Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

40 views(See Rule 26C of Income Tax Rules, 1962) : Form No. 12Bb

(See Rule 26C of Income Tax Rules, 1962) : Form No. 12Bb

Uploaded by

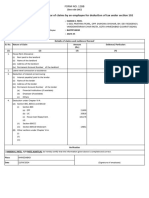

Saad YusufSaad Yusuf submits a Form 12BB for the financial year April 2020 to March 2021 claiming house rent allowance of Rs. 274500 paid to landlord Gaurav Khera residing at 17/1 Kalkaji Firsy Floor Opp. Deshbandhu college new delhi 110019. No other deductions are claimed under sections 80C, 80CCC, 80CCD, 80E, 80G, 80TTA or others. Saad Yusuf verifies the information provided is complete and correct.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- FinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDocument33 pagesFinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDaniel LópezNo ratings yet

- Samsung Refrigerator Tax InvoiceDocument1 pageSamsung Refrigerator Tax InvoiceJyoti Sarkar0% (1)

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofBSNL RBLNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFRudolph Antony ThomasNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- 02 Form-12BBDocument2 pages02 Form-12BByalla1No ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofmaddymatNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence Thereofvijay sharmaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofParmar NileshNo ratings yet

- Form 12BB in Excel FormatDocument4 pagesForm 12BB in Excel Formatkumar45caNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofsujupsNo ratings yet

- Form 12BB in Excel FormatDocument2 pagesForm 12BB in Excel FormatJTO NIBNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofVighneshwarBhatNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form 12BBDocument4 pagesForm 12BBAkhilesh PurohitNo ratings yet

- Form12bb 23-24Document1 pageForm12bb 23-24hanu549549No ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- 1.4 FORM NO 12 BB FinalDocument2 pages1.4 FORM NO 12 BB FinalVinit KayarkarNo ratings yet

- LetterDocument2 pagesLettervgNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Form 12Document2 pagesForm 12sarathNo ratings yet

- Form 12bb NewDocument1 pageForm 12bb NewYogaraj SNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofsivaNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- Form 12BB PDFDocument1 pageForm 12BB PDFbala_thegameNo ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- Tax Investment Form FY 2023-24Document3 pagesTax Investment Form FY 2023-24rishabh.vermaNo ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- 12BB FY 2021 22 Form pdf6010Document3 pages12BB FY 2021 22 Form pdf6010Subhahan BashaNo ratings yet

- Wayanad Department of General and Higher e Centre Pulpally Town PulpallypoDocument24 pagesWayanad Department of General and Higher e Centre Pulpally Town PulpallypoDelta PayNo ratings yet

- Uxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21Document2 pagesUxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21JayCharleysNo ratings yet

- Account Opening Formalities at PBLDocument4 pagesAccount Opening Formalities at PBLMd Mohsin AliNo ratings yet

- MC 2023 02 NpoDocument12 pagesMC 2023 02 Npokat perezNo ratings yet

- Book 1Document6 pagesBook 1Apdev OptionNo ratings yet

- IFRS 13 Fair Value MeasurementDocument2 pagesIFRS 13 Fair Value MeasurementYogesh BhattaraiNo ratings yet

- Annex "C" Income Payor/Withholding Agent'S Sworn DeclarationDocument2 pagesAnnex "C" Income Payor/Withholding Agent'S Sworn Declarationzairah jean baquilarNo ratings yet

- Pob NotesDocument122 pagesPob NotesFarel ThompsonNo ratings yet

- PROGRAM OF WORK N Bill of Materials Handwashing Facility SES 2022 UpdatedDocument2 pagesPROGRAM OF WORK N Bill of Materials Handwashing Facility SES 2022 UpdatedGeoff ReyNo ratings yet

- 1.1 Telecom Sector: A Global Scenario: Mobile TelephonyDocument23 pages1.1 Telecom Sector: A Global Scenario: Mobile TelephonyNeha KumarNo ratings yet

