Professional Documents

Culture Documents

What Happens During A VAT Audit

What Happens During A VAT Audit

Uploaded by

Zahra NAHIDCopyright:

Available Formats

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- VAT AuditDocument3 pagesVAT AuditZahra NAHIDNo ratings yet

- Audit 2Document2 pagesAudit 2Cecilia AngelineNo ratings yet

- Guide 04: Tax Overview For Businesses, Investors & IndividualsDocument8 pagesGuide 04: Tax Overview For Businesses, Investors & IndividualsAbdul NafiNo ratings yet

- FISCAL PROCEDURE Cameroon TaxationDocument8 pagesFISCAL PROCEDURE Cameroon TaxationAmba FredNo ratings yet

- Summary of Tax RemediesDocument15 pagesSummary of Tax Remediesquinn ezekielNo ratings yet

- Tax Administration Self Assessment Regulations NigeriaDocument3 pagesTax Administration Self Assessment Regulations NigeriaMark allenNo ratings yet

- Value-Added Tax: DescriptionDocument26 pagesValue-Added Tax: DescriptionGIGI BODONo ratings yet

- Vol7 - No2.pdf.. TaxationDocument6 pagesVol7 - No2.pdf.. TaxationReyboom BautistaNo ratings yet

- Sycip. Gorres, Velayo & Co. 6760 Ayala Avenue: Memo To Audit StaffDocument14 pagesSycip. Gorres, Velayo & Co. 6760 Ayala Avenue: Memo To Audit StaffKRIS ANNE SAMUDIONo ratings yet

- By Rowena Altura: Volume 9 No.12Document6 pagesBy Rowena Altura: Volume 9 No.12arnelmapzNo ratings yet

- Taxes in IndiaDocument6 pagesTaxes in IndiaRAJIV MURALNo ratings yet

- Relationship Between Tax Compliance and Tax Dispute (Including TP Documentation)Document37 pagesRelationship Between Tax Compliance and Tax Dispute (Including TP Documentation)ryu255No ratings yet

- Value Added Tax-PDocument20 pagesValue Added Tax-PMa. Corazon CaramalesNo ratings yet

- TAX REMEDIES NotesDocument66 pagesTAX REMEDIES NotesJane BiancaNo ratings yet

- Tax AuditDocument9 pagesTax AuditUmar Sajjad AwanNo ratings yet

- PWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionDocument5 pagesPWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionAnonymous FnM14a0No ratings yet

- Chapter 1 General Overview of The Tunisian Tax System: I-IntroductionDocument5 pagesChapter 1 General Overview of The Tunisian Tax System: I-IntroductionsaiyanNo ratings yet

- Due Diligence-Tax Due Dil - FinalDocument6 pagesDue Diligence-Tax Due Dil - FinalEljoe VinluanNo ratings yet

- Tech. Used by The BIR in Tax Audit and Investigation of Tax Payers (10.29.13)Document131 pagesTech. Used by The BIR in Tax Audit and Investigation of Tax Payers (10.29.13)Mark Lord Morales Bumagat100% (1)

- Assessment ReturnDocument10 pagesAssessment ReturnTriila manillaNo ratings yet

- Issues, Problems and Solutions in Tax Audit and Investigation (1-10-13)Document184 pagesIssues, Problems and Solutions in Tax Audit and Investigation (1-10-13)marygrace_apaitan100% (2)

- VAT Taxpayer Guide (Input Tax)Document54 pagesVAT Taxpayer Guide (Input Tax)NstrNo ratings yet

- Value-Added TaxDocument33 pagesValue-Added TaxvicsNo ratings yet

- f2 Taxation Revenue AuditDocument5 pagesf2 Taxation Revenue AuditKishan KudiaNo ratings yet

- Amnisty For Tax and Custom DutiesDocument12 pagesAmnisty For Tax and Custom DutieserishysiNo ratings yet

