Professional Documents

Culture Documents

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

Shrwan SinghCopyright:

Available Formats

You might also like

- Chapter 3 - Adjusting The AccountsDocument85 pagesChapter 3 - Adjusting The AccountsNgân TrươngNo ratings yet

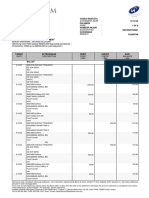

- Bank Statement Bulan 12Document9 pagesBank Statement Bulan 12Yun MiliNo ratings yet

- Scale of Professional FeesDocument16 pagesScale of Professional FeesAre Peace100% (1)

- MTP1 May2022 - Paper 8 FM EcoDocument19 pagesMTP1 May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- 48 17228rtp Ipcc Nov09 Paper3bDocument33 pages48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- 71888bos57845 Inter p8qDocument6 pages71888bos57845 Inter p8qMayank RajputNo ratings yet

- 71487bos57500 p8Document29 pages71487bos57500 p8OPULENCENo ratings yet

- FM RTP Merge FileDocument311 pagesFM RTP Merge FileAritra BanerjeeNo ratings yet

- MTP 12 25 Questions 1696939932Document5 pagesMTP 12 25 Questions 1696939932harshallahotNo ratings yet

- FMECO M.Test EM Question 23.03.2023Document6 pagesFMECO M.Test EM Question 23.03.2023tandelmohik10No ratings yet

- 01 s601 SFM - 2 PDFDocument4 pages01 s601 SFM - 2 PDFMuhammad Zahid FaridNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument29 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNo ratings yet

- 84 Paper-8FinancialManagement&EconomicsforFinanceDocument28 pages84 Paper-8FinancialManagement&EconomicsforFinancerisavey693No ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument115 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- FM Smart WorkDocument17 pagesFM Smart WorkmaacmampadNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- P8 FM Eco New Suggested CA Inter May 18Document28 pagesP8 FM Eco New Suggested CA Inter May 18risavey693No ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- MTP Oct. 2018 FM and Eco QuestionDocument6 pagesMTP Oct. 2018 FM and Eco QuestionAisha MalhotraNo ratings yet

- FINANCIAL MANAGEMENT April 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT April 20172016 PatternSemester IISwati DafaneNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument27 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementSakshi KhandelwalNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiatilokiNo ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- F19 Chapter 18 Working CapitalDocument2 pagesF19 Chapter 18 Working CapitalAshwin MenghaniNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- Assignment - Doc-401 FIM - 24042016113313Document10 pagesAssignment - Doc-401 FIM - 24042016113313Ahmed RaajNo ratings yet

- 8 RTP Nov 21 1Document27 pages8 RTP Nov 21 1Bharath Krishna MVNo ratings yet

- BBA 4th 2012 Financial Management-204Document2 pagesBBA 4th 2012 Financial Management-204Ríshãbh JåíñNo ratings yet

- RM 3Document6 pagesRM 3Harsh KumarNo ratings yet

- Cost of Capital PYQ's SolutionDocument26 pagesCost of Capital PYQ's SolutionOm kumar BajajjNo ratings yet

- CA Inter FM ECO RTP Nov23 Castudynotes ComDocument23 pagesCA Inter FM ECO RTP Nov23 Castudynotes Comspyverse01No ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerSushmanth ReddyNo ratings yet

- Sep23 Ques-1Document5 pagesSep23 Ques-1absankey770No ratings yet

- 5 Financial Statements of CompaniesDocument11 pages5 Financial Statements of Companiessunil.h68 SunilNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- 1 SFM - QuestionsDocument5 pages1 SFM - QuestionsTarun AbichandaniNo ratings yet

- UGB 223 Alternative Exam Assignment QuestionsDocument8 pagesUGB 223 Alternative Exam Assignment QuestionsMaria UrsuleanNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- 2016 AccountingDocument8 pages2016 Accountingpokyik cheungNo ratings yet

- Academic Session 2022 MAY 2022 Semester: AssignmentDocument6 pagesAcademic Session 2022 MAY 2022 Semester: AssignmentChristopher KipsangNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- Final Exam FM Summer 2021Document2 pagesFinal Exam FM Summer 2021AAYAN FARAZNo ratings yet

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamDocument4 pagesÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinNo ratings yet

- FM - CHP 3 - Extra QDocument35 pagesFM - CHP 3 - Extra QGopalNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument27 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysistilokiNo ratings yet

