Professional Documents

Culture Documents

Study of Working Capital Management of Future Supply Chain Solutions Pvt. LTD, Nagpur Form 2014-15 To 2016-17'

Study of Working Capital Management of Future Supply Chain Solutions Pvt. LTD, Nagpur Form 2014-15 To 2016-17'

Uploaded by

Harry rioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Study of Working Capital Management of Future Supply Chain Solutions Pvt. LTD, Nagpur Form 2014-15 To 2016-17'

Study of Working Capital Management of Future Supply Chain Solutions Pvt. LTD, Nagpur Form 2014-15 To 2016-17'

Uploaded by

Harry rioCopyright:

Available Formats

© 2018 JETIR October 2018, Volume 5, Issue 10 www.jetir.

org (ISSN-2349-5162)

‘Study of Working Capital Management of Future

Supply Chain Solutions Pvt. Ltd, Nagpur form 2014-

15 to 2016-17’

1

Rahul Patil and 2 Dr. Swarnalata Philip

1

Student, MBA 4 Semester, JD College of Engineering and Management, Nagpur. 2Assistant

th

Professor, JD College of Engineering and Management, Nagpur.

ABSTRACT: Managing liquidity and profitability is one of the most important tasks of working capital management

which can make or mar a business. Supply chain and logistics are cost intensive and their demand on liquidity and effect on

profitability of a business weigh on most of the business decisions. Though working capital management is a crucial area for each

type of business, this paper studies the same in the context of Future Supply Chain Solutions Pvt. Ltd, Nagpur , a company

engaged in providing logistics and supply chain solutions . The period selected for the study is from 2014-15 to 2016-17. The

paper mainly uses various ratios for this purpose.

Key Words: working capital, liquidity,profitability

INTRODUCTION

Working capital management holds a greater significance in every industry as inadequate working capital may lead to loss

of reputation and even bankruptcy in many cases. Future Supply Chain Solutions Pvt Ltd., Nagpur, the company under study

offers supply chain solutions covering third-party logistics services, including contract logistics, express logistics and

temperature-controlled logistics. Supply chain is a vital link in a business where there is potential of reduction in costs which can

contribute in efficient working capital management. The project studies the techniques of working capital management in Future

Supply Chain Solutions Pvt Ltd., Nagpur to gain an insight into the efficacy of the methods adopted by the company and to

identify the

areas where steps can be taken to further improve the efficiency of working capital management.

Working capital policies have a great effect on a firm's liquidity and profitability. Therefore, the working capital should be

managed in such a way which will ensure higher profitability and adequate liquidity to the business concern. Working capital

management assumes significance in the backdrop of maintaining a ‘good fit' with the ever-changing business and economic

environment and is vital to enhance the capability of the organization to cope with challenges.

DEFINITION OF WORKING CAPITAL

Working capital means the funds which are required to meet the day-to-day transactions of the business. In other words it

refers to that part of the firm's capital which is required for financing current assets such as cash, marketable securities, debtors

and inventories. Gross working capital refers to the total investment in current assets and net working capital refers to the

difference between current assets and current liabilities.

COMPANY PROFILE:

Future supply chains solutions. Pvt. Ltd. Was founded on 2007 promoted by Kishore Biyani of Future Enterprises Limited. The

Company has presence in all over India with five zone respectively, North, East, South , West & Central zone. Mihan is a

Central zone warehouse started in 2010 with seven branches namely Raipur, Bilaspur, Indore, Jabalpur, Nagpur, Gwalior, OCLP

Gumgoan. & two hubs in OCLP Gumgoan & Indore. Currently the company employs 1500 emplyees..FSCS Pvt. Ltd is one of

India’s largest organized third-party supply chain and logistics service provider offering automated and IT-enabled warehousing,

distribution and other logistics solutions to a wide range of customers. The service offerings, warehousing structure, pan-India

distribution network, “hub-and-spoke” transportation model and automated technology systems support the firm’s competitive

market position. The customers of the company span across India, in various sectors including retail, fashion and apparel,

automotive and engineering, food and beverage, fast-moving consumer goods (FMCG), e-commerce, healthcare, electronics and

technology, home and furniture and ATMs.

