Professional Documents

Culture Documents

05 TP

05 TP

Uploaded by

Laiza MalazarteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

05 TP

05 TP

Uploaded by

Laiza MalazarteCopyright:

Available Formats

BM2016

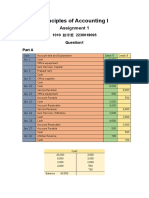

TASK PERFORMANCE (72 points: 24 items x 3 points)

Direction: Read the problem and give what is being asked. Write your answers on another sheet of paper.

1. Santa Maria Hospital is a non-profit organization located in Bulacan. Given below are the transactions and

events of its General Fund for October 20X1:

• Gross patient service revenues of P80,000 were billed to patients. Indigent charity care amounted to

P4,000, of which P2,500 was a receivable from Social Medicare of P6,000 and doubtful accounts of

P8,000.

• Contributed services approximating P10,000 at going salary rates were received from volunteer nurses.

Meals costing P200 were served to the volunteer nurses at no charge by the Santa Maria Hospital

cafeteria.

• New unrestricted pledges due in three (3) months, totaling P5,000, were received from various donors.

Collections on pledges amounted to P3,500, and the provision for doubtful pledges for the month was

P800.

• The amount of P3,000 received from the Restricted Fund was expended for new surgical equipment,

as authorized by the donor.

Required: Prepare the journal entries for the transactions of Santa Maria Hospital for October.

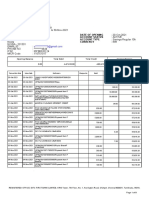

Accounts Receivable P76,000

Patient Service Revenue P76,000

To record gross patient service revenue exclusive of charity care

Contractual Adjustment 6,000

Accounts Receivable 6,000

To record contractual adjustment allowed

Doubtful Account 8,000

Allowance for Doubtful Account 8,000

To record provision for doubtful accounts

Salaries Expense 10,000

Contribution revenue 10,000

To record donated service

Pledge Receivable 5,000

Contribution Revenue 5,000

To record receivables from pledges

Cash 3,500

Pledge Receivable 3,500

To record pledges collected

Doubtful Pledge Expense 800

Allowance for doubtful pledges 800

To provide doubtful pledges

05 Task Performance 1 *Property of STI

Page 1 of 2

BM2016

Restricted Funds

Cash 3,000

Contribution revenue -Temporarily restricted 3,000

To record donation received for the acquisition of equipment

Net Assets released from restrictions 3,000

Cash 3,000

To record funds released from temporarily restriction

Unrestricted Funds

Property and Equipment 3,000

Cash 3,000

To record purchase of equipment

Cash 3,000

Net Assets released from restrictions 3,000

To record transfer of temporarily restricted funds

2. The following events occurred to the Cancer Research Foundation during the fiscal year ended June 30,

20X1:

• Unrestricted pledges for P300,000 were received. It is estimated that 10% will not be collectible.

• P260,000 was collected on pledges. It is estimated that another P10,000 will be collected next year.

• Received P40,000 from Manila Bulletin. The amount was net of P5,000 for fund-raising expenses.

• Invested P35,000 in certificates of deposit. During the year, it collected P2,000 interest. At year-end,

the accrued interest amounted to P1,000.

• Collected P5,000 in cash from sales of its booklet “How to Cope with Cancer.”

• Expenses paid in cash during the year were as follows:

Salaries P90,000

Employee Fringe Benefits 15,000

Payroll Taxes 16,000

Supplies 7,000

Telephone 1,500

Utilities 6,000

Rent 10,000

Conferences, Conventions, and Meetings 5,000

Cost of Booklet “How to Cope with Cancer” 1,000

Miscellaneous 3,000

• Accrued expense at year-end amounted to P1,000 for utilities and P5,000 for salaries.

• The board of directors (BOD) specified that P10,000 should be used to purchase a new computer for

research purposes.

05 Task Performance 1 *Property of STI

Page 2 of 2

BM2016

Required: Prepare the journal entries to record the above events in the Unrestricted Current Fund.

