Professional Documents

Culture Documents

7 The Conversion Cycle

7 The Conversion Cycle

Uploaded by

KaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 The Conversion Cycle

7 The Conversion Cycle

Uploaded by

KaiCopyright:

Available Formats

The Conversion

Cycle

Bulacan Date Developed:

BACHELOR OF SCIENCE IN February 2021

ACCOUNTING Polytechnic Date Revised: Page 1 of 7

College

INFORMATION SYSTEM

Document No. Developed by:

IAIS 223 Sarah Joy D. Martin Revision # 01

c/o Admin

MODULE CONTENT

COURSE TITLE: FINANCIAL ACCOUNTING AND REPORTING 1

MODULE TITLE: The Conversion Cycle

NOMINAL DURATION: 3 HRS (NO. of Hours per topic)

SPECIFIC LEARNING OBJECTIVES:

At the end of this module you MUST be able to:

1. Demonstrated thorough knowledge on the vision, mission, goals

and objectives of the College and of the BSAIS Program.

2. Apply the analytical tools necessary to evaluate users' accounting

information needs.

3. Apply the principles that support the design, implementation,

and maintenance processes of an accounting information system

to typical situations faced by practicing accountants.

4. Identify the security and internal controls required for an

accounting information system, particularly with the Internet

and e-commerce environments.

5. Apply traditional flowcharting and data-flow diagramming as the

basis for designing an accounting information system.

6. Demonstrate the application of theory to the design and

management of relational databases associated with accounting

information systems.

TOPIC: (SUB TOPIC)

1. Introduction

2. Literal review and methodology

3. Transaction support in sql

Bulacan Date Developed:

BACHELOR OF SCIENCE IN February 2021

ACCOUNTING Polytechnic Date Revised: Page 2 of 7

College

INFORMATION SYSTEM

Document No. Developed by:

IAIS 223 Sarah Joy D. Martin Revision # 01

c/o Admin

REFERENCE/S:

1. Board of studies NSW, Stage 6 Information Processes and Technology,

Preliminary and HSC Courses (2007, page 14)

2. Gerhard Weikum, Gottfried Vossen, Transactional information systems:

theory, algorithms, and the practice of concurrency control and

recovery, Morgan Kaufmann, 2002, ISBN 1-55860508-8

3. Jim Gray, Andreas Reuter, Transaction Processing — Concepts and

Techniques, 1993, Morgan Kaufmann, ISBN 1-55860-190-2

4. Philip A. Bernstein, Eric Newcomer, Principles of Transaction

Processing, 1997, Morgan Kaufmann, ISBN 1-55860-415-4

Bulacan Date Developed:

BACHELOR OF SCIENCE IN February 2021

ACCOUNTING Polytechnic Date Revised: Page 3 of 7

College

INFORMATION SYSTEM

Document No. Developed by:

IAIS 223 Sarah Joy D. Martin Revision # 01

c/o Admin

Information Sheet

IAIS 223 -7

The Conversion Cycle

Learning Objectives:

After reading this INFORMATION SHEET, YOU MUST be able to:

1. To review the accounting entries recorded in the conversion cycle.

2. To learn which documents, reports and records are used in the conversion

cycle.

3. To understand how accounting transactions are processed by the application

systems in the conversion cycle.

The conversion cycle is one of the four transactions cycle used by accounting

systems that records one economic event – the consumption of labor, material

and overhead to produce a product or service.

The type of accounting system used differs, depending on whether the

organization is a service, merchandising or manufacturing firm:

Type of organization accounting system

Service Payroll

Cost accounting

Merchandising Inventory

Manufacturing Payroll

Cost accounting Inventory

Bulacan Date Developed:

BACHELOR OF SCIENCE IN February 2021

ACCOUNTING Polytechnic Date Revised: Page 4 of 7

College

INFORMATION SYSTEM

Document No. Developed by:

IAIS 223 Sarah Joy D. Martin Revision # 01

c/o Admin

Inventory Systems

The inventory system maintains inventory records. Manufacturing companies

use them to control the levels of materials and finished goods inventories.

Merchandising companies use them to ensure that goods are available for resale.

The inventory system process two types of transactions originated in the revenue

and expenditure cycles – purchase and sale of inventory.

1) Purchase of inventory

The entry made to record this transaction in expenditure cycle depends on

the method used for inventory accounting:

Periodic method – It relies on a periodic physical inventory count to

determine Cost of Goods Sold and ending inventories.

Perpetual method – An organization maintains an ongoing count of each

inventory item on hand.

