Professional Documents

Culture Documents

Systematic Withdrawal Advantage Plan - June 2020 Editable

Systematic Withdrawal Advantage Plan - June 2020 Editable

Uploaded by

Tarun TiwariCopyright:

Available Formats

You might also like

- Application For MC DD TT FCY 03062018 UnionbankDocument2 pagesApplication For MC DD TT FCY 03062018 UnionbankMelvin Salo55% (11)

- Chapter 4 SolutionsDocument5 pagesChapter 4 SolutionsRose100% (2)

- Copyright Protection For Artificial Intelligence Output BoetticherDocument81 pagesCopyright Protection For Artificial Intelligence Output Boetticherllev2No ratings yet

- Gilles de RaisDocument13 pagesGilles de RaisHarold PerezNo ratings yet

- Canara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormDocument2 pagesCanara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormSudhansuSekharNo ratings yet

- SIP Auto Debit Form 2011Document4 pagesSIP Auto Debit Form 2011Anirudha MohapatraNo ratings yet

- Mirae Sip FormDocument2 pagesMirae Sip Formitkahs120No ratings yet

- Amc Copy: Enrolment FormDocument4 pagesAmc Copy: Enrolment FormAhmad ZaibNo ratings yet

- Fidelity TransactionformDocument2 pagesFidelity TransactionformPankaj BothraNo ratings yet

- Short-Term Loan Remittance Form (STLRF) : HQP-SLF-017Document2 pagesShort-Term Loan Remittance Form (STLRF) : HQP-SLF-017Jo Sh100% (1)

- Common Transaction Request - Non Financial Transaction: A+B+I A+C+I A+D+I A+E+I A+G+I A+F+I A+H+C+IDocument2 pagesCommon Transaction Request - Non Financial Transaction: A+B+I A+C+I A+D+I A+E+I A+G+I A+F+I A+H+C+IChintan JainNo ratings yet

- HDFC Sip Nach FormDocument6 pagesHDFC Sip Nach FormPraveen KumarNo ratings yet

- Sip Enrolment FormDocument1 pageSip Enrolment FormYankit SoniNo ratings yet

- SIP Form DebtDocument6 pagesSIP Form DebtNilesh MahajanNo ratings yet

- Cancellation of Sip STP SWP Form CANARA ROBECODocument2 pagesCancellation of Sip STP SWP Form CANARA ROBECOSabyaNo ratings yet

- Mirae Asset MF Common & SIPDocument5 pagesMirae Asset MF Common & SIPMadhu SudhananNo ratings yet

- Equity SIP Application Form April 2022Document8 pagesEquity SIP Application Form April 2022Selva KumarNo ratings yet

- Systematic Withdrawal Plan - FormDocument2 pagesSystematic Withdrawal Plan - Formme19d012No ratings yet

- Redemption Form: For Individuals & InstitutionsDocument2 pagesRedemption Form: For Individuals & InstitutionsAndersen HarrisNo ratings yet

- Common Transaction Form Financial Transaction Kk3i5z51Document8 pagesCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNo ratings yet

- STP and SWP Form May17 FillPrintDocument2 pagesSTP and SWP Form May17 FillPrintRohan KapoorNo ratings yet

- Av Birla Sip FormDocument1 pageAv Birla Sip FormVikas RaiNo ratings yet

- SIP Facility Appl Form V 1Document4 pagesSIP Facility Appl Form V 1DBCGNo ratings yet

- SBI SIP Registration FormDocument3 pagesSBI SIP Registration FormPrakash JoshiNo ratings yet

- Common Application Form: For Lump Sum/Systematic InvestmentsDocument4 pagesCommon Application Form: For Lump Sum/Systematic Investmentspunitwishes7157No ratings yet

- Common Transaction Form - Non Financial TransactionsDocument2 pagesCommon Transaction Form - Non Financial TransactionsManish SinhaNo ratings yet

- Common Transaction SlipDocument3 pagesCommon Transaction Slipabdriver2000No ratings yet

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- Unit Holder Information: Web FormDocument2 pagesUnit Holder Information: Web FormDibyaranjan SahooNo ratings yet

- 7 Form 7 (Claim Bill) 23Document2 pages7 Form 7 (Claim Bill) 23BEST IN THE UNIVERSE CHECK IT OUTNo ratings yet

- UTI - Systematic Transfer Investment Plan UTI-STP New Editable Application FormDocument1 pageUTI - Systematic Transfer Investment Plan UTI-STP New Editable Application FormAnilmohan SreedharanNo ratings yet

- Sole / First Applicant Second Applicant Third ApplicantDocument2 pagesSole / First Applicant Second Applicant Third ApplicantAnkur KaushikNo ratings yet

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- Application Form STP / SWP: Distributor InformationDocument1 pageApplication Form STP / SWP: Distributor InformationSatya Prakash TrivediNo ratings yet

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Document2 pagesApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Gargi ShuklaNo ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- List Appendices VDocument238 pagesList Appendices VHamza ZainNo ratings yet

