Professional Documents

Culture Documents

Fixed Deposit Confirmation Advice

Fixed Deposit Confirmation Advice

Uploaded by

Sureka SwaminathanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fixed Deposit Confirmation Advice

Fixed Deposit Confirmation Advice

Uploaded by

Sureka SwaminathanCopyright:

Available Formats

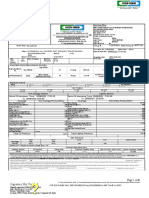

FIXED DEPOSIT CONFIRMATION ADVICE

Deposit Account Number: 50400000776271

Cust ID of 1st Applicant: 43648382

MRS. SUREKA S

Deposit Branch Name: R.K.SALAI

NO 12, PERIYAR NAGAR

Deposit Type: FIXED DEPOSIT -RESIDENT

10TH STREET GENERAL

New Deposit

ADAMBAKKAM

Initial Deposit

CHENNAI-600088 India

PAN No.: BIZPS2769E

Joint 1 : .

Joint 2 : .

Installment Deposit Period Rate of Deposit Aggregate Interest

Amount( In Rs.) Start Date of Deposit(in Months) Interest (%p.a) Maturity Date Amount (in Rs.)

50000.00 08 Oct 2021 60 Month(s) 7.5000 10 Sep 2026 29,084.00

Deposit Amount (in words) : FIFTY THOUSAND ONLY Thank you for banking with us

Mode of operations : SINGLE

Nominee :

Interest Payment Frequency : ON MATURITY

Rahul N Bhagat

Maturity Instruction : REDEEM TO 00041140119285 Country Head - Retail Liabilities

Marketing and Direct Banking Channels

For more information log on to : www.hdfcbank.com HDFC BANK LIMITED

Interest rates are subject to change from time to time. Applicable interest rates will be given as on the date / time of receipt of the funds by the bank. When booking FD through NetBanking please note the actual interest rate being applied on the "Confirm" screen. This screen appears before you confirm your request for opening a new FD. In order to see the latest information, we request you to clear your browsers cache to see the updated interest rates.

It is reiterated that the interest rate applicable on multiple deposits, across all channels, made by the same customer in a single day in one particular tenor bucket would be the rate which is applicable for the aggregate value of such deposits.

Only Senior Citizens / Retired Personnel (60 years and above) who are Resident Indians are eligible. The special rates are applicable only for Resident deposits.

When you open a Fixed deposit with HDFC Bank Interest on Term Deposits is calculated as below

1) On a Quarterly basis for deposits >= 6 months

2) Simple interest is paid at maturity for deposits < 6 months.

3) Cumulative Interest/ re-investment interest is calculated every quarter, and is added to the Principal such that Interest is paid on the Interest earned in the previous quarter as well.

4) In case of monthly deposit scheme, the interest shall be calculated for the quarter and paid monthly at discounted rate over the Standard FD Rate

Tax at source is deducted as per the Income Tax regulations prevalent from time to time.

The Bank computes interest based on the actual number of days in a year. In case, the Deposit is spread over a leap and a non-leap year, the interest is calculated based on the number of days i.e.,366 days in a leap year & 365 days in a non leap year.The period of Fixed Deposit is calculated in number of days.

The Minimum tenure for earning FD interest is 7 days.

The interest rate applicable on premature closure of deposits (all amounts) will be lower of:

Maturity Instructions: _______________________________________________________________________________

__________________________

Signature

For Office Use Only:

Liquidation Instructions

Liquidation : On maturity/Premature withdrawal

Credit Account No. : ________________________________

Issue Pay orders favoring : ________________________________

Date of Liquidation : ________________________________

You might also like

- Iphone 11 Invoice PDFDocument1 pageIphone 11 Invoice PDFspeedenquiry50% (10)

- Estatement PDFDocument1 pageEstatement PDFRudy AlconcherNo ratings yet

- BillDocument2 pagesBillMGGS MDVNo ratings yet

- AxisDocument2 pagesAxisMukeshChoudharyNo ratings yet

- 79297970-108516216167007060120121544567055Document2 pages79297970-108516216167007060120121544567055bahi mansNo ratings yet

- Folio No. 9075 4601 351: Account SummaryDocument2 pagesFolio No. 9075 4601 351: Account SummaryspeedenquiryNo ratings yet

- Folio No. 9104 4783 646: Account SummaryDocument2 pagesFolio No. 9104 4783 646: Account SummarySaurabh BansalNo ratings yet

