Professional Documents

Culture Documents

Veteran Auditor Dolphy D'Souza On "Whether IPO Expenses Should Be Debited To P&L - "

Veteran Auditor Dolphy D'Souza On "Whether IPO Expenses Should Be Debited To P&L - "

Uploaded by

Kunwarbir Singh lohatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Veteran Auditor Dolphy D'Souza On "Whether IPO Expenses Should Be Debited To P&L - "

Veteran Auditor Dolphy D'Souza On "Whether IPO Expenses Should Be Debited To P&L - "

Uploaded by

Kunwarbir Singh lohatCopyright:

Available Formats

Veteran Auditor Dolphy D’Souza on “Whether

IPO Expenses Should Be Debited to P&L?”

Posted Apr 29, 2022

Dolphy D'souza

Senior Partner, SRBC & Co. LLP, Chartered Accountants

Initial Public Offer (IPO) costs involves a combination of share issue costs and listing expenses. Share issue

costs are debited to equity whereas listing expenses are charged to the P&L. Therefore, it becomes

important to allocate the total costs incurred in an IPO to share issue costs and other than share issue

costs, i.e., listing expenses.

“An entity typically incurs various costs in issuing or acquiring its own equity instruments. Those costs

might include registration and other regulatory fees, amounts paid to legal, accounting, and other

professional advisers, printing costs and stamp duties. The transaction costs of an equity transaction are

accounted for as a deduction from equity to the extent they are incremental costs directly attributable to

the equity transaction that otherwise would have been avoided. The costs of an equity transaction that is

abandoned are recognised as an expense”. [Ind AS 32.37].

An entity issues new equity shares and may simultaneously list them. In such a case, a portion (e.g.,

accountants fees relating to prospectus), or the entire amount of certain costs (e.g., cost of handling share

applications) should be recognised in equity.

The table below provides a basis of allocation.

Type of cost Allocation (share-issue, listing or both?)

Stamp duties for shares, Share issue

fees for legal and tax

advice related to share

issue

Copyright (c) 2022 Taxsutra All rights Reserved.

Underwriting fees Share issue

Listing fees paid to stock Listing

exchange/regulator

Accountants' fees relating Both - in practice IPO documents typically relate both to the

to prospectus share offer and the listing.

Valuation fees in respect of Share issue

valuation of shares

Valuation fees in respect of Both. Because IPO documents typically relate to both the

valuation of assets other share offer and the listing. However, if the valuation is not

than shares (e.g., property) required to be disclosed in the prospectus, such costs is not

if the valuation is required directly attributable to the IPO and should be expensed.

to be disclosed in the

prospectus

Tax and legal entity P&L Expense. Corporate restructurings are undertaken as a

restructuring costs in housekeeping matter to facilitate the listing process and are

anticipation of the IPO not directly attributable to the issue of new shares.

Legal fees other than those Both - legal advice is typically required both for the offer of

relating to restructuring in shares to the public and for the listing procedures to comply

IPO above with the requirements established by the relevant securities

regulator/exchange. However, some legal fees may relate to

specifically to share issue or to listing.

Prospectus design and Both - although in cases where most prospectus copies are

printing costs sent to potential new shareholders the majority of such costs

might relate to the share issue.

Sponsor's fees Both - to the extent the sponsor's activities relate to

identifying potential new shareholders and persuading them

to invest, the cost relates to the share issue. The activities of

the sponsor related to compliance with the relevant stock

exchange requirements should be expensed in P&L.

"Roadshow" and advertising Although the "roadshow" might help to sell the offer to

costs potential investors and hence contributes to raising equity, it

is usually also a general promotional activity. Therefore, the

same needs to be allocated between share issue costs and

listing expenses.

Merchant Both – they need to be allocated on a rational basis between

Bankers/Manager’s costs share issue costs and listing expenses

Costs of general advertising These are not related to issuance of equity shares and should

aimed at enhancing the be charged to P&L.

entity's brand; and fees

paid to public relations firm

for enhancing the image

and branding of the entity

as a whole

“Transaction costs that relate to the issue of a compound financial instrument are allocated to the liability

and equity components of the instrument in proportion to the allocation of proceeds. Transaction costs

that relate jointly to more than one transaction (for example, costs of a concurrent offering of some shares

Copyright (c) 2022 Taxsutra All rights Reserved.

and a stock exchange listing of other shares) are allocated to those transactions using a basis of allocation

that is rational and consistent with similar transactions.” [Ind AS 32.38]. Another basis may also be

appropriate if those can be justified in the given situation. Cost of listing existing shares will be charged to

P&L. Cost of issuing new shares will have to be allocated to listing expenses (charged to P&L) and share

issue costs (charged to equity).

