Professional Documents

Culture Documents

Topic 5 Regional Rural Banks in India

Topic 5 Regional Rural Banks in India

Uploaded by

Jaishree Ahlawat0 ratings0% found this document useful (0 votes)

16 views5 pagesRegional Rural Banks (RRBs) were created in India to serve rural areas with basic banking and financial services. RRBs have a limited area of operation within one or more districts in a state. They were conceptualized to meet the credit needs of small farmers, landless laborers, and artisans in rural India, with a focus on the agricultural sector. RRBs are jointly owned by the central government, state government, and a sponsoring bank. They provide banking facilities, carry out government operations, and offer para-banking facilities to support the development of rural areas.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRegional Rural Banks (RRBs) were created in India to serve rural areas with basic banking and financial services. RRBs have a limited area of operation within one or more districts in a state. They were conceptualized to meet the credit needs of small farmers, landless laborers, and artisans in rural India, with a focus on the agricultural sector. RRBs are jointly owned by the central government, state government, and a sponsoring bank. They provide banking facilities, carry out government operations, and offer para-banking facilities to support the development of rural areas.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

16 views5 pagesTopic 5 Regional Rural Banks in India

Topic 5 Regional Rural Banks in India

Uploaded by

Jaishree AhlawatRegional Rural Banks (RRBs) were created in India to serve rural areas with basic banking and financial services. RRBs have a limited area of operation within one or more districts in a state. They were conceptualized to meet the credit needs of small farmers, landless laborers, and artisans in rural India, with a focus on the agricultural sector. RRBs are jointly owned by the central government, state government, and a sponsoring bank. They provide banking facilities, carry out government operations, and offer para-banking facilities to support the development of rural areas.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

Role of RRB in India

Dr. Sandeepa Kaur

What are RRB’s

• Regional Rural Banks are local level banking

organizations operating in different States of India.

• Created with a view to serve primarily the rural areas of

India with basic banking and financial services.

• The area of operation of RRBs is limited to the area as

notified by Government of India covering one or more

districts in the State.

• Narsimham committee conceptualized the foundation of

regional rural banks in India

Structure of RRB’s

• The authorized capital -fixed at Rs. 1 crore

• Issued capital at Rs. 2 lakhs

▫ 50 %– be subscribed by the Central Government,

▫ 15 %by the concerned State Government

▫ Rest 35%by the sponsoring bank.

• RRB are directed and managed by a Board of

Directors consisting

Chairman

The chairman is appointed by the Central Government and

his term of office does not exceed five years.

Three directors

nominated by the Central Government

not more than two directors to be nominated by the State

Government concerned

not more than 3 directors to be nominated by the sponsoring

bank.

Role of RRB’s

• Providing banking facilities to rural and semi-urban areas.

▫ RRB’s were mainly established to meet the credit requirement of small and

marginal farmer, landless labor and artisians of rural India with a focus on agro

sector.

• Government operations

▫ Carrying out government operations like disbursement of wages of MGNREGA

workers, distribution of pensions etc.

• Facilities

▫ Providing Para-Banking facilities like locker facilities, debit and credit cards

• All round development

▫ Rural banking institutions are playing a very important role for all-round

development of rural areas of the country. In order to support the rural banking

sector in recent years, Regional Rural Banks have been set up all over the country

with the objective of meeting the credit needs of the most under privileged sections

of the society.

• Flow of credit

▫ These were envisaged as low cost financial intermediation structure in rural areas

to ensure sufficient flow of institutional credit for agriculture and other rural

sectors.

• Local effect

▫ RRB’s were expected to have the local feel and familiarity of cooperative banks

with managerial expertise of the commercial banks.

• Growth

▫ RRB’s penetrat4ed to every corner of the country and extended a helping hand in

the growth process of the country.

