Professional Documents

Culture Documents

Balance Sheet: Income Statement

Balance Sheet: Income Statement

Uploaded by

Sneha KhaitanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet: Income Statement

Balance Sheet: Income Statement

Uploaded by

Sneha KhaitanCopyright:

Available Formats

17 April 2022 22:19

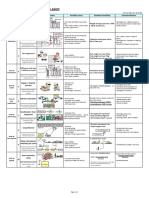

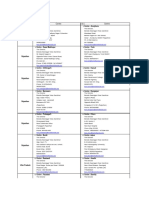

BALANCE SHEET

Assets, Liabilities & Shareholder's Equity

Balance Sheet Account- Permanent Account

1. Cost- Immediate Benefit- Recorded in Income Statement as expense

2. Cost- Future Economic Benefit- Recorded as an asset- When utilized and so future benefit left- transferred

from asset in balance sheet to expense in income statement

INCOME STATEMENT

Income Statement- Revenue and Expenses

Revenue= top-line=sales

Net Income (Profits/Earnings)= Revenue-Expenses

Operating Expenses: COGS and SG&A

COGS- Amount paid to purchase or manufacture the goods that is sold

Gross Profit= Revenue- COGS= Profit available to cover all the expenses

SG&A expenses= Overheads= Salaries/Marketing costs/Operating costs/HR/IT costs= all expenses the company

incurs other than the cost of purchasing or manufacturing inventory

Relative Profitability=Net Income as a percentage of sales

Retained Earnings= Earned Capital/Reinvested capital

Change in RE= Beginning RE +Net Income for the period-Dividends for the period

STATEMENT OF CASH FLOW

Reports change in a company's cash balance over a period of time

RETURN ON ASSETS= Net Income on assets/Average total assets for that period

1. Profitability relates profit to sales= Profit Margin= Net Income (profit after tax) earned on each sales dollar

2. Productivity relates sales to assets= Asset Turnover= Sales generated by each dollar of asset

Average assets= (beginning year assets + ending year assets)/2

RETURN ON EQUITY

1. ROE= Net Income/Average Shareholder's Equity

PORTER'S FIVE FORCES:

1. Industry Competition

2. Bargaining power of buyers

3. Bargaining power of suppliers

4. Threat of substitution

5. Threat of entry

FADM Module 1 Page 1

You might also like

- CMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionDocument7 pagesCMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionGANESH KUNJAPPA POOJARINo ratings yet

- Kaizen ViewpointDocument2 pagesKaizen ViewpointRohit ANo ratings yet

- Marginal Costing & Absorption CostingDocument56 pagesMarginal Costing & Absorption CostingHoàng Phương ThảoNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Economic 041018Document7 pagesEconomic 041018Anna-Maria LevenovaNo ratings yet

- LESSON 1 The Income Statement Multi StepDocument29 pagesLESSON 1 The Income Statement Multi StepGlianne Mae CerreroNo ratings yet

- Formula Sheet-DoneDocument15 pagesFormula Sheet-DoneMark Anthony CasupangNo ratings yet

- Cma Formula SheetDocument7 pagesCma Formula Sheetanushkamohanan0No ratings yet

- Accounting Slides Income StatmentDocument20 pagesAccounting Slides Income StatmentEdouard Rivet-BonjeanNo ratings yet

- RecipeDocument4 pagesRecipesasyedaNo ratings yet

- 1.1 Financial Analytics Toolkit (8 Pages) PDFDocument8 pages1.1 Financial Analytics Toolkit (8 Pages) PDFPartha Protim SahaNo ratings yet

- Cheat SheetDocument4 pagesCheat Sheetppxxdd666No ratings yet

- Category Item Formula: Evaluation Indicator (For An Increase in Indicated Item)Document2 pagesCategory Item Formula: Evaluation Indicator (For An Increase in Indicated Item)ab0cd0No ratings yet

- FABM FINALS Test 2Document1 pageFABM FINALS Test 2Sunshine FrigillanaNo ratings yet