An allocation between listing and issue of shares should not result in the costs attributed to either of the

two components being greater than the costs that would be incurred if either were a stand-alone

transaction. Significant judgement may be involved in determining the allocation. The IFRS Interpretations

Committee (IAS 32 Transaction Costs to be Deducted from Equity, September 2008) discussed this issue

and noted that judgement may be required to determine which costs relate solely to activities other than

equity transactions - e.g., listing existing shares - and which costs relate jointly to equity transactions and

other activities. The IFRIC decided not to add this issue to its agenda

An IPO may involve selling the shares of existing investors, such as, in an Offer for Sales (OFS). All or

portion of allocated costs may be reimbursed by the existing investors, irrespective of whether the IPO is

successful or not. For example, if INR 100 is incurred with respect to OFS shares and INR 60 is reimbursed,

the entity will charge INR 40 to the P&L, this being in the nature of listing shares that are already issued.

When shares are listed without any additional issue of share capital (i.e., a placing of existing shares), no

equity transaction has occurred and, consequently, all expenses should be recognised in profit or loss as

incurred.

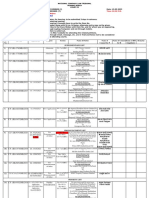

Example – Accounting for IPO costs

List Co is seeking a listing on the stock exchange. 1/3rd of the shares is fresh issuance, the

other 1/3rd is the sale of shares of existing investor under OFS, and the remaining 1/3rd relates

to already existing shares of the promoter that will survive the listing of the entity.

List Co incurs a total expenditure of INR 99 and receives reimbursement of INR 20 from OFS

investors. Of the INR 99, the total listing cost (basis allocation) is INR 60. The table below

presents the allocation of the cost, and the amounts to be charged to share issue costs in

equity and the amount to be charged to P&L, being in the nature of listing expenses.

New shares Existing shares OFS investors

INR INR INR

Total cost allocated @ 33 33 33

1/3rd each

Reimbursement from - - (20)

OFS investors

Listing expenses 20 33 13

rd

charged to P&L (1/3 share of INR 60)

Share issue costs 13 - -

charged to equity

Based on the above, the total costs incurred by List Co is INR 99, of which INR 20 is reimbursed by the OFS

investor. Therefore, List Co incurs a net cost of INR 79. Of the INR 79, only INR 13 relates to share

issuance and is debited to equity, and the remaining INR 66 relates to listing and should be charged to

P&L. INR 66 can also be determined by aggregating the amounts in the 2nd last row.

Copyright (c) 2022 Taxsutra All rights Reserved.

Costs that are related directly to a probable future equity transaction should be recognised as a

prepayment (asset) in the statement of financial position. The costs should be transferred to equity when

the equity transaction is recognised or recognised in profit or loss if the issue or buy-back is no longer

expected to be completed.

Sometimes merchant bankers are paid contingent fees linked to a successful IPO. These costs need to be

provided for as the services are received if the IPO event is probable and outflow of resources is expected.

It may also be noted that in the cash flow statement the costs should be included as follows:

(i) costs which have been expensed – in operating cash flows

(ii) costs deducted from equity – in financing cash flows.

At a particular reporting date, the IPO may be in progress. To the extent the costs incurred are identified

as listing expenses, the same should be charged to P&L. To the extent the costs are identified as share

issue costs, the same may be parked in an advance account, if the IPO is probable. Once the IPO occurs

and shares are issued, the advance amount should be debited to equity. If the IPO is not probable or was

probable but is no longer probable, then the entire expenses should be charged to P&L.

