Professional Documents

Culture Documents

Unit 2

Unit 2

Uploaded by

Avinash yesnoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 2

Unit 2

Uploaded by

Avinash yesnoCopyright:

Available Formats

Financial markets.

What is it???

• Financial market may be defined as ‘a

transmission mechanism between investors

(or lenders) and the borrowers (or users)

through which transfer of funds is

facilitated’.

• It consists of individual investors, financial

institutions and other intermediaries who

are linked by a formal trading rules and

communication network for trading the

various financial assets and credit

instruments.

Arun Chandran Security Analysis and Portfolio Management 2

Features.

• It provides facilities for interaction between the investors

and the borrowers.

• It provides pricing information resulting from the

interaction between buyers and sellers in the market when

they trade the financial assets.

• It provides security to dealings in financial assets.

• It ensures liquidity by providing a mechanism for an

investor to sell the financial assets.

• It ensures low cost of transactions and information.

Arun Chandran Security Analysis and Portfolio Management 3

Segments.

• A financial market consists of two major

segments:

• Money Market.

• Capital Market.

• While the money market deals in short-term

credit, the capital market handles the medium

term and long-term credit.

Arun Chandran Security Analysis and Portfolio Management 4

Money Market.

• The money market is a market for short-term funds, which deals in

financial assets whose period of maturity is up to one year.

• It should be noted that money market does not deal in cash or

money as such but simply provides a market for credit instruments

such as bills of exchange, promissory notes, commercial paper,

treasury bills, etc.

• These financial instruments are close substitute of money.

• Money market does not imply to any specific market place. Rather it

refers to the whole networks of financial institutions dealing in

short-term funds, which provides an outlet to lenders and a source

of supply for such funds to borrowers.

• The Reserve Bank of India is the leader of the money market in

India. Some Non-Banking Financial Companies (NBFCs) and financial

institutions like LIC, GIC, UTI, etc. also operate in the Indian money

market

Arun Chandran Security Analysis and Portfolio Management 5

Money market instruments.

• Call Money: Call money is mainly used by the banks to meet their

temporary requirement of cash. They borrow and lend money

from each other normally on a daily basis. It is repayable on

demand and its maturity period varies in between one day to a

fortnight. The rate of interest paid on call money loan is known as

call rate.

• Treasury Bill: A treasury bill is a promissory note issued by the RBI

to meet the short-term requirement of funds. Treasury bills are

highly liquid instruments, that means, at any time the holder of

treasury bills can transfer of or get it discounted from RBI. These

bills are normally issued at a price less than their face value; and

redeemed at face value. So the difference between the issue price

and the face value of the treasury bill represents the interest on

the investment. These bills are secured instruments and are

issued for a period of not exceeding 364 days. Banks, Financial

institutions and corporations normally play major role in the

Treasury bill market.

Arun Chandran Security Analysis and Portfolio Management 6

Money market instruments.

• Commercial Paper: Commercial paper (CP) is a popular instrument for

financing working capital requirements of companies. The CP is an

unsecured instrument issued in the form of promissory note. It can be

issued for period ranging from 15 days to one year. Commercial papers

are transferable by endorsement and delivery. The highly reputed

companies (Blue Chip companies) are the major player of commercial

paper market.

• Certificate of Deposit: Certificate of Deposit (CDs) are short-term

instruments issued by Commercial Banks and Special Financial

Institutions (SFIs), which are freely transferable from one party to

another. The maturity period of CDs ranges from 91 days to one year.

These can be issued to individuals, co-operatives and companies.

• Trade Bill: Trade bill is an instrument, which enables the drawer of the

bill to get funds for short period to meet the working capital needs.

When trade bills are accepted by Commercial Banks it is known as

Commercial Bills.

Arun Chandran Security Analysis and Portfolio Management 7

Capital Market.

• Capital Market may be defined as a market dealing in medium and

long-term funds. It is an institutional arrangement for borrowing

medium and long-term funds and which provides facilities for

marketing and trading of securities.

• So it constitutes all long-term borrowings from banks and financial

institutions, borrowings from foreign markets and raising of capital

by issue various securities such as shares debentures, bonds, etc.

• The market where securities are traded known as Securities market.

It consists of two different segments namely primary and secondary

market.

• The primary market deals with new or fresh issue of securities and

is, therefore, also known as new issue market; whereas the

secondary market provides a place for purchase and sale of existing

securities and is often termed as stock market or stock exchange.

Security Analysis and Portfolio Management Arun Chandran 8

Primary Market

• Primary market is the financial market in which a security is

first sold by the issuer and bought by investors, before

further changing hands (or owner). New bonds and

securities issued in the capital market are issued by the

primary market.

