Professional Documents

Culture Documents

Far-1 Revaluation JE 2

Far-1 Revaluation JE 2

Uploaded by

Janie HookeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Far-1 Revaluation JE 2

Far-1 Revaluation JE 2

Uploaded by

Janie HookeCopyright:

Available Formats

CPE SCHOOL OF ACCOUNTANCY Test

Topic IAS-16 Revaluation Journal Entries

Paper CAF-1 Financial Accounting and Reporting – I

Total Mark 30 Time 55 M

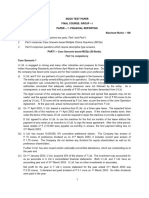

Q.1

Shah Jahan Limited (SJL) runs a cruise business across oceans. Following information in

respect of one of SJL’s cruise ship is available:

i. SJL bought a cruise ship on 1 March 2018. After completing all the required formalities,

the ship was ready to sail on 1 April 2018.

ii. Details regarding components of the ship are as under:

iii. The average monthly sailing of the ship during the last three years are as under:

iv. SJL uses revaluation model for subsequent measurement. SJL accounts for revaluation

on net replacement value method and transfers the maximum possible amount from

the revaluation surplus to retained earnings on an annual basis.

v. The revalued amounts of the ship as at 31 December 2019 and 2020 were determined

as Rs. 1,400 million and Rs. 1,000 million respectively. Revalued amounts are

apportioned between the components on the basis of their book values before the

revaluation.

Required:

Prepare necessary journal entries to record the above transaction from the date of acquisition

of the ship to the year ended 31 December 2020. (15)

Q.2 Choose the most appropriate option :

(i). An asset was purchased on 1 January 2017 for Rs. 100 million with useful life of 6 years

and residual value of Rs. 10 million. On 1 January 2020, it is revalued to Rs. 120 million

with remaining useful life of 3 years and expected residual value of Rs. 15 million.

Howmuch excess depreciation will be charged for the year ended 31 December 2020?

(a) Rs. 15 million (b) Rs. 35 million

(c) Rs. 20 million (d) Rs. 25 million (2)

By: HM Umar Farooq Rana 1

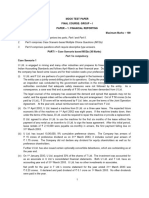

CPE SCHOOL OF ACCOUNTANCY Test

(ii). The correct accounting treatment of initial operating losses incurred during the

commercial production due to under-utilization of the plant would be to:

(a) capitalise as a directly attributable cost

(b) defer and charge to profit or loss account when profit is earned from the plant

(c) charge directly to retained earnings since these are not considered to be normal

operating losses

(d) charge to profit or loss account (1)

Q.3

Meerab Enterprises was incorporated on 1 July 2012.ME depreciates its property, plant and

equipment on straight line basis over their useful life. It uses revaluation model for subsequent

measurement of the property, plant and equipment and has a policy of revaluing these after

every two years.

Following information pertains to its property, plant and equipment:

During the year there were no addition or deletion in the above assets. As per policy, ME transfers

the maximum possible amount from the revaluation surplus to retained earnings on an annual

basis.

Required:

Prepare necessary journal entries for the year ended 30 June 2014 and 2015. (12)

**************

By: HM Umar Farooq Rana 2

You might also like

- Mini-Dungeon - HMD-005 The Temporal Clock TowerDocument5 pagesMini-Dungeon - HMD-005 The Temporal Clock TowerАлексей ЖуравлевNo ratings yet

- Folk Violin SongbookDocument19 pagesFolk Violin SongbookTyler Swinn100% (1)

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- Mock Exam 2Document7 pagesMock Exam 2ZahidNo ratings yet

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- FAR2 ModelpaperDocument7 pagesFAR2 ModelpaperSaif SiddNo ratings yet

- Financial Accounting and Reporting-IIDocument7 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- JS20 SBR Me2 - QDocument9 pagesJS20 SBR Me2 - QNik Hanisah Zuraidi AfandiNo ratings yet

- RTP Cap III GR I June 2022Document92 pagesRTP Cap III GR I June 2022मदन कुमार बिस्टNo ratings yet

- B Com 2023 Examination PaperDocument9 pagesB Com 2023 Examination PaperAkshitaNo ratings yet

- Quarter Test 2 QPDocument7 pagesQuarter Test 2 QPOmair HasanNo ratings yet

- Module 1 Ias 16 & Ias 38Document6 pagesModule 1 Ias 16 & Ias 38Muhammad Zulqarnain NainNo ratings yet