- Check Disbursements Journal: Appendix 4Document1 pageCheck Disbursements Journal: Appendix 4Tesa GDNo ratings yet

- CP 59763585Document1 pageCP 59763585Sunil PatanwadiyaNo ratings yet

- Sbi DocumentDocument1 pageSbi DocumentFaizan ShabirNo ratings yet

- Transaction Statement1626153268Document2 pagesTransaction Statement1626153268Rohit PalNo ratings yet

- Appendix 2 - CRJDocument1 pageAppendix 2 - CRJJohn Hendrix RegulacionNo ratings yet

- PT - Bharinto Ekatama Non Po Expenses FormDocument1 pagePT - Bharinto Ekatama Non Po Expenses FormWahyu Firanto SetionoNo ratings yet

- Benificiary/Remittance Details CPC7207220 Isro 01/2018 - BE002 - 20203296 - 19 Vivek P GDocument1 pageBenificiary/Remittance Details CPC7207220 Isro 01/2018 - BE002 - 20203296 - 19 Vivek P GprasobhaNo ratings yet

- Afna Nadeem InvoiceDocument1 pageAfna Nadeem InvoiceImtiazNo ratings yet

- StatementDocument2 pagesStatementmatjhombeniNo ratings yet

- Benificiary/Remittance Details CPP5296974 RRB Patna 830116699Document1 pageBenificiary/Remittance Details CPP5296974 RRB Patna 830116699M/s. Gayatree CommunicationNo ratings yet

- CPB 9857796Document1 pageCPB 9857796Aashi ShrinateNo ratings yet

- CPK1935816 PDFDocument1 pageCPK1935816 PDFAmit KumarNo ratings yet

- CPK1935816 PDFDocument1 pageCPK1935816 PDFAmit KumarNo ratings yet

- Bengalore: Ree U'sDocument1 pageBengalore: Ree U'sR ChandruNo ratings yet

- Welcome To Central Record Keeping Agency PDFDocument2 pagesWelcome To Central Record Keeping Agency PDFparthi janaNo ratings yet

- Deposition RepresentDocument1 pageDeposition RepresentkartikssivNo ratings yet

- Isgec Heavy Engineering Limited: Earnings DeductionsDocument1 pageIsgec Heavy Engineering Limited: Earnings DeductionsrohanZorbaNo ratings yet

- BP PackDocument1 pageBP PackNHB ENGINEERSNo ratings yet

- Arrears TR-22Document2 pagesArrears TR-22Ana LisaNo ratings yet

- Jaswant GurjarDocument4 pagesJaswant GurjarNOOB FIRENo ratings yet

- 4100CD37037361 SoaDocument2 pages4100CD37037361 SoaamitNo ratings yet

- Form Claim VoucherDocument1 pageForm Claim Voucherwong warasNo ratings yet

- 5030XXXXDocument1 page5030XXXXgaurav sharmaNo ratings yet

- Smart Statement: Home Loan Cards ServiceDocument4 pagesSmart Statement: Home Loan Cards ServiceLakshmi MuvvalaNo ratings yet

- Scan 185Document2 pagesScan 185Pawan Kumar RaiNo ratings yet

- Transaction Statement1624372022Document1 pageTransaction Statement1624372022RamakantaSahooNo ratings yet

- DEEPAKDocument1 pageDEEPAKShivangi SaxenaNo ratings yet

- Adecco India Pvt. LTD.: Payslip For The Month of September 2017Document1 pageAdecco India Pvt. LTD.: Payslip For The Month of September 2017Sajal RathoreNo ratings yet

- Folio No. 91013246685: Account SummaryDocument2 pagesFolio No. 91013246685: Account Summaryvishnudas acharyaNo ratings yet

- Cash Notes: AmountDocument1 pageCash Notes: AmountRishi KhoslaNo ratings yet

- RiskDocument2 pagesRiskrakesh_danduNo ratings yet

- StatementDocument7 pagesStatementcindyqueen635No ratings yet

- Au Financiers (India) Limited: Loan Allocation DetailsDocument1 pageAu Financiers (India) Limited: Loan Allocation DetailsAshish AgrawalNo ratings yet

- Transaction Statement1627022355Document1 pageTransaction Statement1627022355RamakantaSahooNo ratings yet

- New Vinod FDDocument1 pageNew Vinod FDchirag6383sharmaNo ratings yet

- Bill 20190801 6HGQ26 NSE333995 0 PDFDocument1 pageBill 20190801 6HGQ26 NSE333995 0 PDFVenu MadhavNo ratings yet