- STP and SWP FormDocument2 pagesSTP and SWP FormHitesh MiskinNo ratings yet

- IIFL MF Common Transaction Unit Holders 022819Document2 pagesIIFL MF Common Transaction Unit Holders 022819Sabyasachi ChatterjeeNo ratings yet

- Application Form For Change in Bank Account DetailsDocument1 pageApplication Form For Change in Bank Account DetailsARNo ratings yet

- HDFC Sip CancellationDocument1 pageHDFC Sip CancellationMaluNo ratings yet

- Systematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Document3 pagesSystematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Ankur KaushikNo ratings yet

- NHAI Capital Gains Bond Application Form 29-05-2024 230036801Document2 pagesNHAI Capital Gains Bond Application Form 29-05-2024 230036801rayyan.mehtaNo ratings yet

- SLF017 ShortTermLoanRemittanceForm V02Document2 pagesSLF017 ShortTermLoanRemittanceForm V02Marites Paragua75% (4)

- COM0004057712 REG Dist SIP ApplicationDocument1 pageCOM0004057712 REG Dist SIP Applicationraj tripathiNo ratings yet

- Transaction Form For Existing InvestorsDocument4 pagesTransaction Form For Existing InvestorsRRKNo ratings yet

- Family Solutions Transaction FormDocument2 pagesFamily Solutions Transaction FormSelva KumarNo ratings yet

- Form CHG 1 15012019 SignedDocument7 pagesForm CHG 1 15012019 Signedamanbhatia.ynrNo ratings yet

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Document2 pagesApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Chintan JainNo ratings yet

- List Appendices V PDFDocument219 pagesList Appendices V PDFAdnan AzharNo ratings yet

- Sip STP SWP Cancellation FormDocument2 pagesSip STP SWP Cancellation FormMahesh ChandranNo ratings yet

- Short-Term Loan Remittance Form (STLRF) : Pag-Ibig Employer'S Id NumberDocument8 pagesShort-Term Loan Remittance Form (STLRF) : Pag-Ibig Employer'S Id NumberJo ShNo ratings yet

- Nippon SWPDocument1 pageNippon SWPManu S KashyapNo ratings yet

- Kotak - Transaction SlipDocument2 pagesKotak - Transaction SlipJephiasNo ratings yet

- Indiabulls Housing Finance Limited: D D M M Y Y Y YDocument2 pagesIndiabulls Housing Finance Limited: D D M M Y Y Y YSwastik MaheshwaryNo ratings yet

- Form14052021 ARDocument5 pagesForm14052021 ARKasim ShaikhNo ratings yet

- Common Transaction Form: First Unitholder Second Unitholder Third UnitholderDocument1 pageCommon Transaction Form: First Unitholder Second Unitholder Third UnitholderKailash VijayvargiaNo ratings yet

- Sf1199a Direct Deposit FormDocument4 pagesSf1199a Direct Deposit Formleazar.guerreroNo ratings yet

- Sip STP SWP Cancellation FormDocument1 pageSip STP SWP Cancellation FormamarNo ratings yet

- One Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitDocument2 pagesOne Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitAnand KopareNo ratings yet

- ANS A17Q Q2Jun2012 (14sep2012)Document67 pagesANS A17Q Q2Jun2012 (14sep2012)cuonghienNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- HDFC Mutual Fund Common SIP NACH Mandate Application FormDocument6 pagesHDFC Mutual Fund Common SIP NACH Mandate Application FormTarun TiwariNo ratings yet

- Switch Transaction SlipDocument1 pageSwitch Transaction SlipTarun TiwariNo ratings yet

- SIP Modification Application FormDocument2 pagesSIP Modification Application FormTarun TiwariNo ratings yet

- Fund Facts - HDFC TaxSaver - February 2022Document2 pagesFund Facts - HDFC TaxSaver - February 2022Tarun TiwariNo ratings yet

- Schemes - Presentation - Dec - 2021Document19 pagesSchemes - Presentation - Dec - 2021Tarun TiwariNo ratings yet

- Fund Facts - HDFC Focused 30 Fund - July 2021Document2 pagesFund Facts - HDFC Focused 30 Fund - July 2021Tarun TiwariNo ratings yet

- Subscribe To The Free Value Research Insight NewsletterDocument5 pagesSubscribe To The Free Value Research Insight NewsletterTarun TiwariNo ratings yet

- Chandragupt Institute of Management Patna: Submitted By: Tarun Kumar ROLL NO-110114Document4 pagesChandragupt Institute of Management Patna: Submitted By: Tarun Kumar ROLL NO-110114Tarun TiwariNo ratings yet

- UnawarenessDocument6 pagesUnawarenessTarun TiwariNo ratings yet

- Discriminant (2 Groups)Document2 pagesDiscriminant (2 Groups)Tarun TiwariNo ratings yet

- AMSA547 - Adhoc Exemption ApplicationDocument2 pagesAMSA547 - Adhoc Exemption Applicationinmran.gNo ratings yet

- Public Notification Darnell RobertsDocument1 pagePublic Notification Darnell RobertsMichael JohnsonNo ratings yet

