Professional Documents

Culture Documents

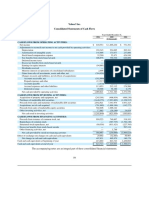

(In Millions) : Consolidated Statements of Cash Flows

(In Millions) : Consolidated Statements of Cash Flows

Uploaded by

rocíoCopyright:

Available Formats

You might also like

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Cashflow Analysis - Beta - GammaDocument14 pagesCashflow Analysis - Beta - Gammashahin selkarNo ratings yet

- 2021 Full Year Cash Flow StatementDocument1 page2021 Full Year Cash Flow StatementROYAL ENFIELDNo ratings yet

- Dell Financial Data Mid Course Quiz 1668627324062Document10 pagesDell Financial Data Mid Course Quiz 1668627324062rohit goyalNo ratings yet

- Yahoo Annual Report 2006Document2 pagesYahoo Annual Report 2006domini809No ratings yet

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsDocument1 pageThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05No ratings yet

- Consolidated Statements of Cash Flows (In Millions) : Year Ended December 31, 2014 2015 2016Document11 pagesConsolidated Statements of Cash Flows (In Millions) : Year Ended December 31, 2014 2015 2016Ritu SinghNo ratings yet

- Ford 18Document6 pagesFord 18Bhavdeep singh sidhuNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- 2021 Full Year FinancialsDocument2 pages2021 Full Year FinancialsFuaad DodooNo ratings yet

- GT BankDocument1 pageGT BankFuaad DodooNo ratings yet

- Microsoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Document1 pageMicrosoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Dylan MakroNo ratings yet

- Final 2021 CBG Summary Fs 2021 SignedDocument2 pagesFinal 2021 CBG Summary Fs 2021 SignedFuaad DodooNo ratings yet

- 2016 Fullyear Cash Flow StatementDocument1 page2016 Fullyear Cash Flow StatementSilvana ElenaNo ratings yet

- Increase in Long Term Loans and AdvancesDocument2 pagesIncrease in Long Term Loans and Advancesusama siddiquiNo ratings yet

- Table #1. Cash Flow StatementDocument6 pagesTable #1. Cash Flow StatementDzerassaNo ratings yet

- Boa Financials For q3 30 Sept. 2021Document1 pageBoa Financials For q3 30 Sept. 2021Fuaad DodooNo ratings yet

- Cash Flow Statement 2016-2020Document8 pagesCash Flow Statement 2016-2020yip manNo ratings yet

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- ILAM FAHARI I REIT - Audited Finacncials 2020Document1 pageILAM FAHARI I REIT - Audited Finacncials 2020An AntonyNo ratings yet

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Document2 pagesReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariNo ratings yet

- 105 10 Amazon Financial StatementsDocument5 pages105 10 Amazon Financial StatementsCharles Vladimir SolvaskyNo ratings yet

- Annual Report 2023Document27 pagesAnnual Report 2023ALNo ratings yet

- Cash Flow Statement Lourdesllanes2022 FINALDocument5 pagesCash Flow Statement Lourdesllanes2022 FINALDv AccountingNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- Cash-Flow-Statement (1) Marvell TechnologiesDocument5 pagesCash-Flow-Statement (1) Marvell TechnologiesRuthNo ratings yet

- Cash Flow, Cash N Cash EquivalentsDocument3 pagesCash Flow, Cash N Cash EquivalentsKalama ZooNo ratings yet

- Coca-Cola Co.: Consolidated Cash Flow StatementDocument6 pagesCoca-Cola Co.: Consolidated Cash Flow StatementDBNo ratings yet

- AirtelDocument2 pagesAirtelShraddha RawatNo ratings yet

- Consolidated Cash Flow StatementDocument1 pageConsolidated Cash Flow Statementsurya553No ratings yet

- UBL Annual Report 2018-170Document1 pageUBL Annual Report 2018-170IFRS LabNo ratings yet

- UBL Annual Report 2018-79Document1 pageUBL Annual Report 2018-79IFRS LabNo ratings yet

- Cashflow 2007Document1 pageCashflow 2007Zeeshan SiddiqueNo ratings yet

- Intermediate AccountingDocument5 pagesIntermediate AccountingWindelyn ButraNo ratings yet

- Sunbeam Group AssignmentDocument9 pagesSunbeam Group Assignmentshubhangini SaindaneNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- Consolidated Cash FlowDocument1 pageConsolidated Cash FlowKingsley EimogaNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- Akzonobel Report18 Cons Cash FlowsDocument1 pageAkzonobel Report18 Cons Cash FlowsS A M E E U L L A H S O O M R ONo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- Access BankDocument1 pageAccess BankFuaad DodooNo ratings yet