- FA Sample PaperDocument10 pagesFA Sample PaperThe ShiningNo ratings yet

- Advanced Accounting and Financial ReportingDocument5 pagesAdvanced Accounting and Financial ReportingYasin ShaikhNo ratings yet

- Term Test-1 FAR-1Document6 pagesTerm Test-1 FAR-1Dua FarmoodNo ratings yet

- MFR203 FAR-4 AssignmentDocument5 pagesMFR203 FAR-4 Assignmentgillian soonNo ratings yet

- 2021 Revision QuestionsDocument10 pages2021 Revision QuestionsTawanda Tatenda HerbertNo ratings yet

- Problem 1Document3 pagesProblem 1Beverly MindoroNo ratings yet

- CA Final FR Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Final FR Q MTP 2 May 2024 Castudynotes ComAudit UserNo ratings yet

- Final Mock by TSB CFAP6 S2020Document5 pagesFinal Mock by TSB CFAP6 S2020Umar FarooqNo ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- Crescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadDocument124 pagesCrescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadAr Sal AnNo ratings yet

- CAF 1 FAR1 Spring 2023Document6 pagesCAF 1 FAR1 Spring 2023haris khanNo ratings yet

- Workbook 2Document19 pagesWorkbook 2zfy020807No ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Assignment No. 2 Section B02Document4 pagesAssignment No. 2 Section B02ThevyaGanesanNo ratings yet

- SKANS School of Accountancy Financial Accounting and Reporting-IIDocument11 pagesSKANS School of Accountancy Financial Accounting and Reporting-IImaryNo ratings yet

- CA Final FR Q MTP 1 May 2024 Castudynotes ComDocument11 pagesCA Final FR Q MTP 1 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- Sir Kahlil Far 1 Batch 4Document6 pagesSir Kahlil Far 1 Batch 4Asim MahmoodNo ratings yet

- Case Set 7 - Subsequent Events and Going ConcernDocument5 pagesCase Set 7 - Subsequent Events and Going ConcernTimothy WongNo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- Ch12hkas36 QDocument8 pagesCh12hkas36 QSigei LeonardNo ratings yet

- Multiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019Document8 pagesMultiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019jad NasserNo ratings yet

- Lecture # 43Document2 pagesLecture # 43HussainNo ratings yet

- Paper 10 Financial ManagementDocument10 pagesPaper 10 Financial ManagementJoseph OsakoNo ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- FR MTP-1 May-24Document11 pagesFR MTP-1 May-24chandrakantchainani606No ratings yet

- Level 3 Accounting Update Text 2022Document105 pagesLevel 3 Accounting Update Text 2022KhinMgLwin100% (1)

- Far560 Financial Accounting and Reporting 4 Test 1Document2 pagesFar560 Financial Accounting and Reporting 4 Test 1Firdaus YahyaNo ratings yet

- CAF1 ModelPaperDocument7 pagesCAF1 ModelPaperahmedNo ratings yet

- C. From The Cash Basis of Accounting To The Accrual Basis of AccountingDocument11 pagesC. From The Cash Basis of Accounting To The Accrual Basis of Accountingelaine aureliaNo ratings yet

- Financial Reporting May 22 Mock Test Ques PPRDocument7 pagesFinancial Reporting May 22 Mock Test Ques PPRVrinda GuptaNo ratings yet

- 2021 COAF 4201 GroupsDocument16 pages2021 COAF 4201 GroupsTawanda Tatenda HerbertNo ratings yet

- FR15. Provision, Contingent Liab & Assets (Practice)Document4 pagesFR15. Provision, Contingent Liab & Assets (Practice)duong duongNo ratings yet

- Final MockDocument5 pagesFinal MockAbdullahSaqibNo ratings yet

- 7 Af 301 FaDocument4 pages7 Af 301 FaAsjad RehmanNo ratings yet

- Ac413 Supp Feb20Document5 pagesAc413 Supp Feb20AnishahNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS February Exam 2020 - Extra SessionDocument8 pagesLebanese Association of Certified Public Accountants - IFRS February Exam 2020 - Extra Sessionjad NasserNo ratings yet

- FRK201 Nov2019Document11 pagesFRK201 Nov2019Alex ViljoenNo ratings yet

- Sraw 2013 QuestionsDocument15 pagesSraw 2013 QuestionsGuillermo Anjo NeilNo ratings yet

- IAS 36 Impairment of Assets (2021)Document12 pagesIAS 36 Impairment of Assets (2021)Tawanda Tatenda HerbertNo ratings yet

- 304.AUDP - .L III Question CMA June 2021 Exam.Document3 pages304.AUDP - .L III Question CMA June 2021 Exam.Md Joinal AbedinNo ratings yet

