Professional Documents

Culture Documents

Investment Brochure: Ace Ventures LTD

Investment Brochure: Ace Ventures LTD

Uploaded by

vysakhkesuCopyright:

Available Formats

You might also like

- Business PlanDocument3 pagesBusiness PlanJumoke Olaniyan67% (9)

- Bulenox ContractDocument9 pagesBulenox Contractjorge.omcrNo ratings yet

- Economic ProjectDocument22 pagesEconomic ProjectSudamMerya73% (22)

- Exchange FunctionDocument14 pagesExchange Functionangelica_jimenez_200% (1)

- Natural Trading, LLC - Leeloo Proprietary Letter and Contract Natural Trading, LLC Montana 59072Document5 pagesNatural Trading, LLC - Leeloo Proprietary Letter and Contract Natural Trading, LLC Montana 59072Andre IsmaelNo ratings yet

- Problem 8 25Document2 pagesProblem 8 25anon_590039258100% (1)

- Currency FuturesDocument4 pagesCurrency FuturesMubin PollobNo ratings yet

- 2-The Markets For Foreign Exchange RatesDocument8 pages2-The Markets For Foreign Exchange Ratesyaseenjaved466No ratings yet

- FX Risk ManagementDocument27 pagesFX Risk ManagementSMO979100% (1)

- International Banking: Exchange Rate FluctuationsDocument42 pagesInternational Banking: Exchange Rate FluctuationsullasNo ratings yet

- 3 - foreignexchangemarket-IBMDocument25 pages3 - foreignexchangemarket-IBMPrashant DixitNo ratings yet

- 15 Handle Foreign Currency TransactionsDocument27 pages15 Handle Foreign Currency TransactionsTegene TesfayeNo ratings yet

- Private Placement Programs.2020 (1) - 1Document5 pagesPrivate Placement Programs.2020 (1) - 1azay100% (1)

- Eliotwave Fund Management AccountDocument9 pagesEliotwave Fund Management AccountToni NathanielNo ratings yet

- Secondary MarketDocument62 pagesSecondary MarketKnishka VermaNo ratings yet

- TDA066Document13 pagesTDA066satishleoNo ratings yet

- Final Project ForexDocument145 pagesFinal Project ForexdamupatelNo ratings yet

- Treasury, Forex and IBDocument53 pagesTreasury, Forex and IBMuktak GoyalNo ratings yet

- Risk Management in Forex MarketDocument13 pagesRisk Management in Forex MarketfarzsabiNo ratings yet

- ACFX Ebook For NewbiesDocument52 pagesACFX Ebook For NewbiesMuhammad Azhar SaleemNo ratings yet

- Welcome To The Wonderful World of InvestingDocument12 pagesWelcome To The Wonderful World of Investingraviraj445No ratings yet

- NSE Welcome KitDocument26 pagesNSE Welcome KitjayabalrNo ratings yet

- UNIT 4 ForexDocument41 pagesUNIT 4 Forexsaurabh thakurNo ratings yet

- Risk Disclosure Statement: For Market Maker Types of Accounts (Standard and Micro)Document3 pagesRisk Disclosure Statement: For Market Maker Types of Accounts (Standard and Micro)AlanAlejandroCastellanosMejiaNo ratings yet

- ActiveTrader User GuideDocument50 pagesActiveTrader User GuideAhmed SaeedNo ratings yet

- The Following Core Values Guide Our Actions As We Strive To Achieve Our MissionDocument10 pagesThe Following Core Values Guide Our Actions As We Strive To Achieve Our Missionpooja1235285No ratings yet

- Bombay Stock ExchangeDocument70 pagesBombay Stock ExchangeAnkit Misra100% (1)

- Measuring and Managing Foreign Exchange Exposure: International Financial ManagementDocument48 pagesMeasuring and Managing Foreign Exchange Exposure: International Financial ManagementprakashputtuNo ratings yet

- InvestorseuropeDocument7 pagesInvestorseuropeapi-27052778No ratings yet

- Exercise Day 6Document9 pagesExercise Day 6bachnguyenquynhnhu8428No ratings yet

- Investment Analysis and Stock Market OperationsDocument45 pagesInvestment Analysis and Stock Market Operationssurabhi24jain4439100% (1)

