Professional Documents

Culture Documents

SBI Brokerage Stucture July20tosep20

SBI Brokerage Stucture July20tosep20

Uploaded by

SunitSGalimathOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SBI Brokerage Stucture July20tosep20

SBI Brokerage Stucture July20tosep20

Uploaded by

SunitSGalimathCopyright:

Available Formats

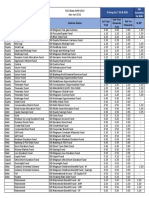

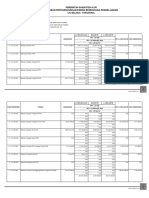

Brokerage Structure

Page 1 of 2 Downloaded on 13 Jul 2020 18:28

Distributor Code : ARN-87155 Distributor Name : INNOVAGE FINTECH PVT LTD

Scheme Name From Date To Date Trail 1st Year Trail 2nd Year Trail 3rd Year Trail 4th Year *B30 Spl Trail**

SBI LONG TERM EQUITY FUND 01-JUL-20 30-SEP-20 1.05 1.05 1.05 1.05 2

SBI FOCUSED EQUITY FUND 01-JUL-20 30-SEP-20 1.05 1.05 1.05 1.05 1.25

SBI BLUE CHIP FUND 01-JUL-20 30-SEP-20 0.95 0.95 0.95 0.95 1.65

SBI EQUITY MINIMUM VARIANCE FUND 01-JUL-20 30-SEP-20 0.35 0.35 0.35 0.35 0

SBI MAGNUM MIDCAP FUND 01-JUL-20 30-SEP-20 1.20 1.20 1.20 1.20 1.35

SBI SMALLCAP FUND 01-JUL-20 30-SEP-20 1.15 1.15 1.15 1.15 0.60

SBI LARGE AND MIDCAP FUND 01-JUL-20 30-SEP-20 1.20 1.20 1.20 1.20 1.75

SBI MAGNUM MULTICAP FUND 01-JUL-20 30-SEP-20 1.10 1.10 1.10 1.10 1.45

SBI MULTI ASSET ALLOCATION FUND 01-JUL-20 30-SEP-20 1.05 1.05 1.05 1.05 1.00

SBI DYNAMIC ASSET ALLOCATION FUND 01-JUL-20 30-SEP-20 1.00 1.00 1.00 1.00 1.50

SBI EQUITY HYBRID FUND 01-JUL-20 30-SEP-20 0.95 0.95 0.95 0.95 1.75

SBI INFRASTRUCTURE FUND 01-JUL-20 30-SEP-20 1.35 1.35 1.35 1.35 2

SBI CONTRA FUND 01-JUL-20 30-SEP-20 1.30 1.30 1.30 1.30 1.75

SBI PSU FUND 01-JUL-20 30-SEP-20 1.35 1.35 1.35 1.35 1.75

SBI BANKING AND FINANCIAL SERVICES FUND 01-JUL-20 30-SEP-20 1.35 1.35 1.35 1.35 1.25

SBI HEALTHCARE OPPORTUNITIES FUND 01-JUL-20 30-SEP-20 1.25 1.25 1.25 1.25 1.25

SBI TECHNOLOGY OPPORTUNITIES FUND 01-JUL-20 30-SEP-20 1.35 1.35 1.35 1.35 1.00

SBI CONSUMPTION OPPORTUNITIES FUND 01-JUL-20 30-SEP-20 1.30 1.30 1.30 1.30 1.75

SBI MAGNUM EQUITY ESG FUND 01-JUL-20 30-SEP-20 1.15 1.15 1.15 1.15 1.55

SBI MAGNUM GLOBAL FUND 01-JUL-20 30-SEP-20 1.10 1.10 1.10 1.10 1.70

SBI MAGNUM COMMA FUND 01-JUL-20 30-SEP-20 1.35 1.35 1.35 1.35 1.75

SBI ARBITRAGE OPPORTUNITIES FUND 01-JUL-20 30-SEP-20 0.50 0.50 0.50 0.50 0

SBI NIFTY INDEX FUND 01-JUL-20 30-SEP-20 0.30 0.30 0.30 0.30 0

SBI DEBT HYBRID FUND 01-JUL-20 30-SEP-20 1.00 1.00 1.00 1.00 1.00

SBI EQUITY SAVINGS FUND 01-JUL-20 30-SEP-20 1.00 1.00 1.00 1.00 2

SBI SAVINGS FUND 01-JUL-20 30-SEP-20 0.50 0.50 0.50 0.50 0

SBI MAGNUM CHILDRENS BENEFIT FUND 01-JUL-20 30-SEP-20 1.30 1.30 1.30 1.30 0

SBI GOLD FUND 01-JUL-20 30-SEP-20 0.20 0.20 0.20 0.20 0

SBI MAGNUM INCOME FUND 01-JUL-20 30-SEP-20 0.90 0.90 0.90 0.90 0

