Professional Documents

Culture Documents

4.4 (READING 3) 22.4 The Confusion Over Inflation - Principles of Economics 2e - OpenStax

4.4 (READING 3) 22.4 The Confusion Over Inflation - Principles of Economics 2e - OpenStax

Uploaded by

Cornelia MarquezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4.4 (READING 3) 22.4 The Confusion Over Inflation - Principles of Economics 2e - OpenStax

4.4 (READING 3) 22.4 The Confusion Over Inflation - Principles of Economics 2e - OpenStax

Uploaded by

Cornelia MarquezCopyright:

Available Formats

22.4 The Confusion Over Inflation - Principles of Economics 2e | OpenStax 5/11/21, 16:29 22.

5/11/21, 16:29 22.4 The Confusion Over Inflation - Principles of Economics 2e | OpenStax 5/11/21, 16:29 22.4 The Confusion Over Inflation - Principles of Economics 2e | OpenStax 5/11/21, 16:29

adjust for inflation only after a time lag, then inflation can cause three types of problems: unintended

Learning Objectives redistributions of purchasing power, blurred price signals, and difficulties in long-term planning.

By the end of this section, you will be able to:

Unintended Redistributions of Purchasing Power

Explain how inflation can cause redistributions of purchasing power

Inflation can cause redistributions of purchasing power that hurt some and help others. People who are

Identify ways inflation can blur the perception of supply and demand

hurt by inflation include those who are holding considerable cash, whether it is in a safe deposit box or in

Explain the economic benefits and challenges of inflation

a cardboard box under the bed. When inflation happens, the buying power of cash diminishes. However,

Economists usually oppose high inflation, but they oppose it in a milder way than many non-economists. cash is only an example of a more general problem: anyone who has financial assets invested in a way

Robert Shiller, one of 2013’s Nobel Prize winners in economics, carried out several surveys during the that the nominal return does not keep up with inflation will tend to suffer from inflation. For example, if a

1990s about attitudes toward inflation. One of his questions asked, “Do you agree that preventing high person has money in a bank account that pays 4% interest, but inflation rises to 5%, then the real rate of

inflation is an important national priority, as important as preventing drug abuse or preventing return for the money invested in that bank account is negative 1%.

deterioration in the quality of our schools?” Answers were on a scale of 1–5, where 1 meant “Fully agree”

The problem of a good-looking nominal interest rate transforming into an ugly-looking real interest rate

and 5 meant “Completely disagree.” For the U.S. population as a whole, 52% answered “Fully agree”

can be worsened by taxes. The U.S. income tax is charged on the nominal interest received in dollar

that preventing high inflation was a highly important national priority and just 4% said “Completely

terms, without an adjustment for inflation. Thus, the government taxes a person who invests $10,000

disagree.” However, among professional economists, only 18% answered “Fully agree,” while the same

and receives a 5% nominal rate of interest on the $500 received—no matter whether the inflation rate is

percentage of 18% answered “Completely disagree.”

0%, 5%, or 10%. If inflation is 0%, then the real interest rate is 5% and all $500 is a gain in buying

The Land of Funny Money power. However, if inflation is 5%, then the real interest rate is zero and the person had no real gain—but

owes income tax on the nominal gain anyway. If inflation is 10%, then the real interest rate is negative

What are the economic problems caused by inflation, and why do economists often regard them with 5% and the person is actually falling behind in buying power, but would still owe taxes on the $500 in

less concern than the general public? Consider a very short story: “The Land of Funny Money.” nominal gains.