- Summary Sheet - Helpful For Retention For Forex MarketsDocument5 pagesSummary Sheet - Helpful For Retention For Forex MarketsSaumyaNo ratings yet

- Role and Function of Brokerage FirmDocument29 pagesRole and Function of Brokerage FirmSrinibash BehuraNo ratings yet

- (B3) 14. Treasury ManagementDocument9 pages(B3) 14. Treasury ManagementNabiha ChoudaryNo ratings yet

- Chapter 4 - Secondary MarketsDocument29 pagesChapter 4 - Secondary MarketsAMAL P VNo ratings yet

- Forex 1Document53 pagesForex 1Irwan HeriyantoNo ratings yet

- ACI DealingDocument210 pagesACI DealingDarshana Shasthri Nakandala0% (1)

- IFM Unit 2Document29 pagesIFM Unit 2etiNo ratings yet

- TFM Session Five FX ManagementDocument64 pagesTFM Session Five FX ManagementmankeraNo ratings yet

- Sebi Grade A 2020: Economics: Foreign Exchange MarketDocument17 pagesSebi Grade A 2020: Economics: Foreign Exchange MarketThabarak ShaikhNo ratings yet

- International Business Finance Report GroupDocument10 pagesInternational Business Finance Report GroupMosesNo ratings yet

- Security Markets - 2Document10 pagesSecurity Markets - 2RakibImtiazNo ratings yet

- Swot and ProductDocument5 pagesSwot and ProductavinishNo ratings yet

- Final FX Risk & Exposure ManagementDocument33 pagesFinal FX Risk & Exposure ManagementkarunaksNo ratings yet

- Foreign ExchangeDocument8 pagesForeign ExchangeLokesh KumarNo ratings yet

- Angel Broking's Suite of Products & Services: 1. EquityDocument9 pagesAngel Broking's Suite of Products & Services: 1. Equityrk_sharktalb214322No ratings yet

- Financial MarketDocument41 pagesFinancial MarketChirag GoyalNo ratings yet

- FX NoteDocument6 pagesFX NoteMinit JainNo ratings yet

- Foreignexchangebasics PDFDocument6 pagesForeignexchangebasics PDFVinayNo ratings yet

- FOREX TRADING MANUAL Beginners To AdvanceDocument65 pagesFOREX TRADING MANUAL Beginners To AdvanceHenryMM75% (4)

- Treasury OperationsDocument28 pagesTreasury OperationsAbhi Maheshwari100% (1)

- $rrency Futures My Part EditedDocument6 pages$rrency Futures My Part EditedShankar VannierNo ratings yet

- EM Investment AccountPing v.1.0 LKDocument2 pagesEM Investment AccountPing v.1.0 LKKaio PiroloNo ratings yet

- Collins Sarri Statham: InvestmentsDocument7 pagesCollins Sarri Statham: InvestmentsKonie LappinNo ratings yet

- Iinternational Finacial ManagementDocument24 pagesIinternational Finacial ManagementSushma GNo ratings yet

- Capital Com Is The Best Online Forex Broker of 2022Document6 pagesCapital Com Is The Best Online Forex Broker of 2022Zain KhalidNo ratings yet

- AMTD086Document26 pagesAMTD086DequeceNo ratings yet

- StandardDocument5 pagesStandardRifqiNo ratings yet

- 2.the Life Cycle of A TradeDocument73 pages2.the Life Cycle of A TradeAnand Joshi100% (1)

- Day Trading for Beginners: The Ultimate Trading Guide. Discover Effective Strategies to Master the Stock Market and Start Making Money Online.From EverandDay Trading for Beginners: The Ultimate Trading Guide. Discover Effective Strategies to Master the Stock Market and Start Making Money Online.No ratings yet

- Day Trading 101: How to Master the Art and Science of Day TradingFrom EverandDay Trading 101: How to Master the Art and Science of Day TradingNo ratings yet

- CFAP 3 SPM Summer 2023Document4 pagesCFAP 3 SPM Summer 2023haris khanNo ratings yet

- Introduction To Alternative InvestmentsDocument44 pagesIntroduction To Alternative Investmentscdietzr100% (1)

