Professional Documents

Culture Documents

What Is Selling, General & Administrative Expense (SG&A) ?: Profitability

What Is Selling, General & Administrative Expense (SG&A) ?: Profitability

Uploaded by

Kui KaranjaCopyright:

Available Formats

You might also like

- Accounting For Architecture FirmsDocument6 pagesAccounting For Architecture FirmsAsmaa Farouk100% (2)

- Cy 2022 Annual Investment Program PDFDocument9 pagesCy 2022 Annual Investment Program PDFEwyn Saulog100% (2)

- Ryanair Case StudyDocument20 pagesRyanair Case Studysid_hegde100% (7)

- Justifying CRM InvestmentsDocument8 pagesJustifying CRM Investmentsrohitgarg1360No ratings yet

- PEO ReportDocument36 pagesPEO ReportBhavesh UsadadNo ratings yet

- Internal Growth Strategies External Growth Strategies: Growth Strategy of Oyo RoomsDocument7 pagesInternal Growth Strategies External Growth Strategies: Growth Strategy of Oyo Roomschetan mNo ratings yet

- SG&ADocument7 pagesSG&ABobby DebNo ratings yet

- Portfolio Assignment-02-BUS-5110 Manegerial AccountingDocument5 pagesPortfolio Assignment-02-BUS-5110 Manegerial AccountingRasel SakilNo ratings yet

- 3.2 Costs and RevenuesDocument22 pages3.2 Costs and RevenuesDanae Illia GamarraNo ratings yet

- General and Administrative ExpensesDocument6 pagesGeneral and Administrative ExpensesmaresNo ratings yet

- All Ears - Financial - Analysis For QualityDocument10 pagesAll Ears - Financial - Analysis For QualitysamebcNo ratings yet

- Administrative ExpensesDocument2 pagesAdministrative ExpensessweetpotatoNo ratings yet

- Overhead Cost and Labour CostDocument8 pagesOverhead Cost and Labour CostMAAN SINGHANIANo ratings yet

- Price AccountingDocument3 pagesPrice AccountingJappy QuilasNo ratings yet

- Fabm2 Week 4Document28 pagesFabm2 Week 4Jeremy SolomonNo ratings yet

- Operating Expnses: 1) Selling Expenses and 2) Administrative Expenses. 1) Selling ExpensesDocument3 pagesOperating Expnses: 1) Selling Expenses and 2) Administrative Expenses. 1) Selling ExpensesFebin ThomasNo ratings yet

- Financial StatementDocument83 pagesFinancial StatementDarkie DrakieNo ratings yet

- How To Write A Traditional Business Plan: Step 1Document5 pagesHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanNo ratings yet

- Hotel Expense Accounting (Chapter 2)Document9 pagesHotel Expense Accounting (Chapter 2)Atif KhosoNo ratings yet

- BUS 5110 Managerial Accounting-Portfolio Activity Unit 2Document5 pagesBUS 5110 Managerial Accounting-Portfolio Activity Unit 2LaVida LocaNo ratings yet

- Work FinalDocument32 pagesWork FinalElhissin ElhissinnNo ratings yet

- Break Even AnalysisDocument3 pagesBreak Even AnalysisNikhil AgrawalNo ratings yet

- Tugas Bahasa Inggris - Dina Adila Putri & Rio Alvyrani - Doc 1Document10 pagesTugas Bahasa Inggris - Dina Adila Putri & Rio Alvyrani - Doc 1Serlima Anggina7No ratings yet

- 2400-Bcom-18 Cost AccountingDocument36 pages2400-Bcom-18 Cost Accountingliza shahNo ratings yet

- Operating Costing, 26-3-24Document10 pagesOperating Costing, 26-3-24studyandstudymore18No ratings yet

- Costs of Production and OperationsDocument1 pageCosts of Production and OperationsPedro RusiNo ratings yet

- PricingDocument10 pagesPricingshlakaNo ratings yet

- What Is The Income Statement?Document3 pagesWhat Is The Income Statement?Mustaeen DarNo ratings yet

- MF IntroductionDocument48 pagesMF IntroductionminsatzzNo ratings yet

- Inc StatmentDocument3 pagesInc StatmentDilawarNo ratings yet

- Trabajo de Ingles FinalDocument7 pagesTrabajo de Ingles FinalRafael Ramon Bastidas BastidasNo ratings yet

