Professional Documents

Culture Documents

Overdraft: Need Based

Overdraft: Need Based

Uploaded by

omkar maharanaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Overdraft: Need Based

Overdraft: Need Based

Uploaded by

omkar maharanaCopyright:

Available Formats

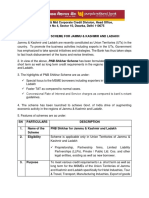

PNB GURUKUL SCHEME

PARAMETERS PARTICULARS

Purpose/ To meet the financial requirements for setting up of new/

Objective expansion/ renovation/ modernization of recognized

Educational Institutes i.e. Schools (including play schools),

Colleges and other educational bodies, running education

institutions having necessary affiliation. Construction of

hostel/canteen/labs etc. is also permissible under the

scheme.

To purchase equipments, Vehicles, Computer/Library books/

furniture /AC/ Lab equipments, etc.

Eligibility Educational institutions, Schools (including play schools),

Colleges and other educational bodies running educational

institutions set up by Firms/ Company/ Trusts/ Society/

Private Ltd. Co./ Public Ltd. Co./ LLP etc. (HUFs are not

eligible).

Education institutions which are covered under the scheme

may also be financed for construction of hostel, canteen,

activity Centre which are exclusively used by the concerned

institution provided cash flow of the education institutions is

sufficient enough to meet the obligation under agreement.

Area of operation All Branches of the Bank.

Type of facility Term Loan: Need based

Overdraft: Need based

Margin 25% for both Term Loan and Working capital

Wherever land is also financed as part of the cost of project

in such cases minimum prescribed margin against cost of

land shall be 40%.

Further, the quantum of finance against cost of the land

shall be restricted to 50% of the total sanctioned loan

amount.

However, maximum finance for the land shall not exceed

Rs. 2.00 crore.

Tenure of Loan Term Loan: Upto 10 years including moratorium period of

maximum upto 24 months.

Overdraft Facility: Shall be sanctioned for a period of one

year subject to annual renewal.

Primary Security Hypothecation of entire equipments, Current & Non-current

assets of the unit.

Mortgage of Project Land with existing / future construction

thereon.

Collateral Minimum 50% of the loan amount (Other than the land

Security and building of the educational institute) shall be

obtained in the form of immovable property / liquid

security.

Institutions whose final approval is pending (After

receipt of Letter of Intent from the concerned authority

like AICTE, UGC, MCI, DCI, CBSE, ICSE etc. as applicable

at particular stage), collateral security shall be 100% of

the loan amount (Other than the land and building of the

educational institute)

Personal guarantees of the Promoters/ Trustees (only office

bearers excluding professional office bearers) / Members of

the Society (only office bearers excluding professional office

bearers)/ Proprietor/ Partners /Directors (excluding

professional or independent directors) of the Institution shall

be obtained.

Note:

1. While sanctioning credit facilities to the Educational

Institutions, comfort should not be derived from the

securities being offered. The viability of the project and

cash flows of the Educational Institutions are to be relied upon

while considering any credit facilities to the Educational

Institutions.

2. Education Institutions are not eligible to be covered under

CGTMSE Scheme.

Rate of Interest As per

You might also like

- Ebook Ebook PDF Personal Finance 12th Edition by Jack Kapoor PDFDocument41 pagesEbook Ebook PDF Personal Finance 12th Edition by Jack Kapoor PDFwarren.beltran184100% (50)

- Ziale Lecture Notes On Mortgages, Debentures and GuaranteesDocument37 pagesZiale Lecture Notes On Mortgages, Debentures and GuaranteesMoses Bwalya Mweene100% (5)

- UdaanDocument39 pagesUdaanAnkit ButtoliaNo ratings yet

- 2000-2009 Bar Exam Qs in Mercantile Law (Nil Part) With AnswersDocument16 pages2000-2009 Bar Exam Qs in Mercantile Law (Nil Part) With Answerssirenangblue100% (4)

- 6 File General Term Loan Scheme Oct 2017 2Document1 page6 File General Term Loan Scheme Oct 2017 2Ashwet GaonkarNo ratings yet

- HEFADocument29 pagesHEFAGK TiwariNo ratings yet

- Skill - Loan - Scheme IDBIDocument1 pageSkill - Loan - Scheme IDBIramakrishnan balanNo ratings yet

- Guidelines Of: University Grants Commission Bahadur Shah Zafar Marg NEW DELHI - 110 002 Website: WWW - Ugc.ac - inDocument7 pagesGuidelines Of: University Grants Commission Bahadur Shah Zafar Marg NEW DELHI - 110 002 Website: WWW - Ugc.ac - inMithilesh Narayan BhattNo ratings yet