- Untitled Spreadsheet - Sheet1Document5 pagesUntitled Spreadsheet - Sheet1Scientist 235No ratings yet

- Andris Ablazevics Baltech Ib GroglassDocument3 pagesAndris Ablazevics Baltech Ib GroglassAndris AblaNo ratings yet

- EM 531 - Lecture Notes 7Document45 pagesEM 531 - Lecture Notes 7Hasan ÖzdemNo ratings yet

- SwotDocument3 pagesSwotCathelyn SaliringNo ratings yet

- EIA of Marble SUB PrintDocument135 pagesEIA of Marble SUB PrintdagimNo ratings yet

- Womens Self-Help Groups Poverty AlleviationDocument11 pagesWomens Self-Help Groups Poverty AlleviationyogameofNo ratings yet

- Caytoa en Canada - Buscar Con GoogleDocument1 pageCaytoa en Canada - Buscar Con GoogleElvira Rodriguez HernandezNo ratings yet

- Japan's Demographic Time BombDocument3 pagesJapan's Demographic Time BombeleziahtorreNo ratings yet

- Ms Thesis Last Final FinalDocument54 pagesMs Thesis Last Final FinalgizaskenNo ratings yet

- QAP For Pneumatic Test BathDocument3 pagesQAP For Pneumatic Test BathRaish AlamNo ratings yet

- Procurement 2: - PGD in Supply Chain Management - BihrmDocument12 pagesProcurement 2: - PGD in Supply Chain Management - BihrmYousufNo ratings yet

- DocumenteDocument5 pagesDocumentemaxim caldarasanNo ratings yet

- Tugas SEB Analisis BCG MatrixDocument8 pagesTugas SEB Analisis BCG MatrixTabilNo ratings yet

- Instructions For Foreclosure BondDocument5 pagesInstructions For Foreclosure BondOneNation100% (2)

- CB Insights - Fintech Report Q3 2021Document236 pagesCB Insights - Fintech Report Q3 2021Seba CabezasNo ratings yet

- Analisis Pengendalian Internal Atas Persediaan Barang Dagangan Pada Toko Alfamart Sat Boom Baru Palembang Sahila Kusminaini ArminDocument26 pagesAnalisis Pengendalian Internal Atas Persediaan Barang Dagangan Pada Toko Alfamart Sat Boom Baru Palembang Sahila Kusminaini ArminDewi NdutNo ratings yet

- End Term Presentation: Robotics in Garment ManufacturingDocument26 pagesEnd Term Presentation: Robotics in Garment ManufacturingAkriti SinghNo ratings yet

- Yavantu DocusDocument3 pagesYavantu DocusEnock MuntuNo ratings yet

(See Rule 26C of Income Tax Rules, 1962) : Form No. 12Bb

(See Rule 26C of Income Tax Rules, 1962) : Form No. 12Bb

Uploaded by

Saad Yusuf0 ratings0% found this document useful (0 votes)

40 views1 pageSaad Yusuf submits a Form 12BB for the financial year April 2020 to March 2021 claiming house rent allowance of Rs. 274500 paid to landlord Gaurav Khera residing at 17/1 Kalkaji Firsy Floor Opp. Deshbandhu college new delhi 110019. No other deductions are claimed under sections 80C, 80CCC, 80CCD, 80E, 80G, 80TTA or others. Saad Yusuf verifies the information provided is complete and correct.

Original Description:

Original Title

CloudPay SmartPerks1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSaad Yusuf submits a Form 12BB for the financial year April 2020 to March 2021 claiming house rent allowance of Rs. 274500 paid to landlord Gaurav Khera residing at 17/1 Kalkaji Firsy Floor Opp. Deshbandhu college new delhi 110019. No other deductions are claimed under sections 80C, 80CCC, 80CCD, 80E, 80G, 80TTA or others. Saad Yusuf verifies the information provided is complete and correct.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