- Seatwork 206Document2 pagesSeatwork 206Vangelyn ManguiranNo ratings yet

- Entrep Business ModelDocument6 pagesEntrep Business ModelElena Salvatierra ButiuNo ratings yet

- Are Depreciation and Amortization Included in Gross Profit - InvestopediaDocument5 pagesAre Depreciation and Amortization Included in Gross Profit - InvestopediaBob KaneNo ratings yet

- By Jennifer F. Bender: Examples of Operating Expenses vs. Administrative ExpensesDocument3 pagesBy Jennifer F. Bender: Examples of Operating Expenses vs. Administrative ExpensesRafael Ramon Bastidas BastidasNo ratings yet

- What Is Cost of Goods SoldDocument19 pagesWhat Is Cost of Goods SoldRanaNo ratings yet

- Understanding The Income StatementDocument4 pagesUnderstanding The Income Statementluvujaya100% (1)

- Income StatementDocument3 pagesIncome StatementMamta LallNo ratings yet

- 2A Income Statement and Statement of Stockholders EquityDocument5 pages2A Income Statement and Statement of Stockholders EquityKevin ChengNo ratings yet

- Use Financial Terms To Get Management To Take Notice of Your Quality MessageDocument12 pagesUse Financial Terms To Get Management To Take Notice of Your Quality MessageAnahii KampanithaNo ratings yet

- 5522 Ppteocs 33Document7 pages5522 Ppteocs 33yfakeloverNo ratings yet

- Financial Analysis MethodsDocument9 pagesFinancial Analysis MethodseliasNo ratings yet

- Chapter 3: Feasibility AnalysisDocument25 pagesChapter 3: Feasibility AnalysisGenevieve Amar Delos SantosNo ratings yet

- IGNOU MBS MS-11 Free Solved Assignment 2012: Presented byDocument4 pagesIGNOU MBS MS-11 Free Solved Assignment 2012: Presented byroshdan23No ratings yet

- Unit-1: Introduction An Overview of Cost and Management AccountingDocument39 pagesUnit-1: Introduction An Overview of Cost and Management AccountingSnn News TubeNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingNiño Rey LopezNo ratings yet

- Charging Out Headquarters CostsDocument9 pagesCharging Out Headquarters CostsAbeer HakimNo ratings yet

- BudgetDocument5 pagesBudgetChey-Chey MagpantayNo ratings yet

- Running Head: BUSINESS 1Document6 pagesRunning Head: BUSINESS 1sheeNo ratings yet

- IBA101 ActivityDocument12 pagesIBA101 ActivityJAN PAOLO LUMPAZNo ratings yet

- Cost Classification For Control and Decision-Making: Prof Magnus Amajirionwu - 4 Mar (Edited 4 Mar)Document3 pagesCost Classification For Control and Decision-Making: Prof Magnus Amajirionwu - 4 Mar (Edited 4 Mar)houryaslmNo ratings yet

- CMA Assignment No 1Document3 pagesCMA Assignment No 1Shivani BalaniNo ratings yet

- Kelompok 1Document13 pagesKelompok 1difarafi97No ratings yet

- Lecture 1 - INTRODUCTIONDocument54 pagesLecture 1 - INTRODUCTIONTgrh TgrhNo ratings yet

- 12 Cost Saving IdeasDocument6 pages12 Cost Saving IdeasRaqib AlamNo ratings yet

- Cma Assignment No 01Document3 pagesCma Assignment No 01Shivani BalaniNo ratings yet

- Gross MarginDocument13 pagesGross MarginIshita Ghosh100% (1)

- Key Performance IndicatorsDocument6 pagesKey Performance IndicatorsfloraNo ratings yet

- 18775Document9 pages18775amitalwarNo ratings yet

- Business Management in Automotive Service May-21Document44 pagesBusiness Management in Automotive Service May-21Le Hoai TrungNo ratings yet

- What Is Cost AccountingDocument3 pagesWhat Is Cost AccountingJappy QuilasNo ratings yet

- How To Measure Roi For CatmanDocument13 pagesHow To Measure Roi For CatmanpendejitusNo ratings yet

- Mastering Operational Performance : The Ultimate KPI HandbookFrom EverandMastering Operational Performance : The Ultimate KPI HandbookNo ratings yet

- Article 10 - Maalvinder SinghDocument8 pagesArticle 10 - Maalvinder SinghAnkit KumarNo ratings yet

- CV-Jabir Ali Revised 2010Document7 pagesCV-Jabir Ali Revised 2010Jabir Ali100% (1)