- Schemevcincludingskilldevsentto Govt 11812Document5 pagesSchemevcincludingskilldevsentto Govt 11812Pavan KumarNo ratings yet

- MITC Student Loan March 2015 CArd DetailsDocument2 pagesMITC Student Loan March 2015 CArd DetailsPranav ShaucheNo ratings yet

- Bridge Loan 31 - 10 - 2011Document2 pagesBridge Loan 31 - 10 - 2011Pawan Kumar RaiNo ratings yet

- Union Guaranteed Emergency Credit Line (UGECL) : SL - No Parameter DetailsDocument2 pagesUnion Guaranteed Emergency Credit Line (UGECL) : SL - No Parameter DetailsshaantnuNo ratings yet

- AdssdDocument25 pagesAdssdshaikNo ratings yet

- Affiliation Criteria 13-07-2017 RevisedDocument15 pagesAffiliation Criteria 13-07-2017 RevisedShahid ImranNo ratings yet

- Regulation HF 2: Types of Housing FinanceDocument3 pagesRegulation HF 2: Types of Housing FinanceMuhammad IshaqNo ratings yet

- A) Studies in India. (Indicative List)Document4 pagesA) Studies in India. (Indicative List)PinazNo ratings yet

- I Learn EL For Studies AbroadDocument7 pagesI Learn EL For Studies AbroadAuctzNo ratings yet

- Notes IBA Model Education Loan - 32031532 - 2024 - 03 - 22 - 21 - 43Document6 pagesNotes IBA Model Education Loan - 32031532 - 2024 - 03 - 22 - 21 - 43maltemayur37No ratings yet

- Union ProfessionalDocument2 pagesUnion Professionalcafirm vizagNo ratings yet

- Model EducationDocument5 pagesModel EducationHASNEIN SADIKOTNo ratings yet

- Scheme of Interest Subsidy636181089437985140Document8 pagesScheme of Interest Subsidy636181089437985140ANIL KUMAR SNo ratings yet

- CSIS Guideline 01.04.2023Document5 pagesCSIS Guideline 01.04.2023nationalinusrancesNo ratings yet

- FAQs Under CSIS SchemeDocument3 pagesFAQs Under CSIS Schemeankitt3022No ratings yet

- Private Colleges RegulationsDocument10 pagesPrivate Colleges RegulationsLaugh Trip TayoNo ratings yet

- Draft Memorandum of UnderstandingDocument10 pagesDraft Memorandum of UnderstandingHuzefaPakitwalaNo ratings yet

- Govt. of NCT of Delhi B-WING, 2 Floor, 5, Sham Nath Marg, Delhi-110054Document8 pagesGovt. of NCT of Delhi B-WING, 2 Floor, 5, Sham Nath Marg, Delhi-110054SkatNo ratings yet

- VCF-ST Brochure - English & HindiDocument8 pagesVCF-ST Brochure - English & Hindivinaykumar.chowdryNo ratings yet

- PIB Press Release: Wednesday, 8 September 2010Document3 pagesPIB Press Release: Wednesday, 8 September 2010bhuvansriNo ratings yet

- Wel 7Document8 pagesWel 7NoobinderNo ratings yet

- Most Important Terms and Conditions: Student Loan SchemeDocument2 pagesMost Important Terms and Conditions: Student Loan SchemeAtharv singh BishtNo ratings yet

- Person With Disabilities UniDocument14 pagesPerson With Disabilities UniParinita SinghNo ratings yet

- Haryana State Board of Technical Education Affiliation Bye-Laws Chapter - I 1. Short Title and DefinitionsDocument35 pagesHaryana State Board of Technical Education Affiliation Bye-Laws Chapter - I 1. Short Title and DefinitionsNarinder PalNo ratings yet

- Section - 2: Financial Norms ofDocument12 pagesSection - 2: Financial Norms ofwqsdNo ratings yet

- Department of Science & Technology Technology Systems Development (TSD) Programme Terms & Conditions of The GrantDocument4 pagesDepartment of Science & Technology Technology Systems Development (TSD) Programme Terms & Conditions of The GrantGautam RanganNo ratings yet

- Union Parivahan SchemeDocument1 pageUnion Parivahan SchemeBUDU GOLLARYNo ratings yet

- Credit and FInanceDocument60 pagesCredit and FInanceKrishna KumarNo ratings yet

- Technology Systems Development (TSD) ProgrammeDocument3 pagesTechnology Systems Development (TSD) ProgrammeRavi ParkheNo ratings yet

- Call For Online Applications For Running Skill-Based Programs For The Academic Year 2020-2021Document3 pagesCall For Online Applications For Running Skill-Based Programs For The Academic Year 2020-2021अखिलेश पाण्डेयNo ratings yet

