Professional Documents

Culture Documents

The Price Elasticity of Demand Measures The Responsiveness of Consumers To Changes in Price-4

The Price Elasticity of Demand Measures The Responsiveness of Consumers To Changes in Price-4

Uploaded by

Raxilla MaxillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Price Elasticity of Demand Measures The Responsiveness of Consumers To Changes in Price-4

The Price Elasticity of Demand Measures The Responsiveness of Consumers To Changes in Price-4

Uploaded by

Raxilla MaxillaCopyright:

Available Formats

-

The price elasticity of demand measures the responsiveness of consumers to changes in price.

For example, if consumers change their purchasing behavior very little in response to a

drastic change in price, demand is said to be inelastic; but if consumers change their

purchasing behavior a lot in response to a small change in price, demand is said to be

elastic.

If a good has several close substitutes, then many consumers will respond to an

increase in the price of the good by purchasing one of those close substitutes. For

example, many people believe that Coke and Pepsi are close substitutes for each other.

Therefore, holding the price of Pepsi constant, if the price of Coke were to increase,

many consumers would decide to switch to Pepsi. Therefore, the demand for Coke is

relatively elastic. By contrast, there are no close substitutes for insulin as a treatment for

diabetes. As a result, an increase in the price of insulin will not lead to a noticeable

decline in insulin consumption. The demand for insulin is relatively inelastic.

-sports car=elastic demand (price is much more of a factor in the purchase of a sports car, because it is

a LUXURY).

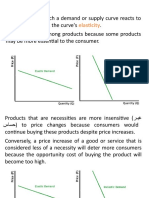

When people buy a luxury good, such as a sports car, the price of the good and the prices of

similar goods (e.g., sports cars) will be major factors in their purchasing decisions. When

people decide whether to purchase a necessary medical treatment, price is much less of

a factor—especially if no other treatments can achieve the same result. Since the price

elasticity of demand measures the responsiveness of buyers to changes in price, the

elasticity of demand for Amputation procedures for diabetes sufferers is likely to be much

lower than the elasticity of demand for sports cars.

-

Merlot - Most Elastic

Wine - In Between

Beverages -Least Elastic

The overall category of beverages has no close substitutes, so the demand for

beverages, in general, is very inelastic. However, the more specific the type of

beverages, the more close substitutes are available. If the price of wine rises, a

consumer could purchase beer or soda, but most people would not consider those very

close substitutes. If the price of merlot rises, consumers could switch to shiraz or

cabernet.

More substitutes are available in the long run than in the short run. If oil prices rise sharply, firms

that currently use oil or oil-based products to produce goods and services will not be

able to quickly switch to another energy input. Furthermore, consumers who rely on

products derived from oil—such as gasoline for cars—will find it difficult to switch to

alternative fuels in the short run.

In the very short run, the demand for oil is highly inelastic. If the price of oil stays high for

a long period of time, firms and families will begin moving away from or finding

substitutions for oil-intensive activities and products. Firms may adopt alternative energy

sources, such as solar power, coal, or ethanol. Households may begin to drive less and

drive more fuel-efficient cars when they do. Since buyers of oil and oil-based products

can pursue more alternatives to oil in the long run, the price elasticity of the long-run

demand for oil is more elastic than the price elasticity of the short-run demand for oil.

You might also like

- Economics for CFA level 1 in just one week: CFA level 1, #4From EverandEconomics for CFA level 1 in just one week: CFA level 1, #4Rating: 4.5 out of 5 stars4.5/5 (2)

- Summary Of "Principles Of Economics" By Alfred Marshall: UNIVERSITY SUMMARIESFrom EverandSummary Of "Principles Of Economics" By Alfred Marshall: UNIVERSITY SUMMARIESNo ratings yet

- Aasignment - Elasticity of DemandDocument15 pagesAasignment - Elasticity of Demandacidreign100% (1)

- Lesson 7 ElasticityDocument8 pagesLesson 7 ElasticityleblanjoNo ratings yet

- Project On Elasticity of DemandDocument11 pagesProject On Elasticity of Demandjitesh82% (50)