Pledges receivable P300,000

Allowance for uncollectible pledges P30,000

Contribution revenue 270,000

Cash 260,000

Pledges receivable 260,000

To record Provision for doubtful pledges

Cash 40,000

Fund raising expense 5,000

Fund raising revenue 45,000

Investment 35,000

Cash 35,000

To record invested certificate of deposits

Cash 5,000

Other operating revenue 5,000

To record sales of booklet

Expenses 154,500

Cash 154,500

To record expenses during the year

Utilities Expense 1,000

Salaries expense 5,000

Accounts Payable 6,000

To record accrued expenses

Cash 10,000

Contribution revenue 10,000

To record donation received for acquisition of equipment

Property and equipment 10,000

Cash 10,000

To record purchase of equipment

05 Task Performance 1 *Property of STI

Page 3 of 2

BM2016

3. Among the transactions and events of Lifegroup School, a non-profit secondary school for the year ended

June 30, 20X1, are the following:

• Paid P50,000 from the Unrestricted Fund for classroom computers to be carried in the Plant Fund.

• Received an unrestricted cash gift of P200,000.

• Disposed of common stocks for P110,000, which had been carried in the Quasi-Endowment Fund at

P100,000. There were no restrictions on the use of the proceeds attributable to the gain.

• Constructed a new school building at a total cost of P2,000,000. A payment was made composed of

P250,000 from the Plant Fund and P1,750,000 obtained on a 5% mortgage note payable.

Rubric: Prepare the journal entries for the transactions of Lifegroup School for the year ended June 30,

20X1.

Rubric for grading:

CRITERIA POINTS

Complete and correct accounts with correct amounts 3

Incomplete but correct accounts with correct amounts 1

05 Task Performance 1 *Property of STI

Page 4 of 2

You might also like

- Quiz 9 FinacrDocument9 pagesQuiz 9 FinacrJen Ner100% (5)

- Quizzes - Chapter 9 - Acctg Cycle of A Service BusinessDocument12 pagesQuizzes - Chapter 9 - Acctg Cycle of A Service BusinessAmie Jane Miranda50% (4)

- Adjusting Entries Problems 2022 DahonogDocument2 pagesAdjusting Entries Problems 2022 DahonogBaltazar JustinianoNo ratings yet

- Solution To Workshop No. 1Document10 pagesSolution To Workshop No. 1Bryan PazNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document6 pagesFinancial Accounting and Reporting: Exercise 1Lenneth MonesNo ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Worksheet ProblemDocument4 pagesWorksheet Problemusernames358No ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- Merchandising Comprrehensive ProblemDocument3 pagesMerchandising Comprrehensive ProblemJalod Hadji AmerNo ratings yet

- Acctg 100C 25 PDFDocument2 pagesAcctg 100C 25 PDFQuid DamityNo ratings yet

- (Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Document2 pages(Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Irene ArantxaNo ratings yet

- Working Paper-Chapters 1-4 Naser AbdelkarimDocument5 pagesWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiNo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Worksheet ProblemsDocument3 pagesWorksheet ProblemsClaren Sidnne MadridNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document8 pagesFinancial Accounting and Reporting: Exercise 1Lenneth Mones0% (1)

- SdsasacsacsacsacsacDocument4 pagesSdsasacsacsacsacsacIden PratamaNo ratings yet

- QUIZ 9 fINACRDocument9 pagesQUIZ 9 fINACRJen NerNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Final Output Cabiltes, Joielyn B SC199 053850Document8 pagesFinal Output Cabiltes, Joielyn B SC199 053850Joielyn CabiltesNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- Advanced Accounting Chapter 22Document9 pagesAdvanced Accounting Chapter 22LJ AggabaoNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- NPO and Partnership TestsDocument20 pagesNPO and Partnership Testskartik aggarwalNo ratings yet

- 104 ReviewDocument4 pages104 ReviewalanNo ratings yet

- ACC101 - Accounting CycleDocument3 pagesACC101 - Accounting CycleJade PielNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Poa HWDocument3 pagesPoa HW赵宇哲No ratings yet