Disclaimer:

The information contained herein is intended solely for the use of the subscriber, user or other entity who

is named in this document, and others authorised to generate/ receive/ use it. If you are using our Services

on behalf of a business, that business accepts these terms. It will hold harmless and indemnify Taxsutra

and its affiliates, officers, agents, and employees from any claim, suit or action arising from or related to

the use of the Services or violation of these terms, including any liability or expense arising from claims,

losses, damages, suits, judgments, litigation costs and attorneys’ fees. If you are an unintended recipient

of this document, please notify us immediately by email and then delete it from your system. Any action

based on content in this document shall be at the sole risk, responsibility and liability of the individual or

other entity taking such action. The contents of this document shall not, under any circumstance, be

construed as any kind of professional advice or opinion and we expressly disclaim any and all liability for

any harm, loss or damage, including without limitation, indirect, consequential, special, incidental or

punitive damages resulting from or caused due to your reliance and actions/ inactions on the basis of this

content. Contents of Disclaimer document available here is an integral part of this disclosure.

Copyright (c) 2022 Taxsutra All rights Reserved.

You might also like

- CPF Retirement Planning BookletDocument17 pagesCPF Retirement Planning BookletStampede VincentNo ratings yet

- Corporate Ch08Document29 pagesCorporate Ch08WallStreet ColeyNo ratings yet

- DCF PrimerDocument30 pagesDCF PrimerAnkit_modi2000No ratings yet

- InventoriesDocument47 pagesInventoriesMarjorie NepomucenoNo ratings yet

- Costs of An Initial Public Offering-Grant ThorntonDocument7 pagesCosts of An Initial Public Offering-Grant ThorntonSS CORPORATE SERVICESNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document6 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)verycooling100% (1)

- Financial Aspects: March 3, 2008Document9 pagesFinancial Aspects: March 3, 2008mohd_rosman_3No ratings yet

- Guideline Companies MethodDocument15 pagesGuideline Companies Methodpaw27No ratings yet

- Chapter Five Cost of Capital 5.1. The Concept of Cost of CapitalDocument16 pagesChapter Five Cost of Capital 5.1. The Concept of Cost of Capitalsamuel kebedeNo ratings yet

- Subject No 16J Corporate Financial Management Pilot Paper Suggested AnswersDocument14 pagesSubject No 16J Corporate Financial Management Pilot Paper Suggested Answerstata-lohNo ratings yet

- Ch-7 Approaches of Business ValuationDocument46 pagesCh-7 Approaches of Business ValuationManan SuchakNo ratings yet

- FM 4-5Document54 pagesFM 4-5zeleke fayeNo ratings yet

- 9 - AirXDocument25 pages9 - AirXSalar AliNo ratings yet

- Gearing RatioDocument1 pageGearing RatiorachanagadekarNo ratings yet

- Uno.r.module 5 Cost of Capital 1Document19 pagesUno.r.module 5 Cost of Capital 1vincent sunNo ratings yet

- EVA, MVA and SVA PrintableDocument20 pagesEVA, MVA and SVA PrintableBibek ShresthaNo ratings yet

- FM Chapter Three-1Document10 pagesFM Chapter Three-1metadelaschale64No ratings yet

- Treatment of Acquisition Related Costs in Ind AS Compliant FinancialsDocument4 pagesTreatment of Acquisition Related Costs in Ind AS Compliant Financialsaneesh mallickNo ratings yet

- Cost of CapitalDocument6 pagesCost of CapitalJagat Pal Singh GohilNo ratings yet

- Cost of CapitalDocument2 pagesCost of CapitalAbhishek SangalNo ratings yet

- Ifrs VS Us GaapDocument118 pagesIfrs VS Us GaapAhmed SabirNo ratings yet

- AFS 17th Mar - CapitalisationDocument5 pagesAFS 17th Mar - CapitalisationhardikNo ratings yet

- Summary of IFRS 3 Business CombinationDocument5 pagesSummary of IFRS 3 Business CombinationAbdullah Al RaziNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document6 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)Seth Relian100% (1)

- 69241asb55316 As13Document10 pages69241asb55316 As13cheyam222No ratings yet

- Financial Concepts: Weighted Average Cost of Capital (WACC)Document6 pagesFinancial Concepts: Weighted Average Cost of Capital (WACC)koshaNo ratings yet

- 74601bos60479 FND cp1 U3Document13 pages74601bos60479 FND cp1 U3kingdksNo ratings yet

- Valuation of Mergers and AcquisitionDocument9 pagesValuation of Mergers and Acquisitionrakeshkumar0076521No ratings yet

- Allowance For Bad Debts: Allowance Method Direct Write-Off MethodDocument5 pagesAllowance For Bad Debts: Allowance Method Direct Write-Off MethodChandradhari JhaNo ratings yet

