 18) Page 3 (Line 34) 0.011

Collection 0.011 0.011

Page 13 (Line 12) 0.011 Page 13 (Line 12) Page 13 (Line 12)

Allowance

Page 17 (Line 8)

Florida Department of Revenue, 2022 Fuel Tax Rates, Page 4

Blender/Retailer of

Terminal Supplier Wholesaler/Importer Florida Air Carrier

Alternative Fuel

DR-309631 DR-309632 DR-309635 DR-182

Local Option Page 4 (Line 21) Page 4 (Line 19) Page 4 (Line 19) Page 3 (Line 35) $0.083

Tax Not

$0.083 $0.083

Entitled to $0.083

Page 13 (Line 14) Page 13 (Line 14) Page 13 (Line 14)

Collection

Allowance Page 17 (Line 10)

Shared Collection Allowance Add-Back Rates (Schedule 12)

Gasoline Page 13 (Line 22) 0.000568 Page 13 (Line 22) 0.000568 Page 13 (Line 22) 0.000568 NA

Undyed Diesel Page 13 (Line 22) 0.00335 Page 13 (Line 22) 0.00335 Page 13 (Line 22) 0.00335 NA

Aviation Page 13 (Line 22) 0.001 Page 13 (Line 22) 0.001 Page 13 (Line 22) 0.001 NA

Exhibit D

Local Option Tax Entitled and Not Entitled to Collection Allowance

(Gasoline, Gasohol, and Fuel Grade Ethanol)