- General Audit Procedures and Documentation-BirDocument3 pagesGeneral Audit Procedures and Documentation-BirAnalyn BanzuelaNo ratings yet

- Interplay of Accounting and Taxation PrinciplesDocument20 pagesInterplay of Accounting and Taxation PrinciplesChelsea BorbonNo ratings yet

- ISE 2019-20 Taxes & Taxation General Rules On Payment of TaxesDocument14 pagesISE 2019-20 Taxes & Taxation General Rules On Payment of TaxesNahidNo ratings yet

- Chapter One .EGADocument13 pagesChapter One .EGAAdugnaNo ratings yet

- Companies Income Tax and Other Taxes As at Feb 2023Document10 pagesCompanies Income Tax and Other Taxes As at Feb 2023BaneNo ratings yet

- 5.1 Taxation IssuesDocument21 pages5.1 Taxation IssuesFranco FungoNo ratings yet

- Net Operating Loss (NOL) Occurs For Tax Purposes in A Year When Tax-Deductible ExpensesDocument2 pagesNet Operating Loss (NOL) Occurs For Tax Purposes in A Year When Tax-Deductible ExpensesYudhis TiraNo ratings yet

- Accounting Standard (As) 22Document12 pagesAccounting Standard (As) 22Sahil GangwaniNo ratings yet

- Tax Management: Planning and ComplianceDocument12 pagesTax Management: Planning and ComplianceNidheesh TpNo ratings yet

- Guidelines and Instructions: BIR Form No. 1702 - Page 4Document2 pagesGuidelines and Instructions: BIR Form No. 1702 - Page 4Vladymir VladymirovnichNo ratings yet

- Deferred Tax IAS 12 by CPA Dr. Peter NjugunaDocument53 pagesDeferred Tax IAS 12 by CPA Dr. Peter Njugunafmsalehin9406No ratings yet

- TAXATIONDocument41 pagesTAXATIONMerry-Jane Ro'a BallesterNo ratings yet

- RR 1 - 1998Document3 pagesRR 1 - 1998Lady Ann CayananNo ratings yet

- Assessment Under Income TaxDocument3 pagesAssessment Under Income TaxBargavi NarayananNo ratings yet

- Acct 304 ProjectDocument12 pagesAcct 304 ProjectAryan DasNo ratings yet

- Statutory Audit ProgramDocument7 pagesStatutory Audit ProgramSuman Pyatha0% (1)

- Taxation - Procedural Due ProcessDocument3 pagesTaxation - Procedural Due ProcessjorgNo ratings yet

- TaxxxxDocument3 pagesTaxxxxfaye gNo ratings yet

- Tax Activity 3..BIR and BOC Reymark GalasinaoDocument2 pagesTax Activity 3..BIR and BOC Reymark Galasinaojaymark canayaNo ratings yet

- Accounting Standard - 22 PPT PresentationDocument25 pagesAccounting Standard - 22 PPT PresentationHimanshu Agrawal0% (1)

- Accounting Standard - 22Document25 pagesAccounting Standard - 22themeditator100% (1)

- TX102 Topic 1 Module 3Document21 pagesTX102 Topic 1 Module 3Richard Rhamil Carganillo Garcia Jr.No ratings yet

- Tax ReviewerDocument17 pagesTax ReviewerSab CardNo ratings yet

- HANDOUT FOR VAT-NewDocument25 pagesHANDOUT FOR VAT-NewCristian RenatusNo ratings yet

- Tax Administration ActDocument52 pagesTax Administration Actasiphileamagiqwa25No ratings yet

- Disposition of Creditable Withholding TaxesDocument2 pagesDisposition of Creditable Withholding TaxesgelskNo ratings yet

- Topic 2 - Tax Administration Taxpayers DutiesDocument12 pagesTopic 2 - Tax Administration Taxpayers DutiesaplacetokeepmynotesNo ratings yet

