Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsDerivatives Market in India

Derivatives Market in India

Uploaded by

Varun VermaThe document outlines the development of the derivatives market in India. It discusses how SEBI established committees in 1996 and 1998 to develop a regulatory framework for derivatives trading and risk containment. The Securities Contracts Act was amended in 1999 to regulate derivatives trading on recognized stock exchanges. Derivatives trading commenced in 2000 with index futures and later expanded to include index and single stock options.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Nebosh PSM SummaryDocument67 pagesNebosh PSM SummaryAhmed Hamad100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Demand Letter Business PermitDocument3 pagesDemand Letter Business PermitJazz Adaza100% (1)

- Income Indirect Taxes VAT Slides ICPAK Presentation Gideon RotichDocument26 pagesIncome Indirect Taxes VAT Slides ICPAK Presentation Gideon RotichREJAY89No ratings yet

- 06 - Qualitative Automotive Glass Bending by Selecting The Right Heat Resistant Tool CoveringDocument18 pages06 - Qualitative Automotive Glass Bending by Selecting The Right Heat Resistant Tool CoveringProvappiNo ratings yet

- Kamrul Hassan Report Submission On RAKUB BCOM FINALDocument6 pagesKamrul Hassan Report Submission On RAKUB BCOM FINALKamrulHassanNo ratings yet

- Workbook 2Document35 pagesWorkbook 2Lalit SapkaleNo ratings yet

- Revised Syllabus For GDMM/PGDMM: Indian Institute of Materials ManagementDocument91 pagesRevised Syllabus For GDMM/PGDMM: Indian Institute of Materials ManagementVanita GanthadeNo ratings yet

- Lesson 5 - Marketing ManagementDocument21 pagesLesson 5 - Marketing Managementmusafnuzair47No ratings yet

- 5 - Intraday Pattern Practice SessionDocument12 pages5 - Intraday Pattern Practice SessioncollegetradingexchangeNo ratings yet

- Stock ValuationDocument18 pagesStock Valuationdurgesh choudharyNo ratings yet

- Agitators: Use and Maintenance ManualDocument154 pagesAgitators: Use and Maintenance ManualbrasgNo ratings yet

- PolicyScehdule - 2023-09-23T194106.545Document4 pagesPolicyScehdule - 2023-09-23T194106.545Sandip PatraNo ratings yet

- MG PresentationDocument14 pagesMG PresentationsiddhNo ratings yet

- Agriculture Supply Chain Risks and COVID 19 Mitigation Strategies and Implications For The PractitionersDocument28 pagesAgriculture Supply Chain Risks and COVID 19 Mitigation Strategies and Implications For The PractitionersRajat SNo ratings yet

- Odoo 14Document2 pagesOdoo 14Anum ShamimNo ratings yet

- Solution Manual For Financial Accounting in An Economic Context Pratt 9th EditionDocument26 pagesSolution Manual For Financial Accounting in An Economic Context Pratt 9th EditionArielCooperbzqsp100% (90)

- Level - 3 - Unit - 3 Workbook Sample CEFR B1+Document8 pagesLevel - 3 - Unit - 3 Workbook Sample CEFR B1+karyee limNo ratings yet

- Financial Accounting Ii-2Document5 pagesFinancial Accounting Ii-2gautham rajeevanNo ratings yet

- GlobeScan SIGWATCH Future of Business NGO Collaboration Summary Report May2023Document5 pagesGlobeScan SIGWATCH Future of Business NGO Collaboration Summary Report May2023ComunicarSe-ArchivoNo ratings yet

- A Project Report On Winning The Strikers: Shagun SharmaDocument59 pagesA Project Report On Winning The Strikers: Shagun SharmaharshNo ratings yet

- Identified Competencies, BA in Accounting and FinanceDocument10 pagesIdentified Competencies, BA in Accounting and FinanceGizachew Nadew80% (5)

- I. Payback Period Same CF Project A Different CF Project BDocument6 pagesI. Payback Period Same CF Project A Different CF Project Bzh12w8No ratings yet