One morning, everyone in the Land of Funny Money awakened to find that everything denominated in Inflation can cause unintended redistributions for wage earners, too. Wages do typically creep up with

money had increased by 20%. The change was completely unexpected. Every price in every store was inflation over time, eventually. The last row of Table 22.1 at the start of this chapter showed that the

20% higher. Paychecks were 20% higher. Interest rates were 20 % higher. The amount of money, average hourly wage in manufacturing in the U.S. economy increased from $3.23 in 1970 to $20.65 in

everywhere from wallets to savings accounts, was 20% larger. This overnight inflation of prices made 2017, which is an increase by a factor of more than six. Over that time period, the Consumer Price Index

newspaper headlines everywhere in the Land of Funny Money. However, the headlines quickly increased by an almost identical amount. However, increases in wages may lag behind inflation for a

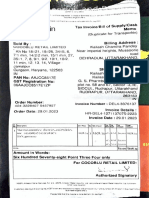

Figure 22.6 U.S. Minimum Wage and Inflation After adjusting for inflation, the federal minimum wage dropped more than

disappeared, as people realized that in terms of what they could actually buy with their incomes, this year or two, since wage adjustments are often somewhat sticky and occur only once or twice a year. 30 percent from 1967 to 2010, even though the nominal figure climbed from $1.40 to $7.25 per hour. Increases in the

inflation had no economic impact. Everyone’s pay could still buy exactly the same set of goods as it did Moreover, the extent to which wages keep up with inflation creates insecurity for workers and may minimum wage in between 2008 and 2010 kept the decline from being worse—as it would have been if the wage had

before. Everyone’s savings were still sufficient to buy exactly the same car, vacation, or retirement that involve painful, prolonged conflicts between employers and employees. If the government adjusts remained the same as it did from 1997 through 2007. Since 2010, the real minimum wage has continued to decline.

they could have bought before. Equal levels of inflation in all wages and prices ended up not mattering minimum wage for inflation only infrequently, minimum wage workers are losing purchasing power from (Sources: http://www.dol.gov/whd/minwage/chart.htm and http://data.bls.gov/cgi-bin/surveymost?cu)

much at all. their nominal wages, as Figure 22.6 shows.

When the people in Robert Shiller’s surveys explained their concern about inflation, one typical reason One sizable group of people has often received a large share of their income in a form that does not

was that they feared that as prices rose, they would not be able to afford to buy as much. In other words, increase over time: retirees who receive a private company pension. Most pensions have traditionally

people were worried because they did not live in a place like the Land of Funny Money, where all prices been set as a fixed nominal dollar amount per year at retirement. For this reason, economists call

and wages rose simultaneously. Instead, people live here on Planet Earth, where prices might rise while pensions “defined benefits” plans. Even if inflation is low, the combination of inflation and a fixed income

wages do not rise at all, or where wages rise more slowly than prices. can create a substantial problem over time. A person who retires on a fixed income at age 65 will find

that losing just 1% to 2% of buying power per year to inflation compounds to a considerable loss of

Economists note that over most periods, the inflation level in prices is roughly similar to the inflation level

buying power after a decade or two.

in wages, and so they reason that, on average, over time, people’s economic status is not greatly

changed by inflation. If all prices, wages, and interest rates adjusted automatically and immediately with Fortunately, pensions and other defined benefits retirement plans are increasingly rare, replaced instead

inflation, as in the Land of Funny Money, then no one’s purchasing power, profits, or real loan payments by “defined contribution” plans, such as 401(k)s and 403(b)s. In these plans, the employer contributes a

would change. However, if other economic variables do not move exactly in sync with inflation, or if they fixed amount to the worker’s retirement account on a regular basis (usually every pay check). The

https://openstax.org/books/principles-economics-2e/pages/22-4-the-confusion-over-inflation Page 1 of 7 https://openstax.org/books/principles-economics-2e/pages/22-4-the-confusion-over-inflation Page 2 of 7 https://openstax.org/books/principles-economics-2e/pages/22-4-the-confusion-over-inflation Page 3 of 7