The distribution centers and delivery network of FSCS form a supply chain system across India. As of July 31, 2017, for the

contract logistics services, the operations are run through 42 distribution centers across India, covering approximately 3.80

million square feet of warehouse space and 2 distribution centers at customer premises, covering area of approximately 0.37

million square feet. The distribution centre at the Multi-modal International Hub Airport at Nagpur (MIHAN) is one of the

largest and most highly automated distribution centers in India with an area of approximately 0.37 million square feet of

warehousing space, housing a high-speed cross-belt sorter system, which was the first of its kind in India, with a sorting capacity

of approximately 2,000 cases per hour.

JETIRI006009 Journal of Emerging Technologies and Innovative Research (JETIR) www.jetir.org 60

© 2018 JETIR October 2018, Volume 5, Issue 10 www.jetir.org (ISSN-2349-5162)

The Company posted revenues of Rs 5,612 million and a net profit of Rs 458 million at the end of the financial year 2016-17.

During the past three years since financial year 2013-14, the revenues from operations of the Company have grown at a

compounded annual growth rate (CAGR) of 17%.

The working capital of the company for three years is depicted in the table below:

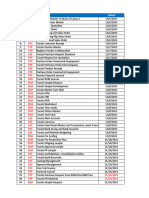

Table 1:: Statement Working Capital of FSCS Pvt. Ltd. Nagpur.

Years 2014-15 2015-16 2016-17

Working Capital 5323.68 7354.41 11222.96

%Increase in Working Capital 38.14 52.60

Working Capital/Total Assets

FIGURE 1: WORKING CAPITAL OF FSCS

EFFICIENCY RATIOS

Working capital management can be assessed by studying the efficiency ratios which indicate the efficiency of the

utilization of various kinds of assets in terms of sales achieved. This ratios are also called as activity ratios or assets management

ratios.

a. Working Capital Turnover Ratio.

b. Inventory Turnover Ratio.

c. Current Assets Turnover Ratio.

d. Debtors Turnover Ratio.

e. Debtors Collection Period.

f. Creditors Turnover Ratio.

g. Fixed Assets Turnover Ratio.

The various turnover ratios for the past three years for the company are depicted in the table

TABLE 2: EFFICIENCY (TURNOVER) RATIOS.

Ratios/Year 2014-15 2015-16 2016-17

Working Capital Turnover 7.45 5.78 3.40

Inventory Turnover 9.395 7.02 6.57

Current Assets Turnover 2.23 2.18 1.68

Debtors turnover Ratio 17.78 15.73 21.14

Debtors Collection 21 23 17

Period(days)

Creditors Turnover Ratio 1.26 1.72 1.45

Fixed asset turnover Ratio 13.79 11.56 9.89

The working capital turnover ratio shows a decline during these three years , i.e., the working capital is comparatively

higher than the previous periods. This might indicate a build- up of stock with more non-moving items. The investment in

working capital seems to be increasing without a corresponding increase in turnover. This might indicate locking of funds.

The inventory turnover ratios are showing a declining trend. This, along with higher working capital turnover ratio

indicates stocks are moving at a slower rate and hence that is one of the major the reasons behind the decrease in working capital

turnover ratio. The same applies to the current assets turnover ratio also. The debtors turnover ratio is increasing which indicates

that the recovery from debtors are better and this is reflected in the declining debtor collection period. This is a welcome

development for the company as its funds would be blocked in debtors for a less period.

JETIRI006009 Journal of Emerging Technologies and Innovative Research (JETIR) www.jetir.org 61

© 2018 JETIR October 2018, Volume 5, Issue 10 www.jetir.org (ISSN-2349-5162)

The creditors turnover ratio is also increasing which implies that the company has also sped up the payment of the creditors,

which means that the company has to look more into internal sources for financing working capital.

Liquidity vs. Profitability: One of the chief objectives of Working capital management is to achieve a trade-off between the twin

objectives of Liquidity and profitability. A large net working capital may reduce the liquidity risk of the firm but excess of

liquidity would lead to idle funds which would adversely affect profitability.The following ratios have been calculated to assess

whether these objectives are adequately met by the company.

TABLE 3: LIQUIDITY RATIOS

RATIOS/YEAR 2014-15 2015-16 2016-17

Current Ratio. 1.43 1.61 1.98

Quick Ratio. 1.09 1.11 1.47

Absolute Liquidity Ratio 0.69 0.49 0.82

The current ratio of the firm is showing an upward trend and indicates that the current assets are sufficient to

cover current liabilities and the liquidity position is quite sound. Quick ratio and the absolute liquidity ratios are also

satisfactory and well above the industry average.