SBI DYNAMIC BOND FUND 01-JUL-20 30-SEP-20 0.95 0.95 0.95 0.95 0

SBI CREDIT RISK FUND 01-JUL-20 30-SEP-20 1.00 1.00 1.00 1.00 0

SBI CORPORATE BOND FUND 01-JUL-20 30-SEP-20 0.50 0.50 0.50 0.50 0

SBI MAGNUM CONSTANT MATURITY FUND 01-JUL-20 30-SEP-20 0.35 0.35 0.35 0.35 0

SBI MAGNUM GILT FUND 01-JUL-20 30-SEP-20 0.60 0.60 0.60 0.60 0

SBI MAGNUM MEDIUM DURATION FUND 01-JUL-20 30-SEP-20 0.65 0.65 0.65 0.65 0

SBI BANKING AND PSU FUND 01-JUL-20 30-SEP-20 0.50 0.50 0.50 0.50 0

SBI SHORT TERM DEBT FUND 01-JUL-20 30-SEP-20 0.50 0.50 0.50 0.50 0

SBI MAGNUM LOW DURATION FUND 01-JUL-20 30-SEP-20 0.60 0.60 0.60 0.60 0

SBI LIQUID FUND 01-JUL-20 30-SEP-20 0.10 0.10 0.10 0.10 0

SBI MAGNUM ULTRA SHORT DURATION FUND 01-JUL-20 30-SEP-20 0.20 0.20 0.20 0.20 0

SBI OVERNIGHT FUND 01-JUL-20 30-SEP-20 0.05 0.05 0.05 0.05 0

Terms & Conditions

1 The above Structure is valid from 01 Jul 2020 till 30 Sep 2020.

2 Only AMFI registered distributors empanelled with SBI Funds Management Pvt Ltd are eligible for above Brokerage structure.

3 Only the Valid application form under Regular Plan with ARN number mentioned in the broker code cell will be considered for above brokerage structure.

4 The above structure is applicable for lumpsum and SIP/STP.

All distributors should abide by the code of conduct and rules/regulations laid down by SEBI & AMFI. The AMC will take disciplinary action against any

5

distrubutor who is found violating these regulations / code of conduct.

6 T30 and B30 Locations are as per AMFI guidelines and list of TOP 30 locations undergo change from time to time based on the AMFI/SEBI guidelines.

*In reference to the SEBI Circular SEBI/HO/IMD/DF2/CIR/P/2018/137, dated 22nd Oct 2018, it has been decided that the additional TER can be charged

based on Inflows only from Retail Investors from B30 Cities. Subsequently SEBI circular SEBI/HO/IMD/DF2/CIR/P/2019/42 dated 25 Mar, 2019 the term

'Retail Investor' has been decided that Inflows of amount upto Rs 2,00,000/- per transaction, by individual investors shall be considered as inflows from retail

7 investor. This circular is effective from 15th April 2019. Therefore, B-30 incentive would be dependant upon the accrual on inflows from retail Investors. The

B30 incentive shall be completely clawed back in case the investment is redeemed / Systematically Transferred /Switched out to another scheme / Switched

out to the Direct Plan within 1year of investment. B30 Incentive will be completely recovered / clawed back from the future brokerage payments.This applies

even for the exit load free period (within the applicable clawback period of 1 year) mandated due to changes in fundamental attributes of the scheme.

