Professional Documents

Culture Documents

Allowance Reimbursement Declaration Form

Allowance Reimbursement Declaration Form

Uploaded by

Amit Neha0 ratings0% found this document useful (0 votes)

13 views1 pageKunal Singh has submitted an allowance/reimbursement declaration form requesting a total allocation of 122,400 INR which includes a car reimbursement of 32,400 INR, telephone reimbursement of 40,000 INR, and a leave travel allowance of 50,000 INR. He declares that any tax liability from this declaration will be borne by him. He is also required to submit a scan of his car registration certificate to enroll for the car reimbursement.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentKunal Singh has submitted an allowance/reimbursement declaration form requesting a total allocation of 122,400 INR which includes a car reimbursement of 32,400 INR, telephone reimbursement of 40,000 INR, and a leave travel allowance of 50,000 INR. He declares that any tax liability from this declaration will be borne by him. He is also required to submit a scan of his car registration certificate to enroll for the car reimbursement.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

13 views1 pageAllowance Reimbursement Declaration Form

Allowance Reimbursement Declaration Form

Uploaded by

Amit NehaKunal Singh has submitted an allowance/reimbursement declaration form requesting a total allocation of 122,400 INR which includes a car reimbursement of 32,400 INR, telephone reimbursement of 40,000 INR, and a leave travel allowance of 50,000 INR. He declares that any tax liability from this declaration will be borne by him. He is also required to submit a scan of his car registration certificate to enroll for the car reimbursement.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

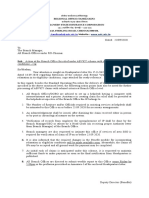

Allowance / Reimbursement Declaration Form

Employee Name: Kunal Singh Emp ID: 72049

Business Title: Analyst Department: Oil Operations

E-mail ID: Kunal.singh@trafigura.com PAN No.: DRGPS1787C

To be filled in by

Flexi Allowance

Employee Payroll Instructions

Components

(Amounts in INR)

Maximum limit of -

- where car Engine <1.6 cc is INR 32,400/- per annum

32,400

- where car Engine >1.6 cc is INR 39,600/- per annum

Car Reimbursement Note –

1. Employees can also claim Driver Allowance INR 900

included in the amounts mentioned above

Maximum limit of INR 40,000/- per annum

1. Employees can submit mobile bills (both prepaid /

postpaid) which clearly outlines the name of the

Telephone employee and the mobile number.

40,000

Reimbursement 2. Internet Bills can also be claimed for the internet

services provided over landline or through dongle

for official purposes.

Leave Travel Allowance

50,000 Maximum limit of INR 150,000/- per annum

(LTA)

Total Amount Allocated 122,400 Compute (Car + Telephone + LTA)

Declaration by the Employee:

I hereby confirm and request the organization to use the above Allowance / Reimbursement Declaration Form for the

purpose of processing my salary. I understand and confirm that any tax liability arising out of the above declaration

will be borne by me.

Name: Kunal Singh Date: 05-April-2022

Note: To enroll for Car Reimbursement, submit a scan copy of your car registration certificate along with this form

You might also like

- Pilates Studio Plan de NegocioDocument30 pagesPilates Studio Plan de NegocioDiego FerreroNo ratings yet

- Offer Lette - Neeraj NayakDocument3 pagesOffer Lette - Neeraj NayakNeerajNayakNo ratings yet

- RFP For Bengaluru Safe City ProjectDocument7 pagesRFP For Bengaluru Safe City Projectkamtiabhilash529No ratings yet

- Appraisal Letter-UnlockedDocument5 pagesAppraisal Letter-UnlockedAnkit SharmaNo ratings yet

- Personnel Manual Corrected FinalDocument284 pagesPersonnel Manual Corrected FinalKajeev Kumar100% (4)

- Payment Process:: Guidelines For Claiming Flexible Allowance FY 2019-20Document3 pagesPayment Process:: Guidelines For Claiming Flexible Allowance FY 2019-20Tanveer BhushanNo ratings yet

- Relevant Income-Tax ProvisionsDocument3 pagesRelevant Income-Tax ProvisionsPratap ReddyNo ratings yet