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- Geographical Division Organizational StructureDocument2 pagesGeographical Division Organizational StructureMaria Sienna LegaspiNo ratings yet

- Introduction To AdvertisingDocument16 pagesIntroduction To AdvertisingarifNo ratings yet

- Work Study and Ergonomics SIRAJ PDFDocument4 pagesWork Study and Ergonomics SIRAJ PDFsirajudeen INo ratings yet

- Day Trading Shares StrategyDocument10 pagesDay Trading Shares StrategyPrabhat BhatNo ratings yet

- Hull RMFI4 e CH 12Document25 pagesHull RMFI4 e CH 12jlosamNo ratings yet

- CapitaMalls Asia Annual Report 2011 (FINAL)Document228 pagesCapitaMalls Asia Annual Report 2011 (FINAL)dr_twiggyNo ratings yet

- Bihar Treasury Code 2011 enDocument268 pagesBihar Treasury Code 2011 enसंजय कुमार चौधरी100% (1)

- Substantive Audit Testing - ExpenditureDocument28 pagesSubstantive Audit Testing - ExpenditureAid BolanioNo ratings yet

- Consumer Fee ScheduleDocument1 pageConsumer Fee ScheduleSai Sunil ChandraaNo ratings yet

- Marxism and "The Doll's House"Document2 pagesMarxism and "The Doll's House"FaizanAzizNo ratings yet

- Chapter 6Document8 pagesChapter 6Bích TrầnNo ratings yet

- 7fOF97bY1uJvo1PS8vcaWg Code Mega Rakeshkumar PDFDocument9 pages7fOF97bY1uJvo1PS8vcaWg Code Mega Rakeshkumar PDFsunwukongNo ratings yet

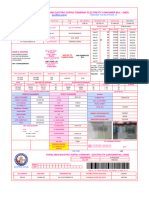

- FESCO Mar24 ONLINE BILLDocument1 pageFESCO Mar24 ONLINE BILLHusnain AbidNo ratings yet

- 2) Instructions For Playing The GameDocument7 pages2) Instructions For Playing The GameAna MariaNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Banking Awareness Topic Wise - FDI &FPIDocument3 pagesBanking Awareness Topic Wise - FDI &FPIVeer AshutoshNo ratings yet

- OD326967657423080100Document1 pageOD326967657423080100Hsus UsusiaiNo ratings yet

- Clear Path To Sustainable Growth: Investor Presentation FY18 ResultsDocument14 pagesClear Path To Sustainable Growth: Investor Presentation FY18 ResultsDiego O CuevasNo ratings yet

- BRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches VizDocument5 pagesBRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches Vizsohansharma75No ratings yet

- Ch.1 - Introduction To Cost-Benefit Analysis - Class 2Document20 pagesCh.1 - Introduction To Cost-Benefit Analysis - Class 2buthaina abdullahNo ratings yet

- parle G PresentationDocument23 pagesparle G Presentationakj1992No ratings yet

What Is Selling, General & Administrative Expense (SG&A) ?: Profitability

What Is Selling, General & Administrative Expense (SG&A) ?: Profitability

Uploaded by

Kui KaranjaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Selling, General & Administrative Expense (SG&A) ?: Profitability

What Is Selling, General & Administrative Expense (SG&A) ?: Profitability

Uploaded by

Kui KaranjaCopyright:

Available Formats

Selling, General & Administrative (SG&A) expenses are the costs a company

incurs to promote, sell and deliver its products and services, as well as to

manage day-to-day operations. Understanding and controlling SG&A can help

companies manage their overhead, reduce costs and sustain profitability.

What Is Selling, General & Administrative

Expense (SG&A)?

SG&A expenses comprise all the day-to-day operating costs of running a

business that aren’t related to producing a good or service. This includes a

wide range of expenses, such as rent, advertising and marketing, and salaries

of management and administrative staff. SG&A does not include the direct

costs of producing goods or acquiring goods for sale, which are calculated

separately as cost of goods sold (COGS). It also excludes research and

development (R&D) costs. The amount that a company spends on SG&A may

play a key role in determining its profitability.

Key Takeaways

Selling, General & Administrative expenses (SG&A) include all everyday

operating expenses of running a business that are not included in the

production of goods or delivery of services.

Typical SG&A items include rent, salaries, advertising and marketing

expenses and distribution costs.

Analyzing SG&A can help companies reduce overhead costs and increase

profitability.