22.4 The Confusion Over Inflation - Principles of Economics 2e | OpenStax 5/11/21, 16:29 22.4 The Confusion Over Inflation - Principles of Economics 2e | OpenStax 5/11/21, 16:29 22.4 The Confusion Over Inflation - Principles of Economics 2e | OpenStax 5/11/21, 16:29

employee often contributes as well. The worker invests these funds in a wide range of investment imprisonment, at which time he wrote his book Mein Kampf, setting forth an inspirational plan losses from inflation, as in the case of a retail business that gets stuck holding too much cash, only to

vehicles. These plans are tax deferred, and they are portable so that if the individual takes a job with a for Germany’s future, suggesting plans for world domination. . .” “. . . Most people in Germany see inflation eroding the value of that cash. However, when a business spends its time focusing on how

different employer, their 401(k) comes with them. To the extent that the investments made generate real today probably do not clearly remember these events; this lack of attention to it may be to profit by inflation, or at least how to avoid suffering from it, an inevitable tradeoff strikes: less time is

rates of return, retirees do not suffer from the inflation costs of traditional pensioners. because its memory is blurred by the more dramatic events that succeeded it (the Nazi seizure spent on improving products and services or on figuring out how to make existing products and services

of power and World War II). However, to someone living through these historical events in more cheaply. An economy with high inflation rewards businesses that have found clever ways of

However, ordinary people can sometimes benefit from the unintended redistributions of inflation.

sequence . . . [the putsch] may have been remembered as vivid evidence of the potential profiting from inflation, which are not necessarily the businesses that excel at productivity, innovation, or

Consider someone who borrows $10,000 to buy a car at a fixed interest rate of 9%. If inflation is 3% at

effects of inflation.” quality of service.

the time the loan is made, then he or she must repay the loan at a real interest rate of 6%. However, if

inflation rises to 9%, then the real interest rate on the loan is zero. In this case, the borrower’s benefit In the short term, low or moderate levels of inflation may not pose an overwhelming difficulty for

from inflation is the lender’s loss. A borrower paying a fixed interest rate, who benefits from inflation, is business planning, because costs of doing business and sales revenues may rise at similar rates. If,

just the flip side of an investor receiving a fixed interest rate, who suffers from inflation. The lesson is that Blurred Price Signals however, inflation varies substantially over the short or medium term, then it may make sense for

when interest rates are fixed, rises in the rate of inflation tend to penalize suppliers of financial capital, Prices are the messengers in a market economy, conveying information about conditions of demand and businesses to stick to shorter-term strategies. The evidence as to whether relatively low rates of inflation

who receive repayment in dollars that are worth less because of inflation, while demanders of financial supply. Inflation blurs those price messages. Inflation means that we perceive price signals more reduce productivity is controversial among economists. There is some evidence that if inflation can be

capital end up better off, because they can repay their loans in dollars that are worth less than originally vaguely, like a radio program received with considerable static. If the static becomes severe, it is hard to held to moderate levels of less than 3% per year, it need not prevent a nation’s real economy from

expected. tell what is happening. growing at a healthy pace. For some countries that have experienced hyperinflation of several thousand

percent per year, an annual inflation rate of 20–30% may feel basically the same as zero. However,

The unintended redistributions of buying power that inflation causes may have a broader effect on In Israel, when inflation accelerated to an annual rate of 500% in 1985, some stores stopped posting several economists have pointed to the suggestive fact that when U.S. inflation heated up in the early

society. America’s widespread acceptance of market forces rests on a perception that people’s actions prices directly on items, since they would have had to put new labels on the items or shelves every few 1970s—to 10%—U.S. growth in productivity slowed down, and when inflation slowed down in the

have a reasonable connection to market outcomes. When inflation causes a retiree who built up a days to reflect inflation. Instead, a shopper just took items from a shelf and went up to the checkout 1980s, productivity edged up again not long thereafter, as Figure 22.7 shows.

pension or invested at a fixed interest rate to suffer, however, while someone who borrowed at a fixed register to find out the price for that day. Obviously, this situation makes comparing prices and shopping

interest rate benefits from inflation, it is hard to believe that this outcome was deserved in any way. for the best deal rather difficult. When the levels and changes of prices become uncertain, businesses