- 1702 Q Guide July 2008Document1 page1702 Q Guide July 2008fatmaaleahNo ratings yet

- DEFINITIONDocument3 pagesDEFINITIONBùi Thị Minh YếnNo ratings yet

- Due Diligence-Tax Due DilDocument4 pagesDue Diligence-Tax Due DilEljoe VinluanNo ratings yet

- Value Added Tax (Vat) : Difference Between VAT and Sales Tax: VAT Is Levied On Goods andDocument4 pagesValue Added Tax (Vat) : Difference Between VAT and Sales Tax: VAT Is Levied On Goods andMuneeb Ghufran DadawalaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- متصرف من الدرجة الثانيةDocument1 pageمتصرف من الدرجة الثانيةZahra NAHIDNo ratings yet

- Chapter 1 - Introduction: Sl. No Description Page NosDocument126 pagesChapter 1 - Introduction: Sl. No Description Page NosZahra NAHIDNo ratings yet

- VAT AuditDocument3 pagesVAT AuditZahra NAHIDNo ratings yet

- The Objectives of A VAT Audit Are To Evaluate The AccuracyDocument3 pagesThe Objectives of A VAT Audit Are To Evaluate The AccuracyZahra NAHIDNo ratings yet

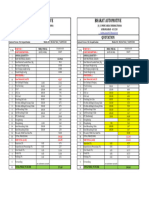

- Nouveau Feuille de Calcul Microsoft ExcelDocument9 pagesNouveau Feuille de Calcul Microsoft ExcelZahra NAHIDNo ratings yet

- Chapter Two 90Document12 pagesChapter Two 90Tamirat HailuNo ratings yet

- PS3Document21 pagesPS3Veysel KabaNo ratings yet

- Gitomer Container Leasing CompanyDocument8 pagesGitomer Container Leasing CompanySHUBHAM NEVASENo ratings yet

- ACCOUNTING NGOs ETHIOPIADocument10 pagesACCOUNTING NGOs ETHIOPIAIndrajit GoswamiNo ratings yet

- For Official Use Only: GMP Audit ReportDocument21 pagesFor Official Use Only: GMP Audit ReportserayemaydaNo ratings yet

- Legal & Regulatory Framework of M&ADocument7 pagesLegal & Regulatory Framework of M&AabdullahshamimNo ratings yet

- Propeller Shaft Dubble BallDocument1 pagePropeller Shaft Dubble BallcontactNo ratings yet

- Managing Strategy Operations and Partnerships 1773803 194477557Document32 pagesManaging Strategy Operations and Partnerships 1773803 194477557Gontla Sai SrijaNo ratings yet

- Flipkart APMDocument10 pagesFlipkart APMAyush ChoubeyNo ratings yet

- BriefHistoryCSR PartOne AdrianDocument2 pagesBriefHistoryCSR PartOne AdrianSadrac CenophatNo ratings yet

- AnswersDocument6 pagesAnswersDracule MihawkNo ratings yet

- PPRA Islamabad Conference Participants ListDocument6 pagesPPRA Islamabad Conference Participants ListAzhar HayatNo ratings yet

- 2 Sales of Goods and ServicesDocument37 pages2 Sales of Goods and ServicesMobile LegendsNo ratings yet

- Online Shopping Website: Electronics and Communication EngineeringDocument10 pagesOnline Shopping Website: Electronics and Communication EngineeringRohit RanaNo ratings yet

- Previous L&M MockexamsDocument10 pagesPrevious L&M MockexamsGlaiza Fe GomezNo ratings yet

- Detroit Case StudyDocument2 pagesDetroit Case Studyjohnnnnn280% (1)

- 681 Termination RequestDocument1 page681 Termination RequestDanielNo ratings yet

- International Economics 9Th Edition Appleyard Solutions Manual Full Chapter PDFDocument35 pagesInternational Economics 9Th Edition Appleyard Solutions Manual Full Chapter PDFjocastaodettezjs8100% (13)