County County Name Local Option Tax Entitled to Local Option Tax Not Entitled

Code Collection Allowance to Collection Allowance

1 Alachua $0.01 $0.05

2 Baker $0.01 0

3 Bay $0.01 0

4 Bradford $0.01 $0.05

5 Brevard 0 0

6 Broward $0.01 $0.05

7 Calhoun 0 0

8 Charlotte $0.01 $0.05

9 Citrus $0.01 $0.05

10 Clay $0.01 $0.05

11 Collier $0.01 $0.05

12 Columbia $0.01 0

13 Miami-Dade $0.01 $0.03

14 DeSoto $0.01 $0.05

15 Dixie 0 0

16 Duval $0.01 $0.05

17 Escambia $0.01 $0.04

18 Flagler $0.01 0

19 Franklin 0 0

20 Gadsden 0 0

21 Gilchrist $0.01 0

22 Glades $0.01 0

23 Gulf $0.01 0

24 Hamilton 0 0

25 Hardee $0.01 $0.05

26 Hendry $0.01 $0.02

27 Hernando $0.01 $0.05

28 Highlands $0.01 $0.05

29 Hillsborough $0.01 0

30 Holmes $0.01 0

31 Indian River 0 0

32 Jackson $0.01 0

33 Jefferson $0.01 $0.05

34 Lafayette 0 0

35 Lake $0.01 0

36 Lee $0.01 $0.05

37 Leon $0.01 $0.05

38 Levy 0 $0.05

39 Liberty $0.01 0

40 Madison $0.01 $0.05

41 Manatee $0.01 $0.05

Florida Department of Revenue, 2022 Fuel Tax Rates, Page 5

County County Name Local Option Tax Entitled to Local Option Tax Not Entitled

Code Collection Allowance to Collection Allowance

42 Marion $0.01 $0.05

43 Martin $0.01 $0.05

44 Monroe $0.01 $0.05

45 Nassau $0.01 $0.05

46 Okaloosa $0.01 $0.03

47 Okeechobee $0.01 $0.05

48 Orange 0 0

49 Osceola $0.01 $0.05

50 Palm Beach $0.01 $0.05

51 Pasco $0.01 $0.05

52 Pinellas $0.01 0

53 Polk $0.01 $0.05

54 Putnam $0.01 $0.05

55 St. Johns 0 0

56 St. Lucie $0.01 $0.05

57 Santa Rosa $0.01 $0.05

58 Sarasota $0.01 $0.05

59 Seminole $0.01 0

60 Sumter $0.01 0

61 Suwannee $0.01 $0.05

62 Taylor 0 0

63 Union $0.01 0

64 Volusia $0.01 $0.05

65 Wakulla $0.01 0

66 Walton $0.01 0

67 Washington $0.01 0

Exhibit E

Pollutants Tax Rates

Coastal Protection

Statute Barrel Gallon Products

206.9935(1) $0.02 $0.00048 Rate applies to all applicable product types

Water Quality

206.9935(2) 0.00 $0.025 Motor Oil and Other Lubricants

0.00 $0.059 Solvents

$0.05 $0.00119 Petroleum Products, Chlorine, and Pesticides

0.00 $5.00 Perchloroethylene

$0.02 $0.00048 Ammonia

Inland Protection

206.9935(3) $0.80 $0.01904 Rate applies to all applicable product types

Florida Department of Revenue, 2022 Fuel Tax Rates, Page 6

Exhibit F

Refund Rates

Application for Fuel Tax Refund

Mass Transit Local Non- Municipalities, Agriculture, Aquacultural, Mass

System Government Public Counties, and Commercial Fishing, and Transit

Provider Fuel User of Diesel Schools School Districts Commercial Aviation System

Tax Return Fuel Tax Return Purposes Users

Form Number DR-309633 DR-309634 DR-190 DR-189 DR-138 DR-160

Gasoline – State Tax

Credit/Refund Rate See Exhibit G $0.16 $0.15 $0.16 $0.16/$0.15** $0.15

**$0.15 applies to commercial aviation purposes only.

Gasoline – Local Option tax

Credit/Refund Rate See Exhibit G NA NA NA See Exhibit H See Exhibit H

Undyed Diesel

Credit/Refund Rate $0.293 $0.16 $0.15 $0.16 NA $0.15

(On-Road Use)

Credit/Refund Rate NA $0.343 NA NA NA NA

(Off-Road Use)

Undyed Diesel – Local Option Tax

Credit/Refund Rate NA NA NA NA NA $0.143

(On-Road Use)

Dyed Diesel (Tax Due)

Tax Rate (On-Road $0.05 $0.183 NA NA NA NA

Use)

NA – Refund, credit or tax rate does not apply.

Exhibit G

Licensed Mass Transit System Provider

Credit/Refund Rate (Gasoline, Gasohol, and Fuel Grade Ethanol)

County County Name Credit/Refund County County Name Credit/Refund Rate

Code Rate Code (State and Local

Option taxes)

1 Alachua $0.343 35 Lake $0.293

2 Baker $0.293 36 Lee $0.343

3 Bay $0.293 37 Leon $0.343

4 Bradford $0.343 38 Levy $0.343

5 Brevard $0.293 39 Liberty $0.293

6 Broward $0.343 40 Madison $0.343

7 Calhoun $0.293 41 Manatee $0.343

8 Charlotte $0.343 42 Marion $0.343

9 Citrus $0.343 43 Martin $0.343

10 Clay $0.343 44 Monroe $0.343

11 Collier $0.343 45 Nassau $0.343

12 Columbia $0.293 46 Okaloosa $0.323

13 Miami-Dade $0.323 47 Okeechobee $0.343

14 DeSoto $0.343 48 Orange $0.293

15 Dixie $0.293 49 Osceola $0.343

16 Duval $0.343 50 Palm Beach $0.343

17 Escambia $0.333 51 Pasco $0.343

18 Flagler $0.293 52 Pinellas $0.293

19 Franklin $0.293 53 Polk $0.343

20 Gadsden $0.293 54 Putnam $0.343

21 Gilchrist $0.293 55 St. Johns $0.293

22 Glades $0.293 56 St. Lucie $0.343

23 Gulf $0.293 57 Santa Rosa $0.343

24 Hamilton $0.293 58 Sarasota $0.343

25 Hardee $0.343 59 Seminole $0.293

Florida Department of Revenue, 2022 Fuel Tax Rates, Page 7

County County Name Credit/Refund County County Name Credit/Refund Rate

Code Rate Code (State and Local

Option taxes)