Selling, General & Administrative Expense

(SG&A) Explained

Many SG&A line items, such as rent and base salaries, are fixed costs that

must be paid regardless of production or sales volumes. Other SG&A costs,

such as distribution costs, are variable and typically change as sales volumes

rise or fall. Still others may be semi-variable, including base costs plus an

additional cost component that varies based on usage. Utilities are a classic

example of a semi-variable cost: You pay the power company a flat rate for

monthly service, plus additional costs for each kilowatt hour you use.

Especially for businesses where most SG&A costs are fixed, SG&A is used to

understand overhead or the costs a business must meet to break even.

What Are Some SG&A Typical Expenses?

Although it may vary depending on your industry, some common SG&A

expenses include the following:

Salaries, wages and benefits for executives and staff not directly involved in

manufacturing or other production tasks

Rent

Utilities

Insurance payments

Marketing, advertising and promotion expenses

Accounting costs

Legal costs

Office supplies

Equipment not associated with manufacturing, such as office computers

referees

Management and Cost Accounting by Colin Drury • Management Information Systems by

Eardley Marshall Ritchie • Refer to Costing notes, STAMIS notes, Business Finance notes and

Quantitative notes • International Accounting Standards (IAS) • Internet

This week we focused on manufacturing costs, but selling, general, and administrative

(SG&A) costs are also important. Using the company you selected for the discussion

forum question, what specific types of SG&A costs would the company incur? How

would these costs be considered in product costing?

As portfolio activities are to be self-reflective, please make sure to connect the portfolio

assignment to:

Your personal experiences. Reflect on how this assignment topic is applicable to

and will benefit you.

Course readings and any external readings.

Discussion forum posts or course objectives.

The Portfolio Activity entry should be a minimum of 500 words and not more than 750

words. Use APA citations and references if you use ideas from the readings or other

sources.

You might also like

- Accounting For Architecture FirmsDocument6 pagesAccounting For Architecture FirmsAsmaa Farouk100% (2)

- Cy 2022 Annual Investment Program PDFDocument9 pagesCy 2022 Annual Investment Program PDFEwyn Saulog100% (2)

- Ryanair Case StudyDocument20 pagesRyanair Case Studysid_hegde100% (7)

- Justifying CRM InvestmentsDocument8 pagesJustifying CRM Investmentsrohitgarg1360No ratings yet

- PEO ReportDocument36 pagesPEO ReportBhavesh UsadadNo ratings yet

- Internal Growth Strategies External Growth Strategies: Growth Strategy of Oyo RoomsDocument7 pagesInternal Growth Strategies External Growth Strategies: Growth Strategy of Oyo Roomschetan mNo ratings yet

- SG&ADocument7 pagesSG&ABobby DebNo ratings yet

- Portfolio Assignment-02-BUS-5110 Manegerial AccountingDocument5 pagesPortfolio Assignment-02-BUS-5110 Manegerial AccountingRasel SakilNo ratings yet

- 3.2 Costs and RevenuesDocument22 pages3.2 Costs and RevenuesDanae Illia GamarraNo ratings yet

- General and Administrative ExpensesDocument6 pagesGeneral and Administrative ExpensesmaresNo ratings yet

- All Ears - Financial - Analysis For QualityDocument10 pagesAll Ears - Financial - Analysis For QualitysamebcNo ratings yet

- Administrative ExpensesDocument2 pagesAdministrative ExpensessweetpotatoNo ratings yet

- Overhead Cost and Labour CostDocument8 pagesOverhead Cost and Labour CostMAAN SINGHANIANo ratings yet

- Price AccountingDocument3 pagesPrice AccountingJappy QuilasNo ratings yet

- Fabm2 Week 4Document28 pagesFabm2 Week 4Jeremy SolomonNo ratings yet

- Operating Expnses: 1) Selling Expenses and 2) Administrative Expenses. 1) Selling ExpensesDocument3 pagesOperating Expnses: 1) Selling Expenses and 2) Administrative Expenses. 1) Selling ExpensesFebin ThomasNo ratings yet

- Financial StatementDocument83 pagesFinancial StatementDarkie DrakieNo ratings yet

- How To Write A Traditional Business Plan: Step 1Document5 pagesHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanNo ratings yet

- Hotel Expense Accounting (Chapter 2)Document9 pagesHotel Expense Accounting (Chapter 2)Atif KhosoNo ratings yet