Similarly, when homeowners benefit from inflation because the price of their homes rises, while renters and individuals find it harder to react to economic signals. In a world where inflation is at a high rate, but

suffer because they are paying higher rent, it is hard to see any useful incentive effects. One of the bouncing up and down to some extent, does a higher price of a good mean that inflation has risen, or

reasons that the general public dislikes inflation is a sense that it makes economic rewards and penalties that supply of that good has decreased, or that demand for that good has increased? Should a buyer of

more arbitrary—and therefore likely to be perceived as unfair – even dangerous, as the next Clear It Up the good take the higher prices as an economic hint to start substituting other products—or have the

feature shows. prices of the substitutes risen by an equal amount? Should a seller of the good take a higher price as a

reason to increase production—or is the higher price only a sign of a general inflation in which the prices

of all inputs to production are rising as well? The true story will presumably become clear over time, but

CLEAR IT UP at a given moment, who can say?

High and variable inflation means that the incentives in the economy to adjust in response to changes in

Is there a connection between German hyperinflation and Hitler’s rise to prices are weaker. Markets will adjust toward their equilibrium prices and quantities more erratically and

power? slowly, and many individual markets will experience a greater chance of surpluses and shortages.

Germany suffered an intense hyperinflation of its currency, the Mark, in the years after World

War I, when the Weimar Republic in Germany resorted to printing money to pay its bills and

Problems of Long-Term Planning

the onset of the Great Depression created the social turmoil that Adolf Hitler was able to take Inflation can make long-term planning difficult. In discussing unintended redistributions, we considered

advantage of in his rise to power. Shiller described the connection this way in a National the case of someone trying to plan for retirement with a pension that is fixed in nominal terms and a high

Bureau of Economic Research 1996 Working Paper: rate of inflation. Similar problems arise for all people trying to save for retirement, because they must

consider what their money will really buy several decades in the future when we cannot know the rate of

“A fact that is probably little known to young people today, even in Germany, is that the final

future inflation. Figure 22.7 U.S. Inflation Rate and U.S. Labor Productivity, 1961–2014 Over the

collapse of the Mark in 1923, the time when the Mark’s inflation reached astronomical levels last several decades in the United States, there have been times when rising

(inflation of 35,974.9% in November 1923 alone, for an annual rate that month of 4.69 × Inflation, especially at moderate or high levels, will pose substantial planning problems for businesses, inflation rates have been closely followed by lower productivity rates and lower

1028%), came in the same month as did Hitler’s Beer Hall Putsch, his Nazi Party’s armed too. A firm can make money from inflation—for example, by paying bills and wages as late as possible inflation rates have corresponded to increasing productivity rates. As the graph

attempt to overthrow the German government. This failed putsch resulted in Hitler’s so that it can pay in inflated dollars, while collecting revenues as soon as possible. A firm can also suffer shows, however, this correlation does not always exist.

https://openstax.org/books/principles-economics-2e/pages/22-4-the-confusion-over-inflation Page 4 of 7 https://openstax.org/books/principles-economics-2e/pages/22-4-the-confusion-over-inflation Page 5 of 7 https://openstax.org/books/principles-economics-2e/pages/22-4-the-confusion-over-inflation Page 6 of 7

22.4 The Confusion Over Inflation - Principles of Economics 2e | OpenStax 5/11/21, 16:29

Any Benefits of Inflation?

Although the economic effects of inflation are primarily negative, two countervailing points are worth

noting. First, the impact of inflation will differ considerably according to whether it is creeping up slowly

at 0% to 2% per year, galloping along at 10% to 20% per year, or racing to the point of hyperinflation at,

say, 40% per month. Hyperinflation can rip an economy and a society apart. An annual inflation rate of

2%, 3%, or 4%, however, is a long way from a national crisis. Low inflation is also better than deflation

which occurs with severe recessions.