- Colgate Cash FlowsDocument2 pagesColgate Cash FlowsChetan DhuriNo ratings yet

- Session 5a Cash Flow Statement: HI5020 Corporate AccountingDocument11 pagesSession 5a Cash Flow Statement: HI5020 Corporate AccountingFeku RamNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Cash Flow Statement: For The Year Ended 31st March, 2019Document2 pagesCash Flow Statement: For The Year Ended 31st March, 2019Abhishek RajpootNo ratings yet

- Cash Flow Statement Nds FINALDocument5 pagesCash Flow Statement Nds FINALDv AccountingNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow StatementFurqan FakharNo ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016Document1 pageTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016LymeParkNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- FBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Document1 pageFBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Fuaad DodooNo ratings yet

- GB20003: International Financial Statement Analysis Individual Case Study (30%)Document7 pagesGB20003: International Financial Statement Analysis Individual Case Study (30%)Priyah RathakrishnahNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Vitrox q42014Document10 pagesVitrox q42014Dennis AngNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- Unaudited Summary Consolidated and Separate Financial StatementsDocument2 pagesUnaudited Summary Consolidated and Separate Financial Statementsbentilwilliams65No ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Oracle Finance Trial Balance and Ledger DetailsDocument59 pagesOracle Finance Trial Balance and Ledger DetailsKatie RuizNo ratings yet

- Notes For Business AnalyticsDocument10 pagesNotes For Business AnalyticsSakshi ShardaNo ratings yet

- Design, Fabrication, Supply & Commissioning of Stainless Steel Chemical SkidsDocument2 pagesDesign, Fabrication, Supply & Commissioning of Stainless Steel Chemical SkidsrutujaNo ratings yet

- Managing Relationship and Building LoyaltyDocument18 pagesManaging Relationship and Building Loyaltypooja TarvanNo ratings yet

- The Implementation of ISO9000 in Vietnam: Case Studies From The Footwear IndustryDocument10 pagesThe Implementation of ISO9000 in Vietnam: Case Studies From The Footwear Industrysps fetrNo ratings yet

- Nestlé OrganisationDocument5 pagesNestlé OrganisationMangerol22100% (2)

- Accounting and Reporting PracticeDocument43 pagesAccounting and Reporting PracticeAgidew ShewalemiNo ratings yet

- Abinbev Esg 2021 FinalDocument96 pagesAbinbev Esg 2021 FinalVan OnNo ratings yet

- 03 0450 22 MS Prov Rma 20022023Document21 pages03 0450 22 MS Prov Rma 20022023abin alexanderNo ratings yet

- Some - Tricks - To - Utilize - Thread - by - Denizhanozay - Feb 2, 23 - From - RattibhaDocument8 pagesSome - Tricks - To - Utilize - Thread - by - Denizhanozay - Feb 2, 23 - From - Rattibhasami lyNo ratings yet

- Changes To IProcurement and Purchasing Effective 5th October 2010Document9 pagesChanges To IProcurement and Purchasing Effective 5th October 2010Aman Khan Badal KhanNo ratings yet

- Berlitz Business EnglishDocument11 pagesBerlitz Business EnglishUscpa Donny100% (2)

- Financial Ratios of HulDocument21 pagesFinancial Ratios of HulVaibhav Trivedi0% (1)

- Wholesale and Retail Notes 2.0Document7 pagesWholesale and Retail Notes 2.0Shaine Cariz Montiero SalamatNo ratings yet

- Indonesia Salary Guide 2011 12Document28 pagesIndonesia Salary Guide 2011 12Ridayani DamanikNo ratings yet

- Test Paper 11Document8 pagesTest Paper 11Sukhjinder SinghNo ratings yet

- DOF HandoverChecklistDocument4 pagesDOF HandoverChecklistRamy AmirNo ratings yet

- About Tata AigDocument3 pagesAbout Tata Aigsatishyadav1234No ratings yet

- 2 - FPA (DTC Format Agreement)Document4 pages2 - FPA (DTC Format Agreement)Thomas DyeNo ratings yet

- Nature, Scope and Objectives of PartnershipDocument4 pagesNature, Scope and Objectives of PartnershipKathleenNo ratings yet

- Chapter 3: Requirements ModelingDocument52 pagesChapter 3: Requirements ModelingMat ProNo ratings yet

- The Basics of Predictive / Preventive MaintenanceDocument6 pagesThe Basics of Predictive / Preventive Maintenanceabhinav2018No ratings yet

- Chapter3 - Concurrent Engineering PDFDocument15 pagesChapter3 - Concurrent Engineering PDFSandeep GogadiNo ratings yet