- Managerial EconomicsDocument31 pagesManagerial EconomicsRaj88% (8)

- A level Economics Revision: Cheeky Revision ShortcutsFrom EverandA level Economics Revision: Cheeky Revision ShortcutsRating: 3 out of 5 stars3/5 (1)

- Tutorial 4 ELASTICITYDocument2 pagesTutorial 4 ELASTICITYCHZE CHZI CHUAHNo ratings yet

- Feasibility Study 2Document49 pagesFeasibility Study 2Kath Garcia100% (1)

- ManagementDocument2 pagesManagementcatherine robertNo ratings yet

- Determinants of Elasticity of DemandDocument4 pagesDeterminants of Elasticity of DemandNoor NabiNo ratings yet

- Economic NewDocument9 pagesEconomic NewradhiaalfonceNo ratings yet

- Assignment 2Document7 pagesAssignment 2Art EastNo ratings yet

- Elasticity (Economy)Document42 pagesElasticity (Economy)Весна ЛетоNo ratings yet

- Karan Desai - GB540M2 - Examine Microeconomic Tools - Competency AssessmentDocument7 pagesKaran Desai - GB540M2 - Examine Microeconomic Tools - Competency AssessmentKaran DesaiNo ratings yet

- What Is 'Elasticity'Document6 pagesWhat Is 'Elasticity'Joyce ballescas100% (1)

- The Relationship Between The Price of A Good and How Much of It SB Wants To BuyDocument6 pagesThe Relationship Between The Price of A Good and How Much of It SB Wants To Buy3.Lưu Bảo AnhNo ratings yet

- Examples of Price Elasticity of DemandDocument1 pageExamples of Price Elasticity of DemandChiragNo ratings yet

- Price ElasticityDocument30 pagesPrice ElasticityAlex KühnNo ratings yet

- Concept of DemandDocument26 pagesConcept of DemandRashmi BansalNo ratings yet

- Objectives For Chapter 4: Elasticity and Its ApplicationDocument19 pagesObjectives For Chapter 4: Elasticity and Its ApplicationAnonymous BBs1xxk96VNo ratings yet

- What Is DemandDocument3 pagesWhat Is DemandDellendo FarquharsonNo ratings yet

- What Is 'Elasticity'Document4 pagesWhat Is 'Elasticity'Helena MontgomeryNo ratings yet

- Elasticity of DemandDocument18 pagesElasticity of DemandXahil MusicNo ratings yet

- Factors Affecting The Magnitude of Price Elasticity of DemandDocument3 pagesFactors Affecting The Magnitude of Price Elasticity of DemandSachin SahooNo ratings yet

- CONCEPT of ELASTICITYDocument60 pagesCONCEPT of ELASTICITYBjun Curada LoretoNo ratings yet

- Factors Affecting Elasticity of DemandDocument9 pagesFactors Affecting Elasticity of DemandVijay Singh Kumar VijayNo ratings yet

- ELASTICITY of DemandDocument16 pagesELASTICITY of DemandKyla TorcatosNo ratings yet

- Factors Influencing Elasticity of DemandDocument2 pagesFactors Influencing Elasticity of Demandrohit251302100% (1)

- I 4 0 EC Introduction-Elasticity-UtilityDocument39 pagesI 4 0 EC Introduction-Elasticity-UtilityDaliah Abu JamousNo ratings yet

- ELASTICITY Is A Measure of A Variable's Sensitivity To A Change in Another Variable. in Business andDocument1 pageELASTICITY Is A Measure of A Variable's Sensitivity To A Change in Another Variable. in Business andJessie J.No ratings yet

- Elasticity Continued : Determinants of Price Elasticity of DemandDocument24 pagesElasticity Continued : Determinants of Price Elasticity of Demandfoyzul 2001No ratings yet

- Elasticity of DemandDocument2 pagesElasticity of DemandMuhammad Yasir GondalNo ratings yet