- Competitiveness, Strategy, and Productivity: Mcgraw-Hill/IrwinDocument39 pagesCompetitiveness, Strategy, and Productivity: Mcgraw-Hill/Irwinsabda badiaNo ratings yet

- 1016 - How To Make $2,000 Per Week With Beyond InfinityDocument10 pages1016 - How To Make $2,000 Per Week With Beyond InfinityPolly WopsNo ratings yet

- Akd 736105709632Document1 pageAkd 736105709632Nguyễn Quang HuyNo ratings yet

- Corporate Sustainability and International Development Assignment 2Document3 pagesCorporate Sustainability and International Development Assignment 2nafis.mehdi9No ratings yet

- JAAB: Jurnal of Applied Accounting and BusinessDocument8 pagesJAAB: Jurnal of Applied Accounting and BusinessBrown kittenNo ratings yet

- Industrial Region IndiaDocument10 pagesIndustrial Region Indiaravi ohlyanNo ratings yet

- Fina Kaizen LG2Document101 pagesFina Kaizen LG2tamirat fikaduNo ratings yet

- Shree Krishna Trading Cowh: Terms &conditionsemensDocument2 pagesShree Krishna Trading Cowh: Terms &conditionsemensGeorge GNo ratings yet

- Generalized PaySlip For EmployeeDocument1 pageGeneralized PaySlip For EmployeePalash NaskarNo ratings yet

- Answer: P 4,800,000.: Nondetachable Warrants Givingthebondholderstherighttopurchase16,000p100parDocument5 pagesAnswer: P 4,800,000.: Nondetachable Warrants Givingthebondholderstherighttopurchase16,000p100parGenelayn TalabocNo ratings yet

- What Is CapitalismDocument5 pagesWhat Is CapitalismAifel Joy Dayao FranciscoNo ratings yet

- History of The Nigerian Postal ServiceDocument26 pagesHistory of The Nigerian Postal ServiceMo HirsiNo ratings yet

What Happens During A VAT Audit

What Happens During A VAT Audit

Uploaded by

Zahra NAHIDOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Happens During A VAT Audit

What Happens During A VAT Audit

Uploaded by

Zahra NAHIDCopyright:

Available Formats

What happens during a VAT audit?

Value Added Tax (VAT) is a self-declared system of taxation. Every three or six

months (or once a month), all taxable persons liable for VAT must send a VAT

return and pay any amounts they owe.

The Federal Tax Administration (FTA) only performs limited audits of VAT returns. The

purpose of these audits is to ensure that all taxable persons are treated equally. They

also serve to provide information on the correct application of the tax directives and the

appropriate reporting of turnover figures, and to determine the amount of input tax

payable.

Companies often state that they appreciate the fact that their accounting is assessed in a

different manner.

On-site audit procedure

The VAT accountant contacts the taxable person by phone before the audit and agrees

with the person in charge (and the fiduciary) on the date, place of audit, period covered

by the audit and its approximate duration. The accountant will also inform the taxable

person of the documents (e.g. accounts, annual financial statements, land register, copy

of the VAT reports, payroll records, outgoing and incoming invoices, import and export

documents, etc.) to be presented.

After the telephone call, other information can be exchanged such as the preparation of

financial statements, whether taxable partner companies are to be audited, etc. The audit

announced by phone will then be confirmed in writing (legal requirement).

The VAT accountant will first obtain information on the business activities, the specific

and specialist features of the company, the management of the business, the number of

employees and the persons responsible for the accounts and VAT returns.

Then, based on various accounting records, the accountant will check that all income

has been fully reported. Such income includes: income derived from deliveries and

services; the consideration derived from the sale of means of production, from private

shares, acquisition taxes, and own use (for individual reasons only). The audit also

covers turnover excluded from the scope of the tax and items not valued as

consideration (such as gifts, dividends, and damages). Such turnover is compared to

items described as consideration (turnover) that the taxable individual has declared on

the VAT return. The total turnover thus determined is compared to items described as

consideration that the taxable individual has declared on the VAT return. The VAT

accountant will discuss any discrepancies, if applicable, and make the appropriate

adjustments.

