Professional Documents

Culture Documents

Greenpath's Weekly Mortgage Newsletter

Greenpath's Weekly Mortgage Newsletter

Uploaded by

CENTURY 21 AwardOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Greenpath's Weekly Mortgage Newsletter

Greenpath's Weekly Mortgage Newsletter

Uploaded by

CENTURY 21 AwardCopyright:

Available Formats

Weekly Mortgage Newsletter

provided to you by

Week of June 12, 2011 Mortgage Market Commentary

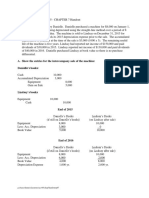

The US economy continues to grow. While that statement is true, the rate of growth continues to slow, and we seem to be hitting an even slower patch. While the economy has been very dependant on manufacturing to drive this recovery, we are seeing some slowing in that segment. In previous recoveries, consumers would generally be returning to spending, and driving more of the recovery effort. However, with the economy slow to add jobs, consumers are still holding back. This week is jam-packed with economic data for markets to digest, including Retail Sales, Industrial Production, and both the Producer and Consumer Price Indices. With so many signs that consumers are not engaging and manufacturing is slowing, a positive Retail Sales report or surprise increase in IP would probably jolt the market, and rates might move upward. Weve had some concerns with inflation accelerating when economic growth is slowing, but as long as the PPI and CPI remain near or below expectations, then they may not provide much upward pressure on mortgage rates. Mortgage Rates

30Yr 4.75% 4.25% 3.75% 3.25% 2.75%

3/17

13,000.00

This Weeks Top Economic Reports and Events

Report/Event Date Prior Est. Impact 6/14 0.5% -0.7% Significant Retail Sales The week could start with mortgage rates trending downward, especially if Retail Sales comes in much lower than expected. 6/14 0.3% 0.2% Producer Price Index (core) Moderate Prices at the wholesale level of the economy have risen significantly, but not all that pressure has been passed through during this recovery. 6/15 0.2% 0.1% Consumer Price Index (core) Significant If consumer prices continue to stay at, or near expectations, then we should not see too much upward pressure on mortgage rates. 6/15 0.0% 0.2% Industrial Production Significant With the economy stumbling a bit, an unexpectedly big increase in IP would be welcome, but it might push mortgage rates upward. 6/17 -0.3% 0.4% Leading Economic Indicators Moderate After dropping last month, a pop back up 0.3% or more would likely generate some moderate upward pressure on mortgage rates.

15Yr

1Yr ARM

3/31

4/14

4/28

5/12

5/26

6/9

Dow Jones

12,750.00 12,500.00 12,250.00 12,000.00 11,750.00 11,500.00 17-Mar 31-Mar 14-Apr 28-Apr 12-May 26-May 9-Jun

9.00

Historical Rates

6.00 3.00 0.00

Jun-06 Jun-07 Jun-08 Jun-09 Jun-10

Mortgage Rate Trends

Short-Term Long-Term Volatility High

Interest Rates and Indexes

1 Yr T-Bill 10 Yr T-Note 6 Month Libor Prime Rate 0.180% 11th D. COFI 1.359% 3.010% COSI 2.230% 0.397% CODI 3.250% MTA 0.305% 0.263%

1 Yr CMT CODI

MTA Prime

COFI

10 Year Treasury Note Trend

3.75 3.50 3.25 3.00 2.75

17-Mar 31-Mar 14-Apr 28-Apr 12-May 26-May 9-Jun

To Receive This Newsletter from your Home Mortgage Consultant, Please Contact Them Directly

26800 Aliso Viejo Pkwy, Suite 100, Aliso Viejo, CA 92656

10 Year Treasury Note

20 Day Moving Ave

You might also like

- Greenpath's Weekly Mortgage Newsletter - 10/2/2011Document1 pageGreenpath's Weekly Mortgage Newsletter - 10/2/2011CENTURY 21 AwardNo ratings yet