You might also like

- Case Study On TwitterDocument6 pagesCase Study On TwitterMd. Zahid HossainNo ratings yet

- Credit Card 1Document11 pagesCredit Card 1Ariel Cruz100% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Rural Banking ProjectDocument55 pagesRural Banking ProjectDelisa Misquitta0% (1)

- Rural Banking in IndiaDocument13 pagesRural Banking in IndiaStanley JonesNo ratings yet

- Final PPT of Concept of RRBsDocument27 pagesFinal PPT of Concept of RRBsManali ShahNo ratings yet

- Regional Rural Bank - WikipediaDocument28 pagesRegional Rural Bank - WikipediaMahesh KhairnarNo ratings yet

- Santu XDocument29 pagesSantu Xmr.santu9876No ratings yet

- Rural Banking: (In India)Document35 pagesRural Banking: (In India)nuro smartNo ratings yet

- Insurance & Banking ProjectDocument15 pagesInsurance & Banking Projectfundoo16No ratings yet

- Regional Rural BanksDocument18 pagesRegional Rural BanksMuzaffar HussainNo ratings yet

- Sbi Rural PubDocument6 pagesSbi Rural PubAafrinNo ratings yet

- Vsit Rohit ProjectDocument10 pagesVsit Rohit ProjectNaresh KhutikarNo ratings yet

- Regional Rural Banks - Indian Banking LawDocument28 pagesRegional Rural Banks - Indian Banking LawNeed NotknowNo ratings yet

- Project Report On Regional Rural Banks (RRBS)Document14 pagesProject Report On Regional Rural Banks (RRBS)Dhairya JainNo ratings yet

- 12 Chapter 2Document36 pages12 Chapter 2Divyanshi JainNo ratings yet

- RRB 180228071053Document10 pagesRRB 180228071053Kool KingNo ratings yet

- Rural BankingDocument11 pagesRural Bankingreach_to_rahulNo ratings yet

- Reserve Bank of India (RBI) : Prof. Mishu Tripathi Assistant Professor-FinanceDocument47 pagesReserve Bank of India (RBI) : Prof. Mishu Tripathi Assistant Professor-Financeatanu7590No ratings yet

- " History and Nationalisation of Banks in India ": PresentationDocument21 pages" History and Nationalisation of Banks in India ": PresentationMayankJainNo ratings yet

- Regional Rural BankDocument3 pagesRegional Rural BankSagar A. Barot100% (1)

- NABARDDocument5 pagesNABARDFlavia NunesNo ratings yet

- Bba ProjectDocument47 pagesBba ProjectAayush SomaniNo ratings yet

- 11 Chapter 1Document39 pages11 Chapter 1Divyanshi JainNo ratings yet

- Ibs F y B.com (H) Unit 1Document18 pagesIbs F y B.com (H) Unit 1Nikunj PatelNo ratings yet

- Rural Banking: Presented By: Hema SinghDocument34 pagesRural Banking: Presented By: Hema SinghRitika HiiNo ratings yet

- Role of Regional Rural BanksDocument17 pagesRole of Regional Rural Banksvigneshkarthik23No ratings yet

- Ms. E. Jeevitha: Rural BankingDocument16 pagesMs. E. Jeevitha: Rural Bankingpravin_kotecha7383100% (1)

- What Is Co-OperationDocument15 pagesWhat Is Co-OperationManaswi Vidyadhar ShetyeNo ratings yet

- Rural Banking in IndiaDocument15 pagesRural Banking in IndiaashishNo ratings yet

- National Bank For Agriculture and Rural Development (Nabard)Document21 pagesNational Bank For Agriculture and Rural Development (Nabard)HASHMI SUTARIYA100% (1)

- A Presentation ON Regional Rural Bank: Presented By: Presented ToDocument20 pagesA Presentation ON Regional Rural Bank: Presented By: Presented ToVîçký BårdêNo ratings yet

- Regional Rural Banking in India - 230326 - 110221Document72 pagesRegional Rural Banking in India - 230326 - 110221Shubham YadavNo ratings yet

- Rural BankingDocument22 pagesRural BankingGungun KumariNo ratings yet

- A Presentation ON Regional Rural Bank: Hina Khan Mba Iii SemDocument13 pagesA Presentation ON Regional Rural Bank: Hina Khan Mba Iii SemAmitNo ratings yet

