Professional Documents

Culture Documents

Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)

Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)

Uploaded by

Mega RefiyaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)

Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)

Uploaded by

Mega RefiyaniCopyright:

Available Formats

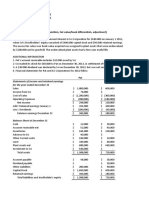

Langkah 2

1. Perhitungan Upstream

PT B PT A Jumlah Konsolidasi Sales =

Sales $ 85,000 $ 85,000

COGS $ 68,000 $ 68,000

Inventory $ 85,000 $ 85,000 $ 68,000

a. Jurnal Eliminasi transaksi antar perusahaan COGS =

Sales $ 85,000

COGS $ 68,000

Inventory $ 17,000 selisih

Langkah 3

Income from PT. B $ 40,000

Adjustment:

Inventory Sold $ 2,500

Amortization Building $ 500

Upstream Profit for upstream sales $ 17,000 $ 20,000

Adjusted Income $ 20,000

Income For PT A

(20.000 x 80%) = 16.000

b. Jurnal Eliminasi Pendapatan dan Dividen dari perusahaan anak dan

menyesuaikan akun investasi ke saldo awal

Income From PT. B $ 16,000

Dividen $ 8,000

Investment in PT. B $ 8,000

Langkah 4

c. Jurnal Penyesuaian Pendapatan untuk NCI dan Dividen dari Perusahaan Anak

NCI Share $ 4,000

Dividen $ 2,000

NCI 31 Des $ 2,000

Langkah 5

d. Eliminasi Akun Resiprokal Investasi dan Ekuitas Perusahaan Anak

Cost of 80% $ 80,000

Implied Value $ 100,000

BV of Net Asset $ 80,000

Excess $ 20,000

NCI (20% x Implied Value) $ 20,000

Common Stock PT. B $ 50,000

Retained Earning PT.B $ 30,000

Unamortized Excess $ 20,000

Investment in PT.B $ 80,000

NCI 1 Jan $ 20,000

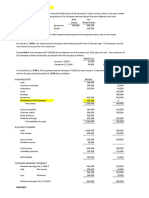

Langkah 6

e. Alokasi Nilai Wajar dari Excess

Inventory $ 2,500

Land $ 7,500

Building & Equipment $ 5,000

Goodwill $ 5,000

Unamortized Excess $ 20,000

Unamortized Unamortized

Excess Jan 1, Amortization Excess Dec 31,

2016 2016

Inventory $ 2,500 $ (2,500) $ -

Land $ 7,500 $ 7,500

Building & Equipment $ 5,000 $ (500) $ 4,500

Goodwill $ 5,000 $ 5,000

$ 20,000 $ (3,000) $ 17,000

f. Amortisasi Nilai Wajar dari Excess

Cost of Goods Sold $ 2,500

Inventory $ 2,500

Depreciation Expense $ 500

Building&Equipment $ 500

200.000 unit x ($ 0,1 x 1,25) + 400.000 unit x ($ 0,12 x 1,25

25.000 + 60.000

85,000

(200.000 x $ 0,1) + (400.000 x $ 0,12)

20.000 + 48.000

68,000

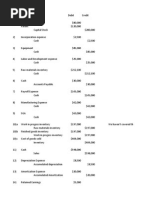

KERTAS KERJA KONSOLIDASI 31 DESEMBER 2020

PT A PT B Adjusted and Elimination

INCOME STATEMENT

Sales 600,000 139,000 85,000

Income From PT B 16,000 16,000

Cost of goods sold (225,000) (104,000) 2,500

Depreciation Expense (30,000) (2,500) 500

Other Expense (107,000) (13,500)

NCI Share 4,000

Controlling Share of Net Income 254,000 19,000

RETAINED EARNING STATEMENT

Retained Earning-PT A 200,000

Retained Earning-PT B 30,000 30,000

Controlling share of Net Income 254,000 19,000

Dividends (20,000) (10,000)

Retained Earnings, December 31 434,000 39,000

BALANCE SHEET AT DECEMBER 31

Cash 515,000 50,000

Account Receivable-net 196,000 20,000

Inventories 80,000 15,000 2,500

Land 150,000 55,000 7,500

Building & Equipment 140,000 20,000 5,000

Investment in PT B 88,000

Patent 40,000

Goodwill 5,000

Unamortized excess 20,000

Total Assets 1,209,000 160,000

Account Payable 125,000 21,000

Other Liabilities 150,000 50,000

Common Stock, $10 Par 500,000 50,000 50,000

Retained Earnings 434,000 39,000

NCI, January 1

NCI, December 31

Total Liability&Equity 1,209,000 160,000 228,000

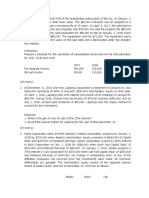

BER 2020

Consolidated

justed and Elimination

Statement

654,000

-

68,000 (263,500)