- Husky 2015Document12 pagesHusky 2015sonicbooahxxxNo ratings yet

- RICS Research On NECDocument9 pagesRICS Research On NECAhmad MajedNo ratings yet

- Rule 78 - Quiazon v. BelenDocument3 pagesRule 78 - Quiazon v. BelenDan MilladoNo ratings yet

- Exam Admit CardDocument2 pagesExam Admit CardLaila MahbubaNo ratings yet

- Angel RPG - Investigator's CasebookDocument183 pagesAngel RPG - Investigator's CasebookDavidHavok60% (5)

- COC-and-other-requirements (HERRERA, CLARK JERZON M.)Document5 pagesCOC-and-other-requirements (HERRERA, CLARK JERZON M.)Kyle FaderangaNo ratings yet

- Jackson v. Birmingham Board of EducationDocument1 pageJackson v. Birmingham Board of EducationReid MurtaughNo ratings yet

- Property Law Exam QsDocument9 pagesProperty Law Exam QssahilNo ratings yet

- The Right To Self DeterminationDocument13 pagesThe Right To Self Determinationnana belloNo ratings yet

- aAFF OF LOSS JAMES CEDRIC UY ALEGREDocument2 pagesaAFF OF LOSS JAMES CEDRIC UY ALEGRERobert marollanoNo ratings yet

- People vs. Mario MapulongDocument4 pagesPeople vs. Mario MapulongJet jet NuevaNo ratings yet

- Revised Debate Guidelines AP Week 2022 1Document3 pagesRevised Debate Guidelines AP Week 2022 1JUSTICE100% (1)

- MOTION - TO DISMISS - Unlawful Detainer - DARABDocument6 pagesMOTION - TO DISMISS - Unlawful Detainer - DARABAianna Bianca Birao (fluffyeol)No ratings yet

- Tentative Synopsis Submitted in Partial Fulfilment of The Requirement For Award of The Degree of Master of LawsDocument12 pagesTentative Synopsis Submitted in Partial Fulfilment of The Requirement For Award of The Degree of Master of LawsAzharNo ratings yet

- Distinction Between Partnership Firm and Hindu Joint Family Firm - YRDocument2 pagesDistinction Between Partnership Firm and Hindu Joint Family Firm - YRMSSLLB1922 SuryaNo ratings yet

- NBCDO Memo Circular No.01 Series of 2005Document2 pagesNBCDO Memo Circular No.01 Series of 2005Roland CepedaNo ratings yet

- Career Executive Service Board Vs CSCDocument2 pagesCareer Executive Service Board Vs CSCxeileen08100% (1)

- Group 4 Jabidah MassacreDocument17 pagesGroup 4 Jabidah MassacrelaatoslocNo ratings yet

- Agreement Contract Australia - Ahsan, AliDocument4 pagesAgreement Contract Australia - Ahsan, AliDanish KhanNo ratings yet

- Student Handbook AY2021-22 (26 Aug)Document28 pagesStudent Handbook AY2021-22 (26 Aug)Oscar RomainvilleNo ratings yet

- 8 Karachi JitDocument106 pages8 Karachi JitInamullah AnsariNo ratings yet

- How To Correct Simulated Birth Through RA 11222Document9 pagesHow To Correct Simulated Birth Through RA 11222Rochelle ToridaNo ratings yet

- Insolvency Theory ArticleDocument14 pagesInsolvency Theory Articlenataliewong1615No ratings yet

- Child Care CertificateDocument1 pageChild Care CertificateRoger WongNo ratings yet

- Doctrine of Group of CompaniesDocument2 pagesDoctrine of Group of Companiesrituparna chandNo ratings yet

Systematic Withdrawal Advantage Plan - June 2020 Editable

Systematic Withdrawal Advantage Plan - June 2020 Editable

Uploaded by

Tarun TiwariOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Systematic Withdrawal Advantage Plan - June 2020 Editable

Systematic Withdrawal Advantage Plan - June 2020 Editable

Uploaded by

Tarun TiwariCopyright:

Available Formats

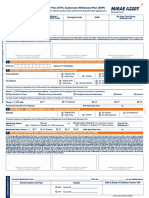

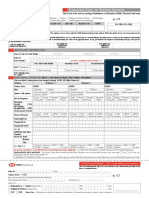

S SYSTEMATIC

W WITHDRAWAL Enrolment Form

A ADVANTAGE (Please refer Product labeling available on cover page of the

KIM and terms and conditions overleaf)

P PLAN

Date : D D M M Y Y Y Y

I / We hereby declare and confirm that I/we have read and agree to abide by the terms and conditions of the scheme related documents and the terms and conditions mentioned

overleaf of Systematic Withdrawal Advantage Pan (SWAP) and of the relevant Scheme(s) and hereby apply to the Trustees for enrolment under the SWAP of the following

Scheme(s)/ Plan(s)/ Options(s). The ARN holder (AMFI registered Distributor) has disclosed to me/us all the commissions (in the form of trail commission or any other

mode), payable to him/them for the different competing Schemes of various Mutual Funds from amongst which the Scheme is being recommended to me/us.