- For Details Refer To Notes Given BelowDocument7 pagesFor Details Refer To Notes Given BelowSurender ReddyNo ratings yet

- Alphonse Irudayaraj Offer LetterDocument4 pagesAlphonse Irudayaraj Offer Letteralphonse INo ratings yet

- Appendix A GehnsDocument3 pagesAppendix A GehnsDevraj DashNo ratings yet

- Formerly Air India Assets Holding LimitedDocument1 pageFormerly Air India Assets Holding Limitedamit nakraNo ratings yet

- It - Lesson 6Document25 pagesIt - Lesson 6Sugandha AgarwalNo ratings yet

- Flexi Benefits Plan April 2016Document25 pagesFlexi Benefits Plan April 2016Shishir MishraNo ratings yet

- FAQ Reimbursement and Investment ProofsDocument8 pagesFAQ Reimbursement and Investment ProofsPrashant TiwariNo ratings yet

- For Details Refer To Notes Given BelowDocument7 pagesFor Details Refer To Notes Given BelowISHWAR SHARMANo ratings yet

- Payroll Guidelines and FAQs - V1Document15 pagesPayroll Guidelines and FAQs - V1Shiva Kant VermaNo ratings yet

- ACFrOgA8B1 AXdvFTvs9j3EM24DahDYIcJzmeVabGUoqlt8xCvhCtozvckYFaqz3P4WJYXOuEu DVmJqZeUF HFF KuUpHKzSp2Ff c9FeMgmMQstd 2g0oW6kOjXdcDocument3 pagesACFrOgA8B1 AXdvFTvs9j3EM24DahDYIcJzmeVabGUoqlt8xCvhCtozvckYFaqz3P4WJYXOuEu DVmJqZeUF HFF KuUpHKzSp2Ff c9FeMgmMQstd 2g0oW6kOjXdcFrancis MFANo ratings yet

- FlexiDocument4 pagesFlexiManish Mani100% (1)

- Employee Tax Benefits: - A Ready ReckonerDocument9 pagesEmployee Tax Benefits: - A Ready ReckonerPRKLN .RNo ratings yet

- COCP Policy - 2022Document7 pagesCOCP Policy - 2022PrasannaNo ratings yet

- Notes PartF 2 PDFDocument1 pageNotes PartF 2 PDFMohd Nor UzairNo ratings yet

- Mobile Reimbursement Policy - 2014 PDFDocument3 pagesMobile Reimbursement Policy - 2014 PDFmahakagrawal3No ratings yet

- Flexi GuidelinesDocument4 pagesFlexi GuidelinesSiddu BalaganurNo ratings yet

- BM Circular Action Points ABVKYDocument1 pageBM Circular Action Points ABVKYSmuggy424gmail.com Kishore0424No ratings yet

- Autocad Draughtsman: Date: 06.08.2019 Mr. Tushar Taral Subject: Offer of EmploymentDocument2 pagesAutocad Draughtsman: Date: 06.08.2019 Mr. Tushar Taral Subject: Offer of EmploymentABHIJITNo ratings yet

- Flexi Benefits PlanDocument6 pagesFlexi Benefits PlanPrajwal Kumar RNo ratings yet

- 2022 10 28 180618 Ycsl5 Financial BidDocument7 pages2022 10 28 180618 Ycsl5 Financial BidRahul HanumanteNo ratings yet

- (Arm:R : Ifii' 3mi) (A Government Of'Lndia Enterprise)Document6 pages(Arm:R : Ifii' 3mi) (A Government Of'Lndia Enterprise)singh0384No ratings yet

- Word - MAADocument3 pagesWord - MAAVaibhavNo ratings yet

- Brief Introduction On Salary Components and Their Income Tax ApplicabilityDocument21 pagesBrief Introduction On Salary Components and Their Income Tax ApplicabilityAkshay ChauhanNo ratings yet

- Nishanth Appointment - LetterDocument10 pagesNishanth Appointment - LetterNishanth GowdaNo ratings yet

- NEW Tour Travel Policy 22 Jan 2018Document6 pagesNEW Tour Travel Policy 22 Jan 2018Indrajeet GiriNo ratings yet

