Professional Documents

Culture Documents

Finance Notes

Finance Notes

Uploaded by

kapiltyagi30Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Notes

Finance Notes

Uploaded by

kapiltyagi30Copyright:

Available Formats

What Does Private Equity Mean? Equity capital that is not quoted on a public exchange.

Private equity consists of investors and funds that make investments directly into private companies or conduct buyouts of public companies that result in a delisting of public equity.Many private equity firms conduct what are known as leveraged buyouts (LBOs), where large amounts of debt are issued to fund a large purchase. Private equity firms will then try to improve the financial results and prospects of the company in the hope of reselling the company to another firm or cashing out via an IPO. private equity firms invest in both privately and publicly held companies. Interest Coverage Ratio The interest coverage ratio is used to determine how easily a company can pay interest expenses on outstanding debt. The ratio is calculated by dividing a company's earnings before interest and taxes (EBIT) by the company's interest expenses for the same period. The lower the ratio, the more the company is burdened by debt expense. When a company's interest coverage ratio is only 1.5 or lower, its ability to meet interest expenses may be questionable. Formula:

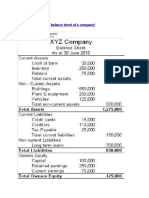

Current Ratio :The current ratio (or liquidity ratio) is a measure of financial strength. The number of times current assets exceed current liabilities is a valuable expression of a business' solvency. Here is the formula to compute the current ratio: Total Current Assets Current Ratio = Total Current Liabilities

A rule-of-thumb puts a strong current ratio at two Quick Ratio :The quick ratio is also called the "acid test" ratio. It is a measure of a company's liquidity. The quick ratio looks only at a company's most liquid assets and divides them by current liabilities. Here is the formula for the quick ratio: Current Assets - Inventory Quick Ratio = Total Current Liabilities

The assets considered to be "quick" assets are cash, stocks and bonds, and accounts receivable (all of the current assets on the balance sheet except inventory). The quick

ratio is an acid test of whether or not a business can meet its obligations if adverse conditions occur. Generally, quick ratios between .50 and 1 are considered satisfactory as long as the collection of receivables is not expected to slow. Working Capital :Working capital should always be a positive number. It is used by lenders to evaluate a company's ability to weather hard times. Often, loan agreements specify a level of working capital that the borrower must maintain. The current ratio, quick ratio and working capital are all measures of a company's liquidity. In general, the higher these ratios are, the better for the business and the higher degree of liquidity. Working Capital = Total Current Assets - Total Current Liabilities Debt/Worth Ratio :The debt/worth ratio (or leverage ratio) is an indicator of a business' solvency. It is a measure of how dependent a company is on debt financing (or borrowings) as compared to owner's equity. It shows how much of a business is owned and how much is owed. The debt/worth ratio is computed as follows: Total Liabilities Debt/Worth Ratio = Net Worth The P/E ratio (price-to-earnings ratio) of a stock (also called its "P/E", or simply "multiple") is a measure of the price paid for ashare relative to the annual net income or profit earned by the firm per share The reciprocal of the P/E ratio is known as the earnings yield.[3] The earnings yield is an estimate of expected return to be earned from holding the stock

"ROE" means Return on equity. The amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested. ROE is expressed as a percentage and calculated as: Return on Equity = Net Income/Shareholder's Equity book value book value means the value of any asset showen in financial statements A contingent liability is a potential liability it depends on a future event occurring or not occurring. If a company is sued by a former employee for Rs500,000 for age discrimination,

the company has a contingent liability. If the company is found guilty, it will have a liability. However, if the company is not found guilty, the company will not have an actual liability.

You might also like

- Rh134 9.0 Student GuideDocument434 pagesRh134 9.0 Student Guidehorvtoys100% (1)

- 2 - Liberty Karaoke - All Songs by ArtistDocument78 pages2 - Liberty Karaoke - All Songs by ArtistAlanFowlerNo ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Homework Coaching Questions 1Document4 pagesHomework Coaching Questions 1Makkai BarbaraNo ratings yet

- Ratio AnalysisDocument48 pagesRatio AnalysisAnuranjanSinha100% (10)

- Ratios Used in Credit Analysis: August 10, 2012Document3 pagesRatios Used in Credit Analysis: August 10, 2012Moaaz AhmedNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisVIPLAV SRIVASTAVNo ratings yet

- Financial Health: What Is 'Working Capital'Document11 pagesFinancial Health: What Is 'Working Capital'arhijaziNo ratings yet

- What Does Capital Expenditure - CAPEX Mean?Document5 pagesWhat Does Capital Expenditure - CAPEX Mean?saber21chatterjeeNo ratings yet

- Study Guide Module 10Document16 pagesStudy Guide Module 10Ryan Paul MangaliagNo ratings yet

- Return On Assets (ROA) : Index of Industrial Production IIP Purchasing Managers' Index PMIDocument4 pagesReturn On Assets (ROA) : Index of Industrial Production IIP Purchasing Managers' Index PMIMuskan MNo ratings yet