Second, economists sometimes argue that moderate inflation may help the economy by making wages

in labor markets more flexible. The discussion in Unemployment pointed out that wages tend to be

sticky in their downward movements and that unemployment can result. A little inflation could nibble

away at real wages, and thus help real wages to decline if necessary. In this way, even if a moderate or

high rate of inflation may act as sand in the gears of the economy, perhaps a low rate of inflation serves

as oil for the gears of the labor market. This argument is controversial. A full analysis would have to

account for all the effects of inflation. It does, however, offer another reason to believe that, all things

considered, very low rates of inflation may not be especially harmful.

https://openstax.org/books/principles-economics-2e/pages/22-4-the-confusion-over-inflation Page 7 of 7

You might also like

- Managing in A Global Economy Demystifying International Macroeconomics 2nd Edition Marthinsen Solutions Manual 1Document36 pagesManaging in A Global Economy Demystifying International Macroeconomics 2nd Edition Marthinsen Solutions Manual 1jenniferrobertsdemknxyjqt100% (29)

- HISTO 11 Oral GuideDocument4 pagesHISTO 11 Oral GuideCornelia Marquez100% (1)

- ARUPE - Men and Women For OthersDocument10 pagesARUPE - Men and Women For OthersCornelia MarquezNo ratings yet

- Subject - Eco 201.1: Task 2Document10 pagesSubject - Eco 201.1: Task 2Style Imports BDNo ratings yet

- Why Do Economists Dread DeflationDocument9 pagesWhy Do Economists Dread DeflationIsaac OwusuNo ratings yet

- 5.5 Macro Chpter 5Document2 pages5.5 Macro Chpter 5Tri WidyastutiNo ratings yet

- 5.1 Inflation: Dep.T of Acfn MacroeconomicsDocument19 pages5.1 Inflation: Dep.T of Acfn Macroeconomicsabadi gebruNo ratings yet

- Chapter 5 MacroDocument18 pagesChapter 5 Macroabadi gebruNo ratings yet

- Global Economic Trend Analysis - Contained DepressionDocument14 pagesGlobal Economic Trend Analysis - Contained DepressionMeishizuo ZuoshimeiNo ratings yet

- Assignment-Managerial Economics AssignmentDocument17 pagesAssignment-Managerial Economics Assignmentnatashashaikh93No ratings yet

- Gillmore The Cost of InflationDocument8 pagesGillmore The Cost of Inflationjuan alvaresNo ratings yet

- Rogerian EsssayDocument5 pagesRogerian Esssayapi-653744567No ratings yet

- 5.1 Inflation: Adigrat University Dep.T of Acfn MacroeconomicsDocument19 pages5.1 Inflation: Adigrat University Dep.T of Acfn Macroeconomicsabadi gebruNo ratings yet

- !!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentDocument6 pages!!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentGeneration GenerationNo ratings yet

- Inflation, Unemployment, Deficits, and Debt: Chapter SummaryDocument4 pagesInflation, Unemployment, Deficits, and Debt: Chapter SummarySam LeNo ratings yet

- Managing in A Global Economy Demystifying International Macroeconomics 2Nd Edition Marthinsen Solutions Manual Full Chapter PDFDocument26 pagesManaging in A Global Economy Demystifying International Macroeconomics 2Nd Edition Marthinsen Solutions Manual Full Chapter PDFtyrone.kelley614100% (11)

- Deflation - Making Sure It Doesn't Happen Here (Ben S. Bernanke)Document8 pagesDeflation - Making Sure It Doesn't Happen Here (Ben S. Bernanke)João Henrique F. VieiraNo ratings yet

- The Broyhill Letter (Q2-11)Document6 pagesThe Broyhill Letter (Q2-11)Broyhill Asset ManagementNo ratings yet

- Surviving Soaring Inflation:: The Opportunity of A LifetimeDocument23 pagesSurviving Soaring Inflation:: The Opportunity of A LifetimeaKNo ratings yet

- Text Book PDF ECONOMYDocument22 pagesText Book PDF ECONOMYelimfsjNo ratings yet