- Weekly Economic Commentary 06-27-2011Document3 pagesWeekly Economic Commentary 06-27-2011Jeremy A. MillerNo ratings yet

- DA Davidson's Fixed Income Markets Comment - August 2, 2013Document3 pagesDA Davidson's Fixed Income Markets Comment - August 2, 2013Davidson CompaniesNo ratings yet

- Monthly Economic Outlook 06082011Document6 pagesMonthly Economic Outlook 06082011jws_listNo ratings yet

- Westpac Red Book July 2013Document28 pagesWestpac Red Book July 2013David SmithNo ratings yet

- Risk Event For This Week September 5-9-2016 2Document5 pagesRisk Event For This Week September 5-9-2016 2randz8No ratings yet

- UBS Weekly Guide: Help WantedDocument13 pagesUBS Weekly Guide: Help Wantedshayanjalali44No ratings yet

- Greenpath's Weekly Mortgage Newsletter - 7/31/2011Document1 pageGreenpath's Weekly Mortgage Newsletter - 7/31/2011CENTURY 21 AwardNo ratings yet

- U.S. Market Update August 12 2011Document6 pagesU.S. Market Update August 12 2011dpbasicNo ratings yet

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightNo ratings yet

- Investec The BriefDocument8 pagesInvestec The Briefapi-296258777No ratings yet

- Cpi 1Document7 pagesCpi 1Naseem AbbasNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 8/28/2011Document1 pageGreenpath's Weekly Mortgage Newsletter - 8/28/2011CENTURY 21 AwardNo ratings yet

- Greenpath's Weekly Mortgage NewsletterDocument1 pageGreenpath's Weekly Mortgage NewsletterCENTURY 21 AwardNo ratings yet

- SEB Report: Asian Recovery - Please Hold The LineDocument9 pagesSEB Report: Asian Recovery - Please Hold The LineSEB GroupNo ratings yet

- Good News Is Bad News Once Again As Stronger Employment Growth Spooks MarketsDocument12 pagesGood News Is Bad News Once Again As Stronger Employment Growth Spooks Marketsjjy1234No ratings yet

- 2015 0622 Hale Stewart Us Equity and Economic Review For The Week of June 15 19 Better News But Still A Touch SlogDocument11 pages2015 0622 Hale Stewart Us Equity and Economic Review For The Week of June 15 19 Better News But Still A Touch SlogcasefortrilsNo ratings yet

- NAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.Document18 pagesNAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.International Business Times AUNo ratings yet

- MFM Jun 17 2011Document13 pagesMFM Jun 17 2011timurrsNo ratings yet

- Data Analysis 10 June 2011 WEBDocument4 pagesData Analysis 10 June 2011 WEBMinh NguyenNo ratings yet

- March 2013 NewsletterDocument2 pagesMarch 2013 NewslettermcphailandpartnersNo ratings yet

- Pioneer 082013Document6 pagesPioneer 082013alphathesisNo ratings yet

- JPM Global Data Watch Se 2012-09-21 946463Document88 pagesJPM Global Data Watch Se 2012-09-21 946463Siddhartha SinghNo ratings yet

- The RBA Observer - A Close Call, But We Still Expect Them To HoldDocument6 pagesThe RBA Observer - A Close Call, But We Still Expect Them To HoldBelinda WinkelmanNo ratings yet

- 2015.10 Q3 CMC Efficient Frontier NewsletterDocument8 pages2015.10 Q3 CMC Efficient Frontier NewsletterJohn MathiasNo ratings yet

- July Retail Update: Momentum Is Limited For U.S. Retail Sales Despite Domestic Economic RecoveryDocument8 pagesJuly Retail Update: Momentum Is Limited For U.S. Retail Sales Despite Domestic Economic Recoveryapi-227433089No ratings yet

- FMR Special Report 2015-008 02-02-2015 GBDocument5 pagesFMR Special Report 2015-008 02-02-2015 GBMontasser KhelifiNo ratings yet