- Econ124 Chapter 5Document5 pagesEcon124 Chapter 5Piola Marie LibaNo ratings yet

- Law of DemandDocument16 pagesLaw of DemandDivya GuptaNo ratings yet

- Demand and SupplyDocument3 pagesDemand and SupplySamiracomputerstation Kuya MarvsNo ratings yet

- Workshop 2 OKDocument7 pagesWorkshop 2 OKAna Luiza BacellarNo ratings yet

- Elasticity of Demand Applied EconomicsDocument43 pagesElasticity of Demand Applied EconomicsgaminokayceeNo ratings yet

- Demand FunctionDocument3 pagesDemand FunctionManas KumarNo ratings yet

- Effect of Price On A Substitute GoodDocument14 pagesEffect of Price On A Substitute GoodfathimaalainaashrafNo ratings yet

- Determinants of Price Elasticity of DemandDocument2 pagesDeterminants of Price Elasticity of DemandUmmu KhashiaNo ratings yet

- Economics Basics: Elasticity: Sponsor: Cook Up A Market-Stomping Stock Portfolio With Our FREE ReportDocument4 pagesEconomics Basics: Elasticity: Sponsor: Cook Up A Market-Stomping Stock Portfolio With Our FREE ReportamitkumartechnowizeNo ratings yet

- Demand Supply CurveDocument13 pagesDemand Supply CurveQNo ratings yet

- Factors That Determines The Elasticity of DemandDocument4 pagesFactors That Determines The Elasticity of DemandPinkuProtimGogoiNo ratings yet

- Elasticity of DemandDocument17 pagesElasticity of DemandDental Sloss100% (1)

- I 4 1 Cross-Price Elasticity of DemandDocument11 pagesI 4 1 Cross-Price Elasticity of DemandDaliah Abu JamousNo ratings yet

- Price Elasticity Research PaperDocument6 pagesPrice Elasticity Research Papersemizizyvyw3100% (1)

- Notes - Elasticity and It's ApplicationDocument10 pagesNotes - Elasticity and It's Applicationshihabsince99No ratings yet

- Chapter 2: Supply & Demand: 2.1 Relationship Between Price and Quantity DemandedDocument4 pagesChapter 2: Supply & Demand: 2.1 Relationship Between Price and Quantity DemandedHoo HetingNo ratings yet

- The Market Forces of Supply & DemandDocument37 pagesThe Market Forces of Supply & Demandhasanimam mahiNo ratings yet

- Demand Elasticity and Its ApplicationsDocument65 pagesDemand Elasticity and Its Applications별거아니더라고No ratings yet

- econoDocument3 pageseconoAshmit DhingraNo ratings yet

- Elasticity of DemandDocument21 pagesElasticity of DemandNitika AggarwalNo ratings yet

- Assignment Unit IIDocument10 pagesAssignment Unit IIHạnh NguyễnNo ratings yet

- Chapter 11 IGCSEDocument88 pagesChapter 11 IGCSEtaj qaiserNo ratings yet

- Chapter 11 Price Elasticity of DemandDocument5 pagesChapter 11 Price Elasticity of DemandDhrisha GadaNo ratings yet

- W6 Elasticity of Demand and SupplyDocument3 pagesW6 Elasticity of Demand and SupplyHAARSHININo ratings yet

- Supply and Demand - InformationDocument4 pagesSupply and Demand - InformationBigDaddy GNo ratings yet

- B Price Income and Cross Elasticities of Demand-U1-Markets in Action-Edexcel IAS IAL Economics Revision NotesDocument8 pagesB Price Income and Cross Elasticities of Demand-U1-Markets in Action-Edexcel IAS IAL Economics Revision Notes张查No ratings yet

- Informe de Ingles MicroeconmiaDocument4 pagesInforme de Ingles MicroeconmiaCARMEN ALBERCA JIMENEZNo ratings yet

- Unit 1: Demand and Supply Review: C. BennettDocument33 pagesUnit 1: Demand and Supply Review: C. BennettCheraleda ExantusNo ratings yet