• In the primary market, new securities are offered for the

first time for sale to increase the capital. And because of

that, it is also known as New Issue Market. In this market,

the company sells the stocks directly to the investor. There

are various intermediaries involved in a primary market,

which includes merchant banks, brokers, debenture

trustees, and portfolio managers.

Arun Chandran Security Analysis and Portfolio Management 9

Features

• Primary markets deal with new and initial issues of a particular security. Any

issue of new securities by companies first float over the primary market.

• The primary market always comes before the secondary market with regards to

the turn of transactions.

• The primary market has no physical existence like secondary markets exist in the

form of stock exchanges.

• Primary markets have various methods of raising funds.

• Primary Markets typically deal with primary instruments. Primary financial

instruments are financial securities whose price is directly referred to its market

value.

• Primary markets do not deal with derivatives, such as futures and options.

Derivatives and other secondary instruments are traded on stock exchanges or

over-the-counter.

Arun Chandran Security Analysis and Portfolio Management 10

Primary Market in India.

• The primary market in India is regulated by the Securities Exchange Board of India

(SEBI).

• SEBI has listed various norms for issuing securities in the primary market, such norms

have to be strictly followed by companies raising capital in the primary market.

• Primary markets also help the Government carry out its disinvestment programs.

• The primary market of India was established in India after Independence in 1947.

• The market was regulated as per the provisions of the Controller of Capital Issues, 1947

Act.

• The Act had several structural issues that kept the markets from functioning efficiently

and transparently.

• It was only post-liberalization and formalization of SEBI as a statutory authority in 1992

that India’s markets were equipped to raise large amounts of capital.

Security Analysis and Portfolio Management Arun Chandran 11

Book building

Offer through prospectus

IPO Fixed Price

Public issue Offer through sales

FPO

Preferential Allotment

Private issue

Methods of raising funds Qualified institutional

in primary market. Placement

Rights issue

Bonus shares

ESOP

Security Analysis and Portfolio Management

Arun Chandran 12

Methods of raising funds.

• Public Issue: A public issue is an issue where anybody and everybody can

subscribe for the securities. When an issue or offer of securities is made to

new investors for becoming part of shareholders’ family of the issuer it is

called a public issue.

• IPO means an offer of specified securities (i.e. equity shares and convertible

securities) by an unlisted issuer to the public for subscription (including an offer for

sale of its existing securities) for the first time. It is the first sale of stock by a company

to the public. The Initial Public Offering can be made through the fixed price

method, book building method or a combination of both. IPO enables listing and

trading of the issuers securities in the securities market.

• FPO When a listed company makes either a fresh issue of securities to the public or in

offer for sale to the public, it is called a FPO. It is also called Follow on Public Offer. It

is the subsequent public offer of securities of a listed company. FPO is also known as

Seasoned or Subsequent Public offer.

Security Analysis and Portfolio Management Arun Chandran 13

IPO methods: Offer through prospectus

Public issue through prospectus is the most popular method of distribution

of shares of a company.

• Prospectus is an offer document containing the details of the company. The name

of the company, address, location of the industry, authorized, paid up and

subscribed capital, date of opening and closing of subscription list, names of lead

merchant banker, brokers and underwriters, name of the board of directors,

activities of the company and other important data must be included in the

prospectus.

• After going through these details, the public can decide either to subscribe or not

to subscribe the shares. The draft of the prospectus must be approved by the board

of directors, financial institutions, designated stock exchange etc. An abridged

prospectus is being annexed to every share application form.

Arun Chandran Security Analysis and Portfolio Management 14

IPO methods: Offer through prospectus

• The permission of SEBI is mandatory for the issue. SEBI also prescribes that application for

listing in stock exchanges should be submitted before a company going for public issue.

Moreover, there should be an agreement with a depository for dematerialization of shares.

• The issuer should appoint one or more merchant bankers, at least one of whom should be a

lead merchant banker. He then appoints other intermediaries (underwriters, brokers, bankers

to issue, syndicate members etc.) to the issue in consultation with the lead merchant banker.

The issuer can determine the price of shares. The justification for the same should be given in

the offer document. There are two methods of issue pricing viz., Fixed Price Issue and Book

Built Issue.

• In fixed price issue, the issuing company, in consultation with the lead merchant banker decides the

price of the issue. The issue will be subscribed by the public on the basis of the issue price fixed and

shares are allotted accordingly.