2) Sale of inventory

A company records the cost of inventory sold in the general ledger account

entitled Cost of Goods Sold. How the company determines this amount

depends on the inventory method used.

Inventory system reports

Inventory system produces control reports and registers like other

applications. In addition, there are four special purposes reports:

Inventory Status Report – it lists all items normally keep in inventory, the

quantity on hand of each item and costs.

Query Inventory Items Report – on-line real-time systems allow an

employee to determine quantities on hand at

the time of inquiry.

Reorder Report – it identifies inventory items that should be replenished.

Physical Inventory Report – it helps by periodically computation the

number of each inventory item on hand.

Bulacan Date Developed:

BACHELOR OF SCIENCE IN February 2021

ACCOUNTING Polytechnic Date Revised: Page 5 of 7

College

INFORMATION SYSTEM

Document No. Developed by:

IAIS 223 Sarah Joy D. Martin Revision # 01

c/o Admin

Cost Accounting Systems

The purpose of a cost accounting system is to determine the cost of

products or services and to record those costs in the accounting records. In a

manufacturing company, the cost accounting system records two transactions

in addition to those recorded in the inventory system:

1) Transfer of material, labor and overheads

A manufacturing company purchases raw material inventory and adds

labor and overhead to it. This produces units of product that are in process.

After the units are completed, the company sells the finished products. The

entry recording this transaction is:

Debit Credit

Work in Process $xxx Raw Material Inventory $xxx

Inventory Direct Labor $xxx

Factory Overhead $xxx

2) Transfer of Completed Goods

When the production process is completed, the products are transferred

to inventory warehouse. The cost of completed goods is transferred out of the

Work in Process account with this entry:

Debit Credit

Finished goods $xxx Work in Process $xxx

Inventory Inventory $xxx

Cost Accounting system reports

Cost accounting systems produce control reports and various production cost

reports.

Payroll Systems

The purposes of payroll application are to calculate the pay due to employees

and maintain cumulative earnings records. The organization could process

Bulacan Date Developed:

BACHELOR OF SCIENCE IN February 2021

ACCOUNTING Polytechnic Date Revised: Page 6 of 7

College

INFORMATION SYSTEM

Document No. Developed by:

IAIS 223 Sarah Joy D. Martin Revision # 01

c/o Admin

payroll transactions by the cash disbursements application in the expenditure

cycle. But there are two main reasons for separated payroll system:

1. Payroll systems must withhold amounts for deductions and taxes and

summarize these in cumulative earnings reports. Such withholding is

unnecessary for processing purchases transactions in the expenditure cycle.

2. Payroll systems produce paycheck made out to employees. This makes fraud

in payroll systems easier to conceal than in those systems that produce

checks for vendors.

Payroll system reports

The payroll systems produce three reports:

Payroll Register – it lists all employees for whom paychecks are due, their gross

pay and list of deductions.

Print Checks Control Report – it aids in detecting missing or unauthorized

checks.

Cumulative Earnings Report – it summarizes the gross pay and tax withheld

for an employee during each quarter of the year for the purposes of government

control.

Bulacan Date Developed:

BACHELOR OF SCIENCE IN February 2021

ACCOUNTING Polytechnic Date Revised: Page 7 of 7

College

INFORMATION SYSTEM

Document No. Developed by:

IAIS 223 Sarah Joy D. Martin Revision # 01

c/o Admin

You might also like

- Lean As A Universal Model of ExcellenceDocument8 pagesLean As A Universal Model of ExcellenceAlicia PerezNo ratings yet

- Ar 735-11-2 - Reporting Supply DiscrepanciesDocument46 pagesAr 735-11-2 - Reporting Supply DiscrepanciesMark CheneyNo ratings yet

- Test Bank With Answers of Accounting Information System by Turner Chapter 01Document24 pagesTest Bank With Answers of Accounting Information System by Turner Chapter 01Ebook free100% (8)

- Keshav Stock Inventory Management SystemDocument66 pagesKeshav Stock Inventory Management SystemVinayak TikheNo ratings yet

- Supply Chain Management AssignmentDocument26 pagesSupply Chain Management Assignmentedo100% (1)

- 8 Financial Reporting and Management Reporting SystemsDocument10 pages8 Financial Reporting and Management Reporting SystemsKaiNo ratings yet

- There Are Eight (7) Pages of Questions, Including ThisDocument7 pagesThere Are Eight (7) Pages of Questions, Including ThisAmyzah NafisahNo ratings yet

