Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsFinancial Modelling: Professor Paolo Zaffaroni

Financial Modelling: Professor Paolo Zaffaroni

Uploaded by

Cathy ChenCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Statistics For The Behavioral Sciences 3rd Edition Ebook PDFDocument61 pagesStatistics For The Behavioral Sciences 3rd Edition Ebook PDFantonia.connor78994% (51)

- Introduction To The Practice of Statistics 9th Edition Ebook PDFDocument61 pagesIntroduction To The Practice of Statistics 9th Edition Ebook PDFjose.waller36898% (53)

- Fundamentals of Biostatistics for Public Health StudentsFrom EverandFundamentals of Biostatistics for Public Health StudentsNo ratings yet

- Course Outline For Advanced StatisticskjhbkDocument2 pagesCourse Outline For Advanced StatisticskjhbkeyassadailehNo ratings yet

- Probability and Statistics Ver.6 - May2013 PDFDocument129 pagesProbability and Statistics Ver.6 - May2013 PDFFarah Najihah Sethjiha100% (1)

- Biostatistics: A Foundation For Analysis in The Health SciencesDocument5 pagesBiostatistics: A Foundation For Analysis in The Health SciencesEri Wijaya HafidNo ratings yet

- Course Syllabus On EconometricsDocument2 pagesCourse Syllabus On EconometricsFrance MoNo ratings yet

- Stqs1023 Statistics For It-Silibus StudentDocument3 pagesStqs1023 Statistics For It-Silibus StudentshahinNo ratings yet

- Introduction To The Practice of Statistics Ninth Edition Ebook PDF VersionDocument61 pagesIntroduction To The Practice of Statistics Ninth Edition Ebook PDF Versionjose.waller368100% (51)

- Ise Elementary Statistics A Step by Step Approach A Brief Version 8E 8Th Edition Allan G Bluman Full ChapterDocument67 pagesIse Elementary Statistics A Step by Step Approach A Brief Version 8E 8Th Edition Allan G Bluman Full Chapterkatelyn.willis396100% (5)

- Foundations of Applied Statistical Methods 2Nd Edition Hang Lee Online Ebook Texxtbook Full Chapter PDFDocument69 pagesFoundations of Applied Statistical Methods 2Nd Edition Hang Lee Online Ebook Texxtbook Full Chapter PDFmarilyn.shay171100% (14)

- 1probability and Statistics For Pre-Engineers Course OutlineDocument3 pages1probability and Statistics For Pre-Engineers Course OutlineBiladenNo ratings yet

- Introduction to Statistics and Data AnalysisDocument567 pagesIntroduction to Statistics and Data AnalysisLeon PatiñoNo ratings yet

- Contents of Basic Biostatistics: ProgramDocument1 pageContents of Basic Biostatistics: ProgramorivallsNo ratings yet

- MATH 233 Syllabus-RevisedDocument3 pagesMATH 233 Syllabus-RevisedmajdfomariNo ratings yet

- Introduction To Econometrics Ebook PDFDocument89 pagesIntroduction To Econometrics Ebook PDFjoseph.bland830No ratings yet

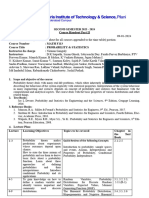

- Faculty of Computer & IT: Course OutlineDocument4 pagesFaculty of Computer & IT: Course OutlineOmar BarcaNo ratings yet

- Midterm Exam Study Guide ST314-3Document4 pagesMidterm Exam Study Guide ST314-3Isak FoshayNo ratings yet

- STAT342 Chap00 PDFDocument18 pagesSTAT342 Chap00 PDFHamzaBaigNo ratings yet

- (Ebook PDF) (Ebook PDF) The Analysis of Biological Data Second Edition All ChapterDocument49 pages(Ebook PDF) (Ebook PDF) The Analysis of Biological Data Second Edition All Chapterjoymeekianti100% (7)

- Business Course OutlineDocument2 pagesBusiness Course OutlineMinyichel BayeNo ratings yet

- Math F113Document3 pagesMath F113lsaidheeraj9No ratings yet

- Introduction To Econometrics 3Rd Edition James H Stock Full ChapterDocument51 pagesIntroduction To Econometrics 3Rd Edition James H Stock Full Chapteragnes.baer637100% (8)

- Test Item Bank LS3 JHSDocument14 pagesTest Item Bank LS3 JHSMaria Geraldhine Dhine LastraNo ratings yet

- CPT Examination: A.Mathematics 1.ratio and ProportionDocument6 pagesCPT Examination: A.Mathematics 1.ratio and ProportionglobalmanagementstudiesNo ratings yet

- Statistics For AnalystDocument11 pagesStatistics For AnalystSKPACANo ratings yet

- Statistics Report..Document34 pagesStatistics Report..Tanvir Ahmed TariqueNo ratings yet