- Adidas FinalDocument39 pagesAdidas Finalgulshan0% (1)

- The Value Chain and Cost Analysis 6Document5 pagesThe Value Chain and Cost Analysis 6Md.Yousuf AkashNo ratings yet

- An Introduction To Marketing Chapter # 14: By: Abdul Jaleel MahesarDocument18 pagesAn Introduction To Marketing Chapter # 14: By: Abdul Jaleel Mahesarpashadahri786No ratings yet

- ABC FOOD CO., LTD Income Statement: Adjustment EntriesDocument11 pagesABC FOOD CO., LTD Income Statement: Adjustment EntriesPham Huyen MyNo ratings yet

- Citigroup LBO PDFDocument32 pagesCitigroup LBO PDFKelvin Lim Wei LiangNo ratings yet

- Acc117 Test 2 Jan2023 - Tapah BRS SSDocument2 pagesAcc117 Test 2 Jan2023 - Tapah BRS SSNajmuddin Azuddin100% (1)

- Problems CF2Document7 pagesProblems CF2TrinhNo ratings yet

- Written Assignment Unit 2-Bus5110Document4 pagesWritten Assignment Unit 2-Bus5110Franklyn Doh-Nani100% (1)

- Strategy For Research and DevelopmentDocument4 pagesStrategy For Research and DevelopmentNrtyaNo ratings yet

- Importance of Personal SellingDocument3 pagesImportance of Personal SellingSudhanshu BhattNo ratings yet

- مدخل متكامل لإدارة التكاليف في ظل المنافسة في الشركات الصناعية د. فؤاد العفيريDocument27 pagesمدخل متكامل لإدارة التكاليف في ظل المنافسة في الشركات الصناعية د. فؤاد العفيريQu Een100% (1)

- Classification of ServiceDocument8 pagesClassification of ServiceShaRiq KhAnNo ratings yet

- WFS Course PlanDocument49 pagesWFS Course PlanBhuva_janaNo ratings yet

- Draft Letter of Buy Back Offer (Company Update)Document52 pagesDraft Letter of Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Assignment Accounting AJE GUIANGDocument14 pagesAssignment Accounting AJE GUIANGIce Voltaire B. GuiangNo ratings yet

- A Study On The Dynamic Impact of The Financial Management in Mindbox LLCDocument57 pagesA Study On The Dynamic Impact of The Financial Management in Mindbox LLCSurya BalaNo ratings yet

- Group 1 The Channel ParticipantsDocument65 pagesGroup 1 The Channel ParticipantsMary Rose BuaronNo ratings yet

- Managerial Accounting Assignment PDFDocument4 pagesManagerial Accounting Assignment PDFanteneh tesfawNo ratings yet

- Marketing Metrics GWRDocument9 pagesMarketing Metrics GWRAdison BrilleNo ratings yet

- Efe, Cpm. Ife Coca ColaDocument7 pagesEfe, Cpm. Ife Coca ColaMohamed RagehNo ratings yet

- # What Is Demand?Document4 pages# What Is Demand?Rifat RahmanNo ratings yet

- Configure Automatic Postings - Valuation and Account AssignmentDocument9 pagesConfigure Automatic Postings - Valuation and Account Assignmentakashbansode34No ratings yet

- Syllabus Banking Diploma, IBB 3Document1 pageSyllabus Banking Diploma, IBB 3sohanantashaNo ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- ACCT 1026 Lesson 7Document10 pagesACCT 1026 Lesson 7ChjxksjsgskNo ratings yet

- 21-22 - P & L and BALANCE SHEETDocument2 pages21-22 - P & L and BALANCE SHEETSidvik InfotechNo ratings yet

- Advertising Module 1Document15 pagesAdvertising Module 1kavya krosuruNo ratings yet

Investment Brochure: Ace Ventures LTD

Investment Brochure: Ace Ventures LTD

Uploaded by

vysakhkesuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Brochure: Ace Ventures LTD

Investment Brochure: Ace Ventures LTD

Uploaded by

vysakhkesuCopyright:

Available Formats

ACE VENTURES LTD.

___________________________________________________________________________

INVESTMENT BROCHURE

__________________________________________________________________________

HEAD OFFICE:

G2-95/1, CENTRAL AVENUE ROAD, KODAMBAKKAM, CHENNAI 600024.