- Lot of CompaniesDocument12 pagesLot of Companiesnishanegi9375No ratings yet

- 1194 Sneha Babu-Teleperformance (CEE) 2019-2020Document3 pages1194 Sneha Babu-Teleperformance (CEE) 2019-2020Dipa PaulNo ratings yet

- Frequently Asked Questions - Profession & Company TaxesDocument4 pagesFrequently Asked Questions - Profession & Company TaxesAnu V PillaiNo ratings yet

- Kaivalya Ashok Ekhande-2383079 - LOIDocument8 pagesKaivalya Ashok Ekhande-2383079 - LOIKaivalya EkhandeNo ratings yet

- Offshore Expenses Incurred Can Be Claimed Using This Form: Travel Self and Family - Sub Total: 1416.00 (INR)Document1 pageOffshore Expenses Incurred Can Be Claimed Using This Form: Travel Self and Family - Sub Total: 1416.00 (INR)chrreddyNo ratings yet

- Permanent Recruitment AgreementDocument7 pagesPermanent Recruitment AgreementRaja MadhanNo ratings yet

- Notes PartF 2Document1 pageNotes PartF 2Puvaneswary BalachandrenNo ratings yet

- Advertisement - Training - FinanceDocument4 pagesAdvertisement - Training - FinancePAWAN YADAVNo ratings yet

- 1194 Sneha Babu-Teleperformance (CSE) 2019-2020Document3 pages1194 Sneha Babu-Teleperformance (CSE) 2019-2020Popi BhowmikNo ratings yet

- ArchanaDocument2 pagesArchanaARCHANA CHAUHANNo ratings yet

- Impact On IT For 2009-10Document7 pagesImpact On IT For 2009-10renjith11121No ratings yet

- KRISHNA 3 134508 Appointment Letter1685338310813Document7 pagesKRISHNA 3 134508 Appointment Letter1685338310813krishna singhNo ratings yet

- Gillela Raghavender 6029273 2022 SALARY REVISION LETTER1Document3 pagesGillela Raghavender 6029273 2022 SALARY REVISION LETTER1Careersjobs IndiaNo ratings yet

- Certificate PDFDocument1 pageCertificate PDFShreyas ShenoyNo ratings yet

- Premium Payment Certificate Savings Suraksha PDFDocument1 pagePremium Payment Certificate Savings Suraksha PDFShreyas ShenoyNo ratings yet

- BSNL Call CenterDocument56 pagesBSNL Call CenterPankaj KumarNo ratings yet

- Wa0015 PDFDocument1 pageWa0015 PDFShreyas ShenoyNo ratings yet

- Premium Payment Certificate Savings SurakshaDocument1 pagePremium Payment Certificate Savings SurakshaShreyas ShenoyNo ratings yet

- Offer Letter JyotiDocument3 pagesOffer Letter Jyotitushar.phalswalNo ratings yet

- CAA CPL - IR-ME - Fee Structure For January 2020Document2 pagesCAA CPL - IR-ME - Fee Structure For January 2020Shravan MeshramNo ratings yet

- Transmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack DueDocument24 pagesTransmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack DueTender 247No ratings yet

- VN No - CIVIL 09 AGM Civil KolkataDocument9 pagesVN No - CIVIL 09 AGM Civil KolkataTanmay SinghNo ratings yet

- Ramboll - India - Payroll Reimbursement Guidelines - V1.1Document7 pagesRamboll - India - Payroll Reimbursement Guidelines - V1.1SHAH PARSHVANo ratings yet

- Naac Data c5-2-1 1661850316893Document4 pagesNaac Data c5-2-1 1661850316893vibhapanchal7470No ratings yet

- Travel Policy B1 TEAM: 1. ObjectiveDocument5 pagesTravel Policy B1 TEAM: 1. ObjectiveBhuvan DhamodharanNo ratings yet

- 931 1 Walk-In-Interview Airport ManagerDocument9 pages931 1 Walk-In-Interview Airport ManagerRio RioNo ratings yet

- Against Inequality The Practical and Ethical Case For Abolishing The Superrich Tom Malleson Full ChapterDocument67 pagesAgainst Inequality The Practical and Ethical Case For Abolishing The Superrich Tom Malleson Full Chapterjose.waller368100% (8)