- Course OutlineDocument1 pageCourse Outlinebeshahashenafe20No ratings yet

- Applied Statistics From Bivariate Through Multivariate Techniques Second Edition Ebook PDF VersionDocument62 pagesApplied Statistics From Bivariate Through Multivariate Techniques Second Edition Ebook PDF Versionteri.sanborn876100% (49)

- Mansinadez Psychstats Midtermexam AnswersheetDocument3 pagesMansinadez Psychstats Midtermexam Answersheetmain.23002079No ratings yet

- Lecture Notes: (Introduction To Medical Laboratory Science Research)Document13 pagesLecture Notes: (Introduction To Medical Laboratory Science Research)Heloise Krystene SindolNo ratings yet

- TTE3004 Lecture 04Document43 pagesTTE3004 Lecture 04nghuziNo ratings yet

- IAI CS1 Syllabus 2024Document6 pagesIAI CS1 Syllabus 2024agnivodeystat1068No ratings yet

- HandoutDocument4 pagesHandoutPrinshu RawatNo ratings yet

- Introduction To Econometrics Pearson Series in Economics Hardcover 3rd Edition Ebook PDFDocument62 pagesIntroduction To Econometrics Pearson Series in Economics Hardcover 3rd Edition Ebook PDFdana.nelson195100% (51)

- Statistical Inference for Models with Multivariate t-Distributed ErrorsFrom EverandStatistical Inference for Models with Multivariate t-Distributed ErrorsNo ratings yet

- Mu CP 23 24Document13 pagesMu CP 23 24Hemil ShahNo ratings yet

- 1.1 Introduction To Data and Measurement IssuesDocument8 pages1.1 Introduction To Data and Measurement IssuesBlake ColegroveNo ratings yet

- Sub Committee For Curriculum Development QS &A SpecializationDocument3 pagesSub Committee For Curriculum Development QS &A SpecializationSumit Kumar SahooNo ratings yet

- Textbook Introduction To Econometrics 3Rd Edition James H Stock Ebook All Chapter PDFDocument53 pagesTextbook Introduction To Econometrics 3Rd Edition James H Stock Ebook All Chapter PDFaaron.plante984100% (13)

- Wan Lin Sim 2014Document18 pagesWan Lin Sim 2014林宗儀No ratings yet

- Haramaya University College of Computing and Informatics Department of StatisticsDocument2 pagesHaramaya University College of Computing and Informatics Department of StatisticsSeenaa N DachaasaaNo ratings yet

- Introductory Biostatistics for the Health Sciences: Modern Applications Including BootstrapFrom EverandIntroductory Biostatistics for the Health Sciences: Modern Applications Including BootstrapRating: 3 out of 5 stars3/5 (1)

- EXPRESS STATISTICS "Hassle Free" ® For Public Administrators, Educators, Students, and Research PractitionersFrom EverandEXPRESS STATISTICS "Hassle Free" ® For Public Administrators, Educators, Students, and Research PractitionersNo ratings yet

- Generalized Linear and Nonlinear Models for Correlated Data: Theory and Applications Using SASFrom EverandGeneralized Linear and Nonlinear Models for Correlated Data: Theory and Applications Using SASNo ratings yet

- The Diagnostic Process: Graphic Approach to Probability and Inference in Clinical MedicineFrom EverandThe Diagnostic Process: Graphic Approach to Probability and Inference in Clinical MedicineNo ratings yet

- Decision Analytics and Optimization in Disease Prevention and TreatmentFrom EverandDecision Analytics and Optimization in Disease Prevention and TreatmentNan KongNo ratings yet

Financial Modelling: Professor Paolo Zaffaroni

Financial Modelling: Professor Paolo Zaffaroni

Uploaded by

Cathy Chen0 ratings0% found this document useful (0 votes)

10 views6 pagesOriginal Title

Session 1 slides

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views6 pagesFinancial Modelling: Professor Paolo Zaffaroni