• In book built issue, the issuer stipulates only a price band consisting of a floor price and a cap price,

and the final price will be decided on the basis of demand for the issue. On the basis of final price

decided by market demand the bids are evaluated and successful bidders get allotment.

Security Analysis and Portfolio Management Arun Chandran 15

Advantages and Disadvantages of issue

through prospectus.

Advantages Disadvantages

• Large number of investors could • It is suitable only for large issues.

be contacted through • The company has to incur

prospectus. additional expenses on

• Services of intermediaries are advertisement, bank’s

not necessary for this. commission, underwriting

• Concentration of shares in few commission, listing fee, legal

hands is avoided as the shares charges etc.

are dispersed over a number of

people.

Arun Chandran Security Analysis and Portfolio Management 16

IPO methods: Offer through sales

• This is outright sale of shares through intermediaries like issue houses,

brokers etc. Shares are not offered to the public directly.

• The intermediaries, after buying the entire shares, resell them to the

investing public. Then it can be called offer for sale.

• In this case the issue houses act as agents of the company.

• The advantage of this method is that the company need not be

bothered about the printing and advertisement of prospectus,

allotment of shares etc.

• Foreign companies who want to participate in the share market and

Indian investors and promoters who want to sell their shares usually

adopt this method.

Security Analysis and Portfolio Management Arun Chandran 17

IPO methods: Private placements.

• Shares can be distributed through outright sale by companies to select

group of persons (u/s 80 of the Companies Act 1956). This is known as

placement or private placement.

• When an issuer makes an issue of securities to a select group of persons

not exceeding 49, and which is neither a rights issue nor a public issue, it is

called a private placement.

• In this case, the issue houses or brokers can buy the securities from the

company and sell them to his own clients.

• The brokers here act as wholesalers. They may resell them at a margin.

• In private placement the promoters may sell a portion of issue to the

friends and well-wishers. The promoters have to make a minimum

contribution before the issue goes to the public. Financial institutions,

mutual funds, investment bank etc. subscribe to placement orders.

Security Analysis and Portfolio Management Arun Chandran 18

IPO methods: Private placements.

• Preferential Issue/Allotment: Preferential Issue means an issue of specified securities by a listed issuer

to any select person or group of persons on a private placement basis. An issuer can make preferential

issue of specified securities only if, a special resolution by the shareholders has been passed.

• Qualified Institutions Placement (QIP): When a listed issuer issues/allots equity shares or securities

convertible in to equity shares to Qualified Institutions Buyers on private placement basis, it is called a

QIP. An issuer can make a QIP only if a special resolution approving the qualified institutions placement

has been passed by its shareholders.

• The QIP should be made at a price not less than the average of the weekly high and low of the closing

prices of the equity shares of the same class quoted on the stock exchange during the two weeks

preceding the relevant date. Placement method is useful, when the market is depressed. The issue cost

is very low. Small companies may also find it useful as they cannot spend huge money on prospectus and

advertisement. The disadvantage of this method is that the shares may be concentrated in few hands

who may take control of the company.

Security Analysis and Portfolio Management Arun Chandran 19

IPO methods: Rights issue

• Shares offered to the existing shareholders of a company are called rights issues. The

shares are offered in a particular proportion to the existing share ownership. The

proportion may be decided on the basis of capital requirement of the company. Such

shares are marketable in the market by the owners. Successful companies adopt this

method for fund raising.

• According to section 81 of the Companies Act 1956, a company can make a rights issue after the

expiry of two years from the date of formation or at any time after the expiry of one year from the

date of allotment of shares for the first time after its formation, whichever is earlier.

• An issuer making a rights issue shall announce a record date for the purpose of determining the

shareholders eligible to apply for specified securities in the proposed rights issue.

• The issue price should be decided before determining the record date.

• The company should send a circular to all existing shareholders stating the fact of rights issue. The

circular should include information on how the additional fund collected is going to be used.

• The company should normally give a time limit of at least 15 days to one month to shareholders to

raise their right before it is offered to the public.

• If the rights are not fully taken up- the balance is to be equitably distributed among the applicants for

additional shares.

Security Analysis and Portfolio Management Arun Chandran 20

IPO methods: Bonus issue.

• Bonus issue is the issue of shares to the existing shareholders out of the free reserves of the company. The

existing shareholders get this as a bonus without payment of any money. Companies usually adopt this

method to bring up the value of shares with market value. As the free reserves are capitalized there is an

increase of equity capital.

• A listed company can issue bonus shares if:

• It is authorized by its articles of association for issue of bonus shares

• It has not defaulted in payment of interest/ principal in respect of fixed deposits/debt securities issued by it.