Please (P) any one. In the absence of indication of the option the form is liable to be rejected.

New Registration: Change in withdrawal amount: Cancellation:

For enrolment under SWAP facility For Change in withdrawal amount under SWAP facility For cancellation of SWAP facility

FOLIO NO. OF EXISTING UNIT HOLDER /

APPLICATION NO. (New Investor)

1) UNIT HOLDER INFORMATION

PAN# or PEKRN#

First / Sole Unit holder

KYC Number

Guardian PAN# or PEKRN#

(in case of First / Sole Unit holder

is a minor) KYC Number

2) SCHEME DETAILS (If the SWAP is to be registered from Direct Plan of the Scheme, please mention so clearly.)

SCHEME NAME #

PLAN

OPTION

# Please note that one SWAP Form must be used for one Scheme / Plan / Option only. Unit holder(s) need to fill in Separate SWAP Form for each Scheme / Plan / Option.

3) WITHDRAWAL DETAILS (Please P choice of Plan)

Fixed Plan (Refer item 8(ii) & (iii) overleaf) Variable Plan (Capital Appreciation, if any)

(Refer item 9(ii) overleaf)

MONTHLY@ QUARTERLY

@

QUARTERLY

HALF-YEARLY YEARLY (@ Default Frequency)

Rs. (in figures)

HALF-YEARLY

Rs. (in words)

YEARLY

(@ Default Frequency)

4) ENROLMENT DETAILS (refer item 7, 8, 9 & 10 overleaf)

Commencement Date : Withdrawal Date

M M Y Y Y Y

(Refer Item 8(v), 9(iii) & 10 overleaf) 1st 2nd 3rd 4th 5th 6th 7th 8th 9th 10th 11th

12th 13th 14th 15th 16th 17th 18th 19th 20th 21st 22nd

Last Withdrawal Date : M M Y Y Y Y 23rd 24th 25th

@

26th 27th 28th 29th 30th 31st (@ Default Date)

5) PAYMENT OF SWAP PROCEEDS (refer item 14)

Redemption proceeds through SWAP will be credited to the default bank account registered in the Folio. If you wish to receive the redemption proceeds into any other

bank account registered in the Folio, please mention the Bank Account No. and Name below:

ACCOUNT NO.

BANK NAME

(If the above mentioned bank details do not match with the registered bank account in your the Folio, proceeds will be credited to the default bank account registered in the Folio.)

6) SIGNATURES ^

First / Sole Unit holder / Guardian Second Unit holder Third Unit holder

^ Please note: Signature(s) should be as it appears in the Folio/ on the Application Form and in the same order.

In case the mode of holding is joint, all Unit holders are required to sign.

ACKNOWLEDGEMENT SLIP (To be filled in by the Unit holder)

HDFC MUTUAL FUND

Head Office : HDFC House, 2nd Floor, H.T. Parekh Marg, ISC Stamp & Signature

Date : 165-166, Backbay Reclamation, Churchgate, Mumbai - 400 020.

Received from Mr. / Ms. / M/s.

a 'SWAP' application for redemption of Units of Scheme / Plan / Option

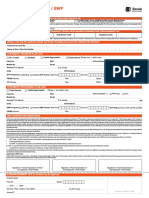

TERMS AND CONDITIONS FOR SWAP

1. Systematic Withdrawal Advantage Plan (SWAP) is available iv. The provision for 'Minimum Redemption Amount' v. If there is nil balance on the SWAP date, the system will

to investors in the following Scheme(s) of HDFC Mutual Fund. specified in the respective Scheme Information automatically cease the SWAP and there will not be any

The SWAP Facility is available only for units held / to be held in Document will not be applicable for SWAP. e.g. the further trigger.

Non - demat Mode in the eligible Scheme(s). minimum redemption amount for HDFC MF Monthly 10. The Unitholder should submit the duly filled in SWAP

Currently all open ended schemes (including Direct Plan Income Plan is Rs. 1,000. However, in case of SWAP, an Enrolment Form atleast 10 days before the first withdrawal

thereunder) except ETFs are eligible for this facility. investor may redeem his investments with the Scheme date^.

with minimum amount of Rs. 500.

The above Scheme(s) are subject to change from time to ^In case the SWAP start date as mentioned in the SWAP

time. Please contact the nearest Investor Service Centre v. Commencement date for Fixed Plan under SWAP is Enrolment Form above does not satisfy this condition, the

(ISC) of HDFC Mutual Fund for updated list. the date from which the first withdrawal will first SWAP date shall be rolled over to begin from the

commence. immediately following Month /Quarter / Half Year / Year, as

2. This enrolment form should be completed in ENGLISH and in

BLOCK LETTERS only. Please tick in the appropriate box for vi. The amount withdrawn under SWAP by Redemption applicable.