26 Hendry $0.313 60 Sumter $0.293

27 Hernando $0.343 61 Suwannee $0.343

28 Highlands $0.343 62 Taylor $0.293

29 Hillsborough $0.293 63 Union $0.293

30 Holmes $0.293 64 Volusia $0.343

31 Indian River $0.293 65 Wakulla $0.293

32 Jackson $0.293 66 Walton $0.293

33 Jefferson $0.343 67 Washington $0.293

34 Lafayette $0.293

Exhibit H

Refundable Portion of Local Option and

State Comprehensive Enhanced Transportation System (SCETS) Tax

County County Name Credit/Refund County County Name Credit/Refund Rate

Code Rate Code (State and Local Option

taxes)

1 Alachua $0.193 35 Lake $0.143

2 Baker $0.143 36 Lee $0.193

3 Bay $0.143 37 Leon $0.193

4 Bradford $0.193 38 Levy $0.193

5 Brevard $0.143 39 Liberty $0.143

6 Broward $0.193 40 Madison $0.193

7 Calhoun $0.143 41 Manatee $0.193

8 Charlotte $0.193 42 Marion $0.193

9 Citrus $0.193 43 Martin $0.193

10 Clay $0.193 44 Monroe $0.193

11 Collier $0.193 45 Nassau $0.193

12 Columbia $0.143 46 Okaloosa $0.173

13 Miami-Dade $0.173 47 Okeechobee $0.193

14 DeSoto $0.193 48 Orange $0.143

15 Dixie $0.143 49 Osceola $0.193

16 Duval $0.193 50 Palm Beach $0.193

17 Escambia $0.183 51 Pasco $0.193

18 Flagler $0.143 52 Pinellas $0.143

19 Franklin $0.143 53 Polk $0.193

20 Gadsden $0.143 54 Putnam $0.193

21 Gilchrist $0.143 55 St. Johns $0.143

22 Glades $0.143 56 St. Lucie $0.193

23 Gulf $0.143 57 Santa Rosa $0.193

24 Hamilton $0.143 58 Sarasota $0.193

25 Hardee $0.193 59 Seminole $0.143

26 Hendry $0.163 60 Sumter $0.143

27 Hernando $0.193 61 Suwannee $0.193

28 Highlands $0.193 62 Taylor $0.143

29 Hillsborough $0.143 63 Union $0.143

30 Holmes $0.143 64 Volusia $0.193

31 Indian River $0.143 65 Wakulla $0.143

32 Jackson $0.143 66 Walton $0.143

33 Jefferson $0.193 67 Washington $0.143

34 Lafayette $0.143

This schedule must be used to determine the refund rate for the gasoline portion of Part II (DR-138 & DR-160).

Florida Department of Revenue, 2022 Fuel Tax Rates, Page 8

Exhibit I

Shared Collection Allowance Rates

Gasoline Undyed Diesel Fuel Aviation Fuel

Fuel Tax Paid * Shared Collection 0.000568 0.00335 0.001

Allowance Rate = Shared Collection

Allowance

Example

Gallons 50,000 50,000 50,000

State Fuel Tax Rate $0.33425 $0.190 $0.0427

Fuel Tax Paid $16,712.50 $9,500.00 $2,135.00

Shared Collection Allowance Rate 0.000568 0.00335 0.001

Shared Collection Allowance $9.50 $31.83 $2.14

Florida Department of Revenue, 2022 Fuel Tax Rates, Page 9

You might also like

- Motion To Disqualify With AffidavitDocument22 pagesMotion To Disqualify With AffidavitGary Detman100% (2)

- Gov Uscourts FLSD 617854 102 1Document38 pagesGov Uscourts FLSD 617854 102 1Kelli R. Grant86% (42)

- Banner Family Lawsuit Against TeslaDocument27 pagesBanner Family Lawsuit Against TeslaGary DetmanNo ratings yet

- Airbnb Lawsuit Over Fentanyl Death in WellingtonDocument26 pagesAirbnb Lawsuit Over Fentanyl Death in WellingtonGary Detman100% (1)

- Palm Beach County School Boundary MapDocument14 pagesPalm Beach County School Boundary MapGary DetmanNo ratings yet

- Flo Rida Complaint 2021Document10 pagesFlo Rida Complaint 2021Gary DetmanNo ratings yet

- 5.4 SCADA System Functional RequirementsDocument85 pages5.4 SCADA System Functional RequirementsYinwu ZhaoNo ratings yet

