Professional Documents

Culture Documents

Stepped Parameter Summary Performance

Stepped Parameter Summary Performance

Uploaded by

James KuahCopyright:

Available Formats

You might also like

- LBO Excel ModelDocument6 pagesLBO Excel Modelrf_1238100% (2)

- Organizational Structure of A Shipping CompanyDocument8 pagesOrganizational Structure of A Shipping CompanySrinivas Pilla80% (5)

- ICICI Bank ProfileDocument12 pagesICICI Bank Profilenavdeep2309100% (2)

- 17020841116Document13 pages17020841116Khushboo RajNo ratings yet

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Case Study 3 PDFDocument4 pagesCase Study 3 PDFBetheemae R. Matarlo100% (1)

- DCF Valuation Financial ModelingDocument10 pagesDCF Valuation Financial ModelingHilal MilmoNo ratings yet

- Mixed Use JK PDFDocument9 pagesMixed Use JK PDFAnkit ChaudhariNo ratings yet

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Document18 pagesTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauNo ratings yet

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- RMN - 0228 - THCOM (Achieving The Impossible)Document4 pagesRMN - 0228 - THCOM (Achieving The Impossible)bodaiNo ratings yet

- Bajaj Auto Result UpdatedDocument11 pagesBajaj Auto Result UpdatedAngel BrokingNo ratings yet

- Roadshow Natixis Mar09Document47 pagesRoadshow Natixis Mar09sl7789No ratings yet

- DMX Technologies: OverweightDocument4 pagesDMX Technologies: Overweightstoreroom_02No ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Economics Se-14, 16Document48 pagesEconomics Se-14, 16Niki poorianNo ratings yet

- BaiduDocument29 pagesBaiduidradjatNo ratings yet

- Sarin Technologies: SingaporeDocument8 pagesSarin Technologies: SingaporephuawlNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- Mfrs 8 Operating SegmentsDocument31 pagesMfrs 8 Operating SegmentsMuhamad DzulhazreenNo ratings yet

- Bajaj Auto: Performance HighlightsDocument12 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiNo ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Tech Mahindra 4Q FY13Document12 pagesTech Mahindra 4Q FY13Angel BrokingNo ratings yet

- Peak Sport Products (1968 HK) : Solid AchievementsDocument9 pagesPeak Sport Products (1968 HK) : Solid AchievementsSai Kei LeeNo ratings yet

- Value Stock Tankrich v1.23Document13 pagesValue Stock Tankrich v1.23pareshpatel99No ratings yet

- Charts EdhecDocument5 pagesCharts EdhecMittal RadhikaNo ratings yet

- 07 DCF Steel Dynamics AfterDocument2 pages07 DCF Steel Dynamics AfterJack JacintoNo ratings yet

- Lecture 7 - Ratio AnalysisDocument39 pagesLecture 7 - Ratio AnalysisMihai Stoica100% (1)

- Financial Analysis of BioconDocument12 pagesFinancial Analysis of BioconNipun KothariNo ratings yet

- FM 6 Financial Statements Analysis MBADocument50 pagesFM 6 Financial Statements Analysis MBAMisganaw GishenNo ratings yet

- Non-GAAP Financial MeasuresDocument1 pageNon-GAAP Financial MeasuresAlok ChitnisNo ratings yet

- Hansson Private Label - FinalDocument34 pagesHansson Private Label - Finalincognito12312333% (3)

- Wyeth Analysis TemplateDocument8 pagesWyeth Analysis TemplateAli Azeem RajwaniNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument12 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- JP Associates: Performance HighlightsDocument12 pagesJP Associates: Performance HighlightsAngel BrokingNo ratings yet

- Selected Financial Summary (U.S. GAAP) : For The YearDocument82 pagesSelected Financial Summary (U.S. GAAP) : For The YearshanzarapunzleNo ratings yet

- Air Thread ConnectionsDocument31 pagesAir Thread ConnectionsJasdeep SinghNo ratings yet

- Ashok Leyland Result UpdatedDocument13 pagesAshok Leyland Result UpdatedAngel BrokingNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- Mahindra Satyam, 4th February, 2013Document12 pagesMahindra Satyam, 4th February, 2013Angel BrokingNo ratings yet

- Assignment Brief Mn2415 2023 24Document7 pagesAssignment Brief Mn2415 2023 24Haseeb DarNo ratings yet

- Tech Mahindra, 7th February, 2013Document12 pagesTech Mahindra, 7th February, 2013Angel BrokingNo ratings yet

- Crompton Greaves: Performance HighlightsDocument12 pagesCrompton Greaves: Performance HighlightsAngel BrokingNo ratings yet

- Infosys 4Q FY 2013, 12.04.13Document15 pagesInfosys 4Q FY 2013, 12.04.13Angel BrokingNo ratings yet

- Reliance Communication Result UpdatedDocument11 pagesReliance Communication Result UpdatedAngel BrokingNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Lecture #3: Financial Analysis - Example (Celerity Technology)Document4 pagesLecture #3: Financial Analysis - Example (Celerity Technology)Jack JacintoNo ratings yet