- SW - Chapter 7Document8 pagesSW - Chapter 7andrie gardoseNo ratings yet

- Adjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingDocument9 pagesAdjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingHassan AliNo ratings yet

- Acct 2301 Spring 2010 TestDocument6 pagesAcct 2301 Spring 2010 Testamittutorials1985No ratings yet

- Mis 26 - 03 - 2024 Isl 197 Closing EntriesDocument1 pageMis 26 - 03 - 2024 Isl 197 Closing Entriessahiny883No ratings yet

- CASE 1: PM Company: Total Current Asset 1,750,000Document3 pagesCASE 1: PM Company: Total Current Asset 1,750,000JanineD.MeranioNo ratings yet

- SOLUTION Illustrative Problem Government Accounting ProcessDocument7 pagesSOLUTION Illustrative Problem Government Accounting ProcessVicente, Liza Mae C.No ratings yet

- 8625adjusting Entries PracticeDocument4 pages8625adjusting Entries PracticeNajia SalmanNo ratings yet

- Adjusting Entries From The Desk F JASDocument3 pagesAdjusting Entries From The Desk F JASMalik of ChakwalNo ratings yet

- Closing and Post-Closing EntriesDocument13 pagesClosing and Post-Closing EntriesBrian Reyes GangcaNo ratings yet

- Assignment - J&RDocument6 pagesAssignment - J&RJie SapornaNo ratings yet

- CCP302Document13 pagesCCP302api-3849444No ratings yet

- Chapter 4 4 4 4 4Document7 pagesChapter 4 4 4 4 4Rabie HarounNo ratings yet

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Exercise. AdjustmentsDocument6 pagesExercise. AdjustmentsDavid Con Rivero79% (14)

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- 162 PreSummative2Document4 pages162 PreSummative2Alvin John San JuanNo ratings yet

- CorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DADocument3 pagesCorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DAMubin Shaikh NooruNo ratings yet

- 11 Accountancy TP Ch04 01 Ladger and Trial BalanceDocument3 pages11 Accountancy TP Ch04 01 Ladger and Trial Balancerenu bhattNo ratings yet

- Adobe Scan 27-Feb-2023Document9 pagesAdobe Scan 27-Feb-2023SudeepNo ratings yet

- AccountingDocument4 pagesAccountingAnne AlagNo ratings yet

- Intacc 3 Fs ProblemsDocument25 pagesIntacc 3 Fs ProblemsUn knownNo ratings yet

- 11 - Final Accounts Assessment 2 PDFDocument6 pages11 - Final Accounts Assessment 2 PDFShreyas ParekhNo ratings yet

- DR Abanico (Journalizing)Document4 pagesDR Abanico (Journalizing)Jesseric RomeroNo ratings yet

- Audit of Financial StatementsDocument4 pagesAudit of Financial StatementsBrit NeyNo ratings yet

- Final Account ExamplesDocument4 pagesFinal Account Examplespranaylanjewar644No ratings yet

- Cash Flow Online April 6 2024 For StudentsDocument5 pagesCash Flow Online April 6 2024 For Studentsraven.jumaoas.eNo ratings yet

- Liabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsDocument3 pagesLiabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsAmit GodaraNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- SalesA5GST 1Document6 pagesSalesA5GST 1Chintan B BhayaniNo ratings yet

- QM CH 5Document18 pagesQM CH 5SaAd Khan0% (1)

- PDFDocument69 pagesPDFPurushothaman KesavanNo ratings yet

- UntitledDocument18 pagesUntitledFelicity LumapasNo ratings yet

- Homeless Emergency Solutions Grant ApplicationDocument17 pagesHomeless Emergency Solutions Grant ApplicationBridgeportCTNo ratings yet

- Majestic Tamworth InformationDocument29 pagesMajestic Tamworth InformationMetaGaxy DAONo ratings yet