- Capital Structure AdaniDocument4 pagesCapital Structure AdaniabhisekNo ratings yet

- Corporate Finance ProjectDocument13 pagesCorporate Finance ProjectAbhay Narayan SinghNo ratings yet

- Cost of CapitalDocument18 pagesCost of CapitalAishvarya PujarNo ratings yet

- Cost of Capital: Financial Management ProjectDocument10 pagesCost of Capital: Financial Management ProjectMoinak DasNo ratings yet

- FM - Chapter 9Document5 pagesFM - Chapter 9sam989898No ratings yet

- Independence and Neutrality of View 3. Network 4. Clarity of QuestionsDocument23 pagesIndependence and Neutrality of View 3. Network 4. Clarity of QuestionsVikas KhichiNo ratings yet

- MS-42 Capital Investment and Financing Decisions 2019Document11 pagesMS-42 Capital Investment and Financing Decisions 2019Rajni KumariNo ratings yet

- Free Cash FlowDocument47 pagesFree Cash FlowpagalinsanNo ratings yet

- Deferred Charge: DEFINITION of 'Regulatory Asset'Document6 pagesDeferred Charge: DEFINITION of 'Regulatory Asset'Joie CruzNo ratings yet

- Cleanup Quality Standards: Talk PageDocument4 pagesCleanup Quality Standards: Talk PageMrityunjayChauhanNo ratings yet

- Investment Banking Technical DefinitionsDocument7 pagesInvestment Banking Technical DefinitionsMaureen AngelaNo ratings yet

- Invest MentsDocument12 pagesInvest MentsPembaLamaNo ratings yet

- The CostDocument25 pagesThe CostRomeo Torreta JrNo ratings yet

- Accounting For InvestmentsDocument11 pagesAccounting For Investmentsstarfish85No ratings yet

- Income Statement Revenues - Expenses Net IncomeDocument4 pagesIncome Statement Revenues - Expenses Net IncomeTanishaq bindalNo ratings yet

- Mutual FundDocument10 pagesMutual FundmadhuNo ratings yet

- What Is A Financial InstrumentDocument9 pagesWhat Is A Financial InstrumentSimon ChawingaNo ratings yet

- ch17 Investment PDFDocument21 pagesch17 Investment PDFJoan Marah Langit JovesNo ratings yet

- Dwnload Full Foundations of Financial Management Canadian 9th Edition Hirt Solutions Manual PDFDocument36 pagesDwnload Full Foundations of Financial Management Canadian 9th Edition Hirt Solutions Manual PDFhenrykr7men100% (14)

- Interview Related QuestionsDocument8 pagesInterview Related QuestionsAnshita GargNo ratings yet

- Chapter 6 NotesDocument3 pagesChapter 6 NotesJay-P100% (1)

- Significant Accounting PoliciesDocument4 pagesSignificant Accounting PoliciesVenkat Sai Kumar KothalaNo ratings yet

- PPT-7 (Intercorporate Investments)Document61 pagesPPT-7 (Intercorporate Investments)Taniya GuptaNo ratings yet

- Average Future Cost of Funds Over The Long RunDocument7 pagesAverage Future Cost of Funds Over The Long Runlaptopk2No ratings yet

- 3 Cost of CapitalDocument6 pages3 Cost of CapitalHarris NarbarteNo ratings yet

- CH 5 Cost of Capital Theory (510139)Document10 pagesCH 5 Cost of Capital Theory (510139)Syeda AtikNo ratings yet

- Fixed AssetsDocument46 pagesFixed AssetsSprancenatu Lavinia0% (1)

- David Corporate AssignmentDocument13 pagesDavid Corporate Assignmentsamuel debebeNo ratings yet

- 08 Revenue, Expense and Capital IssuesDocument35 pages08 Revenue, Expense and Capital IssuesjayaNo ratings yet

- 10.1.9 - Fees and ExpensesDocument3 pages10.1.9 - Fees and Expenseschris1chandlerNo ratings yet

- Notes For CFDocument214 pagesNotes For CFKristian ListNo ratings yet

- 9th JNMCC 2022 BrochureDocument17 pages9th JNMCC 2022 BrochureKunwarbir Singh lohatNo ratings yet

- Business Trusts in IndiaDocument7 pagesBusiness Trusts in IndiaKunwarbir Singh lohatNo ratings yet