- The Otis Absolutes: Made To Move YouDocument23 pagesThe Otis Absolutes: Made To Move Youmathi alaganNo ratings yet

- Clinical Workflow OptimizationDocument2 pagesClinical Workflow Optimizationfl.evangelioNo ratings yet

- NSA 320 (Revised) "Materiality in Planning and Performing An Audit"Document1 pageNSA 320 (Revised) "Materiality in Planning and Performing An Audit"Roshan AddhikariNo ratings yet

- Bridge Software EngineerDocument3 pagesBridge Software EngineerNguyen Manh CuongNo ratings yet

- Peoplesoft ContractsDocument8 pagesPeoplesoft Contractssumit.gujrani8176No ratings yet

- Worksheet PreparationDocument3 pagesWorksheet PreparationJon PangilinanNo ratings yet

- 6 Types Of: Business PlansDocument2 pages6 Types Of: Business PlansRainier TaliteNo ratings yet

(In Millions) : Consolidated Statements of Cash Flows

(In Millions) : Consolidated Statements of Cash Flows

Uploaded by

rocíoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(In Millions) : Consolidated Statements of Cash Flows

(In Millions) : Consolidated Statements of Cash Flows

Uploaded by

rocíoCopyright:

Available Formats

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

Years ended

September 24, September 26, September 27,

2016 2015 2014

Cash and cash equivalents, beginning of the year $ 21,120 $ 13,844 $ 14,259

Operating activities:

Net income 45,687 53,394 39,510

Adjustments to reconcile net income to cash generated by operating

activities:

Depreciation and amortization 10,505 11,257 7,946

Share-based compensation expense 4,210 3,586 2,863

Deferred income tax expense 4,938 1,382 2,347

Changes in operating assets and liabilities:

Accounts receivable, net 1,095 611 (4,232)

Inventories 217 (238) (76)

Vendor non-trade receivables (51) (3,735) (2,220)

Other current and non-current assets 1,090 (179) 167

Accounts payable 1,791 5,400 5,938

Deferred revenue (1,554) 1,042 1,460

Other current and non-current liabilities (2,104) 8,746 6,010

Cash generated by operating activities 65,824 81,266 59,713

Investing activities:

Purchases of marketable securities (142,428) (166,402) (217,128)

Proceeds from maturities of marketable securities 21,258 14,538 18,810

Proceeds from sales of marketable securities 90,536 107,447 189,301

Payments made in connection with business acquisitions, net (297) (343) (3,765)

Payments for acquisition of property, plant and equipment (12,734) (11,247) (9,571)

Payments for acquisition of intangible assets (814) (241) (242)

Payments for strategic investments (1,388) — (10)

Other (110) (26) 26

Cash used in investing activities (45,977) (56,274) (22,579)

Financing activities:

Proceeds from issuance of common stock 495 543 730

Excess tax benefits from equity awards 407 749 739

Payments for taxes related to net share settlement of equity awards (1,570) (1,499) (1,158)

Payments for dividends and dividend equivalents (12,150) (11,561) (11,126)

Repurchases of common stock (29,722) (35,253) (45,000)

Proceeds from issuance of term debt, net 24,954 27,114 11,960

Repayments of term debt (2,500) — —

Change in commercial paper, net (397) 2,191 6,306

Cash used in financing activities (20,483) (17,716) (37,549)

Increase/(Decrease) in cash and cash equivalents (636) 7,276 (415)

Cash and cash equivalents, end of the year $ 20,484 $ 21,120 $ 13,844

Supplemental cash flow disclosure:

Cash paid for income taxes, net $ 10,444 $ 13,252 $ 10,026

Cash paid for interest $ 1,316 $ 514 $ 339

See accompanying Notes to Consolidated Financial Statements.

Apple Inc. | 2016 Form 10-K | 43

You might also like

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Cashflow Analysis - Beta - GammaDocument14 pagesCashflow Analysis - Beta - Gammashahin selkarNo ratings yet

- 2021 Full Year Cash Flow StatementDocument1 page2021 Full Year Cash Flow StatementROYAL ENFIELDNo ratings yet

- Dell Financial Data Mid Course Quiz 1668627324062Document10 pagesDell Financial Data Mid Course Quiz 1668627324062rohit goyalNo ratings yet

- Yahoo Annual Report 2006Document2 pagesYahoo Annual Report 2006domini809No ratings yet

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsDocument1 pageThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05No ratings yet