- Tata Motors.: Liquidity RatiosDocument11 pagesTata Motors.: Liquidity RatiosAamir ShadNo ratings yet

- Financial LeverageDocument7 pagesFinancial LeverageGeanelleRicanorEsperonNo ratings yet

- Financial Strategic MeasuresDocument17 pagesFinancial Strategic MeasuresVIVEK KUMARNo ratings yet

- Most Important Financial RatiosDocument2 pagesMost Important Financial RatiosEllaine Pearl AlmillaNo ratings yet

- Theoretical PerspectiveDocument12 pagesTheoretical PerspectivepopliyogeshanilNo ratings yet

- Current RatioDocument22 pagesCurrent RatioAsawarNo ratings yet

- What Does Receivables Turnover Ratio Mean?Document9 pagesWhat Does Receivables Turnover Ratio Mean?azyNo ratings yet

- Day 10 - Ratio Analysis Part2Document19 pagesDay 10 - Ratio Analysis Part2Darshana RNo ratings yet

- Debt-to-Equity Ratio: Top 5 Financial RatiosDocument2 pagesDebt-to-Equity Ratio: Top 5 Financial RatiosShuva SudebNo ratings yet

- Financial AnalysisDocument28 pagesFinancial AnalysisLowelyn PresidenteNo ratings yet

- Financial RatiosDocument7 pagesFinancial RatiosarungarNo ratings yet

- FM Chapter 3 NotesDocument22 pagesFM Chapter 3 NotesMadesh KuppuswamyNo ratings yet

- Debt To Equity Ratio InterpretationDocument2 pagesDebt To Equity Ratio Interpretationarav0607No ratings yet

- Accounting Ratios Am 71 80Document36 pagesAccounting Ratios Am 71 80Sandy100% (1)

- Ratio Analysis: Theory and ProblemsDocument51 pagesRatio Analysis: Theory and ProblemsAnit Jacob Philip100% (2)

- 58 Ratio Analysis Techniques PDFDocument8 pages58 Ratio Analysis Techniques PDF9raahuulNo ratings yet

- Financial Analysis Tools - HandoutsDocument2 pagesFinancial Analysis Tools - HandoutsJohna Mae Dolar EtangNo ratings yet

- Chapter 2Document12 pagesChapter 2bhavana bhumarajuNo ratings yet

- Unit 2 RatioDocument51 pagesUnit 2 Ratiov9510491No ratings yet

- Financial Statement Ratio AnalysisDocument5 pagesFinancial Statement Ratio AnalysisAdil AliNo ratings yet

- Assignment On: Financial Statement Analysis FIN 4218Document28 pagesAssignment On: Financial Statement Analysis FIN 4218নাফিস ইকবাল আকিলNo ratings yet

- How To Evaluate FSDocument8 pagesHow To Evaluate FSStephany PolinarNo ratings yet

- Liquidity Ratio: What Are Liquidity Ratios?Document11 pagesLiquidity Ratio: What Are Liquidity Ratios?Ritesh KumarNo ratings yet

- Liquidity Ratios:: Current Ratio: It Is Used To Test A Company's LiquidityDocument12 pagesLiquidity Ratios:: Current Ratio: It Is Used To Test A Company's LiquidityDinesh RathinamNo ratings yet

- Ratios and Their Meanings. Leverage RatioDocument3 pagesRatios and Their Meanings. Leverage RatioNaitik JainNo ratings yet

- MIRANDA, ELLAINE - FM - 2021 - ST - Session 3 OutputDocument9 pagesMIRANDA, ELLAINE - FM - 2021 - ST - Session 3 OutputEllaine MirandaNo ratings yet

- C.A IPCC Ratio AnalysisDocument6 pagesC.A IPCC Ratio AnalysisAkash Gupta100% (2)

- Solvency Ratios: Solvency Ratios Come in A Variety of FormsDocument3 pagesSolvency Ratios: Solvency Ratios Come in A Variety of FormssanskritiNo ratings yet

- RatiosDocument4 pagesRatiosAerielle SkyNo ratings yet

- Ratio Analysis of Banking Reports (HBL, UBL, MCB Etc)Document42 pagesRatio Analysis of Banking Reports (HBL, UBL, MCB Etc)Fahad Khan80% (20)

- ITC Question 2Document2 pagesITC Question 2manishtiwari1988No ratings yet

- Ratio Analysis of Life Insurance - IBADocument116 pagesRatio Analysis of Life Insurance - IBANusrat Saragin NovaNo ratings yet

- Interpretations Current RatioDocument3 pagesInterpretations Current RatiorituNo ratings yet

- Lecture No.2 Financial Statements AnalysisDocument17 pagesLecture No.2 Financial Statements AnalysisSokoine Hamad Denis100% (1)

- The Language of BusinessDocument41 pagesThe Language of Businessrowealyn fabreNo ratings yet

- Corporate Banking - Updates RatiosDocument13 pagesCorporate Banking - Updates RatiosDisha NangiaNo ratings yet

- Ratio AnalysisDocument61 pagesRatio AnalysisMuralidharan PuliyasseryNo ratings yet