- Issues Relating To Issue of Notice' Through E-MailDocument8 pagesIssues Relating To Issue of Notice' Through E-MailKunwarbir Singh lohatNo ratings yet

- Mismatch in Tax Liabilities-No Longer A Factual ConcernDocument4 pagesMismatch in Tax Liabilities-No Longer A Factual ConcernKunwarbir Singh lohatNo ratings yet

- Indirect Transfer of Ambuja CementsDocument6 pagesIndirect Transfer of Ambuja CementsKunwarbir Singh lohatNo ratings yet

- Costa Rica and Mexico Trade Case AvocadosDocument5 pagesCosta Rica and Mexico Trade Case AvocadosKunwarbir Singh lohatNo ratings yet

- 030FT Justice International Tax LawDocument608 pages030FT Justice International Tax LawKunwarbir Singh lohatNo ratings yet

- Critical Impact and Analysis of Action Plan 12 On India's Tax Regime: Mandatory Disclosure StandardsDocument6 pagesCritical Impact and Analysis of Action Plan 12 On India's Tax Regime: Mandatory Disclosure StandardsKunwarbir Singh lohatNo ratings yet

- Public Consultation Document Pillar One Amount A Extractives ExclusionDocument14 pagesPublic Consultation Document Pillar One Amount A Extractives ExclusionKunwarbir Singh lohatNo ratings yet

- Guideline On PartyDocument7 pagesGuideline On PartyKunwarbir Singh lohatNo ratings yet

- (1994) 75 TAXMAN 217 (ART) : EditorDocument3 pages(1994) 75 TAXMAN 217 (ART) : EditorKunwarbir Singh lohatNo ratings yet

- Only Net Income Can Be ClubbedDocument5 pagesOnly Net Income Can Be ClubbedKunwarbir Singh lohatNo ratings yet

- Insolvency and Bankruptcy CodeDocument3 pagesInsolvency and Bankruptcy CodeKunwarbir Singh lohatNo ratings yet

- 83 ITR 362 106 ITR 119: EditorDocument3 pages83 ITR 362 106 ITR 119: EditorKunwarbir Singh lohatNo ratings yet

- Lottery, Betting and Gambling - Income-Tax Perspective: Date of PublishingDocument10 pagesLottery, Betting and Gambling - Income-Tax Perspective: Date of PublishingKunwarbir Singh lohatNo ratings yet

- DPC Sem ViiiDocument17 pagesDPC Sem ViiiKunwarbir Singh lohatNo ratings yet

- 15 Transnatl Law 259Document21 pages15 Transnatl Law 259Kunwarbir Singh lohatNo ratings yet

- Service Law ProjectDocument22 pagesService Law ProjectKunwarbir Singh lohatNo ratings yet

- Tax Literature Clubbingof Income Under What Headof IncomeDocument3 pagesTax Literature Clubbingof Income Under What Headof IncomeKunwarbir Singh lohatNo ratings yet

- ExcellenceDocument268 pagesExcellenceKunwarbir Singh lohatNo ratings yet

- Bhim Upi-Singapore Fintech FestivalDocument2 pagesBhim Upi-Singapore Fintech FestivalKunwarbir Singh lohatNo ratings yet

- Judicial Technicality and Efficacyof Clubbing ProvisionDocument5 pagesJudicial Technicality and Efficacyof Clubbing ProvisionKunwarbir Singh lohatNo ratings yet

- Kunwar Bir Singh - DPC Project FinalDocument19 pagesKunwar Bir Singh - DPC Project FinalKunwarbir Singh lohatNo ratings yet

- Sri SrinivasanDocument2 pagesSri SrinivasanKunwarbir Singh lohatNo ratings yet

- Project Finance Collateralized Debt Obligations: An Empirical Analysis On Spread DeterminantsDocument35 pagesProject Finance Collateralized Debt Obligations: An Empirical Analysis On Spread DeterminantsKunwarbir Singh lohatNo ratings yet

- Public Credit Registry: 2A498EFD PDFDocument2 pagesPublic Credit Registry: 2A498EFD PDFKunwarbir Singh lohatNo ratings yet

- Wattal Committee ReportDocument2 pagesWattal Committee ReportKunwarbir Singh lohatNo ratings yet

- Self Regulatory Organizations in Indian MicrofinanDocument8 pagesSelf Regulatory Organizations in Indian MicrofinanKunwarbir Singh lohatNo ratings yet