- Anz Research: Global Economics & StrategyDocument14 pagesAnz Research: Global Economics & StrategyBelinda WinkelmanNo ratings yet

- The Pensford Letter - 11.11.13 PDFDocument4 pagesThe Pensford Letter - 11.11.13 PDFPensford FinancialNo ratings yet

- Global Data Watch: Bumpy, A Little Better, and A Lot Less RiskyDocument49 pagesGlobal Data Watch: Bumpy, A Little Better, and A Lot Less RiskyAli Motlagh KabirNo ratings yet

- Breakfast With Dave 091709Document8 pagesBreakfast With Dave 091709ejlamasNo ratings yet

- Spyglass Macro 08aug22Document13 pagesSpyglass Macro 08aug22Ronan CurranNo ratings yet

- The Pensford Letter - 4.1.13Document3 pagesThe Pensford Letter - 4.1.13Pensford FinancialNo ratings yet

- Weekly Macro Comment The Problem of Serving All MastersDocument3 pagesWeekly Macro Comment The Problem of Serving All MastersFlametreeNo ratings yet

- Viewpoint From Palladiem - January 2015: ValuationDocument1 pageViewpoint From Palladiem - January 2015: Valuationapi-275925231No ratings yet

- The Pensford Letter - 12.8.14Document4 pagesThe Pensford Letter - 12.8.14Pensford FinancialNo ratings yet

- GDP Growth SlowsDocument2 pagesGDP Growth SlowsPavelNo ratings yet

- Bet Against QE3Document1 pageBet Against QE3brandi1252No ratings yet

- Australian Monthly Chartbook - December 2012Document20 pagesAustralian Monthly Chartbook - December 2012economicdelusionNo ratings yet

- Economic CommentaryDocument2 pagesEconomic CommentaryJan HudecNo ratings yet

- Weekly Trends March 20, 2015Document4 pagesWeekly Trends March 20, 2015dpbasicNo ratings yet

- Data Scan: China July CPI and PPIDocument2 pagesData Scan: China July CPI and PPIapi-162199694No ratings yet

- The Pensford Letter - 05.04.2015Document3 pagesThe Pensford Letter - 05.04.2015Pensford FinancialNo ratings yet

- The Pensford Letter - 04.30.12Document3 pagesThe Pensford Letter - 04.30.12Pensford FinancialNo ratings yet

- The Red Book: Westpac Economics With TheDocument26 pagesThe Red Book: Westpac Economics With TheBelinda WinkelmanNo ratings yet

- The Pensford Letter - 4.21.14Document3 pagesThe Pensford Letter - 4.21.14Pensford FinancialNo ratings yet

- Economist Insights 2012Document2 pagesEconomist Insights 2012buyanalystlondonNo ratings yet

- The Pensford Letter - 8.13.12Document5 pagesThe Pensford Letter - 8.13.12Pensford FinancialNo ratings yet

- Atwel - Global Macro 6/2011Document15 pagesAtwel - Global Macro 6/2011Jan KaskaNo ratings yet

- WF WeeklyEconomicFinancialCommentary 01102014Document9 pagesWF WeeklyEconomicFinancialCommentary 01102014Javier EscribaNo ratings yet

- Ip Newhighs Finalv2Document4 pagesIp Newhighs Finalv2Anonymous Feglbx5No ratings yet

- The Pensford Letter - 5.11.15Document3 pagesThe Pensford Letter - 5.11.15Pensford FinancialNo ratings yet

- The Pensford Letter - 06.01.2015Document4 pagesThe Pensford Letter - 06.01.2015Pensford FinancialNo ratings yet

- September 27, 2013: Survey Last Actual Comerica Economics Commentary Fed Funds Rate (Effective)Document3 pagesSeptember 27, 2013: Survey Last Actual Comerica Economics Commentary Fed Funds Rate (Effective)belger5No ratings yet