- Hexaware Result UpdatedDocument14 pagesHexaware Result UpdatedAngel BrokingNo ratings yet

- TVS Motor Result UpdatedDocument12 pagesTVS Motor Result UpdatedAngel BrokingNo ratings yet

- GfiDocument17 pagesGfiasfasfqweNo ratings yet

- Chapter 14Document27 pagesChapter 14IstikharohNo ratings yet

- FlashMemory SLNDocument6 pagesFlashMemory SLNShubham BhatiaNo ratings yet

- DB Corp: Performance HighlightsDocument11 pagesDB Corp: Performance HighlightsAngel BrokingNo ratings yet

- Results Conference CallDocument14 pagesResults Conference CallLightRINo ratings yet

- Tech Mahindra: Performance HighlightsDocument12 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Practical M&A Execution and Integration: A Step by Step Guide To Successful Strategy, Risk and Integration ManagementFrom EverandPractical M&A Execution and Integration: A Step by Step Guide To Successful Strategy, Risk and Integration ManagementNo ratings yet

- The Controller's Function: The Work of the Managerial AccountantFrom EverandThe Controller's Function: The Work of the Managerial AccountantRating: 2 out of 5 stars2/5 (1)

- Brake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryFrom EverandBrake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

- Winning Myanmar Automotive Lubricant's MarketDocument36 pagesWinning Myanmar Automotive Lubricant's MarketJames Kuah67% (3)

- Starburst Holdings: Singapore Company FocusDocument9 pagesStarburst Holdings: Singapore Company FocusJames KuahNo ratings yet

- JLL - The Parkhouse Nishi-Shinjuku Tower 60 CashflowDocument6 pagesJLL - The Parkhouse Nishi-Shinjuku Tower 60 CashflowJames KuahNo ratings yet

- The CF Engine Overview: Vehicle Engine Type Indication Performance Torque Emission Level Daf Cf65Document2 pagesThe CF Engine Overview: Vehicle Engine Type Indication Performance Torque Emission Level Daf Cf65James Kuah100% (1)

- Australia Stocks F Score Sep 13Document12 pagesAustralia Stocks F Score Sep 13James KuahNo ratings yet

- 3 Good Deals - 1 Apr 2013Document10 pages3 Good Deals - 1 Apr 2013James KuahNo ratings yet

- Cotai Strip No 1 ResidencesDocument1 pageCotai Strip No 1 ResidencesJames KuahNo ratings yet

- JWH Market Commentary: February 2011Document4 pagesJWH Market Commentary: February 2011James KuahNo ratings yet

- Credit Suisse - Measuring The MoatDocument70 pagesCredit Suisse - Measuring The MoatJames Kuah100% (1)

- Panama Maritime ClustersDocument24 pagesPanama Maritime ClustersJames KuahNo ratings yet

- Basic Economic ProblemsDocument4 pagesBasic Economic ProblemsSarah Nicole BrionesNo ratings yet

- Operating CostingDocument15 pagesOperating CostingBishnuNo ratings yet

- BSBMKG621 Ass2Document6 pagesBSBMKG621 Ass2Maykiza NiranpakornNo ratings yet

- Insurance ScribdDocument8 pagesInsurance ScribdAnonymous ZJAXUnNo ratings yet

- AL Brothers Prakashan: 7. Outcomes of DemocracyDocument7 pagesAL Brothers Prakashan: 7. Outcomes of DemocracyVino AldrinNo ratings yet

- Students of AravaliDocument36 pagesStudents of AravaliDeepak SethiNo ratings yet

- The Importance of Cost ControlDocument36 pagesThe Importance of Cost ControlfajarNo ratings yet

- 2007 Year End OverviewDocument28 pages2007 Year End OverviewLmoorjaniNo ratings yet

- Project On Tata Finance PDF FreeDocument113 pagesProject On Tata Finance PDF FreeOmkar Kawade100% (1)

- HR MGR or Regional HR Mgr. or Director of HRDocument4 pagesHR MGR or Regional HR Mgr. or Director of HRapi-78733964No ratings yet

- Strategic Management Chapter 4Document9 pagesStrategic Management Chapter 4Optimus PrimeNo ratings yet

- Intrinsic Value Calculator. Book Value and Dividend GrowthDocument4 pagesIntrinsic Value Calculator. Book Value and Dividend GrowthrmilhoriniNo ratings yet

- Recent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022Document64 pagesRecent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022sushant980No ratings yet

- Financial Inclusion-An Overview of MizoramDocument15 pagesFinancial Inclusion-An Overview of MizoramLal NunmawiaNo ratings yet

- Business Plan OverviewDocument3 pagesBusiness Plan Overviewasad ullahNo ratings yet