- Money Laundering and Tax Evasion Via Payments FraudDocument2 pagesMoney Laundering and Tax Evasion Via Payments FraudKunwarbir Singh lohatNo ratings yet

- Arbitartion - Arbitrator (Akash) : Keshav Singh at This 5Document1 pageArbitartion - Arbitrator (Akash) : Keshav Singh at This 5Kunwarbir Singh lohatNo ratings yet

- Modern Investor by Jason SantosoDocument25 pagesModern Investor by Jason SantosostephenNo ratings yet

- Bayyaram Pay BillsDocument6 pagesBayyaram Pay BillsMatta Madhu Sudhana RaoNo ratings yet

- GPRO - 330 - 1 - Monthly Process AuditDocument1 pageGPRO - 330 - 1 - Monthly Process Auditsantosh kumarNo ratings yet

- Module 3 Leadership and Teamwork Activity 1Document1 pageModule 3 Leadership and Teamwork Activity 1PHOEBE BACODNo ratings yet

- CDW With Complete Solutions 100%Document4 pagesCDW With Complete Solutions 100%Gregg ProducerNo ratings yet

- DSWD-GF-010 - Rev 00 / 12 Oct 2021Document3 pagesDSWD-GF-010 - Rev 00 / 12 Oct 2021Carla AngelicNo ratings yet

- Protected Structure Vs Targeted StructureDocument4 pagesProtected Structure Vs Targeted StructureFrom Shark To WhaleNo ratings yet

- 0ANNUALREPORT7075E4Document337 pages0ANNUALREPORT7075E4KarthickNo ratings yet

- Quality Risk BVRDocument36 pagesQuality Risk BVRjaanhoneyNo ratings yet

- What Money Can'T Buy: The Moral Limits of Markets: Book ForumDocument9 pagesWhat Money Can'T Buy: The Moral Limits of Markets: Book ForumIshtar CardonaNo ratings yet

- Finance Assignment' 1Document13 pagesFinance Assignment' 1Daichi FaithNo ratings yet

- Jovana ObućinaDocument2 pagesJovana Obućinajovanao91No ratings yet

- Consumer Behaviour ResearchDocument15 pagesConsumer Behaviour ResearchMaitri PanchalNo ratings yet

- Business Planning & Development (Bba 9135)Document36 pagesBusiness Planning & Development (Bba 9135)townbranch2019No ratings yet

- SRL - CBR FinalDocument19 pagesSRL - CBR FinalheebaNo ratings yet

- Opportunity SeekingDocument12 pagesOpportunity SeekingGhianne Sanchez FriasNo ratings yet

- 2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemDocument4 pages2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemRaghuNo ratings yet

- Investor Presentation - Minneapolis NDRS 3.28.23Document29 pagesInvestor Presentation - Minneapolis NDRS 3.28.23ArianeNo ratings yet

- Transport Economics Module Manual/Guide 2021 (First Edition: 2020)Document87 pagesTransport Economics Module Manual/Guide 2021 (First Edition: 2020)Okuhle MqoboliNo ratings yet

- 3044 Thelorry-Business Deck2Document5 pages3044 Thelorry-Business Deck2tls726No ratings yet

- Module 6 Agency ProblemsDocument6 pagesModule 6 Agency ProblemsRod Jessen A. VillamorNo ratings yet

- Icis Report - Asia Pacific - Feb 12Document6 pagesIcis Report - Asia Pacific - Feb 12Sadman Faiz HaqueNo ratings yet

- APPOINTMENT LETTER Repblick of Kenya WANGANGADocument4 pagesAPPOINTMENT LETTER Repblick of Kenya WANGANGAJose mainaNo ratings yet

- 15.05.2023 Cause List C - IiDocument6 pages15.05.2023 Cause List C - IiPranay ChauguleNo ratings yet

- 3i Research Paper Noriels GroupDocument76 pages3i Research Paper Noriels GroupMICHELLE LENDESNo ratings yet

- Interest RatesDocument21 pagesInterest RatesMariel BerdigayNo ratings yet

- ترجمة جميع مصطلحات PMBOKDocument93 pagesترجمة جميع مصطلحات PMBOKGhazyNo ratings yet

- Inventory ValuationDocument25 pagesInventory ValuationKailas Sree Chandran100% (1)