** Above B-30 Special Incentive Is applicable only upto 14th April 2019, from 15th April 2019 onwords B-30 incentive would be dependant upon the accrual on

8

inflows from retail Investors.

9 *** Additional Trail.

In Case of any regulatory change or management decision with respect to expense ratio, the brokerage structure will be tweaked accordingly from the date of

10

change.

SBI Funds Management Pvt Ltd reserves the right to change /modify/discontinue/ withhold the rates and slabs mentioned at its sole discretion without any

11

prior intimation or notification or in case of Regulatory Changes / Change in Industry practices in respect to payment of brokerages.

The Brokerage rates mentioned above are inclusive of Goods & Services Tax (GST) and other relevant statutory/ regulatory levies as applicable. GST

12

Invoice in the name of SBI Mutual Fund and GST no. is 27AABTS6407Q1ZW.

Mutual Fund Investments are subject to market risks. Please read offer document / SID carefully before investing. For scheme specific risk factors please

13

refer to the respective offer documents. Please refer OD / SID / KIM / FactSheet / Addendums for updated details.

You might also like

- Andrea Larosa 4 Weeks Calisthenics Training Program (Beginner)Document26 pagesAndrea Larosa 4 Weeks Calisthenics Training Program (Beginner)Dimitry Donaire Flores100% (8)

- Benign Prostatic Hyperplasia: Sagittal View of Lower Urinary TractDocument1 pageBenign Prostatic Hyperplasia: Sagittal View of Lower Urinary TractLuke Rose100% (1)

- Retention in Complete DentureDocument53 pagesRetention in Complete DentureVikas Aggarwal67% (3)

- Asset Category Scheme Name 1st Year Trail 2nd Year Onwards Trail 4th Yrs Onwards B-30Document1 pageAsset Category Scheme Name 1st Year Trail 2nd Year Onwards Trail 4th Yrs Onwards B-30PupuDasNo ratings yet

- Brokerage Structure: Skyes & Ray Equities (I) LimitedDocument2 pagesBrokerage Structure: Skyes & Ray Equities (I) Limitedmarketbus12No ratings yet

- A Govt. of India EnterpriseDocument1 pageA Govt. of India EnterprisesushmaNo ratings yet

- Vivek Sir-SegriDocument4 pagesVivek Sir-Segrivivek sharmaNo ratings yet

- Case Study: Security Analysis Abc Bank LTDDocument3 pagesCase Study: Security Analysis Abc Bank LTDSiddharajsinh GohilNo ratings yet

- Goods and Services Tax - Tax Liabilities and ITC ComparisonDocument47 pagesGoods and Services Tax - Tax Liabilities and ITC ComparisonJeberson JebaNo ratings yet

- Harkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedDocument4 pagesHarkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedPawan Kumar SinghNo ratings yet

- Bajaj Financial Securities LTD Member: National Stock Exchange of India LTD / Bombay Stock Exchange LTDDocument6 pagesBajaj Financial Securities LTD Member: National Stock Exchange of India LTD / Bombay Stock Exchange LTDSubaSubramanianSNo ratings yet

- Laporan Pertanggungjawaban Bendahara Pengeluaran: Pemerintah Kabupaten AlorDocument12 pagesLaporan Pertanggungjawaban Bendahara Pengeluaran: Pemerintah Kabupaten AlorYunus TangpadaNo ratings yet

- Salman Khoirudin: Account SummaryDocument3 pagesSalman Khoirudin: Account SummarySalman KhoirudinNo ratings yet

