Professional Documents

Culture Documents

Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced Accounting

Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced Accounting

Uploaded by

Shrwan SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced Accounting

Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced Accounting

Uploaded by

Shrwan SinghCopyright:

Available Formats

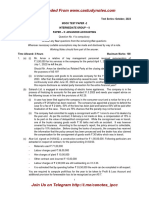

Test Series: March 2022

MOCK TEST PAPER 1

INTERMEDIATE: GROUP – II

PAPER – 5: ADVANCED ACCOUNTING

Question No. 1 is compulsory.

Answer any four questions from the remaining five questions.

Wherever necessary suitable assumptions may be made and disclosed by way of a note.

Working Notes should form part of the answer.

Time Allowed: 3 Hours Maximum Marks: 100

1. (a) (i) Mr. Arnav a relative of key management personnel received remuneration of

` 3,00,000 for his services in the company for the period April 1, 2019 to June 30, 2019. On

July 1, 2019 he left the job.

Should Mr. Arnav be identified as Related Party at the closing date i.e. March 31, 20 20 for

the purposes of AS 18?

(ii) A limited company sold goods to its associate company for the 1 st quarter ending June 30,

2020. After that, the related party relationship ceased to exist. However, goods were supplied

continuously even after June 30, 2020 as was supplied to another ordinary customer. Does

this require disclosure as related party transaction for the entire financial year?

(b) New Era Publications publishes a monthly magazine on 15 th of every month. It sells advertising

space in the magazine to advertisers on the terms of 80% sale value payable in advance and the

balance within 30 days of the release of the publication. The sale of space for the March 2020

issue was made in February 2020. The magazine was published on its scheduled date. It received

` 2,40,000 on 10.3.2020 and ` 60,000 on 10.4.2020 for the March, 2020 issue.

Discuss in the context of AS 9 the amount of revenue to be recognized and the treatment of the

amount received from advertisers for the year ending 31.3.2020. What will be the treatment if the

publication is delayed till 2.4.2020?

(c) Sarita Construction Co. obtained a contract for construction of a dam. The following details a re

available in records of company for the year ended 31 st March, 2021:

` In Lakhs

Total Contract Price 12,000

Work Certified 6,250

Work not certified 1,250

Estimated further cost to completion 8,750

Progress payment received 5,500

Progress payment to be received 1,500

Applying the provisions of Accounting Standard 7 "Accounting for Construction Contracts" you are

required to compute:

(i) Profit/Loss for the year ended 31 st March, 2021.

(ii) Contract work in progress as at end of financial year 2020-21.

(iii) Revenue to be recognized out of the total contract value.

(iv) Amount due from/to customers as at the year end.

© The Institute of Chartered Accountants of India

(d) Sudesh Ltd. acquired a patent at a cost of ` 2,40,00,000 for a period of 5 years and the product

life-cycle was also 5 years. The company capitalized the cost and started amortizing the asset at

` 48,00,000 per annum. After two years it was found that the product life -cycle may continue for

another 5 years from then. The net cash flows from the product during these 5 years were expected

to be ` 36,00,000, ` 46,00,000, ` 44,00,000, ` 40,00,000 and ` 34,00,000. Find out the

amortization cost of the patent for each of the years if the patent was renewable and Sudesh Ltd.

got it renewed after expiry of five years. (4 Parts x 5 Marks = 20 Marks)

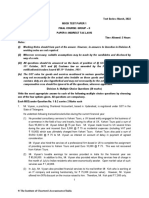

2. (a) A partnership firm was dissolved on 30 th June, 2020. Its Balance Sheet on the date of dissolution

was as follows:

Equity & Liabilities ` ` Assets `

Capitals: Cash 10,800

A 76,000 Sundry Assets 1,89,200

B 48,000

C 36,000 1,60,000

Loan A/c – B 10,000

Sundry Creditors 30,000

2,00,000 2,00,000

The assets were realized in instalments and the payments were made on the proportionate capital

basis. Creditors were paid ` 29,000 in full settlement of their account. Expenses of realization

were estimated to be ` 5,400 but actual amount spent was ` 4,000. This amount was paid on 15 th

September. Draw up a statement showing distribution of cash, which was realized as follows:

`

On 5th July, 2020 25,200

On 30th August, 2020 60,000

On 15th September, 2020 80,000

The partners shared profits and losses in the ratio of 2 : 2 : 1. Prepare a statement showing

distribution of cash amongst the partners by ‘Highest Relative Capital’ method.