- InvoiceDocument1 pageInvoiceSri Cintia DewiNo ratings yet

- Elss 2019 2020Document2 pagesElss 2019 2020Pitabas PradhanNo ratings yet

- CPACWPREZ3Document2 pagesCPACWPREZ3Abdullah siddikiNo ratings yet

- Swastika Investmart LTD.: Payment SuccessfulDocument3 pagesSwastika Investmart LTD.: Payment SuccessfulMd EjazzuddinNo ratings yet

- My Information My Home Branch Information: Mr. Abhilash JDocument4 pagesMy Information My Home Branch Information: Mr. Abhilash JAbhilash JNo ratings yet

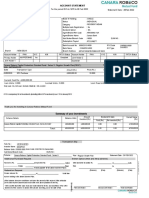

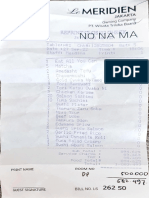

- Nota No Na MaDocument2 pagesNota No Na Magamride09No ratings yet

- Screenshot 2022-09-19 at 1.27.51 PMDocument5 pagesScreenshot 2022-09-19 at 1.27.51 PMhunarjasparNo ratings yet

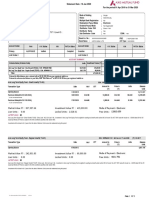

- Inv Fki Jne 1Document1 pageInv Fki Jne 1heri.accNo ratings yet

- Statement of Account 39 09 Nov 19 To 08 Dec 19 866179694 (2) 79604699Document3 pagesStatement of Account 39 09 Nov 19 To 08 Dec 19 866179694 (2) 79604699Ivan UntalanNo ratings yet

- UVSW5 SJXe EHhf X65432Document4 pagesUVSW5 SJXe EHhf X65432NOOB FIRENo ratings yet

- CPADMDKTG8Document1 pageCPADMDKTG8kptcourt1No ratings yet

- Screenshot 2023-08-23 at 10.16.41 AMDocument6 pagesScreenshot 2023-08-23 at 10.16.41 AMKoay Teik boonNo ratings yet

- Benificiary/Remittance Details CPQ3946000 CEN 01 2019 NTPC 12106562277Document1 pageBenificiary/Remittance Details CPQ3946000 CEN 01 2019 NTPC 12106562277manphool singhNo ratings yet

- AxisMF 636161890638030000 40K ELSSDocument1 pageAxisMF 636161890638030000 40K ELSSsamuel270791No ratings yet

- Ts EamcetDocument1 pageTs EamcetGaneshNo ratings yet

- BLW/INV38/04/2020: Note: This Invoice Is Not Valid Whitout Our Official StampDocument2 pagesBLW/INV38/04/2020: Note: This Invoice Is Not Valid Whitout Our Official StampAnisa YosivaNo ratings yet

- Ticket Report - 2021Document106 pagesTicket Report - 2021Sureka SwaminathanNo ratings yet

- TED Java Development Estimation v3Document11 pagesTED Java Development Estimation v3Sureka SwaminathanNo ratings yet

- Programming Question - Batch 2Document6 pagesProgramming Question - Batch 2Sureka SwaminathanNo ratings yet

- Img 20210915 0002Document1 pageImg 20210915 0002Sureka SwaminathanNo ratings yet

- APL NTID For WVD Access-AWSServerDocument5 pagesAPL NTID For WVD Access-AWSServerSureka SwaminathanNo ratings yet

- APL NTID For WVD Access-AWSServer - ShivaDocument5 pagesAPL NTID For WVD Access-AWSServer - ShivaSureka SwaminathanNo ratings yet

- KaribandiRNSSVenkatesh One7tech MuleSoftdeveloperDocument4 pagesKaribandiRNSSVenkatesh One7tech MuleSoftdeveloperSureka SwaminathanNo ratings yet

- NIM64725Document2 pagesNIM64725Sureka SwaminathanNo ratings yet

- LogsDocument4 pagesLogsSureka SwaminathanNo ratings yet

- ALL API Documentation With TokenDocument20 pagesALL API Documentation With TokenSureka SwaminathanNo ratings yet

- ADAVI BALA KOTESWARARAO One7tech MulesoftDeveloperDocument4 pagesADAVI BALA KOTESWARARAO One7tech MulesoftDeveloperSureka SwaminathanNo ratings yet