- Fungsional Februari 2019Document21 pagesFungsional Februari 2019Bayu SegaraNo ratings yet

- year-2022Document14 pagesyear-2022Naveed Ul Qamar MughalNo ratings yet

- StatmentDocument2 pagesStatmentRatan SinghNo ratings yet

- Laporan Pertanggungjawaban Bendahara Pengeluaran (SPJ Belanja - Fungsional)Document9 pagesLaporan Pertanggungjawaban Bendahara Pengeluaran (SPJ Belanja - Fungsional)s mNo ratings yet

- Cash CountDocument4 pagesCash Countvirginia brionesNo ratings yet

- FMR Aug To Nov 20Document12 pagesFMR Aug To Nov 20Medical OfficerNo ratings yet

- Cashflow - 5crs & AboveDocument1 pageCashflow - 5crs & AboveNishant AhujaNo ratings yet

- Special Education Fund - January 2023Document4 pagesSpecial Education Fund - January 2023kessejunsan16No ratings yet

- UntitledhDocument19 pagesUntitledhBabu BNo ratings yet

- RPTSPJ Pengeluaran PerkegDocument23 pagesRPTSPJ Pengeluaran PerkegullaNo ratings yet

- Spartan 5 Lacs TL - MergedDocument13 pagesSpartan 5 Lacs TL - Mergedvermaashish.caNo ratings yet

- Ppacode Date Date of Abm/Saro/Sub-Aro Legalbasis UacsDocument14 pagesPpacode Date Date of Abm/Saro/Sub-Aro Legalbasis UacsHelen Joy Grijaldo JueleNo ratings yet

- SNDT 6 F 231Document10 pagesSNDT 6 F 231Dheer PopatNo ratings yet

- Loan Account Statement: Generated byDocument7 pagesLoan Account Statement: Generated byShaoon HowladerNo ratings yet

- Final Client ProjectionsDocument7 pagesFinal Client ProjectionskaranNo ratings yet

- Fairbairn - September 22 2019Document2 pagesFairbairn - September 22 2019Tiso Blackstar GroupNo ratings yet

- Special Education Fund - February 2023Document4 pagesSpecial Education Fund - February 2023kessejunsan16No ratings yet

- PF Trust Card 2022-2023Document1 pagePF Trust Card 2022-2023niranjan swainNo ratings yet

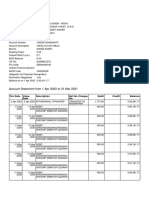

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAmishaNo ratings yet

- SPJ Fungsional 2020Document7 pagesSPJ Fungsional 2020jailaniNo ratings yet

- Fairbairn - June 13 2019Document2 pagesFairbairn - June 13 2019Lisle Daverin BlythNo ratings yet

- Promotionclaimdiscount 8Document3 pagesPromotionclaimdiscount 8Novita DpsNo ratings yet

- Dividend CalendarDocument8 pagesDividend CalendarDhanushka SanjanaNo ratings yet

- Bajfin-OC-17th May - 30th MayDocument2 pagesBajfin-OC-17th May - 30th MaysudhakarrrrrrNo ratings yet

- Report 115965 PDFDocument27 pagesReport 115965 PDFabbasamuNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Document1 pageRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Ridwan YoyoiNo ratings yet

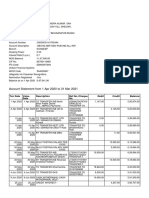

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAbhay RajNo ratings yet

- SBI BhavDocument24 pagesSBI BhavhrdksniNo ratings yet

- Bil Bulan 12 2018Document26 pagesBil Bulan 12 2018ShahZNo ratings yet

- SAUDA DETAIL REPORT cl3618 PDFDocument1 pageSAUDA DETAIL REPORT cl3618 PDFPrachi PatwariNo ratings yet

- SAUDA DETAIL REPORT cl3Document1 pageSAUDA DETAIL REPORT cl3Prachi PatwariNo ratings yet