relevant options wherever applicable. Please do not shall be converted into the specific Scheme/Plan Units 11. Unitholders may change the amount of withdrawal, at any

overwrite. For any correction / changes (if any) made on the at the NAV based prices as on the SWAP withdrawal time by giving the ISC a written notice at least 10 days prior to

application form, the sole/all applicants are requested to date and such Units will be subtracted from the Unit the next withdrawal date. All details except the amount should

authenticate the same by canceling and re-writing the correct Balance of the Unitholders. In case these dates fall on a match with existing registration.

details and counter-signing the same. This enrolment form, holiday or fall during a Book Closure period, the next

12. SWAP facility may be terminated on receipt of a written notice

complete in all respects, should be submitted at any of the Business Day will be considered for this purpose. If

from the Unitholder. Notice of such discontinuation should be

Official Points of Acceptance of HDFC Mutual Fund. there is inadequate balance on the SWAP date, the

received at least 10 days prior to the due date of the next

Incomplete enrolment form is liable to be rejected. SWAP will be processed for the balance units and

withdrawal. SWAP will terminate automatically if all Units are

Redemption and related transaction(s) will not be allowed SWAP will continue. If there is nil balance on the SWAP

liquidated or withdrawn from the folio or pledged or upon

if PAN is not updated in the folios. date, the SWAP will be automatically terminated and

receipt of notification of death of the first named Unitholder.

there will not be any further trigger.

3. Unitholders are advised to read the Scheme information 13. The AMC at its sole discretion retains the right to close a folio

Document of the respective Scheme(s) and Statement of If you decide to opt for this facility, you should be aware

if the outstanding balance, based on the Net Asset Value

Additional Information carefully. of the possibility that you could erode your capital.

(NAV), falls below Rs. 500 due to Redemption or use of

4. New Investors who wish to enroll for SWAP are required to fill Example: If the Unitholder decides to withdraw SWAP and the investor fails to invest sufficient funds to bring

the SWAP enrolment form along with the Scheme Application Rs. 3,000 every quarter and the appreciation is the value of the account upto Rs. 500 within 30 days after a

Form. Existing unit holders should provide their Folio Number. Rs. 2,500, then such redemption proceeds will written intimation in this regard is sent to the Unitholder.

Unitholders’ details and mode of holding (single, jointly, comprise of Rs. 2,500 from the capital appreciation and

14. Bank Account for Payout:

anyone or survivor) will be as per the existing folio number Rs. 500 from the Unitholder's capital amount.

In order to protect the interest of Unitholders from fraudulent

details and would prevail over any conflicting information 9. Variable Plan:

encashment of redemption / dividend cheques, SEBI has

furnished in this form. Unitholders name should match with i. Variable Plan is available for Growth Option only. made it mandatory for investors to provide their bank details

the details in the existing folio, failing which this application

ii. Variable Plan is available for Quarterly/ Half Yearly / viz. name of bank, branch, address, account type and

form is liable to be rejected.

Yearly intervals only. If frequency of Plan is not indicated number, etc. to the Mutual Fund. Unitholders should note

5. Unitholders must use separate 'SWAP' enrolment forms Quarterly will be the Default Frequency. that redemption / withdrawal proceeds under the SWAP

for different Schemes/Plans/Options. will be paid by forwarding a cheque or by directly crediting

iii. Commencement date for variable Plan under SWAP

6. In respect of amount withdrawn under SWAP, the Exit Load, is the date from which capital appreciation, if any, the Bank Account registered in the Scheme or as indicated

if any, applicable to the Scheme/Plan as on the date of will be calculated till the first SWAP withdrawal date. in Section 5 of this form (depending on the mode of receipt

allotment of units in case of lumpsum investments and The capital appreciation, if any, will be calculated of redemption/ dividend proceeds chosen by the

date of registration in case of units allotted under all (subject to completion of lock-in/ pledge period, if any), unitholders & registered in the Scheme) on the date of

Systematic Investment facilities i.e. all types of SIPs / from the commencement date of SWAP under the folio, each withdrawal. In case the Unitholder wishes to receive

STPs, shall be levied. till the first SWAP withdrawal date. Subsequent capital the redemption amount in a bank account which is not

7. Unit holder can avail of this facility by choosing any date of appreciation, if any, will be the capital appreciation* registered in the folio, then it is mandatory to first register the

his/her preference as SWAP withdrawal date. In case the between the previous SWAP date** (where redemption bank account by filling in the Multiple Bank Account

chosen date falls on a holiday or during a Book Closure period has been processed and paid) and the next SWAP Registration Form. Upon receipt of confirmation of

or on a date which is not available in a particular month, the withdrawal date. Provided such capital appreciation is registration of bank details in the folio, the investor needs to

immediate next Business Day will be deemed as the SWAP at least Rs. 300, on each withdrawal date. In case these submit the SWAP enrolment form with the required bank

withdrawal date. In case no date is mentioned 25th will be dates fall on a holiday or fall during a Book Closure details mentioned under Section 5. For further details, please

considered as the Default Date. The amount withdrawn period, the next Business Day will be deemed as the contact any of the Investor Service Centres or visit our

(subject to deduction of tax at source, if any) under SWAP by SWAP withdrawal date. Capital appreciation, if any, in website www.hdfcfund.com

Redemption shall be converted into the specific Scheme / such cases will be calculated upto such deemed 15. Units of HDFC TaxSaver cannot be redeemed / switched - out

Plan Units at the NAV based prices as on the SWAP withdrawal date. until completion of 3 years from the date of allotment of the

withdrawal date of month/quarter/ half-year/year, as * In case of redemption, capital appreciation will be respective units. Units of HDFC Children's Gift Fund and

applicable, and such Units will be subtracted from the Unit computed on the balance units post redemption. HDFC Retirement Savings Fund cannot be redeemed /

Balance of the Unit holders. switched - out till completion of lock-in period..