- 15 Af 503 sfm61Document4 pages15 Af 503 sfm61magnetbox8No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument10 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- ST ST: © The Institute of Chartered Accountants of IndiaDocument9 pagesST ST: © The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Test Series: June, 2022 Mock Test Paper 2 Foundation Course Paper 4: Business Economics and Business and Commercial Knowledge Part-I: Business Economics QuestionsDocument15 pagesTest Series: June, 2022 Mock Test Paper 2 Foundation Course Paper 4: Business Economics and Business and Commercial Knowledge Part-I: Business Economics QuestionsShrwan SinghNo ratings yet

- Y y y y y Y: © The Institute of Chartered Accountants of IndiaDocument17 pagesY y y y y Y: © The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument25 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Financial and Accounting Systems: Learning OutcomesDocument83 pagesFinancial and Accounting Systems: Learning OutcomesShrwan SinghNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Black Money - Corruption - Business Law TopicDocument74 pagesBlack Money - Corruption - Business Law TopicmongarNo ratings yet

- IndiaToday 2021 06 14Document74 pagesIndiaToday 2021 06 14Amit GoyalNo ratings yet

- Notice of Commencement of Bankruptcy Proceedings Announcement From Bankruptcy TrusteeDocument1 pageNotice of Commencement of Bankruptcy Proceedings Announcement From Bankruptcy TrusteeCoder CoderNo ratings yet

- Pay PrepositionDocument17 pagesPay PrepositionWilma LauerNo ratings yet

- CBA Model Question Paper - C04Document21 pagesCBA Model Question Paper - C04Mir Fida NadeemNo ratings yet

- Inter Audit 24 7Document3 pagesInter Audit 24 7rounakagarwal2630No ratings yet

- IibfDocument7 pagesIibfShah DhavalNo ratings yet

- Interest Rates and BondsDocument7 pagesInterest Rates and BondsMarlon A. RodriguezNo ratings yet

- Bustax ReviewerDocument7 pagesBustax ReviewerJeremy JimenezNo ratings yet

- Report Fire Service Task Force Final Report News Release 2017-07-31Document24 pagesReport Fire Service Task Force Final Report News Release 2017-07-31Chelsea April NovakNo ratings yet

- J Curve Pitch Deck TemplateDocument20 pagesJ Curve Pitch Deck TemplateLuis Erazo GalloNo ratings yet

- PPSCI vs. Equitable PCI BankDocument4 pagesPPSCI vs. Equitable PCI BankAnonymous oDPxEkdNo ratings yet

- MailingDocument3 pagesMailingamineelakrouche0No ratings yet

- Lump Sum Contract PDFDocument3 pagesLump Sum Contract PDFLeonidas Uzcategui0% (1)

- BIR Form 2307Document20 pagesBIR Form 2307Lean Isidro0% (1)

- SCM Policy & Procedure Manual - SANRALDocument117 pagesSCM Policy & Procedure Manual - SANRALSushma SelaNo ratings yet

- Philippine National Bank: Information SheetDocument1 pagePhilippine National Bank: Information SheetJasmine AlbetriaNo ratings yet

- Zubair Mukati - Manager Finance-ACCADocument4 pagesZubair Mukati - Manager Finance-ACCAcdeekyNo ratings yet

- Tender Document CONCORDocument109 pagesTender Document CONCORgiri_placid100% (1)

- Confirmation by Company SecretaryDocument2 pagesConfirmation by Company SecretaryAlex WongNo ratings yet

- Dont Trade Like Tony MontanaDocument34 pagesDont Trade Like Tony MontanaLuciano SuarezNo ratings yet

- FrameworkDocument5 pagesFrameworkBernadette Cunanan Ramos0% (1)

- Comparative Study On Equity Schemes of Various Mutual Fund CompaniesDocument58 pagesComparative Study On Equity Schemes of Various Mutual Fund CompaniesChethan.sNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Corporate Account Application FormDocument6 pagesCorporate Account Application FormNavin KRNo ratings yet

- Financial MangementDocument3 pagesFinancial MangementAman JainNo ratings yet

- An Overview of The Philippine Financial SystemDocument5 pagesAn Overview of The Philippine Financial SystemDANICA QUIOMNo ratings yet

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

Shrwan SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

Shrwan SinghCopyright:

Available Formats

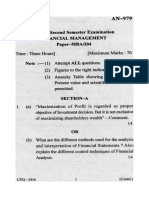

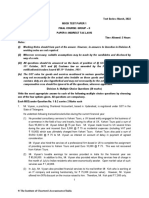

Test Series: March, 2022

MOCK TEST PAPER –1

INTERMEDIATE: GROUP – II

PAPER – 8: FINANCIAL MANAGEMENT & ECONOMICS FOR FINANCE

PAPER 8A: FINANICAL MANAGEMENT

Answers are to be given only in English except in the case of the candidates who have opted for Hindi

medium. If a candidate has not opted for Hindi medium his/ her answers in Hindi will not be valued.