The accountant will also check the following:

Audit of the substantive and formal accuracy of the accounts;

Audit of turnover – random checks of invoices and receipts; correct application of

the different tax rates; and comparison between VAT returns and accounts;

Audit of input tax deductions – for example, are the input tax deductions

calculated by the taxable individual correct? Is the corresponding evidence

available (formal and substantive proof)? Have any necessary corrections to the

input tax or to events related to own use information been deducted and

reported correctly?

The corresponding acquisition tax will be audited at the same time as the audit of

expenses. Consequently, the specialist VAT accountant will also examine the

evidence when the taxable person reports their tax using the net-tax rate or the

flat-rate systems.

Audit of specific elements and tax-generating events such as exchanges of

services with related persons, services that have not been formally justified,

change of use, mixed use, advance payments, contracts, etc.

The final report prepared by the specialist VAT accountant will be reviewed with the

taxable person. He/she will provide provisional lists and calculations for subsequent

payments or credit for individual items. At the end of the VAT audit, the taxable person

will receive a provisional tax calculation (decision can be appealed within 30 days) along

with instructions.

Items most frequently requiring adjustment are:

unexplained and non-justified differences relating to turnover;

corrections or deductions of the input tax not carried out;

own use not declared (correction of the input tax), for sole proprietors;

incorrect or lack of available evidence for the input tax, imports or exports;

charges not justified by the business use.

Recommendation: In practice it is virtually impossible to correct errors made. For this

reason, it is best to regularly consult an accountant who will draw your attention to

systematic errors.

Taxable persons must ensure their accounts tally with the VAT returns reported, in

accordance with the law governing VAT. This process is termed as the finalization of

accounts or the auditing of the compliance between turnover and input tax. Accounts

must be finalized within 180 days following the end of the accounting period. Any

differences (payable by or to the taxable person) must be notified in writing to the

Federal Tax Administration FTA with the 5th VAT return (called the annual compliance

statement or the corrected return).

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- VAT AuditDocument3 pagesVAT AuditZahra NAHIDNo ratings yet

- Audit 2Document2 pagesAudit 2Cecilia AngelineNo ratings yet

- Guide 04: Tax Overview For Businesses, Investors & IndividualsDocument8 pagesGuide 04: Tax Overview For Businesses, Investors & IndividualsAbdul NafiNo ratings yet

- FISCAL PROCEDURE Cameroon TaxationDocument8 pagesFISCAL PROCEDURE Cameroon TaxationAmba FredNo ratings yet

- Summary of Tax RemediesDocument15 pagesSummary of Tax Remediesquinn ezekielNo ratings yet

- Tax Administration Self Assessment Regulations NigeriaDocument3 pagesTax Administration Self Assessment Regulations NigeriaMark allenNo ratings yet

- Value-Added Tax: DescriptionDocument26 pagesValue-Added Tax: DescriptionGIGI BODONo ratings yet

- Vol7 - No2.pdf.. TaxationDocument6 pagesVol7 - No2.pdf.. TaxationReyboom BautistaNo ratings yet

- Sycip. Gorres, Velayo & Co. 6760 Ayala Avenue: Memo To Audit StaffDocument14 pagesSycip. Gorres, Velayo & Co. 6760 Ayala Avenue: Memo To Audit StaffKRIS ANNE SAMUDIONo ratings yet

- By Rowena Altura: Volume 9 No.12Document6 pagesBy Rowena Altura: Volume 9 No.12arnelmapzNo ratings yet