TABLE 4: PROFITABILIITY RATIOS

RATIOS/YEAR 2014-15 2015-16 2016-17

Gross Profit Ratio 15.74 13.45 17.04

Net Profit Ratio 9.16 9.61 12.54

Return on Equity 37.93 32.08 29.33

Return on capital employed. 23.06 33.57 51.58

The Gross profit, Net Profit and the return on capital employed show a positive trend. The Gross profit has increased from

15.74 to 17.04 % during the period of study. Net profit has also shown a positive trend as it has increased from 9.16 in the year

2014-5 to 12.54 in 2016-17. However, the return on equity has declined from 37.93% to 29.33. This might be due to the reduction

of proportion of debt in the capital structure. The return on capital employed , which is the return on total funds invested has also

shown a rising trend which indicates the increase in the profitability of te company.

FINDINGS &CONCLUSIONs

The working capital position of the company is quite sound. The working capital has increased during the three years of

study period. From the study of other efficiency ratios, it is found that current assets have increased and current liabilities have

decreased which has resulted in the increase in working capital. However, this has not affected the profitability as the Gross Profit

, Net Profit and Return on the Capital Employed ratios are showing an upward trend. In the event of the company wishing to

mobilize more capital, the profitability would help in getting good response from the investors. However, the return on equity has

reduced which can become a concern for the owners.

REFERENCES:

[1] Rastogi R P, Financial Management: Theory, Concept and Problems-3rd Edition Galgotia Publishing

Company

[2] Ravi M Kishore, Financial Managemnt, Comprehensive Textbook with Case studies, 7th Edition,

Taxmann’s publications Pvt. Ltd.

[3] An Analysis of Working Capital Management in SAIL and RINL P. Mohan Reddy and N.K. Pradeep

Kumar, Proceedings of 11th Asia-Pacific Business Research Conference 24 - 25 October 2016, East

Asia Institute of Management, Singapore ISBN: 978-1-925488-18-0

[4] Dr. Vivek Singla , ‘A Comparative Study of Financial Performance of Sail and Tata Steel Ltd’,

IJRSR International Manuscript ID : ISSN23194618-V2I1M11-012013

[5] https://www.investopedia.com/terms/w/workingcapital.asp

[6] http://www.futuresupplychains.com/

[7] http://197.14.51.10:81/pmb/CHIMIE/Working%20Capital%20Management.pdf

JETIRI006009 Journal of Emerging Technologies and Innovative Research (JETIR) www.jetir.org 62

© 2018 JETIR October 2018, Volume 5, Issue 10 www.jetir.org (ISSN-2349-5162)

[8] http://worldbizins.org/img/1499929501.pdf

[9] https://www.scribd.com/document/208914727/Sail-Bokaro

[10] https://www.ijrsr.com/January2013/11.pdf

[10] https://www.crisil.com/Ratings/Brochureware/RR_ASSES/CRISIL-Ratings- research-approach-to-

financial-ratios_2013.pdf

JETIRI006009 Journal of Emerging Technologies and Innovative Research (JETIR) www.jetir.org 63

You might also like

- Cambridge International As A Level Accounting Coursebook With Digital Access (2 Years) (Hopkins, David, Malpas, Deborah, Randall Etc.) (Z-Library)Document880 pagesCambridge International As A Level Accounting Coursebook With Digital Access (2 Years) (Hopkins, David, Malpas, Deborah, Randall Etc.) (Z-Library)capsfast100% (5)

- Ratio Analysis Project GMR Infra LTDDocument15 pagesRatio Analysis Project GMR Infra LTDRaja SekharNo ratings yet

- Hospitality Industry Accounting GlossaryDocument26 pagesHospitality Industry Accounting GlossaryKathy Holcomb CraigNo ratings yet

- How To Use CompustatDocument61 pagesHow To Use CompustatEmil VoldNo ratings yet

- Effect of Working Capital Management On Profitability: January 2018Document8 pagesEffect of Working Capital Management On Profitability: January 2018AbelNo ratings yet

- A Study On Efficiency of Working Capital Management of Selected It CompaniesDocument6 pagesA Study On Efficiency of Working Capital Management of Selected It CompaniesRasmiranjan TripathyNo ratings yet

- IJRASETDocument5 pagesIJRASETAnonymous QdPNnb7JDeNo ratings yet

- 4 PDFDocument2 pages4 PDFSarthak ChavanNo ratings yet

- 1252am - 140.EPRA Journals - 4180Document7 pages1252am - 140.EPRA Journals - 4180Kishore ThirunagariNo ratings yet