- Crams - 1Document28 pagesCrams - 1Janam AroraNo ratings yet

- The Effect of Service Quality and Promotion To Customer Satisfaction and Implication of Customer Loyalty in Vehicle Financing Company in Jakarta IndonesiaDocument9 pagesThe Effect of Service Quality and Promotion To Customer Satisfaction and Implication of Customer Loyalty in Vehicle Financing Company in Jakarta Indonesiabuangan kuNo ratings yet

- BACK Final PrintDocument49 pagesBACK Final Printritika duggalNo ratings yet

- Objectives Vs GoalsDocument4 pagesObjectives Vs GoalsDesmahNo ratings yet

- Treasury SharesDocument4 pagesTreasury SharesEmmanNo ratings yet

- ICSI New SyllabusDocument20 pagesICSI New SyllabusAnant MishraNo ratings yet

- Exercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineDocument9 pagesExercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineAllie LinNo ratings yet

- CH1 Final TextDocument62 pagesCH1 Final TextSh Mati ElahiNo ratings yet

- Skilled Manpower Turnover and Its ManagementDocument109 pagesSkilled Manpower Turnover and Its Managementfikru terfaNo ratings yet

- Chevron or CALTEX ReportDocument68 pagesChevron or CALTEX ReportSubayyal AhmedNo ratings yet

- John Sobredo - Summative AssessmentDocument2 pagesJohn Sobredo - Summative Assessmentsandra mae dulayNo ratings yet

- ACC100.101 Analyzing Transactions - Practice QuestionsDocument7 pagesACC100.101 Analyzing Transactions - Practice QuestionsZACARIAS, Marc Nickson DG.No ratings yet

Stepped Parameter Summary Performance

Stepped Parameter Summary Performance

Uploaded by

James KuahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stepped Parameter Summary Performance

Stepped Parameter Summary Performance

Uploaded by

James KuahCopyright:

Available Formats

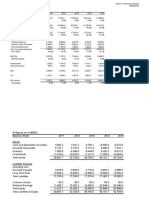

Trading Blox Summary Test Results

Page 1 of 7

Stepped Parameter Summary Performance

Test

1

Ending Balance CAGR%

363,740,511,653.08

36.24%

MAR

0.95

Modified Annual

Sharpe Sharpe

1.26

0.78

Max Total

Equity DD

37.9%

Longest

# Trades

Drawdown

23.5

3,830

file://C:\TradingBlox for WORK2\Results\Test Suite LTB 2011-05-31_07_39_10.htm

5/31/2011

Trading Blox Summary Test Results

file://C:\TradingBlox for WORK2\Results\Test Suite LTB 2011-05-31_07_39_10.htm

Page 2 of 7

5/31/2011

Trading Blox Summary Test Results

file://C:\TradingBlox for WORK2\Results\Test Suite LTB 2011-05-31_07_39_10.htm

Page 3 of 7

5/31/2011

Trading Blox Summary Test Results

file://C:\TradingBlox for WORK2\Results\Test Suite LTB 2011-05-31_07_39_10.htm

Page 4 of 7

5/31/2011

Trading Blox Summary Test Results

Page 5 of 7

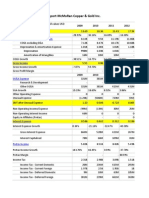

Yearly Performance Summary

Year Days

Closed Balance

End Total Equity Total Equity Gain

Gain % # Trades

1970

365

1,022,184.47

1,090,929.37

90,929.37

9.1%

1971

365

1,025,257.11

1,149,691.11

58,761.73

5.4%

34

51

1972

366

1,213,163.62

1,553,043.18

403,352.08

35.1%

37

1973

365

2,669,500.13

2,874,009.55

1,320,966.37

85.1%

33

1974

365

4,218,698.15

4,468,433.15

1,594,423.60

55.5%

43

1975

365

4,130,539.42

4,519,703.98

51,270.83

1.1%

40

1976

366

4,500,191.34

4,833,942.95

314,238.97

7.0%

65

1977

365

5,116,760.15

5,536,938.15

702,995.20

14.5%

52

1978

365

6,516,568.13

6,844,953.29

1,308,015.14

23.6%

53

1979

365

13,015,858.24

17,920,280.04

11,075,326.75 161.8%

51

1980

366

16,468,384.56

16,909,330.72

-1,010,949.32

-5.6%

55

1981

365

25,081,623.24

28,062,107.42

11,152,776.70

66.0%

33

1982

365

31,906,608.56

32,705,633.70

4,643,526.27

16.5%

60

1983

365

32,763,958.90

33,894,200.70

1,188,567.00

3.6%

68

1984

366

42,342,789.93

48,722,732.88

14,828,532.18

43.7%

53

1985

365

59,086,152.88

62,527,575.38

13,804,842.51

28.3%

54

1986

365

64,464,129.70

69,898,784.14

7,371,208.76

11.8%

80

1987

365

88,634,520.07

103,964,836.76

34,066,052.62

48.7%

79

1988

366

93,917,694.29

98,223,330.12

-5,741,506.64

-5.5%

95

1989

365

98,677,080.74

108,478,458.66

10,255,128.53

10.4%

99

1990

365

167,859,393.47

187,038,275.65

78,559,816.99

72.4%

68

1991

365

214,222,887.85

264,342,377.83

77,304,102.18

41.3%

99

1992

366

292,971,983.88

309,169,690.15

44,827,312.32

17.0%

111

1993

365

362,008,754.67

415,559,565.94

106,389,875.79

34.4%

116

1994

365

555,159,813.12

670,230,305.76

254,670,739.81

61.3%

116

file://C:\TradingBlox for WORK2\Results\Test Suite LTB 2011-05-31_07_39_10.htm

5/31/2011

Trading Blox Summary Test Results

Page 6 of 7

1995

365

731,884,021.60

861,660,074.95

191,429,769.20

28.6%

1996

366

1,023,476,192.26

1,058,763,101.36

197,103,026.41

22.9%

106

102

1997

365

1,002,505,554.41

1,135,605,651.65

76,842,550.29

7.3%

118

1998

365

1,850,315,636.67

1,934,930,667.57

799,325,015.92

70.4%

114

1999

365

1,619,191,122.85

2,012,923,706.45

77,993,038.88

4.0%

136

2000

366

3,467,410,070.11

4,168,355,607.75

2,155,431,901.31 107.1%

129

2001

365

6,478,987,527.54

6,542,884,934.86

2,374,529,327.10

2002

57.0%

126

365 12,286,353,050.71 15,408,930,823.60

8,866,045,888.75 135.5%

125

2003

365 16,667,065,763.03 19,523,478,377.50

4,114,547,553.90

26.7%

144

2004

366 29,300,790,038.51 31,875,557,493.68 12,352,079,116.18

63.3%

139

2005

365 35,742,969,852.24 43,728,782,269.73 11,853,224,776.04

37.2%

142

2006

365 50,279,359,231.45 55,673,339,108.69 11,944,556,838.96

27.3%

154

2007

365 70,524,350,371.23 80,750,898,372.12 25,077,559,263.43

45.0%

153

2008

366 208,206,471,412.14 224,968,065,607.41 144,217,167,235.29 178.6%

122

2009

365 238,829,310,699.78 249,791,769,990.47 24,823,704,383.06

11.0%

139

2010

365 323,177,052,604.15 372,806,126,000.17 123,014,356,009.70

49.2%

142

2011

150 363,740,511,653.08 363,740,511,653.08

-2.4%

94

-9,065,614,347.09

Win/Loss Statistics

Trading Performance

CAGR %

MAR Ratio

RAR %

R-Cubed

Robust Sharpe Ratio

36.24%

0.95

35.28%

0.98

1.28

Margin to Equity Ratio

Daily Return %

Daily Geometric Return %

Daily Standard Deviation %

Daily Downside Deviation %

Daily Sharpe

Daily Geo Sharpe

Daily Sortino

38.12%

0.1286%

0.0847%

1.41%

1.00%

0.085

0.054

0.120

Modified Sharpe Ratio

Annual Sharpe Ratio

Annual Sortino Ratio

Monthly Sharpe Ratio

Monthly Sortino Ratio

Calmar Ratio

R-Squared

1.26

0.78

18.29

0.33

0.70

1.21

0.980

Maximum Total Equity Drawdown %

Longest Total Equity Drawdown (months)

Average Max TE Drawdown %

Average Max TE Drawdown Length (months)

Maximum Monthly Total Equity Drawdown %

Maximum Monthly Closed Equity Drawdown %

Maximum Closed Equity Drawdown %

Average Closed Equity Drawdown %

Round Turns Per Million

Round Turns

Total Trades

37.95%

23.49

31.05%

19.57

30.05%

26.85%

27.50%

5.02%

1,526

1,430,730,559

3,830

Start Account Balance

Total Win Dollars

Total Loss Dollars

Total Profit

Earned Interest

Margin Interest

End Account Balance

End Open Equity

End Total Equity

1,000,000.00

859,505,725,407.85

495,766,213,754.77

363,739,511,653.08

0.00

0.00

363,740,511,653.08

0.00

363,740,511,653.08

Highest Total Equity

Highest Closed Equity

438,759,309,145.64

377,910,180,380.48

Total Commissions

Commission per Round Turn

Total Slippage

Slippage per Round Turn

Total Forex Carry

Total Dividends

Total Other Expenses

42,921,916,770.00

30.00

53,449,609,493.00

37.36

0.00

0.00

0.00

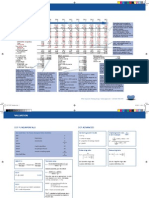

Monte Carlo Confidence Level Statistics

Wins

Losses

1360

2470

35.5%

64.5%

Total

3830

100.0%

Winning Months

Losing Months

317

180

63.8%

36.2%

Total

497

100.0%

Average Risk Percent

Average Win Percent

Average Loss Percent

Average Win Dollars

Average Loss Dollars

Average Trade Percent

Average Trade Dollars

2.01%

2.22%

0.59%

631,989,503.98

200,715,066.30

0.41%

94,971,151.87

Profit Factor

Percent Profit Factor

Expectation

1.73

2.08

0.20

Equity Management

Test Starting Equity

Order Generation Equity

Order Generation Equity High

Leverage (fraction)