COCHIN OFFICE:

2nd ,FLOOR, THE MONARCH, P.T.USHA ROAD, COCHIN - 682011.

Website - www.benzcom.org

ACE VENTURES LTD. FOREX

Background The Foreign Exchange market, also referred to as the "Forex" or "FX" market, is the largest financial market in the world, with a daily average turnover of approximately US$1.5 trillion. Until now, professional traders from major international commercial and investment banks have dominated the FX market. Other market participants range from large multinational corporations, global money managers, registered dealers, international money brokers, and futures and options traders, to private speculators. Why Forex There are three main reasons to participate in the FX market. One is to facilitate an actual transaction, whereby international corporations convert profits made in foreign currencies into their domestic currency. Corporate treasurers and money managers also enter the FX market in order to hedge against unwanted exposure to future price movements in the currency market. The third and more popular reason is speculation for profit. In fact, today it is estimated that less than 5% of all trading on the FX market is actually facilitating a true commercial transaction. How it works Foreign Exchange is the simultaneous buying of one currency and selling of another. The world's currencies are on a floating exchange rate and are always traded in pairs. In every open position, an investor is long in one currency and shorts the other. FX traders express a position in terms of the first currency in the pair. For example, someone who has bought dollars and sold yen (USD/JPY) at 104.37 is considered to be long US Dollars and short Yen. The most often traded or 'liquid' currencies are those of countries with stable governments, respected central banks, and low inflation. Today, over 85% of all daily transactions involve trading of the major currencies, including the US Dollar, Japanese Yen, Euro, British Pound and Swiss Franc. The FX market is considered an Over The Counter (OTC) or 'Interbank' market, due to the fact that transactions are conducted between two counterparts over the telephone or via an electronic network. Trading is not centralized on an exchange, as with the stock and futures markets. Benefits of Trading FX: Deal directly from live price quotes Instantaneous trade execution and confirmation Fast and efficient execution of deals Lower transaction costs Real-time profit and loss analysis Full access to market information 24 hour trading Liquidity Lower transaction costs Margin trading Equal access to market information Profit potential in both rising and falling markets Price manipulations are impossible

Currencies Traded: The base currency is U.S. Dollar. The dollar is traded against Japanese Yen, Euro, British Pound, Australian Dollar, Canadian Dollar and Swiss Franc.

Margin Requirement: Margin requirement for regular $1000.

Fundamental and Technical Analysis: Analysts make decisions based on analysis of fundamental factors and technical tools. They use charts, trend lines, support and resistance levels, and numerous patterns and mathematical analysis to identify trading opportunities. Fundamental analysis involves predicting the future by interpreting a variety of economic information, including news, government-issued indicators, reports, and other demand supply factors. The diversed group of Analysts in Altos is experienced to know all these factors which are influencing the markets. Services: The order of the client shall be executed and confirmed within a minute at any time during the market hours and at the prices desired Round the clock real time prices from various exchanges Analysis, Predictions and Recommendations from time to time. The Client shall be issued a Statement every day declaring his Trades and Equity Status. Account Opening For Forex Client wishing to trade through ACE Ventures Ltd, shall open an account with us with at least the minimum security margin. He shall be allotted an exclusive account number. The Client and ACE Ventures Ltd, shall sign a Risk Disclosure Statement. The Account can be in the name of an Individual or a Corporate Account. Charges o Banking For efficient Clearing, Settlement and Guarantee system, ACE Ventures Ltd. has an Automated Clearing and Settlement system with HDFC Bank as its Clearing Bank. Any Margin amount collected from or withdrawn by the client is maintained in the companys account with the Clearing bank. Withdrawal The withdrawal of profits or part of the margin or the whole of it is at the discretion of the client. The withdrawal shall be through A/C payee cheques only. All withdrawals shall be made on the third working day from the date of submission of the signed withdrawal slip. There is no lock-in period. *Disclaimer The management reserves the right to revise the margin requirement, brokerage or any other charges as and when it is deemed necessary. There is a substantial risk of loss in trading Futures. Do not risk money you cannot afford to lose. For positions held overnight there will be a interest charged or paid.