- A Study On Working Capital Management in Tirumala Dairy PVT LimitedDocument6 pagesA Study On Working Capital Management in Tirumala Dairy PVT LimitedDiwakar BandarlaNo ratings yet

- Working Capital Management of Nestle IndiaDocument4 pagesWorking Capital Management of Nestle IndiaPravin SinghNo ratings yet

- Working Capital Management and Profitability: Evidence From Indian Manufacturing CompaniesDocument14 pagesWorking Capital Management and Profitability: Evidence From Indian Manufacturing CompaniesBewerbungNo ratings yet

- Financial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranDocument8 pagesFinancial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranShreyansh JainNo ratings yet

- In Uence of Working Capital Management On Profitability: A Study On Indian FMCG CompaniesDocument11 pagesIn Uence of Working Capital Management On Profitability: A Study On Indian FMCG Companieschirag PatwariNo ratings yet

- TCS Company Organization HeadsDocument11 pagesTCS Company Organization HeadspriyaNo ratings yet

- Paper 5 PDFDocument15 pagesPaper 5 PDFGowri J BabuNo ratings yet

- 2990 9440 1 PBDocument9 pages2990 9440 1 PBvinal.sharmaNo ratings yet

- Solutions - Chapter 5Document21 pagesSolutions - Chapter 5Dre ThathipNo ratings yet

- Jurnal Pendukung 5Document17 pagesJurnal Pendukung 5ARIF MUDJIONONo ratings yet

- Gp-Impact of Working Capital Management On Profitability of Gokul (GRSL)Document114 pagesGp-Impact of Working Capital Management On Profitability of Gokul (GRSL)Parth ShahNo ratings yet

- ANALYTICAL STUDY ON FINANCIAL PERFORMANCE OF HINDUSTAN UNILEVER LIMITED Ijariie5525Document8 pagesANALYTICAL STUDY ON FINANCIAL PERFORMANCE OF HINDUSTAN UNILEVER LIMITED Ijariie5525Avishi KushwahaNo ratings yet

- (A Study With Reference To Bajaj Finance Limited) : Profitability Analysis of Lease Financing CompanyDocument8 pages(A Study With Reference To Bajaj Finance Limited) : Profitability Analysis of Lease Financing CompanybhupNo ratings yet

- Influence of Working Capital Management On Profitability: A Study On Indian FMCG CompaniesDocument10 pagesInfluence of Working Capital Management On Profitability: A Study On Indian FMCG CompaniesnishaNo ratings yet

- Shubham Gupta 47 Sec ADocument102 pagesShubham Gupta 47 Sec AAshutosh KumarNo ratings yet

- Financial Ratio AssignmentDocument28 pagesFinancial Ratio AssignmentMinh Huyền NguyễnNo ratings yet

- The Relationship Between Working Capital Management and Profitability: Evidence From PakistanDocument12 pagesThe Relationship Between Working Capital Management and Profitability: Evidence From PakistanJudith N Gavidia MNo ratings yet

- Working Capital Management and Corporate Profitability: Empirical Evidences From Nepalese Manufacturing SectorDocument16 pagesWorking Capital Management and Corporate Profitability: Empirical Evidences From Nepalese Manufacturing SectorJulia ConceNo ratings yet

- A Study On Financial Performance of Indian Oil Corporation LimitedDocument3 pagesA Study On Financial Performance of Indian Oil Corporation LimitedYASHWANTH PATIL G JNo ratings yet

- Working Capital Mangement of Wipro Limited: Dr.M.Yasodha, Vaijayantthi.R, Shree Harshini.G, Nivetha.VDocument8 pagesWorking Capital Mangement of Wipro Limited: Dr.M.Yasodha, Vaijayantthi.R, Shree Harshini.G, Nivetha.Vshreyas kadamNo ratings yet

- Ratio Analysis - HeroDocument25 pagesRatio Analysis - HeroGOURAV SHRIVASTAVA Student, Jaipuria IndoreNo ratings yet

- Working Capital PresentationDocument40 pagesWorking Capital PresentationDaman Deep Singh ArnejaNo ratings yet

- A Study On Working Capital ManagementDocument2 pagesA Study On Working Capital ManagementEditor IJTSRDNo ratings yet

- Liquidity Profitability Trade Off A Panel Study of Listed Non Financial Firms in GhanaDocument14 pagesLiquidity Profitability Trade Off A Panel Study of Listed Non Financial Firms in GhanaEditor IJTSRDNo ratings yet