(b) Explain Garner v/s Murray rule applicable in the case of partnership firms. State the conditions

when this rule is not applicable.

(c) A Ltd. holds 80% of the equity capital and voting power in B Ltd. A Ltd sells inventories costing

` 180 lacs to B Ltd at a price of ` 200 lacs. The entire inventories remain unsold with B Ltd at the

financial year end i.e. 31 March 2020. What will be the accounting treatment for this transaction

in the consolidated financial statements of A Ltd? (12+4+4 = 20 Marks)

3. (a) Two companies named Alex Ltd. and Beta Ltd. provide you the following summary of ledger

balances as on 31 st March, 2020:

Alex Ltd. (`) Beta Ltd. (`)

Goodwill 1,40,000 70,000

Building 8,40,000 2,80,000

Machinery 14,00,000 4,20,000

Inventory 7,00,000 4,90,000

Trade receivables 5,60,000 2,80,000

Cash at Bank 1,40,000 56,000

Equity Shares of ` 10 each 28,00,000 8,40,000

8% Preference Shares of ` 100 each 2,80,000 –

© The Institute of Chartered Accountants of India

10% Preference Shares of ` 100 each – 2,80,000

General Reserve 1,96,000 1,96,000

Retirement Gratuity fund 1,40,000 56,000

Trade payables 3,64,000 2,24,000

Beta Ltd. is absorbed by Alex Ltd. on the following terms:

(a) 10% Preference Shareholders are to be paid at 10% premium by issue of 8% Preference

Shares of Alex Ltd.

(b) Goodwill of Beta Ltd. is valued at ` 1,40,000, Buildings are valued at ` 4,20,000 and the

Machinery at ` 4,48,000.

(c) Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created

@ 7.5%.

(d) Equity Shareholders of Beta Ltd. will be issued Equity Shares of Alex Ltd. @ 5% premium.

You are required to:

(i) Prepare necessary Ledger Accounts to close the books of Beta Ltd.

(ii) Show the acquisition entries in the books of Alex Ltd.

(iii) Also draft the Balance Sheet after absorption as at 31st March, 2020.

(b) List the conditions to be fulfilled as per AS 14 (Revised) for an amalgamation to be in the nature of

merger, in the case of companies. (16 + 4 = 20 Marks)

4. (a) Alpha Ltd. furnishes the following information as at 31st March, 2021:

` In lakhs ` In lakhs

Shareholders' Funds

Equity share capital (fully paid up shares of ` 10 each) 2,400

Reserves and Surplus

Securities Premium 350

General Reserve 530

Capital Redemption Reserve 400

Profit & Loss Account 340 1,620

Non-current Liabilities

12% Debentures 1,500

Current Liabilities

Trade PayabIes 1,490

Other Current Liabilities 390 1,880

Non-current Assets

Property, plant and equipment 4,052

Current Assets

Current Investments 148

Inventories 1,200

Trade Receivables 520

Cash and Bank 1,480 3,348

© The Institute of Chartered Accountants of India

(i) On 1st April, 2021, the company announced buy-back of 25% of its equity shares

@ ` 15 per share. For this purpose, it sold all its investment for ` 150 lakhs.

(ii) On 10th April, 2021 the company achieved the target of buy-back.

(iii) On 30th April, 2021, the company issued one fully paid up equity share of ` 10 each by way

of bonus for every four equity shares held by the equity shareholders by capitalization of

Capital Redemption Reserve. Premium (excess of buy-back price over the par value) paid on

buy-back should be adjusted against securities premium account.

You are required to pass necessary journal entries and prepare the Balance Sheet of Alpha Ltd.

after bonus issue.