• It has not defaulted in respect of the payment of statutory dues of the employees.

• It has made partly paid up shared fully paid up.

• SEBI Regulations on Bonus Issue: Chapter IX of SEBI ICDR Regulations 2009 discusses the conditions with

respect to bonus issue.

• The articles of association should contain provision for issue of bonus shares.

• It should be made out of free reserves built out of genuine profits/securities premium collected in cash only. Reserves

created by revaluation of fixed assets are not capitalized.

• The declaration of bonus issue, in lieu of dividend, is not to be made.

• The bonus issue should be implemented within 15 days from the date of its approval by the Board of Directors (BoD) of

the issuer.

• Bonus issue shall not dilute the value or rights of debenture holders.

• A bonus issue once announced cannot be withdrawn.

Security Analysis and Portfolio Management Arun Chandran 21

IPO methods:Employees Stock Option Plan (ESOP):

• An Employee Stock Option Plan (ESOP) is a way in which employees of a

company can own the share of the company they are working. There are

different ways in which employees can receive stocks and shares of their

company. Employees can receive them as a bonus, buy them directly from the

company, or receive them through an ESOP. A stock option is an opportunity

to buy stock at a pre-set price sometime in the future. The main purpose of an

ESOP is to reward and motivate employees.

• Employee Stock Option is an option given to the whole time directors, officer

or employees of a company to purchase the securities offered by the company

at a predetermined price, at a future date.

• The option granted to an employee shall not be transferable to any person-

the option can only be exercised by the employee to whom the option is

granted. Shares can be issued under employee stock option only with the

approval of shareholders by way of Special Resolution.

Security Analysis and Portfolio Management Arun Chandran 22

Book building process.

• SEBI guidelines defines Book Building as "a process undertaken by which a demand for the securities proposed

to be issued by a body corporate is elicited and built-up and the price for such securities is assessed for the

determination of the quantum of such securities to be issued by means of a notice, circular, advertisement,

document or information memoranda or offer document".

• Book Building is basically a process used in Initial Public Offer (IPO) for efficient price discovery. It is a mechanism

where, during the period for which the IPO is open, bids are collected from investors at various prices, which are

above or equal to the floor price. The offer price is determined after the bid closing date.

• In Book Building securities are offered at prices above or equal to the floor prices, whereas securities are offered

at a fixed price in case of a public issue. In case of Book Building, the demand can be known everyday as the book

is built. But in case of the public issue the demand is known at the close of the issue.

Arun Chandran Security Analysis and Portfolio Management 23

Arun Chandran Security Analysis and Portfolio Management 24

Parties involved in new issue.

Merchant Bankers (Managers to the Issue):

• SEBI regulations 1992 prescribes that all public issues should be managed by at least one

merchant banker functioning as Lead manager or Managers to the Issue.

• “Merchant banker means any person/institution who is engaged in the business of issue

management either by making arrangements regarding selling, buying or subscribing to

securities as manager, consultant, advisor or rendering corporate advisory services in

relation to such issue management.” .

• If the size exceeds Rs. 400 crores there can be five or more managers as agreed by SEBI.

• These Managers to the issue assist the promoters in designing the capital structure, drafting

the prospectus and application forms, listing of shares, appointment of registrars and other

operators in the new issue, arrangement of long term loans- marketing of public issues etc.

• The lead manager prepares Draft Red Herring Prospectus (RHP) and is responsible for any

irregularities in the same. The company should enter into a memorandum of understanding

with the managers to the issue in the form prescribed by SEBI.

• The lead merchant bankers appointed by the Issuer Company are referred to as the Book

Running Lead Managers (BRLM) or Book Runners (If the issue is through book building

process).

Security Analysis and Portfolio Management Arun Chandran 25

Parties involved in new issue.

Underwriters to the Issue:

• Underwriters are financial institutions who make a firm

commitment that they will take up the shares up to a certain

amount if the public does not subscribe to it. This is an agreement

with one or more institutions and a guarantee of the marketability of

shares. Under writing is mandatory for the Public Issue.

Underwriters are appointed by the company in consultation with the

managers to the issue. Financial institutions, bankers, members of

stock exchanges, investment companies, trusts etc. can act as under

writers.

Arun Chandran Security Analysis and Portfolio Management 26

Types of Underwriting

• An underwriting agreement may take any of the following forms:

• Standing behind the Issue: Under this method the underwriter

guarantees the sale of a specified number of shares within a specified

period. If the public do not subscribe to the specified amount of issue, the

underwriter will buy the balance. It is also called full underwriting.