- Chapter 2 The Accounting ProcessDocument12 pagesChapter 2 The Accounting ProcessFrakeZNo ratings yet

- Module 004 Week002-Finacct3 Review of The Accounting ProcessDocument6 pagesModule 004 Week002-Finacct3 Review of The Accounting Processman ibeNo ratings yet

- Implementing Milktea Project Inventory System Using PHP and MySQLDocument15 pagesImplementing Milktea Project Inventory System Using PHP and MySQLNesty SarsateNo ratings yet

- Pengelolaan Keuangan Berbasis Web PT. Mutualplus Global Resources Cabang PontianakDocument10 pagesPengelolaan Keuangan Berbasis Web PT. Mutualplus Global Resources Cabang PontianakRizky IkaNo ratings yet

- Accounting Information Systems - An OverviewDocument84 pagesAccounting Information Systems - An OverviewLyvinder CryiasusNo ratings yet

- Amviko PDFDocument36 pagesAmviko PDFHayderAlTamimiNo ratings yet

- Computerised AccountingDocument54 pagesComputerised AccountingsuezanwarNo ratings yet

- Principles of Accounting II: Activity Fund Accounting For Local School PersonnelDocument75 pagesPrinciples of Accounting II: Activity Fund Accounting For Local School PersonnelJiechlat Dak YangNo ratings yet

- PRe 6 MaterialsDocument15 pagesPRe 6 MaterialsV-Heron BanalNo ratings yet

- Accounting Information System For Mia: Employee Multipurpose Cooperative (Mempc)Document24 pagesAccounting Information System For Mia: Employee Multipurpose Cooperative (Mempc)Julius Michael BalingitNo ratings yet

- (FGW HN) - 441752 - 0Document6 pages(FGW HN) - 441752 - 0Minh Thu Nguyen TranNo ratings yet

- Student: Teacher: Matter: Year:: Larry M. Walther Christopher J. SkousenDocument2 pagesStudent: Teacher: Matter: Year:: Larry M. Walther Christopher J. SkousenLaura MartínezNo ratings yet

- AIS Book Chapter 2 AnswerDocument3 pagesAIS Book Chapter 2 AnswerLina SorokinaNo ratings yet

- Receivables & PayableDocument122 pagesReceivables & Payablemanoj phadtareNo ratings yet

- Chapter 1 A Model For Processing AIS (New)Document6 pagesChapter 1 A Model For Processing AIS (New)Muhammad IrshadNo ratings yet

- Introduction of Computer AccountingDocument5 pagesIntroduction of Computer AccountingASHISH SAININo ratings yet

- Assignment Acc. & Finance Col MBA Semester 1Document24 pagesAssignment Acc. & Finance Col MBA Semester 1Zahid Nazir100% (3)

- Cost Management ConceptsDocument24 pagesCost Management ConceptsRaisa Gelera100% (1)

- Accounting PrinciplesDocument15 pagesAccounting PrinciplesGroundXero The Gaming LoungeNo ratings yet

- Chapter 02Document23 pagesChapter 02Lê Chấn PhongNo ratings yet

- Chapter 2Document22 pagesChapter 2reicelle vejeranoNo ratings yet

- 01 - Initial PagesDocument12 pages01 - Initial PagesPrabhakar TripathiNo ratings yet

- Auditing The Expenditure Cycle SummaryDocument7 pagesAuditing The Expenditure Cycle SummaryHimaya Sa KalipayNo ratings yet

- (Accounting Information System) : Module Duration: FEB 3 - March.12,2022Document9 pages(Accounting Information System) : Module Duration: FEB 3 - March.12,2022Gaba, Yna MarieNo ratings yet

- Makalah Kelompok 10 Sistem Informasi AkuntansiDocument38 pagesMakalah Kelompok 10 Sistem Informasi AkuntansiDesy manurungNo ratings yet

- Siena College of Taytay Taytay Rizal Service Education Department (CBA Department)Document3 pagesSiena College of Taytay Taytay Rizal Service Education Department (CBA Department)Rose Anne BautistaNo ratings yet

- Restaruant Business Using Accounting Information in Decesion Making ProcessDocument10 pagesRestaruant Business Using Accounting Information in Decesion Making ProcessAlwin RejiNo ratings yet

- ProposalDocument10 pagesProposalgamdias321No ratings yet

- CHAPTER 4 SUMMARY (The Revenue Cycle)Document6 pagesCHAPTER 4 SUMMARY (The Revenue Cycle)Janica GaynorNo ratings yet