- Consolidated Statements of Cash Flows (In Millions) : Year Ended December 31, 2014 2015 2016Document11 pagesConsolidated Statements of Cash Flows (In Millions) : Year Ended December 31, 2014 2015 2016Ritu SinghNo ratings yet

- Ford 18Document6 pagesFord 18Bhavdeep singh sidhuNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- 2021 Full Year FinancialsDocument2 pages2021 Full Year FinancialsFuaad DodooNo ratings yet

- GT BankDocument1 pageGT BankFuaad DodooNo ratings yet

- Microsoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Document1 pageMicrosoft Corporation: (In Millions) Year Ended June 30, 2010 2009 2008Dylan MakroNo ratings yet

- Final 2021 CBG Summary Fs 2021 SignedDocument2 pagesFinal 2021 CBG Summary Fs 2021 SignedFuaad DodooNo ratings yet

- 2016 Fullyear Cash Flow StatementDocument1 page2016 Fullyear Cash Flow StatementSilvana ElenaNo ratings yet

- Increase in Long Term Loans and AdvancesDocument2 pagesIncrease in Long Term Loans and Advancesusama siddiquiNo ratings yet

- Table #1. Cash Flow StatementDocument6 pagesTable #1. Cash Flow StatementDzerassaNo ratings yet

- Boa Financials For q3 30 Sept. 2021Document1 pageBoa Financials For q3 30 Sept. 2021Fuaad DodooNo ratings yet

- Cash Flow Statement 2016-2020Document8 pagesCash Flow Statement 2016-2020yip manNo ratings yet

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- ILAM FAHARI I REIT - Audited Finacncials 2020Document1 pageILAM FAHARI I REIT - Audited Finacncials 2020An AntonyNo ratings yet

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Document2 pagesReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariNo ratings yet

- 105 10 Amazon Financial StatementsDocument5 pages105 10 Amazon Financial StatementsCharles Vladimir SolvaskyNo ratings yet

- Annual Report 2023Document27 pagesAnnual Report 2023ALNo ratings yet

- Cash Flow Statement Lourdesllanes2022 FINALDocument5 pagesCash Flow Statement Lourdesllanes2022 FINALDv AccountingNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- Cash-Flow-Statement (1) Marvell TechnologiesDocument5 pagesCash-Flow-Statement (1) Marvell TechnologiesRuthNo ratings yet

- Cash Flow, Cash N Cash EquivalentsDocument3 pagesCash Flow, Cash N Cash EquivalentsKalama ZooNo ratings yet

- Coca-Cola Co.: Consolidated Cash Flow StatementDocument6 pagesCoca-Cola Co.: Consolidated Cash Flow StatementDBNo ratings yet

- AirtelDocument2 pagesAirtelShraddha RawatNo ratings yet

- Consolidated Cash Flow StatementDocument1 pageConsolidated Cash Flow Statementsurya553No ratings yet

- UBL Annual Report 2018-170Document1 pageUBL Annual Report 2018-170IFRS LabNo ratings yet

- UBL Annual Report 2018-79Document1 pageUBL Annual Report 2018-79IFRS LabNo ratings yet

- Cashflow 2007Document1 pageCashflow 2007Zeeshan SiddiqueNo ratings yet

- Intermediate AccountingDocument5 pagesIntermediate AccountingWindelyn ButraNo ratings yet

- Sunbeam Group AssignmentDocument9 pagesSunbeam Group Assignmentshubhangini SaindaneNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- Consolidated Cash FlowDocument1 pageConsolidated Cash FlowKingsley EimogaNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- Akzonobel Report18 Cons Cash FlowsDocument1 pageAkzonobel Report18 Cons Cash FlowsS A M E E U L L A H S O O M R ONo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- Access BankDocument1 pageAccess BankFuaad DodooNo ratings yet

- Colgate Cash FlowsDocument2 pagesColgate Cash FlowsChetan DhuriNo ratings yet

- Session 5a Cash Flow Statement: HI5020 Corporate AccountingDocument11 pagesSession 5a Cash Flow Statement: HI5020 Corporate AccountingFeku RamNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Cash Flow Statement: For The Year Ended 31st March, 2019Document2 pagesCash Flow Statement: For The Year Ended 31st March, 2019Abhishek RajpootNo ratings yet

- Cash Flow Statement Nds FINALDocument5 pagesCash Flow Statement Nds FINALDv AccountingNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow StatementFurqan FakharNo ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016Document1 pageTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016LymeParkNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- FBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Document1 pageFBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Fuaad DodooNo ratings yet