** Date of additional purchase to calculate capital

8. Fixed Plan: appreciation of units additionally purchased between 16. HDFC Mutual Fund / HDFC Asset Management Company

i. Fixed Plan is available for Growth and Dividend Option. two SWAP dates. Limited reserves the right to change / modify the terms and

conditions of SWAP.

ii. Fixed Plan is available for Monthly/ Quarterly /Half iv. Unitholders should note that in the event of there being

yearly / Yearly intervals. If the frequency is not no capital appreciation, no withdrawal / payment will be

mentioned Monthly Frequency will be considered as the effected.

default frequency. Example: If the appreciation is Rs. 3,500 in the first

iii. Unitholders under the Fixed Plan can redeem (subject to quarter and Rs. 3,000 in the second quarter, the

completion of lock-in/ pledge period, if any), under each Unitholder will receive only the appreciation i.e.

Scheme / Plan / Option a minimum of Rs. 500 and in Rs. 3,500 in the first quarter and Rs. 3,000 in the

multiples of Rs. 100 thereafter. second quarter.

You might also like

- Application For MC DD TT FCY 03062018 UnionbankDocument2 pagesApplication For MC DD TT FCY 03062018 UnionbankMelvin Salo55% (11)

- Chapter 4 SolutionsDocument5 pagesChapter 4 SolutionsRose100% (2)

- Copyright Protection For Artificial Intelligence Output BoetticherDocument81 pagesCopyright Protection For Artificial Intelligence Output Boetticherllev2No ratings yet

- Gilles de RaisDocument13 pagesGilles de RaisHarold PerezNo ratings yet

- Canara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormDocument2 pagesCanara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormSudhansuSekharNo ratings yet

- SIP Auto Debit Form 2011Document4 pagesSIP Auto Debit Form 2011Anirudha MohapatraNo ratings yet

- Mirae Sip FormDocument2 pagesMirae Sip Formitkahs120No ratings yet

- Amc Copy: Enrolment FormDocument4 pagesAmc Copy: Enrolment FormAhmad ZaibNo ratings yet

- Fidelity TransactionformDocument2 pagesFidelity TransactionformPankaj BothraNo ratings yet

- Short-Term Loan Remittance Form (STLRF) : HQP-SLF-017Document2 pagesShort-Term Loan Remittance Form (STLRF) : HQP-SLF-017Jo Sh100% (1)

- Common Transaction Request - Non Financial Transaction: A+B+I A+C+I A+D+I A+E+I A+G+I A+F+I A+H+C+IDocument2 pagesCommon Transaction Request - Non Financial Transaction: A+B+I A+C+I A+D+I A+E+I A+G+I A+F+I A+H+C+IChintan JainNo ratings yet

- HDFC Sip Nach FormDocument6 pagesHDFC Sip Nach FormPraveen KumarNo ratings yet

- Sip Enrolment FormDocument1 pageSip Enrolment FormYankit SoniNo ratings yet

- SIP Form DebtDocument6 pagesSIP Form DebtNilesh MahajanNo ratings yet

- Cancellation of Sip STP SWP Form CANARA ROBECODocument2 pagesCancellation of Sip STP SWP Form CANARA ROBECOSabyaNo ratings yet

- Mirae Asset MF Common & SIPDocument5 pagesMirae Asset MF Common & SIPMadhu SudhananNo ratings yet

- Equity SIP Application Form April 2022Document8 pagesEquity SIP Application Form April 2022Selva KumarNo ratings yet

- Systematic Withdrawal Plan - FormDocument2 pagesSystematic Withdrawal Plan - Formme19d012No ratings yet

- Redemption Form: For Individuals & InstitutionsDocument2 pagesRedemption Form: For Individuals & InstitutionsAndersen HarrisNo ratings yet

- Common Transaction Form Financial Transaction Kk3i5z51Document8 pagesCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNo ratings yet

- STP and SWP Form May17 FillPrintDocument2 pagesSTP and SWP Form May17 FillPrintRohan KapoorNo ratings yet

- Av Birla Sip FormDocument1 pageAv Birla Sip FormVikas RaiNo ratings yet

- SIP Facility Appl Form V 1Document4 pagesSIP Facility Appl Form V 1DBCGNo ratings yet

- SBI SIP Registration FormDocument3 pagesSBI SIP Registration FormPrakash JoshiNo ratings yet

- Common Application Form: For Lump Sum/Systematic InvestmentsDocument4 pagesCommon Application Form: For Lump Sum/Systematic Investmentspunitwishes7157No ratings yet