- E002 Core 18 - Management Accounting - VI SemDocument75 pagesE002 Core 18 - Management Accounting - VI Semanshusirohi51No ratings yet

- Thakraj 4th Sem.Document29 pagesThakraj 4th Sem.Thakraj Rathore100% (1)

- AISDocument11 pagesAISSANCHEZ, Janna Rosh Hashana M.No ratings yet

- Accounting Information System MidtermsDocument2 pagesAccounting Information System MidtermsHenry ChiongNo ratings yet

- Introduction To Cost Accounting: This Chapter IncludesDocument5 pagesIntroduction To Cost Accounting: This Chapter IncludesMuhammad BasitNo ratings yet

- 020619PapID 03 - CSE - GST Billing System - Naphade NYChaudhariDocument4 pages020619PapID 03 - CSE - GST Billing System - Naphade NYChaudhariudaykiran penumakaNo ratings yet

- Basic Cost Management Concepts: Learning ObjectivesDocument23 pagesBasic Cost Management Concepts: Learning Objectivesmia uyNo ratings yet

- 17 Dr. Abhay UpadhyayaDocument7 pages17 Dr. Abhay UpadhyayaRavi ModiNo ratings yet

- 0383advanced Auditing and AssuranceDocument12 pages0383advanced Auditing and AssuranceSmag SmagNo ratings yet

- TOPIK 3-Accounting System and ControlDocument24 pagesTOPIK 3-Accounting System and Controlfalina88No ratings yet

- Cost Accounting ActivitiesDocument5 pagesCost Accounting ActivitiesTrisha Lorraine RodriguezNo ratings yet

- Jurnal Scopus Q4Document8 pagesJurnal Scopus Q4sucisayangbundaNo ratings yet

- Accounting Information Systems The Processes and Controls 2nd Edition Turner Test BankDocument25 pagesAccounting Information Systems The Processes and Controls 2nd Edition Turner Test BankAlanHolmesarwgf100% (17)

- Charter EGrants ProjectDocument15 pagesCharter EGrants ProjectShaikh BilalNo ratings yet

- Module 3 Recording Business Transactions of A Service Business in ACCO2143 ITDocument30 pagesModule 3 Recording Business Transactions of A Service Business in ACCO2143 ITjilliantrcieNo ratings yet

- Castro, Mae Lalaine B. (Chapter 2 Assignment)Document3 pagesCastro, Mae Lalaine B. (Chapter 2 Assignment)Cheesy MacNo ratings yet

- Week 2 - Lesson 2 The Accounting ProcessDocument16 pagesWeek 2 - Lesson 2 The Accounting ProcessRose RaboNo ratings yet

- 69817bos300322 Interp7aDocument10 pages69817bos300322 Interp7aOwassoNo ratings yet

- An Overview of Business ProcessDocument22 pagesAn Overview of Business Processalemayehu100% (1)

- Assignment # 2Document21 pagesAssignment # 2haroonsaeed12No ratings yet

- AIS NarrativeDocument8 pagesAIS NarrativeandengNo ratings yet

- BCS2A Reviewer PrelimsDocument15 pagesBCS2A Reviewer PrelimsAndrea Angelica Dumo GalvezNo ratings yet

- Af 223 Course OutlineDocument2 pagesAf 223 Course OutlinepalpitopitooNo ratings yet

- Chapter 1 - BeverlyDocument4 pagesChapter 1 - BeverlyJean Madariaga BalanceNo ratings yet

- Unit 20Document9 pagesUnit 20sgod74232No ratings yet

- Chapter 2Document4 pagesChapter 2api-238996284No ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- BSAIS-ISM 323 Information Sheet 2 PDFDocument15 pagesBSAIS-ISM 323 Information Sheet 2 PDFKaiNo ratings yet

- MIT323 - Infosheet 4Document19 pagesMIT323 - Infosheet 4KaiNo ratings yet

- IBT 323 - International Business and TradeDocument7 pagesIBT 323 - International Business and TradeKaiNo ratings yet

- BSAIS-ISM 323 Information Sheet 4 PDFDocument17 pagesBSAIS-ISM 323 Information Sheet 4 PDFKaiNo ratings yet

- MIT323 - Infosheet 7 PDFDocument13 pagesMIT323 - Infosheet 7 PDFKaiNo ratings yet

- InformationSheet 2 GBER 323Document16 pagesInformationSheet 2 GBER 323KaiNo ratings yet

- InformationSheet 4 GBER 323 PDFDocument9 pagesInformationSheet 4 GBER 323 PDFKaiNo ratings yet