- NABARDDocument19 pagesNABARDNiravThakkarNo ratings yet

- Role of Regional Rural Banks in Jammu and Kashmir: Huma Naz, Sarita PariharDocument3 pagesRole of Regional Rural Banks in Jammu and Kashmir: Huma Naz, Sarita PariharinventionjournalsNo ratings yet

- NABARDDocument37 pagesNABARDsanjayyadav007100% (1)

- NABARDDocument24 pagesNABARDMedarihun DympepNo ratings yet

- Ppt. Regional Rural BanksDocument13 pagesPpt. Regional Rural BanksRuchi Arora Arora73% (11)

- IBPS RRB CWE III Quick Reference Guide 2014Document58 pagesIBPS RRB CWE III Quick Reference Guide 2014ilakkikarthiNo ratings yet

- Project II Study On Rural Banking in IndiaDocument53 pagesProject II Study On Rural Banking in IndiaSujeet Pandey100% (3)

- Rural Banking - SCRIPTDocument16 pagesRural Banking - SCRIPTArchisha GargNo ratings yet

- Objectives of Regional Rural Banks 1Document8 pagesObjectives of Regional Rural Banks 1Sandeep Sandy100% (1)

- Priyanka AuroraDocument27 pagesPriyanka AuroraMohmmed KhayyumNo ratings yet

- Rbi Functions ListDocument7 pagesRbi Functions ListVinod Kumar ReddyNo ratings yet

- SUBRATA - Competetive Analysis of Regional Rural Bank1Document15 pagesSUBRATA - Competetive Analysis of Regional Rural Bank1Subrata SahaNo ratings yet

- Dokumen - Tips Rural Banking ProjectDocument57 pagesDokumen - Tips Rural Banking Projectmanoj rajbharNo ratings yet

- No.7. Nilgiris DCCBDocument5 pagesNo.7. Nilgiris DCCBSurenNo ratings yet

- Report On Rural Banking in IndiaDocument15 pagesReport On Rural Banking in IndiaJain AkshatNo ratings yet

- Untitled DocumentDocument11 pagesUntitled Documentsakshiludbe28No ratings yet

- Untitled DocumentDocument11 pagesUntitled Documentsakshiludbe28No ratings yet

- Nationalisationofbanksinindia 150529072100 Lva1 App6891Document9 pagesNationalisationofbanksinindia 150529072100 Lva1 App6891Kool KingNo ratings yet

- Regional Rural BankDocument26 pagesRegional Rural BankVijayeta Nerurkar100% (1)

- This Paper Entitled 'RURAL FINANCING' Throws Light On The Following AspectsDocument6 pagesThis Paper Entitled 'RURAL FINANCING' Throws Light On The Following AspectshazursaranNo ratings yet

- Mercial Banks1Document16 pagesMercial Banks1kanna1808No ratings yet

- Institutional Financial ManagementDocument24 pagesInstitutional Financial ManagementPEDAVALLI LAKSHMANNo ratings yet

- Development of Regional Rural Banks in IndiaDocument2 pagesDevelopment of Regional Rural Banks in IndiaTarunvir KukrejaNo ratings yet

- Commercial Banking in PakistanDocument24 pagesCommercial Banking in PakistanMuhammad RadeelNo ratings yet

- The Role of Regional Rural Banks inDocument4 pagesThe Role of Regional Rural Banks inAnonymous bIDNbP9Z3No ratings yet

- Untitled DocumentDocument5 pagesUntitled Documentsakshiludbe28No ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Political FactorsDocument8 pagesPolitical FactorscebucpatriciaNo ratings yet

- Activity Based Costing ExamplesDocument23 pagesActivity Based Costing ExamplesPinkal PatelNo ratings yet

- Study of Indian Stock MarketDocument107 pagesStudy of Indian Stock MarketMayank Pandey100% (2)