- Common Transaction Form - Non Financial TransactionsDocument2 pagesCommon Transaction Form - Non Financial TransactionsManish SinhaNo ratings yet

- Common Transaction SlipDocument3 pagesCommon Transaction Slipabdriver2000No ratings yet

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- Unit Holder Information: Web FormDocument2 pagesUnit Holder Information: Web FormDibyaranjan SahooNo ratings yet

- 7 Form 7 (Claim Bill) 23Document2 pages7 Form 7 (Claim Bill) 23BEST IN THE UNIVERSE CHECK IT OUTNo ratings yet

- UTI - Systematic Transfer Investment Plan UTI-STP New Editable Application FormDocument1 pageUTI - Systematic Transfer Investment Plan UTI-STP New Editable Application FormAnilmohan SreedharanNo ratings yet

- Sole / First Applicant Second Applicant Third ApplicantDocument2 pagesSole / First Applicant Second Applicant Third ApplicantAnkur KaushikNo ratings yet

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- Application Form STP / SWP: Distributor InformationDocument1 pageApplication Form STP / SWP: Distributor InformationSatya Prakash TrivediNo ratings yet

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Document2 pagesApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Gargi ShuklaNo ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- List Appendices VDocument238 pagesList Appendices VHamza ZainNo ratings yet

- STP and SWP FormDocument2 pagesSTP and SWP FormHitesh MiskinNo ratings yet

- IIFL MF Common Transaction Unit Holders 022819Document2 pagesIIFL MF Common Transaction Unit Holders 022819Sabyasachi ChatterjeeNo ratings yet

- Application Form For Change in Bank Account DetailsDocument1 pageApplication Form For Change in Bank Account DetailsARNo ratings yet

- HDFC Sip CancellationDocument1 pageHDFC Sip CancellationMaluNo ratings yet

- Systematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Document3 pagesSystematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Ankur KaushikNo ratings yet

- NHAI Capital Gains Bond Application Form 29-05-2024 230036801Document2 pagesNHAI Capital Gains Bond Application Form 29-05-2024 230036801rayyan.mehtaNo ratings yet

- SLF017 ShortTermLoanRemittanceForm V02Document2 pagesSLF017 ShortTermLoanRemittanceForm V02Marites Paragua75% (4)

- COM0004057712 REG Dist SIP ApplicationDocument1 pageCOM0004057712 REG Dist SIP Applicationraj tripathiNo ratings yet

- Transaction Form For Existing InvestorsDocument4 pagesTransaction Form For Existing InvestorsRRKNo ratings yet

- Family Solutions Transaction FormDocument2 pagesFamily Solutions Transaction FormSelva KumarNo ratings yet

- Form CHG 1 15012019 SignedDocument7 pagesForm CHG 1 15012019 Signedamanbhatia.ynrNo ratings yet

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Document2 pagesApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Chintan JainNo ratings yet

- List Appendices V PDFDocument219 pagesList Appendices V PDFAdnan AzharNo ratings yet

- Sip STP SWP Cancellation FormDocument2 pagesSip STP SWP Cancellation FormMahesh ChandranNo ratings yet

- Short-Term Loan Remittance Form (STLRF) : Pag-Ibig Employer'S Id NumberDocument8 pagesShort-Term Loan Remittance Form (STLRF) : Pag-Ibig Employer'S Id NumberJo ShNo ratings yet

- Nippon SWPDocument1 pageNippon SWPManu S KashyapNo ratings yet

- Kotak - Transaction SlipDocument2 pagesKotak - Transaction SlipJephiasNo ratings yet

- Indiabulls Housing Finance Limited: D D M M Y Y Y YDocument2 pagesIndiabulls Housing Finance Limited: D D M M Y Y Y YSwastik MaheshwaryNo ratings yet

- Form14052021 ARDocument5 pagesForm14052021 ARKasim ShaikhNo ratings yet

- Common Transaction Form: First Unitholder Second Unitholder Third UnitholderDocument1 pageCommon Transaction Form: First Unitholder Second Unitholder Third UnitholderKailash VijayvargiaNo ratings yet

- Sf1199a Direct Deposit FormDocument4 pagesSf1199a Direct Deposit Formleazar.guerreroNo ratings yet

- Sip STP SWP Cancellation FormDocument1 pageSip STP SWP Cancellation FormamarNo ratings yet

- One Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitDocument2 pagesOne Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitAnand KopareNo ratings yet

- ANS A17Q Q2Jun2012 (14sep2012)Document67 pagesANS A17Q Q2Jun2012 (14sep2012)cuonghienNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- HDFC Mutual Fund Common SIP NACH Mandate Application FormDocument6 pagesHDFC Mutual Fund Common SIP NACH Mandate Application FormTarun TiwariNo ratings yet

- Switch Transaction SlipDocument1 pageSwitch Transaction SlipTarun TiwariNo ratings yet

- SIP Modification Application FormDocument2 pagesSIP Modification Application FormTarun TiwariNo ratings yet