• Outright Purchase: In this method the underwriters purchases the entire

issues at an agreed price and sell them to investors.

• Consortium Method: In mega issues several underwriters join together to

underwrite. They form a consortium/syndicate for this purpose. It is also

called syndicate underwriting.

Arun Chandran Security Analysis and Portfolio Management 27

Types of Underwriting

• Partial Underwriting: The underwriter undertakes the guarantee for only a part

of the issue offered to the public and his liability is limited to the extent of

unsubscribed portion of the issue underwritten by him under this method.

• Joint Underwriting: The issuing company may enter into underwriting agreement

with more than one underwriter in case of large issues. Each under-writer

undertakes the guarantee for the issue of a certain portion of the whole issue

offered to the public and shares the risk.

• Firm Underwriting: Under this method, the underwriter undertakes to buy or

subscribe a certain number of shares irrespective of the subscription from the

public. Underwriter will be liable for shares underwritten as well as that part of

issue unsubscribed by the public.

• Sub-Underwriting: Under this method, the underwriter enters into agreement

with some other underwriters to undertake guarantee for the issue of whole or

part of the issue under-written by him.

Arun Chandran Security Analysis and Portfolio Management 28

Parties involved in new issue.

Brokers to the issue.

• Brokers are persons authorized to market the issues. Companies can engage

any number of brokers to market the new issue.

• The brokers may engage sub-brokers and they send their own circulars, publicity

materials and applications to the clients and follow up the work for canvassing

the subscription.

• Brokers to the issue are not compulsory for public issues, but their expertise

and contacts with investors could be used for marketing the issue.

• Remuneration to the broker and terms and conditions of brokerage is fixed by

SEBI. There are 10,000 brokers and more than 70,000 sub-brokers registered

with SEBI.

Arun Chandran Security Analysis and Portfolio Management 29

Parties involved in new issue.

Registrars to the Issue (Registrar and Share Transfer (R&T) Agents):

• Registrars are persons appointed in consultation with lead managers to assist the issue

management functions. Their work relates to pre-issue management, management

during the currency of issue, pre- allotment Work, allotment work and post allotment

work.

• It is their duty to collect the application forms from bankers to the issue, process them for

allotment and issue certificate of allotment.

• Major functions of registrars can be listed as follows:

• Design and draft the format of application form for the merchant banker or lead manager.

• Collect application forms from banks.

• Scrutinize application forms.

• Finalize the allotment as per the basis approved by the stock exchange.

• Ensures that the corporate action for crediting of shares to the demat accounts of the applicants is

done

• Print refund orders and letters of allotment.

• Submit all statements to the company for their final approval.

• Help the company in getting the shares listed.

Security Analysis and Portfolio Management Arun Chandran 30

Parties involved in new issue.

Bankers to the Issue:

• Bankers to the issue collect the application forms and the money in cash, cheque or ASBA. Depending on

the size of the issue there may be many collection centers and many bankers. They are appointed in

consultation with lead manager. Infrastructure facilities available, manpower, past experience, location of

branches, efficiency and cost effectiveness etc. are parameters for selection of bankers to the issue.

• The Lead Merchant Banker shall ensure that Bankers to the Issue are

appointed in all the mandatory collection centers. The Lead manager also

ensures follow-up with bankers to the issue to get quick estimates of

collection and advising the issuer about closure of the issue, based on the

actual figures.

Arun Chandran Security Analysis and Portfolio Management 31

Parties involved in new issue.

Application Supported By Blocked Amount (ASBA):

• ASBA is an application containing an authorization to block the application money in the bank account,

for subscribing to an issue. If an investor is applying through ASBA, his application money shall be

debited from the bank account only if his/her application is selected for allotment after the basis of

allotment is finalized.

Arun Chandran Security Analysis and Portfolio Management 32

Parties involved in new issue.

Syndicate Members:

• Syndicate Members are commercial or investment banks registered with

SEBI who also carry on the activity of underwriting in IPO.

• They work as intermediaries for Issuer Company and the buyers of the IPO

stocks. Investors submit their bids for IPO shares through Syndicate

Members appointed by the Issuer Company. They are also known as ‘the

Members of the Syndicate’.

• The Members of the Syndicate circulate copies of the Red Herring

Prospectus along with the bid cum application form to potential

investors.

• After receiving the bid for IPO Shares from an investor, Syndicate Member

enters bidding detail into the electronic bidding system and generates a

Transaction Registration Slip (TRS) for each price and demand option and

gives the same to the bidder.