- A Study On Financial Performance of Maruti Suzuki MotorsDocument8 pagesA Study On Financial Performance of Maruti Suzuki MotorsBHAVYA SHREE KNo ratings yet

- Rahul Dissertation ReportDocument37 pagesRahul Dissertation ReportGauravChhokarNo ratings yet

- Working Management On Tata CHINTU BHOIDocument39 pagesWorking Management On Tata CHINTU BHOIRatikant ParidaNo ratings yet

- Analyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionDocument37 pagesAnalyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- An Analysis of Working Capital Management of Tata Motors LimitedDocument9 pagesAn Analysis of Working Capital Management of Tata Motors LimitedAyeesha K.s.No ratings yet

- Working Capital & Dividend PolicyDocument9 pagesWorking Capital & Dividend PolicyLipi Singal0% (1)

- Working Capital Management of Mahindra and MahindraDocument6 pagesWorking Capital Management of Mahindra and MahindraHaris AnsariNo ratings yet

- Working Capital Management in Indian PapDocument11 pagesWorking Capital Management in Indian PapSaurabh NevNo ratings yet

- Ratio AnalysisDocument79 pagesRatio Analysisanjali dhadde100% (1)

- Full Report HereDocument25 pagesFull Report HereAnu PomNo ratings yet

- Fin MGMTDocument6 pagesFin MGMTchiragNo ratings yet

- A Study On Working Capital Management of Kaira District Co-Operative Milk Producers Union LimitedDocument6 pagesA Study On Working Capital Management of Kaira District Co-Operative Milk Producers Union LimitedTechno ErgonomicsNo ratings yet

- Working Capital Management in Indian Pap 2 PDFDocument11 pagesWorking Capital Management in Indian Pap 2 PDFBiniam NegaNo ratings yet

- Dissertation Project On Working Capital ManagementDocument4 pagesDissertation Project On Working Capital ManagementCustomPaperUKNo ratings yet

- Profitability Analysis of Lease Financing Company (A Study With Reference To Bajaj Finance Limited)Document9 pagesProfitability Analysis of Lease Financing Company (A Study With Reference To Bajaj Finance Limited)bhupNo ratings yet

- 13 Dr. Davendra Kumar Sharma Set S S M Page 08Document8 pages13 Dr. Davendra Kumar Sharma Set S S M Page 08Gokul krishnanNo ratings yet

- Comparative Analysis of Mutual Fund Schemes and Major Investment AvenuesDocument52 pagesComparative Analysis of Mutual Fund Schemes and Major Investment AvenuesPrithvi Raj SinghNo ratings yet

- A Study On Working Capital Management at Berger Paints LTDDocument6 pagesA Study On Working Capital Management at Berger Paints LTDdanny kanniNo ratings yet

- Nishat Mills (Afm Report)Document23 pagesNishat Mills (Afm Report)kk5522100% (1)

- A Study On Forcasting Working Capital Management in Anantha Maha Samakhya at AnantapururamuDocument5 pagesA Study On Forcasting Working Capital Management in Anantha Maha Samakhya at AnantapururamuEditor IJTSRDNo ratings yet

- Main ProjectDocument91 pagesMain ProjectJyothirmai PediredlaNo ratings yet

- Assessment of Financial Condition: A Case Study of Saudi Construction CompaniesDocument9 pagesAssessment of Financial Condition: A Case Study of Saudi Construction Companiesفرفشه اضحك بجدNo ratings yet

- Original Research Paper Commerce: A Study On Financial Performance Analysis of Indian Tobacco Corporation LimitedDocument4 pagesOriginal Research Paper Commerce: A Study On Financial Performance Analysis of Indian Tobacco Corporation Limitedemmanual cheeranNo ratings yet

- 2012 - IsSN - Influence of Working Capital Management On Profitability A Study On Indian FMCG CompaniesDocument10 pages2012 - IsSN - Influence of Working Capital Management On Profitability A Study On Indian FMCG CompaniesThi NguyenNo ratings yet

- Financial Statement Analysis of KFCDocument15 pagesFinancial Statement Analysis of KFCPrasiddha PradhanNo ratings yet

- Unit 5. Financial Statement Analysis IIDocument32 pagesUnit 5. Financial Statement Analysis IIsikute kamongwaNo ratings yet