(b) A non-banking finance company provides the extract of its balance sheet as given below:

Equity and Liabilities Amount Assets Amount

` in 000 ` in 000

Paid-up equity capital 400 Leased out assets 3,200

Free reserves 2,000 Investment:

Loans 1,600 In shares of subsidiaries and

Deposits 1,600 group companies 400

In debentures of subsidiaries and

group Companies 400

Cash and bank balances 800

Deferred expenditure 800

5,600 5,600

You are required to compute 'Net owned Fund' of this NBFC as per Non-Banking Financial

Company - Systemically Important Non-Deposit taking Company and Deposit taking Company

(Reserve Bank) Directions, 2016.

(c) State with reason whether the following cash credit accounts are NPA or not:

Case-1 Case-2 Case- 3 Case-4

Sanctioned limit 50,00,000 60,00,000 55,00,000 45,00,000

Drawing power 44,00,000 56,00,000 50,00,000 42,00,000

Amount outstanding continuously 40,00,000 48,00,000 56,00,000 30,00,000

01-01-21 to 31-03-21

Total interest debited for the above 3,20,000 3,84,000 4,48,000 2,40,000

period

Total credits for the above period 1,80,000 Nil 4,48,000 3,20,000

(12 +4 + 4 = 20 Marks)

5. (a) H Ltd. and its subsidiary S Ltd. give the following information as on 31 st March, 2021:

H Ltd. (`) S Ltd. (`)

Share Capital

Equity Share Capital (fully paid up shares of ` 10 each) 12,00,000 2,00,000

Reserves and Surplus

General Reserve 4,35,000 1,55,000

Cr. Balance in Profit and Loss Account 2,80,000 65,000

4

© The Institute of Chartered Accountants of India

Current Liabilities

Trade Payables 3,22,000 1,23,000

Non-Current Assets

Property, Plant and Equipment

Machinery 6,40,000 1,80,000

Furniture 3,75,000 34,000

Non-Current Investments

Shares in S Ltd. - 16,000 shares @ ` 20 each 3,20,000 -

Current Assets

Inventories 2,68,000 62,000

Trade Receivables 4,70,000 2,35,000

Cash and Bank 1,64,000 32,000

H Ltd. acquired the 80% shares of S Ltd. on 1 st April, 2020. On the date of acquisition, General

Reserve and Profit Loss Account of S Ltd. stood at ` 50,000 and ` 30,000 respectively.

Machinery (book value ` 2,00,000) and Furniture (book value ` 40,000) of S Ltd. were revalued at

` 3,00,000 and ` 30,000 respectively on 1 st April,2020 for the purpose of fixing the price of its

shares (rates of depreciation on W.D.V basis: Machinery 10% and Furniture 15%). Trade Payables

of H Ltd. include ` 35,000 due to S Ltd. for goods supplied since the acquisition of the shares.

These goods are charged at 10% above cost. The inventories of H Ltd. includes goods costing

` 55,000 (cost to H Ltd.) purchased from S Ltd.

You are required to prepare the Consolidated Balance Sheet of H Ltd. with its subsidiary as at

31st March, 2021.

(b) Preeti Limited gives the following information as on 31 st March 2021, was as follows:

(`)

Authorized and subscribed capital:

20,000 Equity shares of ` 100 each fully paid 20,00,000

Unsecured loans:

15% Debentures 6,00,000

Interest payable thereon 90,000

Current Liabilities:

Trade payables 1,04,000

Provision for income tax 72,000

Property, plant and equipment:

Machineries 7,00,000

Current Assets:

Inventory 5,06,000

Trade receivables 4,60,000

Bank 40,000

Profit & loss A/c (Dr.) 11,60,000

© The Institute of Chartered Accountants of India

It was decided to reconstruct the company for which necessary resolution was passed and

sanctions were obtained from the appropriate authorities. Accordingly, it was decided that:

(i) Each share be sub-divided into 10 fully paid up equity shares of ` 10 each.

(ii) After sub-division, each shareholder shall surrender to the company 50% of his holding for

the purpose of reissue to debenture holders and trade payables as necessary.