- GB20003: International Financial Statement Analysis Individual Case Study (30%)Document7 pagesGB20003: International Financial Statement Analysis Individual Case Study (30%)Priyah RathakrishnahNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Vitrox q42014Document10 pagesVitrox q42014Dennis AngNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- Unaudited Summary Consolidated and Separate Financial StatementsDocument2 pagesUnaudited Summary Consolidated and Separate Financial Statementsbentilwilliams65No ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Oracle Finance Trial Balance and Ledger DetailsDocument59 pagesOracle Finance Trial Balance and Ledger DetailsKatie RuizNo ratings yet

- Notes For Business AnalyticsDocument10 pagesNotes For Business AnalyticsSakshi ShardaNo ratings yet

- Design, Fabrication, Supply & Commissioning of Stainless Steel Chemical SkidsDocument2 pagesDesign, Fabrication, Supply & Commissioning of Stainless Steel Chemical SkidsrutujaNo ratings yet

- Managing Relationship and Building LoyaltyDocument18 pagesManaging Relationship and Building Loyaltypooja TarvanNo ratings yet

- The Implementation of ISO9000 in Vietnam: Case Studies From The Footwear IndustryDocument10 pagesThe Implementation of ISO9000 in Vietnam: Case Studies From The Footwear Industrysps fetrNo ratings yet

- Nestlé OrganisationDocument5 pagesNestlé OrganisationMangerol22100% (2)

- Accounting and Reporting PracticeDocument43 pagesAccounting and Reporting PracticeAgidew ShewalemiNo ratings yet

- Abinbev Esg 2021 FinalDocument96 pagesAbinbev Esg 2021 FinalVan OnNo ratings yet

- 03 0450 22 MS Prov Rma 20022023Document21 pages03 0450 22 MS Prov Rma 20022023abin alexanderNo ratings yet

- Some - Tricks - To - Utilize - Thread - by - Denizhanozay - Feb 2, 23 - From - RattibhaDocument8 pagesSome - Tricks - To - Utilize - Thread - by - Denizhanozay - Feb 2, 23 - From - Rattibhasami lyNo ratings yet

- Changes To IProcurement and Purchasing Effective 5th October 2010Document9 pagesChanges To IProcurement and Purchasing Effective 5th October 2010Aman Khan Badal KhanNo ratings yet

- Berlitz Business EnglishDocument11 pagesBerlitz Business EnglishUscpa Donny100% (2)

- Financial Ratios of HulDocument21 pagesFinancial Ratios of HulVaibhav Trivedi0% (1)

- Wholesale and Retail Notes 2.0Document7 pagesWholesale and Retail Notes 2.0Shaine Cariz Montiero SalamatNo ratings yet

- Indonesia Salary Guide 2011 12Document28 pagesIndonesia Salary Guide 2011 12Ridayani DamanikNo ratings yet

- Test Paper 11Document8 pagesTest Paper 11Sukhjinder SinghNo ratings yet

- DOF HandoverChecklistDocument4 pagesDOF HandoverChecklistRamy AmirNo ratings yet

- About Tata AigDocument3 pagesAbout Tata Aigsatishyadav1234No ratings yet

- 2 - FPA (DTC Format Agreement)Document4 pages2 - FPA (DTC Format Agreement)Thomas DyeNo ratings yet

- Nature, Scope and Objectives of PartnershipDocument4 pagesNature, Scope and Objectives of PartnershipKathleenNo ratings yet

- Chapter 3: Requirements ModelingDocument52 pagesChapter 3: Requirements ModelingMat ProNo ratings yet

- The Basics of Predictive / Preventive MaintenanceDocument6 pagesThe Basics of Predictive / Preventive Maintenanceabhinav2018No ratings yet

- Chapter3 - Concurrent Engineering PDFDocument15 pagesChapter3 - Concurrent Engineering PDFSandeep GogadiNo ratings yet

- The Otis Absolutes: Made To Move YouDocument23 pagesThe Otis Absolutes: Made To Move Youmathi alaganNo ratings yet

- Clinical Workflow OptimizationDocument2 pagesClinical Workflow Optimizationfl.evangelioNo ratings yet

- NSA 320 (Revised) "Materiality in Planning and Performing An Audit"Document1 pageNSA 320 (Revised) "Materiality in Planning and Performing An Audit"Roshan AddhikariNo ratings yet

- Bridge Software EngineerDocument3 pagesBridge Software EngineerNguyen Manh CuongNo ratings yet

- Peoplesoft ContractsDocument8 pagesPeoplesoft Contractssumit.gujrani8176No ratings yet

- Worksheet PreparationDocument3 pagesWorksheet PreparationJon PangilinanNo ratings yet

- 6 Types Of: Business PlansDocument2 pages6 Types Of: Business PlansRainier TaliteNo ratings yet