- Fund Facts - HDFC TaxSaver - February 2022Document2 pagesFund Facts - HDFC TaxSaver - February 2022Tarun TiwariNo ratings yet

- Schemes - Presentation - Dec - 2021Document19 pagesSchemes - Presentation - Dec - 2021Tarun TiwariNo ratings yet

- Fund Facts - HDFC Focused 30 Fund - July 2021Document2 pagesFund Facts - HDFC Focused 30 Fund - July 2021Tarun TiwariNo ratings yet

- Subscribe To The Free Value Research Insight NewsletterDocument5 pagesSubscribe To The Free Value Research Insight NewsletterTarun TiwariNo ratings yet

- Chandragupt Institute of Management Patna: Submitted By: Tarun Kumar ROLL NO-110114Document4 pagesChandragupt Institute of Management Patna: Submitted By: Tarun Kumar ROLL NO-110114Tarun TiwariNo ratings yet

- UnawarenessDocument6 pagesUnawarenessTarun TiwariNo ratings yet

- Discriminant (2 Groups)Document2 pagesDiscriminant (2 Groups)Tarun TiwariNo ratings yet

- AMSA547 - Adhoc Exemption ApplicationDocument2 pagesAMSA547 - Adhoc Exemption Applicationinmran.gNo ratings yet

- Public Notification Darnell RobertsDocument1 pagePublic Notification Darnell RobertsMichael JohnsonNo ratings yet

- Husky 2015Document12 pagesHusky 2015sonicbooahxxxNo ratings yet

- RICS Research On NECDocument9 pagesRICS Research On NECAhmad MajedNo ratings yet

- Rule 78 - Quiazon v. BelenDocument3 pagesRule 78 - Quiazon v. BelenDan MilladoNo ratings yet

- Exam Admit CardDocument2 pagesExam Admit CardLaila MahbubaNo ratings yet

- Angel RPG - Investigator's CasebookDocument183 pagesAngel RPG - Investigator's CasebookDavidHavok60% (5)

- COC-and-other-requirements (HERRERA, CLARK JERZON M.)Document5 pagesCOC-and-other-requirements (HERRERA, CLARK JERZON M.)Kyle FaderangaNo ratings yet

- Jackson v. Birmingham Board of EducationDocument1 pageJackson v. Birmingham Board of EducationReid MurtaughNo ratings yet

- Property Law Exam QsDocument9 pagesProperty Law Exam QssahilNo ratings yet

- The Right To Self DeterminationDocument13 pagesThe Right To Self Determinationnana belloNo ratings yet

- aAFF OF LOSS JAMES CEDRIC UY ALEGREDocument2 pagesaAFF OF LOSS JAMES CEDRIC UY ALEGRERobert marollanoNo ratings yet

- People vs. Mario MapulongDocument4 pagesPeople vs. Mario MapulongJet jet NuevaNo ratings yet

- Revised Debate Guidelines AP Week 2022 1Document3 pagesRevised Debate Guidelines AP Week 2022 1JUSTICE100% (1)

- MOTION - TO DISMISS - Unlawful Detainer - DARABDocument6 pagesMOTION - TO DISMISS - Unlawful Detainer - DARABAianna Bianca Birao (fluffyeol)No ratings yet

- Tentative Synopsis Submitted in Partial Fulfilment of The Requirement For Award of The Degree of Master of LawsDocument12 pagesTentative Synopsis Submitted in Partial Fulfilment of The Requirement For Award of The Degree of Master of LawsAzharNo ratings yet

- Distinction Between Partnership Firm and Hindu Joint Family Firm - YRDocument2 pagesDistinction Between Partnership Firm and Hindu Joint Family Firm - YRMSSLLB1922 SuryaNo ratings yet

- NBCDO Memo Circular No.01 Series of 2005Document2 pagesNBCDO Memo Circular No.01 Series of 2005Roland CepedaNo ratings yet

- Career Executive Service Board Vs CSCDocument2 pagesCareer Executive Service Board Vs CSCxeileen08100% (1)

- Group 4 Jabidah MassacreDocument17 pagesGroup 4 Jabidah MassacrelaatoslocNo ratings yet

- Agreement Contract Australia - Ahsan, AliDocument4 pagesAgreement Contract Australia - Ahsan, AliDanish KhanNo ratings yet

- Student Handbook AY2021-22 (26 Aug)Document28 pagesStudent Handbook AY2021-22 (26 Aug)Oscar RomainvilleNo ratings yet

- 8 Karachi JitDocument106 pages8 Karachi JitInamullah AnsariNo ratings yet

- How To Correct Simulated Birth Through RA 11222Document9 pagesHow To Correct Simulated Birth Through RA 11222Rochelle ToridaNo ratings yet

- Insolvency Theory ArticleDocument14 pagesInsolvency Theory Articlenataliewong1615No ratings yet

- Child Care CertificateDocument1 pageChild Care CertificateRoger WongNo ratings yet

- Doctrine of Group of CompaniesDocument2 pagesDoctrine of Group of Companiesrituparna chandNo ratings yet