- Scheme Document FDP PDFDocument3 pagesScheme Document FDP PDFdoggaravi07No ratings yet

- Credit Guarantee Trust For Micro - Small Enterprises (CGTMSE)Document12 pagesCredit Guarantee Trust For Micro - Small Enterprises (CGTMSE)Manoj Kumar MannepalliNo ratings yet

- ULP (Word)Document2 pagesULP (Word)RithikaNo ratings yet

- Lgscas-Operational Guidelines - 17 08 2022Document5 pagesLgscas-Operational Guidelines - 17 08 2022Akhtar HussainNo ratings yet

- AmalDocument3 pagesAmalAmal SNo ratings yet

- Circular 257Document5 pagesCircular 257Carlos VelascoNo ratings yet

- Expenses Considered For Loan Under PNB PratibhaDocument3 pagesExpenses Considered For Loan Under PNB Pratibhaasdasd dsd sNo ratings yet

- 1Document3 pages1Mom BidaNo ratings yet

- Kscste Format Srs TcsrsDocument4 pagesKscste Format Srs Tcsrsassistant directorNo ratings yet

- PNB Sampatti Parameters Particulars PurposeDocument4 pagesPNB Sampatti Parameters Particulars PurposeRohit JaroudiyaNo ratings yet

- Education LoanDocument9 pagesEducation LoanPriya Tiku KoulNo ratings yet

- Medium Term Finance (Loan) Is Usually Provided FromDocument19 pagesMedium Term Finance (Loan) Is Usually Provided FromAntora HoqueNo ratings yet

- Letter To IIMB - Loan To Students of IIMsDocument1 pageLetter To IIMB - Loan To Students of IIMsAmit KumarNo ratings yet

- Financial Rules For Competitive GrantsDocument6 pagesFinancial Rules For Competitive GrantsSumbal AfzalNo ratings yet

- CHAPTER 1 Financing of Constructed FacilitiesDocument10 pagesCHAPTER 1 Financing of Constructed FacilitiesBrandy PaceNo ratings yet

- Asset Based Retail Financial ServicesDocument37 pagesAsset Based Retail Financial Servicesjimi02100% (1)

- Education Loan: NF-546 NF-416 NF-440Document11 pagesEducation Loan: NF-546 NF-416 NF-440Santosh Kumar50% (2)

- What Is Credit Linked Back Ended Subsidy and How Is It AdministeredDocument1 pageWhat Is Credit Linked Back Ended Subsidy and How Is It AdministeredVipul BhartiaNo ratings yet

- Luxury Hotels in JaipurDocument5 pagesLuxury Hotels in JaipurmayoonlyNo ratings yet

- Interest RateDocument21 pagesInterest RateSagara AbeykoonNo ratings yet

- MainMenuEnglishLevel-2 FAQ PDFDocument19 pagesMainMenuEnglishLevel-2 FAQ PDFmadhumay23No ratings yet

- BPE 35203 - LN 5 08 Oct 2019Document40 pagesBPE 35203 - LN 5 08 Oct 2019khafaei krikNo ratings yet

- Pages From Central Interest Subsidy Scheme EL 2013Document3 pagesPages From Central Interest Subsidy Scheme EL 2013shubhamsouravNo ratings yet

- Budget Optimization and Allocation: An Evolutionary Computing Based ModelFrom EverandBudget Optimization and Allocation: An Evolutionary Computing Based ModelNo ratings yet

- Egg Storage and Supply: Trupti EnterprisesDocument33 pagesEgg Storage and Supply: Trupti Enterprisesomkar maharana100% (1)

- Building /site Permission /approval From Municipality/Nagar PanchayatDocument2 pagesBuilding /site Permission /approval From Municipality/Nagar Panchayatomkar maharanaNo ratings yet

- Msme& Mid Corporate Credit Division, Head Office Plot No.4, Sector-10, Dwarka, New Delhi-110075Document2 pagesMsme& Mid Corporate Credit Division, Head Office Plot No.4, Sector-10, Dwarka, New Delhi-110075omkar maharanaNo ratings yet

- The Odisha Gazette: Extraordinary Published by AuthorityDocument174 pagesThe Odisha Gazette: Extraordinary Published by Authorityomkar maharanaNo ratings yet

- Rice MillDocument14 pagesRice Millomkar maharanaNo ratings yet

- PNB Shikhar SchemeDocument3 pagesPNB Shikhar Schemeomkar maharanaNo ratings yet