Security Analysis and Portfolio Management

Arun Chandran 33

Advantage.

• Companies can raise capital at relatively low cost, and the securities so issued in

the primary market provide high liquidity as the same can be sold in the

secondary market almost immediately.

• The primary market is an important source for mobilization of savings in an

economy. Funds are mobilized from commoners for investing in other channels. It

leads to monetary resources being put into investment options.

• Chances of price manipulation in the primary market are considerably less when

compared to the secondary market. Such manipulation usually occurs by

deflating or inflating a security price, thereby deliberately interfering with fair and

free operations of the market.

• The primary market acts as a potential avenue for diversification to cut down

on risk. It enables an investor to allocate his/her investment across different

categories involving multiple financial instruments and industries.

• It is not subject to any market fluctuations. The prices of stocks are determined

before an initial public offering, and investors know the actual amount they will

have to invest.

Security Analysis and Portfolio Management

Arun Chandran 34

Disadvantage.

• There may be limited information for an investor to access before

investment in an IPO since unlisted companies do not fall under the

purview of regulatory and disclosure requirements of the Securities

and Exchange Board of India.

• Each stock is exposed to varying degrees of risk, but there is no

historical trading data in a primary market for analyzing IPO shares

because the company is offering its shares to the public for the first

time through an initial public offering.

• In some cases, it may not be favorable for small investors. If a share

is oversubscribed, small investors may not receive share allocation.

Arun Chandran Security Analysis and Portfolio Management 35

Activity.

• Each group select 5 different company that is going to do IPO. (Using

the link below)

• https://www.moneycontrol.com/ipo/ipo-snapshot/upcoming-

issues.html?classic=true

• Study their profile.

• Do a video presentation.

• Deadline: E.O.D 13/09/2021 Monday.

Arun Chandran Security Analysis and Portfolio Management 36

Thank you ☺

Arun Chandran Security Analysis and Portfolio Management 37

Additional reads

• https://www.moneycontrol.com/news/business/ipo/these-ipos-

likely-to-hit-dalal-street-in-september-but-pricing-could-be-reworked-

after-recent-market-nervousness-7406361.html

• https://economictimes.indiatimes.com/markets/ipos/fpos/get-ready-

for-sept-fest-of-ipos-9-cos-plan-to-raise-12500-

cr/articleshow/85778976.cms

• https://www.news18.com/news/business/softbank-backed-snapdeal-

in-talks-over-400-million-ipo-4160768.html

Arun Chandran Security Analysis and Portfolio Management 38

You might also like

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 13Document48 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 13jasperkennedy089% (19)

- Investing Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeFrom EverandInvesting Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeNo ratings yet

- Economics 4th Yr 3Document10 pagesEconomics 4th Yr 3kolkata DariesNo ratings yet

- Investoer To Stock MarketDocument66 pagesInvestoer To Stock MarketMangesh GuptaNo ratings yet

- Newissuemarket 090919095525 Phpapp01Document31 pagesNewissuemarket 090919095525 Phpapp01Dr-Afzal Basha HSNo ratings yet

- Unit III Capital MarketDocument27 pagesUnit III Capital MarketAbin VargheseNo ratings yet

- Indian Financial Market: Rahul Kumar Department of Business AdminestrationDocument52 pagesIndian Financial Market: Rahul Kumar Department of Business AdminestrationDhruv MishraNo ratings yet

- Im Module2Document57 pagesIm Module2Lokesh GowdaNo ratings yet

- Structure of Indian Securities Market SEBIDocument21 pagesStructure of Indian Securities Market SEBIAJ SuriNo ratings yet

- Notes BST CH 10Document9 pagesNotes BST CH 10Aditi ChaudharyNo ratings yet

- New Issue MarketDocument33 pagesNew Issue MarketParul BajajNo ratings yet

- New Issue MarketDocument31 pagesNew Issue MarketAashish AnandNo ratings yet

- FM PresentationDocument33 pagesFM PresentationSudharsan M HarikumarNo ratings yet

- Newissuemarket 090919095525 Phpapp01Document31 pagesNewissuemarket 090919095525 Phpapp01vikramrajuNo ratings yet

- Sapm PPT 1Document21 pagesSapm PPT 1Gitanjali SubbaraajNo ratings yet

- Financial Market - Capital Market - Primary MArketDocument49 pagesFinancial Market - Capital Market - Primary MArketGaurav RathaurNo ratings yet