- Filed: Form GSTR-3BDocument3 pagesFiled: Form GSTR-3Bsammy shergilNo ratings yet

- Income Tax Calculator 2018-2019Document1 pageIncome Tax Calculator 2018-2019Muhammad Hanif SuchwaniNo ratings yet

- Practical Accounting 1Document21 pagesPractical Accounting 1Christine Nicole BacoNo ratings yet

- Realme EarphoneDocument1 pageRealme EarphonePaRtHiNo ratings yet

- Pinnacle Super BrochureDocument14 pagesPinnacle Super BrochureharrisNo ratings yet

- Double TaxationDocument8 pagesDouble TaxationArun KumarNo ratings yet

- Dac 212 Ass.1Document3 pagesDac 212 Ass.1Nickson AkolaNo ratings yet

- General Principles of TaxationDocument88 pagesGeneral Principles of TaxationKristine LumanogNo ratings yet

- Havells India Limited: A Report On Financial Statement AnalysisDocument22 pagesHavells India Limited: A Report On Financial Statement Analysiswritik sahaNo ratings yet

- Nit Ceg9620l19Document118 pagesNit Ceg9620l19Bittudubey officialNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Quarry Permit: Provincial/City Mining Regulatory Board (P/CMRB)Document5 pagesQuarry Permit: Provincial/City Mining Regulatory Board (P/CMRB)cris kuNo ratings yet

- Self Learning Evaluation T.y.b.com Sem 6 2023 2024 1Document73 pagesSelf Learning Evaluation T.y.b.com Sem 6 2023 2024 1ritikchoprasbr2003No ratings yet

- Projection Summary Isargas Group For Investor Oct 2019Document4 pagesProjection Summary Isargas Group For Investor Oct 2019Anton CastilloNo ratings yet

- Iit Training Project: by Kunal SareenDocument50 pagesIit Training Project: by Kunal SareenAbhishek SareenNo ratings yet

- Batch20 Group 6 Macro Economics Project ReportDocument28 pagesBatch20 Group 6 Macro Economics Project ReportHK1959No ratings yet

- Student Allowance ParentsDocument12 pagesStudent Allowance ParentsHinewai PeriNo ratings yet

- Macquarie Equity Lever Adviser PresentationDocument18 pagesMacquarie Equity Lever Adviser PresentationOmkar BibikarNo ratings yet

- (A.J. Auerbach, M. Feldstein) Handbook of Public E (BookFi) PDFDocument671 pages(A.J. Auerbach, M. Feldstein) Handbook of Public E (BookFi) PDFSuci MaulidaNo ratings yet

- For Billing Enquiry Call Tikona Care at 1800-20-94276: Current Bill Details Amount (RS.)Document1 pageFor Billing Enquiry Call Tikona Care at 1800-20-94276: Current Bill Details Amount (RS.)Ashi ShahNo ratings yet

- Myanmar Oil and Gas Week 2014 Full ProgrammeDocument18 pagesMyanmar Oil and Gas Week 2014 Full ProgrammeMehedi HasanNo ratings yet

- 评论Document7 pages评论hfiudphjfNo ratings yet

- Tax Circular Dated 27.2.18Document4 pagesTax Circular Dated 27.2.18Mahendra SharmaNo ratings yet

- Transcript, Tyler v. Hennepin County, No. 22-166 (U.S. Apr. 26, 2023)Document125 pagesTranscript, Tyler v. Hennepin County, No. 22-166 (U.S. Apr. 26, 2023)RHTNo ratings yet

- IGCSE Economics Self Assessment Exam Style Question's Answers - Section 6Document6 pagesIGCSE Economics Self Assessment Exam Style Question's Answers - Section 6DesreNo ratings yet

- US Internal Revenue Service: p678wDocument240 pagesUS Internal Revenue Service: p678wIRSNo ratings yet

- Taxable and NontaxableDocument11 pagesTaxable and NontaxableKhym Jie Purisima100% (1)

- 07 - CLWTAXN Notes On Income TaxationDocument10 pages07 - CLWTAXN Notes On Income TaxationMichael Allen RodrigoNo ratings yet