- Taxes in IndiaDocument6 pagesTaxes in IndiaRAJIV MURALNo ratings yet

- Relationship Between Tax Compliance and Tax Dispute (Including TP Documentation)Document37 pagesRelationship Between Tax Compliance and Tax Dispute (Including TP Documentation)ryu255No ratings yet

- Value Added Tax-PDocument20 pagesValue Added Tax-PMa. Corazon CaramalesNo ratings yet

- TAX REMEDIES NotesDocument66 pagesTAX REMEDIES NotesJane BiancaNo ratings yet

- Tax AuditDocument9 pagesTax AuditUmar Sajjad AwanNo ratings yet

- PWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionDocument5 pagesPWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionAnonymous FnM14a0No ratings yet

- Chapter 1 General Overview of The Tunisian Tax System: I-IntroductionDocument5 pagesChapter 1 General Overview of The Tunisian Tax System: I-IntroductionsaiyanNo ratings yet

- Due Diligence-Tax Due Dil - FinalDocument6 pagesDue Diligence-Tax Due Dil - FinalEljoe VinluanNo ratings yet

- Tech. Used by The BIR in Tax Audit and Investigation of Tax Payers (10.29.13)Document131 pagesTech. Used by The BIR in Tax Audit and Investigation of Tax Payers (10.29.13)Mark Lord Morales Bumagat100% (1)

- Assessment ReturnDocument10 pagesAssessment ReturnTriila manillaNo ratings yet

- Issues, Problems and Solutions in Tax Audit and Investigation (1-10-13)Document184 pagesIssues, Problems and Solutions in Tax Audit and Investigation (1-10-13)marygrace_apaitan100% (2)

- VAT Taxpayer Guide (Input Tax)Document54 pagesVAT Taxpayer Guide (Input Tax)NstrNo ratings yet

- Value-Added TaxDocument33 pagesValue-Added TaxvicsNo ratings yet

- f2 Taxation Revenue AuditDocument5 pagesf2 Taxation Revenue AuditKishan KudiaNo ratings yet

- Amnisty For Tax and Custom DutiesDocument12 pagesAmnisty For Tax and Custom DutieserishysiNo ratings yet

- General Audit Procedures and Documentation-BirDocument3 pagesGeneral Audit Procedures and Documentation-BirAnalyn BanzuelaNo ratings yet

- Interplay of Accounting and Taxation PrinciplesDocument20 pagesInterplay of Accounting and Taxation PrinciplesChelsea BorbonNo ratings yet

- ISE 2019-20 Taxes & Taxation General Rules On Payment of TaxesDocument14 pagesISE 2019-20 Taxes & Taxation General Rules On Payment of TaxesNahidNo ratings yet

- Chapter One .EGADocument13 pagesChapter One .EGAAdugnaNo ratings yet

- Companies Income Tax and Other Taxes As at Feb 2023Document10 pagesCompanies Income Tax and Other Taxes As at Feb 2023BaneNo ratings yet

- 5.1 Taxation IssuesDocument21 pages5.1 Taxation IssuesFranco FungoNo ratings yet

- Net Operating Loss (NOL) Occurs For Tax Purposes in A Year When Tax-Deductible ExpensesDocument2 pagesNet Operating Loss (NOL) Occurs For Tax Purposes in A Year When Tax-Deductible ExpensesYudhis TiraNo ratings yet

- Accounting Standard (As) 22Document12 pagesAccounting Standard (As) 22Sahil GangwaniNo ratings yet

- Tax Management: Planning and ComplianceDocument12 pagesTax Management: Planning and ComplianceNidheesh TpNo ratings yet

- Guidelines and Instructions: BIR Form No. 1702 - Page 4Document2 pagesGuidelines and Instructions: BIR Form No. 1702 - Page 4Vladymir VladymirovnichNo ratings yet

- Deferred Tax IAS 12 by CPA Dr. Peter NjugunaDocument53 pagesDeferred Tax IAS 12 by CPA Dr. Peter Njugunafmsalehin9406No ratings yet