- Primary MarketDocument15 pagesPrimary MarketKapil KumarNo ratings yet

- Wa0005.Document84 pagesWa0005.stekimeuNo ratings yet

- Introduction:: Name: Arti Gupta Roll No: PG-18-18 Specialisation: FinanceDocument11 pagesIntroduction:: Name: Arti Gupta Roll No: PG-18-18 Specialisation: Financearti guptaNo ratings yet

- Unit 1Document18 pagesUnit 1sharmasanskar500No ratings yet

- IAPM 1 (26 Oct)Document8 pagesIAPM 1 (26 Oct)Akriti JaiswalNo ratings yet

- Capital Markets and Instruments: R Srinivasan FCA, FAFD, RV & RPDocument29 pagesCapital Markets and Instruments: R Srinivasan FCA, FAFD, RV & RPusne902No ratings yet

- Module 2 Part 2Document65 pagesModule 2 Part 2Shivam AroraNo ratings yet

- Security Market: 2.1 Concept of Primary MarketDocument10 pagesSecurity Market: 2.1 Concept of Primary MarketTawsif BracNo ratings yet

- Banking DraftDocument6 pagesBanking DraftPritha Behl BhandariNo ratings yet

- Capital MarketDocument38 pagesCapital Marketapi-3798892No ratings yet

- Capital Market Efficiency and Capital Markets in IndiaDocument33 pagesCapital Market Efficiency and Capital Markets in IndiaSamikshya MohantyNo ratings yet

- Financial Management (MBA 2nd Sem) - Unit 5Document18 pagesFinancial Management (MBA 2nd Sem) - Unit 5Dev StatusNo ratings yet

- Indian Securities MarketDocument73 pagesIndian Securities Marketbharti palNo ratings yet

- Unit 1 - Capital MarketsDocument9 pagesUnit 1 - Capital MarketsBhumika BapatNo ratings yet

- Securities Law and Market Operations: Unit-IDocument21 pagesSecurities Law and Market Operations: Unit-IDerain SmilyNo ratings yet

- Assientment 5Document6 pagesAssientment 5anvithapremagowdaNo ratings yet

- Chapter 10 - Financial Markets PDFDocument4 pagesChapter 10 - Financial Markets PDFKelrina D'silvaNo ratings yet

- Capital Markets in IndiaDocument37 pagesCapital Markets in IndiaAnup VermaNo ratings yet

- An Overview of Indian Financial SystemDocument39 pagesAn Overview of Indian Financial SystemPankaj AgriNo ratings yet

- National Stock ExchangeDocument63 pagesNational Stock ExchangePrashantChauhanNo ratings yet

- Indian Financial & Secu. Markets & ProductsDocument93 pagesIndian Financial & Secu. Markets & ProductsLipika haldarNo ratings yet

- Capital MarketsDocument16 pagesCapital MarketsChowdary PurandharNo ratings yet

- Topic-1-B New Issue MarketDocument20 pagesTopic-1-B New Issue MarketTushar BhatiNo ratings yet

- Financial MarketDocument15 pagesFinancial Marketrishu ashiNo ratings yet

- Fundamentals of StockDocument77 pagesFundamentals of StockwhoiamiNo ratings yet

- Financial Market Short Notes & QuestionsDocument12 pagesFinancial Market Short Notes & QuestionssyedmerajaliNo ratings yet

- Primary Secondary Markets SEBIDocument12 pagesPrimary Secondary Markets SEBInehaNo ratings yet

- IBE Module 6Document29 pagesIBE Module 6Prathik_Shetty_204No ratings yet

- Sbaa 7002Document93 pagesSbaa 7002Vamsi KrishnaNo ratings yet

- Unit 2 PDFDocument61 pagesUnit 2 PDFAkankshya Kaushik MishraNo ratings yet

- Chap 10 Short NotesDocument10 pagesChap 10 Short Notesnimisha chaddhaNo ratings yet

- PFM QBDocument22 pagesPFM QBhinowal388No ratings yet

- Financial Markets in IndiaDocument26 pagesFinancial Markets in Indiatadpelliwar_navinNo ratings yet

- Unit IIIDocument17 pagesUnit IIIVidhyaBalaNo ratings yet

- Constituents of A Financial SystemDocument4 pagesConstituents of A Financial SystemDil Shyam D KNo ratings yet

- Submitted To:: Miss. Priyanshu GoyalDocument16 pagesSubmitted To:: Miss. Priyanshu GoyalJyotiNo ratings yet

- Section 2 - Secondary MarketsDocument71 pagesSection 2 - Secondary MarketsABHINAV AGRAWALNo ratings yet

- Basic On Indian Stock MarketDocument30 pagesBasic On Indian Stock MarketadityaNo ratings yet