- Weekly Economic Commentary 5/13/2013Document5 pagesWeekly Economic Commentary 5/13/2013monarchadvisorygroupNo ratings yet

- Market Outlook, Oct 14th 2022Document24 pagesMarket Outlook, Oct 14th 2022elvisgonzalesarceNo ratings yet

- The Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyFrom EverandThe Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyRating: 5 out of 5 stars5/5 (1)

- 2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateFrom Everand2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateNo ratings yet

- 7.27 South IIDocument1 page7.27 South IICENTURY 21 AwardNo ratings yet

- SouthDocument1 pageSouthCENTURY 21 AwardNo ratings yet

- 7.27 South I OHDDocument1 page7.27 South I OHDCENTURY 21 AwardNo ratings yet

- 7.27 North OHDDocument1 page7.27 North OHDCENTURY 21 AwardNo ratings yet

- NorthDocument1 pageNorthCENTURY 21 AwardNo ratings yet

- South 1Document1 pageSouth 1CENTURY 21 AwardNo ratings yet

- Greenpath's Weekly Mortgage NewsletterDocument1 pageGreenpath's Weekly Mortgage NewsletterCENTURY 21 AwardNo ratings yet

- South 2Document1 pageSouth 2CENTURY 21 AwardNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 7/31/2011Document1 pageGreenpath's Weekly Mortgage Newsletter - 7/31/2011CENTURY 21 AwardNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 10/2/2011Document1 pageGreenpath's Weekly Mortgage Newsletter - 10/2/2011CENTURY 21 AwardNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 8/28/2011Document1 pageGreenpath's Weekly Mortgage Newsletter - 8/28/2011CENTURY 21 AwardNo ratings yet

- North 1Document1 pageNorth 1CENTURY 21 AwardNo ratings yet

- South 1Document1 pageSouth 1CENTURY 21 AwardNo ratings yet

- North 1Document1 pageNorth 1CENTURY 21 AwardNo ratings yet

- June ContestDocument1 pageJune ContestCENTURY 21 AwardNo ratings yet

- South 1Document1 pageSouth 1CENTURY 21 AwardNo ratings yet

- Training Wheels: YouTubeDocument14 pagesTraining Wheels: YouTubeCENTURY 21 AwardNo ratings yet

- South 2Document1 pageSouth 2CENTURY 21 AwardNo ratings yet

- North 2Document1 pageNorth 2CENTURY 21 AwardNo ratings yet

- May ContestDocument1 pageMay ContestCENTURY 21 AwardNo ratings yet

- South 3Document1 pageSouth 3CENTURY 21 AwardNo ratings yet

- SouthDocument1 pageSouthCENTURY 21 AwardNo ratings yet

- North 2Document1 pageNorth 2CENTURY 21 AwardNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 5/1/2011Document1 pageGreenpath's Weekly Mortgage Newsletter - 5/1/2011CENTURY 21 AwardNo ratings yet

- North 1Document1 pageNorth 1CENTURY 21 AwardNo ratings yet

- South 1Document1 pageSouth 1CENTURY 21 AwardNo ratings yet

- North 1Document1 pageNorth 1CENTURY 21 AwardNo ratings yet

- South 2Document1 pageSouth 2CENTURY 21 AwardNo ratings yet

- Training Wheels: QR CodesDocument10 pagesTraining Wheels: QR CodesCENTURY 21 AwardNo ratings yet

- North 2Document1 pageNorth 2CENTURY 21 AwardNo ratings yet

- Incremental AnalysisDocument2 pagesIncremental AnalysisganusrsNo ratings yet

- Chapter 7 Handout Solution - Accounting 405-1Document5 pagesChapter 7 Handout Solution - Accounting 405-1Bridget ElizabethNo ratings yet

- ACCA P5 PresentationDocument51 pagesACCA P5 PresentationDobu KolobingoNo ratings yet