- D-333 ExhibitDocument72 pagesD-333 ExhibitGary DetmanNo ratings yet

- Orden de Arresto Jose MartinezDocument35 pagesOrden de Arresto Jose MartinezDiario Las AméricasNo ratings yet

- New Tax Return Transcript 2222Document7 pagesNew Tax Return Transcript 2222James Franklin67% (3)

- Geothermal Energy Poster 2Document1 pageGeothermal Energy Poster 2api-298575301100% (2)

- Blood Pressure Levels For Boys by Age and Height PercentileDocument4 pagesBlood Pressure Levels For Boys by Age and Height PercentileNuzla EmiraNo ratings yet

- Barangay Nutrition Scholar Monthly AccomplishmentDocument7 pagesBarangay Nutrition Scholar Monthly AccomplishmentDianka Glory Cenabre Edrozo75% (4)

- I'm Thinking of Ending Things PDFDocument138 pagesI'm Thinking of Ending Things PDFRicardo VelaNo ratings yet

- Florida Motor Fuel Tax Relief Act of 2022Document9 pagesFlorida Motor Fuel Tax Relief Act of 2022ABC Action NewsNo ratings yet

- Smartpath Price DetailsDocument7 pagesSmartpath Price DetailsIva gjorceskaNo ratings yet

- Smartpath Price DetailsDocument6 pagesSmartpath Price DetailsIva gjorceskaNo ratings yet

- Unhaggle 2022 Toyota Corolla Cross 2 0 Le CVT 4wd 5dr 20220302164736Document9 pagesUnhaggle 2022 Toyota Corolla Cross 2 0 Le CVT 4wd 5dr 20220302164736Deniz KutanNo ratings yet

- Utah Tax Commission Revenue ReportDocument7 pagesUtah Tax Commission Revenue ReportThe Salt Lake TribuneNo ratings yet

- Bank Credit Card Year End Statement 8132Document8 pagesBank Credit Card Year End Statement 8132Mr AssNo ratings yet

- Cost-of-Living Backgrounder 20231031Document2 pagesCost-of-Living Backgrounder 20231031Faelan LundebergNo ratings yet

- Toyota Build and Price 2024 Grand Highlander Hybrid Limited AWDDocument6 pagesToyota Build and Price 2024 Grand Highlander Hybrid Limited AWDRahul DhawanNo ratings yet

- 2029 - 2030 Sky Spirit Studio GSTDocument36 pages2029 - 2030 Sky Spirit Studio GSTWade Stephen BakerNo ratings yet

- Horace Property Property Tax StatementDocument2 pagesHorace Property Property Tax StatementRob PortNo ratings yet

- Bill of Sale Bidder #4659 Invoice Id: 323983 (1 of 1) : Dealer#:250 2020-09-15 Phone: (844) 455-5263 Fax: (856) 437-5292Document2 pagesBill of Sale Bidder #4659 Invoice Id: 323983 (1 of 1) : Dealer#:250 2020-09-15 Phone: (844) 455-5263 Fax: (856) 437-5292Giselle UmañaNo ratings yet

- Ator Property RecordsDocument2 pagesAtor Property RecordsErin LaviolaNo ratings yet

- Tax Bill 2022 120206 PDFDocument1 pageTax Bill 2022 120206 PDFLOUNGE HOMENo ratings yet

- FB County Tax Statement-2022Document1 pageFB County Tax Statement-2022Sageer AbdullaNo ratings yet

- Bassett - Mulhall Homestead Fraud ComplaintDocument116 pagesBassett - Mulhall Homestead Fraud Complaintreef_galNo ratings yet

- 2024 Phev2Document1 page2024 Phev2drsinanalrubayeNo ratings yet

- Tax Bill 2022Document1 pageTax Bill 2022LOUNGE HOMENo ratings yet

- Tax Fiscal Note 060910Document2 pagesTax Fiscal Note 060910jmicekNo ratings yet

- Metal Sheet Rev2Document5 pagesMetal Sheet Rev2Mohammad SyeduzzamanNo ratings yet

- Atm HDR0631Document2 pagesAtm HDR0631Nelson VillegasNo ratings yet

- Toyota Build and Price 2022 RAV4 LE FWDDocument7 pagesToyota Build and Price 2022 RAV4 LE FWDEmanuel Gamboa ChacònNo ratings yet