- Company Tutorial QuesDocument7 pagesCompany Tutorial QuesSIK CHING MEINo ratings yet

- Irr Ra 11697Document20 pagesIrr Ra 11697Jerry Serapion100% (1)

- Basics: How Does GPRS Work?Document3 pagesBasics: How Does GPRS Work?Sopno GhuriNo ratings yet

- Saint Columban College College of Business Education Acctg 104 - Cost Accounting & Control I Cost Accounting CycleDocument1 pageSaint Columban College College of Business Education Acctg 104 - Cost Accounting & Control I Cost Accounting CycleCarlo B CagampangNo ratings yet

- Takunda Advisor PositionsDocument3 pagesTakunda Advisor Positionssilent besaNo ratings yet

- BPR American BankDocument18 pagesBPR American BankGargy ShekharNo ratings yet

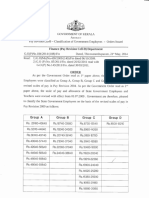

- GO (P) No 184-2014 - (188) - Fin Dated 21-05-2014Document2 pagesGO (P) No 184-2014 - (188) - Fin Dated 21-05-2014Sarath SNo ratings yet

- Stepping Up of Pay: SL - No. Order No. DescriptionDocument4 pagesStepping Up of Pay: SL - No. Order No. DescriptionbyagniNo ratings yet

Derivatives Market in India

Derivatives Market in India

Uploaded by

Varun Verma0 ratings0% found this document useful (0 votes)

15 views7 pagesThe document outlines the development of the derivatives market in India. It discusses how SEBI established committees in 1996 and 1998 to develop a regulatory framework for derivatives trading and risk containment. The Securities Contracts Act was amended in 1999 to regulate derivatives trading on recognized stock exchanges. Derivatives trading commenced in 2000 with index futures and later expanded to include index and single stock options.

Original Description:

Original Title

Derivatives Market in India (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the development of the derivatives market in India. It discusses how SEBI established committees in 1996 and 1998 to develop a regulatory framework for derivatives trading and risk containment. The Securities Contracts Act was amended in 1999 to regulate derivatives trading on recognized stock exchanges. Derivatives trading commenced in 2000 with index futures and later expanded to include index and single stock options.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views7 pagesDerivatives Market in India

Derivatives Market in India

Uploaded by

Varun VermaThe document outlines the development of the derivatives market in India. It discusses how SEBI established committees in 1996 and 1998 to develop a regulatory framework for derivatives trading and risk containment. The Securities Contracts Act was amended in 1999 to regulate derivatives trading on recognized stock exchanges. Derivatives trading commenced in 2000 with index futures and later expanded to include index and single stock options.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

Derivatives Market in India

The first step towards introduction of derivatives trading in India

was the announcement of the Securities Laws (Amendment)

Ordinance, 1995, which withdrew the prohibition on options in

securities.

The market for derivatives, however, did not take off, as there

was no regulatory framework to govern trading of derivatives.

SEBI set up a 24 members committee under the Chairmanship of

Dr. L. C. Gupta on November 18th, 1996 to develop appropriate

regulatory framework for derivatives trading in India.

The committee submitted its report on March 17th, 1998

prescribing necessary pre-conditions for introduction of

derivatives trading in India.

The committee recommended that derivatives should be declared

as 'securities' so that regulatory framework applicable to trading

of 'securities' could also govern trading of securities.

SEBI also set up a group in June 1998 under the Chairmanship of

Prof. J. R. Varma, to recommend measures for risk containment

in derivatives market in India.

The report, which was submitted in October 1998, worked out

the operational details of margining system, methodology for

charging initial margins, broker net worth and real-time

monitoring requirements.

The Securities Contracts (Regulation) Act,1956 was amended in

December 1999 to include derivatives within the range of

'securities' and the regulatory framework was developed for

governing derivatives trading.

• The Act also made it clear that derivatives shall be legal and valid

only if such contracts are traded on a recognized stock exchange,

thus restrict OTC derivatives.