- Data For The Year 2017: 1 Close-End Mutual FundDocument14 pagesData For The Year 2017: 1 Close-End Mutual FundAbdul Moiz YousfaniNo ratings yet

- Provincial Veterinary Office - Statement of Appropriations - June 30, 2023Document2 pagesProvincial Veterinary Office - Statement of Appropriations - June 30, 2023kessejunsan16No ratings yet

- Expense Managemt NEW CT SutosDocument65 pagesExpense Managemt NEW CT SutosSyarif HidayatNo ratings yet

- Cip 2.0Document1 pageCip 2.0JitendraBhartiNo ratings yet

- Saaob DetailedDocument3 pagesSaaob DetailedzcacctgauditNo ratings yet

- Powerpoint DisertationDocument2 pagesPowerpoint DisertationBruce DoyaoenNo ratings yet

- All African Auto SparesDocument1 pageAll African Auto SparesRenier LeeNo ratings yet

- MT Trade Journal TemplateDocument43 pagesMT Trade Journal TemplateSushant KumarNo ratings yet

- Rich and Ppor Dad BookDocument1 pageRich and Ppor Dad BookŤŕī ŚhāñNo ratings yet

- Markets and Commodity Figures: 26 July 2017Document2 pagesMarkets and Commodity Figures: 26 July 2017Tiso Blackstar GroupNo ratings yet

- (For Lump Sum, SIP & STP Investments) : (1st April 2022 To 30th June 2022) ARN-96994Document2 pages(For Lump Sum, SIP & STP Investments) : (1st April 2022 To 30th June 2022) ARN-96994Dark HoundNo ratings yet

- 01 2024Document2 pages01 2024Warissalawan.PraNo ratings yet

- Titipan Tab an SariyahDocument2 pagesTitipan Tab an Sariyahintankumalaaja1414No ratings yet

- Transaction Iquiry: No Post Date Eff Date Ref No Description Debit Kredit Transaction Code Customer Ref NoDocument3 pagesTransaction Iquiry: No Post Date Eff Date Ref No Description Debit Kredit Transaction Code Customer Ref Noeka yuliantaNo ratings yet

- RPTSPJ - Fungsional 2019Document5 pagesRPTSPJ - Fungsional 2019panwascam tabselNo ratings yet

- Fairbairn - September 11 2019Document2 pagesFairbairn - September 11 2019Tiso Blackstar GroupNo ratings yet

- Statement of Appropriations, Allotments, Obligations, Disbursements and Balances by Object of Expenditures (Saaodboe)Document10 pagesStatement of Appropriations, Allotments, Obligations, Disbursements and Balances by Object of Expenditures (Saaodboe)Lilibeth MaramagNo ratings yet

- FIPI Summary Report June 11, 2024...Document3 pagesFIPI Summary Report June 11, 2024...Mudassir Muneer JaamNo ratings yet

- JeevanUmang - 27-5-2023 10.27.40Document7 pagesJeevanUmang - 27-5-2023 10.27.40SunitSGalimathNo ratings yet

- Jtarun - 27-5-2023 10.23.42Document6 pagesJtarun - 27-5-2023 10.23.42SunitSGalimathNo ratings yet

- Is 4454 1 2001 PDFDocument15 pagesIs 4454 1 2001 PDFSunitSGalimathNo ratings yet

- Hot Rolled Coil - Drawing & Forming Steel Grades PDFDocument3 pagesHot Rolled Coil - Drawing & Forming Steel Grades PDFSunitSGalimathNo ratings yet

- Astrum BrochureDocument20 pagesAstrum BrochureGohilakrishnan ThiagarajanNo ratings yet

- Fracture (Cast Care)Document6 pagesFracture (Cast Care)Vane UcatNo ratings yet

- Delayed-Action AcceleratorDocument3 pagesDelayed-Action AcceleratorMOHD FIRDAUSNo ratings yet

- MSDS - Rilsan NylonDocument13 pagesMSDS - Rilsan NylonDv Maria PradhikaNo ratings yet