- Category Margin Micro & Small Enterprises (As Per MSME Defined Ceiling) 10% Medium Enterprises (As Per MSME Defined Ceiling) 15% Others 25%Document3 pagesCategory Margin Micro & Small Enterprises (As Per MSME Defined Ceiling) 10% Medium Enterprises (As Per MSME Defined Ceiling) 15% Others 25%omkar maharanaNo ratings yet

- Msme Prime Plus: SN Parameters ParticularsDocument2 pagesMsme Prime Plus: SN Parameters Particularsomkar maharanaNo ratings yet

- Co - Lending by BanksDocument3 pagesCo - Lending by Banksomkar maharanaNo ratings yet

- CCIM Portfolio BrochureFeb23Document43 pagesCCIM Portfolio BrochureFeb23yaya yahuNo ratings yet

- Usufract AgreementDocument3 pagesUsufract Agreementsonia vallente0% (1)

- Agreement of Mortgage and Transfer of InterestDocument17 pagesAgreement of Mortgage and Transfer of InterestViseshSatyannNo ratings yet

- Bahan Ajar Hutang WeselDocument8 pagesBahan Ajar Hutang Weselcalsey azzahraNo ratings yet

- Opsdog - KPI-Encyclopedia Consumer-Finance Preview 5 PgsDocument5 pagesOpsdog - KPI-Encyclopedia Consumer-Finance Preview 5 PgsJohn CheekanalNo ratings yet

- Confusion or Merger of Rights: Section 4Document17 pagesConfusion or Merger of Rights: Section 4Rowena Shaira AbellarNo ratings yet

- Loan AgreementDocument3 pagesLoan AgreementRichardNo ratings yet

- Petitioner, vs. Metropolitan RespondentsDocument1 pagePetitioner, vs. Metropolitan RespondentsChanel GarciaNo ratings yet

- Islamic Sales Contract: BY Mufti Mahmood AhmadDocument39 pagesIslamic Sales Contract: BY Mufti Mahmood AhmadAbdul Maroof100% (1)

- Exp22 Excel ch02 ml2 - Vacation Property InstructionsDocument2 pagesExp22 Excel ch02 ml2 - Vacation Property Instructionsapi-572422586No ratings yet

- Manila Banking Corp V Teodoro J. & TeodoroDocument2 pagesManila Banking Corp V Teodoro J. & TeodoromoniquehadjirulNo ratings yet

- The ABCs of MoneyDocument254 pagesThe ABCs of Moneyalice michira100% (1)

- Sarfaesi Act 2002Document16 pagesSarfaesi Act 2002Atheena Das0% (1)

- Capacity of PartiesDocument4 pagesCapacity of PartiesSuyash KulkarniNo ratings yet

- Sanctional Letter 3908838977 2020-01-15 PDFDocument1 pageSanctional Letter 3908838977 2020-01-15 PDFSurendra TagleNo ratings yet

- 1 - Credit & Lending - Tutorial Questions Set 1 - 2022Document3 pages1 - Credit & Lending - Tutorial Questions Set 1 - 2022Abdulkarim Hamisi KufakunogaNo ratings yet

- First Information Report: (Under Section 154 CR.P.C.)Document21 pagesFirst Information Report: (Under Section 154 CR.P.C.)Sureshkumar JNo ratings yet

- SLP FormDocument2 pagesSLP FormRaymart H. BorlonNo ratings yet

- ML Upper Intermediate Practice FileDocument96 pagesML Upper Intermediate Practice FilececiliaNo ratings yet

- BSP Personal Loan Application FormDocument2 pagesBSP Personal Loan Application FormLamson ParuaNo ratings yet

- CHATTEL MORTGAGE (Articles 2140 To 2141)Document7 pagesCHATTEL MORTGAGE (Articles 2140 To 2141)Beya AmaroNo ratings yet

- Agreement Between Film Producers and DistributorsDocument4 pagesAgreement Between Film Producers and DistributorsABHI AbrahamNo ratings yet

- Divvy Bike RevolutionDocument4 pagesDivvy Bike Revolutionpahone12No ratings yet

- Quirino Gonzales Logging Concessionaire Va CaDocument15 pagesQuirino Gonzales Logging Concessionaire Va CaViolet BlueNo ratings yet

- EOF Lecture Notes - Rent vs. Buy - Sep 8Document28 pagesEOF Lecture Notes - Rent vs. Buy - Sep 8碧莹成No ratings yet

- Case CompilationDocument72 pagesCase CompilationZen JoaquinNo ratings yet

- Transfer of Property Act. The Case Is A Civil Appeal Filed in Karnataka High Court, AgainstDocument8 pagesTransfer of Property Act. The Case Is A Civil Appeal Filed in Karnataka High Court, AgainstVanshdeep Singh SamraNo ratings yet