Question No. 1 is compulsory.

Attempt any four questions from the remaining five questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours (Total time for 8A and 8B) Maximum Marks – 60

1. Answer the following:

(a) The following figures have been extracted from the annual report of Xee Ltd.:

Net Profit ` 75 lakhs

Outstanding 12% preference shares ` 250 lakhs

No. of equity shares 3 lakhs

Return on Investment 20%

Cost of capital i.e. (K e) 16%

COMPUTE the approximate dividend pay-out ratio so as to keep the share price at ` 105 by using

Walter’s model?

(b) Owner's equity of Yay Ltd. is ` 6,00,000. The financial ratios of the company are given below:

Current debt to total debt 0.4

Total debt to Owner's equity 0.6

Fixed assets to Owner's equity 0.6

Total assets turnover 2 times

Inventory turnover 8 times

COMPLETE the following Balance Sheet from the information given above:

Liabilities (`) Assets (`)

Current Debt - Cash -

Long-term Debt - Inventory -

Total Debt - Total Current Assets -

Owner's Equity - Fixed Assets -

9,60,000 -

(c) The capital structure of Roshan Ltd. for the year ended 31 st March, 2022 consisted as follows:

Particulars Amount (`’ 000)

Equity share capital (face value ` 100 each) 1,50,000

10% debentures (` 100 each) 1,50,000

1

© The Institute of Chartered Accountants of India

During the year 2021-22, sales of the company decreased to 15,00,000 units as compared to

18,00,000 units in the previous year. However, the selling price stood at ` 120 per unit and variable

cost at ` 80 per unit for both the years. The fixed expenses were at ` 3 crore p.a. and the income

tax rate is 30%.

You are required to CALCULATE the following:

(i) The degree of financial leverage at 18,00,000 units and 15,00,000 units.

(ii) The degree of operating leverage at 18,00,000 units and 15,00,000 units.

(iii) The percentage change in EPS.

(d) (i) A company’s equity share is quoted in the market at ` 125 per share currently. The company

pays a dividend of ` 10 per share and the investor’s market expects a growth rate of 6% per

year. CALCULATE the company’s cost of equity capital.

(ii) If the company issues 10% debentures of face value of ` 100 each and realises ` 98 per

debenture while the debentures are redeemable after 12 years at a premium of 1 0%,

CALCULATE cost of debenture using YTM?

Assume Tax Rate to be 50%. [4 × 5 Marks = 20 Marks]

2. PRI Ltd. and SHA Ltd. are identical, however, their capital structure (in market-value terms) differs as

follows:

Company Debt Equity

PRI Ltd. 60% 40%

SHA Ltd. 20% 80%

The borrowing rate for both companies is 8% in a no-tax world and capital markets are assumed to be

perfect.

(a) (i) If Mr. Rhi, owns 6% of the equity shares of PRI Ltd., DETERMINE his return if the Company

has net operating income of ` 9,00,000 and the overall capitalization rate of the company (K o)

is 18%.

(ii) CALCULATE the implied required rate of return on equity of PRI Ltd.

(b) SHA Ltd. has the same net operating income as PRI Ltd.

(i) CALCULATE the implied required equity return of SHA Ltd.

(ii) ANALYSE why does it differ from that of PRI Ltd. [10 Marks]

3. Following information is forecasted by Gween Limited for the year ending 31 st March, 2022:

Balance as at Balance as at

31st March, 2022 31st March, 2021

(` in lakh) (` in lakh)

Raw Material 845 585

Work-in-progress 663 455

Finished goods 910 780

Receivables 1,755 1,456

Payables 923 884

Annual purchases of raw material (all credit) 5,200

Annual cost of production 5,850

Annual cost of goods sold 6,825

2

© The Institute of Chartered Accountants of India

Annual operating cost 4,225

Annual sales (all credit) 7,605

Considering one year as equal to 365 days, CALCULATE:

(i) Net operating cycle period.