- FAQs - For - Listing - of - Commercial - Paper-BSE (26 Nov 2019)Document2 pagesFAQs - For - Listing - of - Commercial - Paper-BSE (26 Nov 2019)HimanshiNo ratings yet

- An Analysis On Maternity Benefit Laws of BangladeshDocument33 pagesAn Analysis On Maternity Benefit Laws of Bangladeshayesha.siddika.241No ratings yet

- Nebosh International Diploma ID1Document6 pagesNebosh International Diploma ID1Haltebaye Djim RahmNo ratings yet

- Manila Golf Vs Iac Digest CaseDocument3 pagesManila Golf Vs Iac Digest CaseMariam PetillaNo ratings yet

- 780B-780C Spec (99014) D.1Document1 page780B-780C Spec (99014) D.1Cristobal ArayaNo ratings yet

- Chapter 13-Variable Pay and Executive Compensation: Multiple ChoiceDocument22 pagesChapter 13-Variable Pay and Executive Compensation: Multiple ChoiceDyenNo ratings yet

- Lect2 Anes Drugs PDFDocument109 pagesLect2 Anes Drugs PDFJidapa SEELADEENo ratings yet

- Sweet DeathDocument5 pagesSweet DeathJBNo ratings yet

- Reviews of Environmental Contamination and Toxicology - Continuation of Residue ReviewsDocument232 pagesReviews of Environmental Contamination and Toxicology - Continuation of Residue ReviewsYoNo ratings yet

- Elecrolysis Cell DrawingDocument2 pagesElecrolysis Cell DrawingRimaNo ratings yet

- Application - Cum - Declaration As To The Physical FitnessDocument2 pagesApplication - Cum - Declaration As To The Physical FitnessSunitha UrumbathNo ratings yet

- Whether Ordinance On Self-Denial of Nuclear Power Harmful To IndiaDocument55 pagesWhether Ordinance On Self-Denial of Nuclear Power Harmful To IndiabksubbaraoNo ratings yet

- Insurance LawDocument15 pagesInsurance LawShruti KambleNo ratings yet

- DocumentDocument4 pagesDocumentAngelica Jusay IbusNo ratings yet

- Importance of SleepDocument10 pagesImportance of SleepKopano'Gucci'ModisenyaneNo ratings yet

- Basic Waste Management Training After Revision (Compatibility Mode)Document64 pagesBasic Waste Management Training After Revision (Compatibility Mode)Gangsar LukmanjayaNo ratings yet

- Mu350 1Document2 pagesMu350 1kresekjoy2No ratings yet

- 10th Grade Spelling BeeDocument1 page10th Grade Spelling BeeAlma GuerraNo ratings yet

- 2011 Douglas County Fair - Schedule of EventsDocument3 pages2011 Douglas County Fair - Schedule of EventsNews-Review of Roseburg OregonNo ratings yet

- 1 Introduction To Management Copy 2Document21 pages1 Introduction To Management Copy 2Angelica Camille B. AbaoNo ratings yet

- Week 9 Activity - Concepts On The CPS Exam Rebecca Miller Commercial Law LEG565 Professor Lori Baggot March 4, 2022Document3 pagesWeek 9 Activity - Concepts On The CPS Exam Rebecca Miller Commercial Law LEG565 Professor Lori Baggot March 4, 2022Rebecca Miller HorneNo ratings yet

- Whistle Blowing PolicyDocument5 pagesWhistle Blowing PolicyAlexandry-Leviasse Levi Mbanzu LuembaNo ratings yet

- 1998 Seadoo GSX Op GuideDocument11 pages1998 Seadoo GSX Op GuideJosé HernándezNo ratings yet

- MRXBOXAB-ECO (3 5) - AESW - MVHR For Wall MountingDocument12 pagesMRXBOXAB-ECO (3 5) - AESW - MVHR For Wall MountingDan RotariNo ratings yet