- Financial Ratio AnalysisDocument6 pagesFinancial Ratio AnalysishraigondNo ratings yet

- Ratio Analysis PresentationDocument39 pagesRatio Analysis PresentationJeevan PrasadNo ratings yet

- Break Even Analysis and Ratio AnalysisDocument63 pagesBreak Even Analysis and Ratio AnalysisJaywanti Akshra Gurbani100% (1)

- How To Read Balance SheetDocument6 pagesHow To Read Balance SheetDanish SheikhNo ratings yet

- Income Statements:: Financial Statement AnalysisDocument11 pagesIncome Statements:: Financial Statement AnalysisSerge Olivier Atchu YudomNo ratings yet

- ABC Ratio AnalysisDocument73 pagesABC Ratio Analysisamitliarliar100% (1)

- Analysis of Financial StatementsDocument80 pagesAnalysis of Financial Statementsmano cherian mathew100% (1)

- National Bank of Pakistan: InterpretationDocument3 pagesNational Bank of Pakistan: InterpretationAhsan QaisraniNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Bronze Shams Al-Ma'Arif Jupiter Al-Alim TalismanDocument2 pagesBronze Shams Al-Ma'Arif Jupiter Al-Alim Talismannspectah1No ratings yet

- Threading (Manufacturing) : Threading Is The Process of Creating ADocument16 pagesThreading (Manufacturing) : Threading Is The Process of Creating AAnonymous mRCnYKz7xBNo ratings yet

- Reg Agrib Investment Profile Rfu 4Document53 pagesReg Agrib Investment Profile Rfu 4Nestor HubacNo ratings yet

- Đề thi thử THPTQG 1Document5 pagesĐề thi thử THPTQG 1dnnnmmny9jNo ratings yet

- 2017 P6Document10 pages2017 P6Johnny HongNo ratings yet

- CBLM Tourman Core 2Document41 pagesCBLM Tourman Core 2John Joseph AmilerNo ratings yet

- Spe-193121-Ms - Integrated Production Optimization WorkflowDocument22 pagesSpe-193121-Ms - Integrated Production Optimization WorkflowAtrian RahadiNo ratings yet

- FIN-01. Purchasing ProcedureDocument7 pagesFIN-01. Purchasing ProcedureVu Dinh ThietNo ratings yet

- Reflection Paper On Rizal in DapitanDocument2 pagesReflection Paper On Rizal in DapitanHads LunaNo ratings yet

- Hill, Therapist Techniques, Client Involvement, and The Therapeutic Relationship, (Hill, 2005)Document12 pagesHill, Therapist Techniques, Client Involvement, and The Therapeutic Relationship, (Hill, 2005)Osman CastroNo ratings yet

- Govt VacancyDocument13 pagesGovt VacancyAllen PonceNo ratings yet

- Ace TechniqueDocument1 pageAce TechniqueXiid DNo ratings yet

- May 13, 2019 National and Local Elections: Official BallotDocument2 pagesMay 13, 2019 National and Local Elections: Official BallotStephany Faye Batas AguilarNo ratings yet

- Application Form: Personal Secondary EducationDocument3 pagesApplication Form: Personal Secondary EducationRed PalustreNo ratings yet

- DPP - (19) 13th IOC - (E) - WADocument1 pageDPP - (19) 13th IOC - (E) - WAassadfNo ratings yet

- Karlan Microeconomics 2ce - Ch. 13Document24 pagesKarlan Microeconomics 2ce - Ch. 13Gurnoor KaurNo ratings yet

- Human Resource Management SPMDocument16 pagesHuman Resource Management SPMsherif_awadNo ratings yet

- DRUG NAME: Octreotide: Synonym (S) : Common Trade Name (S) : ClassificationDocument9 pagesDRUG NAME: Octreotide: Synonym (S) : Common Trade Name (S) : ClassificationChandanaSanjeeNo ratings yet

- 2016 Closing The Gap ReportDocument64 pages2016 Closing The Gap ReportAllan ClarkeNo ratings yet

- EA and HalachaDocument63 pagesEA and HalachaAvraham EisenbergNo ratings yet

- Chapter 4 Referenes Arranged AlphabeticalDocument5 pagesChapter 4 Referenes Arranged AlphabeticalJoselito GelarioNo ratings yet

- Time QuotesDocument6 pagesTime Quoteschristophdollis100% (6)

- Arch AddDocument96 pagesArch AddDeepak RDNo ratings yet

- Bosch CM Coach enDocument21 pagesBosch CM Coach enHélder AraujoNo ratings yet

- Assignment 3 Individual AssignmentDocument13 pagesAssignment 3 Individual AssignmentThư Phan MinhNo ratings yet

- Definition of Science FictionDocument21 pagesDefinition of Science FictionIrene ShatekNo ratings yet

- TAX Chapter 1-2 - Intoduction To Taxation - QuizDocument6 pagesTAX Chapter 1-2 - Intoduction To Taxation - QuizRejay VillamorNo ratings yet