- Summary Account Payable Statement: JiopayDocument1 pageSummary Account Payable Statement: JiopaySureka SwaminathanNo ratings yet

- Shiv Shakti Herbal Center: Retail InvoiceDocument1 pageShiv Shakti Herbal Center: Retail InvoiceSandhya SrivastavaNo ratings yet

- Sistem Informasi Akademik-4Document1 pageSistem Informasi Akademik-4Friscilla NatasyaNo ratings yet

- The Contemporary WorldDocument6 pagesThe Contemporary WorldRental SystemNo ratings yet

- The Origin of The Tourism in The PhilippinesDocument18 pagesThe Origin of The Tourism in The PhilippinesLove Joy Espinueva100% (1)

- SIAT - Datasheet NASTRO-SB M-Series - ENG - Rev1.2Document2 pagesSIAT - Datasheet NASTRO-SB M-Series - ENG - Rev1.2Szabolcs MártonNo ratings yet

- SDG4 Profile BangladeshDocument7 pagesSDG4 Profile BangladeshShayekh M ArifNo ratings yet

- Finacilisationof The Wall Street ConsensusDocument37 pagesFinacilisationof The Wall Street ConsensusLuis MartinezNo ratings yet

- How To Form A Cooperative JepDocument71 pagesHow To Form A Cooperative JepBrenNan ChannelNo ratings yet

- Module-2: Cost and Revenue, Profit FunctionsDocument37 pagesModule-2: Cost and Revenue, Profit FunctionsArpitha KagdasNo ratings yet

- Test Bank of IMDocument5 pagesTest Bank of IMMohamed RashadNo ratings yet

- Working Capital DecisionsDocument15 pagesWorking Capital DecisionsRuksana MalikNo ratings yet

- Respondant MemorialDocument49 pagesRespondant MemorialAnshuSinghNo ratings yet

- Modernization of Metal Electroplating With No Mask FixturesDocument20 pagesModernization of Metal Electroplating With No Mask FixturestonymailinatorNo ratings yet

- Resource AllocationDocument21 pagesResource AllocationKeneth Ornos100% (2)

- A - Deed of Absolute SaleDocument3 pagesA - Deed of Absolute SalenorieNo ratings yet

- Rfpi & RigidlamDocument60 pagesRfpi & RigidlamJake YalongNo ratings yet

- Account Statement 20230530 20230629 110547Document3 pagesAccount Statement 20230530 20230629 110547DARANo ratings yet

- Ratio AnalysisDocument36 pagesRatio AnalysisHARVENDRA9022 SINGHNo ratings yet

- Entrepreneurs: The Driving Force Behind Small Business: Inc. Publishing As Prentice Hall 1Document32 pagesEntrepreneurs: The Driving Force Behind Small Business: Inc. Publishing As Prentice Hall 1omar ahmedNo ratings yet

- Class 9 English II The Heart of The Tree Extract IDocument6 pagesClass 9 English II The Heart of The Tree Extract IManas KhoslaNo ratings yet

- MPlastics Toys and Engineering Private LimitedDocument9 pagesMPlastics Toys and Engineering Private Limitedshihabshibu105No ratings yet

- DPWH Guard HouseDocument3 pagesDPWH Guard HouseErnestNo ratings yet

- 8 Monkwick To Highwoods From 08 Jan 2023 PDFDocument2 pages8 Monkwick To Highwoods From 08 Jan 2023 PDFJian Xu Daniel ChenNo ratings yet

- Rajasthan: Hawa Mahal in Jaipur, RajasthanDocument52 pagesRajasthan: Hawa Mahal in Jaipur, Rajasthangillnirmal111No ratings yet

- Your RBC Personal Banking Account StatementDocument1 pageYour RBC Personal Banking Account StatementJoseph RichardsonNo ratings yet

- Revision of Accounting Midterm OfficialDocument38 pagesRevision of Accounting Midterm Official23005504No ratings yet

- BPP QuestionsDocument11 pagesBPP Questionsmuhammaduzair00788No ratings yet

- SSLIDES - VATEL - LSLIDES - Chap 3Document30 pagesSSLIDES - VATEL - LSLIDES - Chap 3uyenthanhtran2312No ratings yet

- Sweezy Oligopoly: Here We Introduce The Notion of Oligopoly and Look at One Particular ModelDocument9 pagesSweezy Oligopoly: Here We Introduce The Notion of Oligopoly and Look at One Particular ModelMayank SharmaNo ratings yet