- SPECIAL JOURNALS (Final)Document8 pagesSPECIAL JOURNALS (Final)NoroNo ratings yet

- Indian Financial System - Financial System - Introduction - Notes - FinanceDocument13 pagesIndian Financial System - Financial System - Introduction - Notes - Financekaran0% (1)

- 132 Studymat FM Nov 2009Document72 pages132 Studymat FM Nov 2009Ashish NarulaNo ratings yet

- Marketing FunctionsDocument15 pagesMarketing FunctionsKrishna ReddyNo ratings yet

- Approved List of Securities at Zerodha.Document204 pagesApproved List of Securities at Zerodha.Hemanth ReddyNo ratings yet

- Dividend PolicyDocument24 pagesDividend PolicySandhyadarshan Dash100% (1)

- FORMTR12 ChalanDocument2 pagesFORMTR12 ChalanVinod SathyanNo ratings yet

- Trade Finance Letter of Credit (Buy & Sell) in SAP Treasury: BackgroundDocument15 pagesTrade Finance Letter of Credit (Buy & Sell) in SAP Treasury: BackgroundDillip Kumar mallickNo ratings yet

- Financial Management: Graduate School Master of Arts in Education Major: Educational Management Financial ManagementDocument3 pagesFinancial Management: Graduate School Master of Arts in Education Major: Educational Management Financial ManagementJoje Sadili CostañosNo ratings yet

- Acst PDFDocument3 pagesAcst PDFkazliNo ratings yet

- Nifty Fifties ChargesDocument20 pagesNifty Fifties ChargesKelly Phillips ErbNo ratings yet

- VN Top500Document43 pagesVN Top500Vioh NguyenNo ratings yet

- Protection of Historical Monuments and Development of Museums Taken Up Under 12th Finance Commission FundsDocument151 pagesProtection of Historical Monuments and Development of Museums Taken Up Under 12th Finance Commission FundsKeerthana SNo ratings yet

- High Performance Trading Strategies Across Asset Classes: Keynote SpeakersDocument6 pagesHigh Performance Trading Strategies Across Asset Classes: Keynote SpeakersMichael RodovNo ratings yet

- PFRS 1 - First Time Adoption of PFRSDocument2 pagesPFRS 1 - First Time Adoption of PFRSRicaNo ratings yet

- HirinduKawshala, KushaniPanditharathnaDocument6 pagesHirinduKawshala, KushaniPanditharathnabudecimihaelaNo ratings yet

- IDFCFIRSTBankstatement 10078387878 130042647Document8 pagesIDFCFIRSTBankstatement 10078387878 130042647Nikhil Visa ServicesNo ratings yet

- Salient Features of The Revised Irr OF R.A. 9520Document21 pagesSalient Features of The Revised Irr OF R.A. 9520AJ NaragNo ratings yet

- Pengaruh Hutang Dan Ekuitas Terhadap Profitabilitas Pada Perusahaan Aneka Industri Yang Terdaftar Di Bursa Efek IndonesiaDocument11 pagesPengaruh Hutang Dan Ekuitas Terhadap Profitabilitas Pada Perusahaan Aneka Industri Yang Terdaftar Di Bursa Efek IndonesiaTitin SuhartiniNo ratings yet

- Gati Shakti' To Give 100-trn Infra Boost: Ola's Maiden E-Scooter Undercuts CompetitionDocument20 pagesGati Shakti' To Give 100-trn Infra Boost: Ola's Maiden E-Scooter Undercuts CompetitionRavinoor ChahalNo ratings yet

- Cir Vs PascorDocument10 pagesCir Vs PascorRaven DizonNo ratings yet

- DDFDocument66 pagesDDFPankaj Kumar100% (2)

- Managerial Applications of StatisticsDocument10 pagesManagerial Applications of StatisticsSai Aditya100% (1)

- Gen Z - The Breakthrough Generation or The DisruptorsDocument1 pageGen Z - The Breakthrough Generation or The DisruptorslientranftuNo ratings yet