(iii) Out of shares surrendered 20,000 shares of ` 10 each shall be converted into 10% Preference

shares of ` 10 each fully paid up.

(iv) The claims of the debenture holders shall be reduced by 50%. In consider ation of the

reduction, the debenture holder shall receive Preference Shares of ` 2,00,000 which are

converted out of shares surrendered.

(v) Trade payables claim shall be reduced by 25%. Remaining trade payables are to be settled

by the issue of equity shares of ` 10 each out of shares surrendered.

(vi) Balance of Profit and Loss account to be written off.

(vii) The shares surrendered and not re-issued shall be cancelled.

Pass Journal Entries giving effect to the above. (15+5=20 Marks)

6. (a) On 1st April, 2019 a company had 6,00,000 equity shares of ` 10 each (` 5 paid up by all

shareholders). On 1 st September, 2019 the remaining ` 5 was called up and paid by all

shareholders except one shareholder having 60,000 equity shares. The net profit for the year

ended 31 st March, 2020 was ` 21,96,000 after considering dividend on preference shares and

dividend distribution tax on such dividend totalling to ` 3,40,000.

You are required to compute Basic EPS for the year ended 31 st March, 2020 as per Accounting

Standard 20 "Earnings Per Share".

(b) The financial statements of Alpha Ltd. for the year 2019-2020 were approved by the Board of

Directors on 15 th July, 2020. The following information was provided:

(i) A suit against the company’s advertisement was filed by a party on 20 th April, 2020 claiming

damages of ` 25 lakhs.

(ii) The terms and conditions for acquisition of business of another company had been decided

by March, 2020. But the financial resources were arranged in April, 2020 and amount invested

was ` 50 lakhs.

(iii) Theft of cash of ` 5 lakhs by the cashier on 31 st March, 2020, was detected on 16 th July, 2020.

(iv) The company started a negotiation with a party to sell an immovable property for ` 40 lakhs

in March, 2020. The book value of the property is ` 30 lakh on 31 st March, 2020. However,

the deed was registered on 15 th April, 2020.

(v) A major fire had damaged the assets in a factory on 5 th April, 2020. However, the assets

were fully insured.

With reference to AS 4, state whether the above mentioned events will be treated as contingencies,

adjusting events or non-adjusting events occurring after the balance sheet date.

OR

XYZ Ltd. has not made provision for warrantee in respect of certain goods due to the fact that th e

company can claim the warranty cost from the original supplier. Hence the accountant of the

company says that the company is not having any liability for warrantees on a particular date as

the amount gets reimbursed. You are required to comment on the accounting treatment done by

the XYZ Ltd. in line with the provisions of AS 29.

© The Institute of Chartered Accountants of India

(c) ABC Limited went into voluntary liquidation. Details are as follows :

1,000 - 10% Preference Shares of ` 100 each fully paid up

Class A - 1,200 Equity shares of ` 100 each (` 80 paid up)

Class B - 800 Equity shares of ` 100 each (` 65 paid up)

Assets realized ` 3,50,000 and liquidation expenses is ` 8,000. Company has secured Bank Loan

of ` 60,000 and salary of 3 clerks for 3 months at a rate of ` 500 per month are outstanding.

Creditors are ` 70,000.

Calculate amount receivable from / or returnable to equity shareholders.

(d) Suvidhi Ltd. offered 50 stock options to each of its 1500 employees on 1 st April 2019 for ` 30.

Option was exercisable within a year it was vested. The shares issued under this plan shall be

subject to lock-in on transfer for three years from the grant date. The market price of shares of the

company is ` 50 per share on grant date. Due to post vesting restrictions on transfer, the fair value

of shares issued under the plan is estimated at ` 38 per share. On 31 st March, 2020,1200

employees accepted the offer and paid ` 30 per share purchased. Nominal value of each share is

` 10. Record the issue of shares in the books of the company under the aforesaid plan.