- BUS 5110 Managerial Accounting-Portfolio Activity Unit 2Document5 pagesBUS 5110 Managerial Accounting-Portfolio Activity Unit 2LaVida LocaNo ratings yet

- Work FinalDocument32 pagesWork FinalElhissin ElhissinnNo ratings yet

- Break Even AnalysisDocument3 pagesBreak Even AnalysisNikhil AgrawalNo ratings yet

- Tugas Bahasa Inggris - Dina Adila Putri & Rio Alvyrani - Doc 1Document10 pagesTugas Bahasa Inggris - Dina Adila Putri & Rio Alvyrani - Doc 1Serlima Anggina7No ratings yet

- 2400-Bcom-18 Cost AccountingDocument36 pages2400-Bcom-18 Cost Accountingliza shahNo ratings yet

- Operating Costing, 26-3-24Document10 pagesOperating Costing, 26-3-24studyandstudymore18No ratings yet

- Costs of Production and OperationsDocument1 pageCosts of Production and OperationsPedro RusiNo ratings yet

- PricingDocument10 pagesPricingshlakaNo ratings yet

- What Is The Income Statement?Document3 pagesWhat Is The Income Statement?Mustaeen DarNo ratings yet

- MF IntroductionDocument48 pagesMF IntroductionminsatzzNo ratings yet

- Inc StatmentDocument3 pagesInc StatmentDilawarNo ratings yet

- Trabajo de Ingles FinalDocument7 pagesTrabajo de Ingles FinalRafael Ramon Bastidas BastidasNo ratings yet

- Seatwork 206Document2 pagesSeatwork 206Vangelyn ManguiranNo ratings yet

- Entrep Business ModelDocument6 pagesEntrep Business ModelElena Salvatierra ButiuNo ratings yet

- Are Depreciation and Amortization Included in Gross Profit - InvestopediaDocument5 pagesAre Depreciation and Amortization Included in Gross Profit - InvestopediaBob KaneNo ratings yet

- By Jennifer F. Bender: Examples of Operating Expenses vs. Administrative ExpensesDocument3 pagesBy Jennifer F. Bender: Examples of Operating Expenses vs. Administrative ExpensesRafael Ramon Bastidas BastidasNo ratings yet

- What Is Cost of Goods SoldDocument19 pagesWhat Is Cost of Goods SoldRanaNo ratings yet

- Understanding The Income StatementDocument4 pagesUnderstanding The Income Statementluvujaya100% (1)

- Income StatementDocument3 pagesIncome StatementMamta LallNo ratings yet

- 2A Income Statement and Statement of Stockholders EquityDocument5 pages2A Income Statement and Statement of Stockholders EquityKevin ChengNo ratings yet

- Use Financial Terms To Get Management To Take Notice of Your Quality MessageDocument12 pagesUse Financial Terms To Get Management To Take Notice of Your Quality MessageAnahii KampanithaNo ratings yet

- 5522 Ppteocs 33Document7 pages5522 Ppteocs 33yfakeloverNo ratings yet

- Financial Analysis MethodsDocument9 pagesFinancial Analysis MethodseliasNo ratings yet

- Chapter 3: Feasibility AnalysisDocument25 pagesChapter 3: Feasibility AnalysisGenevieve Amar Delos SantosNo ratings yet

- IGNOU MBS MS-11 Free Solved Assignment 2012: Presented byDocument4 pagesIGNOU MBS MS-11 Free Solved Assignment 2012: Presented byroshdan23No ratings yet

- Unit-1: Introduction An Overview of Cost and Management AccountingDocument39 pagesUnit-1: Introduction An Overview of Cost and Management AccountingSnn News TubeNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingNiño Rey LopezNo ratings yet

- Charging Out Headquarters CostsDocument9 pagesCharging Out Headquarters CostsAbeer HakimNo ratings yet

- BudgetDocument5 pagesBudgetChey-Chey MagpantayNo ratings yet

- Running Head: BUSINESS 1Document6 pagesRunning Head: BUSINESS 1sheeNo ratings yet

- IBA101 ActivityDocument12 pagesIBA101 ActivityJAN PAOLO LUMPAZNo ratings yet

- Cost Classification For Control and Decision-Making: Prof Magnus Amajirionwu - 4 Mar (Edited 4 Mar)Document3 pagesCost Classification For Control and Decision-Making: Prof Magnus Amajirionwu - 4 Mar (Edited 4 Mar)houryaslmNo ratings yet