Financial Modelling: Professor Paolo Zaffaroni

Uploaded by

Cathy ChenCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

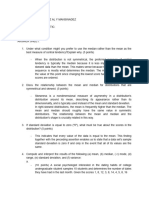

Financial Modelling

Professor Paolo Zaffaroni

© Imperial College Business School

1. Summarizing Data

1.1 Graphical summaries of the data

Dot plot and histogram

The time series plot

1.2 Numerical descriptive measures

1.3 Measures of central tendency

The sample mean

The median

Mean versus median

1.4 Measures of dispersion

The sample variance

The sample standard deviation

1.5 The empirical rule

1.6 How to relate two things

1.7 Linearly related variables

Linear functions

Mean and variance of a linear function

Linear combinations

Mean and variance of a linear combination

2. Continuous Random Variables

2.1 Probability and Random Variables

2.2 Continuous Random Variables, the p.d.f

2.3 The Normal Family of Distributions

2.4 The C.d.F

2.5 I.I.D. Random Variables

2.6 I.I.D. Draws from the Normal Distribution

2.7 The Histogram and I.I.D. Draws

2.8 The Normal Distribution and Data

2.9 Standardization

© Imperial College Business School

3. Numerical Summaries

for Random Variables

3.1 Expected Value as Long Run Average

3.2 Theoretical Variance as Long Run Sample Variance

3.3 Expected Value and Variance of a Continuous RV

3.4 Population versus Sample Quantities

3.5 Mean and Variance of a Linear Function

3.6 Covariance and Correlation for RVs

3.7 Mean and Variance of a Linear Combination

3.8 The Central Limit Theorem

3.9 Combinations of Independent Normals

© Imperial College Business School

4. Estimates and Confidence

Intervals

4.1 Estimating a Normal Mean

4.2 The Distribution of the Normal Sample Mean

4.3 Normal Data, Confidence Interval for µ, s Known

4.4 Normal Data, Confidence Interval for µ, s Unknown

(the t-distribution)

4.5 The Central Limit Theorem and a General

Approximate Confidence Interval for µ

4.6 Summary

4.7 Prediction with I.I.D. Normal Data

© Imperial College Business School

5. Hypothesis Tests and

P-values

5.1 Hypothesis Tests for µ

5.2 P-values

5.3 Confidence Intervals and Hypothesis Tests:

The big picture

© Imperial College Business School

You might also like

- Statistics For The Behavioral Sciences 3rd Edition Ebook PDFDocument61 pagesStatistics For The Behavioral Sciences 3rd Edition Ebook PDFantonia.connor78994% (51)

- Introduction To The Practice of Statistics 9th Edition Ebook PDFDocument61 pagesIntroduction To The Practice of Statistics 9th Edition Ebook PDFjose.waller36898% (53)

- Fundamentals of Biostatistics for Public Health StudentsFrom EverandFundamentals of Biostatistics for Public Health StudentsNo ratings yet

- Course Outline For Advanced StatisticskjhbkDocument2 pagesCourse Outline For Advanced StatisticskjhbkeyassadailehNo ratings yet

- Probability and Statistics Ver.6 - May2013 PDFDocument129 pagesProbability and Statistics Ver.6 - May2013 PDFFarah Najihah Sethjiha100% (1)

- Biostatistics: A Foundation For Analysis in The Health SciencesDocument5 pagesBiostatistics: A Foundation For Analysis in The Health SciencesEri Wijaya HafidNo ratings yet

- Course Syllabus On EconometricsDocument2 pagesCourse Syllabus On EconometricsFrance MoNo ratings yet

- Stqs1023 Statistics For It-Silibus StudentDocument3 pagesStqs1023 Statistics For It-Silibus StudentshahinNo ratings yet

- Introduction To The Practice of Statistics Ninth Edition Ebook PDF VersionDocument61 pagesIntroduction To The Practice of Statistics Ninth Edition Ebook PDF Versionjose.waller368100% (51)

- Ise Elementary Statistics A Step by Step Approach A Brief Version 8E 8Th Edition Allan G Bluman Full ChapterDocument67 pagesIse Elementary Statistics A Step by Step Approach A Brief Version 8E 8Th Edition Allan G Bluman Full Chapterkatelyn.willis396100% (5)

- Foundations of Applied Statistical Methods 2Nd Edition Hang Lee Online Ebook Texxtbook Full Chapter PDFDocument69 pagesFoundations of Applied Statistical Methods 2Nd Edition Hang Lee Online Ebook Texxtbook Full Chapter PDFmarilyn.shay171100% (14)

- 1probability and Statistics For Pre-Engineers Course OutlineDocument3 pages1probability and Statistics For Pre-Engineers Course OutlineBiladenNo ratings yet

- Introduction to Statistics and Data AnalysisDocument567 pagesIntroduction to Statistics and Data AnalysisLeon PatiñoNo ratings yet

- Contents of Basic Biostatistics: ProgramDocument1 pageContents of Basic Biostatistics: ProgramorivallsNo ratings yet

- MATH 233 Syllabus-RevisedDocument3 pagesMATH 233 Syllabus-RevisedmajdfomariNo ratings yet

- Introduction To Econometrics Ebook PDFDocument89 pagesIntroduction To Econometrics Ebook PDFjoseph.bland830No ratings yet

- Faculty of Computer & IT: Course OutlineDocument4 pagesFaculty of Computer & IT: Course OutlineOmar BarcaNo ratings yet

- Midterm Exam Study Guide ST314-3Document4 pagesMidterm Exam Study Guide ST314-3Isak FoshayNo ratings yet