- CheatSheet Midterm v2Document10 pagesCheatSheet Midterm v2besteNo ratings yet

- ICAEW - Chapter 12 - Company Financial Statement Under IFRSDocument28 pagesICAEW - Chapter 12 - Company Financial Statement Under IFRSvothituongnhi7703No ratings yet

- 5.3 - Income Statements - IGCSE AIDDocument4 pages5.3 - Income Statements - IGCSE AIDt.dyakivNo ratings yet

- Jem MCOM Managerial Finance Class SolutionsDocument66 pagesJem MCOM Managerial Finance Class SolutionsIvy TulesiNo ratings yet

- Final AccountsDocument40 pagesFinal AccountsCA Deepak Ehn100% (1)

- Sesi 2 Akuntansi Manajemen - Rev1Document32 pagesSesi 2 Akuntansi Manajemen - Rev1Dian Permata SariNo ratings yet

- 1.3 Income Statement and Statement of Comrehensive IncomeDocument20 pages1.3 Income Statement and Statement of Comrehensive IncomeRula Abu NuwarNo ratings yet

- SOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateDocument2 pagesSOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateRahul KapurNo ratings yet

- Income Statement 2022Document37 pagesIncome Statement 2022Vinay MehtaNo ratings yet

- Sesi 2 Akuntansi ManajemenDocument33 pagesSesi 2 Akuntansi ManajemenDian Permata SariNo ratings yet

- Chapters 2 and 3 HandoutsDocument8 pagesChapters 2 and 3 HandoutsCarter LeeNo ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management FormulasDaniel Kahn GillamacNo ratings yet

- Summary of Key FormulaeDocument1 pageSummary of Key FormulaeAlejandro ArbuluNo ratings yet

- Final AcccountDocument20 pagesFinal Acccountbtamilarasan88No ratings yet

- Formula For Ratio AnalysisDocument8 pagesFormula For Ratio AnalysiszainNo ratings yet

- Ratio Analysis SummaryDocument5 pagesRatio Analysis SummaryPhuoc TruongNo ratings yet

- Statement of Comprehensive Income: Presentation of Financial StatementsDocument17 pagesStatement of Comprehensive Income: Presentation of Financial StatementsClaire GarciaNo ratings yet

- Formules Managerial Accounting 1Document56 pagesFormules Managerial Accounting 1Nour MkaouriNo ratings yet

- Dupont Decomposition: Operating ProfitabilityDocument2 pagesDupont Decomposition: Operating ProfitabilitySatrujit MohapatraNo ratings yet

- Quizlet PDFDocument1 pageQuizlet PDFShatha QamhiehNo ratings yet

- Unit 1 Book Keeping, Accounting, AS & IFRS PDFDocument43 pagesUnit 1 Book Keeping, Accounting, AS & IFRS PDFShreyash PardeshiNo ratings yet

- ACFINMA ReveiwerDocument14 pagesACFINMA ReveiwerKat LontokNo ratings yet

- Cost of Capital and Capital StructureDocument4 pagesCost of Capital and Capital StructureAnouck PereiraNo ratings yet

- Reviewer - CM, FR, ValDocument3 pagesReviewer - CM, FR, ValbabeeandreaaNo ratings yet

- Pertemuan 2 - Ch02-Keown-New (Understanding FS & CF)Document26 pagesPertemuan 2 - Ch02-Keown-New (Understanding FS & CF)ilham setiawanNo ratings yet

- Cost Sheet Format Objects & Methods of PreparatiDocument2 pagesCost Sheet Format Objects & Methods of PreparatiPrateek BhardwajNo ratings yet

- AccountingDocument1 pageAccountingniranjanisnairNo ratings yet

- Data DictionaryDocument6 pagesData DictionaryRikshitNo ratings yet

- Data DictionaryDocument6 pagesData DictionarySravanNo ratings yet

- 2 FS Analysis USTDocument22 pages2 FS Analysis USTFk TnccNo ratings yet

- Types of Business: Sole ProprietorshipDocument4 pagesTypes of Business: Sole ProprietorshipedrianclydeNo ratings yet