- TAXATIONDocument41 pagesTAXATIONMerry-Jane Ro'a BallesterNo ratings yet

- RR 1 - 1998Document3 pagesRR 1 - 1998Lady Ann CayananNo ratings yet

- Assessment Under Income TaxDocument3 pagesAssessment Under Income TaxBargavi NarayananNo ratings yet

- Acct 304 ProjectDocument12 pagesAcct 304 ProjectAryan DasNo ratings yet

- Statutory Audit ProgramDocument7 pagesStatutory Audit ProgramSuman Pyatha0% (1)

- Taxation - Procedural Due ProcessDocument3 pagesTaxation - Procedural Due ProcessjorgNo ratings yet

- TaxxxxDocument3 pagesTaxxxxfaye gNo ratings yet

- Tax Activity 3..BIR and BOC Reymark GalasinaoDocument2 pagesTax Activity 3..BIR and BOC Reymark Galasinaojaymark canayaNo ratings yet

- Accounting Standard - 22 PPT PresentationDocument25 pagesAccounting Standard - 22 PPT PresentationHimanshu Agrawal0% (1)

- Accounting Standard - 22Document25 pagesAccounting Standard - 22themeditator100% (1)

- TX102 Topic 1 Module 3Document21 pagesTX102 Topic 1 Module 3Richard Rhamil Carganillo Garcia Jr.No ratings yet

- Tax ReviewerDocument17 pagesTax ReviewerSab CardNo ratings yet

- HANDOUT FOR VAT-NewDocument25 pagesHANDOUT FOR VAT-NewCristian RenatusNo ratings yet

- Tax Administration ActDocument52 pagesTax Administration Actasiphileamagiqwa25No ratings yet

- Disposition of Creditable Withholding TaxesDocument2 pagesDisposition of Creditable Withholding TaxesgelskNo ratings yet

- Topic 2 - Tax Administration Taxpayers DutiesDocument12 pagesTopic 2 - Tax Administration Taxpayers DutiesaplacetokeepmynotesNo ratings yet

- 1702 Q Guide July 2008Document1 page1702 Q Guide July 2008fatmaaleahNo ratings yet

- DEFINITIONDocument3 pagesDEFINITIONBùi Thị Minh YếnNo ratings yet

- Due Diligence-Tax Due DilDocument4 pagesDue Diligence-Tax Due DilEljoe VinluanNo ratings yet

- Value Added Tax (Vat) : Difference Between VAT and Sales Tax: VAT Is Levied On Goods andDocument4 pagesValue Added Tax (Vat) : Difference Between VAT and Sales Tax: VAT Is Levied On Goods andMuneeb Ghufran DadawalaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- متصرف من الدرجة الثانيةDocument1 pageمتصرف من الدرجة الثانيةZahra NAHIDNo ratings yet

- Chapter 1 - Introduction: Sl. No Description Page NosDocument126 pagesChapter 1 - Introduction: Sl. No Description Page NosZahra NAHIDNo ratings yet

- VAT AuditDocument3 pagesVAT AuditZahra NAHIDNo ratings yet

- The Objectives of A VAT Audit Are To Evaluate The AccuracyDocument3 pagesThe Objectives of A VAT Audit Are To Evaluate The AccuracyZahra NAHIDNo ratings yet

- Nouveau Feuille de Calcul Microsoft ExcelDocument9 pagesNouveau Feuille de Calcul Microsoft ExcelZahra NAHIDNo ratings yet

- Chapter Two 90Document12 pagesChapter Two 90Tamirat HailuNo ratings yet

- PS3Document21 pagesPS3Veysel KabaNo ratings yet

- Gitomer Container Leasing CompanyDocument8 pagesGitomer Container Leasing CompanySHUBHAM NEVASENo ratings yet

- ACCOUNTING NGOs ETHIOPIADocument10 pagesACCOUNTING NGOs ETHIOPIAIndrajit GoswamiNo ratings yet