- Content ServerDocument26 pagesContent Serverdepiwos852No ratings yet

- Backbase Winning Strategies To Jumpstart Your Digital Transformation Microsoft EbookDocument35 pagesBackbase Winning Strategies To Jumpstart Your Digital Transformation Microsoft Ebooks4shivNo ratings yet

- ME Assignment-1Document2 pagesME Assignment-1Manoj NagNo ratings yet

- 2.3 Strategic Capacity Planning - 21 Dec 2022Document53 pages2.3 Strategic Capacity Planning - 21 Dec 2022Nahom AberaNo ratings yet

- Coporate Governance Presentation 1Document10 pagesCoporate Governance Presentation 1nellaNo ratings yet

- CPI Data DashboardExtractDocument21 pagesCPI Data DashboardExtractAimane CAFNo ratings yet

- Tender Document For Purchase Of: Turnkey Project For Supply of STP Tender Number: 6000012984/SAFETY, Dated: 11.05.2019Document51 pagesTender Document For Purchase Of: Turnkey Project For Supply of STP Tender Number: 6000012984/SAFETY, Dated: 11.05.2019aneile liegiseNo ratings yet

- RPMES Forms No. 2 5Document5 pagesRPMES Forms No. 2 5Edmond BautistaNo ratings yet

- Balance Sheet ITCDocument2 pagesBalance Sheet ITCProsenjit RoyNo ratings yet

- A Practical Approach For Social Life Cycle Assessment in The Automotive IndustryDocument60 pagesA Practical Approach For Social Life Cycle Assessment in The Automotive IndustryMarialicia JaureguiNo ratings yet

- Unit 4 Accounting For LabourDocument18 pagesUnit 4 Accounting For LabourAayushi KothariNo ratings yet

- تحليل نماذج الادارة الاستراتيجية للموارد البشريةDocument17 pagesتحليل نماذج الادارة الاستراتيجية للموارد البشريةkarim lehroucheNo ratings yet

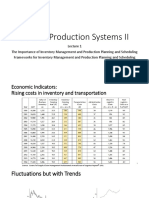

- Chapter 1 Importance of Inventory Management and Production SystemsDocument39 pagesChapter 1 Importance of Inventory Management and Production Systemsjane chahineNo ratings yet

- ECF Education Care Foundation: Public Private Partnership in Cluster Based TrainingsDocument6 pagesECF Education Care Foundation: Public Private Partnership in Cluster Based TrainingsASIF RAFIQUE BHATTINo ratings yet

- Japan Medical Device Reimbursement PolicyDocument26 pagesJapan Medical Device Reimbursement Policyanimeshsarkar87No ratings yet

- Week 2 Working Capital Tutorial Questions-1Document1 pageWeek 2 Working Capital Tutorial Questions-1Tran NguyenNo ratings yet

- Fundamentals of Project Management: Unit 1Document39 pagesFundamentals of Project Management: Unit 1Jyoti Arvind PathakNo ratings yet

- Acknowledgement of DebtDocument2 pagesAcknowledgement of DebtvernardNo ratings yet

- What Is The Difference Between Regionalism and GlobalizationDocument5 pagesWhat Is The Difference Between Regionalism and GlobalizationFAUL MANGAYANo ratings yet

- MIS Case StudiesDocument3 pagesMIS Case StudiesAshutosh AgalNo ratings yet

- Employer CostDocument753 pagesEmployer CostAlinda Gupta AbhroNo ratings yet

- 680 - Madhouse Mobile India PVT Ltd. - IMRO56978Document1 page680 - Madhouse Mobile India PVT Ltd. - IMRO56978Prateek PriyadarshiNo ratings yet

- The Archaeology of Ancient State EconomiesDocument31 pagesThe Archaeology of Ancient State EconomiesCyrus BanikazemiNo ratings yet

- 8.cash Flow StatementDocument16 pages8.cash Flow Statementnarangdiya602No ratings yet

- The Next Big Challenge For HR: Post RecessionDocument17 pagesThe Next Big Challenge For HR: Post RecessionVidhi ThakkarNo ratings yet