- Chris Marcus - 2011 OutlookDocument26 pagesChris Marcus - 2011 Outlookaeroc76797No ratings yet

- Unit 6 InflationDocument10 pagesUnit 6 Inflation22je0766No ratings yet

- Post Mid Sem EEFDocument64 pagesPost Mid Sem EEFYug ChaudhariNo ratings yet

- BasicsDocument2 pagesBasicsdhwerdenNo ratings yet

- Inflation: Does Inflation Always Bad in Economics??? BY Charles J. MwamtobeDocument5 pagesInflation: Does Inflation Always Bad in Economics??? BY Charles J. MwamtobeSarwat YousafNo ratings yet

- An Analysis of A Recent Event That Has Substantial Impacts On Your Industry/sectorDocument3 pagesAn Analysis of A Recent Event That Has Substantial Impacts On Your Industry/sectorNatala WillzNo ratings yet

- Howard Marks Fourth Quarter 2009 MemoDocument12 pagesHoward Marks Fourth Quarter 2009 MemoDealBook100% (3)

- Business Economics Qasim Masood SAP ID 21362Document3 pagesBusiness Economics Qasim Masood SAP ID 21362Qasim MasoodNo ratings yet

- Final Tpaper of BeeeeeeeeeeeeDocument2 pagesFinal Tpaper of BeeeeeeeeeeeeSebak RoyNo ratings yet

- Perbaikan Kuis Lingkungan BisnisDocument3 pagesPerbaikan Kuis Lingkungan BisnisMalielMaleo YTchannelNo ratings yet

- Immaculate DisinflationDocument10 pagesImmaculate Disinflationuchihagaming2000No ratings yet

- Endless Intervention: by John MauldinDocument10 pagesEndless Intervention: by John Mauldinantics20No ratings yet

- InflationDocument2 pagesInflationandm.enactusftuNo ratings yet

- Effects of InflationDocument21 pagesEffects of InflationRanjeet Ramaswamy Iyer50% (6)

- Economics PresentationDocument9 pagesEconomics PresentationKalvin Wanchu BhutiaNo ratings yet

- Advantage - Impact of Inflation On Retirement Planning Be Flexible To Cope With InflationDocument2 pagesAdvantage - Impact of Inflation On Retirement Planning Be Flexible To Cope With InflationStellina JoeshibaNo ratings yet

- Inflation Risk AnalysisDocument2 pagesInflation Risk AnalysisChudi EzeNo ratings yet

- EconomicssamplepagesDocument8 pagesEconomicssamplepagesUmesh NihalaniNo ratings yet

- Questions: Answer: Options Are To Reduce Government Spending, Increase Taxes, or SomeDocument5 pagesQuestions: Answer: Options Are To Reduce Government Spending, Increase Taxes, or Somecourse101No ratings yet

- Unit 2. Lesson 3Document4 pagesUnit 2. Lesson 3halam29051997No ratings yet

- Modern Principles Macroeconomics 3rd Edition Cowen Solutions ManualDocument6 pagesModern Principles Macroeconomics 3rd Edition Cowen Solutions Manualkibitkarowdyismqph9100% (24)

- Conflict Between Economic Growth and InflationDocument17 pagesConflict Between Economic Growth and Inflationsatish4647No ratings yet

- Macroeconomic Goals - ECON102 Macroeconomics Theory and PracticeDocument4 pagesMacroeconomic Goals - ECON102 Macroeconomics Theory and PracticeMarilou Arcillas PanisalesNo ratings yet

- Frbrich Covid19 Paper 202005 Eb PDFDocument6 pagesFrbrich Covid19 Paper 202005 Eb PDFSanchit MiglaniNo ratings yet

- Side DishesDocument3 pagesSide Dishesnosheen90No ratings yet

- Five Debates Over Macroeconomic PolicyDocument27 pagesFive Debates Over Macroeconomic Policyayushmehar22No ratings yet

- Deflation: Feeling DownDocument2 pagesDeflation: Feeling DownDei VidNo ratings yet