(4 Parts x 5 Marks = 20 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Collateral Agreement: % Per MonthDocument2 pagesCollateral Agreement: % Per MonthGlaiza Flores67% (9)

- Quiambao Vs China Banking CorpDocument1 pageQuiambao Vs China Banking CorpShanon CristyNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- CA Inter Adv Account Q MTP 2 Nov23 Castudynotes ComDocument7 pagesCA Inter Adv Account Q MTP 2 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- 73601bos59426 Inter p5qDocument7 pages73601bos59426 Inter p5qKali KhannaNo ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- 12th Account - Practice Test 1 - Que - SMJDocument5 pages12th Account - Practice Test 1 - Que - SMJVarun BotharaNo ratings yet

- Paper 33Document6 pagesPaper 33AVS InfraNo ratings yet

- PartnershipDocument10 pagesPartnershipOm JainNo ratings yet

- 12 Accounts 2020 21 Practice Paper 2Document8 pages12 Accounts 2020 21 Practice Paper 2Vijey RamalingamNo ratings yet

- Advanced AccountingDocument39 pagesAdvanced AccountingHemanth Singh RajpurohitNo ratings yet

- 71696bos57679 Inter p5qDocument8 pages71696bos57679 Inter p5qMayank RajputNo ratings yet

- Vidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document9 pagesVidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54shrenik bhuratNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument12 pages(In Lakhs) : © The Institute of Chartered Accountants of IndiaIndhuNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- MTP - Nov - 20 AccountsDocument19 pagesMTP - Nov - 20 AccountsPartibha GehlotNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- 63926bos51394finalold p1Document42 pages63926bos51394finalold p1marshadNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- CA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul AgrawalDocument8 pagesCA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul Agrawalharshveersingh480No ratings yet

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - ADocument6 pagesFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- Book Keeping and AccountancyDocument9 pagesBook Keeping and AccountancyPriyanka SHELKENo ratings yet

- Adv Accounts - QuestionsDocument7 pagesAdv Accounts - QuestionsKhushi AggarwalNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- 4 CO4CRT11 - Corporate Accounting II (T)Document5 pages4 CO4CRT11 - Corporate Accounting II (T)emildaraisonNo ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- CBCS BCOM HONS Sem-3 COMMERCEDocument5 pagesCBCS BCOM HONS Sem-3 COMMERCEbittughNo ratings yet

- Master Test 03 _ Test Papers (Accounting) __ PDF OnlyDocument6 pagesMaster Test 03 _ Test Papers (Accounting) __ PDF Onlytushar singh rajputNo ratings yet

- 71592bos57621 Inter p1qDocument7 pages71592bos57621 Inter p1qRahul MishraNo ratings yet

- Accounting Questions 27.04.2022Document5 pagesAccounting Questions 27.04.2022psree7281No ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument17 pages(In Lakhs) : © The Institute of Chartered Accountants of Indiaarihant bokdiaNo ratings yet

- 12 20 Ca Appl Q ADocument119 pages12 20 Ca Appl Q AHassaniNo ratings yet

- Accounting New Syllabus Question PaperDocument7 pagesAccounting New Syllabus Question Paperpradhiba meenakshisundaramNo ratings yet

- Syjc - B. K. - Prelim Exam No. 7Document4 pagesSyjc - B. K. - Prelim Exam No. 7karkeraadiyaNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument10 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Y y y y y Y: © The Institute of Chartered Accountants of IndiaDocument17 pagesY y y y y Y: © The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- ST ST: © The Institute of Chartered Accountants of IndiaDocument9 pagesST ST: © The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Test Series: June, 2022 Mock Test Paper 2 Foundation Course Paper 4: Business Economics and Business and Commercial Knowledge Part-I: Business Economics QuestionsDocument15 pagesTest Series: June, 2022 Mock Test Paper 2 Foundation Course Paper 4: Business Economics and Business and Commercial Knowledge Part-I: Business Economics QuestionsShrwan SinghNo ratings yet

- Financial and Accounting Systems: Learning OutcomesDocument83 pagesFinancial and Accounting Systems: Learning OutcomesShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument25 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- B Com Semester 6 Auditing and Assurance Multiple Choice QuestionsDocument113 pagesB Com Semester 6 Auditing and Assurance Multiple Choice QuestionsBhavesh DhandeNo ratings yet