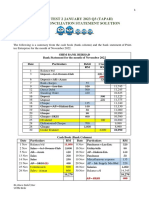

Margin Requirement Details

FOREX CURRENCY EURO JAPANESE STERLING SWISS FRANC AUSTRALIAN DOLLAR CANADIAN DOLLAR SYMBOL EUR/USD YENUSD/JPY POUNDGBP/USD USD/CHF AUD/USD USD/CAD SPOT $1,000.00 $1,000.00 $1,000.00 $1,000.00 $2,750.00 $1,000.00 MINI $500.00 $500.00 $500.00 $500.00 $1,750.00 $500.00

You might also like

- Business PlanDocument3 pagesBusiness PlanJumoke Olaniyan67% (9)

- Bulenox ContractDocument9 pagesBulenox Contractjorge.omcrNo ratings yet

- Economic ProjectDocument22 pagesEconomic ProjectSudamMerya73% (22)

- Exchange FunctionDocument14 pagesExchange Functionangelica_jimenez_200% (1)

- Natural Trading, LLC - Leeloo Proprietary Letter and Contract Natural Trading, LLC Montana 59072Document5 pagesNatural Trading, LLC - Leeloo Proprietary Letter and Contract Natural Trading, LLC Montana 59072Andre IsmaelNo ratings yet

- Problem 8 25Document2 pagesProblem 8 25anon_590039258100% (1)

- Currency FuturesDocument4 pagesCurrency FuturesMubin PollobNo ratings yet

- 2-The Markets For Foreign Exchange RatesDocument8 pages2-The Markets For Foreign Exchange Ratesyaseenjaved466No ratings yet

- FX Risk ManagementDocument27 pagesFX Risk ManagementSMO979100% (1)

- International Banking: Exchange Rate FluctuationsDocument42 pagesInternational Banking: Exchange Rate FluctuationsullasNo ratings yet

- 3 - foreignexchangemarket-IBMDocument25 pages3 - foreignexchangemarket-IBMPrashant DixitNo ratings yet

- 15 Handle Foreign Currency TransactionsDocument27 pages15 Handle Foreign Currency TransactionsTegene TesfayeNo ratings yet

- Private Placement Programs.2020 (1) - 1Document5 pagesPrivate Placement Programs.2020 (1) - 1azay100% (1)

- Eliotwave Fund Management AccountDocument9 pagesEliotwave Fund Management AccountToni NathanielNo ratings yet

- Secondary MarketDocument62 pagesSecondary MarketKnishka VermaNo ratings yet

- TDA066Document13 pagesTDA066satishleoNo ratings yet

- Final Project ForexDocument145 pagesFinal Project ForexdamupatelNo ratings yet

- Treasury, Forex and IBDocument53 pagesTreasury, Forex and IBMuktak GoyalNo ratings yet

- Risk Management in Forex MarketDocument13 pagesRisk Management in Forex MarketfarzsabiNo ratings yet

- ACFX Ebook For NewbiesDocument52 pagesACFX Ebook For NewbiesMuhammad Azhar SaleemNo ratings yet

- Welcome To The Wonderful World of InvestingDocument12 pagesWelcome To The Wonderful World of Investingraviraj445No ratings yet

- NSE Welcome KitDocument26 pagesNSE Welcome KitjayabalrNo ratings yet

- UNIT 4 ForexDocument41 pagesUNIT 4 Forexsaurabh thakurNo ratings yet

- Risk Disclosure Statement: For Market Maker Types of Accounts (Standard and Micro)Document3 pagesRisk Disclosure Statement: For Market Maker Types of Accounts (Standard and Micro)AlanAlejandroCastellanosMejiaNo ratings yet

- ActiveTrader User GuideDocument50 pagesActiveTrader User GuideAhmed SaeedNo ratings yet

- The Following Core Values Guide Our Actions As We Strive To Achieve Our MissionDocument10 pagesThe Following Core Values Guide Our Actions As We Strive To Achieve Our Missionpooja1235285No ratings yet

- Bombay Stock ExchangeDocument70 pagesBombay Stock ExchangeAnkit Misra100% (1)