• The Government also cancelled in March 2000, the three decade

old notification, which prohibited forward trading in securities.

Derivatives trading commenced in India in June 2000 after SEBI

granted the final approval to this effect in May 2000.

SEBI permitted the derivative segments of two stock exchanges,

NSE and BSE, and their clearing house/corporation to commence

trading and settlement in approved derivatives contracts.

To begin with, SEBI approved trading in index futures contracts

based on S&P CNX Nifty and BSE-30 (Sensex) index.

CNX stands for Credit Rating Information Services of India

Limited (CRISIL) and the National Stock Exchange of India

(NSE).

This was followed by approval for trading in options based on

these two indexes and options on individual securities.

The trading in index options commenced in June 2001 and the

trading in options on individual securities commenced in July

2001.

Trading and settlement in derivative contracts is done in

accordance with the rules, byelaws, and regulations of the

respective exchanges and their clearing house/corporation duly

approved by SEBI and notified in the official gazette.

Forward Market in India

In India, the forward markets facilitate the hedging of

transactional and contractual exposures.

Transactional exposures are allowed to be hedged up to the

amount of the underlying exposure after providing documentary

evidence of the transaction.

Contractual exposures are permitted to be hedged up to the extent

of the previous year’s turnover or the average of the previous

three years’ turnover, whichever is higher.

Documents have to be provided at the time of the maturity of the

contract.

Since competitive exposure is based on the changes in

technology, product mix, sources of inputs, marketing approach,

shifting of production base etc., the measurement of competitive

exposure is complex and can be inaccurate.

It is for this reason that players are not allowed to hedge their

competitive exposures in the forward market.

The foreign exchange market in India has grown and

matured significantly in the last decade.

This can be attributed to the more liberalized and

globalized environment within which market

participants’ function.

As there has been increasing volatility in exchange rates

and interest rates, there has been a greater need to hedge

foreign exchange risk exposures.

The main players in the forward markets in India are the

Authorized Dealers ( ADs).

These ADs are allowed to deal forward in any permitted

currency.

The following entities can transact with the ADs in the

forward market:

a. The Reserve Bank of India can enter into swap

transactions with the ADs

b. A resident, that is, an importer or exporter can enter into

forward contracts with ADs to hedge against exchange risks.

These importers and exporters are bound by an eligible limit on

the forward contracts. The eligible limit is defined as the

average of the import or export turnover of the last three years

or the previous year’s turnover, whichever is higher.

c. Foreign Institutional Investors (FIIs) are also eligible for

forward contracts with ADs up to the full extent of their

investments in debt and equity.

d. Foreign Direct Investors ( FDI) are also eligible to enter into

forward contract with ADs for a period not exceeding six

months. Besides, they are allowed to hedge their risk only after

they have completed all formalities and obtained necessary

approvals.

e. Residents with overseas direct investment in equities and loans

may also hedge against foreign exchange risks arising from

such investments.

In the current scheme of things, hedging of

foreign currency exposure is not permitted in

the Indian forward market.

This currency exposure arises when a

customer who has a rupee exposure converts

it into a foreign currency exposure through a

rupee-foreign currency swap.

In such a swap, the customer faces two types

of risk, one is the currency risk , that is the

fear of the depreciation of the rupee vs the

foreign currency and the other is the interest

rate risk.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Nebosh PSM SummaryDocument67 pagesNebosh PSM SummaryAhmed Hamad100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Demand Letter Business PermitDocument3 pagesDemand Letter Business PermitJazz Adaza100% (1)

- Income Indirect Taxes VAT Slides ICPAK Presentation Gideon RotichDocument26 pagesIncome Indirect Taxes VAT Slides ICPAK Presentation Gideon RotichREJAY89No ratings yet

- 06 - Qualitative Automotive Glass Bending by Selecting The Right Heat Resistant Tool CoveringDocument18 pages06 - Qualitative Automotive Glass Bending by Selecting The Right Heat Resistant Tool CoveringProvappiNo ratings yet