- Gas Smarts: Hundreds of Small Ways to Save Big Time at the PumpFrom EverandGas Smarts: Hundreds of Small Ways to Save Big Time at the PumpNo ratings yet

- Econ Assignment AnswersDocument4 pagesEcon Assignment AnswersKazımNo ratings yet

- OS ReportDocument28 pagesOS ReportAjaath KankarNo ratings yet

- Factors Affecting The Growth of Small Businesses in The Midst of Pandemic in Indang, CaviteDocument9 pagesFactors Affecting The Growth of Small Businesses in The Midst of Pandemic in Indang, Cavitemain.krisselynreigne.moralesNo ratings yet

- Theory of Demand - 1Document32 pagesTheory of Demand - 1hiriiiitii100% (2)

- ElasticityDocument69 pagesElasticityAmit TyagiNo ratings yet

- Strategic ManagementDocument14 pagesStrategic ManagementannetteNo ratings yet

- ME AssignmentDocument2 pagesME AssignmentRoba Jirma BoruNo ratings yet

- Session 10 - The IS LM ModelDocument14 pagesSession 10 - The IS LM ModelUtkarsh BhalodeNo ratings yet

- Two Marks Question and AnswersDocument71 pagesTwo Marks Question and AnswersBoopathy KarthikeyanNo ratings yet

- HR Project ReportDocument5 pagesHR Project ReportSolo BgmNo ratings yet

- Applied Macroeconomics Test BankDocument23 pagesApplied Macroeconomics Test BankfelixsoNo ratings yet

- Managerial EconomicDocument360 pagesManagerial Economic96805291% (11)

- B 10 ClubbDocument7 pagesB 10 ClubbAnmol SaxenaNo ratings yet

- Sociology - I Course Code: A) Introduction: Credit: 4Document23 pagesSociology - I Course Code: A) Introduction: Credit: 4Disha BafnaNo ratings yet

- Dehydrated Fruit and VegetablesDocument17 pagesDehydrated Fruit and Vegetableskassahun meseleNo ratings yet

- B.A EconomicsDocument21 pagesB.A Economicskishan singhNo ratings yet

- EIC Unit 7Document29 pagesEIC Unit 7Samit ShresthaNo ratings yet

- Fairness CreamDocument23 pagesFairness CreamSh_munnakhantaha100% (1)

- 0801 - Ec 1Document21 pages0801 - Ec 1haryhunter100% (3)

- Indian Watch IndustryDocument28 pagesIndian Watch Industryapi-382911467% (9)

- Traffic Growth Rate Estimation Using Transport Demand Elasticity Method: A Case Study For National Highway-63 IntroductionDocument7 pagesTraffic Growth Rate Estimation Using Transport Demand Elasticity Method: A Case Study For National Highway-63 Introductionmspark futuristicNo ratings yet

- NMIMS Distance Learning ProgramDocument38 pagesNMIMS Distance Learning ProgramAiDLoNo ratings yet

- Module 5 6 7Document5 pagesModule 5 6 7aaaaaaaaaaaapaaaaaahNo ratings yet

- Keynes TheoryDocument25 pagesKeynes TheoryAhsan KhanNo ratings yet

- Implications of Market Pricing in Making Economic Decisions Lesson 4 2Document22 pagesImplications of Market Pricing in Making Economic Decisions Lesson 4 2LittleMissAddict VideosNo ratings yet

- Emerging Trends in Rural MarketingDocument21 pagesEmerging Trends in Rural MarketingChirag GoyaniNo ratings yet

- Full Download Managerial Economics Foundations of Business Analysis and Strategy 11th Edition Thomas Test BankDocument36 pagesFull Download Managerial Economics Foundations of Business Analysis and Strategy 11th Edition Thomas Test Bankthuyradzavichzuk100% (41)

- Why Do Interest Rates Change?Document33 pagesWhy Do Interest Rates Change?Ahmad RahhalNo ratings yet