- Measuring and Managing Foreign Exchange Exposure: International Financial ManagementDocument48 pagesMeasuring and Managing Foreign Exchange Exposure: International Financial ManagementprakashputtuNo ratings yet

- InvestorseuropeDocument7 pagesInvestorseuropeapi-27052778No ratings yet

- Exercise Day 6Document9 pagesExercise Day 6bachnguyenquynhnhu8428No ratings yet

- Investment Analysis and Stock Market OperationsDocument45 pagesInvestment Analysis and Stock Market Operationssurabhi24jain4439100% (1)

- Summary Sheet - Helpful For Retention For Forex MarketsDocument5 pagesSummary Sheet - Helpful For Retention For Forex MarketsSaumyaNo ratings yet

- Role and Function of Brokerage FirmDocument29 pagesRole and Function of Brokerage FirmSrinibash BehuraNo ratings yet

- (B3) 14. Treasury ManagementDocument9 pages(B3) 14. Treasury ManagementNabiha ChoudaryNo ratings yet

- Chapter 4 - Secondary MarketsDocument29 pagesChapter 4 - Secondary MarketsAMAL P VNo ratings yet

- Forex 1Document53 pagesForex 1Irwan HeriyantoNo ratings yet

- ACI DealingDocument210 pagesACI DealingDarshana Shasthri Nakandala0% (1)

- IFM Unit 2Document29 pagesIFM Unit 2etiNo ratings yet

- TFM Session Five FX ManagementDocument64 pagesTFM Session Five FX ManagementmankeraNo ratings yet

- Sebi Grade A 2020: Economics: Foreign Exchange MarketDocument17 pagesSebi Grade A 2020: Economics: Foreign Exchange MarketThabarak ShaikhNo ratings yet

- International Business Finance Report GroupDocument10 pagesInternational Business Finance Report GroupMosesNo ratings yet

- Security Markets - 2Document10 pagesSecurity Markets - 2RakibImtiazNo ratings yet

- Swot and ProductDocument5 pagesSwot and ProductavinishNo ratings yet

- Final FX Risk & Exposure ManagementDocument33 pagesFinal FX Risk & Exposure ManagementkarunaksNo ratings yet

- Foreign ExchangeDocument8 pagesForeign ExchangeLokesh KumarNo ratings yet

- Angel Broking's Suite of Products & Services: 1. EquityDocument9 pagesAngel Broking's Suite of Products & Services: 1. Equityrk_sharktalb214322No ratings yet

- Financial MarketDocument41 pagesFinancial MarketChirag GoyalNo ratings yet

- FX NoteDocument6 pagesFX NoteMinit JainNo ratings yet

- Foreignexchangebasics PDFDocument6 pagesForeignexchangebasics PDFVinayNo ratings yet

- FOREX TRADING MANUAL Beginners To AdvanceDocument65 pagesFOREX TRADING MANUAL Beginners To AdvanceHenryMM75% (4)

- Treasury OperationsDocument28 pagesTreasury OperationsAbhi Maheshwari100% (1)

- $rrency Futures My Part EditedDocument6 pages$rrency Futures My Part EditedShankar VannierNo ratings yet

- EM Investment AccountPing v.1.0 LKDocument2 pagesEM Investment AccountPing v.1.0 LKKaio PiroloNo ratings yet

- Collins Sarri Statham: InvestmentsDocument7 pagesCollins Sarri Statham: InvestmentsKonie LappinNo ratings yet

- Iinternational Finacial ManagementDocument24 pagesIinternational Finacial ManagementSushma GNo ratings yet

- Capital Com Is The Best Online Forex Broker of 2022Document6 pagesCapital Com Is The Best Online Forex Broker of 2022Zain KhalidNo ratings yet

- AMTD086Document26 pagesAMTD086DequeceNo ratings yet

- StandardDocument5 pagesStandardRifqiNo ratings yet

- 2.the Life Cycle of A TradeDocument73 pages2.the Life Cycle of A TradeAnand Joshi100% (1)

- Day Trading for Beginners: The Ultimate Trading Guide. Discover Effective Strategies to Master the Stock Market and Start Making Money Online.From EverandDay Trading for Beginners: The Ultimate Trading Guide. Discover Effective Strategies to Master the Stock Market and Start Making Money Online.No ratings yet