- Class Exercises - Reporting AssetsDocument6 pagesClass Exercises - Reporting AssetsShiftussy Enjoyer (JoniXx)No ratings yet

- Financial Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesFinancial Accounting: The Institute of Chartered Accountants of PakistanShakeel IshaqNo ratings yet

- Assignment 1Document8 pagesAssignment 1Ivan SsebugwawoNo ratings yet

- Quiz 1 Amp 2 Far PDFDocument27 pagesQuiz 1 Amp 2 Far PDFVon Rother Celoso DiazNo ratings yet

- 007 - Chapter 04 - IAS 16 Property, Plant and EquipmentDocument7 pages007 - Chapter 04 - IAS 16 Property, Plant and EquipmentHaris ButtNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- Public Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveNo ratings yet

- Father Dowling Mysteries - Wikipedia2Document11 pagesFather Dowling Mysteries - Wikipedia2Vocal Samir0% (1)

- 20 - Feb - 2019 - 170439480IDKL5X0QAnnexPFRDocument44 pages20 - Feb - 2019 - 170439480IDKL5X0QAnnexPFRGavoutha BisnisNo ratings yet

- AAA EDR Container DescriptionDocument12 pagesAAA EDR Container DescriptionmadhumohanNo ratings yet

- Food ServiceDocument148 pagesFood ServiceAkash SinghNo ratings yet

- XFS ReferenceDocument215 pagesXFS ReferenceDanielNo ratings yet

- English8 q1 Mod4of5 Cohesivedevices v2Document19 pagesEnglish8 q1 Mod4of5 Cohesivedevices v2shania puppyNo ratings yet

- My 100 Colour Pencil PortraitsDocument102 pagesMy 100 Colour Pencil PortraitsAnonymous 5u2Cvl100% (2)

- Abita Brand GuideDocument7 pagesAbita Brand GuideGabriel Bedini de JesusNo ratings yet

- EIA Consultant OrganizationDocument52 pagesEIA Consultant OrganizationRimika K100% (1)

- Reverse CalculationDocument7 pagesReverse CalculationKanishka Thomas Kain100% (1)

- Dsem TRM 0514 0052 1 - LRDocument68 pagesDsem TRM 0514 0052 1 - LRAbhishek JirelNo ratings yet

- Resume Word OriginDocument5 pagesResume Word Originaflkvapnf100% (1)

- 014 - 030 Single Reduction Worm IntroductionDocument17 pages014 - 030 Single Reduction Worm IntroductionAlejandro MartinezNo ratings yet

- Heaptic EncephalopathyDocument16 pagesHeaptic Encephalopathydk.clinicalresearchNo ratings yet

- Piyumal PereraDocument1 pagePiyumal Pererays7mjwyqhsNo ratings yet

- VIR - Reform in TelecommunicationsDocument10 pagesVIR - Reform in TelecommunicationsNgu HoangNo ratings yet

- Energy and Energy Transformations: Energy Makes Things HappenDocument8 pagesEnergy and Energy Transformations: Energy Makes Things HappenLabeenaNo ratings yet

- Thermotherapy PDFDocument51 pagesThermotherapy PDFRUdraNo ratings yet

- YL Clarity - Chromatography SW: YOUNG IN ChromassDocument4 pagesYL Clarity - Chromatography SW: YOUNG IN Chromasschâu huỳnhNo ratings yet

- Sikkim ENVIS-REPORT ON WED 2021Document25 pagesSikkim ENVIS-REPORT ON WED 2021CHANDER KUMAR MNo ratings yet

- Avian Helminths and Protozoa15413Document109 pagesAvian Helminths and Protozoa15413yomifgaramuNo ratings yet

- Waste Heat Boiler Deskbook PDFDocument423 pagesWaste Heat Boiler Deskbook PDFwei zhou100% (1)

- Talent AcquisitionDocument2 pagesTalent AcquisitionkiranNo ratings yet

- MUXDocument5 pagesMUXAmit SahaNo ratings yet

- AHN Eafit Sarmiento 2011 Llanos Petroleum GeologyDocument177 pagesAHN Eafit Sarmiento 2011 Llanos Petroleum Geology2032086No ratings yet

- Test (Passive)Document6 pagesTest (Passive)Nune GrigoryanNo ratings yet

- Dr. N. Kumarappan IE (I) Council Candidate - Electrical DivisionDocument1 pageDr. N. Kumarappan IE (I) Council Candidate - Electrical Divisionshanmugasundaram32No ratings yet

- Allen StoneDocument4 pagesAllen StoneRubén FernándezNo ratings yet