Trading Equity Base

Drawdown Reduction Threshold (%)

Drawdown Reduction Amount (%)

1,000,000.00

0.00

0.00

1.00

Total Equity

0.00%

0.00%

Global Simulation Parameters

Earn Interest

Earn Dividends

Pay Margin on Stocks

Commission per Stock Trade

Commission per Stock Share

Commission per Contract

Commission by Stock Value (%)

Slippage Percent

Minimum Slippage

Forex Trade Size

Account for Forex Carry

Use Pip Based Slippage

Account for Contract Rolls

Roll Slippage in % of ATR

Minimum Stock Volume

Minimum Futures Volume

Max Percent Volume Per Trade

Entry Day Retracement

Max Margin Equity

Trade on Lock Days

Convert Profit by Stock Split

Trade Always on Tick

FALSE

TRUE

TRUE

0.00

0.01

30.00

0.00%

5.00%

15.00

1,000.00

TRUE

FALSE

TRUE

5.00%

10,000

0

0.00%

0.00%

100.00%

FALSE

TRUE

TRUE

file://C:\TradingBlox for WORK2\Results\Test Suite LTB 2011-05-31_07_39_10.htm

5/31/2011

Trading Blox Summary Test Results

90% Return

90% Sharpe

90% MAR

90% R Squared

90% Maximum Drawdown

90% Second Largest Drawdown

90% Third Largest Drawdown

90% Longest Drawdown

90% Second Longest Drawdown

90% Third Longest Drawdown

Page 7 of 7

30.30%

0.05

0.70

0.975

47.46%

38.70%

34.86%

45.7

30.2

23.6

Test Period

First Test Date

Last Test Date

1970-01-01

2011-05-30

Smart Fill Exit

Use Start Date Stepping

Use Broker Positions

TRUE

FALSE

FALSE

Preferences

Risk Free Rate

Load Volume

Load Unadjusted Close

Raise Negative Data

Process Weekly Bars

Process Monthly Bars

Process Daily Bars

Process Weekends

Additional Years of Data

3.00%

TRUE

TRUE

FALSE

TRUE

TRUE

TRUE

TRUE

5.00

Instrument Performance Summary

Symbol

Wins

% Losses

% Trades

Win

Months

Loss

Months

Avg. Win

%

Avg. Avg. Trade

Loss %

%

% Proft

Factor

AD

28

34.6%

53

65.4%

81

377

75.9%

120

24.1%

1.87%

0.54%

0.30%

1.84

C2

42

31.8%

90

68.2%

132

285

57.3%

212

42.7%

2.02%

0.67%

0.19%

1.41

CON

22

43.1%

29

56.9%

51

417

83.9%

80

16.1%

2.11%

0.76%

0.47%

2.09

CT2

48

35.0%

89

65.0%

137

291

58.6%

206

41.4%

2.13%

0.49%

0.43%

2.35

CU

50

43.1%

66

56.9%

116

320

64.4%

177

35.6%

1.93%

0.60%

0.49%

2.45

DA2

14

35.0%

26

65.0%

40

432

86.9%

65

13.1%

4.91%

0.60%

1.33%

4.41

DX

31

41.9%

43

58.1%

74

379

76.3%

118

23.7%

1.67%

0.49%

0.42%

2.48

EBL

18

42.9%

24

57.1%

42

438

88.1%

59

11.9%

1.13%

0.55%

0.17%

1.54

EBM

16

37.2%

27

62.8%

43

438

88.1%

59

11.9%

1.52%

0.48%

0.26%

1.88

EBS

12

26.7%

33

73.3%

45

435

87.5%

62

12.5%

1.65%

0.58%

0.01%

1.03

ED

32

47.1%

36

52.9%

68

378

76.1%

119

23.9%

2.79%

0.56%

1.01%

4.40

FC

37

28.9%

91

71.1%

128

292

58.8%

205

41.2%

2.13%

0.59%

0.20%

1.47

FCH

16

43.2%

21

56.8%

37

441

88.7%

56

11.3%

2.67%

0.54%

0.85%

3.78

FEI

13

44.8%

16

55.2%

29

440

88.5%

57

11.5%

1.91%

0.75%

0.44%

2.07

FF2

25

54.3%

21

45.7%

46

416

83.7%

81

16.3%

3.97%

0.92%

1.74%

5.13

GC2

43

37.7%

71

62.3%

114

308

62.0%

189

38.0%

2.34%

0.56%

0.54%

2.54

HG2

46

29.3%

111

70.7%

157

275

55.3%

222

44.7%

2.37%

0.60%

0.27%

1.65

ICL

14.3%

18

85.7%

21

474

95.4%

23

4.6%

2.38%

0.46%

-0.06%

0.86

LB

47

32.9%

96

67.1%

143

281

56.5%

216

43.5%

2.35%

0.66%

0.33%

1.73

LC

48

32.9%

98

67.1%

146

280

56.3%

217

43.7%

1.75%

0.57%

0.19%

1.51

LCO

28

41.8%

39

58.2%