(33,000)

(120,500)

(4,000)

233,000

200,000

-

233,000

8,000

(20,000)

2,000

413,000

565,000

216,000

17,000

78,000

2,500

212,500

500 164,500

80,000

-

8,000

40,000

5,000

20,000 -

1,281,000

146,000

200,000

500,000

413,000

20,000 20,000

2,000 2,000

228,000 1,281,000

You might also like

- AfarDocument128 pagesAfarlloyd77% (57)

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument16 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (22)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- Applied Group Fin Reporting-Changes in Group Structure PDFDocument25 pagesApplied Group Fin Reporting-Changes in Group Structure PDFObey SitholeNo ratings yet

- Gitman IM Ch03Document15 pagesGitman IM Ch03tarekffNo ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Tugas Pertemuan 5Document5 pagesTugas Pertemuan 5Ilham FaridNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- Assignment Akl Bab 4 (Kel. 7)Document5 pagesAssignment Akl Bab 4 (Kel. 7)Nadiyah ShofwahNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Dian Sari (A031171703) Tugas Akl IiDocument3 pagesDian Sari (A031171703) Tugas Akl Iidian sariNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Chapter 3 SolutionsDocument7 pagesChapter 3 Solutionshassan.murad63% (8)

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Soal AKM 2015Document24 pagesSoal AKM 2015Siti Armayani RayNo ratings yet

- Assignment 3 ACC 401Document9 pagesAssignment 3 ACC 401ShannonNo ratings yet

- AFA Tut 2Document16 pagesAFA Tut 2Đỗ Kim ChiNo ratings yet

- AKL1C - Soal7 Dan E6-11 - Marhaendra Ihza Pahlevi - 18013010085Document4 pagesAKL1C - Soal7 Dan E6-11 - Marhaendra Ihza Pahlevi - 18013010085mahendra ihzaNo ratings yet

- Alfiani - QUIZ 1 IASDocument23 pagesAlfiani - QUIZ 1 IASWilda Sania MtNo ratings yet

- Asynchronous Statement of Financial Position XYZ CompanyDocument5 pagesAsynchronous Statement of Financial Position XYZ CompanyDiana Fernandez MagnoNo ratings yet

- Accounting 3 4 Module 3aDocument2 pagesAccounting 3 4 Module 3aMnriMinaNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsTamar PkhakadzeNo ratings yet

- Account For Home Office and Branch Transactions. ProblemDocument2 pagesAccount For Home Office and Branch Transactions. ProblemDevine Grace A. MaghinayNo ratings yet

- H.W ch4q7 Acc418Document4 pagesH.W ch4q7 Acc418SARA ALKHODAIRNo ratings yet

- BE Chap 17Document3 pagesBE Chap 17TIÊN NGUYỄN LÊ MỸNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- Account Debit CreditDocument4 pagesAccount Debit CreditMcKenzie WNo ratings yet

- C. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Document1 pageC. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Shaira GampongNo ratings yet

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzNo ratings yet

- 6306903Document4 pages6306903maudiNo ratings yet

- MGMT AssignmentDocument79 pagesMGMT AssignmentLuleseged Gebre100% (1)

- Dispensers of California (Jeff)Document9 pagesDispensers of California (Jeff)Jeffery KaoNo ratings yet

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- 5.1 Kunci Jawaban Minggu 5 Lap Konsol 15 - 19 Feb 2016Document6 pages5.1 Kunci Jawaban Minggu 5 Lap Konsol 15 - 19 Feb 2016agustadivNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- BAb V Buku Bu IInDocument6 pagesBAb V Buku Bu IInAditya Agung SatrioNo ratings yet

- LabChapt P3-34 P3-35Document5 pagesLabChapt P3-34 P3-35Meisya VianqaNo ratings yet

- Afar PDFDocument128 pagesAfar PDFMelyn Bustamante100% (1)

- 2208 ch22Document7 pages2208 ch22Clyde Ian Brett PeñaNo ratings yet

- P4-3 WPDocument4 pagesP4-3 WPAna LailaNo ratings yet

- Interco Trans AnsDocument5 pagesInterco Trans Ansmartinfaith958No ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- Gina Purdiyanti - 20181211031 Asdos AKL2Document6 pagesGina Purdiyanti - 20181211031 Asdos AKL2gina amsyarNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Problem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Document6 pagesProblem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Vincent FrancoNo ratings yet