- For Official Use Only: GMP Audit ReportDocument21 pagesFor Official Use Only: GMP Audit ReportserayemaydaNo ratings yet

- Legal & Regulatory Framework of M&ADocument7 pagesLegal & Regulatory Framework of M&AabdullahshamimNo ratings yet

- Propeller Shaft Dubble BallDocument1 pagePropeller Shaft Dubble BallcontactNo ratings yet

- Managing Strategy Operations and Partnerships 1773803 194477557Document32 pagesManaging Strategy Operations and Partnerships 1773803 194477557Gontla Sai SrijaNo ratings yet

- Flipkart APMDocument10 pagesFlipkart APMAyush ChoubeyNo ratings yet

- BriefHistoryCSR PartOne AdrianDocument2 pagesBriefHistoryCSR PartOne AdrianSadrac CenophatNo ratings yet

- AnswersDocument6 pagesAnswersDracule MihawkNo ratings yet

- PPRA Islamabad Conference Participants ListDocument6 pagesPPRA Islamabad Conference Participants ListAzhar HayatNo ratings yet

- 2 Sales of Goods and ServicesDocument37 pages2 Sales of Goods and ServicesMobile LegendsNo ratings yet

- Online Shopping Website: Electronics and Communication EngineeringDocument10 pagesOnline Shopping Website: Electronics and Communication EngineeringRohit RanaNo ratings yet

- Previous L&M MockexamsDocument10 pagesPrevious L&M MockexamsGlaiza Fe GomezNo ratings yet

- Detroit Case StudyDocument2 pagesDetroit Case Studyjohnnnnn280% (1)

- 681 Termination RequestDocument1 page681 Termination RequestDanielNo ratings yet

- International Economics 9Th Edition Appleyard Solutions Manual Full Chapter PDFDocument35 pagesInternational Economics 9Th Edition Appleyard Solutions Manual Full Chapter PDFjocastaodettezjs8100% (13)

- Competitiveness, Strategy, and Productivity: Mcgraw-Hill/IrwinDocument39 pagesCompetitiveness, Strategy, and Productivity: Mcgraw-Hill/Irwinsabda badiaNo ratings yet

- 1016 - How To Make $2,000 Per Week With Beyond InfinityDocument10 pages1016 - How To Make $2,000 Per Week With Beyond InfinityPolly WopsNo ratings yet

- Akd 736105709632Document1 pageAkd 736105709632Nguyễn Quang HuyNo ratings yet

- Corporate Sustainability and International Development Assignment 2Document3 pagesCorporate Sustainability and International Development Assignment 2nafis.mehdi9No ratings yet

- JAAB: Jurnal of Applied Accounting and BusinessDocument8 pagesJAAB: Jurnal of Applied Accounting and BusinessBrown kittenNo ratings yet

- Industrial Region IndiaDocument10 pagesIndustrial Region Indiaravi ohlyanNo ratings yet

- Fina Kaizen LG2Document101 pagesFina Kaizen LG2tamirat fikaduNo ratings yet

- Shree Krishna Trading Cowh: Terms &conditionsemensDocument2 pagesShree Krishna Trading Cowh: Terms &conditionsemensGeorge GNo ratings yet

- Generalized PaySlip For EmployeeDocument1 pageGeneralized PaySlip For EmployeePalash NaskarNo ratings yet

- Answer: P 4,800,000.: Nondetachable Warrants Givingthebondholderstherighttopurchase16,000p100parDocument5 pagesAnswer: P 4,800,000.: Nondetachable Warrants Givingthebondholderstherighttopurchase16,000p100parGenelayn TalabocNo ratings yet

- What Is CapitalismDocument5 pagesWhat Is CapitalismAifel Joy Dayao FranciscoNo ratings yet

- History of The Nigerian Postal ServiceDocument26 pagesHistory of The Nigerian Postal ServiceMo HirsiNo ratings yet