67

391

78.7%

106

21.3%

2.06%

0.59%

0.52%

2.51

LGO

34

35.1%

63

64.9%

97

347

69.8%

150

30.2%

2.27%

0.71%

0.33%

1.72

LH

47

32.4%

98

67.6%

145

271

54.5%

226

45.5%

1.67%

0.58%

0.15%

1.39

LRC

42

34.4%

80

65.6%

122

288

57.9%

209

42.1%

3.14%

0.68%

0.63%

2.42

LSU

24

33.8%

47

66.2%

71

384

77.3%

113

22.7%

2.73%

0.60%

0.53%

2.32

1.73

MW

49

32.9%

100

67.1%

149

279

56.1%

218

43.9%

2.21%

0.63%

0.31%

NBB

14

33.3%

28

66.7%

42

421

84.7%

76

15.3%

5.37%

1.05%

1.09%

2.56

NE

19

44.2%

24

55.8%

43

434

87.3%

63

12.7%

2.85%

0.88%

0.77%

2.57

NG2

26

36.1%

46

63.9%

72

399

80.3%

98

19.7%

1.29%

0.51%

0.14%

1.42

NK

21

30.9%

47

69.1%

68

403

81.1%

94

18.9%

2.02%

0.48%

0.29%

1.89

O30

23

47.9%

25

52.1%

48

410

82.5%

87

17.5%

1.87%

0.66%

0.55%

2.61

PA2

42

36.5%

73

63.5%

115

319

64.2%

178

35.8%

2.35%

0.46%

0.57%

2.95

PL2

51

36.4%

89

63.6%

140

275

55.3%

222

44.7%

1.73%

0.58%

0.26%

1.71

RB2

30

31.3%

66

68.8%

96

365

73.4%

132

26.6%

1.68%

0.55%

0.15%

1.40

RR2

24

32.0%

51

68.0%

75

378

76.1%

119

23.9%

2.39%

0.52%

0.41%

2.17

RS

50

33.3%

100

66.7%

150

273

54.9%

224

45.1%

2.04%

0.59%

0.28%

1.71

RY

15

37.5%

25

62.5%

40

439

88.3%

58

11.7%

2.70%

0.46%

0.73%

3.55

SB2

51

39.5%

78

60.5%

129

282

56.7%

215

43.3%

2.43%

0.61%

0.59%

2.62

SI2

49

30.6%

111

69.4%

160

284

57.1%

213

42.9%

2.58%

0.55%

0.41%

2.08

SM2

45

31.5%

98

68.5%

143

275

55.3%

222

44.7%

1.95%

0.60%

0.21%

1.51

SSG

15

50.0%

15

50.0%

30

446

89.7%

51

10.3%

1.77%

0.40%

0.69%

4.46

3.36

TF

10

41.7%

14

58.3%

24

457

92.0%

40

8.0%

1.50%

0.32%

0.44%

TU

27

49.1%

28

50.9%

55

416

83.7%

81

16.3%

2.43%

0.53%

0.93%

4.43

TY

33

33.3%

66

66.7%

99

363

73.0%

134

27.0%

1.80%

0.54%

0.24%

1.67

Copyright Trading Blox, LLC 2011

file://C:\TradingBlox for WORK2\Results\Test Suite LTB 2011-05-31_07_39_10.htm

5/31/2011

You might also like

- LBO Excel ModelDocument6 pagesLBO Excel Modelrf_1238100% (2)

- Organizational Structure of A Shipping CompanyDocument8 pagesOrganizational Structure of A Shipping CompanySrinivas Pilla80% (5)

- ICICI Bank ProfileDocument12 pagesICICI Bank Profilenavdeep2309100% (2)

- 17020841116Document13 pages17020841116Khushboo RajNo ratings yet

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Case Study 3 PDFDocument4 pagesCase Study 3 PDFBetheemae R. Matarlo100% (1)

- DCF Valuation Financial ModelingDocument10 pagesDCF Valuation Financial ModelingHilal MilmoNo ratings yet

- Mixed Use JK PDFDocument9 pagesMixed Use JK PDFAnkit ChaudhariNo ratings yet

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Document18 pagesTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauNo ratings yet

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- RMN - 0228 - THCOM (Achieving The Impossible)Document4 pagesRMN - 0228 - THCOM (Achieving The Impossible)bodaiNo ratings yet

- Bajaj Auto Result UpdatedDocument11 pagesBajaj Auto Result UpdatedAngel BrokingNo ratings yet

- Roadshow Natixis Mar09Document47 pagesRoadshow Natixis Mar09sl7789No ratings yet

- DMX Technologies: OverweightDocument4 pagesDMX Technologies: Overweightstoreroom_02No ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Economics Se-14, 16Document48 pagesEconomics Se-14, 16Niki poorianNo ratings yet