- Bai Tap KTQT 2Document12 pagesBai Tap KTQT 2Tram NguyenNo ratings yet

- AKL Kelompok 2Document11 pagesAKL Kelompok 2Wbok ZapztwvNo ratings yet

- Cost Management 2Document5 pagesCost Management 2melesemelaku1234No ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Extra Session 2 (30 Sept 2022) Spreadsheet (CH 3)Document2 pagesExtra Session 2 (30 Sept 2022) Spreadsheet (CH 3)georgius gabrielNo ratings yet

- Practice For Quiz #3 Solutions For StudentsDocument10 pagesPractice For Quiz #3 Solutions For Studentssylstria.mcNo ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Intangibles - TOADocument20 pagesIntangibles - TOAYen100% (2)

- Intangible AssetsDocument4 pagesIntangible AssetsDianna DayawonNo ratings yet

- D2Document12 pagesD2neo14No ratings yet

- Business Combination SummaryDocument5 pagesBusiness Combination SummaryClarice ClaritoNo ratings yet

- IFRS-at-a-Glance 30 June 2021Document132 pagesIFRS-at-a-Glance 30 June 2021Asad MuhammadNo ratings yet

- 20 Admission of PartnerDocument12 pages20 Admission of PartnerNadeem Manzoor100% (1)

- Book AccountingDocument220 pagesBook Accountingcunbg vubNo ratings yet

- CFAP AAFR Winter 2021 AnswersDocument7 pagesCFAP AAFR Winter 2021 AnswersHassanNo ratings yet

- Partnership AcctgDocument3 pagesPartnership AcctgcessbrightNo ratings yet

- Scaling Operations Worksheet2Document56 pagesScaling Operations Worksheet2olusegun0% (2)

- Akuntansi Keuangan LanjutanDocument28 pagesAkuntansi Keuangan LanjutanYulitaNo ratings yet

- EngineeringDocument29 pagesEngineeringi aNo ratings yet

- Business CombinationsDocument164 pagesBusiness CombinationsOmar Elmi DiriehNo ratings yet

- IAS 36 - Impairment of AssetsDocument6 pagesIAS 36 - Impairment of AssetsStanley RobertNo ratings yet

- Barth Etal The Relevance of The Value Relevance AnotherviewDocument28 pagesBarth Etal The Relevance of The Value Relevance AnotherviewMaz ShuliztNo ratings yet

- Reverse Acquisition MillanDocument5 pagesReverse Acquisition MillanJessica IslaNo ratings yet

- Chapter 3 ProblemsDocument11 pagesChapter 3 Problemsahmed arfan100% (1)

- 2023 Hacc421 Hspac427 Wip BDocument7 pages2023 Hacc421 Hspac427 Wip Bagrippa [OrleanNo ratings yet

- December 2020 DipIFR - Question - AnswerDocument25 pagesDecember 2020 DipIFR - Question - Answerksaqib89No ratings yet

- Small and Medium-Sized Entities (Smes) : Page 1 of 6Document6 pagesSmall and Medium-Sized Entities (Smes) : Page 1 of 6globeth berbanoNo ratings yet

- This Study Resource Was: Problem 1-PatentDocument6 pagesThis Study Resource Was: Problem 1-PatentJan JanNo ratings yet

- Baker Chapter 1Document40 pagesBaker Chapter 1rahmawNo ratings yet

- Activity - Home Office, Branch Accounting & Business Combination (REVIEWER MIDTERM)Document11 pagesActivity - Home Office, Branch Accounting & Business Combination (REVIEWER MIDTERM)Paupau100% (1)

- Retirement of Partner, Treatment of GoodwillDocument6 pagesRetirement of Partner, Treatment of GoodwillBoobalan RNo ratings yet

- Accounting For Business CombinationsDocument116 pagesAccounting For Business CombinationsarakeelNo ratings yet

- Pas 38 - Intangible AssetsDocument6 pagesPas 38 - Intangible AssetsJessie ForpublicuseNo ratings yet

- Materi Lab 3 - Stock Investment PDFDocument4 pagesMateri Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Verification of Assets and LiabilitiesDocument51 pagesVerification of Assets and Liabilitiessherly joiceNo ratings yet

- Consolidation AccountingDocument3 pagesConsolidation AccountingTauseef AbbasNo ratings yet