(ii) Number of operating cycles in the year.

(iii) Amount of working capital requirement. [10 Marks]

4. A manufacturing company is presently paying a garbage disposer company ` 0.50 per kilogram to

dispose-off the waste resulting from its manufacturing operations. At normal operating capacity, the

waste is about 2,00,000 kilograms per year.

After spending ` 1,20,000 on research, the company discovered that the waste could be sold for ` 5

per kilogram if it was processed further. Additional processing would, however, require an investment of

` 12,00,000 in new equipment, which would have an estimated life of 10 years with no salvage value.

Depreciation would be calculated by straight line method.

No change in the present selling and administrative expenses is expected except for the costs incurred

in advertising ` 40,000 per year, if the new product is sold. Additional processing costs would include

variable cost of ` 2.50 per kilogram of waste put into process along with fixed cost of ` 60,000 per year

(excluding Depreciation).

There will be no losses in processing, and it is assumed that the total waste proce ssed in a given year

will be sold in the same year. Estimates indicate that 2,00,000 kilograms of the product could be sold

each year.

The management when confronted with the choice of disposing off the waste or processing it further

and selling it, seeks your ADVICE. Which alternative would you RECOMMEND? Assume that the firm's

cost of capital is 15% and it pays on an average 50% Tax on its income.

Consider Present value of Annuity of ` 1 per year @ 15% p.a. for 10 years as 5.019. [10 Marks]

5. (a) X Ltd. is considering two mutually exclusive projects A and B.

Net Cash flow probability distribution of each project has been given below:

Project-A Project-B

Net Cash Flow (`) Probability Net Cash Flow (`) Probability

1,72,000 0.30 3,38,000 0.20

1,82,000 0.30 3,18,000 0.30

1,92,000 0.40 2,98,000 0.50

(i) COMPUTE the following:

(I) Expected Net Cash Flow of each project.

(II) Variance of each project.

(III) Standard Deviation of each project.

(IV) Coefficient of Variation of each project.

(ii) IDENTIFY which project do you recommend? Give reason. [8 Marks]

(b) DISTINGUISH between Sensitivity Analysis & Scenario Analysis. [2 Marks]

© The Institute of Chartered Accountants of India

6. (a) ‘Financial distress is a position where Cash inflows of a firm are inadequate to meet all its current

obligations.’

Based on above mentioned context, EXPLAIN Financial Distress along with Insolvency. [4 Marks]

(b) EXPLAIN any four types of Packing Credit. [4 Marks]

(c) EXPLAIN in brief Callable bonds and Puttable bonds.

Or

STATE in brief four features of Samurai Bond. [2 Marks]

© The Institute of Chartered Accountants of India

PAPER 8B: ECONOMICS FOR FINANCE

Time Allowed – 1:15 Hours Maximum Marks - 40

QUESTIONS

1. (a) How does national income can be explained as a flow concept? (2 Marks)

(b) How GDP and GNP differ in their treatment of international transaction? (3 Marks)

(c) What role tariff plays as response to trade distortions? (2 Marks)

(d) Calculate Gross National Product at Market Price Using Value added Method: (3 Marks)

` in Crores

Value of output in Primary Sector 700

Value of output in Secondary Sector 900

Value of output in tertiary Sector 1000

Intermediate Consumption in Primary Sector 350

Intermediate Consumption in Secondary Sector 250

Intermediate Consumption in Tertiary Sector 100

Net Factor from Abroad 40

2. (a) Explain Investment multiplier and its relevance in two sector model? (2 Marks)

(b) According to Keynesian theory of income and employment how aggregate effective demand

helps in determining national income? (3 Marks)

(c) Calculate Equilibrium level of national income from the following data: (3 Marks)

C = 20+0.60 Yd

I = 80

G = 30

T = 30

(d) Calculate the Velocity of Money: (2 Marks)

Money Supply = 2000

Price = 100

Value of Transaction: 60

3. (a) Explain how the role of State is Pivotal in Public Finance? (3 Marks)

(b) What are the conflict in designing budgetary Policy? (2 Marks)

(c) What are the rationale for the government Stabilization Function? (2 Marks)

(d) Explain the Characteristic of Private Good. (3 Marks)

4. (a) What are the distinction between pure and impure public good? (3 Marks)

(b) Elucidate the limitation of Fiscal Policy? (2 Marks)

(c) What is Balanced budget multiplier? (2 Marks)

5

© The Institute of Chartered Accountants of India

(d) How does the Situation of Liquidity Trap happen? (3 Marks)

5. (a) Explain the reason for empirical analysis of money supply? (3 Marks)

(b) What are the indirect instrument of implementing monetary policy? (2 Marks)

(c) Explain the importance of market stabilization Scheme? (3 Marks)

(d) Do International Trade beneficial for all nations? (2 Marks)

OR

What role tariff plays as response to trade distortions?