- BaiduDocument29 pagesBaiduidradjatNo ratings yet

- Sarin Technologies: SingaporeDocument8 pagesSarin Technologies: SingaporephuawlNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- Mfrs 8 Operating SegmentsDocument31 pagesMfrs 8 Operating SegmentsMuhamad DzulhazreenNo ratings yet

- Bajaj Auto: Performance HighlightsDocument12 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiNo ratings yet

- Tech Mahindra: Performance HighlightsDocument11 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Tech Mahindra 4Q FY13Document12 pagesTech Mahindra 4Q FY13Angel BrokingNo ratings yet

- Peak Sport Products (1968 HK) : Solid AchievementsDocument9 pagesPeak Sport Products (1968 HK) : Solid AchievementsSai Kei LeeNo ratings yet

- Value Stock Tankrich v1.23Document13 pagesValue Stock Tankrich v1.23pareshpatel99No ratings yet

- Charts EdhecDocument5 pagesCharts EdhecMittal RadhikaNo ratings yet

- 07 DCF Steel Dynamics AfterDocument2 pages07 DCF Steel Dynamics AfterJack JacintoNo ratings yet

- Lecture 7 - Ratio AnalysisDocument39 pagesLecture 7 - Ratio AnalysisMihai Stoica100% (1)

- Financial Analysis of BioconDocument12 pagesFinancial Analysis of BioconNipun KothariNo ratings yet

- FM 6 Financial Statements Analysis MBADocument50 pagesFM 6 Financial Statements Analysis MBAMisganaw GishenNo ratings yet

- Non-GAAP Financial MeasuresDocument1 pageNon-GAAP Financial MeasuresAlok ChitnisNo ratings yet

- Hansson Private Label - FinalDocument34 pagesHansson Private Label - Finalincognito12312333% (3)

- Wyeth Analysis TemplateDocument8 pagesWyeth Analysis TemplateAli Azeem RajwaniNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument12 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- JP Associates: Performance HighlightsDocument12 pagesJP Associates: Performance HighlightsAngel BrokingNo ratings yet

- Selected Financial Summary (U.S. GAAP) : For The YearDocument82 pagesSelected Financial Summary (U.S. GAAP) : For The YearshanzarapunzleNo ratings yet

- Air Thread ConnectionsDocument31 pagesAir Thread ConnectionsJasdeep SinghNo ratings yet

- Ashok Leyland Result UpdatedDocument13 pagesAshok Leyland Result UpdatedAngel BrokingNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- Mahindra Satyam, 4th February, 2013Document12 pagesMahindra Satyam, 4th February, 2013Angel BrokingNo ratings yet

- Assignment Brief Mn2415 2023 24Document7 pagesAssignment Brief Mn2415 2023 24Haseeb DarNo ratings yet

- Tech Mahindra, 7th February, 2013Document12 pagesTech Mahindra, 7th February, 2013Angel BrokingNo ratings yet

- Crompton Greaves: Performance HighlightsDocument12 pagesCrompton Greaves: Performance HighlightsAngel BrokingNo ratings yet

- Infosys 4Q FY 2013, 12.04.13Document15 pagesInfosys 4Q FY 2013, 12.04.13Angel BrokingNo ratings yet

- Reliance Communication Result UpdatedDocument11 pagesReliance Communication Result UpdatedAngel BrokingNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Lecture #3: Financial Analysis - Example (Celerity Technology)Document4 pagesLecture #3: Financial Analysis - Example (Celerity Technology)Jack JacintoNo ratings yet

- Hexaware Result UpdatedDocument14 pagesHexaware Result UpdatedAngel BrokingNo ratings yet

- TVS Motor Result UpdatedDocument12 pagesTVS Motor Result UpdatedAngel BrokingNo ratings yet

- GfiDocument17 pagesGfiasfasfqweNo ratings yet

- Chapter 14Document27 pagesChapter 14IstikharohNo ratings yet

- FlashMemory SLNDocument6 pagesFlashMemory SLNShubham BhatiaNo ratings yet

- DB Corp: Performance HighlightsDocument11 pagesDB Corp: Performance HighlightsAngel BrokingNo ratings yet

- Results Conference CallDocument14 pagesResults Conference CallLightRINo ratings yet

- Tech Mahindra: Performance HighlightsDocument12 pagesTech Mahindra: Performance HighlightsAngel BrokingNo ratings yet

- Practical M&A Execution and Integration: A Step by Step Guide To Successful Strategy, Risk and Integration ManagementFrom EverandPractical M&A Execution and Integration: A Step by Step Guide To Successful Strategy, Risk and Integration ManagementNo ratings yet

- The Controller's Function: The Work of the Managerial AccountantFrom EverandThe Controller's Function: The Work of the Managerial AccountantRating: 2 out of 5 stars2/5 (1)

- Brake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryFrom EverandBrake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

- Winning Myanmar Automotive Lubricant's MarketDocument36 pagesWinning Myanmar Automotive Lubricant's MarketJames Kuah67% (3)