- INTRODUCTIONDocument26 pagesINTRODUCTION9022756315yashpatel2003No ratings yet

- An Overview of Indian Financial SystemDocument17 pagesAn Overview of Indian Financial Systemankitspx2010No ratings yet

- Unit Two.Document29 pagesUnit Two.Neetu PrasadNo ratings yet

- Regulation of Capital MarketDocument5 pagesRegulation of Capital MarketKritika KesriNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Indian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaFrom EverandIndian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaRating: 3.5 out of 5 stars3.5/5 (8)

- Plastic MoneyDocument15 pagesPlastic MoneyRazzat AroraNo ratings yet

- Session. 25. Letters of Credit and Bank GuaranteesDocument30 pagesSession. 25. Letters of Credit and Bank GuaranteesHemant KawalkarNo ratings yet

- AXA CoRE Europe Fund - Consolidated Financial Statement - 31122022Document92 pagesAXA CoRE Europe Fund - Consolidated Financial Statement - 31122022ariadna.ojogNo ratings yet

- Fabm 2 and FinanceDocument5 pagesFabm 2 and FinanceLenard TaberdoNo ratings yet

- Chapter 2 Accounting CycleDocument17 pagesChapter 2 Accounting CycleEzy playboyNo ratings yet

- Financial Statements Analysis - Ratio AnalysisDocument44 pagesFinancial Statements Analysis - Ratio AnalysisDipanjan SenguptaNo ratings yet

- Cfa Notes IftDocument15 pagesCfa Notes IftShubham SharmaNo ratings yet

- MTJA Tax TreatyDocument43 pagesMTJA Tax TreatyRosliNo ratings yet

- Annual Report 2016Document202 pagesAnnual Report 2016Asif NawazNo ratings yet

- Baysa ParcorChapter 1-5 Answer KeyDocument52 pagesBaysa ParcorChapter 1-5 Answer KeymoonjianneNo ratings yet

- Due Diligence ChecklistDocument4 pagesDue Diligence ChecklistPink PantherNo ratings yet

- Here Are Five Reasons Why Should I Study FinanceDocument5 pagesHere Are Five Reasons Why Should I Study Financekazi A.R RafiNo ratings yet

- The Financial Management Practices of Small and Medium EnterprisesDocument15 pagesThe Financial Management Practices of Small and Medium EnterprisesJa MieNo ratings yet

- Intro Swap MKTDocument18 pagesIntro Swap MKTshih_kaichihNo ratings yet

- Ramcharan Tharu Laxmi BankDocument3 pagesRamcharan Tharu Laxmi BankNikhil Visa ServicesNo ratings yet

- Letter of CreditDocument11 pagesLetter of CreditPalani RajanNo ratings yet

- The Inter Bank MarketsDocument30 pagesThe Inter Bank MarketsLeana Grace NopiaNo ratings yet

- Bài tập nhóm chương 3 - nhóm 4-k24kt02Document18 pagesBài tập nhóm chương 3 - nhóm 4-k24kt02Lúa PhạmNo ratings yet

- Pention and GratuityDocument19 pagesPention and GratuitygopubooNo ratings yet

- Airtel PDFDocument1 pageAirtel PDFShubham PandeyNo ratings yet

- Accounting Problems - PERIODICDocument17 pagesAccounting Problems - PERIODICChris AdoraNo ratings yet

- Invoice RG6197 FEBRUARY 2020Document1 pageInvoice RG6197 FEBRUARY 2020Ram KumarNo ratings yet

- Principles of Accounting Chapter 1 QuestionsDocument45 pagesPrinciples of Accounting Chapter 1 Questionsahmed156039No ratings yet

- Case 1 MACCDocument4 pagesCase 1 MACCFatima ShakeelNo ratings yet

- Buoyant Factsheet 2023 11Document4 pagesBuoyant Factsheet 2023 11Sabyasachi ChatterjeeNo ratings yet

- 134 Accounting Managers FreshersDocument4 pages134 Accounting Managers Freshersdchandru271No ratings yet

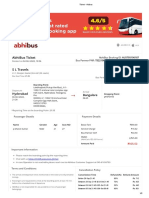

- Ticket - AbibusDocument2 pagesTicket - Abibuspalyadabharat kumarNo ratings yet

- 02 S2 Special Topics in Mercantile LawDocument160 pages02 S2 Special Topics in Mercantile Lawsaeloun hrdNo ratings yet

- Synopsis On Financial DerivativesDocument13 pagesSynopsis On Financial Derivativesgursharan4march67% (3)