- The Outsourcing Revolution (Review and Analysis of Corbett's Book)From EverandThe Outsourcing Revolution (Review and Analysis of Corbett's Book)No ratings yet

- Mastering Operational Performance : The Ultimate KPI HandbookFrom EverandMastering Operational Performance : The Ultimate KPI HandbookNo ratings yet

- Quiz 2 Set 1Document7 pagesQuiz 2 Set 1Umar Farooq100% (1)

- (L) Chapter 13 Accounts For Limited CompanyDocument13 pages(L) Chapter 13 Accounts For Limited CompanyCHZE CHZI CHUAHNo ratings yet

- Jadwal Kut & UatDocument21 pagesJadwal Kut & UatsebriansahNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/12Document12 pagesCambridge International AS & A Level: Accounting 9706/12Nadine JanganoNo ratings yet

- Sensitivity Analysis Class Practice Example - S SolutionDocument1 pageSensitivity Analysis Class Practice Example - S SolutionAyesha SaddiqueNo ratings yet

- Microeconomics Principles Applications and Tools 8th Edition OSullivan Test Bank DownloadDocument67 pagesMicroeconomics Principles Applications and Tools 8th Edition OSullivan Test Bank DownloadMichael ColemanNo ratings yet

- Problems On Ratio AnalysisDocument5 pagesProblems On Ratio AnalysisPadyala Sriram100% (1)

- Platts Fuel Oil PriceDocument6 pagesPlatts Fuel Oil PricesalmanNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- Financial Distress, Managerial Incentives and InformationDocument12 pagesFinancial Distress, Managerial Incentives and InformationAbdy ShahNo ratings yet

- The Securitzation of Commodities - RitterDocument6 pagesThe Securitzation of Commodities - RitterCervino InstituteNo ratings yet

- Spectre WhitepaperDocument23 pagesSpectre WhitepaperGungaa JaltsanNo ratings yet

- Solutions Corporate FinanceDocument28 pagesSolutions Corporate FinanceUsman UddinNo ratings yet

- Wealth Creation GuideDocument12 pagesWealth Creation GuideRenju ReghuNo ratings yet

- Diandra Murti Liza Aulia 2022210006 Tugas P-12 Pengantar Akuntansi 2Document3 pagesDiandra Murti Liza Aulia 2022210006 Tugas P-12 Pengantar Akuntansi 2Diandra MurtiNo ratings yet

- Elasticity ProblemsDocument28 pagesElasticity ProblemsCheyenne Megan Kohchet-ChuaNo ratings yet

- Successful Backtesting of Algorithmic Trading Strategies - Part II - QuantStart PDFDocument4 pagesSuccessful Backtesting of Algorithmic Trading Strategies - Part II - QuantStart PDFenghoss77No ratings yet

- A. Preamble of The SyllabusDocument2 pagesA. Preamble of The SyllabussanjayNo ratings yet

- In Venture Growth & Securities Ltd.Document424 pagesIn Venture Growth & Securities Ltd.adhavvikasNo ratings yet

- FM213 - AT - Problem Set 5 - Class NotesDocument10 pagesFM213 - AT - Problem Set 5 - Class NotesGuido MaiaNo ratings yet

- Group 2 - Business PlanDocument14 pagesGroup 2 - Business PlanPipito FportNo ratings yet

- United Paragon Mining Corp. SEC 23-B FAO ASC For Feb2022Document4 pagesUnited Paragon Mining Corp. SEC 23-B FAO ASC For Feb2022Julius Mark Carinhay TolitolNo ratings yet

- Subsequent To Acquisition DateDocument1 pageSubsequent To Acquisition DateJean De GuzmanNo ratings yet

- WW5050 Progettoricerca Cordazzo WebDocument1 pageWW5050 Progettoricerca Cordazzo WebGhislaine Umuhoza GakubaNo ratings yet

- HTTPS: - Zerodha-Common.s3.ap-South-1.amazonaws - Com - Varsity - Modules - Module 1 - Introduction To Stock Markets PDFDocument111 pagesHTTPS: - Zerodha-Common.s3.ap-South-1.amazonaws - Com - Varsity - Modules - Module 1 - Introduction To Stock Markets PDFbhaveshNo ratings yet

- Binomial Option Pricing Model: T-1 T, U T, DDocument4 pagesBinomial Option Pricing Model: T-1 T, U T, DVincent AlexNo ratings yet

- Basic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkDocument67 pagesBasic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkthiruvilanNo ratings yet