- Starburst Holdings: Singapore Company FocusDocument9 pagesStarburst Holdings: Singapore Company FocusJames KuahNo ratings yet

- JLL - The Parkhouse Nishi-Shinjuku Tower 60 CashflowDocument6 pagesJLL - The Parkhouse Nishi-Shinjuku Tower 60 CashflowJames KuahNo ratings yet

- The CF Engine Overview: Vehicle Engine Type Indication Performance Torque Emission Level Daf Cf65Document2 pagesThe CF Engine Overview: Vehicle Engine Type Indication Performance Torque Emission Level Daf Cf65James Kuah100% (1)

- Australia Stocks F Score Sep 13Document12 pagesAustralia Stocks F Score Sep 13James KuahNo ratings yet

- 3 Good Deals - 1 Apr 2013Document10 pages3 Good Deals - 1 Apr 2013James KuahNo ratings yet

- Cotai Strip No 1 ResidencesDocument1 pageCotai Strip No 1 ResidencesJames KuahNo ratings yet

- JWH Market Commentary: February 2011Document4 pagesJWH Market Commentary: February 2011James KuahNo ratings yet

- Credit Suisse - Measuring The MoatDocument70 pagesCredit Suisse - Measuring The MoatJames Kuah100% (1)

- Panama Maritime ClustersDocument24 pagesPanama Maritime ClustersJames KuahNo ratings yet

- Basic Economic ProblemsDocument4 pagesBasic Economic ProblemsSarah Nicole BrionesNo ratings yet

- Operating CostingDocument15 pagesOperating CostingBishnuNo ratings yet

- BSBMKG621 Ass2Document6 pagesBSBMKG621 Ass2Maykiza NiranpakornNo ratings yet

- Insurance ScribdDocument8 pagesInsurance ScribdAnonymous ZJAXUnNo ratings yet

- AL Brothers Prakashan: 7. Outcomes of DemocracyDocument7 pagesAL Brothers Prakashan: 7. Outcomes of DemocracyVino AldrinNo ratings yet

- Students of AravaliDocument36 pagesStudents of AravaliDeepak SethiNo ratings yet

- The Importance of Cost ControlDocument36 pagesThe Importance of Cost ControlfajarNo ratings yet

- 2007 Year End OverviewDocument28 pages2007 Year End OverviewLmoorjaniNo ratings yet

- Project On Tata Finance PDF FreeDocument113 pagesProject On Tata Finance PDF FreeOmkar Kawade100% (1)

- HR MGR or Regional HR Mgr. or Director of HRDocument4 pagesHR MGR or Regional HR Mgr. or Director of HRapi-78733964No ratings yet

- Strategic Management Chapter 4Document9 pagesStrategic Management Chapter 4Optimus PrimeNo ratings yet

- Intrinsic Value Calculator. Book Value and Dividend GrowthDocument4 pagesIntrinsic Value Calculator. Book Value and Dividend GrowthrmilhoriniNo ratings yet

- Recent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022Document64 pagesRecent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022sushant980No ratings yet

- Financial Inclusion-An Overview of MizoramDocument15 pagesFinancial Inclusion-An Overview of MizoramLal NunmawiaNo ratings yet

- Business Plan OverviewDocument3 pagesBusiness Plan Overviewasad ullahNo ratings yet

- Crams - 1Document28 pagesCrams - 1Janam AroraNo ratings yet

- The Effect of Service Quality and Promotion To Customer Satisfaction and Implication of Customer Loyalty in Vehicle Financing Company in Jakarta IndonesiaDocument9 pagesThe Effect of Service Quality and Promotion To Customer Satisfaction and Implication of Customer Loyalty in Vehicle Financing Company in Jakarta Indonesiabuangan kuNo ratings yet

- BACK Final PrintDocument49 pagesBACK Final Printritika duggalNo ratings yet

- Objectives Vs GoalsDocument4 pagesObjectives Vs GoalsDesmahNo ratings yet

- Treasury SharesDocument4 pagesTreasury SharesEmmanNo ratings yet

- ICSI New SyllabusDocument20 pagesICSI New SyllabusAnant MishraNo ratings yet

- Exercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineDocument9 pagesExercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineAllie LinNo ratings yet

- CH1 Final TextDocument62 pagesCH1 Final TextSh Mati ElahiNo ratings yet

- Skilled Manpower Turnover and Its ManagementDocument109 pagesSkilled Manpower Turnover and Its Managementfikru terfaNo ratings yet

- Chevron or CALTEX ReportDocument68 pagesChevron or CALTEX ReportSubayyal AhmedNo ratings yet

- John Sobredo - Summative AssessmentDocument2 pagesJohn Sobredo - Summative Assessmentsandra mae dulayNo ratings yet

- ACC100.101 Analyzing Transactions - Practice QuestionsDocument7 pagesACC100.101 Analyzing Transactions - Practice QuestionsZACARIAS, Marc Nickson DG.No ratings yet