- Parcel 5006128 ParcelDetailHistoryDocument5 pagesParcel 5006128 ParcelDetailHistoryAfuiHJaewfkhBSDNo ratings yet

- 2022 Budget TemplateDocument192 pages2022 Budget Templateojo bamideleNo ratings yet

- Unhaggle 2022 Toyota Corolla Hybrid CVT Li 20220302164154Document9 pagesUnhaggle 2022 Toyota Corolla Hybrid CVT Li 20220302164154Deniz KutanNo ratings yet

- Driver Settlement Statement For 2112326 Ontario Inc., .: Period DetailsDocument5 pagesDriver Settlement Statement For 2112326 Ontario Inc., .: Period Detailspeppa pigNo ratings yet

- EKGW2Y003020Document5 pagesEKGW2Y003020peppa pigNo ratings yet

- Compilation of Computation Issuances by JLNBDocument218 pagesCompilation of Computation Issuances by JLNBjanna.barbasaNo ratings yet

- Toyota Build and Price 2018 COROLLA CE 6MDocument4 pagesToyota Build and Price 2018 COROLLA CE 6MDanielle WatsonNo ratings yet

- Income Taxation MIDTERMSDocument7 pagesIncome Taxation MIDTERMSgamit gamitNo ratings yet

- The Budget Hole Has Been Known ForDocument110 pagesThe Budget Hole Has Been Known ForThe PitchNo ratings yet

- EKTW4Z000020Document5 pagesEKTW4Z000020peppa pigNo ratings yet

- 2011-2012 County RevenuesDocument23 pages2011-2012 County RevenuesMichael ToddNo ratings yet

- DDocument2 pagesDKedia FinanceNo ratings yet

- 2018 Honda Civic Sedan LX CVT: Dealer Cost ReportDocument7 pages2018 Honda Civic Sedan LX CVT: Dealer Cost ReportKieran HealeyNo ratings yet

- MnDOR LetterDocument3 pagesMnDOR LetterTim NelsonNo ratings yet

- 994df8e9-e5da-4ffb-95b7-fac92d7266daDocument2 pages994df8e9-e5da-4ffb-95b7-fac92d7266daparentmatthew226No ratings yet

- Driver Settlement Statement For 2112326 Ontario Inc., .: Period DetailsDocument5 pagesDriver Settlement Statement For 2112326 Ontario Inc., .: Period Detailspeppa pigNo ratings yet

- Sales Tax Cap Memo. Contributed / City of FargoDocument3 pagesSales Tax Cap Memo. Contributed / City of FargoMelissa Van Der StadNo ratings yet

- Wa0020.Document1 pageWa0020.Zé RobertoNo ratings yet

- Account No: 931850463 Monthly Statement Period: MAY - 2021Document6 pagesAccount No: 931850463 Monthly Statement Period: MAY - 2021Muhammad Riza Nor RohmanNo ratings yet

- Toyota Build and Price 2023 Highlander XSE AWDDocument6 pagesToyota Build and Price 2023 Highlander XSE AWDGracieeNo ratings yet

- Toyota Build and Price 2024 Tacoma 4x4 Double Cab 6MDocument7 pagesToyota Build and Price 2024 Tacoma 4x4 Double Cab 6Mjenetik.zapperNo ratings yet

- Driver Settlement Statement For 2112326 Ontario Inc., .: Period DetailsDocument5 pagesDriver Settlement Statement For 2112326 Ontario Inc., .: Period Detailspeppa pigNo ratings yet

- At&t 2018 Ip7 PlusDocument1 pageAt&t 2018 Ip7 Plusadnan aliNo ratings yet

- PolicyDocument2 pagesPolicyVinod KumarNo ratings yet

- Boe 2870155Document1 pageBoe 2870155gejomo7869No ratings yet

- ReceiptDocument1 pageReceiptderek49cleanerNo ratings yet

- Toyota Build and Price 2022 Corolla Cross LE AWDDocument6 pagesToyota Build and Price 2022 Corolla Cross LE AWDkuoshengchenNo ratings yet