- Business FinanceDocument3 pagesBusiness Financesk001No ratings yet

- FIN 201 Chapter 02Document27 pagesFIN 201 Chapter 02ImraanHossainAyaanNo ratings yet

- Key Finance TermsDocument30 pagesKey Finance TermshammadNo ratings yet

- Week 4 T3 Lectures 7 & 8 Income Statement I With SolutionsDocument59 pagesWeek 4 T3 Lectures 7 & 8 Income Statement I With SolutionsAbdullah HashmatNo ratings yet

- Accounting SummaryDocument5 pagesAccounting Summaryj.vanteeselingNo ratings yet

- AFFS w5Document13 pagesAFFS w5Thi Kim Ngan TranNo ratings yet

- Sample MAS (Absorption & Variable Costing With Pricing Decision)Document6 pagesSample MAS (Absorption & Variable Costing With Pricing Decision)Gwyneth CartallaNo ratings yet

- Far05. PpeDocument4 pagesFar05. PpeJohn Kenneth BacanNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisUdayan KarnatakNo ratings yet

- Class Notes: Class: XI Topic: Financial StatementDocument3 pagesClass Notes: Class: XI Topic: Financial StatementRajeev ShuklaNo ratings yet

- Note Taking - Corporate Finacial Statement AnalysisDocument4 pagesNote Taking - Corporate Finacial Statement AnalysisTrần Thiện Ngọc ĐàiNo ratings yet

- MS-44D Absorption Variable Costing With Pricing DecisionsDocument6 pagesMS-44D Absorption Variable Costing With Pricing Decisionsxyzcompany39No ratings yet

- Fabm 2Document8 pagesFabm 2CAYABAN, RISHA MARIE DV.No ratings yet

- Module 2: Conceptual Framework For Financial ReportingDocument5 pagesModule 2: Conceptual Framework For Financial Reportingmonsta x noona-yaNo ratings yet

- MS ReviewerDocument12 pagesMS ReviewerMarvi Ned Xigrid CruzNo ratings yet

- 1) Activity RatiosDocument28 pages1) Activity RatiosNyanNo ratings yet

- Ducation: Indian School of Business, PGP in Management: Intended Majors in Strategy & FinanceDocument1 pageDucation: Indian School of Business, PGP in Management: Intended Majors in Strategy & FinanceSneha KhaitanNo ratings yet

- Canvas Painting Workshop, 7pm, Aug 9th, Atrium (1-32)Document3 pagesCanvas Painting Workshop, 7pm, Aug 9th, Atrium (1-32)Sneha KhaitanNo ratings yet

- XLRI ClockspeedDocument15 pagesXLRI ClockspeedSneha KhaitanNo ratings yet

- Quiz 2Document5 pagesQuiz 2Sneha KhaitanNo ratings yet

- D5 - Marketing and Communication StrategyDocument9 pagesD5 - Marketing and Communication StrategySneha KhaitanNo ratings yet

- Apparel Supply Chain and Its VariantsDocument10 pagesApparel Supply Chain and Its VariantsSneha KhaitanNo ratings yet

- Internet of Things and Blockchain Technology in Apparel Manufacturing Supply Chain Data ManagementDocument8 pagesInternet of Things and Blockchain Technology in Apparel Manufacturing Supply Chain Data ManagementSneha KhaitanNo ratings yet

- BCOM AssignmentDocument8 pagesBCOM AssignmentSneha KhaitanNo ratings yet

- Session-4 SSMDocument24 pagesSession-4 SSMSneha KhaitanNo ratings yet

- Questions For Reflection: - These Questions Are Merely Guidelines For Your Group Discussion. You MayDocument4 pagesQuestions For Reflection: - These Questions Are Merely Guidelines For Your Group Discussion. You MaySneha KhaitanNo ratings yet

- Cambridge International AS & A Level: Economics 9708/32Document12 pagesCambridge International AS & A Level: Economics 9708/32ayan sajjadNo ratings yet

- Odi MejiDocument1 pageOdi MejigopuremagicNo ratings yet

- Tax 2 Finals ReviewerDocument6 pagesTax 2 Finals ReviewerSkylee SoNo ratings yet