- Business Plan: Omega Designs 1Document18 pagesBusiness Plan: Omega Designs 1api-335664543No ratings yet

- Bancel & Mittoo (2004a)Document36 pagesBancel & Mittoo (2004a)Leonardo CunhaNo ratings yet

- Raymond Limited QuatationDocument1 pageRaymond Limited QuatationASA PolyPlastNo ratings yet

- Chapter 5 SDocument13 pagesChapter 5 SLê Đăng Cát NhậtNo ratings yet

- CH 02Document55 pagesCH 02indah lestariNo ratings yet

- Fair Value: T I V ADocument11 pagesFair Value: T I V AHarryNo ratings yet

- Business Valuations: Net Asset Value (Nav)Document9 pagesBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNo ratings yet

- MTF of Uttar Pradesh For FCI Wheat Auctions On 1 September 2016Document16 pagesMTF of Uttar Pradesh For FCI Wheat Auctions On 1 September 2016chengadNo ratings yet

- ValuationDocument7 pagesValuationSiva SankariNo ratings yet

- Breadtalk Group Limited: The Dough Is RisingDocument33 pagesBreadtalk Group Limited: The Dough Is Risingmandster1978No ratings yet

- Audit of Property, Plant and Equipment: Auditing ProblemsDocument5 pagesAudit of Property, Plant and Equipment: Auditing ProblemsLei PangilinanNo ratings yet

- How Capitalism Can Work For Everyone: Audiobook Reference GuideDocument30 pagesHow Capitalism Can Work For Everyone: Audiobook Reference GuideBayuNo ratings yet

- Valuation Concepts and Methods - CompressDocument10 pagesValuation Concepts and Methods - CompressCJ ReynoNo ratings yet

- Initiating Coverage Report - TVS Motor Company LTDDocument14 pagesInitiating Coverage Report - TVS Motor Company LTDshreya2626No ratings yet

- A Case Study On Nasir Glass IndustriesDocument14 pagesA Case Study On Nasir Glass IndustriesMasood Pervez0% (1)

- Agila 2 Merchandising PeriodicDocument1 pageAgila 2 Merchandising PeriodicJoaquin CortesNo ratings yet

- Basics of Tariff CalculationDocument27 pagesBasics of Tariff Calculationpintu ramNo ratings yet

- Manufacturing AccountsDocument9 pagesManufacturing AccountsCrystal Johnson100% (1)

- Wallstreetjournal 20170930 TheWallStreetJournalDocument54 pagesWallstreetjournal 20170930 TheWallStreetJournalJohn Paul (eschatology101 info)No ratings yet

- Agricultural Commercialization and Diversification: Processes and PoliciesDocument15 pagesAgricultural Commercialization and Diversification: Processes and PoliciesRia Darmayanti HaedarNo ratings yet

- The Effects of Promotion Framing On Consumers' Price PerceptionsDocument12 pagesThe Effects of Promotion Framing On Consumers' Price PerceptionsNIANo ratings yet

- Financial Times (Europe Edition) No. 41,393 (04 Aug 2023)Document18 pagesFinancial Times (Europe Edition) No. 41,393 (04 Aug 2023)Dizzy_88No ratings yet

- Tutorial 1 QuestionsDocument3 pagesTutorial 1 Questionsguan junyanNo ratings yet

- Advances in Business Cycle Theory: MacroeconomicsDocument23 pagesAdvances in Business Cycle Theory: MacroeconomicsAyan PalNo ratings yet

- Construction Planning and Management Civil Engineering Objective TypeDocument27 pagesConstruction Planning and Management Civil Engineering Objective TypePrashant Sunagar100% (1)

- Study Questions For Chapter 4 23082022 105517amDocument2 pagesStudy Questions For Chapter 4 23082022 105517amDayyan QureshiNo ratings yet

- Tutorial - 3Document4 pagesTutorial - 3danrulz18No ratings yet