- Intrinsic Value CalculationDocument9 pagesIntrinsic Value Calculationmumbaideepika100% (1)

- Santa Maria - 2008.38 - 277666913Document2 pagesSanta Maria - 2008.38 - 277666913Amanda MathiasNo ratings yet

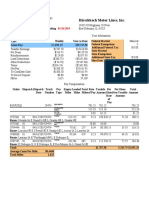

- Hirschbach Motor Lines, Inc.: XXX-XX-6687 11/13/2018Document3 pagesHirschbach Motor Lines, Inc.: XXX-XX-6687 11/13/2018Shawn HaleNo ratings yet

- EMMSXN000020Document5 pagesEMMSXN000020peppa pigNo ratings yet

- Microeconomics 5th Edition Krugman Solutions Manual instant download all chapterDocument38 pagesMicroeconomics 5th Edition Krugman Solutions Manual instant download all chaptervramawansun100% (2)

- ENCQA1000020Document5 pagesENCQA1000020peppa pigNo ratings yet

- Hyundai-2022-Elantra-Preferred IVTDocument6 pagesHyundai-2022-Elantra-Preferred IVTGaurav PatilNo ratings yet

- Driver Settlement Statement For 2112326 Ontario Inc., .: Period DetailsDocument5 pagesDriver Settlement Statement For 2112326 Ontario Inc., .: Period Detailspeppa pigNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Broward Teacher InvestigationDocument34 pagesBroward Teacher InvestigationGary DetmanNo ratings yet

- Senate Bill 1342Document11 pagesSenate Bill 1342Gary DetmanNo ratings yet

- Principal Under InvestigationDocument1 pagePrincipal Under InvestigationGary DetmanNo ratings yet

- Alligator Bite Data in FloridaDocument5 pagesAlligator Bite Data in FloridaGary DetmanNo ratings yet

- State Attorney Report On Deputy ShootingDocument34 pagesState Attorney Report On Deputy ShootingGary DetmanNo ratings yet

- IRC Report On Deputy ShootingDocument4 pagesIRC Report On Deputy ShootingGary DetmanNo ratings yet

- Sheriff Snyder's Letter To President BidenDocument1 pageSheriff Snyder's Letter To President BidenGary DetmanNo ratings yet

- New Motion in Killer Clown CaseDocument28 pagesNew Motion in Killer Clown CaseGary DetmanNo ratings yet

- Sheriff Snyder's Letter To President BidenDocument1 pageSheriff Snyder's Letter To President BidenGary DetmanNo ratings yet

- Motion For Bifurcated TrialDocument20 pagesMotion For Bifurcated TrialGary DetmanNo ratings yet

- RPO Petition For Robert KrasnickiDocument12 pagesRPO Petition For Robert KrasnickiGary DetmanNo ratings yet

- Elderly Abuse Arrest ReportDocument10 pagesElderly Abuse Arrest ReportGary DetmanNo ratings yet

- Publix Shooting LawsuitDocument20 pagesPublix Shooting LawsuitGary DetmanNo ratings yet

- Mar-a-Lago Trespasser ArrestedDocument8 pagesMar-a-Lago Trespasser ArrestedGary DetmanNo ratings yet

- Former Chief Nathan Osgood Sues City of Riviera BeachDocument17 pagesFormer Chief Nathan Osgood Sues City of Riviera BeachGary DetmanNo ratings yet

- Osgood LawsuitDocument17 pagesOsgood LawsuitGary DetmanNo ratings yet

- 502022ca012191xxxxmb 3Document17 pages502022ca012191xxxxmb 3Gary DetmanNo ratings yet

- Ramirez V Kraft Heinz Food Company LawsuitDocument16 pagesRamirez V Kraft Heinz Food Company LawsuitElizabeth WashingtonNo ratings yet

- Hab 2001Document15 pagesHab 2001Fred LamertNo ratings yet

- Power Plant Redevelopment PlanDocument14 pagesPower Plant Redevelopment PlanGary DetmanNo ratings yet

- Mark Sohn Internal Affairs ReportDocument32 pagesMark Sohn Internal Affairs ReportPeterBurke100% (1)

- Noah Galle Motion DeniedDocument1 pageNoah Galle Motion DeniedGary DetmanNo ratings yet