- بحث التوريق المنشور195257868Document17 pagesبحث التوريق المنشور195257868Chiku ProdNo ratings yet

- Formula / Mathematical MethodDocument7 pagesFormula / Mathematical MethodRabiaSaleemNo ratings yet

- JPSP - 2022 - 512Document10 pagesJPSP - 2022 - 512Khanh TranNo ratings yet

- IAT-II Question Paper With Solution of 16MBA13 Accounting For Managers Nov-2017 - Hema Vidya CS PDFDocument10 pagesIAT-II Question Paper With Solution of 16MBA13 Accounting For Managers Nov-2017 - Hema Vidya CS PDFSahil KhanNo ratings yet

- Fieval Leasing Company Signs An Agreement On January 1 2010 PDFDocument1 pageFieval Leasing Company Signs An Agreement On January 1 2010 PDFAnbu jaromiaNo ratings yet

- Account Statement: Penyata AkaunDocument2 pagesAccount Statement: Penyata AkaunAsyraf SyazwanNo ratings yet

- Budgeting Student - 9.1 Student Activity Packet - Kyla BurdinDocument4 pagesBudgeting Student - 9.1 Student Activity Packet - Kyla BurdinburdinkylaNo ratings yet

- Fabric Quality: Shahkam Industries Private LTDDocument30 pagesFabric Quality: Shahkam Industries Private LTDFahad AkbarNo ratings yet

- Part A Fin STMT TemplatesDocument15 pagesPart A Fin STMT Templatesvrushali_acharyaNo ratings yet

- Disintegration of Tokugawa RegimeDocument10 pagesDisintegration of Tokugawa RegimeantonioNo ratings yet

- Ey 2022 Global Insurance Outlook ReportDocument29 pagesEy 2022 Global Insurance Outlook ReportBernewsAdminNo ratings yet

- Global Prospects and Policies - IMF - April 2023Document44 pagesGlobal Prospects and Policies - IMF - April 2023Clasicos DominicanosNo ratings yet

- Name of Bank City State BranchDocument2 pagesName of Bank City State BranchLisa KamlNo ratings yet

- Waterfront Hotel and Casino Tunacao Alliah Lalingkay May R. Bsba FM 1 FDocument15 pagesWaterfront Hotel and Casino Tunacao Alliah Lalingkay May R. Bsba FM 1 FSalmia AmatodingNo ratings yet

- Assigment 1 Malaysian EcoDocument3 pagesAssigment 1 Malaysian EcoVanessa SajiliNo ratings yet

- Safe Self RelianceDocument1,029 pagesSafe Self RelianceTheNatureDoctorNo ratings yet

- Product (GDP) of Many Small Countries,"adding,"this TimeDocument5 pagesProduct (GDP) of Many Small Countries,"adding,"this Timenadya umairaNo ratings yet

- Managing The External Environment P1Document10 pagesManaging The External Environment P1Bright InfoNo ratings yet

- Saral Pension V8 LeafletDocument2 pagesSaral Pension V8 LeafletNidhi ShahNo ratings yet

- Project ProposalDocument11 pagesProject ProposalGarima DhirNo ratings yet

- State SR Centre SR Centre: RajasthanDocument5 pagesState SR Centre SR Centre: RajasthanJai mishraNo ratings yet

- Derivatives 1Document2 pagesDerivatives 1adm raflyNo ratings yet

- CBSE-XII Economics - Chap-A4 (Government Budget & The Economy)Document11 pagesCBSE-XII Economics - Chap-A4 (Government Budget & The Economy)balajayalakshmi96No ratings yet

- MPT Staff Rules of Service - Latest XXXYDocument126 pagesMPT Staff Rules of Service - Latest XXXYwaheedNo ratings yet

- Training - Quote - IRES-Quote SampleDocument1 pageTraining - Quote - IRES-Quote SampleNaseef ThalibNo ratings yet

- Resume SKD 2022Document5 pagesResume SKD 2022S SasikumarNo ratings yet