- Economy Part 5Document13 pagesEconomy Part 5Shilpi PriyaNo ratings yet

- InflationDocument9 pagesInflationUniversal MusicNo ratings yet

- Bernanke On Deflation - November 21, 2002Document12 pagesBernanke On Deflation - November 21, 2002Shyam SunderNo ratings yet

- Chapter 10: Output, Inflation, and Unemployment: Alternative ViewsDocument11 pagesChapter 10: Output, Inflation, and Unemployment: Alternative Viewsstanely ndlovuNo ratings yet

- 2013 5 24 Aftershock InflationDocument6 pages2013 5 24 Aftershock InflationphuawlNo ratings yet

- Article NotesDocument3 pagesArticle NotesHaniya ShoaibNo ratings yet

- VGQ Macro ArticleDocument7 pagesVGQ Macro Articleapi-286530940No ratings yet

- DeflationDocument4 pagesDeflationan rajammaniNo ratings yet

- InflationDocument37 pagesInflationbhargavanisetti7No ratings yet

- Currency: Inflation Is A Key Concept in Macroeconomics, and A Major Concern For Government PolicymakersDocument3 pagesCurrency: Inflation Is A Key Concept in Macroeconomics, and A Major Concern For Government PolicymakersElvie Abulencia-BagsicNo ratings yet

- Eco400 Eco400 Assignment 3Document2 pagesEco400 Eco400 Assignment 3Mohammad ZamanNo ratings yet

- Seminar in Economic Policies: Assignment # 1Document5 pagesSeminar in Economic Policies: Assignment # 1Muhammad Tariq Ali KhanNo ratings yet

- Reflation Is The Act Of: Stimulating Economy Money Supply Taxes Business Cycle DisinflationDocument4 pagesReflation Is The Act Of: Stimulating Economy Money Supply Taxes Business Cycle Disinflationmeenakshi56No ratings yet

- LLAW 115 SyllabusDocument7 pagesLLAW 115 SyllabusCornelia MarquezNo ratings yet

- Apple Ranks No. 1 in 2019 Best Global BrandsDocument1 pageApple Ranks No. 1 in 2019 Best Global BrandsCornelia MarquezNo ratings yet

- BUS2 Finance ReviewerDocument12 pagesBUS2 Finance ReviewerCornelia MarquezNo ratings yet

- Dermaline Vs Myra Pharmaceuticals TM Digest PDFDocument1 pageDermaline Vs Myra Pharmaceuticals TM Digest PDFCornelia MarquezNo ratings yet

- Eco102-Basic Problems PDFDocument5 pagesEco102-Basic Problems PDFCornelia MarquezNo ratings yet

- Eco102-Analysis of Perfectly Competitive Markets PDFDocument3 pagesEco102-Analysis of Perfectly Competitive Markets PDFCornelia MarquezNo ratings yet

- 07 - Creativity and Intuition Management by Eduardo Morato, JRDocument19 pages07 - Creativity and Intuition Management by Eduardo Morato, JRCornelia MarquezNo ratings yet

- Palm On The Run (A Reflection On Faith and Tradition) by Shakira SisonDocument2 pagesPalm On The Run (A Reflection On Faith and Tradition) by Shakira SisonCornelia MarquezNo ratings yet

- Why Is Academic Writing So Academic? by Joshua RothmanDocument2 pagesWhy Is Academic Writing So Academic? by Joshua RothmanCornelia MarquezNo ratings yet

- Classical vs. Keynesian EconomicsDocument7 pagesClassical vs. Keynesian EconomicsRamon VillarealNo ratings yet

- Exchange Rates in The Short RunDocument29 pagesExchange Rates in The Short RunChi VũNo ratings yet

- Samara University: College of Business and EconomicsDocument7 pagesSamara University: College of Business and EconomicsGebremeden AnduamlakNo ratings yet

- MONETARY POLICY MEASURES - QualitativeDocument11 pagesMONETARY POLICY MEASURES - QualitativeAina ZalinaNo ratings yet