- STAT342 Chap00 PDFDocument18 pagesSTAT342 Chap00 PDFHamzaBaigNo ratings yet

- (Ebook PDF) (Ebook PDF) The Analysis of Biological Data Second Edition All ChapterDocument49 pages(Ebook PDF) (Ebook PDF) The Analysis of Biological Data Second Edition All Chapterjoymeekianti100% (7)

- Business Course OutlineDocument2 pagesBusiness Course OutlineMinyichel BayeNo ratings yet

- Math F113Document3 pagesMath F113lsaidheeraj9No ratings yet

- Introduction To Econometrics 3Rd Edition James H Stock Full ChapterDocument51 pagesIntroduction To Econometrics 3Rd Edition James H Stock Full Chapteragnes.baer637100% (8)

- Test Item Bank LS3 JHSDocument14 pagesTest Item Bank LS3 JHSMaria Geraldhine Dhine LastraNo ratings yet

- CPT Examination: A.Mathematics 1.ratio and ProportionDocument6 pagesCPT Examination: A.Mathematics 1.ratio and ProportionglobalmanagementstudiesNo ratings yet

- Statistics For AnalystDocument11 pagesStatistics For AnalystSKPACANo ratings yet

- Statistics Report..Document34 pagesStatistics Report..Tanvir Ahmed TariqueNo ratings yet

- Course OutlineDocument1 pageCourse Outlinebeshahashenafe20No ratings yet

- Applied Statistics From Bivariate Through Multivariate Techniques Second Edition Ebook PDF VersionDocument62 pagesApplied Statistics From Bivariate Through Multivariate Techniques Second Edition Ebook PDF Versionteri.sanborn876100% (49)

- Mansinadez Psychstats Midtermexam AnswersheetDocument3 pagesMansinadez Psychstats Midtermexam Answersheetmain.23002079No ratings yet

- Lecture Notes: (Introduction To Medical Laboratory Science Research)Document13 pagesLecture Notes: (Introduction To Medical Laboratory Science Research)Heloise Krystene SindolNo ratings yet

- TTE3004 Lecture 04Document43 pagesTTE3004 Lecture 04nghuziNo ratings yet

- IAI CS1 Syllabus 2024Document6 pagesIAI CS1 Syllabus 2024agnivodeystat1068No ratings yet

- HandoutDocument4 pagesHandoutPrinshu RawatNo ratings yet

- Introduction To Econometrics Pearson Series in Economics Hardcover 3rd Edition Ebook PDFDocument62 pagesIntroduction To Econometrics Pearson Series in Economics Hardcover 3rd Edition Ebook PDFdana.nelson195100% (51)

- Statistical Inference for Models with Multivariate t-Distributed ErrorsFrom EverandStatistical Inference for Models with Multivariate t-Distributed ErrorsNo ratings yet

- Mu CP 23 24Document13 pagesMu CP 23 24Hemil ShahNo ratings yet

- 1.1 Introduction To Data and Measurement IssuesDocument8 pages1.1 Introduction To Data and Measurement IssuesBlake ColegroveNo ratings yet

- Sub Committee For Curriculum Development QS &A SpecializationDocument3 pagesSub Committee For Curriculum Development QS &A SpecializationSumit Kumar SahooNo ratings yet

- Textbook Introduction To Econometrics 3Rd Edition James H Stock Ebook All Chapter PDFDocument53 pagesTextbook Introduction To Econometrics 3Rd Edition James H Stock Ebook All Chapter PDFaaron.plante984100% (13)

- Wan Lin Sim 2014Document18 pagesWan Lin Sim 2014林宗儀No ratings yet

- Haramaya University College of Computing and Informatics Department of StatisticsDocument2 pagesHaramaya University College of Computing and Informatics Department of StatisticsSeenaa N DachaasaaNo ratings yet

- Introductory Biostatistics for the Health Sciences: Modern Applications Including BootstrapFrom EverandIntroductory Biostatistics for the Health Sciences: Modern Applications Including BootstrapRating: 3 out of 5 stars3/5 (1)

- EXPRESS STATISTICS "Hassle Free" ® For Public Administrators, Educators, Students, and Research PractitionersFrom EverandEXPRESS STATISTICS "Hassle Free" ® For Public Administrators, Educators, Students, and Research PractitionersNo ratings yet

- Generalized Linear and Nonlinear Models for Correlated Data: Theory and Applications Using SASFrom EverandGeneralized Linear and Nonlinear Models for Correlated Data: Theory and Applications Using SASNo ratings yet

- The Diagnostic Process: Graphic Approach to Probability and Inference in Clinical MedicineFrom EverandThe Diagnostic Process: Graphic Approach to Probability and Inference in Clinical MedicineNo ratings yet

- Decision Analytics and Optimization in Disease Prevention and TreatmentFrom EverandDecision Analytics and Optimization in Disease Prevention and TreatmentNan KongNo ratings yet