- InformationSheet 5 GBER 323 PDFDocument17 pagesInformationSheet 5 GBER 323 PDFKaiNo ratings yet

- InformationSheet 3 GBER 323Document11 pagesInformationSheet 3 GBER 323KaiNo ratings yet

- BSAIS-ISOM 323 Information Sheet 4 - Roles of IS Pesronnels PDFDocument7 pagesBSAIS-ISOM 323 Information Sheet 4 - Roles of IS Pesronnels PDFKaiNo ratings yet

- FLIB 223 8 LawonCreditTransactionsDocument8 pagesFLIB 223 8 LawonCreditTransactionsKaiNo ratings yet

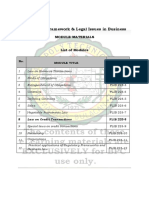

- Regulatory Framework & Legal Issues in Business: Module MaterialsDocument7 pagesRegulatory Framework & Legal Issues in Business: Module MaterialsKaiNo ratings yet

- A Generate The Material Requirements You Need A Bom ForDocument1 pageA Generate The Material Requirements You Need A Bom ForDoreenNo ratings yet

- Sap MM PDFDocument2 pagesSap MM PDFMurali TungaNo ratings yet

- Material Ledgers: Actual Costing - SAP BlogsDocument34 pagesMaterial Ledgers: Actual Costing - SAP Blogsvivaldikid0% (1)

- MSMDDocument27 pagesMSMDvidvenkeNo ratings yet

- COSACC Assignment 2Document3 pagesCOSACC Assignment 2Kenneth Jim HipolitoNo ratings yet

- Mallikarjun - CV-UpdatedDocument4 pagesMallikarjun - CV-UpdatedPrathamNo ratings yet

- Anurag Joshi: EducationDocument1 pageAnurag Joshi: EducationThe Cultural CommitteeNo ratings yet

- Dynamics 365 Licensing Guide - May 2022Document61 pagesDynamics 365 Licensing Guide - May 2022Camilo Ardila OrtizNo ratings yet

- As 2Document7 pagesAs 2Hema VakhariaNo ratings yet

- Ifrs Vs GaapDocument5 pagesIfrs Vs GaapKsenia DroNo ratings yet

- Nbnfi Fe2020120799638Document7 pagesNbnfi Fe2020120799638Jerome PolicarpioNo ratings yet

- Financial RatioDocument25 pagesFinancial Ratiohaname4No ratings yet

- Cooking The BooksDocument8 pagesCooking The Booksmromariz1No ratings yet

- Cost AccountingDocument32 pagesCost AccountingInu Ya ShaNo ratings yet

- BuddDocument34 pagesBuddPeishi Ong50% (2)

- Material Requirements PlanningDocument3 pagesMaterial Requirements PlanningJai RathorNo ratings yet

- GovDocument48 pagesGovajlouiseibanezNo ratings yet

- ANALISIS RASIO PT Prima Cakrawala AbadiDocument15 pagesANALISIS RASIO PT Prima Cakrawala AbadiotovitasariNo ratings yet

- BMC Colg WorkDocument3 pagesBMC Colg Workvishal sinhaNo ratings yet

- Introduction To Operations ManagementDocument24 pagesIntroduction To Operations ManagementBopzilla0911No ratings yet

- How Brooks Brothers Is Building Its Omni-Channel World of FashionDocument3 pagesHow Brooks Brothers Is Building Its Omni-Channel World of FashionYoucef MOUSSOUD (FR)No ratings yet

- Add: Desired Ending Raw Materials Inventory (130% From Following Month's Production and 2000Document4 pagesAdd: Desired Ending Raw Materials Inventory (130% From Following Month's Production and 2000Kyla Kim AriasNo ratings yet

- Accounting Management For Oil and Gas CompanyDocument2 pagesAccounting Management For Oil and Gas Company200772No ratings yet

- Scheduling: Production PlanningDocument9 pagesScheduling: Production Planningashok pradhanNo ratings yet

- Nouman Shakeel Strategic Audit Report Honda Atlas Cars (Pakistan) Limited (2020)Document18 pagesNouman Shakeel Strategic Audit Report Honda Atlas Cars (Pakistan) Limited (2020)nouman shakeelNo ratings yet

- FAR FPB With Answer KeysDocument16 pagesFAR FPB With Answer KeysPj ManezNo ratings yet

- Syllabus of Shivaji University MBADocument24 pagesSyllabus of Shivaji University MBAmaheshlakade755No ratings yet