© The Institute of Chartered Accountants of India

You might also like

- Chapter 3 - Adjusting The AccountsDocument85 pagesChapter 3 - Adjusting The AccountsNgân TrươngNo ratings yet

- Bank Statement Bulan 12Document9 pagesBank Statement Bulan 12Yun MiliNo ratings yet

- Scale of Professional FeesDocument16 pagesScale of Professional FeesAre Peace100% (1)

- MTP1 May2022 - Paper 8 FM EcoDocument19 pagesMTP1 May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- 48 17228rtp Ipcc Nov09 Paper3bDocument33 pages48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- 71888bos57845 Inter p8qDocument6 pages71888bos57845 Inter p8qMayank RajputNo ratings yet

- 71487bos57500 p8Document29 pages71487bos57500 p8OPULENCENo ratings yet

- FM RTP Merge FileDocument311 pagesFM RTP Merge FileAritra BanerjeeNo ratings yet

- MTP 12 25 Questions 1696939932Document5 pagesMTP 12 25 Questions 1696939932harshallahotNo ratings yet

- FMECO M.Test EM Question 23.03.2023Document6 pagesFMECO M.Test EM Question 23.03.2023tandelmohik10No ratings yet

- 01 s601 SFM - 2 PDFDocument4 pages01 s601 SFM - 2 PDFMuhammad Zahid FaridNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument29 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNo ratings yet

- 84 Paper-8FinancialManagement&EconomicsforFinanceDocument28 pages84 Paper-8FinancialManagement&EconomicsforFinancerisavey693No ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument115 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- FM Smart WorkDocument17 pagesFM Smart WorkmaacmampadNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- P8 FM Eco New Suggested CA Inter May 18Document28 pagesP8 FM Eco New Suggested CA Inter May 18risavey693No ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- MTP Oct. 2018 FM and Eco QuestionDocument6 pagesMTP Oct. 2018 FM and Eco QuestionAisha MalhotraNo ratings yet

- FINANCIAL MANAGEMENT April 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT April 20172016 PatternSemester IISwati DafaneNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument27 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementSakshi KhandelwalNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiatilokiNo ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- F19 Chapter 18 Working CapitalDocument2 pagesF19 Chapter 18 Working CapitalAshwin MenghaniNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- Assignment - Doc-401 FIM - 24042016113313Document10 pagesAssignment - Doc-401 FIM - 24042016113313Ahmed RaajNo ratings yet

- 8 RTP Nov 21 1Document27 pages8 RTP Nov 21 1Bharath Krishna MVNo ratings yet

- BBA 4th 2012 Financial Management-204Document2 pagesBBA 4th 2012 Financial Management-204Ríshãbh JåíñNo ratings yet

- RM 3Document6 pagesRM 3Harsh KumarNo ratings yet

- Cost of Capital PYQ's SolutionDocument26 pagesCost of Capital PYQ's SolutionOm kumar BajajjNo ratings yet

- CA Inter FM ECO RTP Nov23 Castudynotes ComDocument23 pagesCA Inter FM ECO RTP Nov23 Castudynotes Comspyverse01No ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerSushmanth ReddyNo ratings yet

- Sep23 Ques-1Document5 pagesSep23 Ques-1absankey770No ratings yet

- 5 Financial Statements of CompaniesDocument11 pages5 Financial Statements of Companiessunil.h68 SunilNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- 1 SFM - QuestionsDocument5 pages1 SFM - QuestionsTarun AbichandaniNo ratings yet

- UGB 223 Alternative Exam Assignment QuestionsDocument8 pagesUGB 223 Alternative Exam Assignment QuestionsMaria UrsuleanNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- 2016 AccountingDocument8 pages2016 Accountingpokyik cheungNo ratings yet

- Academic Session 2022 MAY 2022 Semester: AssignmentDocument6 pagesAcademic Session 2022 MAY 2022 Semester: AssignmentChristopher KipsangNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- Final Exam FM Summer 2021Document2 pagesFinal Exam FM Summer 2021AAYAN FARAZNo ratings yet