- Day Trading 101: How to Master the Art and Science of Day TradingFrom EverandDay Trading 101: How to Master the Art and Science of Day TradingNo ratings yet

- CFAP 3 SPM Summer 2023Document4 pagesCFAP 3 SPM Summer 2023haris khanNo ratings yet

- Introduction To Alternative InvestmentsDocument44 pagesIntroduction To Alternative Investmentscdietzr100% (1)

- Adidas FinalDocument39 pagesAdidas Finalgulshan0% (1)

- The Value Chain and Cost Analysis 6Document5 pagesThe Value Chain and Cost Analysis 6Md.Yousuf AkashNo ratings yet

- An Introduction To Marketing Chapter # 14: By: Abdul Jaleel MahesarDocument18 pagesAn Introduction To Marketing Chapter # 14: By: Abdul Jaleel Mahesarpashadahri786No ratings yet

- ABC FOOD CO., LTD Income Statement: Adjustment EntriesDocument11 pagesABC FOOD CO., LTD Income Statement: Adjustment EntriesPham Huyen MyNo ratings yet

- Citigroup LBO PDFDocument32 pagesCitigroup LBO PDFKelvin Lim Wei LiangNo ratings yet

- Acc117 Test 2 Jan2023 - Tapah BRS SSDocument2 pagesAcc117 Test 2 Jan2023 - Tapah BRS SSNajmuddin Azuddin100% (1)

- Problems CF2Document7 pagesProblems CF2TrinhNo ratings yet

- Written Assignment Unit 2-Bus5110Document4 pagesWritten Assignment Unit 2-Bus5110Franklyn Doh-Nani100% (1)

- Strategy For Research and DevelopmentDocument4 pagesStrategy For Research and DevelopmentNrtyaNo ratings yet

- Importance of Personal SellingDocument3 pagesImportance of Personal SellingSudhanshu BhattNo ratings yet

- مدخل متكامل لإدارة التكاليف في ظل المنافسة في الشركات الصناعية د. فؤاد العفيريDocument27 pagesمدخل متكامل لإدارة التكاليف في ظل المنافسة في الشركات الصناعية د. فؤاد العفيريQu Een100% (1)

- Classification of ServiceDocument8 pagesClassification of ServiceShaRiq KhAnNo ratings yet

- WFS Course PlanDocument49 pagesWFS Course PlanBhuva_janaNo ratings yet

- Draft Letter of Buy Back Offer (Company Update)Document52 pagesDraft Letter of Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Assignment Accounting AJE GUIANGDocument14 pagesAssignment Accounting AJE GUIANGIce Voltaire B. GuiangNo ratings yet

- A Study On The Dynamic Impact of The Financial Management in Mindbox LLCDocument57 pagesA Study On The Dynamic Impact of The Financial Management in Mindbox LLCSurya BalaNo ratings yet

- Group 1 The Channel ParticipantsDocument65 pagesGroup 1 The Channel ParticipantsMary Rose BuaronNo ratings yet

- Managerial Accounting Assignment PDFDocument4 pagesManagerial Accounting Assignment PDFanteneh tesfawNo ratings yet

- Marketing Metrics GWRDocument9 pagesMarketing Metrics GWRAdison BrilleNo ratings yet

- Efe, Cpm. Ife Coca ColaDocument7 pagesEfe, Cpm. Ife Coca ColaMohamed RagehNo ratings yet

- # What Is Demand?Document4 pages# What Is Demand?Rifat RahmanNo ratings yet

- Configure Automatic Postings - Valuation and Account AssignmentDocument9 pagesConfigure Automatic Postings - Valuation and Account Assignmentakashbansode34No ratings yet

- Syllabus Banking Diploma, IBB 3Document1 pageSyllabus Banking Diploma, IBB 3sohanantashaNo ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- ACCT 1026 Lesson 7Document10 pagesACCT 1026 Lesson 7ChjxksjsgskNo ratings yet

- 21-22 - P & L and BALANCE SHEETDocument2 pages21-22 - P & L and BALANCE SHEETSidvik InfotechNo ratings yet

- Advertising Module 1Document15 pagesAdvertising Module 1kavya krosuruNo ratings yet