- The Cardiovascular System: The Heart: Part B: Prepared by Barbara Heard, Atlantic Cape Community CollegeDocument80 pagesThe Cardiovascular System: The Heart: Part B: Prepared by Barbara Heard, Atlantic Cape Community CollegeBrianna PinchinatNo ratings yet

- NYJC Prelim 2006 P2Document12 pagesNYJC Prelim 2006 P2miiewNo ratings yet

- SeizureDocument10 pagesSeizureRomeo ReyesNo ratings yet

- Individual Field MappingDocument46 pagesIndividual Field MappingAmyNo ratings yet

- Offtake Oc035 Preparation Go No Go ChecklistDocument8 pagesOfftake Oc035 Preparation Go No Go ChecklistIhwan AsrulNo ratings yet

- ETP Plant AsignmentDocument11 pagesETP Plant AsignmentFzUsman100% (2)

- MASS 2021 10-v2Document121 pagesMASS 2021 10-v2Fidel MangoldNo ratings yet

- 10594-2020.04.20 - (Public Consultation) Technical Design Reference For Private Hospital DMP (UPC)Document59 pages10594-2020.04.20 - (Public Consultation) Technical Design Reference For Private Hospital DMP (UPC)LucasNo ratings yet

- Abdikamalov Xodjabay Ismamutovich, Najimov Paraxat Ibrayimovich, Abstract. The Article Discusses The Importance and Necessity of PhysicalDocument7 pagesAbdikamalov Xodjabay Ismamutovich, Najimov Paraxat Ibrayimovich, Abstract. The Article Discusses The Importance and Necessity of PhysicalNurnazar PirnazarovNo ratings yet

- Lecture 7 Inclusions and Pinhole Formation in DIDocument33 pagesLecture 7 Inclusions and Pinhole Formation in DILuis Arturo RamirezNo ratings yet

- Presentation - Education in EmergenciesDocument30 pagesPresentation - Education in EmergenciesSHERYL WYCOCONo ratings yet

- Snowball SamplingDocument3 pagesSnowball SamplingHamza ChNo ratings yet

- Latah SyndromeDocument2 pagesLatah SyndromenazNo ratings yet

- Revised Case Report - HemorrhoidsDocument47 pagesRevised Case Report - Hemorrhoidschristina_love08100% (2)

- Iso 50001 Enms - Manual-Procedures-Forms-Matrix - P-XXX NumbersDocument1 pageIso 50001 Enms - Manual-Procedures-Forms-Matrix - P-XXX NumbersAngelo SantiagoNo ratings yet

- Reference HelicoilDocument1 pageReference HelicoilPetrotrim ServicesNo ratings yet

- UN SMA 2008 Bahasa Inggris: Kode Soal P44Document7 pagesUN SMA 2008 Bahasa Inggris: Kode Soal P44hestyNo ratings yet

- Hypogear 80W-90 - BP Australia Pty LTDDocument5 pagesHypogear 80W-90 - BP Australia Pty LTDBiju_PottayilNo ratings yet

- Choose The Correct Answer by Crossing A, B, C, or D!: Test Chapter I: Greeting, Leave Taking, Thanking, and AppologizingDocument3 pagesChoose The Correct Answer by Crossing A, B, C, or D!: Test Chapter I: Greeting, Leave Taking, Thanking, and AppologizingFerdi AnsyahNo ratings yet

- A La Carte MenuDocument1 pageA La Carte Menuhappy frankensteinNo ratings yet

- From Gathering To Growing Food: Neinuo's LunchDocument10 pagesFrom Gathering To Growing Food: Neinuo's Lunchsoumya KavdiaNo ratings yet

- Procedure Cum Check List: Gujarat State Petroleum Corporation LimitedDocument17 pagesProcedure Cum Check List: Gujarat State Petroleum Corporation LimitedDanny BoysieNo ratings yet

- EpitheliumDocument48 pagesEpitheliumdrpankaj28100% (1)

- Enviline VLD ENDocument4 pagesEnviline VLD EN8b8m724mb9No ratings yet

- Industrial Combustion AnalyzerDocument2 pagesIndustrial Combustion AnalyzerjeffchengNo ratings yet