- LB-303-Company Law - 2022Document365 pagesLB-303-Company Law - 2022Syed Farhan AliNo ratings yet

- Bai Tap 7Document6 pagesBai Tap 7Bích DiệuNo ratings yet

- Financial Accounting Assignment 1Document3 pagesFinancial Accounting Assignment 1Mr Chaitanya Valiveti IPENo ratings yet

- MARTIN ALAMISI AMIDU Vs AG, WATERVILEE & WOYOMEDocument60 pagesMARTIN ALAMISI AMIDU Vs AG, WATERVILEE & WOYOMESelwyn Spencer SackeyNo ratings yet

- Benefits of Mortgage Refinancing You Must KnowDocument3 pagesBenefits of Mortgage Refinancing You Must KnowriyaNo ratings yet

- Accounting Question BanksDocument130 pagesAccounting Question BanksLinh Trần Khánh100% (1)

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202No ratings yet

- Midterms FMDocument10 pagesMidterms FMShay MitchNo ratings yet

- Accounts Chapter-Wise Test 6 (Suggested Answers)Document3 pagesAccounts Chapter-Wise Test 6 (Suggested Answers)Shweta BhadauriaNo ratings yet

- Business Law: Atty. Sherwin Marc Arcega LindoDocument2 pagesBusiness Law: Atty. Sherwin Marc Arcega LindoJugie Ann MarieyyNo ratings yet

- Financial Statement, Taxes and Cash Flow (With Answers)Document16 pagesFinancial Statement, Taxes and Cash Flow (With Answers)Haley James ScottNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/22 October/November 2017Document12 pagesCambridge Assessment International Education: Accounting 0452/22 October/November 2017pyaaraasingh716No ratings yet

- Partnership Accounting Table of Contents: Partnership Formation, Operation & DissolutionDocument18 pagesPartnership Accounting Table of Contents: Partnership Formation, Operation & DissolutionGuinevereNo ratings yet

- XII Accts Re First Board Exam 20-21Document9 pagesXII Accts Re First Board Exam 20-21Sagar SharmaNo ratings yet

- Defective ContractsDocument41 pagesDefective ContractsKiri Soriano100% (1)

- Terminal ReportDocument3 pagesTerminal ReportGOTINGA, CHRISTIAN JUDE AVELINONo ratings yet

- SOLUTION MAF503 - JUN 2015 AmmendDocument8 pagesSOLUTION MAF503 - JUN 2015 Ammendanis izzatiNo ratings yet

- UNIT 06 (Part 01) Financial Statements For Sole TradersDocument8 pagesUNIT 06 (Part 01) Financial Statements For Sole TradersSandunika DevasingheNo ratings yet

- Public Finance: ANSWER: The Example of This Is When The People FindDocument8 pagesPublic Finance: ANSWER: The Example of This Is When The People FindGian Paula MonghitNo ratings yet

- SSS Webinar Short Term LoanDocument12 pagesSSS Webinar Short Term Loanmelvanne tamboboyNo ratings yet

- Deed of Cession and Direct Payment AgreementDocument6 pagesDeed of Cession and Direct Payment Agreementtholoana sentiNo ratings yet

- Audit of Receivables: Problem 1Document33 pagesAudit of Receivables: Problem 1Marnelli CatalanNo ratings yet

- Penyelesaian Tugas MYOB IDocument29 pagesPenyelesaian Tugas MYOB Iandiwahyudi745No ratings yet

- Petition For Voluntary Liquidation Sample Scribd - Google SearchDocument3 pagesPetition For Voluntary Liquidation Sample Scribd - Google SearchNielgem Beja0% (2)

- Mobile Shop Project ReportDocument19 pagesMobile Shop Project ReportArghya dey100% (1)

- Small Business Chart of Accounts: Account Name Code Financial Statement Group Sub-Group NormallyDocument3 pagesSmall Business Chart of Accounts: Account Name Code Financial Statement Group Sub-Group NormallyShajib AhmedNo ratings yet

- Blank 9Document11 pagesBlank 9shaira doctorNo ratings yet