- Kamrul Hassan Report Submission On RAKUB BCOM FINALDocument6 pagesKamrul Hassan Report Submission On RAKUB BCOM FINALKamrulHassanNo ratings yet

- Workbook 2Document35 pagesWorkbook 2Lalit SapkaleNo ratings yet

- Revised Syllabus For GDMM/PGDMM: Indian Institute of Materials ManagementDocument91 pagesRevised Syllabus For GDMM/PGDMM: Indian Institute of Materials ManagementVanita GanthadeNo ratings yet

- Lesson 5 - Marketing ManagementDocument21 pagesLesson 5 - Marketing Managementmusafnuzair47No ratings yet

- 5 - Intraday Pattern Practice SessionDocument12 pages5 - Intraday Pattern Practice SessioncollegetradingexchangeNo ratings yet

- Stock ValuationDocument18 pagesStock Valuationdurgesh choudharyNo ratings yet

- Agitators: Use and Maintenance ManualDocument154 pagesAgitators: Use and Maintenance ManualbrasgNo ratings yet

- PolicyScehdule - 2023-09-23T194106.545Document4 pagesPolicyScehdule - 2023-09-23T194106.545Sandip PatraNo ratings yet

- MG PresentationDocument14 pagesMG PresentationsiddhNo ratings yet

- Agriculture Supply Chain Risks and COVID 19 Mitigation Strategies and Implications For The PractitionersDocument28 pagesAgriculture Supply Chain Risks and COVID 19 Mitigation Strategies and Implications For The PractitionersRajat SNo ratings yet

- Odoo 14Document2 pagesOdoo 14Anum ShamimNo ratings yet

- Solution Manual For Financial Accounting in An Economic Context Pratt 9th EditionDocument26 pagesSolution Manual For Financial Accounting in An Economic Context Pratt 9th EditionArielCooperbzqsp100% (90)

- Level - 3 - Unit - 3 Workbook Sample CEFR B1+Document8 pagesLevel - 3 - Unit - 3 Workbook Sample CEFR B1+karyee limNo ratings yet

- Financial Accounting Ii-2Document5 pagesFinancial Accounting Ii-2gautham rajeevanNo ratings yet

- GlobeScan SIGWATCH Future of Business NGO Collaboration Summary Report May2023Document5 pagesGlobeScan SIGWATCH Future of Business NGO Collaboration Summary Report May2023ComunicarSe-ArchivoNo ratings yet

- A Project Report On Winning The Strikers: Shagun SharmaDocument59 pagesA Project Report On Winning The Strikers: Shagun SharmaharshNo ratings yet

- Identified Competencies, BA in Accounting and FinanceDocument10 pagesIdentified Competencies, BA in Accounting and FinanceGizachew Nadew80% (5)

- I. Payback Period Same CF Project A Different CF Project BDocument6 pagesI. Payback Period Same CF Project A Different CF Project Bzh12w8No ratings yet

- Company Tutorial QuesDocument7 pagesCompany Tutorial QuesSIK CHING MEINo ratings yet

- Irr Ra 11697Document20 pagesIrr Ra 11697Jerry Serapion100% (1)

- Basics: How Does GPRS Work?Document3 pagesBasics: How Does GPRS Work?Sopno GhuriNo ratings yet

- Saint Columban College College of Business Education Acctg 104 - Cost Accounting & Control I Cost Accounting CycleDocument1 pageSaint Columban College College of Business Education Acctg 104 - Cost Accounting & Control I Cost Accounting CycleCarlo B CagampangNo ratings yet

- Takunda Advisor PositionsDocument3 pagesTakunda Advisor Positionssilent besaNo ratings yet

- BPR American BankDocument18 pagesBPR American BankGargy ShekharNo ratings yet

- GO (P) No 184-2014 - (188) - Fin Dated 21-05-2014Document2 pagesGO (P) No 184-2014 - (188) - Fin Dated 21-05-2014Sarath SNo ratings yet

- Stepping Up of Pay: SL - No. Order No. DescriptionDocument4 pagesStepping Up of Pay: SL - No. Order No. DescriptionbyagniNo ratings yet