40 views1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12Bb

(See Rule 26C of Income Tax Rules, 1962) : Form No. 12Bb

Uploaded by

Saad YusufSaad Yusuf submits a Form 12BB for the financial year April 2020 to March 2021 claiming house rent allowance of Rs. 274500 paid to landlord Gaurav Khera residing at 17/1 Kalkaji Firsy Floor Opp. Deshbandhu college new delhi 110019. No other deductions are claimed under sections 80C, 80CCC, 80CCD, 80E, 80G, 80TTA or others. Saad Yusuf verifies the information provided is complete and correct.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

6/21/2020 Form-B

FORM NO. 12BB

(See Rule 26C of Income tax Rules, 1962)

1. Name and address of the employee: Saad Yusuf

2. Permanent Account Number of the employee: AFHPY9638N

3. Financial year: April,2020-March,2021

Details of claims and evidence thereof

Sl

Nature of claim Amount (₹) Evidence/particulars

No.

(1) (2) (3) (4)

House Rent Allowance:

(i) Rent paid to the landlord

274500

(ii) Name of the landlord

Gaurav Khera

(iii) Address of the landlord

1 R/O 17/1 Kalkaji Firsy Floor Opp. Deshbandhu

(iv) Permanent Account Number of the landlord

college new delhi 110019

Note: Permanent Account Number shall be furnished if the

AKTPK1851G

aggregate rent paid during the previous year exceeds one

lakh rupees

2 Leave travel concessions or assistance

Deduction of interest on borrowing:

(i) Interest payable/paid to the lender 0

(ii) Name of the lender

(iii) Address of the lender

3

(iv) Permanent Account Number of the lender

(a) Financial Institutions(if available)

(b) Employer(if available)

(c) Others

4 Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(ii) Section 80CCC 0

(ii) Section 80CCD 0

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.)

under Chapter VI-A.

Verification

I,Saad Yusuf,son/daughter of .... do hereby certify that the information given above is complete and correct.

Place.............................

Date: ..21/06/2020.. (Signature of the employee)

Designation: ..-.. Full Name: Saad Yusuf

https://apps.trespay.in/emp9/Menu.aspx# 1/1

You might also like

- FinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDocument33 pagesFinQuiz - CFA Level 2, 2020 - 2021 - Formula SheetDaniel LópezNo ratings yet

- Samsung Refrigerator Tax InvoiceDocument1 pageSamsung Refrigerator Tax InvoiceJyoti Sarkar0% (1)

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofBSNL RBLNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFRudolph Antony ThomasNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- 02 Form-12BBDocument2 pages02 Form-12BByalla1No ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofmaddymatNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence Thereofvijay sharmaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofParmar NileshNo ratings yet

- Form 12BB in Excel FormatDocument4 pagesForm 12BB in Excel Formatkumar45caNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofsujupsNo ratings yet

- Form 12BB in Excel FormatDocument2 pagesForm 12BB in Excel FormatJTO NIBNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofVighneshwarBhatNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form 12BBDocument4 pagesForm 12BBAkhilesh PurohitNo ratings yet

- Form12bb 23-24Document1 pageForm12bb 23-24hanu549549No ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- 1.4 FORM NO 12 BB FinalDocument2 pages1.4 FORM NO 12 BB FinalVinit KayarkarNo ratings yet

- LetterDocument2 pagesLettervgNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Form 12Document2 pagesForm 12sarathNo ratings yet

- Form 12bb NewDocument1 pageForm 12bb NewYogaraj SNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofsivaNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- Form 12BB PDFDocument1 pageForm 12BB PDFbala_thegameNo ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- Tax Investment Form FY 2023-24Document3 pagesTax Investment Form FY 2023-24rishabh.vermaNo ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- 12BB FY 2021 22 Form pdf6010Document3 pages12BB FY 2021 22 Form pdf6010Subhahan BashaNo ratings yet

- Wayanad Department of General and Higher e Centre Pulpally Town PulpallypoDocument24 pagesWayanad Department of General and Higher e Centre Pulpally Town PulpallypoDelta PayNo ratings yet

- Uxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21Document2 pagesUxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21JayCharleysNo ratings yet

- Account Opening Formalities at PBLDocument4 pagesAccount Opening Formalities at PBLMd Mohsin AliNo ratings yet

- MC 2023 02 NpoDocument12 pagesMC 2023 02 Npokat perezNo ratings yet

- Book 1Document6 pagesBook 1Apdev OptionNo ratings yet

- IFRS 13 Fair Value MeasurementDocument2 pagesIFRS 13 Fair Value MeasurementYogesh BhattaraiNo ratings yet

- Annex "C" Income Payor/Withholding Agent'S Sworn DeclarationDocument2 pagesAnnex "C" Income Payor/Withholding Agent'S Sworn Declarationzairah jean baquilarNo ratings yet

- Pob NotesDocument122 pagesPob NotesFarel ThompsonNo ratings yet

- PROGRAM OF WORK N Bill of Materials Handwashing Facility SES 2022 UpdatedDocument2 pagesPROGRAM OF WORK N Bill of Materials Handwashing Facility SES 2022 UpdatedGeoff ReyNo ratings yet

- 1.1 Telecom Sector: A Global Scenario: Mobile TelephonyDocument23 pages1.1 Telecom Sector: A Global Scenario: Mobile TelephonyNeha KumarNo ratings yet

- Untitled Spreadsheet - Sheet1Document5 pagesUntitled Spreadsheet - Sheet1Scientist 235No ratings yet

- Andris Ablazevics Baltech Ib GroglassDocument3 pagesAndris Ablazevics Baltech Ib GroglassAndris AblaNo ratings yet

- EM 531 - Lecture Notes 7Document45 pagesEM 531 - Lecture Notes 7Hasan ÖzdemNo ratings yet

- SwotDocument3 pagesSwotCathelyn SaliringNo ratings yet

- EIA of Marble SUB PrintDocument135 pagesEIA of Marble SUB PrintdagimNo ratings yet

- Womens Self-Help Groups Poverty AlleviationDocument11 pagesWomens Self-Help Groups Poverty AlleviationyogameofNo ratings yet

- Caytoa en Canada - Buscar Con GoogleDocument1 pageCaytoa en Canada - Buscar Con GoogleElvira Rodriguez HernandezNo ratings yet

- Japan's Demographic Time BombDocument3 pagesJapan's Demographic Time BombeleziahtorreNo ratings yet

- Ms Thesis Last Final FinalDocument54 pagesMs Thesis Last Final FinalgizaskenNo ratings yet

- QAP For Pneumatic Test BathDocument3 pagesQAP For Pneumatic Test BathRaish AlamNo ratings yet

- Procurement 2: - PGD in Supply Chain Management - BihrmDocument12 pagesProcurement 2: - PGD in Supply Chain Management - BihrmYousufNo ratings yet

- DocumenteDocument5 pagesDocumentemaxim caldarasanNo ratings yet

- Tugas SEB Analisis BCG MatrixDocument8 pagesTugas SEB Analisis BCG MatrixTabilNo ratings yet

- Instructions For Foreclosure BondDocument5 pagesInstructions For Foreclosure BondOneNation100% (2)

- CB Insights - Fintech Report Q3 2021Document236 pagesCB Insights - Fintech Report Q3 2021Seba CabezasNo ratings yet

- Analisis Pengendalian Internal Atas Persediaan Barang Dagangan Pada Toko Alfamart Sat Boom Baru Palembang Sahila Kusminaini ArminDocument26 pagesAnalisis Pengendalian Internal Atas Persediaan Barang Dagangan Pada Toko Alfamart Sat Boom Baru Palembang Sahila Kusminaini ArminDewi NdutNo ratings yet

- End Term Presentation: Robotics in Garment ManufacturingDocument26 pagesEnd Term Presentation: Robotics in Garment ManufacturingAkriti SinghNo ratings yet

- Yavantu DocusDocument3 pagesYavantu DocusEnock MuntuNo ratings yet