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamDocument4 pagesÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinNo ratings yet

- FM - CHP 3 - Extra QDocument35 pagesFM - CHP 3 - Extra QGopalNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument27 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysistilokiNo ratings yet

- 15 Af 503 sfm61Document4 pages15 Af 503 sfm61magnetbox8No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument10 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- ST ST: © The Institute of Chartered Accountants of IndiaDocument9 pagesST ST: © The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Test Series: June, 2022 Mock Test Paper 2 Foundation Course Paper 4: Business Economics and Business and Commercial Knowledge Part-I: Business Economics QuestionsDocument15 pagesTest Series: June, 2022 Mock Test Paper 2 Foundation Course Paper 4: Business Economics and Business and Commercial Knowledge Part-I: Business Economics QuestionsShrwan SinghNo ratings yet

- Y y y y y Y: © The Institute of Chartered Accountants of IndiaDocument17 pagesY y y y y Y: © The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument25 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Financial and Accounting Systems: Learning OutcomesDocument83 pagesFinancial and Accounting Systems: Learning OutcomesShrwan SinghNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Black Money - Corruption - Business Law TopicDocument74 pagesBlack Money - Corruption - Business Law TopicmongarNo ratings yet

- IndiaToday 2021 06 14Document74 pagesIndiaToday 2021 06 14Amit GoyalNo ratings yet

- Notice of Commencement of Bankruptcy Proceedings Announcement From Bankruptcy TrusteeDocument1 pageNotice of Commencement of Bankruptcy Proceedings Announcement From Bankruptcy TrusteeCoder CoderNo ratings yet

- Pay PrepositionDocument17 pagesPay PrepositionWilma LauerNo ratings yet

- CBA Model Question Paper - C04Document21 pagesCBA Model Question Paper - C04Mir Fida NadeemNo ratings yet

- Inter Audit 24 7Document3 pagesInter Audit 24 7rounakagarwal2630No ratings yet

- IibfDocument7 pagesIibfShah DhavalNo ratings yet

- Interest Rates and BondsDocument7 pagesInterest Rates and BondsMarlon A. RodriguezNo ratings yet

- Bustax ReviewerDocument7 pagesBustax ReviewerJeremy JimenezNo ratings yet

- Report Fire Service Task Force Final Report News Release 2017-07-31Document24 pagesReport Fire Service Task Force Final Report News Release 2017-07-31Chelsea April NovakNo ratings yet

- J Curve Pitch Deck TemplateDocument20 pagesJ Curve Pitch Deck TemplateLuis Erazo GalloNo ratings yet

- PPSCI vs. Equitable PCI BankDocument4 pagesPPSCI vs. Equitable PCI BankAnonymous oDPxEkdNo ratings yet

- MailingDocument3 pagesMailingamineelakrouche0No ratings yet

- Lump Sum Contract PDFDocument3 pagesLump Sum Contract PDFLeonidas Uzcategui0% (1)

- BIR Form 2307Document20 pagesBIR Form 2307Lean Isidro0% (1)

- SCM Policy & Procedure Manual - SANRALDocument117 pagesSCM Policy & Procedure Manual - SANRALSushma SelaNo ratings yet

- Philippine National Bank: Information SheetDocument1 pagePhilippine National Bank: Information SheetJasmine AlbetriaNo ratings yet

- Zubair Mukati - Manager Finance-ACCADocument4 pagesZubair Mukati - Manager Finance-ACCAcdeekyNo ratings yet

- Tender Document CONCORDocument109 pagesTender Document CONCORgiri_placid100% (1)

- Confirmation by Company SecretaryDocument2 pagesConfirmation by Company SecretaryAlex WongNo ratings yet

- Dont Trade Like Tony MontanaDocument34 pagesDont Trade Like Tony MontanaLuciano SuarezNo ratings yet

- FrameworkDocument5 pagesFrameworkBernadette Cunanan Ramos0% (1)

- Comparative Study On Equity Schemes of Various Mutual Fund CompaniesDocument58 pagesComparative Study On Equity Schemes of Various Mutual Fund CompaniesChethan.sNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Corporate Account Application FormDocument6 pagesCorporate Account Application FormNavin KRNo ratings yet

- Financial MangementDocument3 pagesFinancial MangementAman JainNo ratings yet

- An Overview of The Philippine Financial SystemDocument5 pagesAn Overview of The Philippine Financial SystemDANICA QUIOMNo ratings yet