- CMA Assignment No 1Document3 pagesCMA Assignment No 1Shivani BalaniNo ratings yet

- Kelompok 1Document13 pagesKelompok 1difarafi97No ratings yet

- Lecture 1 - INTRODUCTIONDocument54 pagesLecture 1 - INTRODUCTIONTgrh TgrhNo ratings yet

- 12 Cost Saving IdeasDocument6 pages12 Cost Saving IdeasRaqib AlamNo ratings yet

- Cma Assignment No 01Document3 pagesCma Assignment No 01Shivani BalaniNo ratings yet

- Gross MarginDocument13 pagesGross MarginIshita Ghosh100% (1)

- Key Performance IndicatorsDocument6 pagesKey Performance IndicatorsfloraNo ratings yet

- 18775Document9 pages18775amitalwarNo ratings yet

- Business Management in Automotive Service May-21Document44 pagesBusiness Management in Automotive Service May-21Le Hoai TrungNo ratings yet

- What Is Cost AccountingDocument3 pagesWhat Is Cost AccountingJappy QuilasNo ratings yet

- How To Measure Roi For CatmanDocument13 pagesHow To Measure Roi For CatmanpendejitusNo ratings yet

- Mastering Operational Performance : The Ultimate KPI HandbookFrom EverandMastering Operational Performance : The Ultimate KPI HandbookNo ratings yet

- Article 10 - Maalvinder SinghDocument8 pagesArticle 10 - Maalvinder SinghAnkit KumarNo ratings yet

- CV-Jabir Ali Revised 2010Document7 pagesCV-Jabir Ali Revised 2010Jabir Ali100% (1)

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- Geographical Division Organizational StructureDocument2 pagesGeographical Division Organizational StructureMaria Sienna LegaspiNo ratings yet

- Introduction To AdvertisingDocument16 pagesIntroduction To AdvertisingarifNo ratings yet

- Work Study and Ergonomics SIRAJ PDFDocument4 pagesWork Study and Ergonomics SIRAJ PDFsirajudeen INo ratings yet

- Day Trading Shares StrategyDocument10 pagesDay Trading Shares StrategyPrabhat BhatNo ratings yet

- Hull RMFI4 e CH 12Document25 pagesHull RMFI4 e CH 12jlosamNo ratings yet

- CapitaMalls Asia Annual Report 2011 (FINAL)Document228 pagesCapitaMalls Asia Annual Report 2011 (FINAL)dr_twiggyNo ratings yet

- Bihar Treasury Code 2011 enDocument268 pagesBihar Treasury Code 2011 enसंजय कुमार चौधरी100% (1)

- Substantive Audit Testing - ExpenditureDocument28 pagesSubstantive Audit Testing - ExpenditureAid BolanioNo ratings yet

- Consumer Fee ScheduleDocument1 pageConsumer Fee ScheduleSai Sunil ChandraaNo ratings yet

- Marxism and "The Doll's House"Document2 pagesMarxism and "The Doll's House"FaizanAzizNo ratings yet

- Chapter 6Document8 pagesChapter 6Bích TrầnNo ratings yet

- 7fOF97bY1uJvo1PS8vcaWg Code Mega Rakeshkumar PDFDocument9 pages7fOF97bY1uJvo1PS8vcaWg Code Mega Rakeshkumar PDFsunwukongNo ratings yet

- FESCO Mar24 ONLINE BILLDocument1 pageFESCO Mar24 ONLINE BILLHusnain AbidNo ratings yet

- 2) Instructions For Playing The GameDocument7 pages2) Instructions For Playing The GameAna MariaNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Banking Awareness Topic Wise - FDI &FPIDocument3 pagesBanking Awareness Topic Wise - FDI &FPIVeer AshutoshNo ratings yet

- OD326967657423080100Document1 pageOD326967657423080100Hsus UsusiaiNo ratings yet

- Clear Path To Sustainable Growth: Investor Presentation FY18 ResultsDocument14 pagesClear Path To Sustainable Growth: Investor Presentation FY18 ResultsDiego O CuevasNo ratings yet

- BRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches VizDocument5 pagesBRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches Vizsohansharma75No ratings yet

- Ch.1 - Introduction To Cost-Benefit Analysis - Class 2Document20 pagesCh.1 - Introduction To Cost-Benefit Analysis - Class 2buthaina abdullahNo ratings yet

- parle G PresentationDocument23 pagesparle G Presentationakj1992No ratings yet