- The Rational Expectations HypothesisDocument22 pagesThe Rational Expectations Hypothesisaashutosh.jha2021fNo ratings yet

- Module 3 (FINE-6)Document4 pagesModule 3 (FINE-6)John Mark GabrielNo ratings yet

- 50 Most Important Questions Economics SPCCDocument4 pages50 Most Important Questions Economics SPCCtwisha malhotraNo ratings yet

- Nathan - Tankus - The New Monetary PolicyDocument47 pagesNathan - Tankus - The New Monetary PolicycjflemingNo ratings yet

- Forms of OwnershipDocument2 pagesForms of OwnershipChelcey PascuaNo ratings yet

- Dependency ApproachDocument24 pagesDependency Approachlumos maximaNo ratings yet

- Quantitative and Qualitative Instruments of Monetary PolicyDocument11 pagesQuantitative and Qualitative Instruments of Monetary PolicyVenkat SaiNo ratings yet

- FM Topic 2B Chapter 2B Topic 3 PrintableDocument6 pagesFM Topic 2B Chapter 2B Topic 3 PrintableGrezel Mae ProvidoNo ratings yet

- Chapter 31 - Open-Economy Macroeconomics - Basic Concepts - StudentsDocument25 pagesChapter 31 - Open-Economy Macroeconomics - Basic Concepts - StudentsPham Thi Phuong Anh (K16 HCM)No ratings yet

- UNICEF Working Paper On Political Economy Analysis in The Health Sector - 27aug15Document15 pagesUNICEF Working Paper On Political Economy Analysis in The Health Sector - 27aug15Tanja PekezNo ratings yet

- Chapter 14: Money - Demand, Supply and Monetary Policy. Practical QuestionsDocument4 pagesChapter 14: Money - Demand, Supply and Monetary Policy. Practical Questionssv netNo ratings yet

- Macroeconomics 10th Edition Parkin Test Bank Full Chapter PDFDocument44 pagesMacroeconomics 10th Edition Parkin Test Bank Full Chapter PDFcarlarodriquezajbns100% (13)

- Unit 6 ExercisesDocument8 pagesUnit 6 ExercisesJuvaniaNo ratings yet

- Chapter 4 of Public FinanceDocument4 pagesChapter 4 of Public FinanceNathNo ratings yet

- Lect-8 IS-LM ModelDocument18 pagesLect-8 IS-LM ModelRohit BeheraNo ratings yet

- De Villa - Lesson 3 The Global EconomyDocument8 pagesDe Villa - Lesson 3 The Global EconomyShane De VillaNo ratings yet

- The Evolution of Economic ThinkingDocument3 pagesThe Evolution of Economic ThinkingStudy AccountNo ratings yet

- Kimberly Amadeo: Money SupplyDocument3 pagesKimberly Amadeo: Money SupplytawandaNo ratings yet

- Adobe Scan 31 Jan 2023Document4 pagesAdobe Scan 31 Jan 2023Prasoon PandeyNo ratings yet

- Dependency Theory PDFDocument12 pagesDependency Theory PDFVartikaNo ratings yet

- Simple Loan Calculator and Amortization Table1Document7 pagesSimple Loan Calculator and Amortization Table1Justine Jay Chatto AlderiteNo ratings yet

- Arithmetic - Simple InterestDocument1 pageArithmetic - Simple InterestVenkateswararao BuridiNo ratings yet

- Chapter 4: Money and InflationDocument37 pagesChapter 4: Money and InflationMinh HangNo ratings yet

- CH 03Document17 pagesCH 03mieyy roslanNo ratings yet

- Act 6 CCLDocument7 pagesAct 6 CCLnemesis acobaNo ratings yet

- Ramos - Value and Price of Production. New Evidence On Marx's Transformation Procedure.1999Document16 pagesRamos - Value and Price of Production. New Evidence On Marx's Transformation Procedure.1999Alejandro RamosNo ratings yet